Discover and read the best of Twitter Threads about #AMZN

Most recents (18)

🇨🇱¿Cuándo me van a dejar comprar acciones o poder elegir el #ETF que más me gusta? “Quiero Nike. Me gustaría invertir en el Nasdaq. Hay un ETF del S&P 500 que encuentro es mejor. Un ETF de clean energy me hace sentido”. Ahora con Fintual Acciones* te la hacemos fácil. Abro hilo🧵

Lo pensamos, le dimos una vuelta y ahora lo tenemos. Hoy Fintual Acciones ofrece construirte un portafolio con + de 1000 activos, sin comisiones y con un spread de dólar de máximo un peso respecto del precio al que acceden las mesas de dinero de los propios bancos y corredoras.

El dólar te lo entregamos a lo que realmente cuesta. No como cuando pagas tu tarjeta de crédito y te cobran un tipo de cambio de fantasía, de 15, 20 o 30 pesos más caro que lo que está mostrando google. fintualist.com/chile/educacio…

A Sell report by a convertible bond analyst about a company starting with “A” that didn’t quite go right in retrospect…

This one goes back 20+ years and imo is One of the most interesting phases of Amazons history - it’s journey through the dot com bust…let’s dig in…#AMZN

This one goes back 20+ years and imo is One of the most interesting phases of Amazons history - it’s journey through the dot com bust…let’s dig in…#AMZN

The report was written by Ravi Suria - a Chennai boy when he was all of 29. Imagine what it might have taken to take head on internal pressure, board me,get pressure and from the company targeted…he admitted it ruined his life for two years sfgate.com/business/netwo…

If we imagine ourselves at that time, How to react to such a caustic congruence of red flags??100s of M$ burnt in failed e-comm acquisitions, high attrition in senior team, lack of confidence amongst internal senior team, list of failed initiatives outnumbered ones that succeeded

The CPI report came in Thursday with headline at 7.7% and core at 6.3%, both lower than expected. And boy oh boy did risk assets like that. Everything was partying like there was no tomorrow.

Let’s have a quick look at what F happened here?

1/n

Let’s have a quick look at what F happened here?

1/n

$SPY Closed above Wk 50%. High Chance of going OB Wk. 🎯405.84

FTC⬆️EMA☁️🐻Futures⬆️

Over extended on Wk (404.2)

Wk bounced off UTL

GAP⬆️419.96 - 421.22

50D MA ~401.6

Inverted C/H & Inverted H/S

FTC⬆️EMA☁️🐻Futures⬆️

Over extended on Wk (404.2)

Wk bounced off UTL

GAP⬆️419.96 - 421.22

50D MA ~401.6

Inverted C/H & Inverted H/S

SUPPLY: 402.42 - 406.03

DEMAND: 380.66 - 389.09 / 389.45 - 390.9

D FVG: 405.84 - 414.09

DEMAND: 380.66 - 389.09 / 389.45 - 390.9

D FVG: 405.84 - 414.09

$SPY Wk still over extended (~403) 4.65pts. Futures↔️

EMA☁️🐻

Closed above the Wk 50%. High probability to go outside week🎯405.84

GAP⬆️419.96 - 421.22

50D MA ~401.25

Inverted C/H & Inverted H/S

D. Setup: 2⃣2⃣

L. Entry: 398.59 / S. Entry: 390.2

#SPY

EMA☁️🐻

Closed above the Wk 50%. High probability to go outside week🎯405.84

GAP⬆️419.96 - 421.22

50D MA ~401.25

Inverted C/H & Inverted H/S

D. Setup: 2⃣2⃣

L. Entry: 398.59 / S. Entry: 390.2

#SPY

How to Read my Chart:

E = Early Entry

S = Safer Entry

D = Daily Entry (Previous Day High / Low)

Wk = Weekly Entry (Previous Week High / Low)

BF = Broadening Formation

D/UTL = Down/Up Trendline

IB = Inside Bar1⃣

OB = Outside Bar3⃣

FTC = Full Time Frame

#StocksafterDark #SADTips

E = Early Entry

S = Safer Entry

D = Daily Entry (Previous Day High / Low)

Wk = Weekly Entry (Previous Week High / Low)

BF = Broadening Formation

D/UTL = Down/Up Trendline

IB = Inside Bar1⃣

OB = Outside Bar3⃣

FTC = Full Time Frame

#StocksafterDark #SADTips

#SADnation - You do NOT need to trade every Day. You do NOT need to hit the🌙on each trade. You do NOT need to go ALL in. You do NEED a plan & CONSISTENCY is🔑

2022 has 251 days:

$100/D = $25.1K

$500/D = 125.5K

$1K/D = 251K

$5K/D = $1.25M

2023 = 250D

#SADucation #SADtips

1⃣

2022 has 251 days:

$100/D = $25.1K

$500/D = 125.5K

$1K/D = 251K

$5K/D = $1.25M

2023 = 250D

#SADucation #SADtips

1⃣

#SADnation Have you gone 🟢➡️🔴?

Have a 🎯 & 🛑 in mind before entering into a trade.

Learn to scale out of your positions & adjust your 🛑Where you place them is your personal Risk➡️Reward tolerance.

Learn to get ⬆️ & walkaway when you’re🟢.

5% > -1%

Wins compound.

2️⃣

Have a 🎯 & 🛑 in mind before entering into a trade.

Learn to scale out of your positions & adjust your 🛑Where you place them is your personal Risk➡️Reward tolerance.

Learn to get ⬆️ & walkaway when you’re🟢.

5% > -1%

Wins compound.

2️⃣

Storytime: A while ago, #AWS outmaneuvered one of our competitors in the cloud

#AMZN isn’t just big, they can out-think you too. Wardley Maps are one of their tools. (@swardley)

Our friends made a Facial Recognition (FR) system specifically for Fraud Detection on AWS. 1/8

#AMZN isn’t just big, they can out-think you too. Wardley Maps are one of their tools. (@swardley)

Our friends made a Facial Recognition (FR) system specifically for Fraud Detection on AWS. 1/8

#AWS noticed the usage analytics and recommended using it for general user authentication (red).

Our competitor saw no problems with this – their secret sauce was the algorithm - not the UI or API.

Everything was built on EC2. 2/8

Our competitor saw no problems with this – their secret sauce was the algorithm - not the UI or API.

Everything was built on EC2. 2/8

1/ $SOFI is a Sleeping Giant👇

1.Banking Merger Pending

2.@Galileo_Tweets powers 70% of world #Fintech

3. Trades Crypto

4. Trades stocks

5. provides - all kind of Loans

6. provides Insurance

7. International expansion

8. single app for all your need

9. User growth very high

1.Banking Merger Pending

2.@Galileo_Tweets powers 70% of world #Fintech

3. Trades Crypto

4. Trades stocks

5. provides - all kind of Loans

6. provides Insurance

7. International expansion

8. single app for all your need

9. User growth very high

2/

#Sofi owns @Galileo_Tweets is the #amzn of #Fintech

2020: CEO Clay Wilkes Galileo Powers 👇

95% of digital banking in USA runs

70 of the top 100 #fintech in the world are clients, such as Robinhood, Chime, DAVE, Monzo, Moneylion, Transferwise, Klarna

seekingalpha.com/article/443416…

#Sofi owns @Galileo_Tweets is the #amzn of #Fintech

2020: CEO Clay Wilkes Galileo Powers 👇

95% of digital banking in USA runs

70 of the top 100 #fintech in the world are clients, such as Robinhood, Chime, DAVE, Monzo, Moneylion, Transferwise, Klarna

seekingalpha.com/article/443416…

3/ When @Marqeta with 400M revenue is valued at ~ $16B then just the @Galileo_Tweets part of #sofi $SOFI needs to be valued at $8B .

Marqeta gets 400M Rev

Galileo gets 200M rev

what about valuation of banking , crypto, loans, insurance , Stocks , china expansion of #Sofi ?

Marqeta gets 400M Rev

Galileo gets 200M rev

what about valuation of banking , crypto, loans, insurance , Stocks , china expansion of #Sofi ?

A 🧵 about investment mistakes from a guy that has made them all. Topic:

WHEN SHOULD I SELL?

We have seen the Crypto market drop over 50% from its previous highs earlier this year.

IMO the decision to sell is the hardest decision anyone is faced with when investing money.

WHEN SHOULD I SELL?

We have seen the Crypto market drop over 50% from its previous highs earlier this year.

IMO the decision to sell is the hardest decision anyone is faced with when investing money.

It doesn’t matter if you’re investing in cryptocurrencies or stocks. Whether it’s #Bitcoin or #AMZN, selling is a difficult call to make.

My personal struggle with the “should I sell” decision is likely a common struggle.

The decision to buy is easy. You’ve done your research

My personal struggle with the “should I sell” decision is likely a common struggle.

The decision to buy is easy. You’ve done your research

and you truly believe in the utility of the token - so you buy. In a bull market with everything going up - you buy. You believe in the business or the product - so you buy. You believe you have inside information - so you buy. You experience FOMO - so you buy.

Voce sabe o que a #AMZN, #UBER, #ABNB, #MELI, #FB, #TWTR, #RBLX, #ENJU3, #NINJ3 e Ifood tem em comum? O famoso Network Effect, ou em bom portugues, efeito rede.

A grosso modo o efeito rede significa que quanto mais consumidores tiver um produto ou serviço, maior será sua demanda, tanto de fornecedores quanto de usuários.

Ex: O que faz o whatsapp uma ferramenta tao interessante? O fato de que quase todo mundo usa! Quantos mais usuários vc tem, mais trafego se tem e por consequência mais usuários vc captura.

💥He recopilado las 69 MEJORES EMPRESAS que lo pueden hacer mejor en los próximos años💥

👉Descripción, precio, crecimiento, características y valuación de 5 años en un sola página⚡️

🔥SUPER hilo desglosado en sectores🔥

⬇️

El informe completo en mi web carlosmatag.com

👉Descripción, precio, crecimiento, características y valuación de 5 años en un sola página⚡️

🔥SUPER hilo desglosado en sectores🔥

⬇️

El informe completo en mi web carlosmatag.com

16 sectores con mucho potencial:

1 Base de datos🖥️

2 Internet💻

3 Games / Streaming🎮

4 Fintech💸

5 Impresoras 3D📟

6 Evs🚗

7 Semiconductores🔌

8 Drones🚁

9 Realidad virtual📺

10 Software💽

11 Renovables☀️

12 IoT📠

13 Telemedicina🩺

14 Medicina🧬

15 Ecommerce🛒

16 Cannabis🍀

1 Base de datos🖥️

2 Internet💻

3 Games / Streaming🎮

4 Fintech💸

5 Impresoras 3D📟

6 Evs🚗

7 Semiconductores🔌

8 Drones🚁

9 Realidad virtual📺

10 Software💽

11 Renovables☀️

12 IoT📠

13 Telemedicina🩺

14 Medicina🧬

15 Ecommerce🛒

16 Cannabis🍀

1. I JUST RECENTLY BOUGHT $493,000 of $ROKU stock.

I missed the +217% one year run up in 2020. But as of today, I'm up about 27% for a 2 month hold so far.

Here's my extensive 25-post due diligence on #ROKU.

(read the full thread)

I missed the +217% one year run up in 2020. But as of today, I'm up about 27% for a 2 month hold so far.

Here's my extensive 25-post due diligence on #ROKU.

(read the full thread)

2. First, stop thinking of $ROKU as a hardware company.

STOP!

They started that way, but have shifted into a much more lucrative space - their 'Platform.'

More on that shortly.

Think of them as having part of their biz as hardware, but most of it as their Platform.

STOP!

They started that way, but have shifted into a much more lucrative space - their 'Platform.'

More on that shortly.

Think of them as having part of their biz as hardware, but most of it as their Platform.

3. Most people I talk to say, "Why do I need #ROKU if my TV already has its own build in apps?"

I get it. People don't yet realize what ROKU offers. But they will. Just like people didn't understand other tech at the start (Paypal, Amazon, Netflix, etc.)

I get it. People don't yet realize what ROKU offers. But they will. Just like people didn't understand other tech at the start (Paypal, Amazon, Netflix, etc.)

1/ One of the models I use most in business analysis is tech stack trees 🌳

Every product is built on and enabled by 1 or more technologies.

Understanding where a product fits on its higher-level tech stack is an important part of any long-term strategy or investment thesis.

Every product is built on and enabled by 1 or more technologies.

Understanding where a product fits on its higher-level tech stack is an important part of any long-term strategy or investment thesis.

1/ Confessions of a retired #trader.

In July 2000 I bought #AMZN at $30 a share. I was a big fan and day trading to pay my startup bills.

A few days later as it touched $45, I flipped it. The trade paid for our parents visit to the US that summer.

My kids found out yesterday.

In July 2000 I bought #AMZN at $30 a share. I was a big fan and day trading to pay my startup bills.

A few days later as it touched $45, I flipped it. The trade paid for our parents visit to the US that summer.

My kids found out yesterday.

2/ It was less than a thousand shares. Total gain on the trade - $5k to $6k (in 2000 US$).

Just enough for 4 tickets from Karachi to LA for Ammi, Abba and my two sisters.

I bought it again in July 2001. Sold it when I got wiped out after the market closure post 9/11

Just enough for 4 tickets from Karachi to LA for Ammi, Abba and my two sisters.

I bought it again in July 2001. Sold it when I got wiped out after the market closure post 9/11

Anyone else feel a bit nauseous when they see this?

$AMZN 1999-2010

vs

$BTC 2017-2021

Just for the record, I'm not Macro bearish, but this fractal makes me 🤮 a little.

$AMZN 1999-2010

vs

$BTC 2017-2021

Just for the record, I'm not Macro bearish, but this fractal makes me 🤮 a little.

If this plays out... #Bitcoin

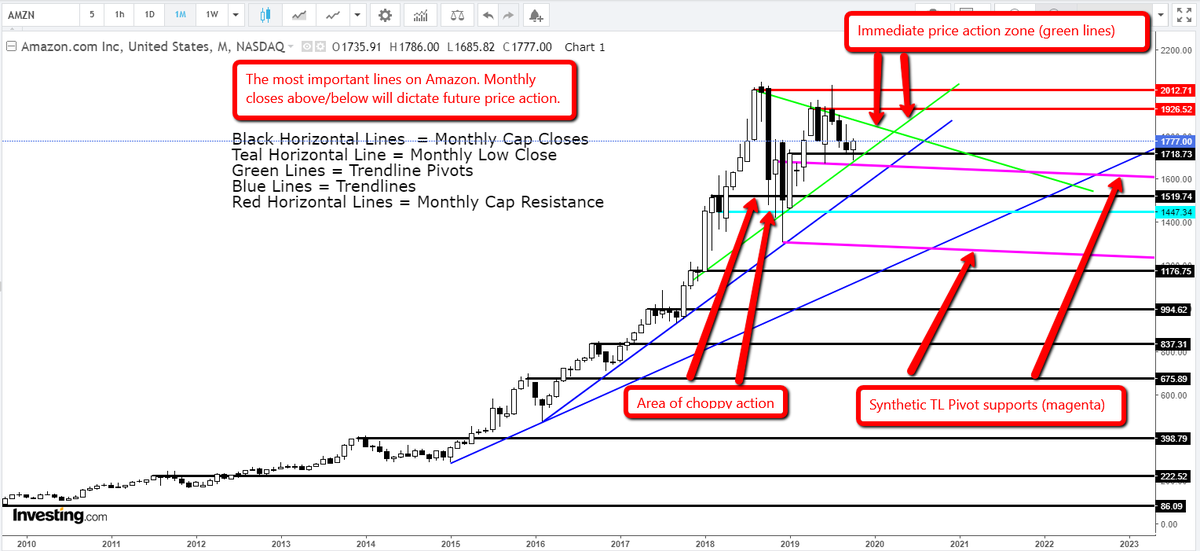

Analysis: #NASDAQ: #AMZN

Case 11 #Amazon.com Inc

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

Thread 👇👇👇

1/8

Case 11 #Amazon.com Inc

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

Thread 👇👇👇

1/8

Amazon has seen a tremendous uptrend since early 2015 culminating in a top @ $2050.50 reached in September 2018. Conditions since then have become broadly range bound.

2/8

2/8