Discover and read the best of Twitter Threads about #APR

Most recents (22)

❇️ Curious about how #APR will be decided?

Join us in exploring the process and rationale behind it.

Join us in exploring the process and rationale behind it.

The APR on NFT collections will initially be set by the Kairos team based on the current market.

1/

#VagaChain thread - financial investors / speculators view:

For investors, $VAGA, the native currency of #VagaChain is pretty interesting my opinion. Lets start with basic aspects:

#VagaChain thread - financial investors / speculators view:

For investors, $VAGA, the native currency of #VagaChain is pretty interesting my opinion. Lets start with basic aspects:

2/

► Great tokenomics:

Only around 40 mio $VAGA will be circulating at mainnet launch on 6th December 2022. Over time the max. circulating supply will be 80 mio $VAGA. Total supply will be 200 mio $VAGA. Low supply is good for price development imo.

► Great tokenomics:

Only around 40 mio $VAGA will be circulating at mainnet launch on 6th December 2022. Over time the max. circulating supply will be 80 mio $VAGA. Total supply will be 200 mio $VAGA. Low supply is good for price development imo.

3/

► Usage of the network:

1) #VagaChain is not a theoretical draft on the paper. It brings real utility and impact into the economic world with a real product that fits the market needs. Its the same in another way as @Ripple is. Both are independent of bull or bear markets.

► Usage of the network:

1) #VagaChain is not a theoretical draft on the paper. It brings real utility and impact into the economic world with a real product that fits the market needs. Its the same in another way as @Ripple is. Both are independent of bull or bear markets.

#APR À l’origine, Agnès Pannier-Runacher est un pilier discret d’En Marche. Référente du mouvement dans le 16ème arrondissement de Paris, cette inspectrice des finances passée par HEC a connu Alexis Kohler le secrétaire général de l’Elysée à l'ENA (1) lemediatv.fr/articles/enque…

#APR C’est en fait via les réseaux de la puissante Caisse des Dépôts, bras armé financier de l’État, qu’Agnès Pannier-Runacher va se retrouver au cœur de la macronie des débuts. Elle fut administratrice d’Icade, la filiale immobilière de la Caisse (extrait Grand Manipulateur) (2)

#APR Elle fut surtout numéro 2 de la Compagnie des Alpes, filiale de la Caisse des Dépôts dirigée par Dominique Marcel, ex conseiller économique de Mitterrand. Elle y prépara notamment un partenariat avec le groupe chinois Fosun (3) france3-regions.francetvinfo.fr/auvergne-rhone…

Always feels great to close allocation & reward our awesome #delegators🤗

$GRT fam, we are open for delegation. Stake with us today for high performance & ~13% consistent #APR🔥

Delegate: thegraph.com/explorer/profi…

@graphprotocol #Web3 #graph $GRT (1/6)🧵

$GRT fam, we are open for delegation. Stake with us today for high performance & ~13% consistent #APR🔥

Delegate: thegraph.com/explorer/profi…

@graphprotocol #Web3 #graph $GRT (1/6)🧵

We have special channel on discord for graph-delegators where we discuss everything around #subgraph, @graphprotocol and analytics 🤝

Join now for any questions🚀

Discord: dapplooker.com/community (2/6)🧵

Join now for any questions🚀

Discord: dapplooker.com/community (2/6)🧵

Our effective cut is under 10% so delegators gets the maximum benefit.

Learn about our indexer infrastructure and operations here 👇

@graphopsxyz #Decentralization #indexer (3/6)🧵

Learn about our indexer infrastructure and operations here 👇

@graphopsxyz #Decentralization #indexer (3/6)🧵

Leveraging on @SturdyFinance to deploy a #Long strategy on $BTC and make profits💸💸

The bear season is usually made of so many volatilities in almost all assets with the exception of #Stablecoins.

So now the big question is; how does one earn during the bear market?🤷

The bear season is usually made of so many volatilities in almost all assets with the exception of #Stablecoins.

So now the big question is; how does one earn during the bear market?🤷

When the market gets rough and your holding values goes left and right, up and down, staking comes as a good way of creating some passive income from current stash.

So you might want to consider staking with a defi lending and borrowing provider with lower fees.

So you might want to consider staking with a defi lending and borrowing provider with lower fees.

Most crypto traders often neglect or forget about the small holdings or left overs, but if you stake this, you invest for the future because you will surely earn.

Here I'll show you how to leverage on @SturdyFinance to deploy a long strategy on $BTC and make profits 💸💰🚀

Here I'll show you how to leverage on @SturdyFinance to deploy a long strategy on $BTC and make profits 💸💰🚀

1/13 Have you ever heard a world where #DeFi rewards are automatically harvested & reinvested? Welcome in the #YieldOptimizer World. Here is a 🧵why they are one of the first door to open for newcomers in #DeFi 👇

Concrete example on @optimismPBC with @beethoven_x & @beefyfinance

Concrete example on @optimismPBC with @beethoven_x & @beefyfinance

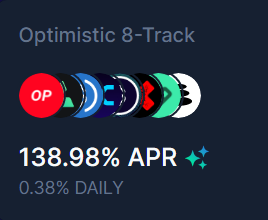

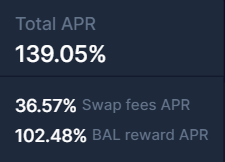

2/13 When you deposit into a Liquidity Pool, you receive token(s) reward based on the #APR of this pool. APR stands for: Annual Percentage Rate. On @beethoven_x , this pool is made up of 8 #tokens, with an APR of 139%

$OP $LYRA $USDC $SNX $BEETS $sUSD $PERP $BAL

$OP $LYRA $USDC $SNX $BEETS $sUSD $PERP $BAL

3/13 As you may know @beethoven_x is a friendly fork of @BalancerLabs coming from #Fantom who deployed their platform on #Optimism. Reward of this pool are split:

- 37% of swap fees => your LP token will increase in quantity

- 102% liquidity mining => Reward received in $BAL

- 37% of swap fees => your LP token will increase in quantity

- 102% liquidity mining => Reward received in $BAL

Difference between APY and APR

APR

For example, a yield farming program offers an APR of 100%/yr. You use $1000 to join this program. One year later you will receive $2,000, where $1000 is the initial capital and $1000 is APR.

#apr #apy #DeFi #blockchain

APR

For example, a yield farming program offers an APR of 100%/yr. You use $1000 to join this program. One year later you will receive $2,000, where $1000 is the initial capital and $1000 is APR.

#apr #apy #DeFi #blockchain

Once you see the APR, it is possible to immediately calculate how much profit will be earned at the end of the period. This profit comes from your staking or farming, so just join at the beginning to get the result for APR interest.

Formular

APR = r x N

Where:

r: The interest rate of the year;

N: Interest period (N = 1, means 1 year).

APR = r x N

Where:

r: The interest rate of the year;

N: Interest period (N = 1, means 1 year).

ANIVERSARE DISRUPTIVE DIGITAL 🥳

2 ani de creștere, învățare, găsirea soluțiilor și extinderea comunității noastre! Dorim să sărbătorim alături de voi, așa că avem 2 anunțuri de făcut!

1️⃣ Vom reduce fee-ul la 5%

2️⃣ Anunțăm lansarea token-ului DISRUPTIVE-c20f7c

1/ 👇

2 ani de creștere, învățare, găsirea soluțiilor și extinderea comunității noastre! Dorim să sărbătorim alături de voi, așa că avem 2 anunțuri de făcut!

1️⃣ Vom reduce fee-ul la 5%

2️⃣ Anunțăm lansarea token-ului DISRUPTIVE-c20f7c

1/ 👇

1️⃣ Vom reduce fee-ul la 5% pentru ambele Smart Contracts Disruptive până la sfârșitul lunii mai:

💙Disruptive Digital

💙Disruptive Unlimited

Acest lucru va crește #APR al agenției!🥳 O veste importantă pentru delegatorii noștri!

2/ 👇

💙Disruptive Digital

💙Disruptive Unlimited

Acest lucru va crește #APR al agenției!🥳 O veste importantă pentru delegatorii noștri!

2/ 👇

2️⃣ Anunțăm lansarea token-ului DISRUPTIVE-c20f7c

Distribuit în special comunității Disruptive Digital & Kryptodots, ca incentivare cu anumite condiții.

Prima utilitate: achiziția de produse și servicii pe kryptodots.com & ulterior pe site-urile partenere.

3/ 👇

Distribuit în special comunității Disruptive Digital & Kryptodots, ca incentivare cu anumite condiții.

Prima utilitate: achiziția de produse și servicii pe kryptodots.com & ulterior pe site-urile partenere.

3/ 👇

HAPPY BIRTHDAY, DISRUPTIVE DIGITAL!🥳

#2 years of continuous growing, learning, finding solutions & expanding our beloved community!

We want to celebrate this achievement with you, so we have #2 announcements!

1️⃣ We reduce fee to 5%!

2️⃣ We launch DISRUPTIVE-c20f7c token!

1/👇

#2 years of continuous growing, learning, finding solutions & expanding our beloved community!

We want to celebrate this achievement with you, so we have #2 announcements!

1️⃣ We reduce fee to 5%!

2️⃣ We launch DISRUPTIVE-c20f7c token!

1/👇

1️⃣ We will reduce the fee to 5% for both Disruptive Smart Contracts until the end of May for:

💙Disruptive Digital

💙Disruptive Unlimited

This will increase the agency's #APR!🥳

2/ 👇

💙Disruptive Digital

💙Disruptive Unlimited

This will increase the agency's #APR!🥳

2/ 👇

2️⃣ We announce the launching of the DISRUPTIVE-c20f7c token!

Distributed especially to the Disruptive Digital & Kryptodots community, as an incentive with certain conditions.

First utility: acquisition of products on kryptodots.com & later on other websites.

3/ 👇

Distributed especially to the Disruptive Digital & Kryptodots community, as an incentive with certain conditions.

First utility: acquisition of products on kryptodots.com & later on other websites.

3/ 👇

Splitting ("refracting") your #LUNA into #yLUNA and #pLUNA can currently earn you the highest attainable #LUNA yield in the @terra_money ecosystem 👀

That is, if you know what to do 💡

A quick 🧵 on how to maximize your #LUNA #ROI on @prism_protocol 🔥

That is, if you know what to do 💡

A quick 🧵 on how to maximize your #LUNA #ROI on @prism_protocol 🔥

1/ First step: Refract your #LUNA (see above). You now own an identical amount of #yLUNA and #pLUNA.

These tokens can always be merged back together to form a full #LUNA (well, #cLUNA, which has to unbond back to #LUNA for 21-24 days, like #bLUNA - but you get the point!)

These tokens can always be merged back together to form a full #LUNA (well, #cLUNA, which has to unbond back to #LUNA for 21-24 days, like #bLUNA - but you get the point!)

2/ #yLUNA is #LUNA's yield component. Therefore, it can be staked, just like regular #LUNA. You can attain the "normal" staking yield in @prism_protocol's "stake" tab.

#Airdrops are automatically claimed by the protocol, further simplyfing your UX.

#Airdrops are automatically claimed by the protocol, further simplyfing your UX.

1./ $LUNA is one of the best yielding assets. I honestly don't care about the price. I take profit from the yield I make. Not from selling $LUNA. Partially compounding, partially cashing. $LUNA is my life time passive income.

A thread on how to make $LUNA yield 🧵

A thread on how to make $LUNA yield 🧵

2./ In the past year many protocols launched on @terra_money. For almost all projects $LUNA and $UST are the most important assets and especially for $LUNA many of them made a derivative. We have $nLUNA, $bLUNA, $LUNAx and so on... I'll try to cover all of them one by one.

3./ First: $bLUNA

$bLUNA was the first $LUNA use case and still is very popular. Bond your $LUNA, receive $bLUNA use it as collateral and borrow $UST. With this $UST you can do whatever you want. All of this is made possible by @anchor_protocol

$bLUNA was the first $LUNA use case and still is very popular. Bond your $LUNA, receive $bLUNA use it as collateral and borrow $UST. With this $UST you can do whatever you want. All of this is made possible by @anchor_protocol

Plan de diversificación en #Stables, toma 4 🎞️

🥅 Red: #WAVES

⏳Tiempo de uso: Semanas

💵Monedas: #USDC #USDT

- Actualización -

🥅 Red: #WAVES

⏳Tiempo de uso: Semanas

💵Monedas: #USDC #USDT

- Actualización -

Antes de empezar, un par de aclaraciones:

🟢 #Vires viene rindiendo entre un 14 y 28 % (APY) anual en USDT y USDC, más el #APR -

🔵 Lo que subo, lo pruebo antes, por ej acá tengo metido 2 tías y un primo dentro del pool que si los pierdo no me afecta -

🟣 Siempre #DYOR y #NFA

🟢 #Vires viene rindiendo entre un 14 y 28 % (APY) anual en USDT y USDC, más el #APR -

🔵 Lo que subo, lo pruebo antes, por ej acá tengo metido 2 tías y un primo dentro del pool que si los pierdo no me afecta -

🟣 Siempre #DYOR y #NFA

1⃣ Para ir a #WAVES, primero tenemos 3 formas de registro, la más fácil es mediante e-mail o sino instalando la billetera de "Waves Keeper" y asociarla (Dejo link)

waves.exchange/sign-in/

waves.exchange/sign-in/

Plan de diversificación en #Stables, toma 3 🎞️

🥅 Red: #Polygon

⏳Tiempo de uso: Semanas

💵Monedas: #DAI

🫂 Créditos: @diego_defi

#DPP #DEFI @definovato @MakerGrowth

🥅 Red: #Polygon

⏳Tiempo de uso: Semanas

💵Monedas: #DAI

🫂 Créditos: @diego_defi

#DPP #DEFI @definovato @MakerGrowth

📝Arrancamos con la idea de que todos tienen #Metamask instalado, con la red #Polygon anexada desde chainlist.org

1) Vamos a polygon.curve.fi/pools

2) Buscamos el #Pool de am3CRV, que es este 👇

1) Vamos a polygon.curve.fi/pools

2) Buscamos el #Pool de am3CRV, que es este 👇

Weekly Wednesday - DAO Investment Summary

Each Wednesday, I'll post a thread with a table summarizing the weekly gains from my daily summaries for @Reaper_Farm / @tombfinance, @HectorDAO_HEC, @nemesis_dao, @Wonderland_fi. Will also update on any news that's happened the week.

Each Wednesday, I'll post a thread with a table summarizing the weekly gains from my daily summaries for @Reaper_Farm / @tombfinance, @HectorDAO_HEC, @nemesis_dao, @Wonderland_fi. Will also update on any news that's happened the week.

2/ It's interesting to see how the #DAOs are all figuring out how to survive. Most #DAOs have seen a 90%+ decline in price last month. As I mentioned in last week's thread, they are a great way to raise funds quickly: . Now we will see those in action

3/ @tombfinance has seen the best returns so far, although I'm still down overall. $TShare price is fluctuating, but the #APR is adjusting beneficially when the price is low. Using @Reaper_Farm has been seamless and I've been happy so far.

New financial thread about $PROTO and $ELCT value!

In just 2days we have collected almost 250k for the Fission that will give the possibility to $ELCT stakers to earn $DAI.

By assuming to use a minimum of 100k$ for the first 3days of #Fission protocol this means that...

In just 2days we have collected almost 250k for the Fission that will give the possibility to $ELCT stakers to earn $DAI.

By assuming to use a minimum of 100k$ for the first 3days of #Fission protocol this means that...

The value of Electron can be calculated as below and consequently the $proto value, as you need $proto to get $ELCT.

Tomorrow there will be less than 2M ELCT in circulation but let's assume they are 2M for semplicity in making our calculations.

This means you will get...

Tomorrow there will be less than 2M ELCT in circulation but let's assume they are 2M for semplicity in making our calculations.

This means you will get...

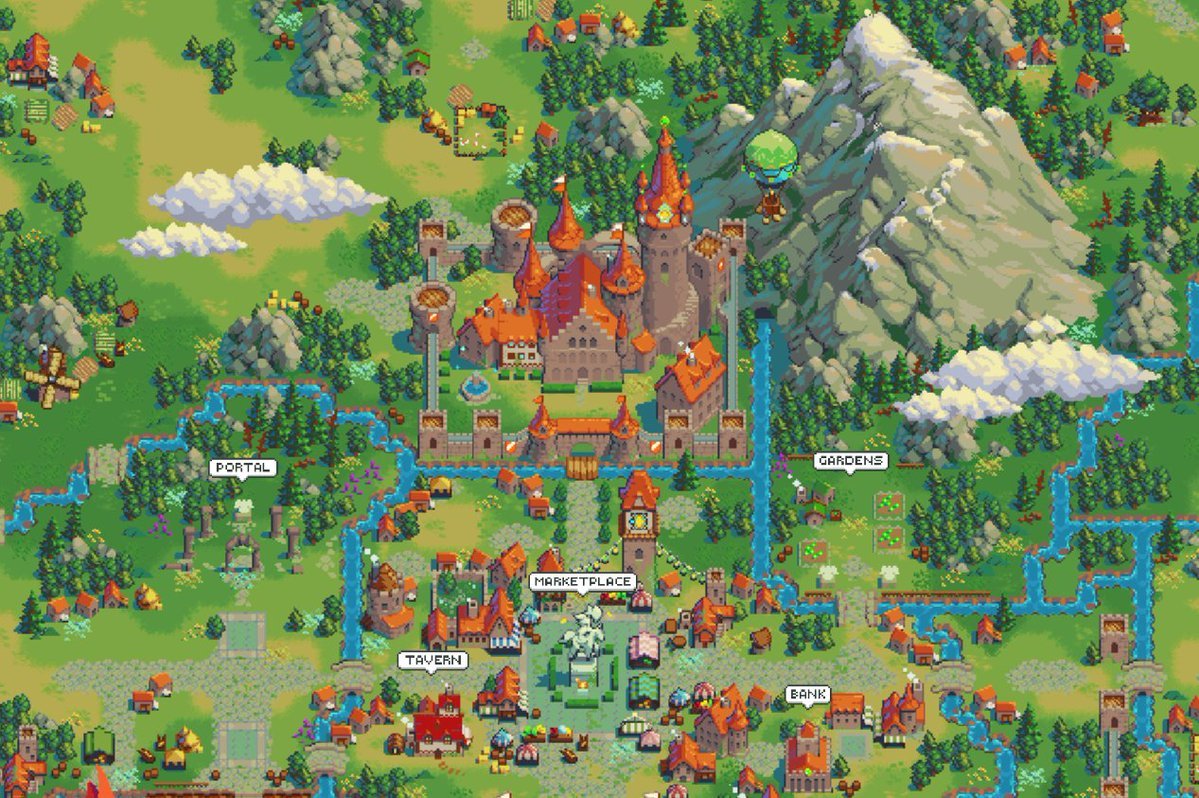

1/24) @AuroryProject is a turn-based tactical RPG #game that is being developed in the @solana #Blockchain.

Aurory’s Team goal is to set the standard for the #playtoearn games by creating innovative and attractive gameplay that also cultivates the virtual ingame #economies.

Aurory’s Team goal is to set the standard for the #playtoearn games by creating innovative and attractive gameplay that also cultivates the virtual ingame #economies.

2) There was some hype when we made this analysis.

We know these times are though and nobody likes a sea of red, although we never get distracted by the sentiment and instead keep doing our #duediligence on quality #crypto projects such as the one we are about to cover⬇️

We know these times are though and nobody likes a sea of red, although we never get distracted by the sentiment and instead keep doing our #duediligence on quality #crypto projects such as the one we are about to cover⬇️

As you can imagine we barely scratch the surface in this thread, if you want to read the full analysis please refer to our medium article:

medium.com/@daolecticrese…

medium.com/@daolecticrese…

[THREAD DEFI] L’IMPERMANENT LOSS (IL) 👨🌾

Tu dois te dire : il nous saoul le collègue avec son franglais dégueulasse et puis c’est quoi encore cette carabistouille qu’est l’IL ?

Mon jeune ami ne t’arrête pas à cela et partons découvrir ensemble ce point essentiel de la #DeFi !

Tu dois te dire : il nous saoul le collègue avec son franglais dégueulasse et puis c’est quoi encore cette carabistouille qu’est l’IL ?

Mon jeune ami ne t’arrête pas à cela et partons découvrir ensemble ce point essentiel de la #DeFi !

👉L’impermanent loss un point technique fondamental pour un farmeur ?

En effet, tous bon farmeur un minimum expérimenté sait que l’IL est un point à ne pas négliger dans son choix de stratégie et de #farm pour tirer la meilleure performance possible ! 🚜

En effet, tous bon farmeur un minimum expérimenté sait que l’IL est un point à ne pas négliger dans son choix de stratégie et de #farm pour tirer la meilleure performance possible ! 🚜

[#Thread] Après plusieurs jours d'expérimentation, c'est avec beaucoup de plaisir que je vous présente le projet @DefiKingdoms

Le coupable ? @DocMarmott

A cause de lui, j'ai été obligé de faire de la #DeFi, du staking, yield farming et #PlayToEarn... Voyons ça de plus près ⬇️

Le coupable ? @DocMarmott

A cause de lui, j'ai été obligé de faire de la #DeFi, du staking, yield farming et #PlayToEarn... Voyons ça de plus près ⬇️

J'en profite également pour faire une petite expérimentation.

Ce #thread sera donc considéré comme un #guide ultime et complet autour du #PlaytoEarn @DefiKingdoms.

Je pense même en faire un deuxième thread qui serait plus orienté suite à mes tests, résultats et avis. Let's go !

Ce #thread sera donc considéré comme un #guide ultime et complet autour du #PlaytoEarn @DefiKingdoms.

Je pense même en faire un deuxième thread qui serait plus orienté suite à mes tests, résultats et avis. Let's go !

@DefiKingdoms (DFK), c’est quoi exactement

DFK pour les intimes, c’est l’union d’un #PlaytoEarn et de la #DeFi.

Accessible sur la blockchain @harmonyprotocol ( $ONE ), c’est le mélange d’un jeu-vidéo et d’un DEX #crypto dans lequel de nombreuses interactions sont possibles.

DFK pour les intimes, c’est l’union d’un #PlaytoEarn et de la #DeFi.

Accessible sur la blockchain @harmonyprotocol ( $ONE ), c’est le mélange d’un jeu-vidéo et d’un DEX #crypto dans lequel de nombreuses interactions sont possibles.

Bueno, sale hilo de @GeistFinance para sumar mas herramientas en la red de la joya #Fantom

#Geist es un protocolo de mercado de liquidez descentralizado sin custodia donde se puede participar como depositante o prestatario.

1/14

#Geist es un protocolo de mercado de liquidez descentralizado sin custodia donde se puede participar como depositante o prestatario.

1/14

Los depositantes dan liquidez al mercado para obtener un ingreso pasivo, mientras que los prestatarios pueden pedir prestado en forma sobre-colateralizada (perpetuamente) o sub-colateralizada (liquidez de un bloque).

2/14

2/14

@GeistFinance es un mercado de lending and borrowing en #Fantom basado en uno de los protocolos #DeFi más grandes, #AAVE ha crecido hasta convertirse en uno de los protocolos más respetados y seguros en el espacio, pero #Geist quiere hacer las cosas de manera diferente.

3/14

3/14

[🧶THREAD] #APR #APY | Depuis 2020, la #DeFi explose et propose aujourd’hui une diversité incroyable d’apps et de blockchains. Le #farming, alternative #crypto au livret bancaire, s'est vite popularisé grâce à ses rendements élevés. Mais quelle différence entre APY et APR ?👇

Avant de commencer, il est important de comprendre deux termes financiers : le #principal - il s’agit du montant investi sur lequel tes intérêts sont calculés - et les #intérêts - soit la rémunération touchée en contre partie de ton placement sur une durée donnée. [2/10]

Si tu as déjà interagi avec un #SmartContract de type #StakingPool ou #LiquidityProviding tu as forcément déjà croisé les termes #APR / #APY qui permettent de te faire une idée de ton ROI potentiel avant investissement. [3/10]

1./ What if all stable coins on #Ethereum will be converted into $UST? Is that bullish? What would this mean for $LUNA?

I think this is possible. The only thing we need is a collaboration between @orion_money and @prism_protocol.

Let me explain what I'm thinking about:

I think this is possible. The only thing we need is a collaboration between @orion_money and @prism_protocol.

Let me explain what I'm thinking about:

2./ As we all know by now @prism_protocol is planning to split tokens into yield bearing tokens and principal tokens. Also stable coins. We also know @orion_money is giving the best APR's on $DAI, $USDT, $USDC, $FRAX and $BUSD by making use of @anchor_protocol.

3./ Not even to mention the APR's @orion_money will provide when their token $ORION launches.

Behind the scenes those stables are converted to $UST to receive this #APR. But what if we let @prism_protocol join the party?

Behind the scenes those stables are converted to $UST to receive this #APR. But what if we let @prism_protocol join the party?

1. En cette période de commémoration, je voudrais parler de Rose, une grande dame pour laquelle je veux tenir nos mémoires en éveil. Sa vie a basculé entre le 22/04 et le 17/06/1994. Chaque jour jusqu'au 17/06, je vais vous parler de celle qu'elle fut #laVieDeRose #Rwanda #RwOT🇷🇼

2. Comme toute chronique, l’itinéraire de vie que je vais vous raconter est divisé en plusieurs périodes. L'histoire de Rose suit le calendrier de l'Histoire de son pays natal, le Rwanda : avant 1959, entre 1959 et 1994, entre avril et juillet 1994 et après 1994. #laVieDeRose

3. Elle s’appelait donc Rose, et elle était aussi belle que la reine des fleurs. Comme ne tarderait pas à le démontrer son parcours accidenté de jeune fille, de femme, de mère puis de veuve, Rose appartenait à la version la plus résistante de l’arbuste dont elle porte le nom.