Discover and read the best of Twitter Threads about #compound

Most recents (23)

2/

About 12 hours ago, whale"0x3356" created a new address to deposit 52.5M $USDC and borrowed 40M $USDT on #Aave and #Compound.

Then he started depositing 40M $USDT into #Coinbase and #Kraken 6 hours ago.

About 12 hours ago, whale"0x3356" created a new address to deposit 52.5M $USDC and borrowed 40M $USDT on #Aave and #Compound.

Then he started depositing 40M $USDT into #Coinbase and #Kraken 6 hours ago.

3/

$USDT started depegging after whale"0x3356" deposited $USDT to exchanges.

And whale"0x3356" withdrew 25M $USDC from #Coinbase 4 hours after depositing $USDT.

etherscan.io/address/0x3356…

$USDT started depegging after whale"0x3356" deposited $USDT to exchanges.

And whale"0x3356" withdrew 25M $USDC from #Coinbase 4 hours after depositing $USDT.

etherscan.io/address/0x3356…

Share a SmartMoney who made more than $10M in 2 years.

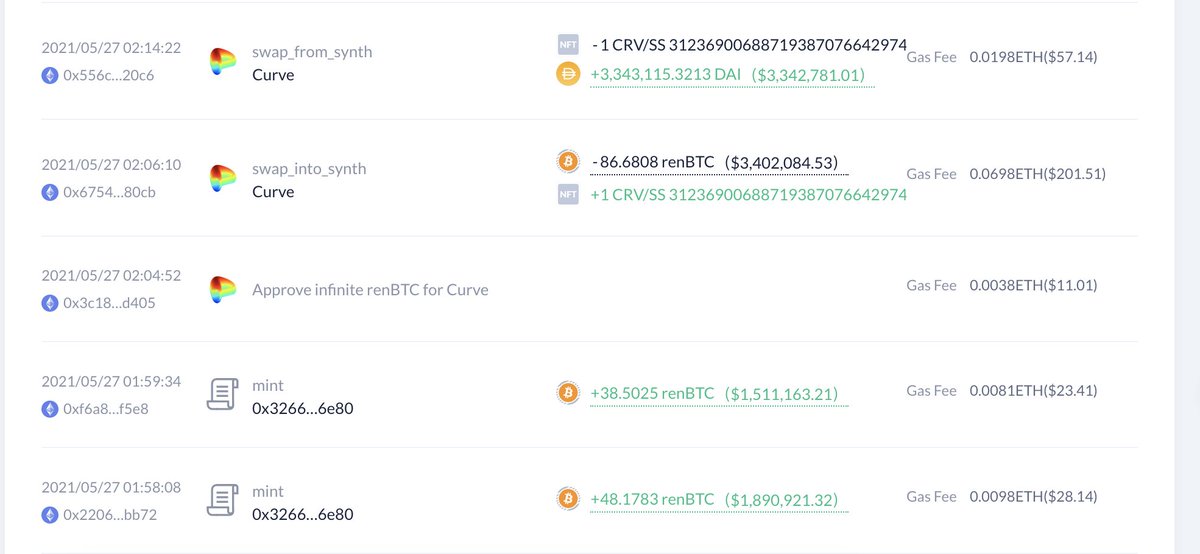

His cost is 2,675 $ETH ($1.6M) and 86.68 $BTC ($3.4M).

Now he holds 3,503 $ETH ($5.27M), 100 $WBTC ($2.08M) and 8,046,825 $DAI.

1.

Let's see how he makes money.👇

debank.com/profile/0xd68b…

His cost is 2,675 $ETH ($1.6M) and 86.68 $BTC ($3.4M).

Now he holds 3,503 $ETH ($5.27M), 100 $WBTC ($2.08M) and 8,046,825 $DAI.

1.

Let's see how he makes money.👇

debank.com/profile/0xd68b…

2.

The SmartMoney received 2,675 $ETH ($1.6 million) on November 15, 2020, when the price of $ETH was $605.

Sold 2,670 $ETH for 7.77M $DAI on May 2, 2021 at a price of $2,910.

Then deposit 7M $DAI into #Compound to earn interest.

The SmartMoney received 2,675 $ETH ($1.6 million) on November 15, 2020, when the price of $ETH was $605.

Sold 2,670 $ETH for 7.77M $DAI on May 2, 2021 at a price of $2,910.

Then deposit 7M $DAI into #Compound to earn interest.

The relationship between the #EthereumMerge and #DeFi is a fascinating case study for a changing economic ecosystem.💎

And @variantfund's Twitter Space dove deep into how the #merge affects #DeFi.✨

Here is the summarized version:👇

And @variantfund's Twitter Space dove deep into how the #merge affects #DeFi.✨

Here is the summarized version:👇

The space was conducted by @variantfund and @eulerfinance.⚡

@spencernoon, @gham1lt0n and @Derekmw23 represented Variant.💰

@MacroMate8, or Seraphim, the head of risk at Euler, was the Euler side's representative.👑

@spencernoon, @gham1lt0n and @Derekmw23 represented Variant.💰

@MacroMate8, or Seraphim, the head of risk at Euler, was the Euler side's representative.👑

@variantfund @eulerfinance @spencernoon @gham1lt0n @Derekmw23 @MacroMate8 @MacroMate8 first laid out what the long-term focus of @eulerfinance would be.👀

Euler will focus more on #Oracle technology to improve smart contracts.💎

This is why the #Euler team has added @chainlink support to the ecosystem.🤝

Euler will focus more on #Oracle technology to improve smart contracts.💎

This is why the #Euler team has added @chainlink support to the ecosystem.🤝

Amazing new paper of my (former) PhD student Friedrich Burger (now postdoc), co-authored by @JensTerhaar and @froeltho on compound #marineheatwaves and ocean acidity extremes. A thread (1/n)

ift.tt/8tyFCDp

ift.tt/8tyFCDp

#Compound events in two or more ecosystem stressors are considered as a major concern for marine life. This study quantifies the frequency of compound MHW-OAX events, during which marine heatwaves (MHWs) co-occur with ocean acidity extremes (OAX) (i.e., extremely high [H+]).(2/n)

#reflexivity between #bubbles vs #antibubbles once again distorting markets

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

1) Embrace #volatiltiy. Don’t fight it.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

4) Seek #Emotional indifference. If your trading makes you overly happy or sad, you are trading too big.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

Weekly Summary - May 4th

Here's another weekly summary for all of my investments. Week-over-week has seem some nasty returns over the last few weeks with this market, but hopefully we'll see a turnaround and some pumps now that we're in May. Check it out!

🧵👇

Here's another weekly summary for all of my investments. Week-over-week has seem some nasty returns over the last few weeks with this market, but hopefully we'll see a turnaround and some pumps now that we're in May. Check it out!

🧵👇

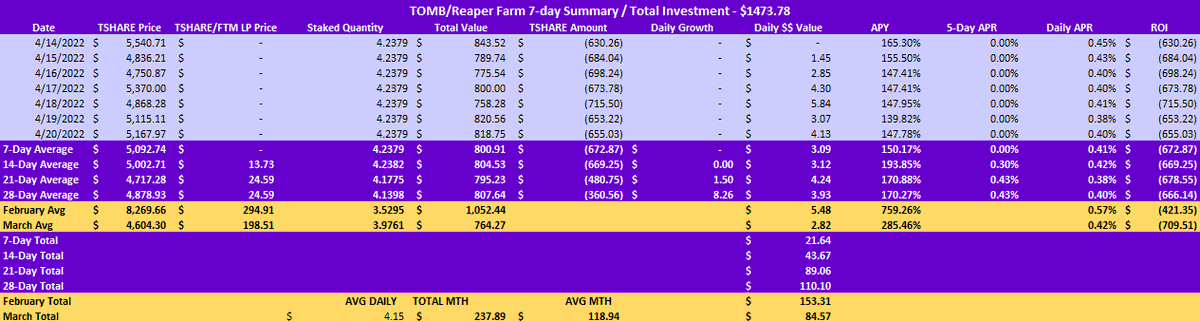

2/ First is @tombfinance and the returns on $Tshare / $FTM LP. There's A LOT going on with the $Tomb. The LP APR and $Tshare price declined a lot last month, but there is a lot of utility being released this month. April's total however saw an increase from March, so good news!

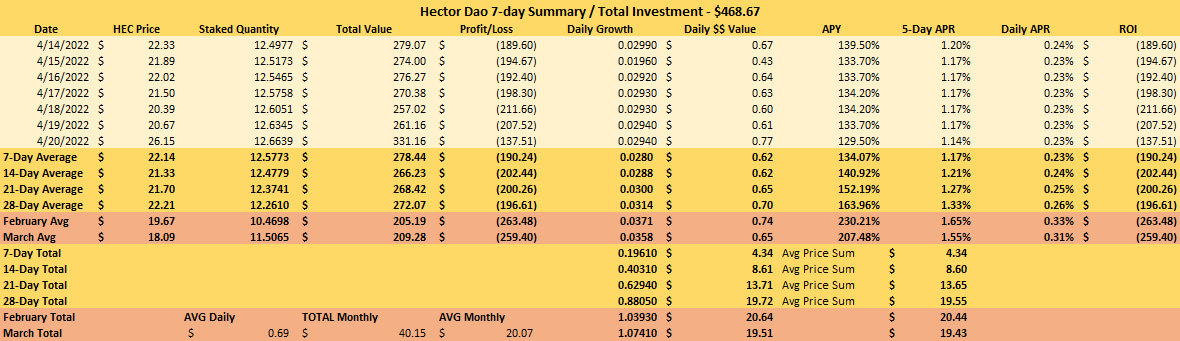

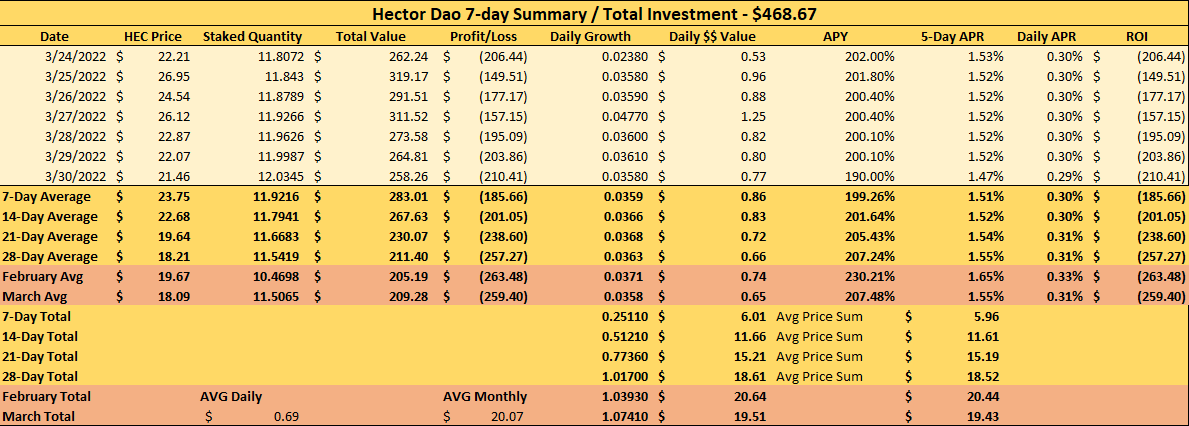

3/ @HectorDAO_HEC continues to be boring, which worked quite well for them during the downtrend. Price is relatively stable. The team is really investing a LOT in the market downturn, which will pay dividends nicely in an upturn. I'm liking how the team is building and investing.

Weekly Update - Happy 4/20!

Hope you all enjoyed your brownies yesterday. Per usual, here's our weekly thread for the data that came in. Some good, some ugly, no rugs <-- that's always a win. Here we go, enjoy!

🧵👇

Hope you all enjoyed your brownies yesterday. Per usual, here's our weekly thread for the data that came in. Some good, some ugly, no rugs <-- that's always a win. Here we go, enjoy!

🧵👇

2/ First for @tombfinance. $Tomb has seen some prints in the last week, so slowly adding my $Tshare and letting it sit. I really miss using @Reaper_Farm to grow my LP position, but ultimately I want to accumulate $Tomb and then add it to the $Tomb / $MAI LP Pool.

3/ Next we have @HectorDAO_HEC, where $Hec is seeing healthy and steady growth. The protocol has it's legs under it after rebranding and now starting to see life. APY is still pretty decent considering, as long as the price holds/grows.

Day 1 after EU Crypto Catastrophe:

A post-mortem & How to win the war!

Yesterdays battle for EU crypto, for privacy, for Web3 & for DEFI was lost.

It left big & bleeding wound. Few won, only winner was FUD

Future of EU crypto will be determined by what we do now...

A 🧵

A post-mortem & How to win the war!

Yesterdays battle for EU crypto, for privacy, for Web3 & for DEFI was lost.

It left big & bleeding wound. Few won, only winner was FUD

Future of EU crypto will be determined by what we do now...

A 🧵

The spill-over from this EU crypto crisis on other jurisdictions will harm all. We needs to stand together.

Save Web3, Defi, DAOs, Metaverse & everything crypto by countering this sneak-attack on privacy & freedom to transact

Let’s quickly look at status quo & what happened:

Save Web3, Defi, DAOs, Metaverse & everything crypto by countering this sneak-attack on privacy & freedom to transact

Let’s quickly look at status quo & what happened:

Weekly Progress Update!

Here we go again for another round of weekly summaries for @tombfinance; @HectorDAO_HEC; @nemesis_dao; @osmosiszone; @ThorNodes; @VaporNodes; & @AngelNodes.

Trudging along with building an empire, glad to have you witness the journey!

🧵👇

Here we go again for another round of weekly summaries for @tombfinance; @HectorDAO_HEC; @nemesis_dao; @osmosiszone; @ThorNodes; @VaporNodes; & @AngelNodes.

Trudging along with building an empire, glad to have you witness the journey!

🧵👇

2/ First as always is @tombfinance, investing in $TShare / $FTM LP. This month I transferred back to #TombSwap so I can take advantage of the inevitable $Tomb printing run, once $FTM goes on price recovery. Will then dump earned $Tomb into the $Tomb / $MAI LP. Daily $$ is $4.15

3/ Next is @HectorDAO_HEC, which is slow and steady. Price floored in March and has seen a steady upper and lower threshold. Will be waiting for a long time for this to do something, but I'm not going anywhere. Currently, daily $$ is $.69

@Ronin_Network is now on the top of crypto hack leaderboard at 625M. The new emerging narrative is bridges but it will take some time and pain until we get it right. Let's look at bridge tech and different designs. MEGA THREAD! 🧵👇

$ETH $SOL $AVAX $DOT $LINK $STG

$ETH $SOL $AVAX $DOT $LINK $STG

1/Blockchain bridges work just as bridges in a physical world just instead of connecting two physical locations they connect two blockchains. Bridges facilitate communication between blockchains through the transfer of information and assets.

2/Interoperability drives innovation. More specifically:

- Greater productivity and utility for existing cryptoassets

- Greater product capabilities for existing protocols

- Unlocking new features and use cases for users and developers

- Greater productivity and utility for existing cryptoassets

- Greater product capabilities for existing protocols

- Unlocking new features and use cases for users and developers

Weekly Summary - March 23

It's that time of the week again for weekly summary of gains/losses for the following projects:

@tombfinance @HectorDAO_HEC @nemesis_dao @osmosiszone @AngelNodes @ThorNodes @VaporNodes

Take a look below and tell me what you think.

🧵👇

It's that time of the week again for weekly summary of gains/losses for the following projects:

@tombfinance @HectorDAO_HEC @nemesis_dao @osmosiszone @AngelNodes @ThorNodes @VaporNodes

Take a look below and tell me what you think.

🧵👇

2/ @tombfinance and $TShare had a tough week, continuing a decline. This is mainly due to $FTM dumping. But I'm anticipating a long period where $Tomb will start printing. So moved my $TShare / $FTM LP over to #Tomb so I can print #TShare. Will move $Tomb into new $Tomb / $MAI LP

3/ @HectorDAO_HEC came out of nowhere this week with some good price action. #HECTEAM implemented a $15K+ OTC treasury direct sell feature that will really help the price dumps. Will see if the momentum continues.

4-Week Summary on daily tracking. Have good data now for 1,2,3, and 4 weeks now. Also added tracking for the #NodeLife investments. Data from last week is not perfect since I was in Dubai, but extracted decent averages so numbers are fairly accurate.

🧵👇

🧵👇

2/ First is @tombfinance, staking through @Reaper_Farm. Considering I bought $Tshare at ATH, the LP staking has seen the most consistent APY and returns so far. Still down, but the LP amount is growing, which is all I care about for the first few months.

3/ Next is @HectorDAO_HEC. Price has seen a hit the last month but is stable now. They cut the APR a lot and released a lot of #DEFI utility. I have no idea how this will affect the price of $HEC, but the last month has only produced ~$20 in value. Might exit once even.

1/ I just read #KuCoin's 2021 Annual Report and 2022 Forecast on the Crypto Industry.

Here are my key takeaways, a thread. 🧵

Lets go! 👇👇👇

#DeFI / #NFT / #DAO / #Stablescoins / #Memecoins / #Risks

Here are my key takeaways, a thread. 🧵

Lets go! 👇👇👇

#DeFI / #NFT / #DAO / #Stablescoins / #Memecoins / #Risks

2/ #BTC and #ETH remain the undisputed market leaders.

🔸BTC was the best performing major asset in 2021

🔹ETH has also been gaining traction as a store of value

ETH becoming deflationary is a big change (pictured).

More on ETH next 👇

🔸BTC was the best performing major asset in 2021

🔹ETH has also been gaining traction as a store of value

ETH becoming deflationary is a big change (pictured).

More on ETH next 👇

3/ #ETH Gas Fees

ETH network occupancy rate was over 98% in 2021 (pictured)!

This is close to its resource critical point leading to high gas fees / the scaling problem.

#DeFI ecosystem is limited by the performance of ETH.

ETH2.0 is expected in 2022. Next, #shitcoins 👇

ETH network occupancy rate was over 98% in 2021 (pictured)!

This is close to its resource critical point leading to high gas fees / the scaling problem.

#DeFI ecosystem is limited by the performance of ETH.

ETH2.0 is expected in 2022. Next, #shitcoins 👇

New financial thread about $PROTO and $ELCT value!

In just 2days we have collected almost 250k for the Fission that will give the possibility to $ELCT stakers to earn $DAI.

By assuming to use a minimum of 100k$ for the first 3days of #Fission protocol this means that...

In just 2days we have collected almost 250k for the Fission that will give the possibility to $ELCT stakers to earn $DAI.

By assuming to use a minimum of 100k$ for the first 3days of #Fission protocol this means that...

The value of Electron can be calculated as below and consequently the $proto value, as you need $proto to get $ELCT.

Tomorrow there will be less than 2M ELCT in circulation but let's assume they are 2M for semplicity in making our calculations.

This means you will get...

Tomorrow there will be less than 2M ELCT in circulation but let's assume they are 2M for semplicity in making our calculations.

This means you will get...

1/ Introduction au Yield Farming :

Le #YieldFarming est le processus qui consiste à placer vos cryptomonnaies pour en gagner davantage sous forme de revenu passif.

Cela permet de profiter de l'augmentation des prix tout en ayant un rendement par dessus.

Le #YieldFarming est le processus qui consiste à placer vos cryptomonnaies pour en gagner davantage sous forme de revenu passif.

Cela permet de profiter de l'augmentation des prix tout en ayant un rendement par dessus.

2/Ce rendement est exprimé par l'un de ces deux termes :

- APR : Taux de rendement annuel perçu à la fin de la période

- APY : Taux annuel calculé dans le cas où les intérêts cumulés pendant la période sont réinvestis.

On a donc APY>APR

- APR : Taux de rendement annuel perçu à la fin de la période

- APY : Taux annuel calculé dans le cas où les intérêts cumulés pendant la période sont réinvestis.

On a donc APY>APR

3/ Mais que se passe-t-il en arrière-plan et d'où vient le rendement ?

Passons en revue brièvement le #YieldFarming.

Passons en revue brièvement le #YieldFarming.

1/ Introduction à la #DeFi : Partie 1

En parallèle de l’ascension fulgurante des prix des cryptos, une réelle économie est entrain d’émerger.

La technologie sur laquelle se base cette dernière a le pouvoir de perturber beaucoup d’industries dans les mois/années futures.

En parallèle de l’ascension fulgurante des prix des cryptos, une réelle économie est entrain d’émerger.

La technologie sur laquelle se base cette dernière a le pouvoir de perturber beaucoup d’industries dans les mois/années futures.

2/ Parlons DeFi ! 1/2

La #DeFi ou finance décentralisée est l’un des secteurs de cette économie où il y'a les innovations les plus importantes.

C'est un projet qui vise à créer un nouveau système financier ouvert à tous et ne nécessitant pas d'intermédiaires comme les banques.

La #DeFi ou finance décentralisée est l’un des secteurs de cette économie où il y'a les innovations les plus importantes.

C'est un projet qui vise à créer un nouveau système financier ouvert à tous et ne nécessitant pas d'intermédiaires comme les banques.

3/ Parlons DeFi ! 2/2

Pour y parvenir, la #DeFi repose fortement sur la cryptographie, la blockchain et les smart contracts.

Pour y parvenir, la #DeFi repose fortement sur la cryptographie, la blockchain et les smart contracts.

1️⃣ #defi platformu #Compound kodlamasında ki sadece bir harf kaynaklı hatası ile kullanıcılara 80 Milyon$ değerinde token talep etmesine neden oldu.

Gelin bu teknik hataya bakalım ⬇️

Gelin bu teknik hataya bakalım ⬇️

2️⃣ Compound, kullanıcıların, kripto paralarını platformun desteklediği çok sayıda havuzdan birine yatırarak faiz kazanmalarına olanak sağlayan bir DeFi kredi protokolüdür.

Bir kullanıcı, tokenlerini bir Compound havuzuna yatırdığında karşılık olarak cToken alır.

Bir kullanıcı, tokenlerini bir Compound havuzuna yatırdığında karşılık olarak cToken alır.

3️⃣Örneğin bir havuza ETH yatırdığınızda karşılık olarak cETH alırsınız. cToken'lerin asıl varlığa takas oranı zamanla artıyor. Bu sayede onlarla, başta koyduğunuzdan daha fazla miktarda esas varlığı geri alabilirsiniz. Faiz, bu şekilde dağıtılıyor.

Kurucusu ve ceosu @rleshner

Kurucusu ve ceosu @rleshner

✅ मध्यमवर्गीयांसाठी #INSURANCE + #RETURN अशी विमा योजना खरच फायदेशीर आहे का ? आणि एक मध्यमवर्गीय माणूस आयुष्यभर पैसे कमवून पण श्रीमंत का होत नाही त्याचे उत्तर 👇

मस्त एक चहा घ्या आणि वाचा #Thread थोडा मोठा आहे

#Thread

मस्त एक चहा घ्या आणि वाचा #Thread थोडा मोठा आहे

#Thread

2) खूप लोक विचारात होते की लाइफ insurance कोणता घेतला पाहिजे आणि का त्या सर्वांसाठी हा खूप महत्वाचा #Thread

जर मध्यमवर्गीय वर्गाने Insurance ( विमा योजना ) मध्ये गुंतवणूक करण्याऐवजी वेगळा(Seprate) जीवन विमा(Term Insurance) घेऊन उर्वरित रक्कम चांगल्या गुंतवणुकीच्या

जर मध्यमवर्गीय वर्गाने Insurance ( विमा योजना ) मध्ये गुंतवणूक करण्याऐवजी वेगळा(Seprate) जीवन विमा(Term Insurance) घेऊन उर्वरित रक्कम चांगल्या गुंतवणुकीच्या

3)पर्यायामध्ये गुंतवली तर त्याला कसा फायदा होऊ शकतो ते आपण पाहू .

एका चांगल्या नावाजलेल्या Insurance कंपनी कडून Mr. Kiran यांना काल एक फोन आला . त्यामध्ये एक चांगला व्यक्ती जो कि Senior Sales Manager आहे तो किरण यांना insurance बद्दल माहिती देत होता तसा तो बोलताना खुप अनुभवी

एका चांगल्या नावाजलेल्या Insurance कंपनी कडून Mr. Kiran यांना काल एक फोन आला . त्यामध्ये एक चांगला व्यक्ती जो कि Senior Sales Manager आहे तो किरण यांना insurance बद्दल माहिती देत होता तसा तो बोलताना खुप अनुभवी

#DeFi was battle-tested in last week's dip, that would have sent TradFi into turmoil.

DeFi Pulse Index $DPI gives broad market-cap weighted exposure to blue-chip protocols in the DeFi space.

14 DeFi tokens wrapped into ONE!

Current $DPI allocations 👇 1/16

Video: @earth_maze

DeFi Pulse Index $DPI gives broad market-cap weighted exposure to blue-chip protocols in the DeFi space.

14 DeFi tokens wrapped into ONE!

Current $DPI allocations 👇 1/16

Video: @earth_maze

#رشتو

موضوع: نقش #اثرشبکه در پروژه های #کریپتوکارنسی

وقتی دارید پروژه های کریپتو رو بررسی می کنید، نکته حیاتی رو باید در نظر بگیرید که تا حالا چقدر این پروژه کاربردی بوده؟ چند شرکت، کاربر یا dapp از اون استفاده می کنند، میدونید که از ico های سال ۲۰۱۷ خیلی از پروژه ها مردند.

1

موضوع: نقش #اثرشبکه در پروژه های #کریپتوکارنسی

وقتی دارید پروژه های کریپتو رو بررسی می کنید، نکته حیاتی رو باید در نظر بگیرید که تا حالا چقدر این پروژه کاربردی بوده؟ چند شرکت، کاربر یا dapp از اون استفاده می کنند، میدونید که از ico های سال ۲۰۱۷ خیلی از پروژه ها مردند.

1

صرف یک ایده نمیتونه نشان کاربردی بودن پروژه باشه،کاربرد باعث ایجاد اثرشبکه میشه واثرشبکه محرک رشده، چرا قیمت اتریوم با اینکه مشکل مقیاس پذیری داره درحال رشده، چرا قیمت ایاس و ترون ضعیفتر از رقبا، افزایشی است؟چون کاربران وبرنامه های زیادی دارنداز اونها استفاده می کنند(اثرشبکه)

2

2

بعضی ها می پرسند کار دیفای کی تموم میشه؟ من میگم هیچ وقت، نیاز به کاربردهای دیفای همیشه وجود داره، آیا ممکنه روزی بیاد مردم وام نگیرند یا سپرده گذاری نکنند؟ هرگز، ولی خیلی از پروژه های دیفای هم از بین خواهند رفت مگر اینکه کاربران خود را زیاد کنند.

3

3

(1/15)

#Arweave protocol/network leads the pack in permanent, decentralized, censorship-resistant data storage

Pay once, store forever (~200yrs)

Permanent storing & hosting for NFTs & Web3 apps

Thread 👉

#Arweave protocol/network leads the pack in permanent, decentralized, censorship-resistant data storage

Pay once, store forever (~200yrs)

Permanent storing & hosting for NFTs & Web3 apps

Thread 👉

(2/15)

Arweave Proof-of-Work (PoW) is free from “state bloat,” so less risk to decentralization

How?

Arweave-Solana bridge 👉

arweave.medium.com/introducing-so…

&

medium.com/solana-labs/an…

Arweave Proof-of-Work (PoW) is free from “state bloat,” so less risk to decentralization

How?

Arweave-Solana bridge 👉

arweave.medium.com/introducing-so…

&

medium.com/solana-labs/an…

(3/15)

New use cases:

1. Improved data access

(SPoRA) prevents remote storage on servers like AWS, emphasizing speed of access, but does not prevent pooling:

👉

github.com/ArweaveTeam/ar…

New use cases:

1. Improved data access

(SPoRA) prevents remote storage on servers like AWS, emphasizing speed of access, but does not prevent pooling:

👉

github.com/ArweaveTeam/ar…

1. ♥Ethereum is still the most actively developed Blockchain protocol, followed by #Cardano and #Bitcoin ;

♦Multi-chain protocols like #Polkadot , #Cosmos and #Avalanche are seeing a consistent rise in core development and developer contribution.

♦Multi-chain protocols like #Polkadot , #Cosmos and #Avalanche are seeing a consistent rise in core development and developer contribution.