Discover and read the best of Twitter Threads about #BTFD

Most recents (24)

Stop searching for random tools to identify HOW and WHEN to BUY THE DIP.

In the next 5 minutes I’m going to share this amazing strategy called “BTFD”

Using this you can BUY LOW & SELL HIGH

Click on “Show this thread” to get the strategy 👇

In the next 5 minutes I’m going to share this amazing strategy called “BTFD”

Using this you can BUY LOW & SELL HIGH

Click on “Show this thread” to get the strategy 👇

Hello Tuesday

Have you noticed the now almost daily $VIX pop in the overnight, providing bait 🎣 for vol 🌊 sellers?

Let's dig into the market 🧮!

Have you noticed the now almost daily $VIX pop in the overnight, providing bait 🎣 for vol 🌊 sellers?

Let's dig into the market 🧮!

Asia mostly ↘️

$NIKK 28620 +0.1%

$SSEC 3265 -0.3%

$TWII 15371 -1.65%

$HSI 19618 -1.7%

$KOSPI 2489 -1.35%

$IDX holiday 🕌

Australia ↔️

$ASX 7322 -0.1%

India ↗️

$BSE 60243 +0.3%

$NIKK 28620 +0.1%

$SSEC 3265 -0.3%

$TWII 15371 -1.65%

$HSI 19618 -1.7%

$KOSPI 2489 -1.35%

$IDX holiday 🕌

Australia ↔️

$ASX 7322 -0.1%

India ↗️

$BSE 60243 +0.3%

Europe decidedly ↘️

$DAX 15835 -0.2%

$FTSE 7890 -0.3%

$CAC 7521 -0.7%

$AEX 757 -0.75%

$IBEX 9282 -1.3%

$MIB 27239 -1.1%

$SMI 11489 +0.2% ⬅️

$MOEX 2632 -0.15%

$VSTOXX 17.80 🔺

$DAX range = 15600 - 16129 ♉️

$DAX 15835 -0.2%

$FTSE 7890 -0.3%

$CAC 7521 -0.7%

$AEX 757 -0.75%

$IBEX 9282 -1.3%

$MIB 27239 -1.1%

$SMI 11489 +0.2% ⬅️

$MOEX 2632 -0.15%

$VSTOXX 17.80 🔺

$DAX range = 15600 - 16129 ♉️

COACHING THREAD: In response to the @NickTimiraos article I tweeted, I've had no less than two dozen retail investors tweet at me some version of the following:

"High credit card debt = the household sector balance sheet is not healthy nor is consumer spending resilient".

1/

"High credit card debt = the household sector balance sheet is not healthy nor is consumer spending resilient".

1/

Ignoring the very obvious fact that anchoring on a NON-STATIONARY TIME SERIES like nominal credit card debt should not ever ever ever be used to form the basis of CYCLICAL (read: stationary) determinations, the reason high credit card debt it misses the mark is threefold... 2/

1. The US household sector is FLUSH with checkable Cash on both an absolute ($7.6tn), share-of-total-assets (5%), and share-of-disposable-personal-income (41%) basis.

2. Household debt is low, at only 88% of nominal disposable personal income (vs. 115% pre-GFC)... 3/

2. Household debt is low, at only 88% of nominal disposable personal income (vs. 115% pre-GFC)... 3/

Wiele lat temu, przeglądając historyczne wykresy indeksów w kontekście danych makro, wskaźników koniunktury/nastrojów, stóp%, miejsca w cyklu, nie potrafiłem zrozumieć, jak to możliwe, że przy tak wielu negatywnych sygnałach, inwestorów łapały 50-70% obsunięcia cen #inwestowanie

Od początku 2022 roku postanowiłem poświęcić znacznie więcej czasu na Twittera. Moim zdaniem potrafi on bardzo dużo "powiedzieć" o bieżących emocjach i podejściu do rynku giełdowych graczy. Przecież nasze wpisy to przejaw oceny rynku, ale też oczekiwań, życzeń, a często... marzeń

Co dostrzegłem? Między innymi kłócenie się z rynkiem. Nie ma znaczenia, że mocno spadło, czy ile spadło. Dla wielu inwestorów każdy kolejny spadek, to "zaniżanie przed odpałem", a każda kolejna konsolidacja to "zbieranie, przed mocnym ruchem w górę".

Hello Monday and the resumption of primary trend!

$USD ↗️

$TNX ↗️

$WTIC ↗️

$ES ↘️

$GOLD ↘️

#Bitcoin ↘️

Let's dig into the 🧮!

$USD ↗️

$TNX ↗️

$WTIC ↗️

$ES ↘️

$GOLD ↘️

#Bitcoin ↘️

Let's dig into the 🧮!

Asia, ex-China, ↘️ ↘️

$NIKK 27879 -2.65%

$SSEC 3241 +0.15% ⬅️

$TWII 14926 -2.3%

$HSI 2427 -2.2%

$KOSPI 2427 -2.2%

$IDX 7108 -0.4%

Australia ↘️

$ASX 6955 -1.95%

India ↘️

$BSE 58047 -1.35%

$NIKK 27879 -2.65%

$SSEC 3241 +0.15% ⬅️

$TWII 14926 -2.3%

$HSI 2427 -2.2%

$KOSPI 2427 -2.2%

$IDX 7108 -0.4%

Australia ↘️

$ASX 6955 -1.95%

India ↘️

$BSE 58047 -1.35%

Europe ↘️ at the open

$DAX 12803 -1.3%

$FTSE 7427 -0.7%

$CAC 6192 -1.3%

$AEX 696 -1.3%

$IBEX 7964 -1.25%

$MIB 21691 -0.95%

$SMI 10913 -0.25%

$MOEX 2290 +0.95% ⬅️🪆

$VSTOXX 28.87 🔺

$DAX range = 12758 - 13533 🐻

$DAX 12803 -1.3%

$FTSE 7427 -0.7%

$CAC 6192 -1.3%

$AEX 696 -1.3%

$IBEX 7964 -1.25%

$MIB 21691 -0.95%

$SMI 10913 -0.25%

$MOEX 2290 +0.95% ⬅️🪆

$VSTOXX 28.87 🔺

$DAX range = 12758 - 13533 🐻

1/ What up! 😆✌️ BULLISH #EGLD Market Update T.A. ⚡ @ElrondNetwork - Couple days ago U saw my market update with bearish perspectives, but U know my perma-bull never left! 👉 Balancing perspectives is key! 🔑 Expect downside yet maintain exposure to capture the upside! 🧠🔥🧵

2/ Before we get into it, some key elements to the plan for success: 📝💡

→ Capture the average

→ Make few trades

→ Maintain exposure

Your brain is a muscle, therefore I remind U the importance of muscle memory & that it applies to trading! Train regularly & consistently.

→ Capture the average

→ Make few trades

→ Maintain exposure

Your brain is a muscle, therefore I remind U the importance of muscle memory & that it applies to trading! Train regularly & consistently.

3/ When training 🏋️ it's vital to develop muscle memory with proper technique AND recovery! We must give our muscles the proper time ⌛ and nutrition 🥩🥗🥛🥔 to recover. 😴

In trading 📈 this equates to sitting on sidelines while volatility seeks to suck U in.

In trading 📈 this equates to sitting on sidelines while volatility seeks to suck U in.

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Global Macro Review

5/29/2022

1/9

🐻 market rallies are wicked, like a 🕷 luring the 🪰 into her 🕸

Sentiment surveys do not tell the full story; options pricing does with $SPY IVOL/RVOL at -40 with the ETF +6.6% in 6 days, right into the 😬 of #QT

Global Macro Review

5/29/2022

1/9

🐻 market rallies are wicked, like a 🕷 luring the 🪰 into her 🕸

Sentiment surveys do not tell the full story; options pricing does with $SPY IVOL/RVOL at -40 with the ETF +6.6% in 6 days, right into the 😬 of #QT

1a/9

Indeed, #complacency reigns supreme

But on 6/01, the FOMC will begin to 🎬 the balance sheet by 47.5B per month

💦 is already ↘️ -50B from 4/13/22 high as operation 👊🥣 removal gets under way

Chart: Federal Reserve Balance Sheet 5/25/22

Indeed, #complacency reigns supreme

But on 6/01, the FOMC will begin to 🎬 the balance sheet by 47.5B per month

💦 is already ↘️ -50B from 4/13/22 high as operation 👊🥣 removal gets under way

Chart: Federal Reserve Balance Sheet 5/25/22

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global macro review 4/24/2022

1/11

We got a parade of FOMC members this week, starting with Bullard 🐻 and ending with Powell 💩

Their message was clear - no 👊🥣 for you!

The equity market 🤮, $CRB ↘️, $TNX ↗️, and $USD 🚀

Let’s dig into the 🧮!

Global macro review 4/24/2022

1/11

We got a parade of FOMC members this week, starting with Bullard 🐻 and ending with Powell 💩

Their message was clear - no 👊🥣 for you!

The equity market 🤮, $CRB ↘️, $TNX ↗️, and $USD 🚀

Let’s dig into the 🧮!

THIS WEEK IN SHOPIFY APPS

Vol. 2

Your weekly thread on everything that's happened in Shopify Apps.

What. A. Week. Let’s go! ⬇️

Vol. 2

Your weekly thread on everything that's happened in Shopify Apps.

What. A. Week. Let’s go! ⬇️

Flexytime.

Not everyone dreams of diamond Rolex Datejust watches but it’s still fun to watch people build incredible businesses on top of Shopify + enjoy life. @dennishegsted should get himself a custom @orderbump watch from econde-seconde.com 💦💦

Not everyone dreams of diamond Rolex Datejust watches but it’s still fun to watch people build incredible businesses on top of Shopify + enjoy life. @dennishegsted should get himself a custom @orderbump watch from econde-seconde.com 💦💦

Spotlight.

Getting exposure for your app matters. Getting featured in the app store matters a lot. Congrats goes out to @nomad_maker for being featured for a second time. Her thread includes some tips to get featured. Hint: make friends at Shopify.

Getting exposure for your app matters. Getting featured in the app store matters a lot. Congrats goes out to @nomad_maker for being featured for a second time. Her thread includes some tips to get featured. Hint: make friends at Shopify.

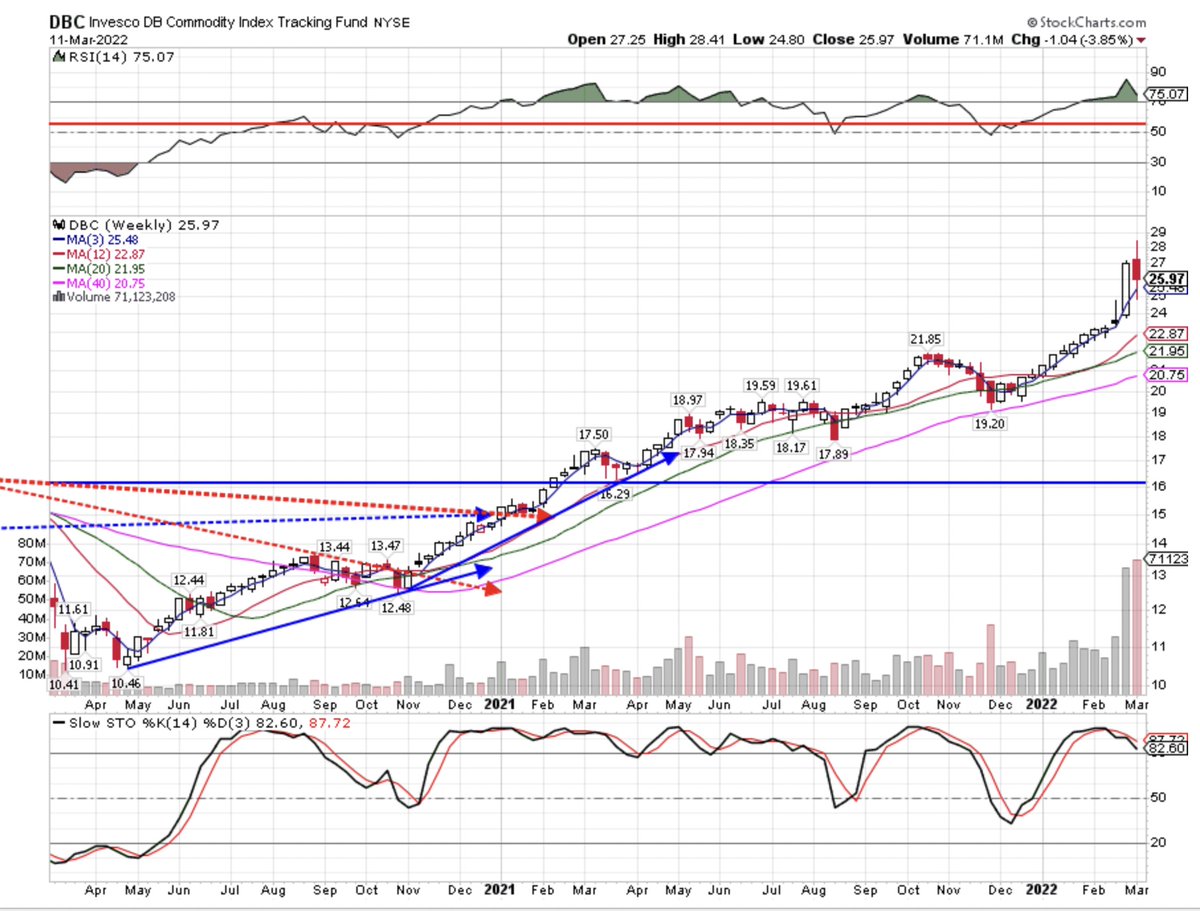

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 03/13/22

1/11

Focus on what’s working - long #inflation 🛢, #vol 🌊, and long USD 💵

Nothing says these will continue to work, given the geopolitical risk 💥☮️

But, what choice do you have? Fade it?

Let’s dig into the 🧮!

Global Macro Review 03/13/22

1/11

Focus on what’s working - long #inflation 🛢, #vol 🌊, and long USD 💵

Nothing says these will continue to work, given the geopolitical risk 💥☮️

But, what choice do you have? Fade it?

Let’s dig into the 🧮!

Hello 🐫 day!

And what a classic 🐫 day it is!

First equity 🐻 get 🐫 along with CRB ♉️

And then…

Let's dig into the 🧮!

And what a classic 🐫 day it is!

First equity 🐻 get 🐫 along with CRB ♉️

And then…

Let's dig into the 🧮!

Asia closed ↔️

$NIKK 24718 -0.3%

$SSEC 3256 -1.15% ⬅️

$TWII 17015 +1.15% ⬅️

$HSI 20628 -0.65%

$KOSPI closed for 🗳️

$IDX 6864 +0.75%

Australia ↗️

$ASX 7053 +1.05%

India ↗️

$BSE 54647 +2.05%

$NIKK 24718 -0.3%

$SSEC 3256 -1.15% ⬅️

$TWII 17015 +1.15% ⬅️

$HSI 20628 -0.65%

$KOSPI closed for 🗳️

$IDX 6864 +0.75%

Australia ↗️

$ASX 7053 +1.05%

India ↗️

$BSE 54647 +2.05%

Europe with a 🐻 market 🚀🚀

$DAX 13443 +4.75%

$FTSE 7066 +1.45%

$CAC 6225 +4.4%

$AEX 679 +3.45%

$IBEX 8003 +2.8%

$MIB 23417 +4.85%

$SMI 11312 +2.3%

$MOEX closed for 💥🪆

$VSTOXX 45.56 🔻

$DAX 13443 +4.75%

$FTSE 7066 +1.45%

$CAC 6225 +4.4%

$AEX 679 +3.45%

$IBEX 8003 +2.8%

$MIB 23417 +4.85%

$SMI 11312 +2.3%

$MOEX closed for 💥🪆

$VSTOXX 45.56 🔻

Hello Tuesday from 🇲🇽!

The $VIX spiked to the top end of the BB while the $SPX sank to the bottom, and for once the big #dix at 42.1 were not buyers. Is big money now the contra indicator?

Let's dig into the 🧮!

The $VIX spiked to the top end of the BB while the $SPX sank to the bottom, and for once the big #dix at 42.1 were not buyers. Is big money now the contra indicator?

Let's dig into the 🧮!

No relief for late to the 🐻🪅 Asian equities ↘️

$NIKK 24791 -1.7%

$SSEC 6980 -0.85%

$TWII 16825 -2.05%

$HSI 20766 -1.4%

$KOSPI 2622 -1.1%

$IDEX 6814 -0.8%

Australia ↘️

$ASX 6930 -0.85%

India trading ↗️

$BSE 53424 +1.1% ⬅️

$NIKK 24791 -1.7%

$SSEC 6980 -0.85%

$TWII 16825 -2.05%

$HSI 20766 -1.4%

$KOSPI 2622 -1.1%

$IDEX 6814 -0.8%

Australia ↘️

$ASX 6930 -0.85%

India trading ↗️

$BSE 53424 +1.1% ⬅️

Europe 🏀 ↗️ mid-morning

$DAX 12941 +0.8%

$DTSE 6963 +0.05%

$CAC 6057 +1.25%

$AEX 660 -1.35%

$IBEX 7844 +2.6%

$MIB 22694 +2.4%

$SMI 11101 -0.9%

$MOEX closed 🪆

$VSTOXX 48.24 ⬅️

implied moves of +/- 3%

$DAX 12941 +0.8%

$DTSE 6963 +0.05%

$CAC 6057 +1.25%

$AEX 660 -1.35%

$IBEX 7844 +2.6%

$MIB 22694 +2.4%

$SMI 11101 -0.9%

$MOEX closed 🪆

$VSTOXX 48.24 ⬅️

implied moves of +/- 3%

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 02/013/22

1/11

Lots of speculation about where to from here?

Sometimes, it’s as simple as looking at clear Trends

Equities 🐻

Bonds 🐻

Commodities ♉️

Volatility ♉️

USD 😑

Gold 😑

Let’s dig into the 🧮!

Global Macro Review 02/013/22

1/11

Lots of speculation about where to from here?

Sometimes, it’s as simple as looking at clear Trends

Equities 🐻

Bonds 🐻

Commodities ♉️

Volatility ♉️

USD 😑

Gold 😑

Let’s dig into the 🧮!

Hello Friday!

WTD #dispersion

$CAC -0.65%

$COMPQ -3.0%

$AORD -5.0%

$NIKK -4.9%

$KOSPI -7.75%

$VXN +7.6%

$BTC +0.55%

$AUDUSD -1.95%

$GOLD -2.0%

$NATGAS +13.25%

$PALL +12.45%

$BRENT +2.5%

$CORN+1.45%

$CRB +1.0%

$COPPER -2.2%

$TLT -0.4%

Let's dig into the early morning 🧮!

WTD #dispersion

$CAC -0.65%

$COMPQ -3.0%

$AORD -5.0%

$NIKK -4.9%

$KOSPI -7.75%

$VXN +7.6%

$BTC +0.55%

$AUDUSD -1.95%

$GOLD -2.0%

$NATGAS +13.25%

$PALL +12.45%

$BRENT +2.5%

$CORN+1.45%

$CRB +1.0%

$COPPER -2.2%

$TLT -0.4%

Let's dig into the early morning 🧮!

🐻 held sway in Asia with indices ↔️

$NIKK 26717 +2.1% ⬅️

$SSEC 3361 -0.95%

$TWII 17674 -0.15%

$HSI 23550 -1.1%

$KOSPI 2663 +1.85% ⬅️

$IDX 6645 +0.5%

Australia 🦘↗️

$ASX 6998 +2.2%

India ↘️

$BSE 57197 -0.15%

$NIKK 26717 +2.1% ⬅️

$SSEC 3361 -0.95%

$TWII 17674 -0.15%

$HSI 23550 -1.1%

$KOSPI 2663 +1.85% ⬅️

$IDX 6645 +0.5%

Australia 🦘↗️

$ASX 6998 +2.2%

India ↘️

$BSE 57197 -0.15%

Europe succumbing to the 🐻↘️

$DAX 15293 -1.5%

$FTSE 7486 -0.9%

$CAC 6843 -1.15%

$AEX 742 -1.45%

$IBEX 8602 -1.15%

$FTSE 26561 -1.2%

$SMI 12083 -0.75%

$MOEX 3504 +1.4% ⬅️🪆

$VSTOXX 28.03

$DAX 15293 -1.5%

$FTSE 7486 -0.9%

$CAC 6843 -1.15%

$AEX 742 -1.45%

$IBEX 8602 -1.15%

$FTSE 26561 -1.2%

$SMI 12083 -0.75%

$MOEX 3504 +1.4% ⬅️🪆

$VSTOXX 28.03

21 days into 2022:

Virgin Galactic ⬇️ 36%

GameStop ⬇️33%

Netflix ⬇️ 33%

Ethereum ⬇️27%

Tesla ⬇️ 20%

Nvidia ⬇️ 20%

Revlon ⬇️20%

AMD ⬇️19%

Starbucks ⬇️17%

Bitcoin ⬇️25%

Nasdaq ⬇️ 12%

S&P 500 ⬇️8%

Virgin Galactic ⬇️ 36%

GameStop ⬇️33%

Netflix ⬇️ 33%

Ethereum ⬇️27%

Tesla ⬇️ 20%

Nvidia ⬇️ 20%

Revlon ⬇️20%

AMD ⬇️19%

Starbucks ⬇️17%

Bitcoin ⬇️25%

Nasdaq ⬇️ 12%

S&P 500 ⬇️8%

stock market has peeps pushing 🅿️ain

Hello Thursday!

Big moves ↗️ yesterday in metals and grains

China cuts and $HSI 🚀

Some reprieve from the equity 🐻 with #OPEX on tap tomorrow

Let's dig into the 🧮!

Big moves ↗️ yesterday in metals and grains

China cuts and $HSI 🚀

Some reprieve from the equity 🐻 with #OPEX on tap tomorrow

Let's dig into the 🧮!

$NIKK 🏀 and $HSI 🚀 as Asia closes ↔️

$NIKK 27773 +1.1%

$SSEC 3555 -0.1%

$TWII 18218 -0.05%

$HSI 24952 +3.4% ⬅️🚀

$KOSPI 2863 +0.7%

$IDX 6627 +0.55%

Australia ↗️

$ASX 7342 +0.15%

India 🩸↘️

$BSE 59267 -1.4%

$NIKK 27773 +1.1%

$SSEC 3555 -0.1%

$TWII 18218 -0.05%

$HSI 24952 +3.4% ⬅️🚀

$KOSPI 2863 +0.7%

$IDX 6627 +0.55%

Australia ↗️

$ASX 7342 +0.15%

India 🩸↘️

$BSE 59267 -1.4%

Europe unable to build on gains ↘️

$DAX 15790 -0.1%

$CAC 7138 -0.5%

$FTSE 7576 -0.15%

$AEX 773 +0.05%

$IBEX 8768 -0.1%

$MIB 27408 +0.1%

$SMI 12492 -0.3%

$MOEX 3461 +0.7% 🪆

$VSTOXX 22.36 🔺

$DAX 15790 -0.1%

$CAC 7138 -0.5%

$FTSE 7576 -0.15%

$AEX 773 +0.05%

$IBEX 8768 -0.1%

$MIB 27408 +0.1%

$SMI 12492 -0.3%

$MOEX 3461 +0.7% 🪆

$VSTOXX 22.36 🔺

Hello Friday

Week to date

$BTC -10.12%

$GOLD -2.15%

$EUR -0.69%

$USD +0.77%

$CAC +1.35%

$SPX -1.47%

$KOSPI -1.92%

$COMPQ -3.61%

$WHEAT -3.21%

$COPPER -2.44%

$NATGAS +2.2%

$SOYB +3.58%

$GASO +3.58%

$WTIC +5.65%

$LUMBER +6.66%

$CRB +1.88%

$TNX +14.62%

Let's dig into the 🧮!

Week to date

$BTC -10.12%

$GOLD -2.15%

$EUR -0.69%

$USD +0.77%

$CAC +1.35%

$SPX -1.47%

$KOSPI -1.92%

$COMPQ -3.61%

$WHEAT -3.21%

$COPPER -2.44%

$NATGAS +2.2%

$SOYB +3.58%

$GASO +3.58%

$WTIC +5.65%

$LUMBER +6.66%

$CRB +1.88%

$TNX +14.62%

Let's dig into the 🧮!

Asia closed ↔️ for the week

$NIKK 28479 -0.05%

$SSEC 3580 -0.2%

$TWII 18170 -1.1%

$HSI 23493 +1.8%

$KOSPI 2955 +1.2%

$IDX 59578 +0.7%

Australia ↗️

$ASX 7453 +1.3%

India ↔️

$BSE 50577 -0.05%

$NIKK 28479 -0.05%

$SSEC 3580 -0.2%

$TWII 18170 -1.1%

$HSI 23493 +1.8%

$KOSPI 2955 +1.2%

$IDX 59578 +0.7%

Australia ↗️

$ASX 7453 +1.3%

India ↔️

$BSE 50577 -0.05%

Europe opens ↔️

$IBEX 8741 -0.55%

$DAX 16000 -0.3%

$CAC 7241 -0.1%

$SMI 12787 -0.05%

$FTSE 7458 +0.1%

$AEX 788 +0.25%

$MOEX 3277 +0.5% 🪆

$MIB 27832 +0.66%

$VSTOXX 20.10 🔺

$IBEX 8741 -0.55%

$DAX 16000 -0.3%

$CAC 7241 -0.1%

$SMI 12787 -0.05%

$FTSE 7458 +0.1%

$AEX 788 +0.25%

$MOEX 3277 +0.5% 🪆

$MIB 27832 +0.66%

$VSTOXX 20.10 🔺

1/ #BTFD they all say, but they never say HOW.

Buying the dip is a science.

The more $BTC bleeds, the more #altcoins bleed. With blood comes profit. Red is green.

In this MEGA-THREAD I'll show you how to turn red into green.

Like, retweet and follow for more 😘

Buying the dip is a science.

The more $BTC bleeds, the more #altcoins bleed. With blood comes profit. Red is green.

In this MEGA-THREAD I'll show you how to turn red into green.

Like, retweet and follow for more 😘

2/ -- DIP FUND --

I routinely tell people to keep a min of 30%-50% of their portfolio in #stablecoin. This is your dip fund.

When #crypto is bullish, you can get away with 30%. When it's bearish or crabby, 50%+ is a good dip fund.

I hope you have a dip fund ready to go.

I routinely tell people to keep a min of 30%-50% of their portfolio in #stablecoin. This is your dip fund.

When #crypto is bullish, you can get away with 30%. When it's bearish or crabby, 50%+ is a good dip fund.

I hope you have a dip fund ready to go.

3/ -- DIP FUND SPLIT --

My dip fund is split 70% for buying dip (strategically), 30% for investing in projects in a bear market.

More on buying the dip on tweet 6, let's talk bear launches first.

My dip fund is split 70% for buying dip (strategically), 30% for investing in projects in a bear market.

More on buying the dip on tweet 6, let's talk bear launches first.

So market broke down and you are panicking?

Learn how to hedge your positions in the $LUNA ecosystem.

$LUNA gives you the tools to profit regardless of market conditions.

Lets dive in.

🧵

Learn how to hedge your positions in the $LUNA ecosystem.

$LUNA gives you the tools to profit regardless of market conditions.

Lets dive in.

🧵

1. @anchor_protocol

The easiest and probably most obvious way to hedge your portfolio.

Hold $UST and deposit it in @anchor_protocol .

Your $UST turns into $aUST and automatically compounds to earn 19.5% APR regardless of market conditions.

Simple. Easy. Boomer Proof.

The easiest and probably most obvious way to hedge your portfolio.

Hold $UST and deposit it in @anchor_protocol .

Your $UST turns into $aUST and automatically compounds to earn 19.5% APR regardless of market conditions.

Simple. Easy. Boomer Proof.

2. @mirror_protocol mAssets LP

Not a stable coin hedge but allows you to apportion your portfolio to assets like $mARKK or $mGOOGL that are independent of crypto prices.

Add the mAssets to $UST LPs and earn 22% ~ 44% APR

I personally use the $mGLXY - $UST LP 😉

Not a stable coin hedge but allows you to apportion your portfolio to assets like $mARKK or $mGOOGL that are independent of crypto prices.

Add the mAssets to $UST LPs and earn 22% ~ 44% APR

I personally use the $mGLXY - $UST LP 😉

Welcome to ever grand Monday where the sky is red and so if your long book.

Let's dig into the good, the grand, and the #fugly

Let's dig into the good, the grand, and the #fugly

Shanghai showing no signs of stress but $HSI ↘️

$NIKK 30500 +0.6%

$SSEC 3614 +0.2%

$TWII 12277 unch

$HSI 24077 -3.4%

$KOSPI 3141 +0.35%

$IDX 6076 -0.9%

Australia ↘️

$ASX 7248 -2.1%

India ↘️

$BSE 58891 -0.2%

$NIKK 30500 +0.6%

$SSEC 3614 +0.2%

$TWII 12277 unch

$HSI 24077 -3.4%

$KOSPI 3141 +0.35%

$IDX 6076 -0.9%

Australia ↘️

$ASX 7248 -2.1%

India ↘️

$BSE 58891 -0.2%

European bourses ↘️↘️

$DAX 15163 -2.1%

$CAC 6428 -2.2%

$FTSE 6865 -1.4%

$AEX 778 -1.4%

$IBEX 8577 -2.1%

$MIB 25149 -2.2%

$SMI 11781 -1.3%

$MOEX 3985 -1.2%

$DAX 15163 -2.1%

$CAC 6428 -2.2%

$FTSE 6865 -1.4%

$AEX 778 -1.4%

$IBEX 8577 -2.1%

$MIB 25149 -2.2%

$SMI 11781 -1.3%

$MOEX 3985 -1.2%

Global Macro Review 09/19/2021

1/13

#OPEX did not disappoint.

Volatility ↗️, SPX sold ↘️, and the USD ↗️ for the 2nd week in a row, causing damage to EU and EM longs.

Let’s dig in to the damage done and opportunities ahead

(Please retweet ❤️)

1/13

#OPEX did not disappoint.

Volatility ↗️, SPX sold ↘️, and the USD ↗️ for the 2nd week in a row, causing damage to EU and EM longs.

Let’s dig in to the damage done and opportunities ahead

(Please retweet ❤️)

Hello #opex Friday!

Quick recap of drivers in Global Macro WTD

$SPX +0.34%

$VIX 18.69 -10.79%

$USD 92.92 +0.36%

$WTIC 72.61 +4.15%

$TNX 1.331 -0.75%

$GOLD 1757 -1.98%

$DAX 15652 +0.27%

So, overall risk assets have fared well ↗️

Let's dig into the early morning data!

Quick recap of drivers in Global Macro WTD

$SPX +0.34%

$VIX 18.69 -10.79%

$USD 92.92 +0.36%

$WTIC 72.61 +4.15%

$TNX 1.331 -0.75%

$GOLD 1757 -1.98%

$DAX 15652 +0.27%

So, overall risk assets have fared well ↗️

Let's dig into the early morning data!

After a week that saw weakness in HSI -5.87% and SSEC -2.59%, Asian equities closed ↗️ on the day

$NIKK 30500 +0.6%

$SSEC 3614 +0.2%

$TWII 12277 unch

$HSI 24882 +0.9%

$KOSPI 3141 +0.3%

$IDX 6133 +0.4%

Australia ↘️

$ASX 7404 -0.75%

India ↗️

$BSE 59262 +0.2%

$NIKK 30500 +0.6%

$SSEC 3614 +0.2%

$TWII 12277 unch

$HSI 24882 +0.9%

$KOSPI 3141 +0.3%

$IDX 6133 +0.4%

Australia ↘️

$ASX 7404 -0.75%

India ↗️

$BSE 59262 +0.2%

Europe building ↗️ on Thursday's gains

$DAX 15713 +0.4%

$FTSE 7046 +0.25%

$CAC 6683 +0.9%

$AEX 803 +0.6%

$IBEX 8624 +1.15%

$MIB 26122 +0.6%

$SMI 12066 +0.3%

$MOEX 4044 unch

$DAX 15713 +0.4%

$FTSE 7046 +0.25%

$CAC 6683 +0.9%

$AEX 803 +0.6%

$IBEX 8624 +1.15%

$MIB 26122 +0.6%

$SMI 12066 +0.3%

$MOEX 4044 unch

Hello, Tuesday and a similar "🟥 sky" start to the day

We all know what happened yesterday - traders #BTFD sending $BTC and $COPPER 🚀 with the $USD ↘️

Repeat today? or is ⚠️ the word in the face of the 🇨🇳🇭🇰 crash and the start to the #FOMC meeting?

Let's dig in!

We all know what happened yesterday - traders #BTFD sending $BTC and $COPPER 🚀 with the $USD ↘️

Repeat today? or is ⚠️ the word in the face of the 🇨🇳🇭🇰 crash and the start to the #FOMC meeting?

Let's dig in!

🇨🇳 and 🇭🇰 under significant ↘️ pressure

$SSEC 3381 -2.5% 🇨🇳

$HSI 25061 -4.4% 🇭🇰

$NIKK 27970 +0.5%

$TWII 17270 -0.8%

$KOSPI 3233 +0.25%

$IDX 6097 -0.15%

Australia ↘️

$ASX 7431 +0.5%

India ↘️

$BSE 52534 -0.6%

$SSEC 3381 -2.5% 🇨🇳

$HSI 25061 -4.4% 🇭🇰

$NIKK 27970 +0.5%

$TWII 17270 -0.8%

$KOSPI 3233 +0.25%

$IDX 6097 -0.15%

Australia ↘️

$ASX 7431 +0.5%

India ↘️

$BSE 52534 -0.6%

Europe ↔️ yesterday but ↘️ today 🟥

$DAX 15487 -0.85%

$FTSE 6966 -0.85%

$CAC 6537 -0.6%

$AEX 739 -0.8%

$IBEX 8707 -0.8%

$MIB 25092 -0.8%

$SMI 12003 -0.4%

$MOEX 3750 unch

$DAX 15487 -0.85%

$FTSE 6966 -0.85%

$CAC 6537 -0.6%

$AEX 739 -0.8%

$IBEX 8707 -0.8%

$MIB 25092 -0.8%

$SMI 12003 -0.4%

$MOEX 3750 unch