Discover and read the best of Twitter Threads about #BerkshireHathaway

Most recents (23)

My Top 5 Takeaways from the #BerkshireHathaway Annual Shareholders Meeting 2023: 🎩🔮 I watched the online stream and came away with five key points that really stood out to me:

1/ 🏦 Cash is King: #Buffett revealed that he sold lots of shares in Q1 2023 and is currently holding a substantial amount of cash. He emphasized that cash isn't trash and even suggested that 0% inflation would be better. Seems like he's preparing for something!!

2/ 🚀 Warren Buffett praised @elonmusk's adventurous spirit, saying that he tries the impossible. However, he also noted that they prefer lower-risk investments and wouldn't invest in Tesla due to its uncertain future. He emphasized the importance of not losing money.

We all start our investing journey with #WarrenBuffett - The greatest investor of all time

In this detailed thread I have covered some of the most interesting case studies and how he kept on improving his investment framework over the time !

Like and retweet for maximum reach!

In this detailed thread I have covered some of the most interesting case studies and how he kept on improving his investment framework over the time !

Like and retweet for maximum reach!

Journey of Warren Buffet

Warren Buffet started his investing journey at the age of 13 by selling groceries from his grandfather’s shop. He sold chewing gum and newspapers door to door and simultaneously collected caps of Coca-Cola bottles. This was his first exposure to

Warren Buffet started his investing journey at the age of 13 by selling groceries from his grandfather’s shop. He sold chewing gum and newspapers door to door and simultaneously collected caps of Coca-Cola bottles. This was his first exposure to

Coca-Cola and from here he gradually built his understanding of Coca-Cola and created massive wealth by investing in this stock. He used a similar strategy to create massive wealth in his other investments as well.

1/10 🌟 Let's explore 🔟 Fortune 100 companies and how they could potentially benefit from building dApps on @Conste11ation $DAG. Get ready for some exciting use cases! #Constellation #Fortune100

2/10 🚘 #1 Walmart $WMT: The retail giant could build a dApp on Constellation for supply chain management, tracking products from source to store, ensuring transparency, and reducing inefficiencies. #Walmart #SupplyChain

3/10 ⚡ #2 Amazon $AMZN: Amazon could leverage Constellation for a decentralized e-commerce platform, creating a secure, transparent, and efficient marketplace for buyers and sellers. #Amazon #eCommerce

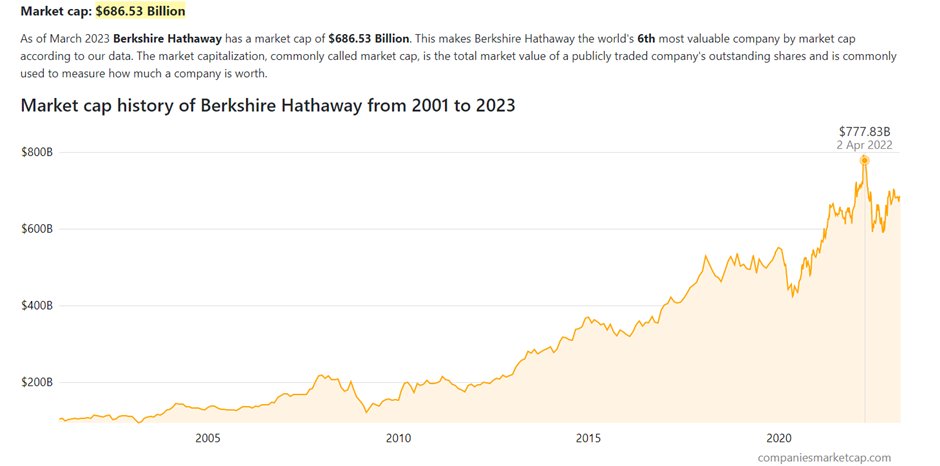

1/ #BerkshireHathaway is one of the world’s largest companies in terms of market cap ($686 billion, sixth largest). It is also one of the top few (top 15) globally in terms of total revenue.

Here is a thread briefly exploring the company.

Here is a thread briefly exploring the company.

3/ Whenever the company is mentioned, one often finds charts like the following (a comparison with S&P 500) to highlight the value that #BerkshireHathaway has created for its investors over time.

🧵THREAD - La lettre de Warren #Buffett

Une lettre de 9 pages vient d'être envoyée aux investisseurs de #BerkshireHathaway

Il y partage ses opinions, et ses résultats et surtout son portefeuille.

Le résumé👇

Une lettre de 9 pages vient d'être envoyée aux investisseurs de #BerkshireHathaway

Il y partage ses opinions, et ses résultats et surtout son portefeuille.

Le résumé👇

Les résultats financiers de #Berkshire au Q4 :

Le bénéfice ont chuté de 54 % pour atteindre 18,16 milliards de $ soit 12412$ par action.

Mais Buffett conseille aux #investisseurs d'examiner plutôt les bénéfices d'exploitation qui éliminent les fluctuations trimestrielles.

Le bénéfice ont chuté de 54 % pour atteindre 18,16 milliards de $ soit 12412$ par action.

Mais Buffett conseille aux #investisseurs d'examiner plutôt les bénéfices d'exploitation qui éliminent les fluctuations trimestrielles.

¿Por qué a Warren Buffett y Charlie Munger no quieren al #bitcoin?.

No es porque no lo entiendan como dicen muchos, a quien se le ocurre que semejantes mentes no lo entenderían?. Tampoco porque sea veneno para ratas 🐀 como lo dijo una vez en público.

Le digo la razón:

1/5

No es porque no lo entiendan como dicen muchos, a quien se le ocurre que semejantes mentes no lo entenderían?. Tampoco porque sea veneno para ratas 🐀 como lo dijo una vez en público.

Le digo la razón:

1/5

Su empresa #BerkshireHathaway tiene invertido en bancos como Bank of América, BanCorp, Citigroup, New York Mellon y empresas como Visa, Mastercard y American Express, la cantidad de $67.395.041.000.

Esto según el último informe reportado a la @SECGov en noviembre 2022. 🤡

2/5

Esto según el último informe reportado a la @SECGov en noviembre 2022. 🤡

2/5

Empresas del sector financiero (FIAT) y aseguradoras, les han generado muchísimo dinero durante toda su vida.

Por ejemplo, solamente en el Bank of America, #BerkshireHathaway tiene el 10,30% de todo su portafolio. Es decir, puede manipular en ciertos momentos ese mercado.

3/5

Por ejemplo, solamente en el Bank of America, #BerkshireHathaway tiene el 10,30% de todo su portafolio. Es decir, puede manipular en ciertos momentos ese mercado.

3/5

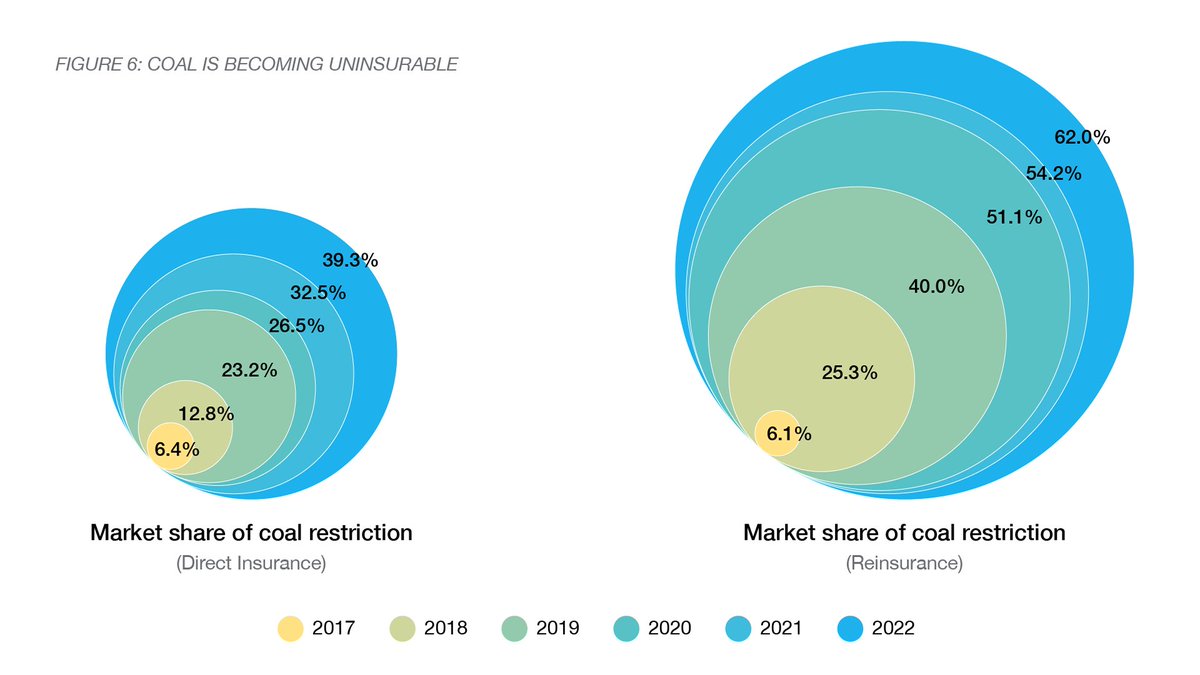

🔥 Insurance is the Achilles heel of the fossil fuel industry. A new #InsureOurFuture report published today finds that new coal power plants have become near uninsurable and that insurers have finally started to move away from oil and gas. A short 🧵 on leaders and laggards! 🔥

67 yaşında halen aktif olarak portföyünü yöneten Thomas Russo, takip ettiğim ve portföyünü izlediğim bir değer yatırımcısı. Büyüyen kaliteli şirketleri al ve tut stratejisinin başarılı bir örneği; 30-40 yıl önce aldığı bir çok pozisyonu hala koruyor.

Stanford'da okurken 1982’de okula gelip şirketlerin marka değerini vurguladığı bir konuşma yapan Buffet’ı dinledikten sonra bazı şirketlere yatırım yapıyor ki bir kısmı hala portföyünde. O zamanlar aldığı Berkshire Hathaway, Nestle ve Heineken hisselerini 40 yıldır hiç satmadı.

Yaklaşık 10 mlr $ yönetiyor ve bu üç şirket portföyünün %36’sını oluşturuyor. Yatırım yapmaya başladığında Berkshire hissesi 900$ seviyesindeydi, şimdi 400 bin $’ın üzerinde. En büyük pozisyonu hala Berkshire Hathaway, portföyünün %18’ini oluşturuyor.

🛡️#T3OccultAstrology

🚨MARKET CRASH PREDICTION

#BerkshireHathaway and #Blackstone have BILLIONS IN CASH to buy knowing the crash is near. These predatious inside traders are telling us in their own way what's about to happen. But when?

Let me explain.

+1

zerohedge.com/markets/blacks…

🚨MARKET CRASH PREDICTION

#BerkshireHathaway and #Blackstone have BILLIONS IN CASH to buy knowing the crash is near. These predatious inside traders are telling us in their own way what's about to happen. But when?

Let me explain.

+1

zerohedge.com/markets/blacks…

+2

#1

On 3/9/22 #JoeBack created Executive Order #EO14067 - Ensuring Responsible Development of Digital Assets -

📢DUE OCTOBER

#1

On 3/9/22 #JoeBack created Executive Order #EO14067 - Ensuring Responsible Development of Digital Assets -

📢DUE OCTOBER

+3

#2

On 6/5/22 Saturn turned Retro - heading back to🟥 Uranus. We went thru this tumultuous time last year w/ GOV tyranny over cv19. This time will be worse. Saturn has unfinished business to attend to.

📢Saturn ARRIVES OCTOBER

#2

On 6/5/22 Saturn turned Retro - heading back to🟥 Uranus. We went thru this tumultuous time last year w/ GOV tyranny over cv19. This time will be worse. Saturn has unfinished business to attend to.

📢Saturn ARRIVES OCTOBER

1/n

¿Qué es un SPLIT de acciones? ¿Cómo afecta esto al mercado y a mi portafolio?

Si eres inversor y trader, este es un término el cual debes conocer y entender, por eso te lo explicamos en el siguiente 🧵

#EducacionFinanciera

¿Qué es un SPLIT de acciones? ¿Cómo afecta esto al mercado y a mi portafolio?

Si eres inversor y trader, este es un término el cual debes conocer y entender, por eso te lo explicamos en el siguiente 🧵

#EducacionFinanciera

2/n

Un SPLIT o división de acciones ocurre cuando una empresa aumenta el número de sus acciones en circulación para aumentar su liquidez.

Por ejemplo, encontrarás que una empresa hace:

▪️ Split 2 a 1 (2:1)

▪️ Split 4 a 1 (10:1)

▪️ Split 20 a 1 (20:1)

Un SPLIT o división de acciones ocurre cuando una empresa aumenta el número de sus acciones en circulación para aumentar su liquidez.

Por ejemplo, encontrarás que una empresa hace:

▪️ Split 2 a 1 (2:1)

▪️ Split 4 a 1 (10:1)

▪️ Split 20 a 1 (20:1)

3/n

⚠️ Aunque el número de acciones en circulación aumente (según el tipo de SPLIT), la capitalización de la empresa no sufre ninguna variación, ya que el precio por acción se dividirá.

¿Dónde puedo revisar la capitalización de una empresa? 👉 companiesmarketcap.com

⚠️ Aunque el número de acciones en circulación aumente (según el tipo de SPLIT), la capitalización de la empresa no sufre ninguna variación, ya que el precio por acción se dividirá.

¿Dónde puedo revisar la capitalización de una empresa? 👉 companiesmarketcap.com

(1/5)

Nos anos 2000, a Berkshire Hathaway superou o índice S&P 500 em 37%.

Então, @WarrenBuffett escreveu uma carta para os acionistas.

Nos anos 2000, a Berkshire Hathaway superou o índice S&P 500 em 37%.

Então, @WarrenBuffett escreveu uma carta para os acionistas.

Charlie, Charlie, Charlie, damn dude, c'mon now, this is not a good look for you. Let's break this anti#bitcoin quote down. "It's stupid because it's still likely to go to zero" - have you seen the massive effort people are putting into this monetary system around the world?

The bitcoin tech is disrupting industry after industry including banking, retail, farming, social justice. It's value proposition goes way beyond a number on a balance sheet. It's inherent value of immutability, fungability and censorship resistance is growth oriented.

Charlie says "It's evil because it undermines the Federal Reserve System". That's not evil, that's smart. The Fed is a failed economic model run by elites that incentivizes riskier asset investment and arguably war. If War is evil, the financial system that props it up is evil.

1/n

El día de mañana se llevará a cabo en Omaha el evento más esperado por muchos inversionistas, se realizará de forma presencial la reunión anual de accionistas 2022 de #BerkshireHathaway 🔥

El día de mañana se llevará a cabo en Omaha el evento más esperado por muchos inversionistas, se realizará de forma presencial la reunión anual de accionistas 2022 de #BerkshireHathaway 🔥

2/n

Hoy vamos a revisar las mejores frases y también detalles importantes de la carta anual de accionistas publicada en febrero de este año.

¿La leyeron? ✏️📖🧠

Hoy vamos a revisar las mejores frases y también detalles importantes de la carta anual de accionistas publicada en febrero de este año.

¿La leyeron? ✏️📖🧠

3/n

Como nos tiene acostumbrados, en la primera parte nos muestra el comparativo de performance entre Berkshire 🆚 el S&P 500. Otro dato importante es el Compouned Annual Gain desde 1965 al 2021:

- Berkshire 20.1%

- S&P500 10.5%

#nuncaparesdeinvertir

Como nos tiene acostumbrados, en la primera parte nos muestra el comparativo de performance entre Berkshire 🆚 el S&P 500. Otro dato importante es el Compouned Annual Gain desde 1965 al 2021:

- Berkshire 20.1%

- S&P500 10.5%

#nuncaparesdeinvertir

You have all heard of Warren Buffett.

"The Oracle of Omaha"

"The greatest investor of all time"

His track record is undeniable: between 1965 and 2020, Warren's investment company #BerkshireHathaway has yielded an avg. annual return of 20%, almost double that of the S&P 500.

"The Oracle of Omaha"

"The greatest investor of all time"

His track record is undeniable: between 1965 and 2020, Warren's investment company #BerkshireHathaway has yielded an avg. annual return of 20%, almost double that of the S&P 500.

Some initial thoughts on the #berkshirehathaway annual report.

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Buffett points out that Berkshire paid $3.3 billion or 8/10ths of ALL federal corporate income tax in the United States. That's some $9 million per day to the US Treasury.

Float amounts to an incredible $147 billion. Better still, because of share repurchases, the figure is up 25% over the past two years to just shy of $100k per $BRKA. That's $66 per $BRKB share of (essentially, and for now) better-than-cost-free money working for shareholders

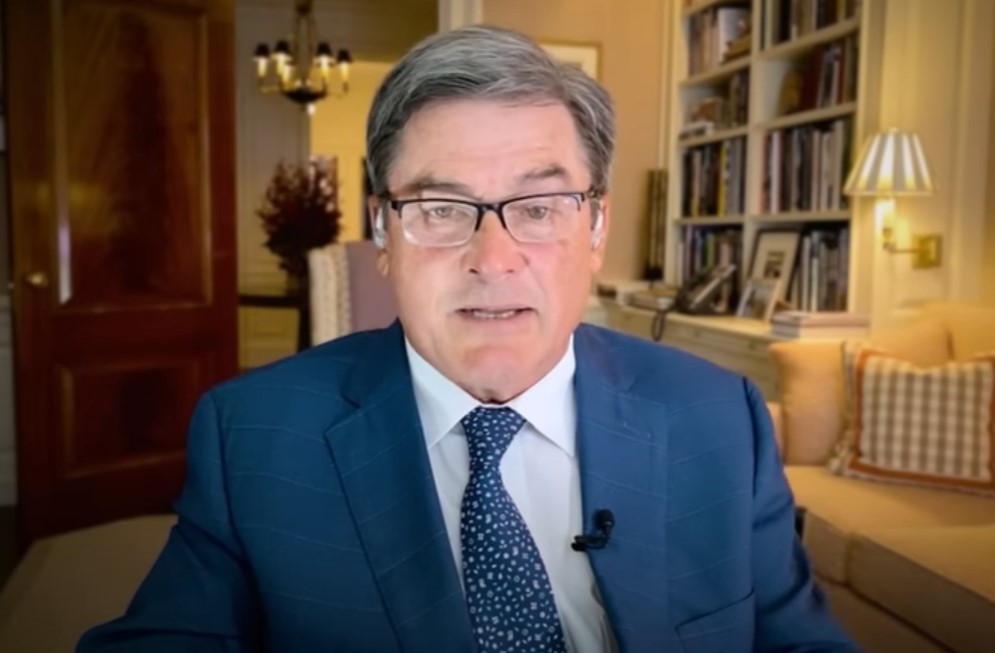

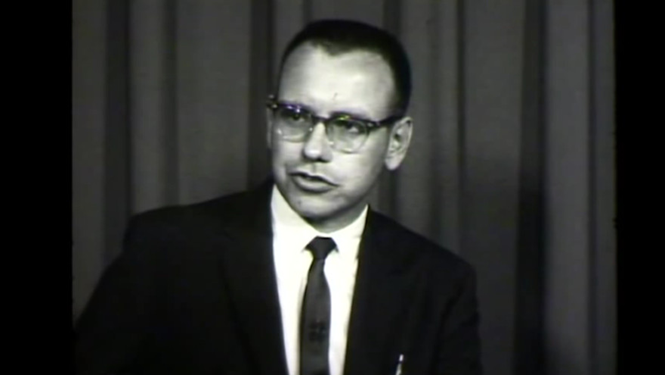

1/🧵

Here’s Buffett at 32, when he earned a million per year - or $8.8M per year in today’s dollars.

In this thread, we celebrate #BerkshireHathaway AGM weekend by looking closer at how he did it. We finish with a link to the 152 pages of gold: Buffett Partnership letters.

Here’s Buffett at 32, when he earned a million per year - or $8.8M per year in today’s dollars.

In this thread, we celebrate #BerkshireHathaway AGM weekend by looking closer at how he did it. We finish with a link to the 152 pages of gold: Buffett Partnership letters.

2/🧵

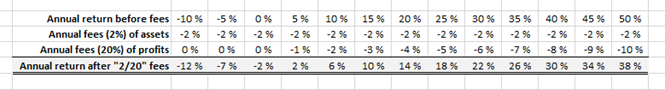

Many hedge fund managers expense so-called “2/20”, meaning that whatever happens with the investments, they get 2% of the assets plus 20% of any profits.

Even though they’d underperform the market, such system would incentivize them for the effort.

“Thanks!”

Many hedge fund managers expense so-called “2/20”, meaning that whatever happens with the investments, they get 2% of the assets plus 20% of any profits.

Even though they’d underperform the market, such system would incentivize them for the effort.

“Thanks!”

Read Warren Buffett’s annual letter to Berkshire Hathaway shareholders @CNBC

#StockMarket #WarrenBuffett #Investing #Invest #Stocks cnbc.com/2021/02/27/rea…

#StockMarket #WarrenBuffett #Investing #Invest #Stocks cnbc.com/2021/02/27/rea…

PDF version of Annual Letter from #WarrenBuffett #BerkshireHathaway

berkshirehathaway.com/letters/2020lt…

berkshirehathaway.com/letters/2020lt…

#WarrenBuffett #BerkshireHathaway #AnnualLetter

Summary by @CNBC

Buffett says 'never bet against America' in letter noting company's U.S. assets cnbc.com/2021/02/27/war…

Summary by @CNBC

Buffett says 'never bet against America' in letter noting company's U.S. assets cnbc.com/2021/02/27/war…

BREAKING: Coal is becoming uninsurable but major laggards are still offering cover and insurers have so far not moved away from oil and gas, the @InsOurFuture’s new scorecard report shows. A quick 🧵 on the good, the bad and the ugly!

Why are developers describing tiny Polkadot as the ($400 billion) Amazon Web Service of blockchain?

Scan 30 bullets about the worst kept secret in the next-generation blockchain.

• Discover why Warren Buffet’s #BerkshireHathaway owns more #Polkadot than you.

[THREAD]

Scan 30 bullets about the worst kept secret in the next-generation blockchain.

• Discover why Warren Buffet’s #BerkshireHathaway owns more #Polkadot than you.

[THREAD]

• The truth about why Bitcoin coders jumped ship to rack-up crazy hours coding Polkadot. Ever heard of the “sharp knife” theory?

• Why never compare Ethereum to Polkadot (even if #Ethereum leads the $9 billion #DeFi boom)

• Why never compare Ethereum to Polkadot (even if #Ethereum leads the $9 billion #DeFi boom)

• The world’s most powerful blockchain scaling strategy: is this the code to finally unshackle 4 billion internet users from privacy abusing Google?

• The often overlooked feature that can see #Polkadot 10X before the next scandal bursts into the headlines about crypto forks!

• The often overlooked feature that can see #Polkadot 10X before the next scandal bursts into the headlines about crypto forks!

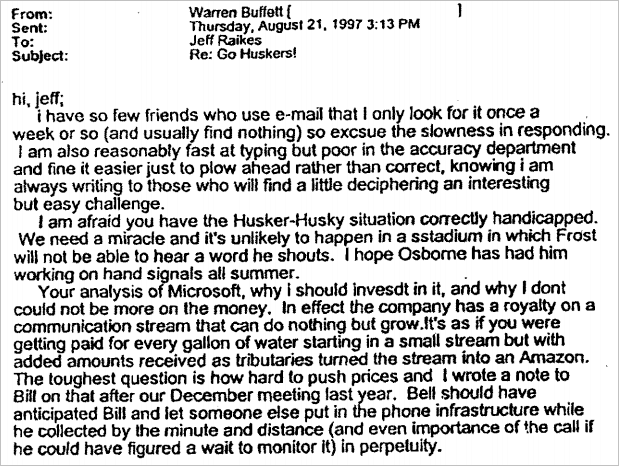

#charliemunger #BerkshireHathaway

#WarrenBuffett

#Apple

Why #WarrenBuffett missed the transformation from Hard assets to Soft assets , Why the legend never understood the transition to Software and it’s future and he underestimated the Internet to a very vast extent

#WarrenBuffett

#Apple

Why #WarrenBuffett missed the transformation from Hard assets to Soft assets , Why the legend never understood the transition to Software and it’s future and he underestimated the Internet to a very vast extent

It was 1997 and Warren was offered an opportunity to buy Microsoft stock and he said he believes MS story is pretty good in the short term , but he doesn’t see a great future in another 2 decades.

MS was trading at $16-18 at that times and has split thrice since then...

MS was trading at $16-18 at that times and has split thrice since then...

Berkshire purchased GEICO in 1995-96. It came to Warren’s attention that GEICO was paying $10 to search engine Google for every mouse click on GEICO ad

The cost of this service provided by Google was NIL

Warren couldn’t read the thesis behind this kind of income Google generated

The cost of this service provided by Google was NIL

Warren couldn’t read the thesis behind this kind of income Google generated

#DividendInvesting

#dividends #yield

With interest rates depressed and likely to remain so for years, stocks with ample and secure dividends could benefit as investors search for yield.

One approach is to consider companies whose dividend yields nicely exceed their bond yields

#dividends #yield

With interest rates depressed and likely to remain so for years, stocks with ample and secure dividends could benefit as investors search for yield.

One approach is to consider companies whose dividend yields nicely exceed their bond yields

This can be a good way to find high-quality stocks because low bond yields are often a sign of financial strength & dividend stability

The stock of any company whose safe dividend yield is materially higher than its own 10 year bond yield may have a compelling risk/reward profile

The stock of any company whose safe dividend yield is materially higher than its own 10 year bond yield may have a compelling risk/reward profile

The approach doesn’t predict that a stock will outperform, but it has been very effective at identifying stocks with limited risk

Let’s take an example Johnson & Johnson (JNJ), whose dividend yield of 2.7% is more than double the about 1% on its 10-year debt.

Let’s take an example Johnson & Johnson (JNJ), whose dividend yield of 2.7% is more than double the about 1% on its 10-year debt.

.@WarrenBuffet on

Why he's not buying stocks in size: sensitivity to tail events and the '08 reminder "we don't see all the problems the first day."

On whether others should buy now: Only if you expect to hold for a long time and are financially and psychologically ready to do so

Why he's not buying stocks in size: sensitivity to tail events and the '08 reminder "we don't see all the problems the first day."

On whether others should buy now: Only if you expect to hold for a long time and are financially and psychologically ready to do so

@warrenbuffet .@WarrenBuffett repeated what Charlie Munger told the @WSJ earlier on why #BerkshireHathaway didn't repeat the 2008-09 experience of lending to stressed companies:

"We haven't seen anything attractive," especially after the #Fed quickly opened the #markets for companies to borrow

"We haven't seen anything attractive," especially after the #Fed quickly opened the #markets for companies to borrow

@warrenbuffet @WarrenBuffett @WSJ In continuing to express relative caution overall, @WarrenBuffett stresses that, when it comes to the impact of the #CoronaVirus shock;

- "You can't rule out any possibility" and

- #BerkshireHathaway wants to be prepared for many possible scenerios.

#markets #economy #COVID19

- "You can't rule out any possibility" and

- #BerkshireHathaway wants to be prepared for many possible scenerios.

#markets #economy #COVID19

1/ The concept of a Holding Company in CPG to be the @ProcterGamble for the 21st Century is the worst kept secret idea over the past 24 months.

Kind of a lot of people are trying to build this.

Kind of a lot of people are trying to build this.

2/ I personally get pitched on it 5x-10x a month. And those are only the emails/calls I respond to. Here is why people are excited about it and the challenges they are discovering to date.

TLDR: I’m bullish on the concept but lots of kinks to be worked out.

TLDR: I’m bullish on the concept but lots of kinks to be worked out.

3/ The basic idea being kicked around is to acquire (or start) many different consumer brands under one Holding Company. Likely then have some shared “back office” (**murky alert**). Shared marketing/finance/sales as an example.