Discover and read the best of Twitter Threads about #Bitfinex

Most recents (24)

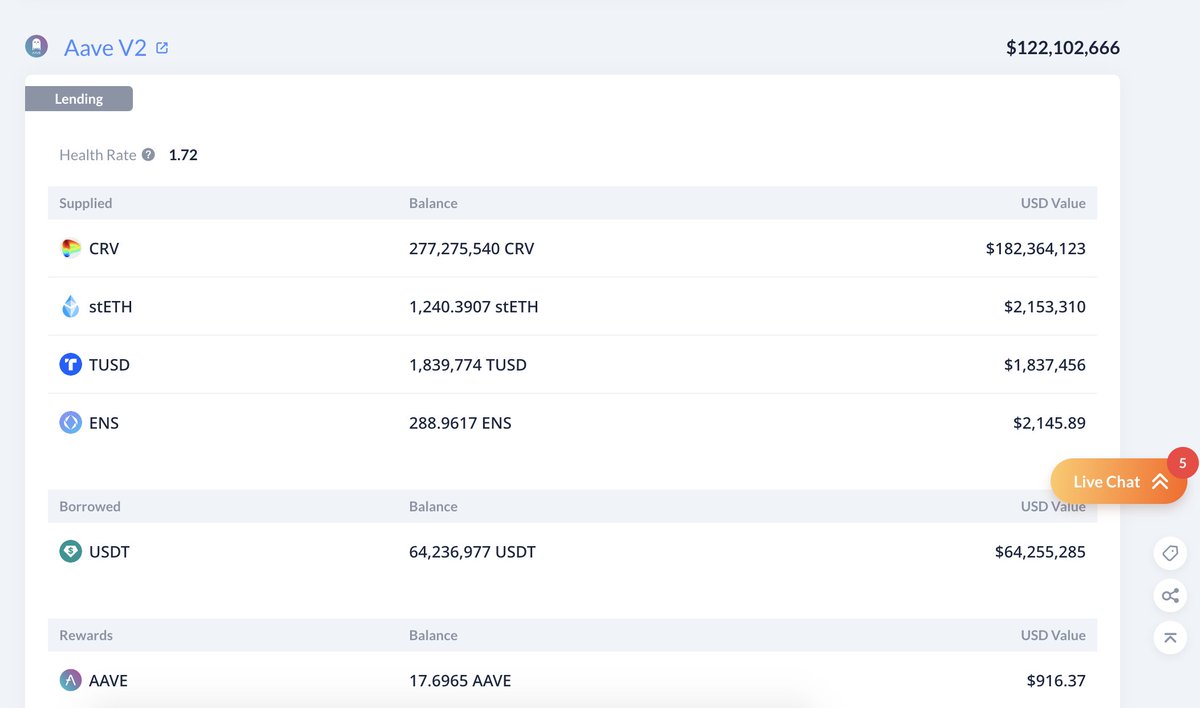

1/ The founder of Curve.fi always deposits $CRV to #Aave and borrows $USDC& $USDT.

He deposited 291M $CRV (34% of the Circulating Supply) on #Aave and borrowed $65M $USDT & $USDC now.

Let's take a thread to see where these $USDT and $USDC were transferred to.

He deposited 291M $CRV (34% of the Circulating Supply) on #Aave and borrowed $65M $USDT & $USDC now.

Let's take a thread to see where these $USDT and $USDC were transferred to.

2/ Let's start with a summary.

- 37.7M $USDT was deposited to #Bitfinex;

- 51M $USDC was transferred to Wintermute Trading;

- 14.2M $USDT was used to buy ETH and USDC during the USDC depegging.

- 37.7M $USDT was deposited to #Bitfinex;

- 51M $USDC was transferred to Wintermute Trading;

- 14.2M $USDT was used to buy ETH and USDC during the USDC depegging.

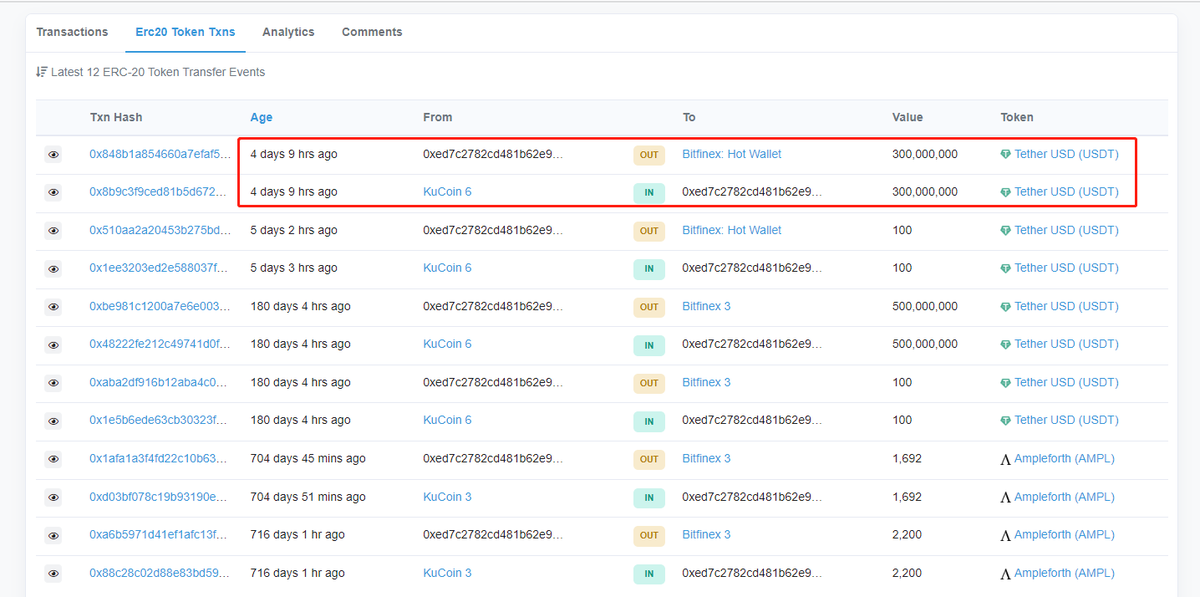

3/ Curve.fi Founder deposited a total of 37.7M $USDT to #Bitfinex.

Among them, 31M $USDT was transferred to #Bitfinex from April 10th to April 14th.

At that time, the price of $BTC rose above $30,000.

etherscan.io/token/0xdac17f…

Among them, 31M $USDT was transferred to #Bitfinex from April 10th to April 14th.

At that time, the price of $BTC rose above $30,000.

etherscan.io/token/0xdac17f…

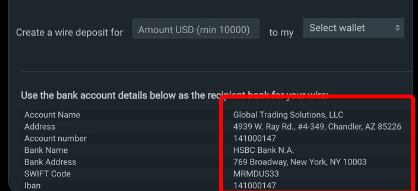

@GOllumfun @ParrotCapital @RetzefCapital @Annihil4tionGod @letshearthetru @StockJabber @peakprosperity @Bitfinexed @MikeBurgersburg @ExkrementKoin @AlderLaneEggs @ThegreatLambiny @ImDrinknWyn @buyside4life @scoopercooper @Protos @RasooliSheida @thebankerislaw @AIMhonesty @Integrity4mkts @nycdemandmore @ttmygh speaking of #egold you'll love this. who remembers the infamous #HSBC #bitfinex account that #reginaldfowler setup in Arizona?

@GOllumfun @ParrotCapital @RetzefCapital @Annihil4tionGod @letshearthetru @StockJabber @peakprosperity @Bitfinexed @MikeBurgersburg @ExkrementKoin @AlderLaneEggs @ThegreatLambiny @ImDrinknWyn @buyside4life @scoopercooper @Protos @RasooliSheida @thebankerislaw @AIMhonesty @Integrity4mkts @nycdemandmore @ttmygh what you might not remember is back in 2018 another sketchy payment services group #epay was shilling itself as an official partner of #bitfinex and #tether

@GOllumfun @ParrotCapital @RetzefCapital @Annihil4tionGod @letshearthetru @StockJabber @peakprosperity @Bitfinexed @MikeBurgersburg @ExkrementKoin @AlderLaneEggs @ThegreatLambiny @ImDrinknWyn @buyside4life @scoopercooper @Protos @RasooliSheida @thebankerislaw @AIMhonesty @Integrity4mkts @nycdemandmore @ttmygh So what.....well #epay only had a single point of presence in the US and it just happened to be Arizona.

An #incompentence #MasterClass

by #bitfinex own statement it was working with #cryptocapital from 2014.

#bitfinex was also working with #coinapult we know this as they are referenced in the incident report when #coinapult was hacked in 2015.

by #bitfinex own statement it was working with #cryptocapital from 2014.

#bitfinex was also working with #coinapult we know this as they are referenced in the incident report when #coinapult was hacked in 2015.

So what happened with #coinapult. That's a great question...I'm glad you asked. In May 2015 (a couple months after the hack) they announced they were being 'integrated' into #cryptocapital and would no long be undertaking #kyc as they had a tip top fully regulated partner,

Obviously to effect such an important transaction #coinapult would have gone to great length to ensure their partner who was taking over the KYC and banking functions were who they said they were.

@threadreaderapp So I thought I'd add a couple of extra tweets to my thread re: the fake bank #bandenia. Last week I banged on about about some pretty easy to spot fudging of financials. Most scammers battle to read financial statements so they are not particularly good at fudging.

@threadreaderapp More problematic than the scammers crappy accounting is that mostly no one bothers to spend more than 2 mins looking. (remember... #celsius....anyone?) So here's some even dumber examples of the same fraudulent attempted alchemy.

#Tether watch!

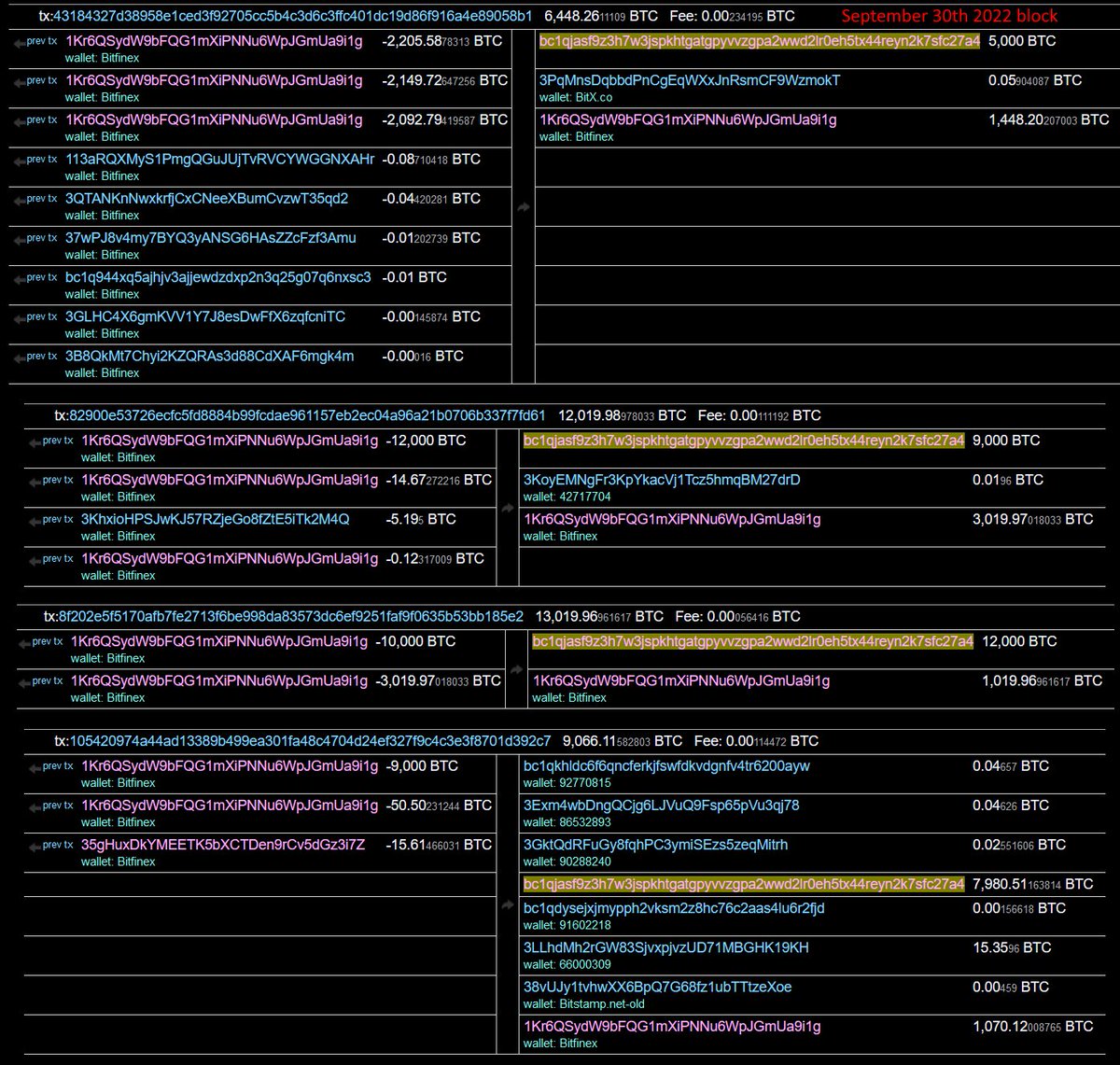

Alright, i promised a post on this so here goes. #Bitfinex is amassing a much bigger Bitcoin hoard than previously disclosed. Either that (by far most likely), or some whale trusts only trusts Bitfinex to trade with, and only accumulates at quarter end, in bulk.

Alright, i promised a post on this so here goes. #Bitfinex is amassing a much bigger Bitcoin hoard than previously disclosed. Either that (by far most likely), or some whale trusts only trusts Bitfinex to trade with, and only accumulates at quarter end, in bulk.

#Tether watch!

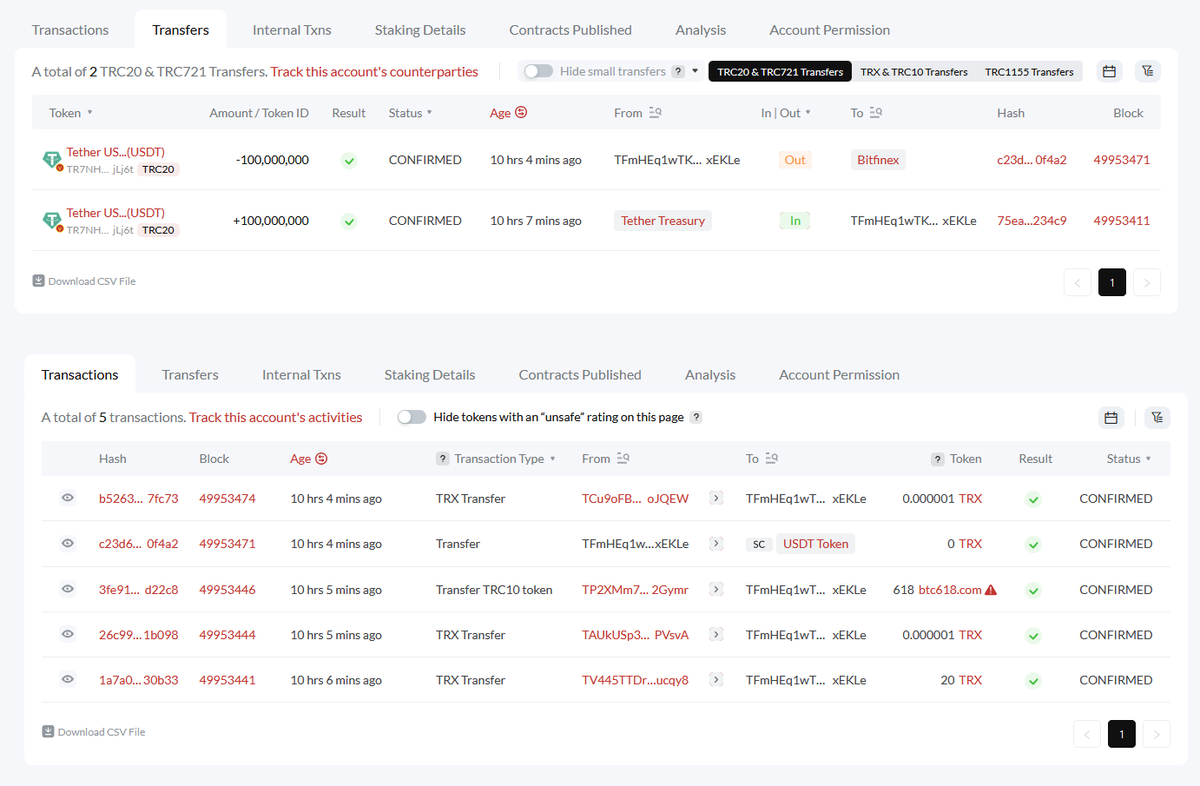

#Bitfinex is printing themselves money again. Quite literally. They're using a new account to try and obscure it but i can pretty much prove it at this point.

Lemme walk you through.

#Bitfinex is printing themselves money again. Quite literally. They're using a new account to try and obscure it but i can pretty much prove it at this point.

Lemme walk you through.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod what we are witnessing is akin to what happens when a hacker targets a vulnerability in a system and is able to release malware and it causes havoc to its target.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod There is literally hundreds of zero day attacks in crypto. But rather than addressing bad actors and patching vulnerabilities in the ecosystem. - they were embraced as innovation - literal onramps to the promised land.

@ParrotCapital @JackInabinet @9thdecimal @Cryptadamist @MikeBurgersburg @ExkrementKoin @crypto1nfern0 @vidar_research @AureliusValue @AlderLaneEggs @Annihil4tionGod The Signet walled garden is a perfect example - if a bad actor gets into your walled garden as soon as its flagged you excise them and patch the vunerability. If you don't they propagate and destroy your garden. Instead those who could have, should have taken action

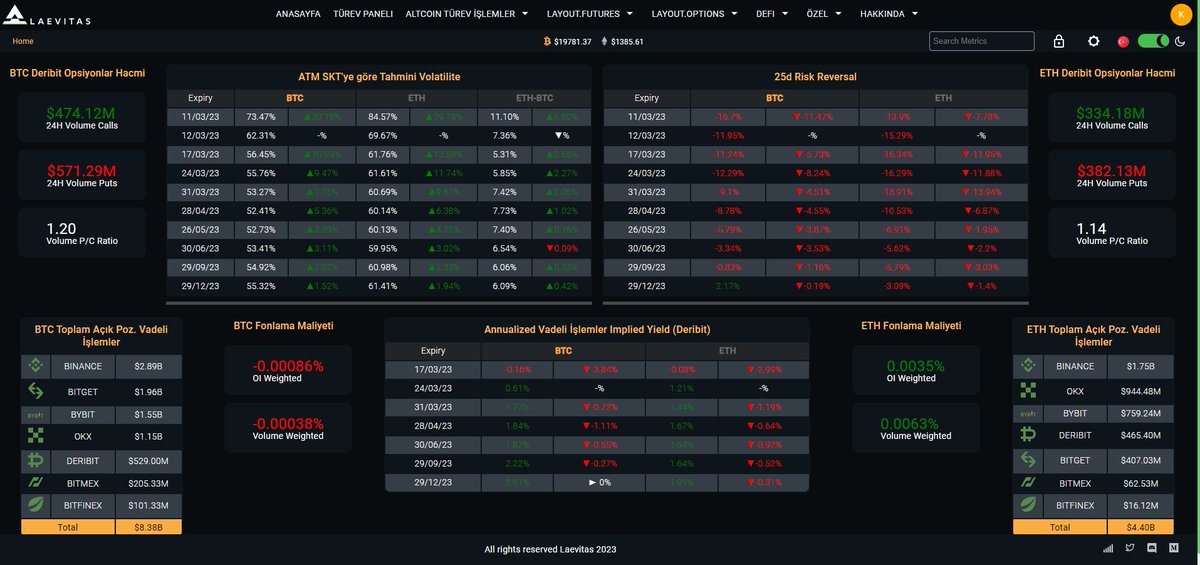

Opsiyonlar konusunda çok fazla veri olduğu için hergün yeni bir bölüm tanıta tanıta ilerliyeceğiz.Aceleye gerek yok,sağlam olsun tam olsun 🤗 @laevitas1

+++🧵

+++🧵

Öncelikle sitemize giriş yaptğınızda sizi böyle bir sayfa karşılayacak (Gözünüzü korkutmasın hepsini açıklacağım 🤗) ayrıca sitemizin Türkçe dil desteği var (yukarıda sağdan değiştirebilirsiniz).

+++🧵

+++🧵

Sol tarafta BTC #Deribit Opsiyonlar Hacmi yer alıyor.Peki Derebit borsası neden önemli ? @DeribitExchange ,Amsterdam merkezli bir kripto para türevleri borsasıdır ve Bitcoin opsiyonları,vadeli işlemleri başta olmak üzere çeşitli türev ürünleri sunmaktadır. (photo:@RektHQ)

+++🧵

+++🧵

#Tether watch!

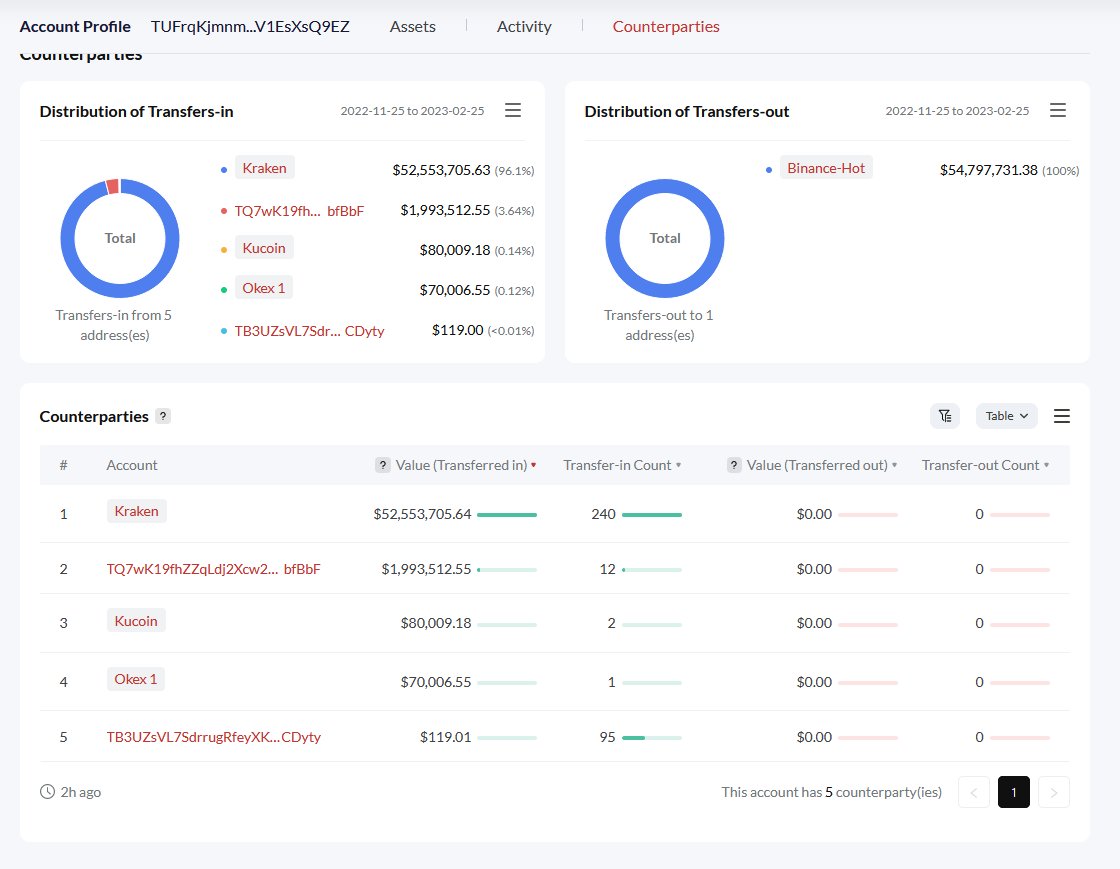

Got another juicy thread today tracking down Binance wash trading. Very juicy.

So, i was looking at the #USDT again that keeps flowing into #Binance via #Kraken. I did the crazy thing again, and found it in Binance Hot.

But this time i went even further.

Got another juicy thread today tracking down Binance wash trading. Very juicy.

So, i was looking at the #USDT again that keeps flowing into #Binance via #Kraken. I did the crazy thing again, and found it in Binance Hot.

But this time i went even further.

🧵1/Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

🧵2/Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

🧵3/Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

LOS ORÍGENES DE $USDT.

¿Cómo y por qué se creó #Tether? ¿Qué hay detrás de la #stablecoin más grande del mercado?

En este hilo os vamos a mostrar los inicios de Tether y la verdad oculta de cómo su token creció tanto de repente.

Dentro hilo 🧵👇🏻

1/

¿Cómo y por qué se creó #Tether? ¿Qué hay detrás de la #stablecoin más grande del mercado?

En este hilo os vamos a mostrar los inicios de Tether y la verdad oculta de cómo su token creció tanto de repente.

Dentro hilo 🧵👇🏻

1/

Empezaremos por sus orígenes:

En 2012 se crea en Hong Kong la empresa IFinex Inc, que se convertiría más adelante en la poseedora de Tether Ltd y el exchange Bitfinex.

#Bitfinex fue uno de los exchanges de #criptomonedas más grandes del mundo.

2/

En 2012 se crea en Hong Kong la empresa IFinex Inc, que se convertiría más adelante en la poseedora de Tether Ltd y el exchange Bitfinex.

#Bitfinex fue uno de los exchanges de #criptomonedas más grandes del mundo.

2/

A su vez, en 2012, JR Willet (famoso por haber concebido la primera ICO) publicaba un whitepaper en el que describía la posibilidad de construir nuevas criptomonedas sobre la blockchain de Bitcoin. Así nació la fundación Mastercoin.

3/

3/

peeps would recognise a few other connected domain names. noblex.io was one of the domains for #nobleinvestment bank.

We all experiencing a very long bear market in #Bitcoin and #cryptocurrencies. We are about -77% in #Bitcoin price and below -90% in many altcoins🩸 In the following 🧵we want to show why we see this as an opportunity not the other way around.Your Stockmoney Lizards🦎

The market situation of #Bitcoin is often referred to as dead and there is no shortage of postulating new lows.

-12k, -10k (very popular), -8k or even -6k🩸🩸🩸 Everything is possible, but much is priced in already. We trade the future, not the present😘

-12k, -10k (very popular), -8k or even -6k🩸🩸🩸 Everything is possible, but much is priced in already. We trade the future, not the present😘

Currently, we have the 4th major bear market in #Bitcoin. Compared to the last bear markets, there are clear patterns that repeat themselves🧊

We think we are at the end of the current bear market. All bear markets show falling wedge formation that needs to be broken.

We think we are at the end of the current bear market. All bear markets show falling wedge formation that needs to be broken.

@CasPiancey @BennettTomlin just listened to #ftx podcast. The bit when you discussed the irony re: #coindesk & #digitalcurrencygroup reminded me of one of my favourite (and I believe most under rated in importance) is #coinapult

Here's a #coindesk article from Oct 2014 covering an investment into #coinapult which included #bitcoinopportunitycorp aka #dcg aka #digitalcurrencygroup

I've been scratching my head thinking why does #curacao sound familiar re: #ifinex #tether #bitfinex finally I remembered Bitfinex Prediction Markets N.V was incorporated in Curacao

From the registry filing #Bitfinex Prediction Markets N.V was placed in liquidation August 2021.

So what was Bitfinex Prediction Markets? well its actually meant to be "Betfinex" and was first promoted in the crappy #leo #whitepaper (you know the one where #ifinex had c.$600m unpaid dividends (liabilities) to its shareholders and no way to pay them without the Leo raise).

So one thing I've learnt if you are a money launder or scammer stay away from #vatfraud. Ripping off citizen's is low risk but if you tax authorities they will hunt you down. check @nicolaborzi article.

ilfattoquotidiano.it/in-edicola/art…

ilfattoquotidiano.it/in-edicola/art…

European #vatfraud appears to be such a small world. reading through the article I recognised the reference to a MTIC VAT fraud scheme.

As it was #vatfraud that brought down #dannybarrs

founder of #globaltransactionservices and his associated #onestopshop favoured by #ponzi promoters for almost a decade.

founder of #globaltransactionservices and his associated #onestopshop favoured by #ponzi promoters for almost a decade.

Last September, Chicago-bound trading giant Jump Trading made a widely publicized crypto push by investing in decentralized exchange Serum, on #Solana.

Serum and Jump had inked a deal for an undisclosed amount that would see the outfit provide the liquidity…,

Serum and Jump had inked a deal for an undisclosed amount that would see the outfit provide the liquidity…,

necessary to make Serum-powered platforms like Mango Markets usable.

Since then, #Tether has issued Jump:

$1.1 billion in $USDT on Solana this year,

equal to almost 99% of all #USDT that exists on that blockchain.

Since then, #Tether has issued Jump:

$1.1 billion in $USDT on Solana this year,

equal to almost 99% of all #USDT that exists on that blockchain.

Jump Crypto is considered the top liquidity provider to Mango Markets and #Solana overall.

Jump “officially” spun out its Crypto subsidiary this September.

At the time, press materials said Jump Crypto builds tooling and other software infrastructure for blockchains!

Jump “officially” spun out its Crypto subsidiary this September.

At the time, press materials said Jump Crypto builds tooling and other software infrastructure for blockchains!

#TETHER distributed $108.5 billion in USDT,

received $32.7 billion in $USDT in that same period,

sent a staggering majority of $USDT directly to market makers and liquidity providers.

received $32.7 billion in $USDT in that same period,

sent a staggering majority of $USDT directly to market makers and liquidity providers.

Some of these entities maintain crypto exchanges; the data presented here relates specifically to their operational addresses as companies.

#Tether supplied categorized “market makers” with 89.2% of all $USDT ($97 billion) it sent.

Trading funds and other miscellaneous companies received $9.2 billion (8.5%).

Smaller transactions deemed to have been received by “individuals” amounted to $2.35 billion (2.3%).

Trading funds and other miscellaneous companies received $9.2 billion (8.5%).

Smaller transactions deemed to have been received by “individuals” amounted to $2.35 billion (2.3%).

1/6 Exclusive: there's a secret behind the founding of #Bitfinex and #Tether, a secret that links Italian #cryptocurrency guru Giancarlo #Devasini and Dutchman Ludovicus Jan van der Velde to Europe's Vat fraud king. #Thread by @nicolaborzi, @StefanoVergine and @EICnetwork

2/6 Devasini and van der Velde are considered the managers who created #Tether from scratch. But who is behind #Tether? ilfattoquotidiano.it/in-edicola/art…

3/6 Giancarlo #Devasini, the world's most famous Italian in the field of #cryptocurrency, has a judicial stain in his career dating back to 1996 and an additional one dated 2007. We told you about it here bit.ly/3Ts28zm

1/6 Esclusiva: c'è un segreto dietro la fondazione di #Bitfinex e #Tether, un segreto che lega il guru italiano delle #criptovalute, Giancarlo #Devasini e l'olandese Ludovicus Jan van der Velde al re europeo delle frodi d'Iva #Thread di @nicolaborzi, @StefanoVergine e @EICnetwork

2/6 Devasini e van der Velde sono considerati i manager che hanno creato #Tether dal nulla. Ma chi c'è dietro #Tether? ilfattoquotidiano.it/in-edicola/art…

3/6 Giancarlo #Devasini, l'italiano più famoso al mondo nel campo delle #criptovalute, ha una macchia giudiziaria nella sua carriera risalente al 1996 e una ulteriore datata 2007. Ve ne avevamo parlato qui bit.ly/3Ts28zm

İşinize yarayacağını düşünerek derli toplu dursun diye merkezi borsa rezervlerini ve rezervleri takip edebileceğiniz linkleri paylaşıyorum 🏦

Some of our fans in the telegram group are worried about #Kucoin's shortage of funds.

We analyzed the stablecoins hold by #Kucoin and found that in the past 7 days, there were not too many stablecoins flowing out from #Kucoin.

1.

A short thread.🧵

We analyzed the stablecoins hold by #Kucoin and found that in the past 7 days, there were not too many stablecoins flowing out from #Kucoin.

1.

A short thread.🧵

2.

Data from Nansen shows that #Kucoin’s stablecoin holdings on Ethereum have decreased by $236.6M in the past 7 days.

This is the main reason why users are worried.

Data from Nansen shows that #Kucoin’s stablecoin holdings on Ethereum have decreased by $236.6M in the past 7 days.

This is the main reason why users are worried.

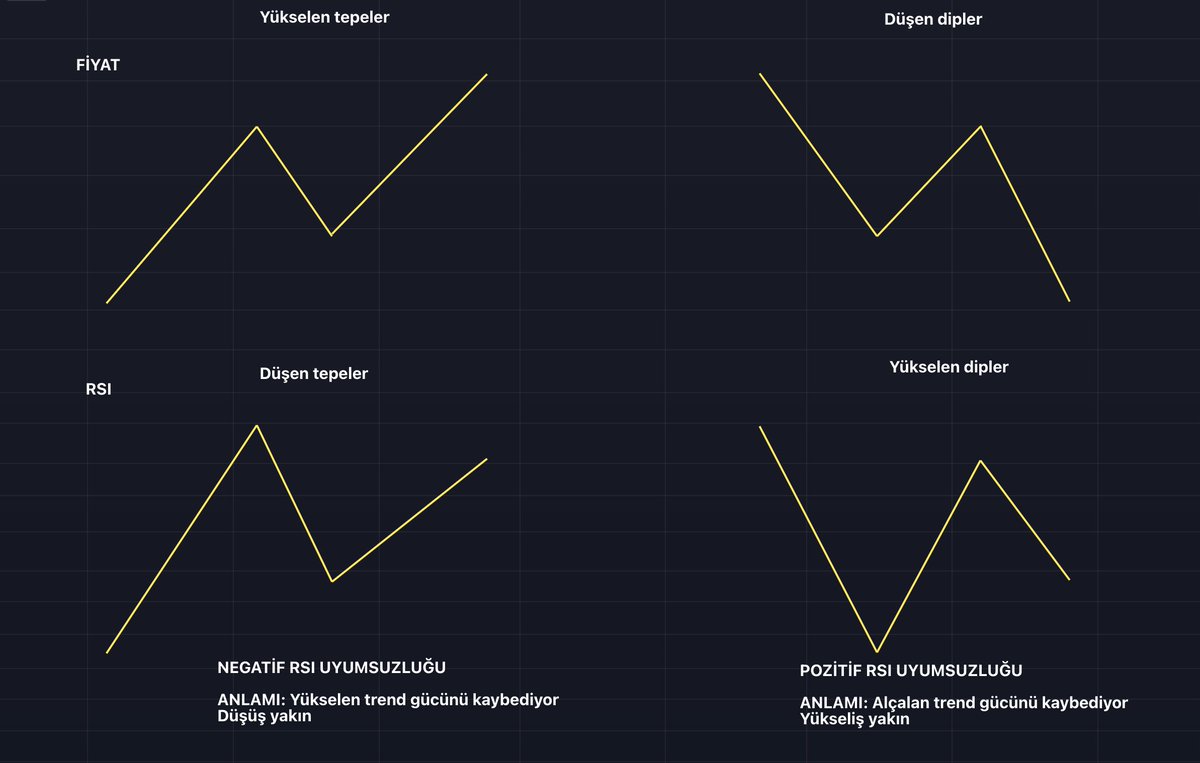

-EĞİTİM-

Momentum indikatörleri özellikle trend piyasalarda sıkça kullanılan değerli göstergelerdir.

RSI da bunlar arasında en çok kullanılanlar arasında.

RSI ile fiyat uyumsuzluğu genelde trend sonlarında oluşur ve momentumun tükendiğini gösterir.

#Bitfinex

@BitfinexTR

Momentum indikatörleri özellikle trend piyasalarda sıkça kullanılan değerli göstergelerdir.

RSI da bunlar arasında en çok kullanılanlar arasında.

RSI ile fiyat uyumsuzluğu genelde trend sonlarında oluşur ve momentumun tükendiğini gösterir.

#Bitfinex

@BitfinexTR

Whale closed 300.000 Long positions on Bitfinex😱

Let's find out WHY this is important and WHAT it could mean for the market 👇

#Bitcoin #Ethereum #Crypto #Bitfinex #Futures

Let's find out WHY this is important and WHAT it could mean for the market 👇

#Bitcoin #Ethereum #Crypto #Bitfinex #Futures

ETHUSDLONGS, a chart on tradingview which displays the total amount of open Long positions on Ethereum at Bitfinex. This metric has a major change in the recent data which is very important to be aware off.

The amount of ETHUSD Longs has been reduced with ± 300.000 (!!). That is a massive change on it's own, but it becomes more important when we take a look at historical data.