Discover and read the best of Twitter Threads about #CDMO

Most recents (16)

#PIIndustries is an established player in the Innovative Agro #CDMO space in India. They were planning to enter the Pharma CDMO space and have recently done some acquisitions as part of this plan through PI Health Sciences which is its wholly owned subsidiary for the Pharma space

1. Acquisition 1:

-The company has acquired 100% stake in Therachem Research Medilab India Pvt Ltd and Solis Pharmachem which are the Indian subsidiaries of the American entity Therachem Research Medilab LLC.

-The company has acquired 100% stake in Therachem Research Medilab India Pvt Ltd and Solis Pharmachem which are the Indian subsidiaries of the American entity Therachem Research Medilab LLC.

-These acquisitions have been done at a consideration value of $42 million and $3 million respectively. The company has also acquired some of the assets of TRM US for a consideration of $5 million through its subsidiary PIHS LLC.

#CRO vs #CDMO - Which business model is better? 🧬

Like & Retweet for max reach !

While both CROs and CDMOs work on novel drugs and help innovators reduce costs and time to market, there are some key differences between their business models.

Like & Retweet for max reach !

While both CROs and CDMOs work on novel drugs and help innovators reduce costs and time to market, there are some key differences between their business models.

1.Type of services provided

Contract Research Organizations (CRO) provide research services and clinical development support to innovative pharma companies to innovative pharma companies in the preclinical and clinical development stages of the drug development process.

Contract Research Organizations (CRO) provide research services and clinical development support to innovative pharma companies to innovative pharma companies in the preclinical and clinical development stages of the drug development process.

They are usually not involved in the commercial manufacturing of the drug.

Contract Development and Manufacturing Organizations (CDMO) provide drug development, scale up and commercial manufacturing services to innovators.

Contract Development and Manufacturing Organizations (CDMO) provide drug development, scale up and commercial manufacturing services to innovators.

Syngene is delighted to share that we are part of Fortune India’s Top 100 Wealth Creators list for 2021.

The criteria involved being a listed company with a 5-year CAGR of 7.5% plus in terms of market cap, revenue &profit (2017-21).

#FortuneIndia #Syngene #FortuneList #CDMO

1/5

The criteria involved being a listed company with a 5-year CAGR of 7.5% plus in terms of market cap, revenue &profit (2017-21).

#FortuneIndia #Syngene #FortuneList #CDMO

1/5

Those incurring a net loss in any of the 5 fiscals (2016-20) were filtered out. The final 100 were based on firms having revenues of Rs 300 crores or more in FY20.

2/5

2/5

Key to our success has been our growing clientele who regard us more as a strategic partner with flexibility to work across a spectrum of clients -MNCs to start-ups. We also have a consistent client retention rate of 90%.

#strategicpartnership #clientele #USA #Europe #Japan

3/5

#strategicpartnership #clientele #USA #Europe #Japan

3/5

#jubilantingrevia

Extracts from the investor presentation by the company for March 2021

#Q4updates🐝

#Nifty #sensex #stocks #pharma #cdmo #API #specialitychemicals

Extracts from the investor presentation by the company for March 2021

#Q4updates🐝

#Nifty #sensex #stocks #pharma #cdmo #API #specialitychemicals

#lauruslabs

No's in line

Rev 1411.9 vs 839.1 cr yoy

EBIDTA 450.3 vs 191.8 Cr

EBITDA Margin 31.9% vs 22.9% yoy

PAT 296.9 vs 110.2 Cr yoy EPS 5.53 vs 2.06

Fy21 /20

Rev 4837 vs 2837

PAT 317 vs 38

EPS 18.36 vs 4.79

#Q4updates🐝

No's in line

Rev 1411.9 vs 839.1 cr yoy

EBIDTA 450.3 vs 191.8 Cr

EBITDA Margin 31.9% vs 22.9% yoy

PAT 296.9 vs 110.2 Cr yoy EPS 5.53 vs 2.06

Fy21 /20

Rev 4837 vs 2837

PAT 317 vs 38

EPS 18.36 vs 4.79

#Q4updates🐝

#lauruslabs

Investor presentation Q4fy21

Generic API division robust growth 61% YoY

Anti Viral growth of 70% YoY

Generic FDF Rev up 102% YoY

Growth led by higher LMIC mkt vols & increased

vols from US & EU

Custom Synthesis division recorded a strong growth of 35% YoY

Investor presentation Q4fy21

Generic API division robust growth 61% YoY

Anti Viral growth of 70% YoY

Generic FDF Rev up 102% YoY

Growth led by higher LMIC mkt vols & increased

vols from US & EU

Custom Synthesis division recorded a strong growth of 35% YoY

#sequentScientific #Q3marketupdates #Q3investorpresentations

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Formulations

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

@LaurusLabs #lauruslabs #Q3marketupdates #Q3investorpresentations

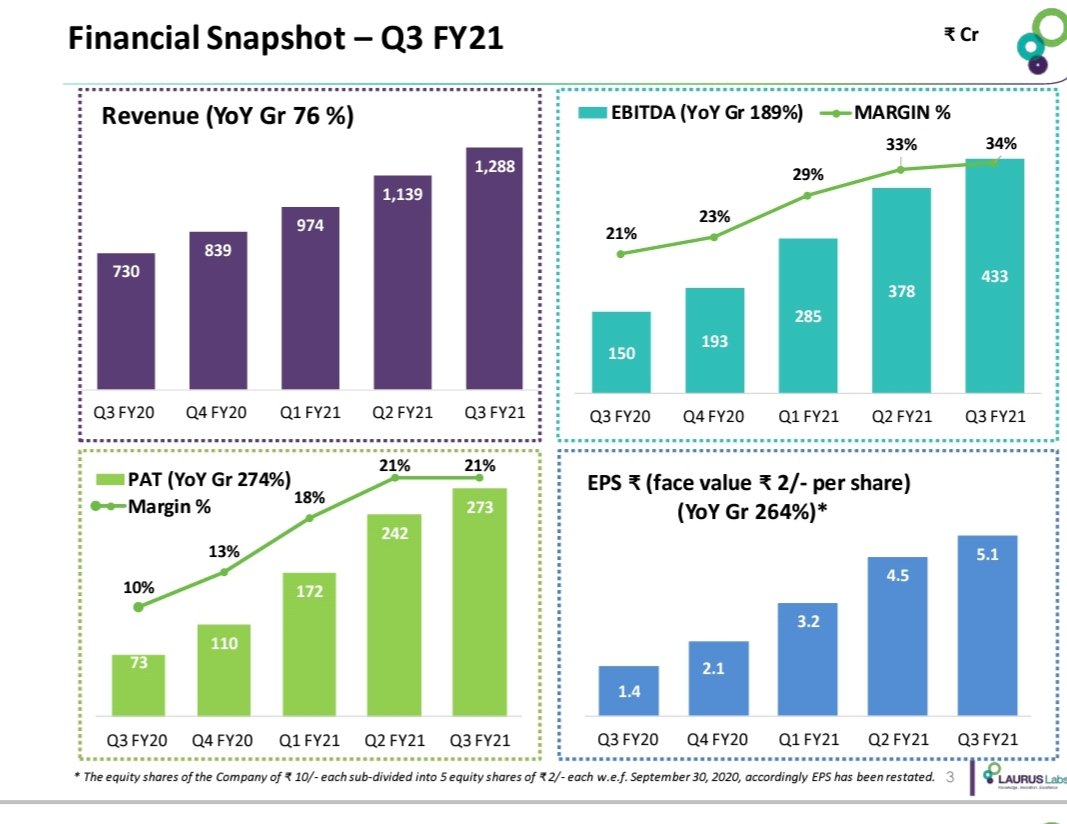

Q3fy21/20 in crs

Rev 1288/730 ,up 76%

Ebidta 433/150

PAT 273/73 ,up 274%

EPS 5.1/1.4

Generic API growth 103% yoy

ARVs up 175% yoy

Generic FDF up 47%

Custom synthesis up 63% yoy

Onco API growth 36%

Q3fy21/20 in crs

Rev 1288/730 ,up 76%

Ebidta 433/150

PAT 273/73 ,up 274%

EPS 5.1/1.4

Generic API growth 103% yoy

ARVs up 175% yoy

Generic FDF up 47%

Custom synthesis up 63% yoy

Onco API growth 36%

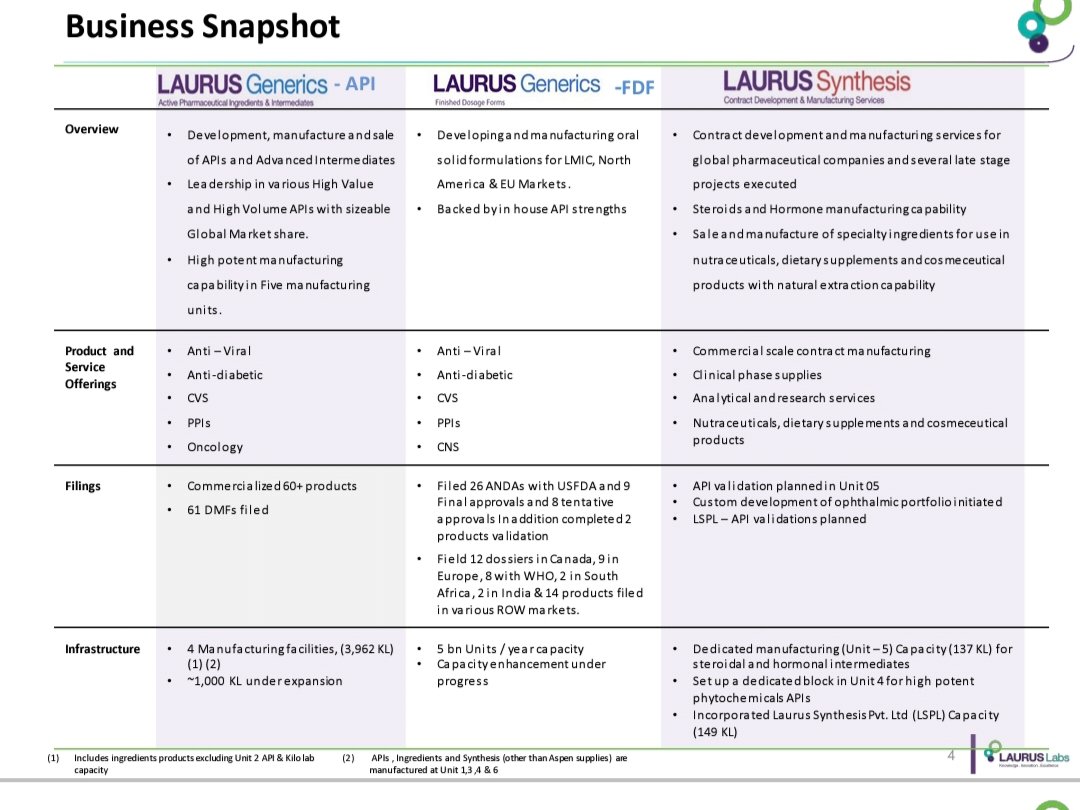

Generic APIs

ARV,Anti-DM,CVS,PPIs,Onco

Commercialized 60+ products

61 DMFs filed

Generic FDF

ARV,Anti-DM,CVS,PPIs,Onco

Filed 26 ANDAs with USFDA

9 final & 8 tentative approvals

Filed 12 dossiers in Canada, 9 in EU ,8 with WHO,2 in S.Africa, 2 in India

ARV,Anti-DM,CVS,PPIs,Onco

Commercialized 60+ products

61 DMFs filed

Generic FDF

ARV,Anti-DM,CVS,PPIs,Onco

Filed 26 ANDAs with USFDA

9 final & 8 tentative approvals

Filed 12 dossiers in Canada, 9 in EU ,8 with WHO,2 in S.Africa, 2 in India

#glandpharma

#Q3marketupdates #Q3investorpresentations

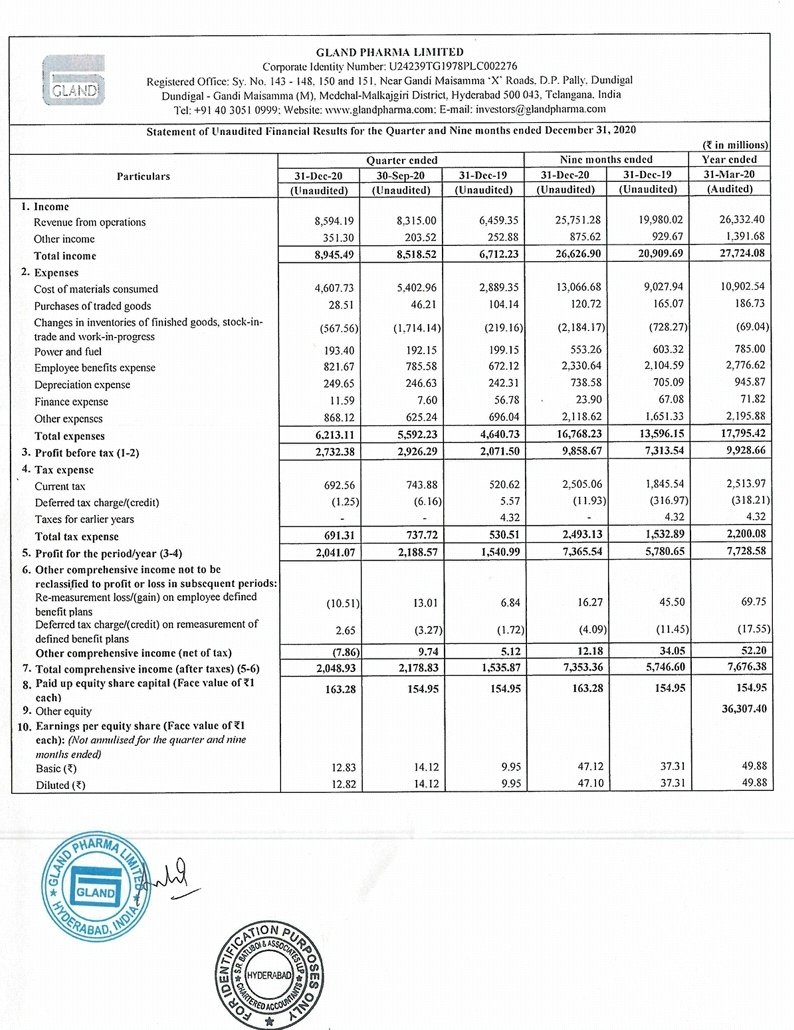

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

#Q3marketupdates #Q3investorpresentations

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

R&D expenses INR Mn

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

New launches

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

#glandpharma

Injectable focused B2B company

Mkt includes US,Europe,India,Australia

Niche area - sterile injectables,Oncology,Opthalmic solns

Focus -complex injectables,first to file,NCE-1, 505(b)(2) filings

Chinese promoter Shanghai Fosun Pharma is a global pharma major

#pharma

Injectable focused B2B company

Mkt includes US,Europe,India,Australia

Niche area - sterile injectables,Oncology,Opthalmic solns

Focus -complex injectables,first to file,NCE-1, 505(b)(2) filings

Chinese promoter Shanghai Fosun Pharma is a global pharma major

#pharma

Fosun acquired controlling stake in gland 74% in 2017 for $1.09 bn

Gland has 267 ANDA filings in the US Mkt, 215 approved

267 filings - 191 sterile injectables, 50 oncology ,26 ophthalmic

Out of 267,101 ANDA are owned by Gland of which 71 approved

Good regulatory compliance

Gland has 267 ANDA filings in the US Mkt, 215 approved

267 filings - 191 sterile injectables, 50 oncology ,26 ophthalmic

Out of 267,101 ANDA are owned by Gland of which 71 approved

Good regulatory compliance

@JubilantLifeSci

Q2fy21 Revenue up 4.8% yoy to 2347.9 crs led by traction in CMO/Generics in Pharma & Life sciences in LSI segment

- Radiopharma business impacted by Covid & launch of macroaggregated Albumin (MAA) by competitor Curium(jubilant was sole player)

#pharma #Nifty

Q2fy21 Revenue up 4.8% yoy to 2347.9 crs led by traction in CMO/Generics in Pharma & Life sciences in LSI segment

- Radiopharma business impacted by Covid & launch of macroaggregated Albumin (MAA) by competitor Curium(jubilant was sole player)

#pharma #Nifty

MAA business witnessed price & mkt share erosion

-DTPA business impacted by decrease in ventilation scan due to covid

-Generic business growth led by traction existing products,launch of Remdesivir

-JLS to launch Remdesivir in 70 countries, exported API to US & injs in India

-DTPA business impacted by decrease in ventilation scan due to covid

-Generic business growth led by traction existing products,launch of Remdesivir

-JLS to launch Remdesivir in 70 countries, exported API to US & injs in India

Radiopharma 90% & allergy business 100% precovid levels

-Partnership with SOFIE Biosciences in molecular theranostics

- JLS to double DDDS capacity by Fy22

- LSI business speciality declined 2% & nutritional grew 11% led by VIT D exports to EU while ethyl acetate muted growth

-Partnership with SOFIE Biosciences in molecular theranostics

- JLS to double DDDS capacity by Fy22

- LSI business speciality declined 2% & nutritional grew 11% led by VIT D exports to EU while ethyl acetate muted growth

After months of use ,billions of $ for pharma companies

Oxygen,steroids,and heparin,glucose control,early diagnosis & treatment mainstay

@Cipla_Global

#gilead

WHO suspends Remdesivir from list of medicines timesofindia.indiatimes.com/world/europe/w…

Download the TOI app now:

timesofindia.onelink.me/mjFd/toisupers…

Oxygen,steroids,and heparin,glucose control,early diagnosis & treatment mainstay

@Cipla_Global

#gilead

WHO suspends Remdesivir from list of medicines timesofindia.indiatimes.com/world/europe/w…

Download the TOI app now:

timesofindia.onelink.me/mjFd/toisupers…

@USFDA & @WHO appear to take different paths

Barcitinab approved for use with #remdesivir for #COVID19 infection

#API

#cdmo #pharma #Nifty #sensex #stocks

expresspharma.in/covid19-update…

Barcitinab approved for use with #remdesivir for #COVID19 infection

#API

#cdmo #pharma #Nifty #sensex #stocks

expresspharma.in/covid19-update…

Mild to mod cases with early treatment

Early diagnosis & treatment holds the key

#dontletdownthatmaskyet

#COVID19

#LongCovid

#Nifty

#stocks

City docs find proof Favipiravir works for the moderately ill

toi.in/ZJsSBa14/

Download the TOI app now:

timesofindia.onelink.me/mjFd/toisupers…

Early diagnosis & treatment holds the key

#dontletdownthatmaskyet

#COVID19

#LongCovid

#Nifty

#stocks

City docs find proof Favipiravir works for the moderately ill

toi.in/ZJsSBa14/

Download the TOI app now:

timesofindia.onelink.me/mjFd/toisupers…

@SyngeneIntl conference call transcript Q2FY21

Revenue from operations up 12%, 519 cr ,Ebidta 169 cr, PAT 84 cr

#COVID19 impacting operations of the company & its clients

Set up the busiest PCR testing center in Bangalore

Overall growth driven by discovery science,R & D center

Revenue from operations up 12%, 519 cr ,Ebidta 169 cr, PAT 84 cr

#COVID19 impacting operations of the company & its clients

Set up the busiest PCR testing center in Bangalore

Overall growth driven by discovery science,R & D center

#Navinfluorine investor presentation Q2fy21

Revenue 512 cr

High value business

H1FY20/H1FY21 - 253/332 ,increase 32%

Ebidta - 146 cr

Operating PBT - 125cr

H1FY21 revenue contribution from high value business - 65%

#Nifty #sensex #StockMarket #stocks

Revenue 512 cr

High value business

H1FY20/H1FY21 - 253/332 ,increase 32%

Ebidta - 146 cr

Operating PBT - 125cr

H1FY21 revenue contribution from high value business - 65%

#Nifty #sensex #StockMarket #stocks

Q2FY21

Revenue 308 cr

High value business Q2Fy20/Q2Fy21- 141/201 ,increase 42%

Ebidta 93cr

PBT 83cr

H1Fy20/H1Fy21

Legacy business 253/180 ,decrease 29%

High value business

253/332 ,increase 32%

Total revenue 506/512 ,increase 1%

Operating Ebidta 128/146

#chemicals

Revenue 308 cr

High value business Q2Fy20/Q2Fy21- 141/201 ,increase 42%

Ebidta 93cr

PBT 83cr

H1Fy20/H1Fy21

Legacy business 253/180 ,decrease 29%

High value business

253/332 ,increase 32%

Total revenue 506/512 ,increase 1%

Operating Ebidta 128/146

#chemicals

Piramal Q2 results update

28% increase in equity

39% reduction in debt D/E 0.96

12% YoY increase net profit 1124cr

No.of exposure >15% net worth of financial services - 1

Pharma arm valued EV of $ 2.7-3.1bn

CDMO revenue growth YoY 20%

@PiramalGroup #pharma #Nifty #sensex

28% increase in equity

39% reduction in debt D/E 0.96

12% YoY increase net profit 1124cr

No.of exposure >15% net worth of financial services - 1

Pharma arm valued EV of $ 2.7-3.1bn

CDMO revenue growth YoY 20%

@PiramalGroup #pharma #Nifty #sensex

India consumer product YoY growth +25%

Ebidta margin Q2fy21 23%

Net debt :

Mar'19 - 55,122cr

Oct'20 - 33457 cr

D/E - 2 to 0.96

Segment wise equity allocation

Financial 48%

Pharma 22%

Unallocated 23%

Equity of 25,000 cr for financial services to acquire oppurtunities

Ebidta margin Q2fy21 23%

Net debt :

Mar'19 - 55,122cr

Oct'20 - 33457 cr

D/E - 2 to 0.96

Segment wise equity allocation

Financial 48%

Pharma 22%

Unallocated 23%

Equity of 25,000 cr for financial services to acquire oppurtunities

Consolidation in real estate picking pace - industry wise decline in number of developers since 2012 - 53%

Wholesale loanbook

Mar 19 - 51436cr

Sep 20 - 45840cr

Top 10 exposure

Mar 19 - 18404cr

Sep 20 - 14717cr,down by 20%

No.of account with> 15% net worth decreased frm 3 to 1

Wholesale loanbook

Mar 19 - 51436cr

Sep 20 - 45840cr

Top 10 exposure

Mar 19 - 18404cr

Sep 20 - 14717cr,down by 20%

No.of account with> 15% net worth decreased frm 3 to 1

Extracts from Syngene Annual Report

CRO,CMO Business

Global CRO Market to grow at CAGR of 7.6% 2019 to 2025 to reach $61 billion

Pharma & biopharmaceutical companies - primary users of CRO services

CRO,CMO Business

Global CRO Market to grow at CAGR of 7.6% 2019 to 2025 to reach $61 billion

Pharma & biopharmaceutical companies - primary users of CRO services

Offlate medical device companies, consumer products,cosmetics, specialty & agrochemicals are also employing the services of CROs

CROs are alts to inhouse R&D, help pharma & biopharma to cut R&D costs manage regulatory requirements, increase speed to market of life saving drugs

CROs are alts to inhouse R&D, help pharma & biopharma to cut R&D costs manage regulatory requirements, increase speed to market of life saving drugs

CRO market

A)Drug discovery - market expected to grow from $3.9bn in 2017 to $6.8bn in 2025 ,CAGR of 7.37%

B)Pre clinical - market expected to grow from $3.5bn in 2017 to $ 6.6bn in 2025 ,CAGR of 8.31%

C) Clinical - market to grow from $25.5bn in 2017 to $41.2bn in 2025

A)Drug discovery - market expected to grow from $3.9bn in 2017 to $6.8bn in 2025 ,CAGR of 7.37%

B)Pre clinical - market expected to grow from $3.5bn in 2017 to $ 6.6bn in 2025 ,CAGR of 8.31%

C) Clinical - market to grow from $25.5bn in 2017 to $41.2bn in 2025