Discover and read the best of Twitter Threads about #CFPB

Most recents (8)

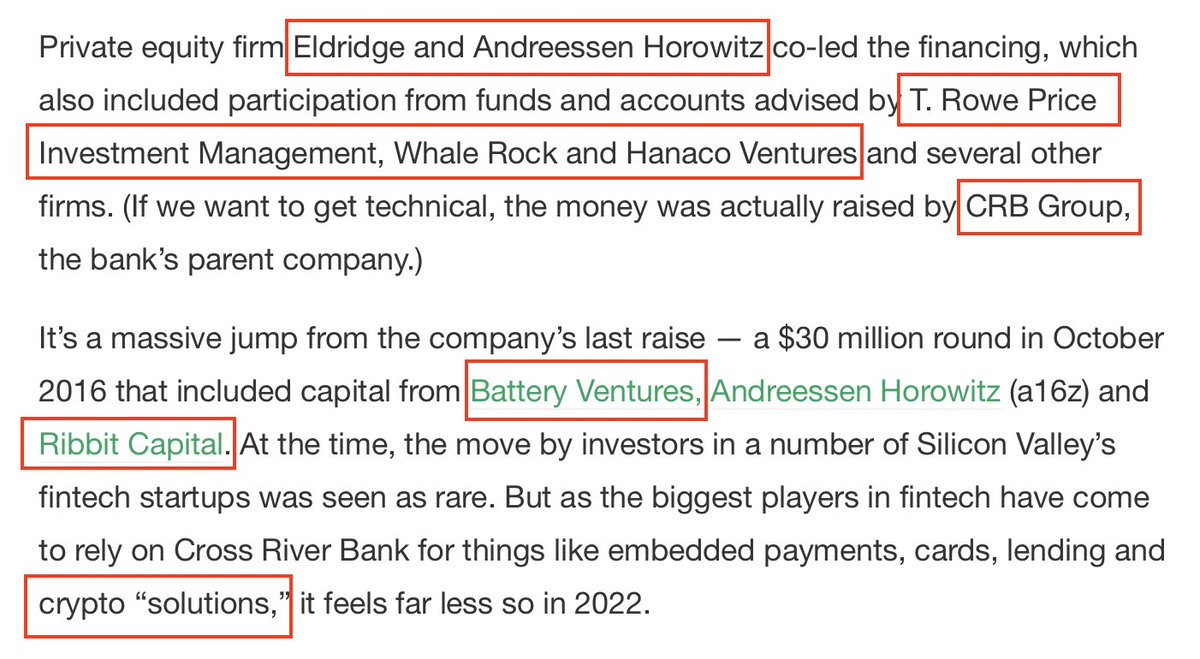

🧵1/Ω A few things about @crossriverbank, a tiny #a16z funded lender that originated more #PPP loans for "small businesses" than anyone besides Chase, BofA, and Wells Fargo, mostly for people who were not their customers.

Also @coinbase's preferred bank.

techcrunch.com/2022/03/30/cro…

Also @coinbase's preferred bank.

techcrunch.com/2022/03/30/cro…

🧵2/Ω They paid @McKinsey a bunch of money to tell the world that "while most banks originated PPP loans to their own customers, Cross River leads in originations to new customers"

mckinsey.com/industries/fin…

mckinsey.com/industries/fin…

🧵3/Ω Unlike other banks that blew up on "fund banking" recently (*cough* $SBNY $SIVB *cough*) @crossriverbank does their "fund banking" differently:

They package all the loans and sell them to weird "fintech" companies like @Upstart. @mikulaja

They package all the loans and sell them to weird "fintech" companies like @Upstart. @mikulaja

I'm happy to report that my most recent article (with @DeucesTecum) has been published with @DickinsonLRev.

It uses student loan complaints in the CFPB database as a proxy for customer satisfaction.

ideas.dickinsonlaw.psu.edu/cgi/viewconten…

#studentloans #fintech #CFPB #consumercomplaints

It uses student loan complaints in the CFPB database as a proxy for customer satisfaction.

ideas.dickinsonlaw.psu.edu/cgi/viewconten…

#studentloans #fintech #CFPB #consumercomplaints

We created a novel data set drawn from the @CFPB's consumer complaint database. Using only student loan complaints, we found 212 companies were complained about.

We then identified which complained-about companies were fintechs.

We then identified which complained-about companies were fintechs.

We then compared the complaints against these fintech lenders and/or servicers to the complaints against non-fintech lender/servicers.

In general, we find very few complaints against fintechs. Are fintechs doing a particularly good job making and servicing student loans?

In general, we find very few complaints against fintechs. Are fintechs doing a particularly good job making and servicing student loans?

Y’all still following the #ToryLanezTrial? Meanwhile..

“#WellsFargo agreed to a $3.7B settlement with the Consumer Financial Protection Bureau over customer abuses tied to checking accounts, mortgages & auto loans, with some of the misconduct happening as recently as this year.”

“#WellsFargo agreed to a $3.7B settlement with the Consumer Financial Protection Bureau over customer abuses tied to checking accounts, mortgages & auto loans, with some of the misconduct happening as recently as this year.”

“The company was ordered to pay a record $1.7 billion civil penalty and more than $2 billion to customers with 16 million accounts, the #CFPB said in a statement.”

#WellsFargo

cnbc.com/amp/2022/12/20…

#WellsFargo

cnbc.com/amp/2022/12/20…

“"Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank."”

#WellsFargo

cnbc.com/amp/2022/12/20…

#WellsFargo

cnbc.com/amp/2022/12/20…

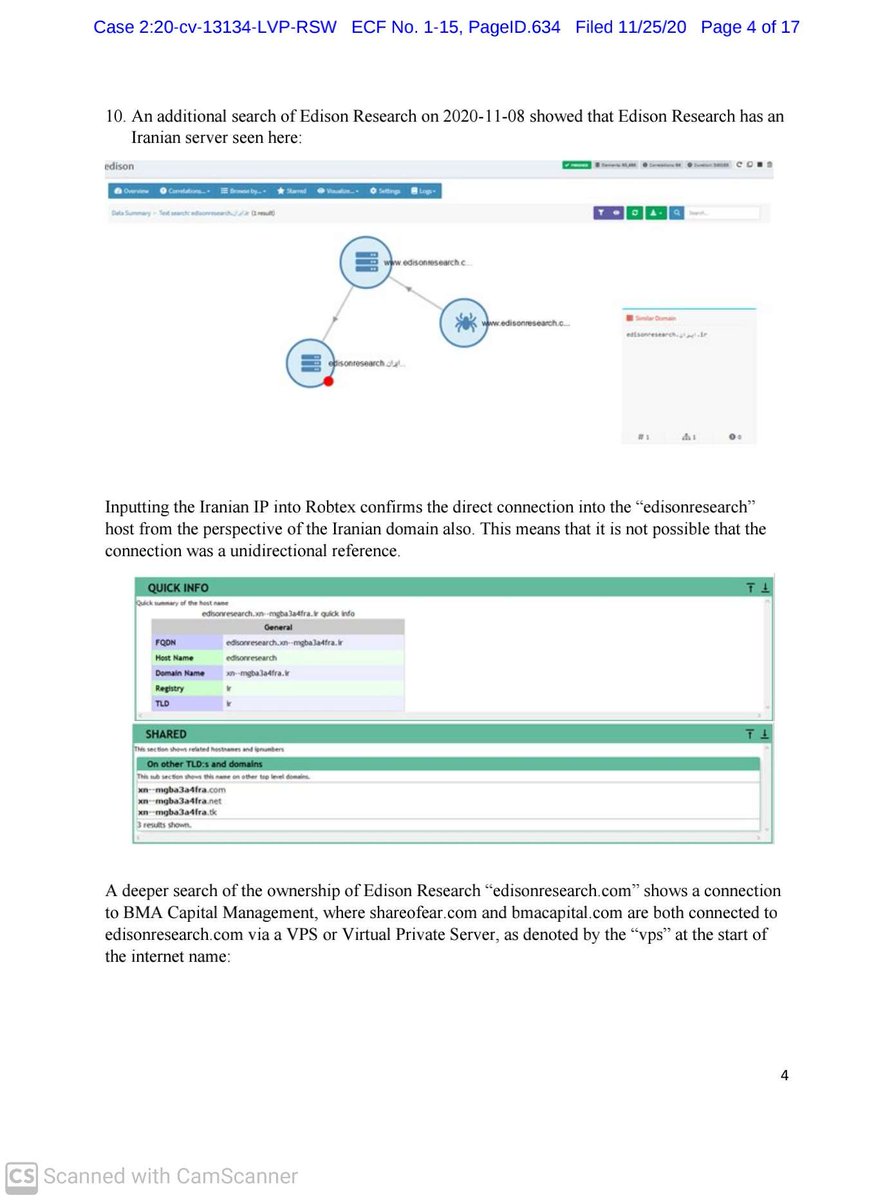

1. How the electi0n was st0len in '17' easy pages from #SidneyPowell filing in Michigan.

#Exhibit105 pages 1-4

Direct connection to #Serbia #Iran #BMACapitalManagement #DominionVotingSystems #EdisonResearch #DecisionHQ #Spiderfoot #Robtex @POTUS

#Exhibit105 pages 1-4

Direct connection to #Serbia #Iran #BMACapitalManagement #DominionVotingSystems #EdisonResearch #DecisionHQ #Spiderfoot #Robtex @POTUS

2. And now here comes #China

Records of #IPAddresses accessing server #ChinaUnicom even the Dominion domain was registered thru Godaddy to #Hunan China #BMACapitalManagement provides #Iran access to money averting US #sanctions and here is #Scorecard #ACORN #obama #Robtex @POTUS

Records of #IPAddresses accessing server #ChinaUnicom even the Dominion domain was registered thru Godaddy to #Hunan China #BMACapitalManagement provides #Iran access to money averting US #sanctions and here is #Scorecard #ACORN #obama #Robtex @POTUS

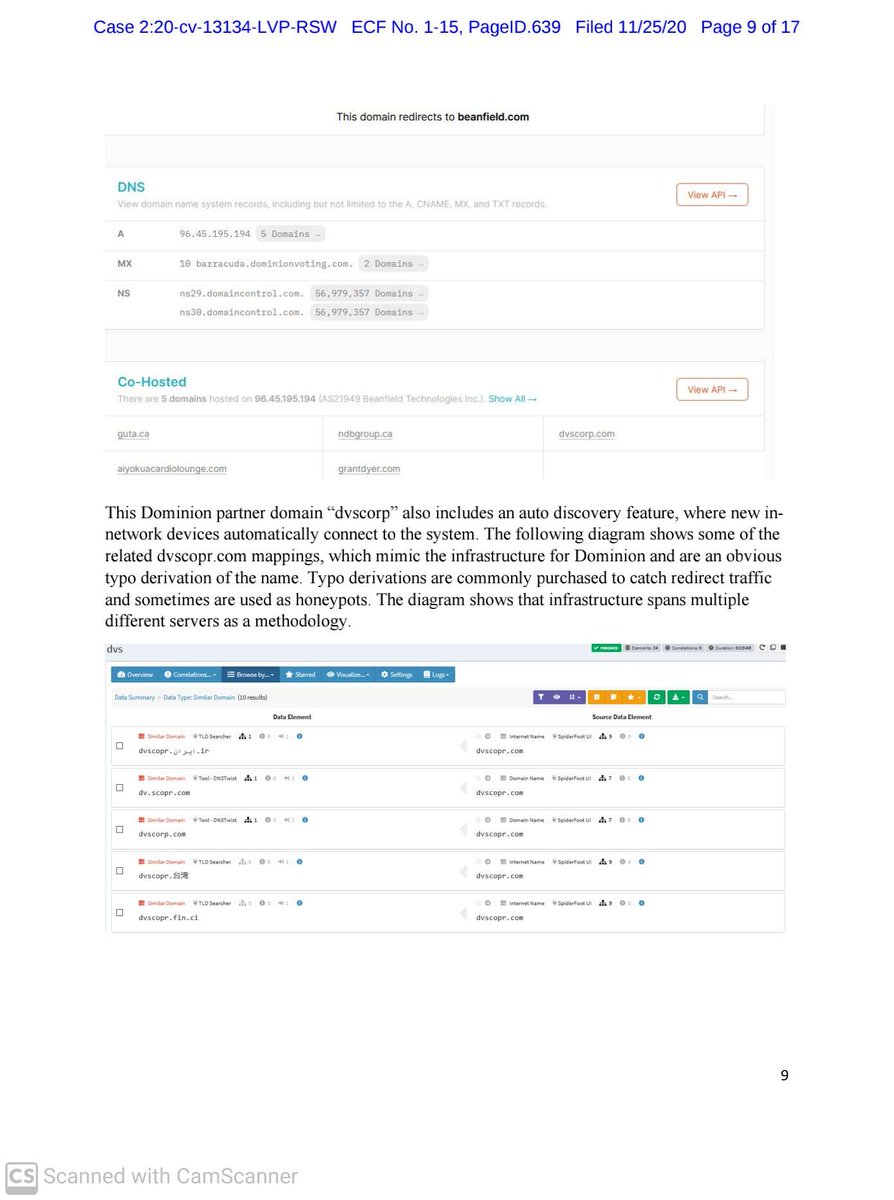

3. In pages 9-12 of #Exhibit105 enter #Canada with alternate domain #DVScorp redirected to #Beanfield

For those with fatfingers domains like #DVScopr were also used thru #China Dominion "loaned" their intellectual property patents to #HSBCbank in #China selling out USA. @POTUS

For those with fatfingers domains like #DVScopr were also used thru #China Dominion "loaned" their intellectual property patents to #HSBCbank in #China selling out USA. @POTUS

THREAD: When it comes to political appointees, the Trump admin has 1 standard: personal loyalty to the president. In typical norm breaking fashion, applicants for political positions have been asked to their describe public commentary on Mr. Trump

1/8

1/8

Political appointees are also subject to “reinterviews” to further test their loyalty. Those who fail to advance Trump’s agenda are swiftly removed. At RDP we are wary of these lasting appointees who have survived the admin’s loyalty tests.

2/8

2/8

While the vast majority of Trump’s loyalists will step down on Biden’s inauguration day, a small but powerful group will not. These appointees could sabotage a federal government that works in the public’s interest.

3/8

3/8

We’ve been parsing the decision and rulings of the #CFPB case today but we haven’t gotten too far into its potential ramifications. There are places reporting that the decision by #SCOTUS means the FHFA director is subject to firing. Well ...

In the case study category of why states matter for consumer protection and protecting against #predatorylending, this story of a policy failure of the #CFPB to address payday loans merits notice. nytimes.com/2020/04/29/bus…

The painful reality is--"many borrowers find themselves unable to repay their debts quickly, and borrow again. Half of all payday loans are extended at least nine times, piling up fees that can exceed the value of the original loan." That's why we in Colorado banned payday loans.

And the #CFPB knew all of this, as demonstrated by their research. But the leadership insisted on disregarding it and seeking to help payday lenders, not consumers. Thankfully, we have states who can pay attention to the data and protect consumers.

Thread on Stanley Fischer, who's mentioned in this Grassley letter to Mnuchin.

Stanley Fischer was Federal Reserve Vice Chairman in 2015 when he met w/ Russians Maria Butina & Alexander Torshin and Nathan Sheets, then-Treasury undersecretary for international affairs

#Spygate

Stanley Fischer was Federal Reserve Vice Chairman in 2015 when he met w/ Russians Maria Butina & Alexander Torshin and Nathan Sheets, then-Treasury undersecretary for international affairs

#Spygate

Fischer previously served as Governor of Bank of Israel 2005 to 2013

and Chief economist World Bank

Obama nominated him for Vice-Chair of the Fed on January 10, 2014

Fischer announced his resignation on September 6, 2017 for "personal reasons" (uh huh)

en.wikipedia.org/wiki/Stanley_F…

and Chief economist World Bank

Obama nominated him for Vice-Chair of the Fed on January 10, 2014

Fischer announced his resignation on September 6, 2017 for "personal reasons" (uh huh)

en.wikipedia.org/wiki/Stanley_F…

Fischer had already previously served as Vice Chairman of Citigroup, President of Citigroup International, and Head of the Public Sector Client Group.

He also stepped down as governor of the Bank of Israel on June 30, 2013, halfway into his 2nd term.

He also stepped down as governor of the Bank of Israel on June 30, 2013, halfway into his 2nd term.