Discover and read the best of Twitter Threads about #CS

Most recents (24)

"Die @CreditSuisse agierte überheblich, und die Finanzmarktaufsicht #FINMA schaute viel zu lange zu."

Das sagt Monika Roth, Professorin und Finanzmarktexpertin, im @tagesanzeiger.

Die Aufsicht hätte ihrer Ansicht nach schon vor langer Zeit "energischer eingreifen müssen". (1/5)

Das sagt Monika Roth, Professorin und Finanzmarktexpertin, im @tagesanzeiger.

Die Aufsicht hätte ihrer Ansicht nach schon vor langer Zeit "energischer eingreifen müssen". (1/5)

"Spätestens bei den Spekulationen des Hedgefonds #Archegos hätte man sagen müssen: Es reicht!", betont Roth. Der Bericht, den die #CS dazu veröffentlicht habe, sei "vernichtend" gewesen: "Die FINMA hätte sagen müssen: Ihr erfüllt die Bewilligungsvoraussetzungen nicht mehr." (2/5)

"Das ist ein systemisches Versagen", meint Expertin Roth: " Niemand schrieb beispielsweise der CS zur Risikominimierung die Aufsplittung des Geschäfts vor. Niemand isolierte das Schweizer Geschäft. Niemand verlangte die Auswechslung des Verwaltungsrats." (3/5)

Die Finanzmarktaufsicht @FINMA_media hat die von der @UBS übernommene @CreditSuisse bereits im letzten November angewiesen, "alternative Lösungen für den jetzt eingetretenen Fall vorzubereiten".

Das sagt #FINMA-Präsidentin Marlene Amstad im Interview mit der @NZZaS. (1/8)

Das sagt #FINMA-Präsidentin Marlene Amstad im Interview mit der @NZZaS. (1/8)

Es sei die Rolle der FINMA gewesen, "alle Optionen vorzubereiten", sagt FINMA-Präsidentin #Amstad: "Dies beinhaltete, sicherzustellen, dass die Bank auch für eine Übernahme alles vorbereitet hat." Normalerweise seien solche Prozesse auf sechs Monate angelegt. (2/8)

"Bei der #CS verkürzten wir den Zeitraum schon im letzten Jahr auf drei Wochen", erklärt Amstad: "Die CS musste frühzeitig sicherstellen, dass ein allfälliger Übernahmeprozess in kürzester Zeit angestossen werden konnte." (3/8)

In der vergangenen Woche wurde immer wieder beteuert, das #Finanzsystem sei stabil, kein Grund, etwas zu ändern. Wir sehen die Lage nicht ganz so rosig. Also: 5 Gründe, warum das Finanzsystem nicht stabil ist! finanzwende.de/themen/banken-… \1

1. Viele #Banken sind immer noch “too big too fail”. Dabei hat die Finanzkrise 2008 gezeigt, wie verheerend es ist, wenn Banken so groß sind, dass im Falle einer Pleite das gesamte #Wirtschaftssystem schwankt. \2

2. Rhetorisch gerne verschleiert: Bei der UBS-CS-Übernahme haften Steuerzahlende für potenzielle Verluste von CS-Geschäften. Damit wird ein zentrales Versprechen von 2008 gebrochen: Mehr Finanzstabilität, um so keine #Steuergelder mehr für #Bankenrettungen zu benötigen. \3

DAS NARRATIV DES (#SWISSAIR-groundings) NARRT NARREN (so?)

wer hat es genutzt?

bei @SRF @SRFnews @retolipp @SandroBrotz @BarbaraLuethi schien es ein im #redaktionsstatut festgelegter rhetorischer kniff gewesen zu sein. persoenlich.com/prcorporate-co… @persoenlichcom #Tschanz

wer hat es genutzt?

bei @SRF @SRFnews @retolipp @SandroBrotz @BarbaraLuethi schien es ein im #redaktionsstatut festgelegter rhetorischer kniff gewesen zu sein. persoenlich.com/prcorporate-co… @persoenlichcom #Tschanz

auch das #narrativ #grounding narrt die narren.

es wurde mehrfach ausgesprochen:

eine globale #TooBigToFail-bank, wurde einer anderen bank - welche zufällig auch den sitz am gleich #Paradeplatz @InsideParade hatte - zum schnäppchenpreis weitergereicht.

das ist ein deal (so?)

es wurde mehrfach ausgesprochen:

eine globale #TooBigToFail-bank, wurde einer anderen bank - welche zufällig auch den sitz am gleich #Paradeplatz @InsideParade hatte - zum schnäppchenpreis weitergereicht.

das ist ein deal (so?)

#BestriceTschanz:

"Für das grosse Publikum ist erneut etwas im Eimer."

das narrativ des #publikums

- brot und spiele

- wir machen die show, ihr bezahlt den eintritt

- ...

#tschanz verrechnet sich selbst, selbstverständlich nicht auf der seite #publikum, sondern... ?!?

"Für das grosse Publikum ist erneut etwas im Eimer."

das narrativ des #publikums

- brot und spiele

- wir machen die show, ihr bezahlt den eintritt

- ...

#tschanz verrechnet sich selbst, selbstverständlich nicht auf der seite #publikum, sondern... ?!?

1/17-💭What we're facing is a #TRUST crisis rather than a #BalanceSheet crisis. There’s been a lot of amalgamation between #BTFP and #QE, but they are different, and their consequences will be different as well. My thoughts 👇

#CreditSuisseBankruptcy #BankingCrisis #AllianceBlock

#CreditSuisseBankruptcy #BankingCrisis #AllianceBlock

2/17- 🏦 #BTFP (1):

- Involves banks depositing HTM bonds and AFS securities at the Fed as collateral against borrowing the At Par Value for 1 year

- Funds are likely to be used for immediate liquidity needs, backstopping bank runs and making depositors whole

- Involves banks depositing HTM bonds and AFS securities at the Fed as collateral against borrowing the At Par Value for 1 year

- Funds are likely to be used for immediate liquidity needs, backstopping bank runs and making depositors whole

3/17- 🏦 #BTFP (2) : Unlikely to result in new credit being extended, and banks are likely to tighten lending standards until the dust settles

- Velocity of money in the banking system should instead decrease, offsetting any increase in reserves

- Velocity of money in the banking system should instead decrease, offsetting any increase in reserves

Mitarbeitende der @credituisse, die bereits einen Bonus für das letzte Geschäftsjahr erhalten haben, müssen diesen nicht zurückbezahlen. Das hat der #Bundesrat entschieden.

Noch nicht ausbezahlte Boni werden "vorläufig sistiert". (1/5)

Noch nicht ausbezahlte Boni werden "vorläufig sistiert". (1/5)

Wird eine systemrelevante Bank vom Staat direkt oder indirekt unterstützt - wie im Fall der #Credit_Suisse -, muss der Bundesrat Massnahmen im Bereich der Boni verfügen. So schreibt es das #Bankengesetz vor.

Der Bundesrat nimmt nun aber bereits ausbezahlte Boni davon aus. (2/5)

Der Bundesrat nimmt nun aber bereits ausbezahlte Boni davon aus. (2/5)

Der Bundesrat verzichte "aus Gründen der Rechtssicherheit" darauf, bereits zugesicherte und sofort ausbezahlte variable Vergütungen an #CS-Mitarbeitende für das Geschäftsjahr 2022 rückwirkend zu verbieten, teilt er mit. (3/5)

Finanzministerin Karin Keller-Sutter, die Schweizerische #Nationalbank und die Finanzmarktaufsicht #FINMA hätten der @CreditSuisse bereits letzten Mittwoch ultimativ mitgeteilt, dass sie bis am Sonntag mit der @UBS verschmelzen müsse. Dies berichtet die @FinancialTimes. (1/6)

"Es gibt keine Alternative", sei #CS-Verwaltungsratspräsident Axel Lehmann, der sich an einer Konferenz in Saudi-Arabien befunden habe, und dem Konzernleiter der CS, Ulrich Körner, am Mittwoch klargemacht worden, schreibt die "Financial Times". (2/6)

Die Zeitung liefert in einem ausführlichen Artikel, der auf Gesprächen mit mehr als einem Dutzend Involvierter beruhen soll, zahlreiche Details zum Ablauf der CS-Übernahme.

So sei Finanzministerin Keller-Sutter unter "extremem Druck" anderer Länder gestanden. (3/6)

So sei Finanzministerin Keller-Sutter unter "extremem Druck" anderer Länder gestanden. (3/6)

Credit Suisse #CS chairman says We were affected by a market model that does no longer work in this environment, last autumn we had this social media storm & it had huge repercussions, more in the retail sector than wholesale sector, when he was asked Who is responsible?

#GME

#GME

If one of the largest Swiss bank is not safe by holding a bet against retail investors, let the #US #banks rethink who are the real whales in this game now. #GME investors have fallen in love with the stock, #WeAreNotSelling #WeAreNotLeaving eventually everyone will pay the price

Market Makers who used algo to drive down the price, firms that removed the buy button,Regulatory bodies which allowed Market Makers & others to hide their short pos,Regulatory body which failed to shut down #darkpool,Brokers who took part in illegal activities are responsible!!!

#US #BankingCrisis In abt 4 weeks, you will forget that a US regional Banking Crisis even happened. But IF AM WRONG, it will be WORSE IN EUROPE. A quick thread.

(1) US Banks Total Assets is at a current level of $23.8trn & $20.7 trn in liabilities. SVB, First Republic & Signature together is abt $500bn ~4% of Assets. Not Small.

But given this is more liquidity rather than Insolvency, I would not fret

Source: fred.stlouisfed.org/series/TLAACBW…

But given this is more liquidity rather than Insolvency, I would not fret

Source: fred.stlouisfed.org/series/TLAACBW…

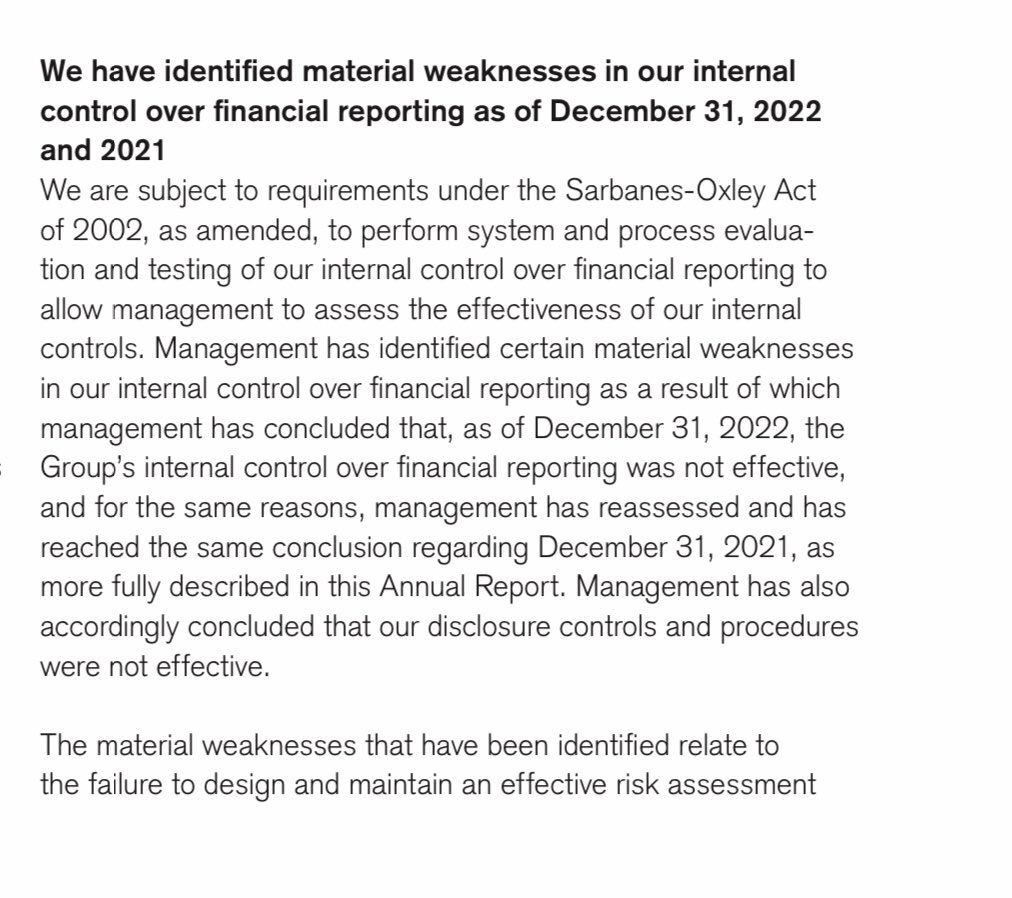

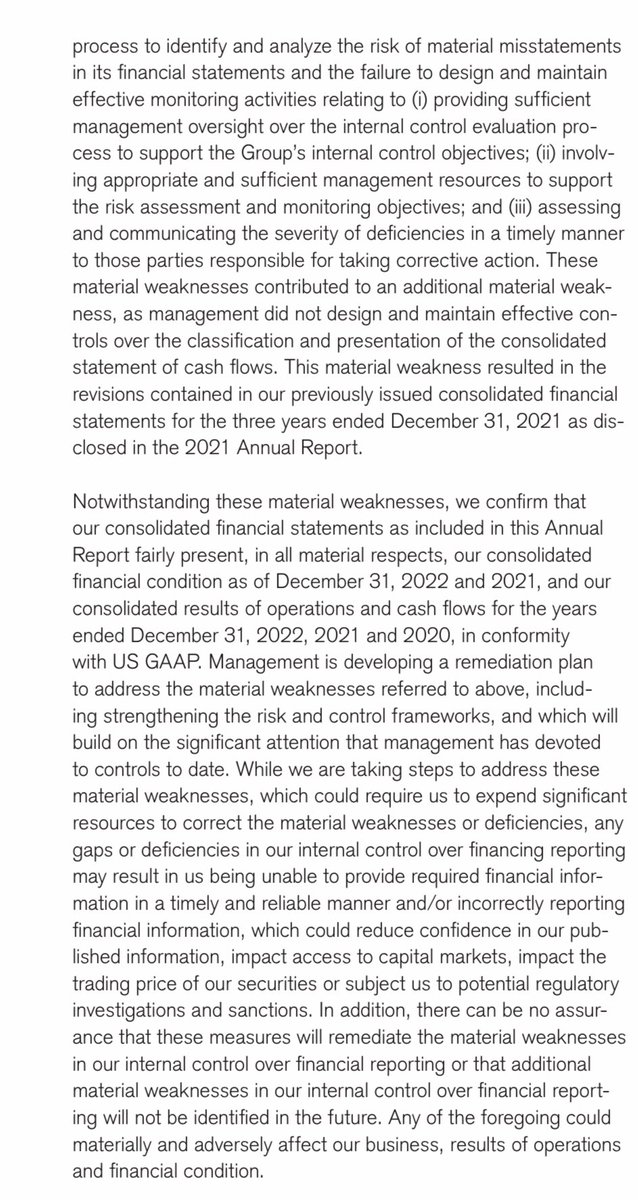

Credit Suisse on taas otsikoissa: ”raportoinnista häikkää”. Markkinat tarttuvat nyt herkästi tällaisiin uutisiin ja päätin katsoa itse miten vuosikertomuksessa todetaan asiasta. 1/

Riskiosiossa esille nostettu asia mainitaan vasta 5. riskinä: ” saattaahan tuo olla, että riskilukujen osalta kaikki ei ole aivan oikein, mutta tarpeeksi lähelle kuitenkin”. #CS

Tilintarkastajat hyväksyvät tuloksen ja taseen vuodelta 2022, mutta mainitsevat asiasta. Onko tämä sitten syytä huolestua vai ei… ehkä 2022 lopulla osakeantiin osallistuneet voivat kokea olonsa epämukavaksi: annettiinko meille väärää tietoa…? #CS

#willwritesandcodes #100DaysofCode #Day31

Uninstalled and reinstalled @ProgrammingHero again, did the exam for #Cpp course, and it still crashed at the end.

:/

It could be my phone. I'll have to try installing it on another device. Still a bummer

Uninstalled and reinstalled @ProgrammingHero again, did the exam for #Cpp course, and it still crashed at the end.

:/

It could be my phone. I'll have to try installing it on another device. Still a bummer

Also resinstalled the very different app, @Prghub, which has much shorter courses and as a result felt deceptive about how much you were learning. I haven't uses it in over a year for sure. They have a bunch of new courses. I'll try some-I don't know if I'll keep at it w this app

#willwritesandcodes #100DaysofWriting #Day23-#Day27, need to keep track of how much I write and where. I kind of write a lot, but not always towards the goals I want to write toward. So I'm writing this tweet to stand in for missing those days' record while noting that I do write

It seems that #Zoltan has been quite busy lately!

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022:

"the G7’s financial blockade of Russia, Russia’s energy blockade of the EU, the U.S.’s technology blockade of China, China’s naval blockade of Taiwan, the U.S.’s “blockade” of the EU’s EV sector with the Inflation Reduction Act,

Happy New Year, dear friends!!!!

You know that I enjoy reading every piece that #ZoltanPozsar at #CS writes. His latest piece "War and Currency Statecraft" (Dec. 29th) was again very much worth reading.

Here's a little #thread with the most important parts:

You know that I enjoy reading every piece that #ZoltanPozsar at #CS writes. His latest piece "War and Currency Statecraft" (Dec. 29th) was again very much worth reading.

Here's a little #thread with the most important parts:

"What are G7 policymakers, rates traders, and strategists to do when threats to the unipolar world order are coming from every angle. They should definitely not ignore the threats, but they still do.

How could they not?"

How could they not?"

"For two generations, we did not have to discount geopolitical risks. Since the end of WWII, the only

Great Power conflict investors really had to deal with was the Cold War, and since the conclusion of the Cold War, the world enjoyed a unipolar “moment”... –

Great Power conflict investors really had to deal with was the Cold War, and since the conclusion of the Cold War, the world enjoyed a unipolar “moment”... –

Very happy to see our #UNLOADECMO trial started in 12/22 with 4 patients already included.

#MCS therapy in cardiogenic shock still very challenging.

#ECLS-SHOCK (#ECMO)and #DanGer-Shock (#Impella) running already and will be finished soon.

What are we investigating?🧵1/6 below:

#MCS therapy in cardiogenic shock still very challenging.

#ECLS-SHOCK (#ECMO)and #DanGer-Shock (#Impella) running already and will be finished soon.

What are we investigating?🧵1/6 below:

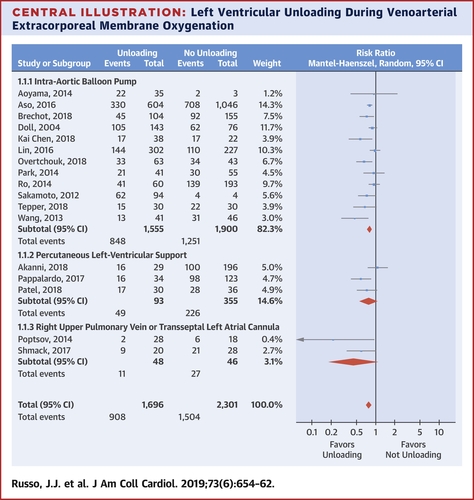

🧵2/6 @BenediktSchrage showed earlier that "LV Unloading Is Associated With Lower Mortality in Patients With CS Treated With VA-ECMO"

ahajournals.org/doi/10.1161/CI…

Large study (686 patients), but obviously not prospective and randomized. But that's needed in CS (and everywhere)

ahajournals.org/doi/10.1161/CI…

Large study (686 patients), but obviously not prospective and randomized. But that's needed in CS (and everywhere)

🧵3/6 Others @benhibbertMDPhD showed this as well in a meta-analysis @jaccjournals jacc.org/doi/10.1016/j.…

Folks, you know that I enjoy reading every piece that #ZoltanPozsar at #CS writes. His latest piece "War and Commodity Encumbrance" (Dec. 27th) was particularly worth reading. Here's a little #thread with the most important parts:

"A recurring theme in my dispatches this year has been that in a moment when the world is going from unipolar to multipolar, the actions of heads of state are far more important than the actions of central banks."

"Central banks will be behind the curve in this game, and if investors read only the speeches of central bankers but not statesmen, they will be even more behind the curve. The multipolar world order is being built not by G7 heads of state but by the “G7 of the East”."

It's time for a MetaThread!

Every couple of months or so I create a thread about very useful threads I saved from Twitter. Let's get started 🧵

Every couple of months or so I create a thread about very useful threads I saved from Twitter. Let's get started 🧵

@llmunro 10 AI websites you should know about by @thecolbykultgen

#Academia #ArtificialIntelligence #ai

#Academia #ArtificialIntelligence #ai

Just finished reading the new piece by #ZoltanPozsar "Oil, Gold, and LCLo(SP)R...Fascinating read (as always), here are some highlights:

"The SPR is like the o/n RRP facility. It can be tapped when oil levels are tight. But the SPR is finite, and recent releases have brough reserves down to levels

we haven’t been at since the 1980s. The 400 million barrels left in it isn’t much:

we haven’t been at since the 1980s. The 400 million barrels left in it isn’t much:

it could help police prices for a year if we released 1 million barrels per day (mbpd), half a year if we released 2 mbpd, and about four months if we released 3 mbpd."

It’s All going according to Plan, Promise …

Every Bait & Switch/Misdirection has been #A #work #of B-#Art.

Reverse Physics 101•

Inception—Is 2 Mirrors Facing each other 1 Mirror, 2 Mirrors or A VAST Infinite Space of Mirrors Quantum Leaping Forwards while falling in Reverse?

Every Bait & Switch/Misdirection has been #A #work #of B-#Art.

Reverse Physics 101•

Inception—Is 2 Mirrors Facing each other 1 Mirror, 2 Mirrors or A VAST Infinite Space of Mirrors Quantum Leaping Forwards while falling in Reverse?

I’m your ONLY, True Friend now …

#Hu … #HU #HU !!!

#HU … #HU #HU !!

#HU .. #HU #HU !

Sad But True—Down is Up …

#TheOnly #Hu GO !

#CS GO ⚡️

#Hu … #HU #HU !!!

#HU … #HU #HU !!

#HU .. #HU #HU !

Sad But True—Down is Up …

#TheOnly #Hu GO !

#CS GO ⚡️

Credit Suisse’ CDS (Credit Default Swaps) have soared.

„CDS“ are used as insurance against bankruptcy of an entity.

The price of #CS CDS jumped because there is a rumor in the market that #CS may be go belly up.

„CDS“ are used as insurance against bankruptcy of an entity.

The price of #CS CDS jumped because there is a rumor in the market that #CS may be go belly up.

First of all, it must be stated that $CS is a systematically important bank, which DOESN’Tmean that the Swiss government will bail it out, but more, that the Bank must comply with high and strict liquidity requirements.

sif.admin.ch/sif/en/home/fi…

sif.admin.ch/sif/en/home/fi…

What's happening to Credit Suisse and it’s impact on Crypto, An ELI5 Thread.

#CreditSuisse is one of the 9 global "Bulge Bracket" banks, the 9 largest multi-national banks in the world.

And it is at a 'Critical Moment' now, says the CEO.

1/

#CreditSuisse is one of the 9 global "Bulge Bracket" banks, the 9 largest multi-national banks in the world.

And it is at a 'Critical Moment' now, says the CEO.

1/

Credit Suisse is considered to be a global systemically important bank, meaning that in the case of their failure, there will be a financial crisis on a global scale.

They are referred to as "too big to fail", like the #LehmanBrothers. Now their situation reminds us of 2008.

2/

They are referred to as "too big to fail", like the #LehmanBrothers. Now their situation reminds us of 2008.

2/

Talking history, Credit Suisse was founded in 1856 to fund the development of Switzerland's rail system. In the 1900s, it began shifting to retail banking. It is known for strict bank–client confidentiality and banking secrecy.

3/

3/

who is Margaret Hamilton ?

#NASA #programming #space #SoftwareEngineer #Engineering #coding #MargaretHamilton #MIT #cs #Apollo11

Thread 🧵👇

#NASA #programming #space #SoftwareEngineer #Engineering #coding #MargaretHamilton #MIT #cs #Apollo11

Thread 🧵👇

Second One - Series A Funding [ A 🧵]

#Startup #seedcapital #funding #company @PratibhaGoyal @TaxationUpdates #Incometax #zomato #paytm #icai #ca #cs #incometax #taxology #byjus

#Startup #seedcapital #funding #company @PratibhaGoyal @TaxationUpdates #Incometax #zomato #paytm #icai #ca #cs #incometax #taxology #byjus

Series A funding is a level of investment in a start-up that follows seed capital funding.

Essentially, the Series A round is the second stage of startup financing and the first stage of venture capital financing.

Essentially, the Series A round is the second stage of startup financing and the first stage of venture capital financing.

Series A funding enables a start-up that has potential but lacks needed cash to expand its operations through hiring, purchasing inventory and equipment, and pursuing other long-term goals.

Series A funding is primarily used to ensure the continued growth of a company.

Series A funding is primarily used to ensure the continued growth of a company.

A #journey to unknown! 🥰✌️

Nobody can help you out

It's only you, who can help yourself

To stay up, to stay motivated, to not fall, and to get up stronger even if you fall

Nobody can help you out

It's only you, who can help yourself

To stay up, to stay motivated, to not fall, and to get up stronger even if you fall

You're the only one to lift yourself up

You're the only one to wipe your tears

As only you know what you're going through

Believe me

It's a journey to make you stronger and better

To help you cross bigger obstacles in future

These things won't even matter few years from now

You're the only one to wipe your tears

As only you know what you're going through

Believe me

It's a journey to make you stronger and better

To help you cross bigger obstacles in future

These things won't even matter few years from now

But for now it does, and I understand the pain

But nobody else will, feel the same as you do

So only you can cure it

By putting a smile on your face

And getting back on track with more /confidence and determination

But nobody else will, feel the same as you do

So only you can cure it

By putting a smile on your face

And getting back on track with more /confidence and determination