Discover and read the best of Twitter Threads about #DeathCross

Most recents (4)

1/23 It's easy to find bullish and bearish elements in the charts to fit you bias, but being a maxi can be risky. Remember:

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

3/23 The #GoldenCross printed and the #DeathCross between the 200 & 50 WMA's is coming on the next candle. Knowing why we have conflicting signals isn't as critical as knowing how price will react, but if I had to guess, I'd say, short term manipulation.

The almighty #deathcross has nicely marked two bottoms for #DXY

If you wanna know more about this lagging indicator follow to the thread below as it is not only the case in #Bitcoin 👇

If you wanna know more about this lagging indicator follow to the thread below as it is not only the case in #Bitcoin 👇

It doesn't stop there the #deathcross also marked close to the bottom of the 08 financial crisis.

The last Weekly #deathcross to this day has also marked the bottom of the #Apple stock price in 01 followed by a 42000% rally

A thread

1/ #Bitcoin - How I’ll be trading the #deathcross!

The trade, should the patterns from 2014/18 bear markets repeat, is to buy weakness 7-10days heading into the 50/200 SMA death cross (2H~ of June) & sell 3-4wks later if & when we see the 50/200 EMA golden cross.

1/ #Bitcoin - How I’ll be trading the #deathcross!

The trade, should the patterns from 2014/18 bear markets repeat, is to buy weakness 7-10days heading into the 50/200 SMA death cross (2H~ of June) & sell 3-4wks later if & when we see the 50/200 EMA golden cross.

2/** DEATH CROSS INCOMING **

I recently read a great thread from @rektcapital summarising price action around major death cross signals on Bitcoin. In short, a death cross (50day below 200day) looks possible for the first time in this bear market by 2H of June to early July.

I recently read a great thread from @rektcapital summarising price action around major death cross signals on Bitcoin. In short, a death cross (50day below 200day) looks possible for the first time in this bear market by 2H of June to early July.

3/ ** HISTORICALLY SIGNIFICANT MED-TERM DOWNSIDE AFTER A DEATH CROSS **

In 2014 it was followed by 71%~ downside before the cycle lows. In 2017 there was a further 65%~ correction to cycle lows. HOWEVER in both these cases the death cross was a s-term buying opportunity.

In 2014 it was followed by 71%~ downside before the cycle lows. In 2017 there was a further 65%~ correction to cycle lows. HOWEVER in both these cases the death cross was a s-term buying opportunity.

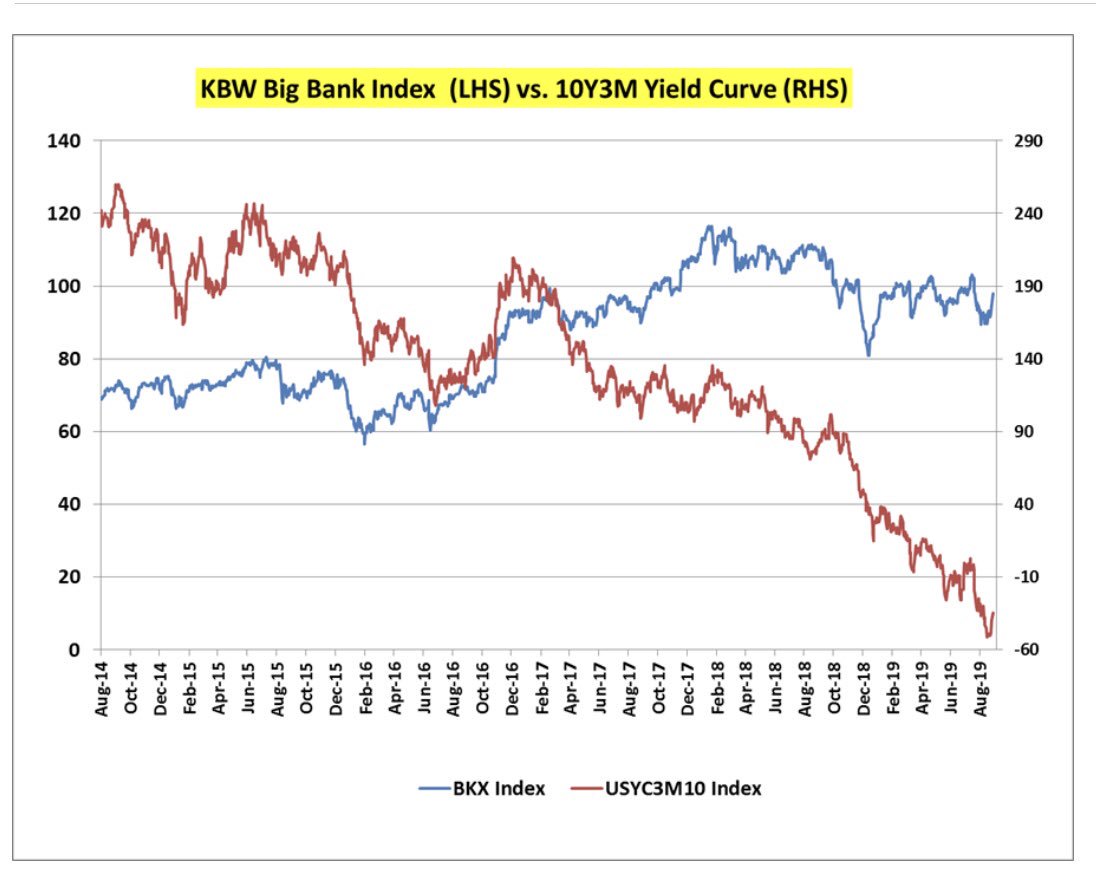

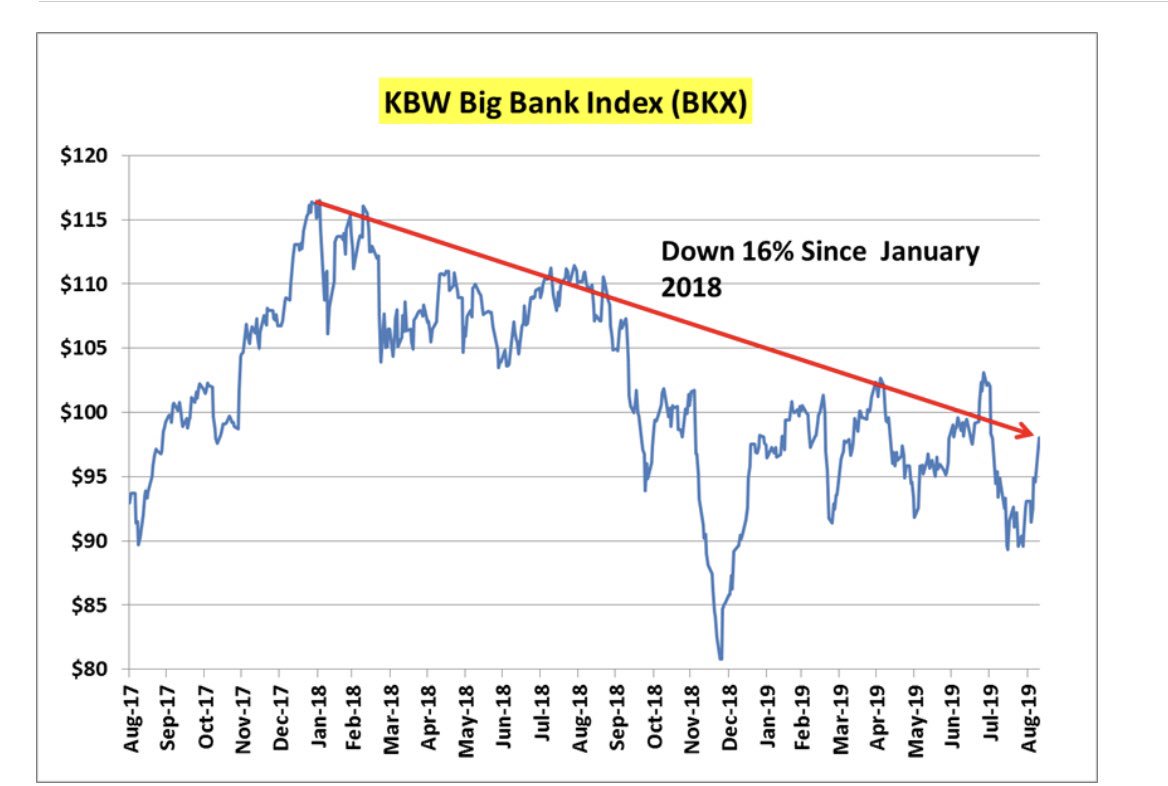

It’s just the beginning.. rate cuts take time to price in. Spread between bond market rate expectations & Bank stocks are large. There’s a lot of $XLF complacency imho..just hear Bank CEOs talk up the economy & their book. Credit costs are edging higher in C&I & already in Cards.

At some point the gravitational pull of the Yield Curve may be a rude awakening for Street Consensus $XLF Bulls & Bank Management.. unless the assertions that this time is different with the Curve comes to Bear over time.

BKX Index approaching a #DeathCross

$TLT $KRE $IWM

BKX Index approaching a #DeathCross

$TLT $KRE $IWM