Discover and read the best of Twitter Threads about #FixedIncome

Most recents (15)

1. Many can benefit from these fixed return saving instruments

1. Senior citizen saving scheme: 8.2% interest

2. Sukanya Samriddhi yojana: 8% interest

3. Mahila Samman Saving certificate: 7.5% interest

4. Public provident fund: 7.1% interest

#FixedIncome #savings #investments

1. Senior citizen saving scheme: 8.2% interest

2. Sukanya Samriddhi yojana: 8% interest

3. Mahila Samman Saving certificate: 7.5% interest

4. Public provident fund: 7.1% interest

#FixedIncome #savings #investments

2. Senior citizen savings scheme

*For people aged >60 yrs

*Can invest from Rs 1000 to 30 lakhs

*Duration for 5 years (extendable by 3 years)

*Interest is paid quarterly on the 1st day of April, July, October and January

*For people aged >60 yrs

*Can invest from Rs 1000 to 30 lakhs

*Duration for 5 years (extendable by 3 years)

*Interest is paid quarterly on the 1st day of April, July, October and January

3. Sukanya Samriddhi yojana

*Account can be opened in the name of girl child below age 10

*Payment: Rs 250 to 1.5 lakhs per year for 15 years

*Maturity after 21 years

*Can be availed for maximum of two daughters per family

*Account can be opened in the name of girl child below age 10

*Payment: Rs 250 to 1.5 lakhs per year for 15 years

*Maturity after 21 years

*Can be availed for maximum of two daughters per family

Are you a Senior Citizen looking to secure your Retirement and generate regular income?

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

As we grow older, it's important to plan for retirement and consider investment options that offer stability and security.

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

#1 Senior Citizen Savings Scheme (SCSS)

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

Here are some highlights from the Voices of Tomorrow Bangalore Chapter! (1/n)

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

Session #01

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

“We want to make Millennials as $ Millionaires – a well-managed wealth corpus for the 90’s born.” - @shyamsek on what ithought wants to accomplish.

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

A confluence of unprecedented events in 2022 weakened asset prices across all markets. (1/n)

#assetallocation #investing #personalfinance #throwback #thread

#assetallocation #investing #personalfinance #throwback #thread

The Fed’s pivot to a less aggressive monetary policy is likely to set the tone for the markets in 2023. (2/n)

#FED #FederalReserve #monetarypolicy

#FED #FederalReserve #monetarypolicy

It is expected that global inflation will continue to be higher in this decade, in combination with a significant slowdown of the U.S. economy. (3/n)

#inflation #interestrates #globalmarket

#inflation #interestrates #globalmarket

To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

The #financialyear is coming to an end, which means it’s appraisal time. As we assess how we did last year as a wealth manager, here’s a report card of how the Scripbox recommended basket of #mutualfunds performed. A thread. (1/8)

Within our recommended basket of #equity funds, a few have outperformed the benchmark across time periods, while a few funds have admittedly underperformed, based on the benchmark. Let’s dig in deeper: (2/8)

Thanks to @steve_sedgwick & @cnbcKaren for having me on #CNBC #SquawkBox this AM.

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

Are people in denial or is the #centralbank money flood just drowning all the signals?

2/n

#inflation

2/n

#inflation

#Commodities, #freight, #carbon - and a whole lot besides - sure do cost a lot more, these days.

3/n

3/n

In preparation for my slot on #SquawkBox yesterday, I sent the guys a few slides as a synopsis of my last, detailed subscriber report for the discussion.

I called it #Pyromania. Feel free to take a look

1/x

#macro #bonds #commodities #dollar #inflation #centralbanks #fiscal

I called it #Pyromania. Feel free to take a look

1/x

#macro #bonds #commodities #dollar #inflation #centralbanks #fiscal

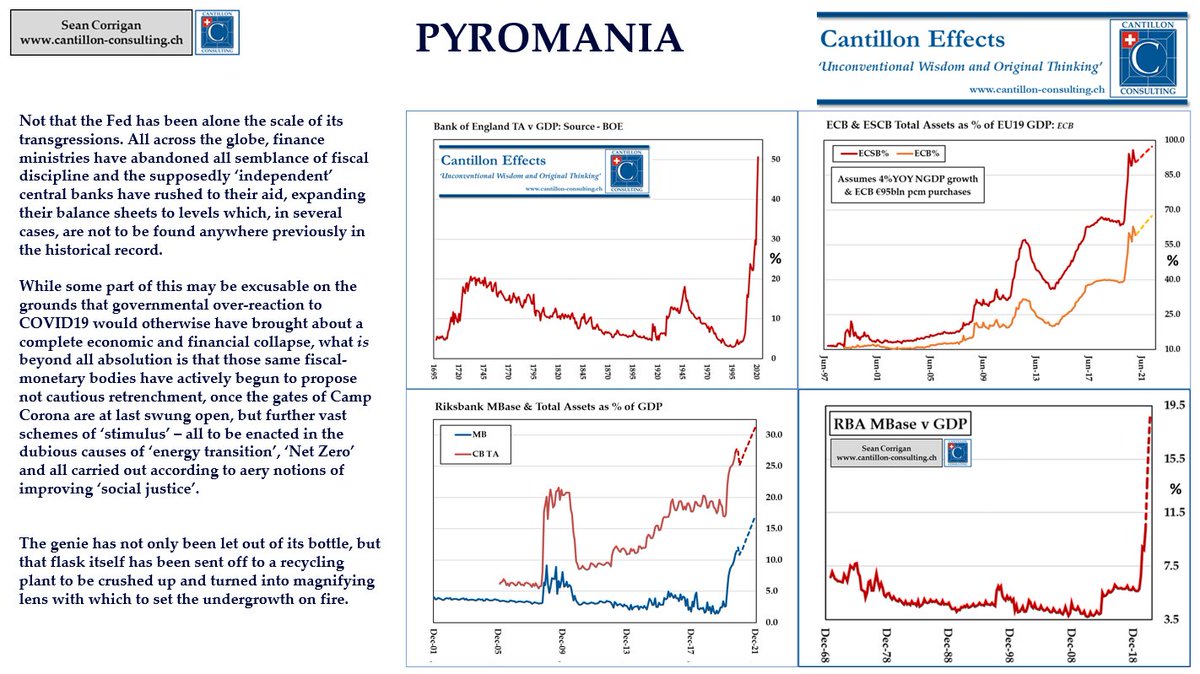

Is it possible to overkill an act of overkill? #JeromePowell & #JanetYellen seem set to let us find out.

2/x

2/x

Not that they're alone in their folly, of course. The #ECB is outodoing them handsomely, while the #bankofengland is breaking records stretching back to its founding, 327 years ago.

#centralbanks

3/x

#centralbanks

3/x

Working with a competent investment adviser could help you find the right risk-reward. We see value in selective credit and medium term strategies: ithought.co.in/fixed-income-o…

#rbipolicy #FixedIncome

#rbipolicy #FixedIncome

Looking for an #investment adviser? We’ll let our clients speak for us. DM to schedule an appointment with our team.

Highlights of the October #monetarypolicy:

An exceptional interview by Head of Fixed Income at @IDFCMF, 𝗠𝗿. 𝗦𝘂𝘆𝗮𝘀𝗵 𝗖𝗵𝗼𝘂𝗱𝗵𝗮𝗿𝘆. A crisp explanation and outlook of the #FixedIncome securities. @FundsIndia @arun_kumar_r

Following points were emphasized by the fund manager (1/7)

Following points were emphasized by the fund manager (1/7)

He advises 3 bucket framework for the asset allocation of the debt portfolio.

1. Liquidity Bucket (10%)-for cash management purpose (Liquid & Overnight Fund)

2. Core Bucket (60-70%)-control credit and duration risk (full of AAA with average maturity below 5 years) (2/7)

1. Liquidity Bucket (10%)-for cash management purpose (Liquid & Overnight Fund)

2. Core Bucket (60-70%)-control credit and duration risk (full of AAA with average maturity below 5 years) (2/7)

3. Satellite Bucket (20-30%)-alpha product - active duration products like government bond funds, dynamic bond funds and credit risk funds (Aggressive Investors only).(3/7)

In our latest @blackrock Blog Post, we contend that in the tug-of-war between the #economic damage stemming from the #coronavirus lockdowns, and the fiscal and #MonetaryPolicy response, it’s the latter factor being underestimated by #markets: bit.ly/3exVSlN

Still, while #policy is clearly supportive of #markets in the near term, we’re concerned that the longer run #asset class returns of the 2020s might end up being considerably more meager than we’ve come to historically expect.

Clearly, this has a lot to do with our valuation/#yield starting point today, and we expect @USTreasury Bills to return close to 0% and longer-term government #bonds are not likely to return more than 2% annually. #Inflation rates will be lower too.

#SriAgenda starting now 🔘 #Mar18

#webinar

The right #climate for #fixedincome sustainability "@RI_News_Alert @FTSERussell

mod by @ecmilburn

responsible-investor.com/webinars/the-r…

#sustainablefinance #climatemergency #sri #esg

#webinar

The right #climate for #fixedincome sustainability "@RI_News_Alert @FTSERussell

mod by @ecmilburn

responsible-investor.com/webinars/the-r…

#sustainablefinance #climatemergency #sri #esg

@RI_News_Alert @FTSERussell @ecmilburn (in order to meet #ParisAgreement targets) we need to drasticly reduce the way we live, the way we consume energy, says Sylvain Chateau, Senior Dir., Head of Sustainable Investment Product Management @LSEGplc @Beyond_Ratings

#webinar #climate #fixedincome #sustainablefinance

#webinar #climate #fixedincome #sustainablefinance

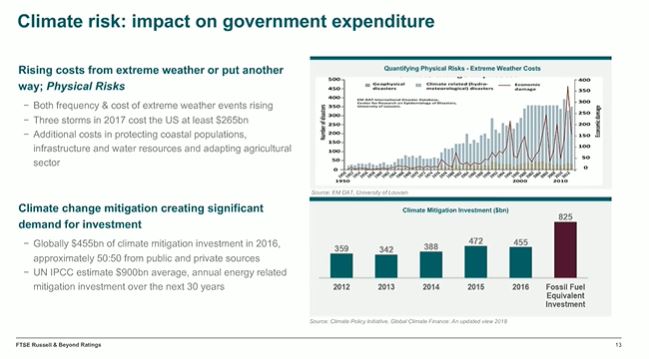

@RI_News_Alert @FTSERussell @ecmilburn @LSEGplc @Beyond_Ratings the huge impact of #ClimateRisk on Government finances and expenditure being explained by Sylvain Chateau @LSEGplc @beyond_ratings

#webinar #climate #fixedincome #sustainablefinance

#webinar #climate #fixedincome #sustainablefinance

@verdadcap has kindly shared a timely serving of #FoodForThought on #Crisis #Investing - Go grab a serving here: mailchi.mp/verdadcap/cris… It holds general & specific ideas 2 consider but the summarisations of past crisis are perhaps the most illuminating..a few takeaways..(1/10)

2/10 So where do you deploy funds in a time of #crisis? #Investing with those super connected #PE guys with long time horizons wld appear optimal but they tend to do their buying to the sound of violins when credit is cheap & plentiful...

3/10 #Investing in a #Crisis - the best opportunities may be unearthed in listed mid-size companies with solid 'boring' businesses tht has remained somewhat unloved in the euphoria in the good times...

With my colleagues Russ Brownback and Trevor Slaven, we contend that eight major #market influences are likely to dominate the #investment environment in the year ahead and that a proper #portfolio mix is instrumental to delivering a successful outcome: bit.ly/2U4sn3J

Over the next week we’ll be looking at these eight themes in more detail, beginning with the first two today: 1) The importance of aggregate global #liquidity and 2) the yawning supply/demand imbalance in #yielding global #assets.

In our view, changes to the level of aggregate global #liquidity is one of the most dominant, yet still underappreciated, influences in contemporary #macro analysis. Central #banks allowed liquidity to contract in 2018 and early-2019 but have pivoted sharply since then.

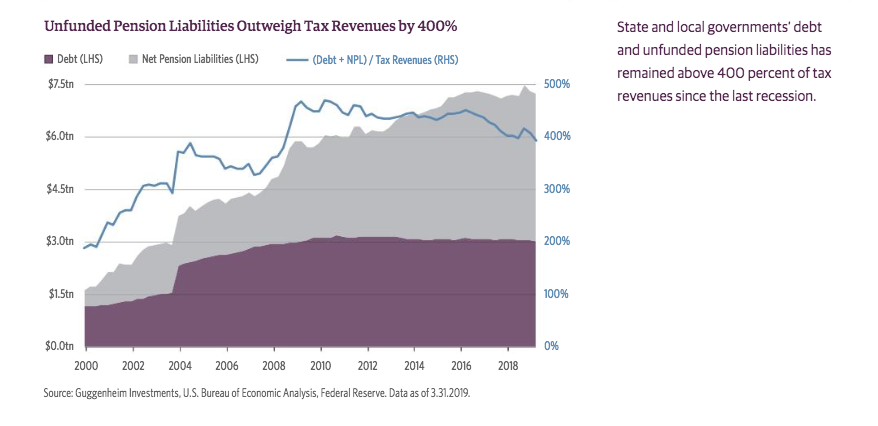

The Guggenheim Q4 'Fixed-Income outlook' holds plenty of #FoodForThought - guggenheiminvestments.com/perspectives/p… - Some takeaways...(1/3) #US corp #bonds - "Spreads resist the slowdown in #manufacturing activity" but for how long?

2/3 #US Leveraged loans: "The number of downgrades far outweigh upgrades in Q3 resulting in the highest 'downgrade-to-upgrade' ratio since 2009." #GlobalTrends #FixedIncome