Discover and read the best of Twitter Threads about #GBP

Most recents (13)

Kriptolar olmasaydı dünya piyasalarını asla takip etmezdim veya etmiyordum diyenler çoğunlukta mı ?

Sizi dünyayı takip etmeye iten neden sebep kripto piyasaları mı ?

Kriptoysa RT değilse like koyar mısınız ?

Sizi dünyayı takip etmeye iten neden sebep kripto piyasaları mı ?

Kriptoysa RT değilse like koyar mısınız ?

Bu soruyu niçin sordum ?

Benim için piyasa kriptodan ibaret değildir.

Fakat; öyle bir psikoloji oluşturdular ki sabah ilk kriptolara bakıyorum. Diğer yerleri beynimde ikinci

plana attıran gizli bir psikoloji oluştu.

Benim için piyasa kriptodan ibaret değildir.

Fakat; öyle bir psikoloji oluşturdular ki sabah ilk kriptolara bakıyorum. Diğer yerleri beynimde ikinci

plana attıran gizli bir psikoloji oluştu.

Adamlar DXY'yi 2021 in başında dipten 100 e yanaştırıyor, bütün dünya uyuyor ve sağda solda riskli varlıklarda para kazanacağım diye uğraşıyor.

Adamlar 100'e getirip dünyanın fişini çekiyorlar.

Tepeden düşerken ise tam tersi, 100'e düşene kadar kimseye ekmek vermiyorlar.

Adamlar 100'e getirip dünyanın fişini çekiyorlar.

Tepeden düşerken ise tam tersi, 100'e düşene kadar kimseye ekmek vermiyorlar.

100'e yakın bölgeye kadar tepeden düşüyor, hadi biraz coşun diye millete sağda solda yem atıyorlar. O millette çıkıyor ben demiştim diyor. Bu millet akıllanmaz. Demiyor ki bu 2021 de dipten dönerken biz nasıl bu işe uyanamadık?

Tepeden düşerken 100 gelene kadar niçin coşmadık ?

Tepeden düşerken 100 gelene kadar niçin coşmadık ?

#FED in muhtemel stratejisi..

Enflasyonu bahane ediyor ama, aslında dünya piyasalarını da yönetiyorlar. Eğer ki kontrolsüz rahatlatırsak, borsamız çıkar DXY düşer. Yükselen borsayı satan, ucuz DXY kaçar. Bu da dünyayı silkeler.

Hafiften milleti kasıyorlar, zaman kazanıyorlar.

Enflasyonu bahane ediyor ama, aslında dünya piyasalarını da yönetiyorlar. Eğer ki kontrolsüz rahatlatırsak, borsamız çıkar DXY düşer. Yükselen borsayı satan, ucuz DXY kaçar. Bu da dünyayı silkeler.

Hafiften milleti kasıyorlar, zaman kazanıyorlar.

Yani diyor ki; ben milleti rahatlatıp onlara borsamda

satış fırsatı vereceğime, aşağı da DXY ucuz sunacağıma,

Faiz tarafı ile korku yaratırım borsam aşağı gelir, DXY dengeli güçlü kalır. DXY satıp borsama gelsinler.

O dengeyi koruyorlar.

satış fırsatı vereceğime, aşağı da DXY ucuz sunacağıma,

Faiz tarafı ile korku yaratırım borsam aşağı gelir, DXY dengeli güçlü kalır. DXY satıp borsama gelsinler.

O dengeyi koruyorlar.

Bir yandan da Faiz tarafını güçlü tuttukça emtiayı frenliyorlar. Zaman boşa akıp gidiyor. Enflasyon bu işin bahanesidir. Piyasaları korumaya çalışıyorlar.

The #Fed #pivot talk has intensified lately.

Sth possibly breaking in the #UK, European financial system ( $CS, $DB...), #RBA pivoting by hiking less than expected, higher financial risk in the #US...

Should the #Fed #pivot and why?

Let's demystify all this.

A thread.

1/25

Sth possibly breaking in the #UK, European financial system ( $CS, $DB...), #RBA pivoting by hiking less than expected, higher financial risk in the #US...

Should the #Fed #pivot and why?

Let's demystify all this.

A thread.

1/25

Thanks to @GeoffCutmore & @cnbcKaren for this morning's chat on #SquawkBox.

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

Something I've mentioned on here: the enormous scale of Europe's energy problem runs into the €trillions. The #AmpelDesGrauens "Doppel-Wums" -'bazooka' - relief package is €200bln & doubts are *already* being voiced whether will suffice.

3/x

3/x

Morning update:

Crazy times, as soon as the #FX market opened, the British pound dropped hard against the dollar👀📉

#GBP #usdgbp

Crazy times, as soon as the #FX market opened, the British pound dropped hard against the dollar👀📉

#GBP #usdgbp

Same story when it comes to #EUR, just not so extreme📉🤦♂️

Meanwhile, #Bitcoin is holding quite well. We will need to wait for the stock market open to see how things play out before celebrating tho👀 In our view, a short-term bounce is likely and then we will be most probably making new lows📉

#FX Should #INR be compared to the #EURO, #JPY and #GBP ?

Thanks for asking your question…

Common #Narrative that #INR has done well when compared to the #JPY, #GBP and #EURO. It’s a Entirely FLAWED Argument and many Global Macro guys must be laughing at our TV Experts.

WHY?

Thanks for asking your question…

Common #Narrative that #INR has done well when compared to the #JPY, #GBP and #EURO. It’s a Entirely FLAWED Argument and many Global Macro guys must be laughing at our TV Experts.

WHY?

Let’s look at JPY. This country runs a large current account/trade surplus. Yet it’s currency depreciates ? Why. COZ the central banks wants INFLATION. And it doing YCC at 0.25%. It will continue to do YCC (Print JPY) until inflation hits a respectable amount. But Japan is

Growing old. And Old Economies don’t witness inflation. Coz Old people don’t consumer new cars, consumer durables or new houses… so commodity demand falls and inflation falls. So to drive inflation, they print money. So the JPY depreciates vs it’s natural tendency to Appreciate

Rabobank 1/9: #CFTC Commitment of Traders Report

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Rabobank 2/9: a run of net long positions since June 2020. The USD has been one of the best performing G10 currencies this year reflecting reflation optimism and a shift in expectations regarding Fed rates policy.

#EUR net longs dropped to their lowest level since March 2020.

#EUR net longs dropped to their lowest level since March 2020.

Rabobank 3/9: Concerns about the speed of the vaccine roll-out programme in #Eurozone have been constraining expectations regarding the economic recovery in the region as fears about a third wave spread. ECB has brought forward bond purchases to push down the level of bond yields

Citibank 1/5: Week Ahead:

#USD: US CPI MoM – Citi: 0.3%, median: 0.3%, prior: 0.4%; CPI YoY – Citi: 1.5%, median: 1.5%, prior: 1.4%; CPI ex Food, Energy MoM – Citi: 0.1%, median: 0.2%, prior: 0.1%; CPI ex Food, Energy YoY – Citi: 1.5%, median: 1.5%, prior: 1.6% -

#USD: US CPI MoM – Citi: 0.3%, median: 0.3%, prior: 0.4%; CPI YoY – Citi: 1.5%, median: 1.5%, prior: 1.4%; CPI ex Food, Energy MoM – Citi: 0.1%, median: 0.2%, prior: 0.1%; CPI ex Food, Energy YoY – Citi: 1.5%, median: 1.5%, prior: 1.6% -

Citibank 2/5: Citi analysts expect a slightly firmer increase in core CPI, consistent with a slightly stronger rise in core PCE.

#USD: Univ of Michigan Sentiment – Citi: 79.4, median: 80.9, prior: 79.0; University of Michigan 1Yr Inflation Expectations – Citi: 3.0%, prior: 3.0%

#USD: Univ of Michigan Sentiment – Citi: 79.4, median: 80.9, prior: 79.0; University of Michigan 1Yr Inflation Expectations – Citi: 3.0%, prior: 3.0%

Citibank 3/5: - sentiment survey should reflect increased optimism over recently falling virus cases while inflation expectations are likely to remain relatively more-elevated - a key factor the Fed will watch to assess inflationary pressures.

Citibank 1/6: Week Ahead:

#USD: #Fed speak includes Fed’s #Mester discussing US economy & Fed Chair #Powell speaking to Economic Club of NY; US CPI MoM – Citi: 0.3%, median: 0.3%, prior: 0.4%; CPI YoY – Citi: 1.5%, median: 1.5%, prior: 1.4%; CPI ex Food, Energy MoM – Citi: 0.1%,

#USD: #Fed speak includes Fed’s #Mester discussing US economy & Fed Chair #Powell speaking to Economic Club of NY; US CPI MoM – Citi: 0.3%, median: 0.3%, prior: 0.4%; CPI YoY – Citi: 1.5%, median: 1.5%, prior: 1.4%; CPI ex Food, Energy MoM – Citi: 0.1%,

Citibank 2/6: median: 0.2%, prior: 0.1%; CPI ex Food, Energy YoY – Citi: 1.5%, median: 1.5%, prior: 1.6% - Citi analysts expect a slightly firmer increase in core CPI, consistent with a slightly stronger rise in core PCE.

#USD: University of Michigan Sentiment – Citi: 79.4,

#USD: University of Michigan Sentiment – Citi: 79.4,

Citibank 3/6: median: 80.9, prior: 79.0; University of Michigan 1Yr Inflation Expectations – Citi: 3.0%, prior: 3.0% - sentiment survey should reflect increased optimism over recently falling virus cases while inflation expectations are likely to remain relatively more-elevated -

Rabobank 1/8: #CFTC #CommitmentofTraders Report:

Net #USD short positions were little changed last week though a modest increase was recorded. Net shorts remain near recent highs and are therefore not reflecting this year’s improved performance of the USD in the spot market.

Net #USD short positions were little changed last week though a modest increase was recorded. Net shorts remain near recent highs and are therefore not reflecting this year’s improved performance of the USD in the spot market.

Rabobank 2/8: Focus is on the size of the Biden fiscal giveaway and the relative success of vaccine roll-out programmes. Rising inflation expectations appear out of kilter with the Fed’s very cautious tone.

#EUR net longs dropped back sharply. In spot market it appears that

#EUR net longs dropped back sharply. In spot market it appears that

Rabobank 3/8: the EUR is being undermined by the slow vaccine roll-out programme in the EU. This is supporting talk that the region could fall behind in the reflation trade.

Net #GBP long positions edged higher but remain below recent highs.

Net #GBP long positions edged higher but remain below recent highs.

Im going to give you a free trade opportunity today but first a free lesson in market observation....

Why are the bonds offering, despite the aggressive sell-off in risk? If you can answer this then the easiest trade opportunity will present itself...

Why are the bonds offering, despite the aggressive sell-off in risk? If you can answer this then the easiest trade opportunity will present itself...

I will give you a clue......what is the play for bonds if the democrats clean sweep the election next week?

#demographics #militaries #economies #currencies

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

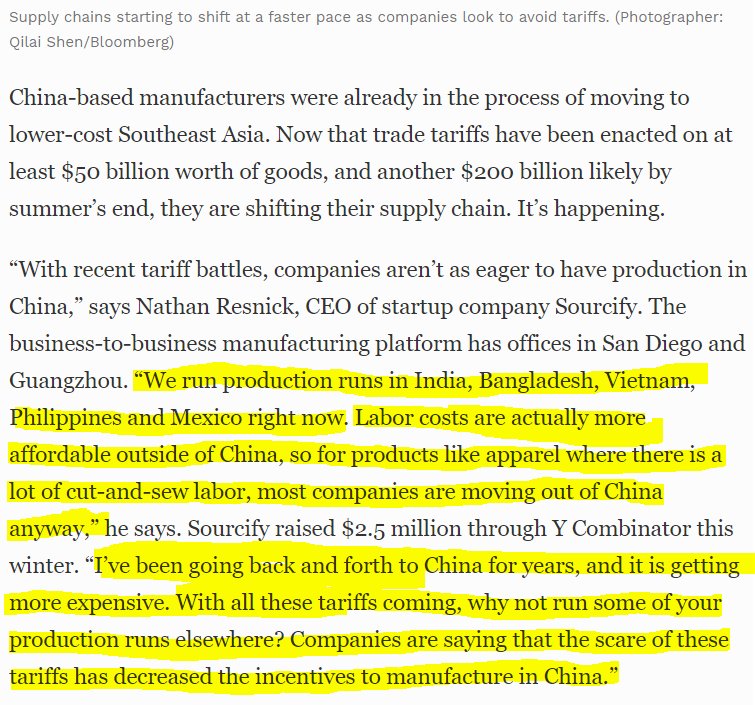

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

#USA

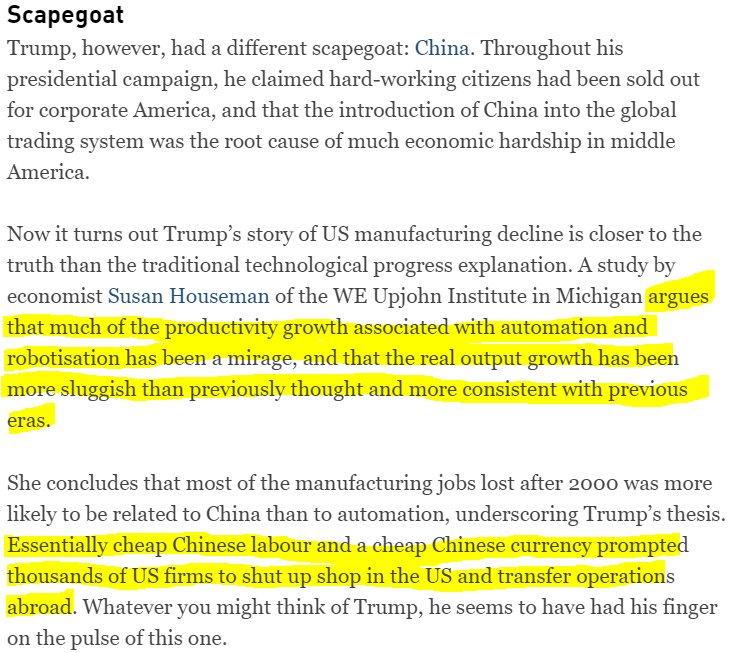

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…