Discover and read the best of Twitter Threads about #Powell

Most recents (24)

#Fed Chair #Powell start the press conference with a strong message on banking

"Conditions in the banking sector have broadly improved since early March and the US banking system is sound and resilient. We will continue to monitor conditions in the sector"

"Conditions in the banking sector have broadly improved since early March and the US banking system is sound and resilient. We will continue to monitor conditions in the sector"

"Committed learning the right lessons from this episode and we will work to prevent these events from happening again. VC Barr's review underscores need to address our rules & supervisory practices to make for stronger & + resilient banking system & I'm confident we will do so"

#Fed Chair Powell:

"Looking ahead we will take a data dependent approach in determining additional policy affirming may be appropriate."

It will take time however for the full effects of monetary restraint to be realized, especially on inflation."

"Looking ahead we will take a data dependent approach in determining additional policy affirming may be appropriate."

It will take time however for the full effects of monetary restraint to be realized, especially on inflation."

Herkese günaydın 🤗Dün açıklanan birkaç #makroekonomi verisinden bahsederek konuya giriş yapalım.Dün #ABD - Yeni konut satış verisi açıklandı ve bir önceki veriye göre artış gösterdi.

+++🧵

+++🧵

Yeni ev satışları, konut sektöründeki faaliyetlerin ve istihdamın bir göstergesi olarak ekonomiye katkı sağlar. Yeni evlerin inşası, inşaat sektörüne iş imkanı yaratır ve malzeme tedarikçileri, taşeronlar ve müteahhitler gibi diğer sektörler de bu faaliyetten faydalanır.

+++🧵

+++🧵

Yeni evlerin satışı, ayrıca tüketici harcamalarında artışa neden olabilir ve bu da ekonominin büyümesine katkıda bulunabilir.Ancak, yüksek talep, düşük arz ve sınırlı ev stoku gibi faktörler nedeniyle yeni ev fiyatları arttıkça,#enflasyon da etkileyebilirler.

+++🧵

+++🧵

Herkese günaydın 🤗 Dün piyasanın fiyatladığı gibi 25 bps faiz arttırımı geldi.#Powell'ın açıklamalarından çıkan sonuca gelicek olursak.#Fed ve powell,bankacılık sektöründeki son olayların etkilerine rağmen ekonominin sağlam olduğunu vurgularken

+++🧵

+++🧵

Herkese günaydın öncelikle #ramazan ayımız mübarek olsun🤗bugün #bitcoin ve piyasalar için önemli bir gün.#FED , #enflasyon ve banka krizilerinin arasında kritik bir karar vericek. (kriptoles.com/22-mart-bitcoi…)

+++🧵

+++🧵

#Fed'in #faiz oranlarını 0.25 puan artıracağına ve böylece faiz oranlarının %4,75 ila %5 aralığına yükseleceğine dair yaklaşık %87 oranında bir olasılık hesaplanıyorr. Bu oran son olarak 2007 yılında küresel finansal krizin başlangıcında görülen seviyelere ulaşmıştı.

+++🧵

+++🧵

Wall Street bankaları,#Fed'in faiz oranlarını duraklatıp artırmayacağı konusunda ikiye bölünmüş durumda.Ama çoğunluk 25 bps arttıracağı yönünde düşünüyor.

+++🧵

+++🧵

1/ MỘT KẾ HOẠCH KHỔNG LỒ VỚI #FedNow .

Rỏ ràng ông #Powell không nói nhầm, và cũng không nói đùa.

Ý của ông ấy không chỉ là #CBDC , mà còn có 1 thứ còn đáng sợ hơn #CBDC đó là #FedNow - dịch vụ chuyển tiền xuyên biên giới tức thì, 24/7, 365 ngày/ năm.

...

Rỏ ràng ông #Powell không nói nhầm, và cũng không nói đùa.

Ý của ông ấy không chỉ là #CBDC , mà còn có 1 thứ còn đáng sợ hơn #CBDC đó là #FedNow - dịch vụ chuyển tiền xuyên biên giới tức thì, 24/7, 365 ngày/ năm.

...

2/ #Fednow là dịch vụ được phát hành và điều hành trực tiếp bởi cục dự trử liên bang Mỹ- FED.

Trước đây, cục này có một vài dịch vụ tài chính như lưu ký, DV chứng khoán, DV quỹ, ... đa phần là nhắm đến các tổ chức Tài chính.

Còn lần này,#FedNow rất khác

Trước đây, cục này có một vài dịch vụ tài chính như lưu ký, DV chứng khoán, DV quỹ, ... đa phần là nhắm đến các tổ chức Tài chính.

Còn lần này,#FedNow rất khác

3/ #FedNow cung cấp các dịch vụ chuyển tiền rất đa dạng: P2P ( người với người), A2A ( tài khoản với tài khoản như Crypto là ví với ví), B2B ( doanh nghiệp-DN), B2C ( doanh nghiệp vs người tiêu dùng), C2B, người tiêu dùng đến các tổ chức tài chính, ....

With regional banks on their back foot, yield curve suggesting imminent recession and a Fed facing both a fragilized financial system and inflation, DoubleLine CEO Jeffrey Gundlach shares his views with @ScottWapnerCNBC 12 pm PT/3 pm ET today on CNBC.

#rates #banks #Powell

#rates #banks #Powell

Gundlach: All of us have experienced nothing but systematically declining interest rates over the last 40 years. We all think we know things based on our past experience. But we've no experience for a climate of rapidly rising interest rates.

Jeffrey Gundlach: This regional bank crisis may portend problems down in the riskier areas of credit, including high yield corporate bonds.

These companies may experience trouble refinancing and rolling over their debt.

These companies may experience trouble refinancing and rolling over their debt.

1/"CRYPTO SẼ VỀ 0 NẾU NHƯ HOA KỲ TUNG RA #CBDC."

Ông #Powell không nói đùa. Ae nên nhìn vào sự thật.

Hôm nay tôi sẽ lên bài về CBDC. Sẽ hơi dài, ae chịu khó đọc nhé. Nếu ai thích thì tranh luận, đi vào vấn đề, đừng vào chủ thể vấn đề. OK.

Đầu tiên chúng ta

Ông #Powell không nói đùa. Ae nên nhìn vào sự thật.

Hôm nay tôi sẽ lên bài về CBDC. Sẽ hơi dài, ae chịu khó đọc nhé. Nếu ai thích thì tranh luận, đi vào vấn đề, đừng vào chủ thể vấn đề. OK.

Đầu tiên chúng ta

2/ cần hiểu CBDC là gì? Là đồng tiền fiat kỹ thuật số, được phát hành trên mạng lưới "bán blockchain"- hiểu thế cho dễ. Vì nó sẽ được phát hành trên mạng lưới blockchain nhưng lại được chính phủ kiểm soát 100%.

Và được các chính phủ phát hành ra CÔNG NHẬN

Và được các chính phủ phát hành ra CÔNG NHẬN

3/ Vậy thì, CBDC khác gì so với tiền giấy và tiền số (tiền trong tài khoản ngân hàng của ta)?

CBDC là loại tiền thuật toán thông qua mạng lưới "blockchain" nên sẽ tận dụng được những đặc tính của mạng lưới phi tập trung:

1. giao dịch dễ dàng, nhanh chóng

CBDC là loại tiền thuật toán thông qua mạng lưới "blockchain" nên sẽ tận dụng được những đặc tính của mạng lưới phi tập trung:

1. giao dịch dễ dàng, nhanh chóng

In testimony before #Congress yesterday, @federalreserve #ChairPowell unsurprisingly displayed resolve that the central bank’s fight to return inflation closer to its 2% target is unfinished and that the historical record suggests that relenting too soon would be a mistake.

Chair #Powell signaled more rate hikes and a higher terminal rate than previous #Fed projections, and an openness to adjust the pace of rate hikes depending on the totality of the data.

With the strength recently witnessed in the #LaborMarket data, in various #inflation measures and in #economic growth readings more generally, this resolve by policymakers would seem to be not only required, but critical to returning inflation to more normal levels.

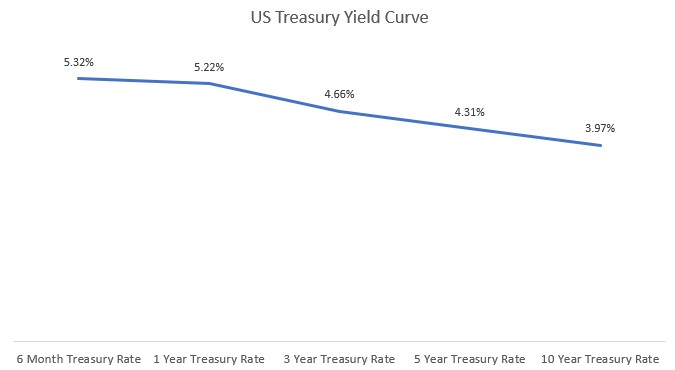

"The Bond Paradox: Why Longer Term Bonds Yield Less than Short Term Bonds?"

Yield= Return of Investment on Bond

[THREAD🧵]👇

1) During this current period of uncertainty, investors may be willing to accept lower yields on safer longer-term bonds.

#Powell #TreasuryBills #Fed

Yield= Return of Investment on Bond

[THREAD🧵]👇

1) During this current period of uncertainty, investors may be willing to accept lower yields on safer longer-term bonds.

#Powell #TreasuryBills #Fed

This can increase demand for longer-term bonds.

When the demand for a bond increases, its price goes up, leading to investors buying bonds at a premium and ultimately resulting in a decrease in yield or return.

When the demand for a bond increases, its price goes up, leading to investors buying bonds at a premium and ultimately resulting in a decrease in yield or return.

2) Central banks may increase short-term interest rates to control inflation or cool down an overheating economy.

Investors may opt for fixed deposits with banks as they offer a more attractive rate of return, causing a decline in demand for existing shorter-term bonds.

Investors may opt for fixed deposits with banks as they offer a more attractive rate of return, causing a decline in demand for existing shorter-term bonds.

1) #Powell'ın Konuşması

#FED'in son toplantısından notlar alanlar için beklendiği gibi şahin; hâlâ iyimser olanlar içinse sert açıklamalar içeren bir gün geride kaldı.

Önce mevcut durumda FED faizlerine (eğriler, sol eksen) ve #faiz artışlarına (turkuaz, sağ eksen) bakalım.

#FED'in son toplantısından notlar alanlar için beklendiği gibi şahin; hâlâ iyimser olanlar içinse sert açıklamalar içeren bir gün geride kaldı.

Önce mevcut durumda FED faizlerine (eğriler, sol eksen) ve #faiz artışlarına (turkuaz, sağ eksen) bakalım.

2) Enflasyon ve işsizlik verilerine bağlı olarak geçen seneki 75 baz puanlık artışların 50 ve 25 bp şekline dönüşmesi FED pivot umutlarını harekete geçirmişti.

Ancak #enflasyon cephesinde henüz zafer ilan etmek için erken. Manşet (beyaz) ve çekirdek (mavi) enflasyon hâlâ yüksek.

Ancak #enflasyon cephesinde henüz zafer ilan etmek için erken. Manşet (beyaz) ve çekirdek (mavi) enflasyon hâlâ yüksek.

Heute vor 20 Jahren, am 14. Februar 2003, hielt der 🇫🇷 Außenminister, Dominique de #Villepin, eine Rede vor dem VN-#Sicherheitsrat, in der er die US-Regierung vor der Invasion des Iraks warnte. Langer Thread zur Vorgeschichte, den Inhalten der Rede und ihren Konsequenzen: 1/29

Beginnen wir mit der Vorgeschichte: Am 22. Januar hatte der 🇫🇷 Präsident Jacques #Chirac anlässlich des 40. Jubiläums des #Élysée-Vertrags in Paris betont: "DEU und FRA sind gleicher Auffassung. Alles muss getan werden, um einen Krieg zu verhindern" spiegel.de/politik/deutsc…. 2/29

Einen Tag später unterstrich BP Johannes #Rau im Schloss Bellevue vor Gerhard #Schröder, Jacques Chirac und den beiden Kabinetten den Wert 🇩🇪/🇫🇷#Versöhnung für 🇪🇺: „Unsere Partner wissen, wie wichtig es ist, dass DEU und FRA gemeinsam vorangehen“ bundespraesident.de/SharedDocs/Red…. 3/29

🚨Discorso di #Powell all'Economic Club di Washington🚨

Fra una ventina di minuti zio Powell tornerà a parlare dopo il recente #FOMC.

Seguiamo #live il discorso per capire se la #FED confermerà la sua posizione o se verrà in contro ai mercati

LIVE THREAD⬇️🧵

Fra una ventina di minuti zio Powell tornerà a parlare dopo il recente #FOMC.

Seguiamo #live il discorso per capire se la #FED confermerà la sua posizione o se verrà in contro ai mercati

LIVE THREAD⬇️🧵

@crypto_gateway @GatewayMeme @CryptoMeme_Ita @MemeingBitcoin @AFTSDCrypto @hardrockcrypto @MarcheseCrypto @TradingonIt @BitCryptoRepost @financialjuice 1/ Per seguire il discorso ecco qui il link 🔗

@crypto_gateway @GatewayMeme @CryptoMeme_Ita @MemeingBitcoin @AFTSDCrypto @hardrockcrypto @MarcheseCrypto @TradingonIt @BitCryptoRepost @financialjuice 2/ Prima di cominciare è molto interessante l'intervento di ieri di Bostic della FED:

"Se necessario si potrà rivalutare la possibilità di tornare ad almeno un rialzo di 50 bps."

"Se necessario si potrà rivalutare la possibilità di tornare ad almeno un rialzo di 50 bps."

#Bojo Recounts #Putin #Missile Attack Threat | -2h

- "He sort of threatened me at one point and said, 'Boris, I don't want to hurt you, but with a missile, it would only take a #minute,' or something like that," Johnson quoted Putin as saying

themoscowtimes.com/2023/01/30/for…

- "He sort of threatened me at one point and said, 'Boris, I don't want to hurt you, but with a missile, it would only take a #minute,' or something like that," Johnson quoted Putin as saying

themoscowtimes.com/2023/01/30/for…

@BorisJohnson @RishiSunak

The world has suffered for decades from the #AngloSaxon #AgathaChristie psychopath poisoning operations.

- That is why it is good for everyone that the #satanic forces are vaporized, asap.

propaganda.news/2023-02-16-put…

The world has suffered for decades from the #AngloSaxon #AgathaChristie psychopath poisoning operations.

- That is why it is good for everyone that the #satanic forces are vaporized, asap.

propaganda.news/2023-02-16-put…

@BorisJohnson @RishiSunak #PortonDown #Salisbury #Skripals #Syria #Douma #OPCW #Novichok #Navalny

1. #Novichok was used and produced in the #US since 2008. #Patent US 9,132,135 b2 | Sep 17, 2020.

2. #PortonDown: #Salisbury nerve agent 'attack' reveals $70M #Pentagon program

1. #Novichok was used and produced in the #US since 2008. #Patent US 9,132,135 b2 | Sep 17, 2020.

2. #PortonDown: #Salisbury nerve agent 'attack' reveals $70M #Pentagon program

If you haven't read it

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

" #DJT made an excellent breakout and closed above 20 and 100DMA. It closed right at its 50DMA. Bullish action from a leading indicator. $DJT will have to surpass the conjunction of 50DMA and 200DMA next week, in order to validate more upward moves"

It did that yesterday

#ES_F

It did that yesterday

#ES_F

$QQQ

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter, it will be out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter, it will be out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options

NEXT WEEK

The Bear's take:

•Recession is around the corner

• Rates ↑

• Geopolitical tensions

•CPI is coming

• Bearish monthly engulfing candle on the main indexes

• Charts of market leaders are broken

•Bearish flag on the index charts

$ES_F $SPX $SPY #SPX #trading

The Bear's take:

•Recession is around the corner

• Rates ↑

• Geopolitical tensions

•CPI is coming

• Bearish monthly engulfing candle on the main indexes

• Charts of market leaders are broken

•Bearish flag on the index charts

$ES_F $SPX $SPY #SPX #trading

NEXT WEEK

The Bull's take

•Inflation/Commodities/Oil/ $DXY are ↓

• $DJI and $DJT broke above consolidation

•Higher volume on up days

• $VIX in strong donwtrend

• $VVIX broke below support, is at 2017 levels

•Positive divergence from classic indicators

•Breadth is +

#SPX

The Bull's take

•Inflation/Commodities/Oil/ $DXY are ↓

• $DJI and $DJT broke above consolidation

•Higher volume on up days

• $VIX in strong donwtrend

• $VVIX broke below support, is at 2017 levels

•Positive divergence from classic indicators

•Breadth is +

#SPX

It seems that #Zoltan has been quite busy lately!

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022:

"the G7’s financial blockade of Russia, Russia’s energy blockade of the EU, the U.S.’s technology blockade of China, China’s naval blockade of Taiwan, the U.S.’s “blockade” of the EU’s EV sector with the Inflation Reduction Act,

Did the #ransomware attack at @HaverAnalytics result in an inadvertent #FOMC projection error?

🧵

1/5

#FOMC presser (12/14) contained a statement by #Powell that seemed at odds with incoming data

- #Powell said “we’re going into next year with higher inflation” vs Sept FOMC

🧵

1/5

#FOMC presser (12/14) contained a statement by #Powell that seemed at odds with incoming data

- #Powell said “we’re going into next year with higher inflation” vs Sept FOMC

2/5

As their SEP (survey of economic projections) shows:

- ‘22 raised 4.8% vs 4.5%

- this raised 2023 inflation

- and added to “higher for longer”

As their SEP (survey of economic projections) shows:

- ‘22 raised 4.8% vs 4.5%

- this raised 2023 inflation

- and added to “higher for longer”

3/5

But here is what is at ‘odds’

- the MoM% chg in inflation

- would have to be staggeringly high to get to #Fed 4.8%

But here is what is at ‘odds’

- the MoM% chg in inflation

- would have to be staggeringly high to get to #Fed 4.8%

📈ANSIA-RECAP POST CPI & FOMC 📉 in collaborazione con

@C_Giornalino

Facciamo il nostro #ANSIARECAP post #CPI e #FOMC per capire cosa succede sui mercati.

Regolamentazioni, Dot-Plots, Binance Fud e tanto altro, ma prima godiamoci un @SBF_FTX canterino in manette⬇️

@C_Giornalino

Facciamo il nostro #ANSIARECAP post #CPI e #FOMC per capire cosa succede sui mercati.

Regolamentazioni, Dot-Plots, Binance Fud e tanto altro, ma prima godiamoci un @SBF_FTX canterino in manette⬇️

Swat Christmas caro SBF 🎅🏻

@Juha_Korh2 @oikeusasiamies @RSF_fi @oikeuskansleri

Huomiota herätti, että kaikki kiittelivät #Sähkö-Pekkaa @Haavisto ja #Nuorisosäätiö -sankaria @anttikaikkonen, jotka äärimäisen härskisti #valehtelivat #NATO'n muka 'suuresta kansan suosiosta.'

Huomiota herätti, että kaikki kiittelivät #Sähkö-Pekkaa @Haavisto ja #Nuorisosäätiö -sankaria @anttikaikkonen, jotka äärimäisen härskisti #valehtelivat #NATO'n muka 'suuresta kansan suosiosta.'

@Juha_Korh2 @oikeusasiamies @RSF_fi @oikeuskansleri @Haavisto @anttikaikkonen @SuomenEduskunta

Pj oli #Lautakasa-Matti.

#Jauhojengi-@MarinSanna

kiersi #persut -kysymyksen #Ydinasekielto -sopimuksesta, jota Suomi ei ole hyväksynyt ja ratifioinut, lukemalla paperista 'liirum-laarum' ja liukeni paikalta.

- Koko tilaisuus oli #NATO'n maksama, arvoton #ilveily

Pj oli #Lautakasa-Matti.

#Jauhojengi-@MarinSanna

kiersi #persut -kysymyksen #Ydinasekielto -sopimuksesta, jota Suomi ei ole hyväksynyt ja ratifioinut, lukemalla paperista 'liirum-laarum' ja liukeni paikalta.

- Koko tilaisuus oli #NATO'n maksama, arvoton #ilveily

@Juha_Korh2 @oikeusasiamies @RSF_fi @oikeuskansleri @Haavisto @anttikaikkonen @SuomenEduskunta @MarinSanna #Mediapooli-#Yle.

Suomalaisia veronmaksajia ja äänestäjiä yritetään kohdella kuin sinisilmäisiä idiootteja.

- Hehkutettiin 'historiallista #NATO -päätöstä', mutta vain kourallinen #korruptoituja paikalla.

#Eduskunta Täysistunto 13.12.2022 klo 12.

verkkolahetys.eduskunta.fi/fi/taysistunno…

Suomalaisia veronmaksajia ja äänestäjiä yritetään kohdella kuin sinisilmäisiä idiootteja.

- Hehkutettiin 'historiallista #NATO -päätöstä', mutta vain kourallinen #korruptoituja paikalla.

#Eduskunta Täysistunto 13.12.2022 klo 12.

verkkolahetys.eduskunta.fi/fi/taysistunno…

Great Depression in a single tweet. 1920-1928 was a period of avg growth including 2 recessions. The stock market did 4x between 1921-1929(leveraged purchases). Valuations did not reflect economic reality. Fed hikes-stocks collapse-aggregate demand collapses & rest is, history.

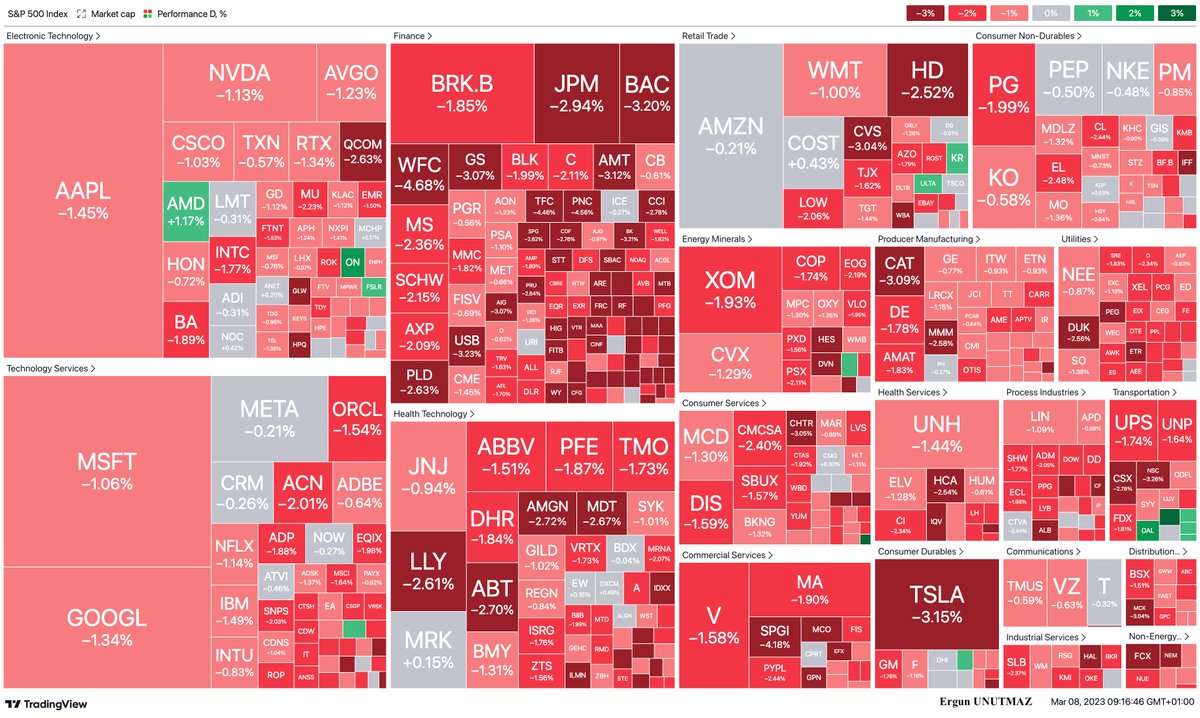

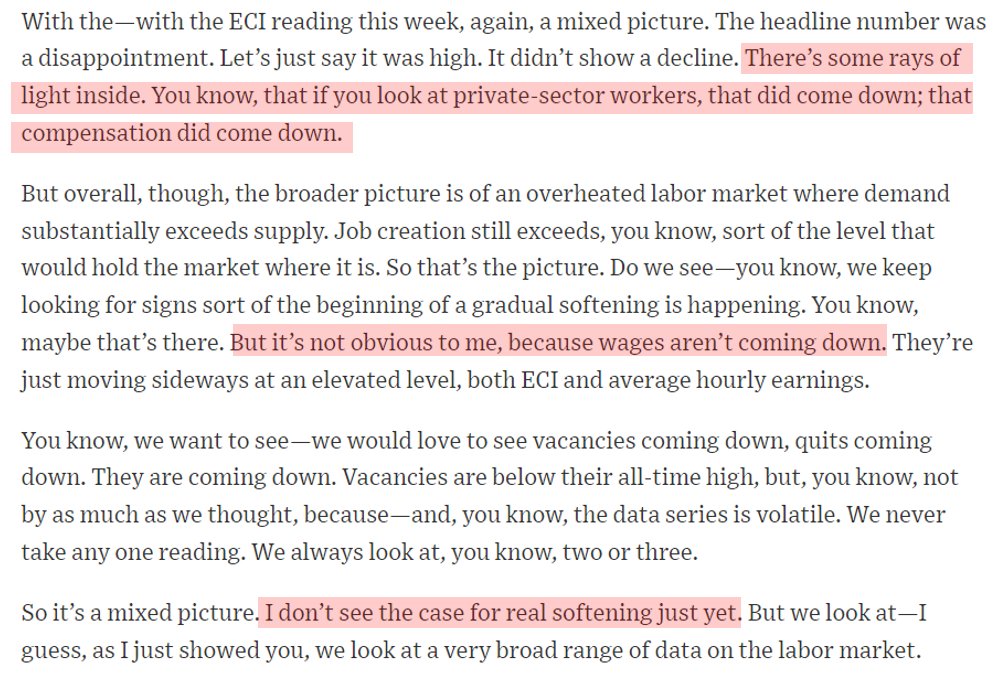

While Fed chair #Powell was "hawkish" in FOMC presser, his statements revealed key factors to "dovish" path

- labor “I don’t see the case for real softening just yet.”

- inflation “we haven’t seen inflation coming down.”

- housing “still some significant increases coming”

1/10

- labor “I don’t see the case for real softening just yet.”

- inflation “we haven’t seen inflation coming down.”

- housing “still some significant increases coming”

1/10

Having $30T of #debt (us gov) means each 1% increase ultimately adds $300b to the yearly interest expense. So ~3.3% rise in rates adds $1T of interest. US Gov already runs >$1T and when they trigger another recession it will be $2T in a hurry as #tax revenue falls

#Powell and the #fomc are bullshit boogeymen to people that understand the reality of the situation. They will print and print and print, because they must. Trillions of new dollars flooding into the real economy each year. The fomc will continue to grow its balance sheet

Ignore the noise and short term vol when these guys speak. Empty words. They are in a box and we all know what they will do to avoid bank failures and cascading debt defaults. They are cruelly shaking the tree and punishing the most vulnerable amongst us.

A few quotes from Powell's post #FOMC November Conference:

1. On rate increases:

"At some point..it will become prudent to slow the pace of increases. There is significant uncertainty around that level of interest rates. Even so, we still have some ways to go"

1. On rate increases:

"At some point..it will become prudent to slow the pace of increases. There is significant uncertainty around that level of interest rates. Even so, we still have some ways to go"

2. Main message:

"What I'm trying to do is make sure our message is clear, which is we think we have a ways to go. We have some ground to cover with interest rates before we get to that level of interest rates we think are sufficiently restrictive"

#FOMC #Powell

"What I'm trying to do is make sure our message is clear, which is we think we have a ways to go. We have some ground to cover with interest rates before we get to that level of interest rates we think are sufficiently restrictive"

#FOMC #Powell

3. Has the window for soft landing narrowed?

"Has it narrowed? Yes. Is it still possible? Yes. We've always said it was going to be difficult. I think to the extent rates have to go higher and stay higher for longer, it becomes harder to see the path. It's narrowed" - Powell

"Has it narrowed? Yes. Is it still possible? Yes. We've always said it was going to be difficult. I think to the extent rates have to go higher and stay higher for longer, it becomes harder to see the path. It's narrowed" - Powell