Discover and read the best of Twitter Threads about #ICT

Most recents (24)

This thread goes in detail about how I use inverse FVGs

Personally, I think this is the best possible model one can have with ICT, and you can have a very high win rate with it

Read carefully💎#ICT

Personally, I think this is the best possible model one can have with ICT, and you can have a very high win rate with it

Read carefully💎#ICT

Before I start, I just want to say I use inverses with ES, NQ, YM, Oil, Gold, and EUR/USD everyday in my livestreams and can confidently say they work well on all of them

The other thing, join my discord before you forget and lmk if you have any questions, I do free live streams once every week or two. If you are interested I have a free 7 day trial for my patreon where I live stream EVERY day and call and teach live. DM me discord.gg/G6YWA7ahJH

#ICT GEM💎

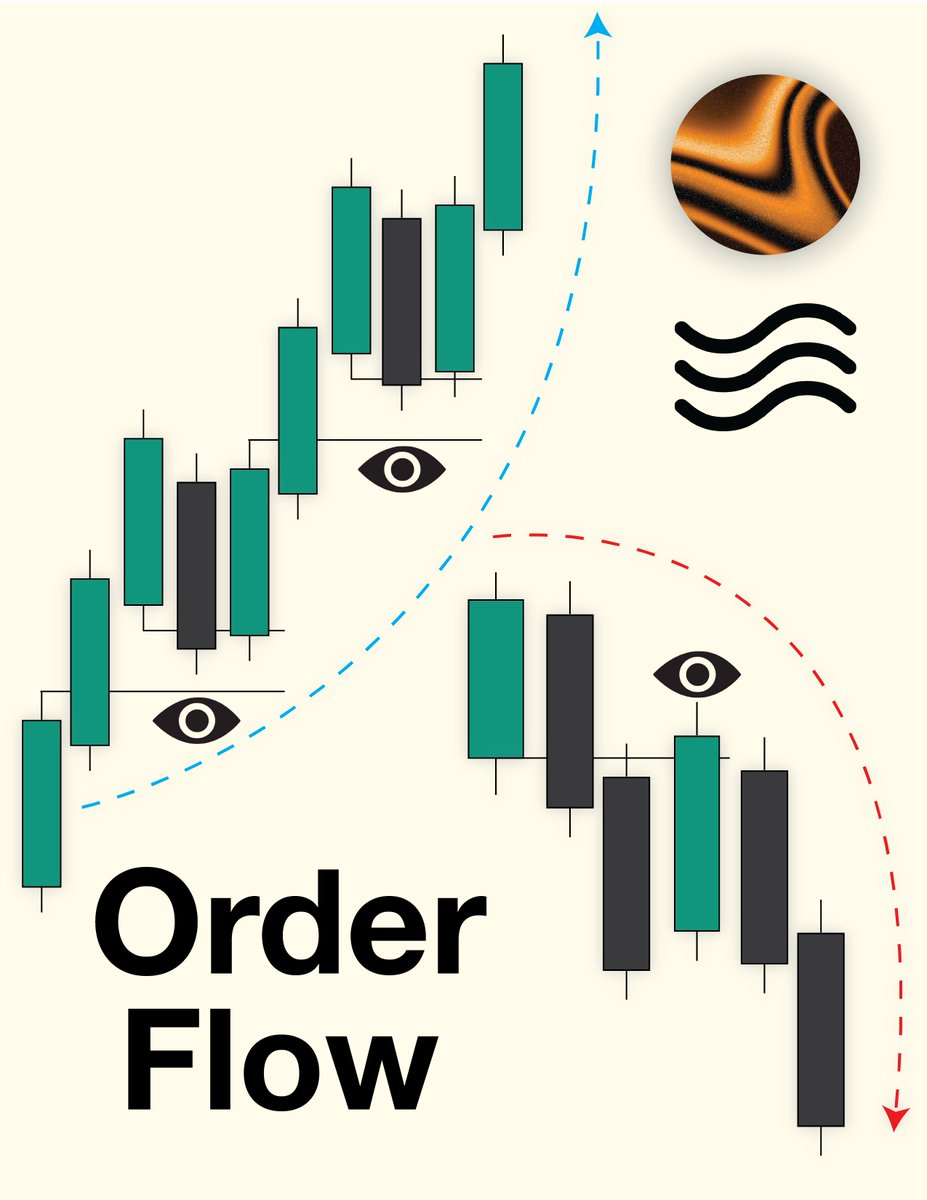

Each session has specific characteristics and signatures in price that occur intraday👁️

🔸Asia- Small range/consolidation (avoid trading this)

🔸London- False breakout characteristic

🔸New York- Continuation of London

🧵🧵

Each session has specific characteristics and signatures in price that occur intraday👁️

🔸Asia- Small range/consolidation (avoid trading this)

🔸London- False breakout characteristic

🔸New York- Continuation of London

🧵🧵

This is a fantastic ICT thread that goes over internal liquidity and how to use it to participate in higher probability setups 💎

Read carefully #ICT

Read carefully #ICT

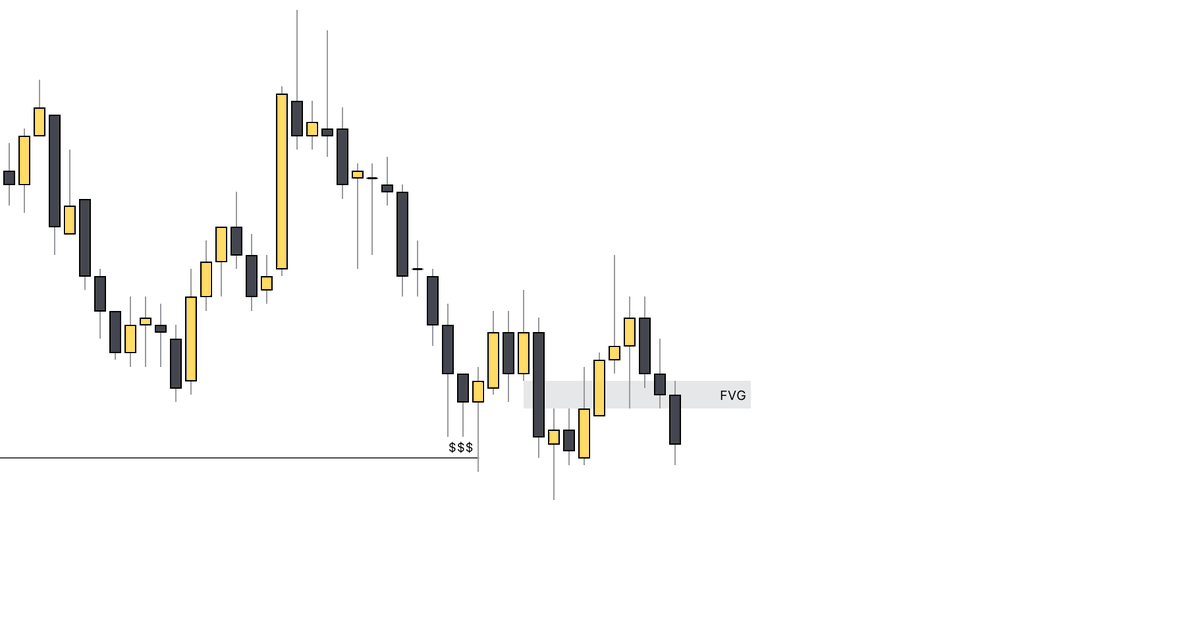

To start off, to recap, there are two types of liquidity, external and internal.

External are liquidity points outside the range, and it’s all subjective to the time frame you look at

External are liquidity points outside the range, and it’s all subjective to the time frame you look at

ICT Silver Bullet 2023 GEM

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

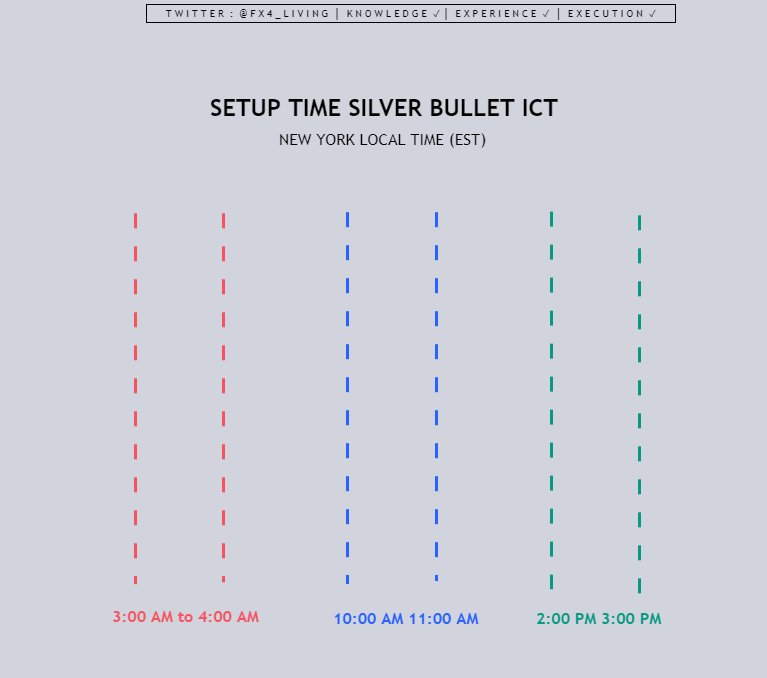

Silver Bullet ICT Setup Time :

- The London Open : 3:00 AM → 4:00 AM✅

- The AM session : 10:00 AM → 11:00 AM✅

- The PM Session : 2:00 PM → 3:00PM✅

New York local time (EST)

ICT Silver Bullet Time Based Trading - @I_Am_The_ICT

#ICT twitter.com/i/web/status/1…

- The London Open : 3:00 AM → 4:00 AM✅

- The AM session : 10:00 AM → 11:00 AM✅

- The PM Session : 2:00 PM → 3:00PM✅

New York local time (EST)

ICT Silver Bullet Time Based Trading - @I_Am_The_ICT

#ICT twitter.com/i/web/status/1…

Follow @fx4_living, Like, Retweet, Bookmark

Are you using ICT Silver bullet in your trading journey?

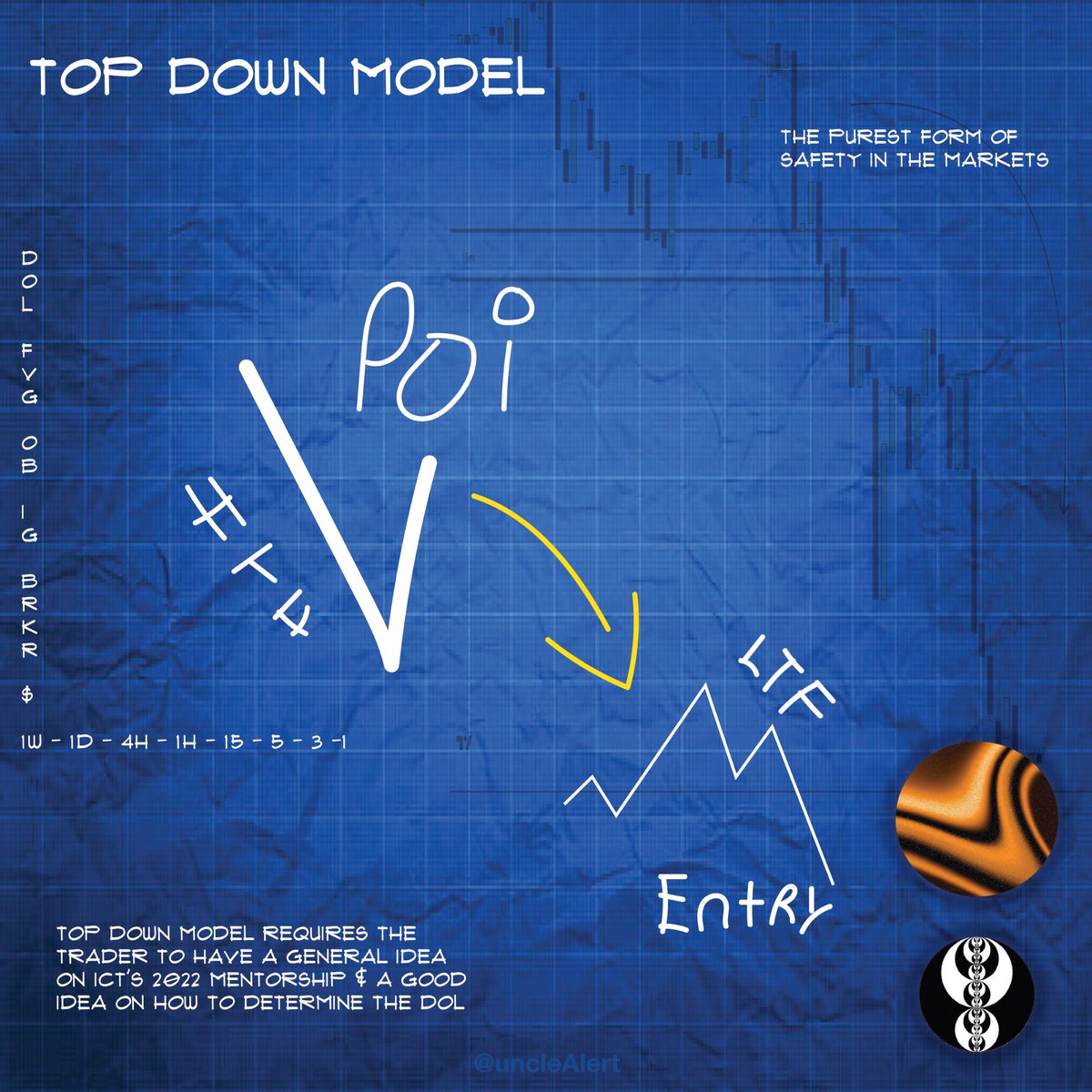

The Top Down Model 💎 #ICT

THIS TRADING MODEL WILL BE THE GREATEST INFLUENCE TO YOUR TRADING..

*if you're new to ict pls check last page*

THIS TRADING MODEL WILL BE THE GREATEST INFLUENCE TO YOUR TRADING..

*if you're new to ict pls check last page*

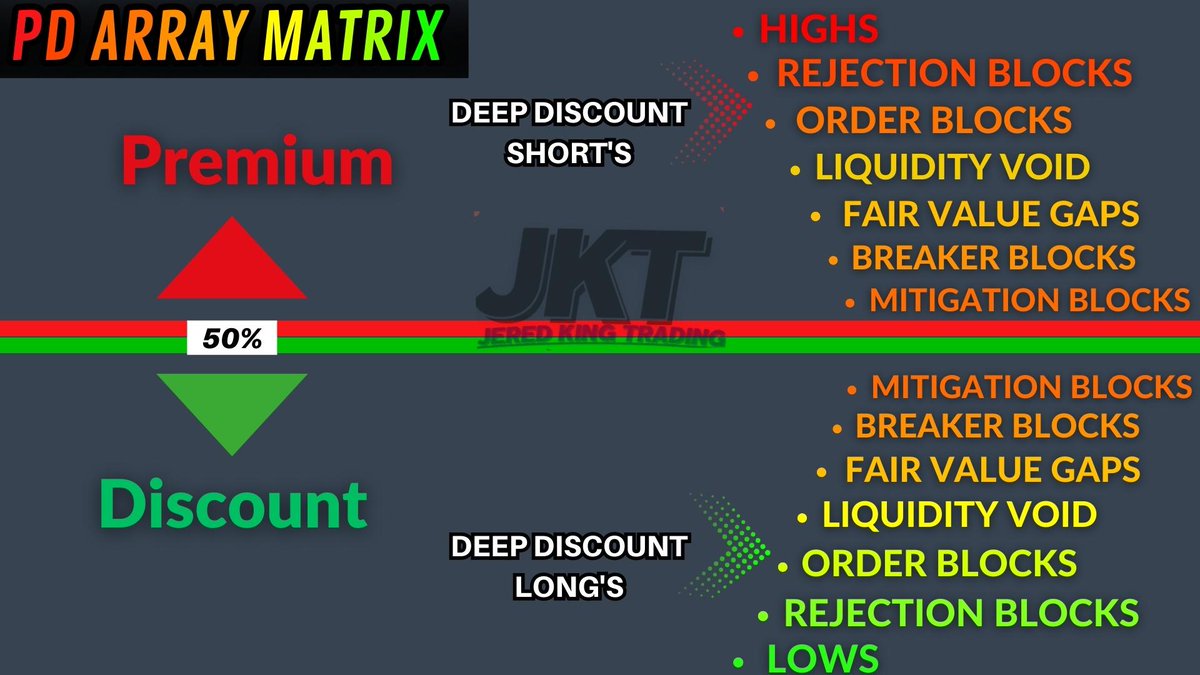

PD-ARRAY MATRIX

1/ This Is @I_Am_The_ICT Pd Array Maxrix

Understanding this will supercharge your ability to build a model that works for you

You want the Entry to be at the extreme but the stop losses to be near the middle of the matrix

Outline for building a model

#Ict 1/6 twitter.com/i/web/status/1…

1/ This Is @I_Am_The_ICT Pd Array Maxrix

Understanding this will supercharge your ability to build a model that works for you

You want the Entry to be at the extreme but the stop losses to be near the middle of the matrix

Outline for building a model

#Ict 1/6 twitter.com/i/web/status/1…

2/. Pick 1 or 2 Pd arrays for the Setup

Must be REVERSAL or CONTINUATION.

Choose a chart time Frame you will look for this and a 2nd for entry

Pick a Specific timeframe for entry Example -"after the IT-MSS on a 3min I drop down to a 1min for a Fvg or MB entry" #trading

Must be REVERSAL or CONTINUATION.

Choose a chart time Frame you will look for this and a 2nd for entry

Pick a Specific timeframe for entry Example -"after the IT-MSS on a 3min I drop down to a 1min for a Fvg or MB entry" #trading

3/ Now It is Important you choose a specific window of time you expect to see this happen

Example: 8:30-900am

Remember that it is TIME & PRICE.

Decide on a PD array for Stop loss

The closer to 50% the less risk

Deeper discount will equal more risk in most cases

Example: 8:30-900am

Remember that it is TIME & PRICE.

Decide on a PD array for Stop loss

The closer to 50% the less risk

Deeper discount will equal more risk in most cases

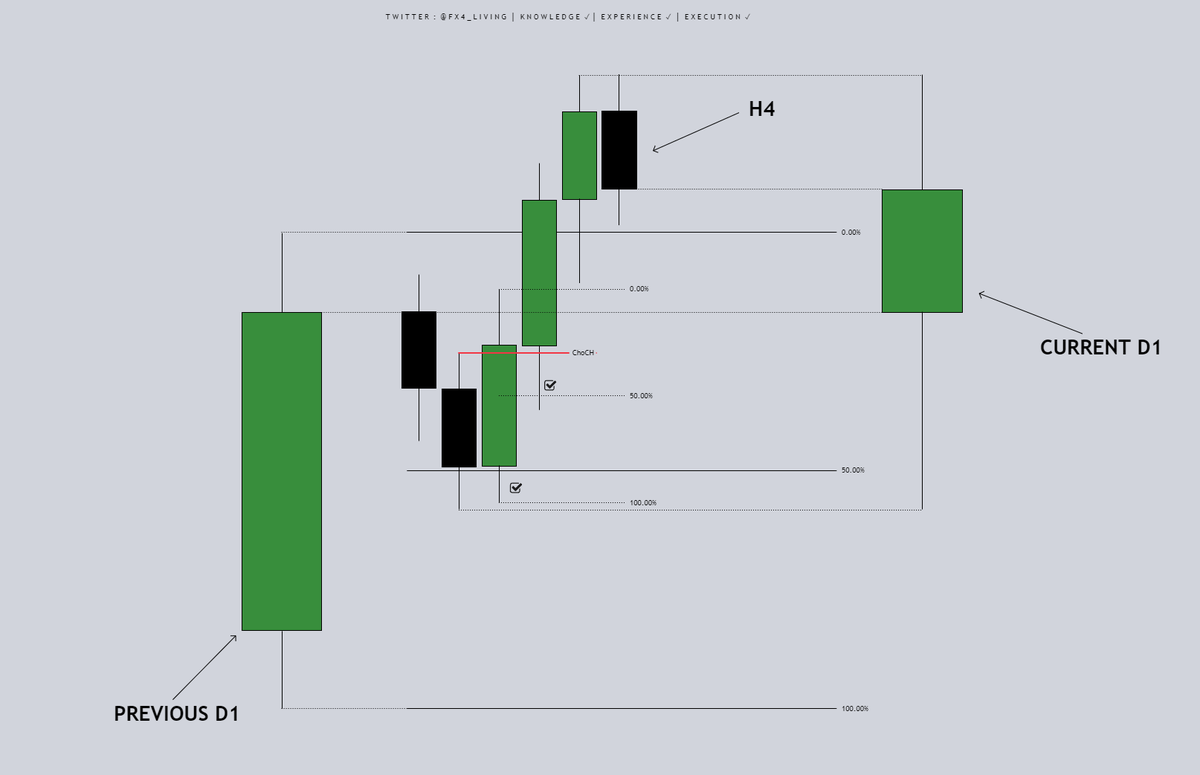

6x (H4) candles into one daily candle (D1) can be useful, using Open, High, Low, Close (OHLC) data from each candle.

Retweet and Bookmark 📚

#ICT #OHLC

A thread 🧵:

Retweet and Bookmark 📚

#ICT #OHLC

A thread 🧵:

The 6x H4 candle into 1x Daily Candle is a powerful concept. It condenses six 4-hour candles into one daily candle, providing a good perspective of the intraday market movements.

The daily candle's range holds valuable information about market sentiment and potential breakouts.

Do you ever wonder why some PD arrays get ignored, and your stop gets run? Here is exactly how to identify when that is likely to happen!

#ICT #Thread 🧵

#ICT #Thread 🧵

A simplified visualization for ICT’s concepts..

These are flashcards for newer #ICT traders. Make sure to bookmark this post or save it to your device

Very simple to read, goal is to introduce the concepts at an easier to read level :)

These are flashcards for newer #ICT traders. Make sure to bookmark this post or save it to your device

Very simple to read, goal is to introduce the concepts at an easier to read level :)

This thread will be explain WHAT Low Resistance Liquidity (LRLR) is and HOW I use it to predict the way price moves

🧵💎#ICT

🧵💎#ICT

Low resistance liquidity, is like a trend line, but forget anything you ever learned about a trendline, trust me. We do not use it like a trendline. We are not buying the breakout.

HOW TO FIND THE DRAW ON LIQUIDITY 🧲 #ICT

this mini thread will go over the key basics to understanding where the market is likely to go (1/3)

Key components to DOL

- Equal Highs (eqh)

- Support Levels

- Resistance levels

[ $ES 1H]

this mini thread will go over the key basics to understanding where the market is likely to go (1/3)

Key components to DOL

- Equal Highs (eqh)

- Support Levels

- Resistance levels

[ $ES 1H]

Here are the 6 Daily #ICT Index Templates in an easy format to refer to throughout the day💎

I recommend you save this and print it out!

I recommend you save this and print it out!

Here is my thread on them with examples ⬇️

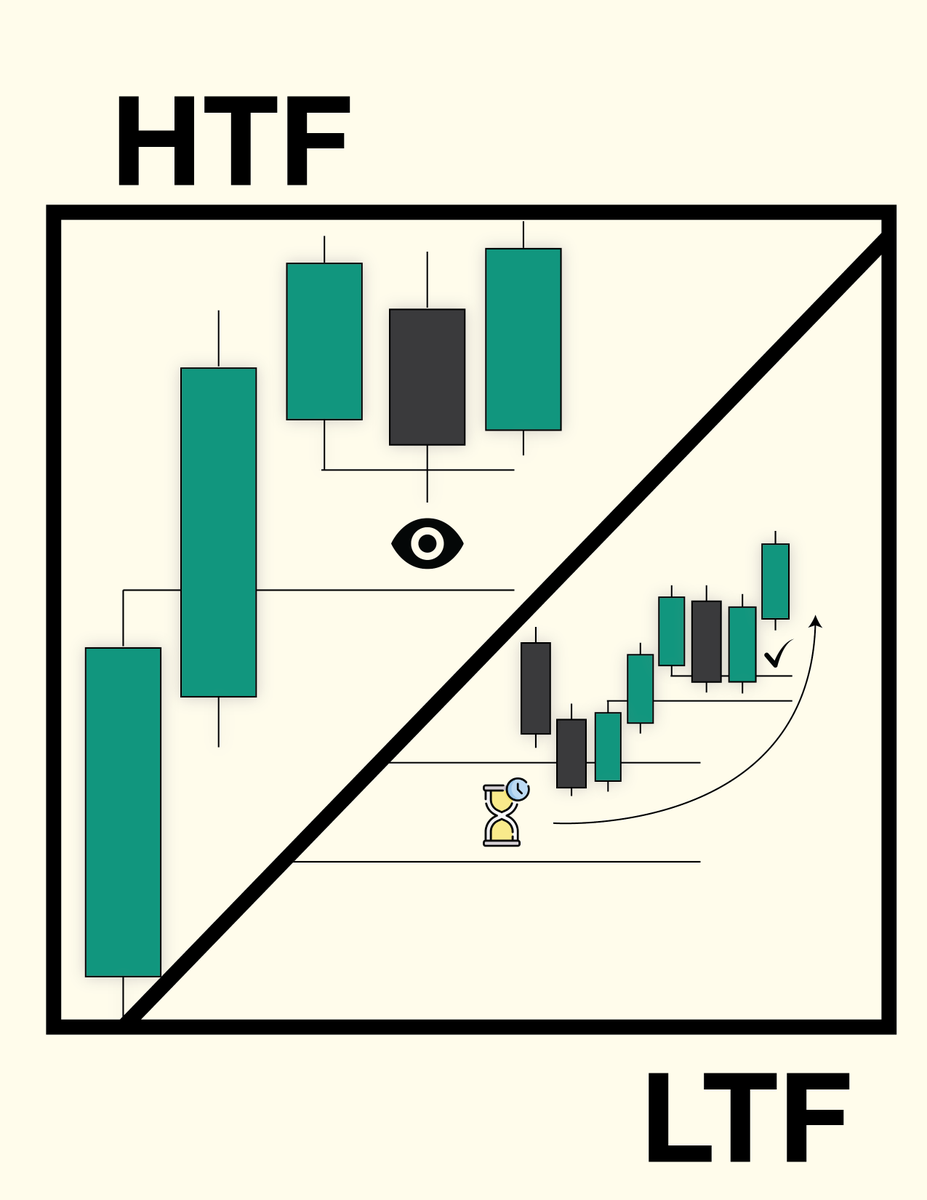

HTF PD Arrays= 4h, Daily, Weekly, Monthly

LTF PD Arrays= 1h and below

LTF PD Arrays= 1h and below

I PRESENT TO YOU

A MEGA THREAD OF ALL MY BEST POSTS/THREADS FOR #ICT Content👑🎁

All in one place so you don’t have to scroll through my twitter:)

This will accelerate your learning if you are a ICT student💎

A MEGA THREAD OF ALL MY BEST POSTS/THREADS FOR #ICT Content👑🎁

All in one place so you don’t have to scroll through my twitter:)

This will accelerate your learning if you are a ICT student💎

Thread on mistakes new ICT students make💎

Thread on when not to take an FVG 💎

Learning How to Analyze the Indexes in 3D Will Greatly Improved Your Accuracy And Bias Within the Market. TRUST ME.

Warning: ⚠️This thread is Pretty Advanced even for Veteran ICT Traders

Anyways, Here’s How👇💎#ICT

Warning: ⚠️This thread is Pretty Advanced even for Veteran ICT Traders

Anyways, Here’s How👇💎#ICT

Analyzing indexes in 3D is not something that came to me for a while. It’s better if you have a few different monitors to do this, but 1 is fine as long as you can scroll through quick enough.

You must be quick, and you must have a decent memory in order for this to work.

You must be quick, and you must have a decent memory in order for this to work.

Analyzing in 3D requires ES, NQ, and YM. If you want to go a step further, use DXY or the US10, 20, or 30 year bond.

I personally don’t feel as these are required. I have done very good analysis without the use of DXY. Only use DXY if you really aren’t sure about ES/NQ.

I personally don’t feel as these are required. I have done very good analysis without the use of DXY. Only use DXY if you really aren’t sure about ES/NQ.

This is my signature model that is the main reasoning behind my 100% win rate my last 11 trades💎

Go backtest this in the charts #ICT

Go backtest this in the charts #ICT

This will be the highest probability with equal lows or high formed during market hours as the draw

The #1 reason why traders struggle is they don’t know when to hold or when to take profit

I’ve learnt a simple trick called the Power of 3 #ICT , to make the process effortless

I’ve learnt a simple trick called the Power of 3 #ICT , to make the process effortless

The market works in 3 phases

1.) Accumulation 📊

2.) Manipulation 😵💫

3.) Distribution 📈📉

Lets look on a higher timeframe to see which one the market is in

1.) Accumulation 📊

2.) Manipulation 😵💫

3.) Distribution 📈📉

Lets look on a higher timeframe to see which one the market is in

ICT - UNTIL THE BRAKES FALL OFF 💎

"Between 10 o'clock & 11 o'clock in the morning, NY local time

YOU WILL FIND A FVG THAT WILL DELIVER 5 HANDLES EVERY FUCKING DAY

GUARANTEEED

ABSOLU FUCKING GUARANTEED 🔥

@I_Am_The_ICT

#ICT

🧵 1/x

"Between 10 o'clock & 11 o'clock in the morning, NY local time

YOU WILL FIND A FVG THAT WILL DELIVER 5 HANDLES EVERY FUCKING DAY

GUARANTEEED

ABSOLU FUCKING GUARANTEED 🔥

@I_Am_The_ICT

#ICT

🧵 1/x

It's never gonna be a day

even on a shit show day like on Friday

IT WILL ALWAYS

ALWAYS

BE THERE AIMING FOR AN OPPOSING POOL OF LIQUIDITY

sell-side or buy side"

even on a shit show day like on Friday

IT WILL ALWAYS

ALWAYS

BE THERE AIMING FOR AN OPPOSING POOL OF LIQUIDITY

sell-side or buy side"

"I know as long as I get to my charts by 10 o'clock and I can stay there until 11 o'clock

I can take something out

EVERY FUCKING DAY

EVERY DAY

EVERY DAY

even on days that have the shortened holiday schedule

🧵 3/x

I can take something out

EVERY FUCKING DAY

EVERY DAY

EVERY DAY

even on days that have the shortened holiday schedule

🧵 3/x

I suggest printing these out and putting them on your desk or something. It’s nice to see them side by side with the framework you are looking for live time

ICT MENTORSHIP 2023 SETUP W EXAMPLES🍿

"between 3 to 415pm, more precisely between 315 to 345. If you know where you are looking for for liquidity to end the day, swing or imbalance, price will offer an entry towards it before close"

Now lets look at some examples 👇

#ICT

"between 3 to 415pm, more precisely between 315 to 345. If you know where you are looking for for liquidity to end the day, swing or imbalance, price will offer an entry towards it before close"

Now lets look at some examples 👇

#ICT

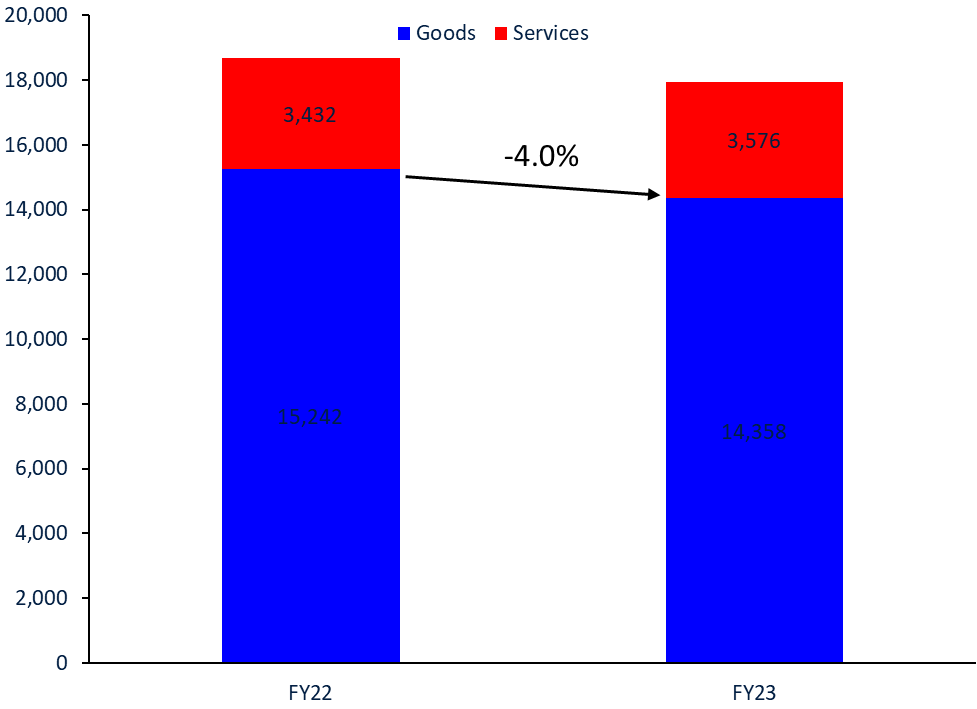

. @StateBank_Pak has released disaggregated #trade data for #Pakistan, for the first half of FY23. Some analysis on main trends in 🧵👇👇

1) #Pakistan's #exports have declined in H1 FY23 relative to H1 FY22 by 4%. The fall is driven by goods #exports that fell by 5.8%.

2) By #destination, the largest #export contractions are observed to the USA, China, the UK and the UAE.

#Pakistan

#Pakistan

‼️ ICT Price Delivery (Fiyat Teslimatı) ‼️

Fiyat şu şekilde teslim edilir:

Genişletme -> Sipariş bloğu

Düzeltme -> Likidite boşluğu / Fvg

Ters çevirme -> Likidite havuzu

Konsolidasyon -> Denge / %50

#ICT #Price #Algorithm

Örnek grafik -->

Fiyat şu şekilde teslim edilir:

Genişletme -> Sipariş bloğu

Düzeltme -> Likidite boşluğu / Fvg

Ters çevirme -> Likidite havuzu

Konsolidasyon -> Denge / %50

#ICT #Price #Algorithm

Örnek grafik -->

Fiyat şuan hangi hareketi yaptı?

Sıradaki hareket ne?

Size bir tüyo:

Tüm hareketlerin her birine kafanızda bir kodlama yapıp bu kodları kombinleyerek kendinize bir model oluşturabilirsiniz.

Örnek: 2-4-1-3 (boğa) / 3-1-4-2(ayı) 🤪👊

---->

Sıradaki hareket ne?

Size bir tüyo:

Tüm hareketlerin her birine kafanızda bir kodlama yapıp bu kodları kombinleyerek kendinize bir model oluşturabilirsiniz.

Örnek: 2-4-1-3 (boğa) / 3-1-4-2(ayı) 🤪👊

---->

Kütüphaneme kaydettiğim farklı görselleri harmanlayarak hazırladım. Traderların isimlerini hatırlamıyorum. Bilen varsa yorum bırakabilir daha fazla kaynağa ulaşabiliriz.

İçerik devamı için desteklerseniz sevinirim 🖤🥷

İçerik devamı için desteklerseniz sevinirim 🖤🥷

⏳London Killzone⏳

- Günün high veya low oluşma ihtimali yüksektir.

- Genellikle gidilecek yönün tersine manipüle hareket yapar. Buna Judas swing'de denir.

-Asia'da sert hareketler olursa London işlem alınmaz.

- Haftanın High veya Low'u Salı veya Çarşamba oluşur.

Devam-->

- Günün high veya low oluşma ihtimali yüksektir.

- Genellikle gidilecek yönün tersine manipüle hareket yapar. Buna Judas swing'de denir.

-Asia'da sert hareketler olursa London işlem alınmaz.

- Haftanın High veya Low'u Salı veya Çarşamba oluşur.

Devam-->

Örnek grafik:

- Yatay geçen Asia range sonrası 00:00 algoritmanın açılması ile London killzone vaktinde fiyat manipüle yapıp hareketine devam ediyor.

- Newyork killzone'de ote bölgesinden tekrar giriş şansı tanıyor.

--->

- Yatay geçen Asia range sonrası 00:00 algoritmanın açılması ile London killzone vaktinde fiyat manipüle yapıp hareketine devam ediyor.

- Newyork killzone'de ote bölgesinden tekrar giriş şansı tanıyor.

--->

@DenizhanOzay notları:

-Londra 02.30-03.00 arası judas swing'tir.

-Fiyat 02.30 öncesi likiditeye saldırmamış ise 02.30 ila 03.00 arası harekete geçer. En dip/tepe fiyat 03.00 veya 03.30 arası oluşur. En yüksek ihtimalli tradeler her zaman 03.00-03.30 aralığında çıkar.

-Londra 02.30-03.00 arası judas swing'tir.

-Fiyat 02.30 öncesi likiditeye saldırmamış ise 02.30 ila 03.00 arası harekete geçer. En dip/tepe fiyat 03.00 veya 03.30 arası oluşur. En yüksek ihtimalli tradeler her zaman 03.00-03.30 aralığında çıkar.