Discover and read the best of Twitter Threads about #IFO

Most recents (9)

1/7🧐So what's new on @0xconcentrator over this Sunny Month of August. You could read my previous update here below. Quick summary and financial figures in the below 🧵 Things are moving up!🧐

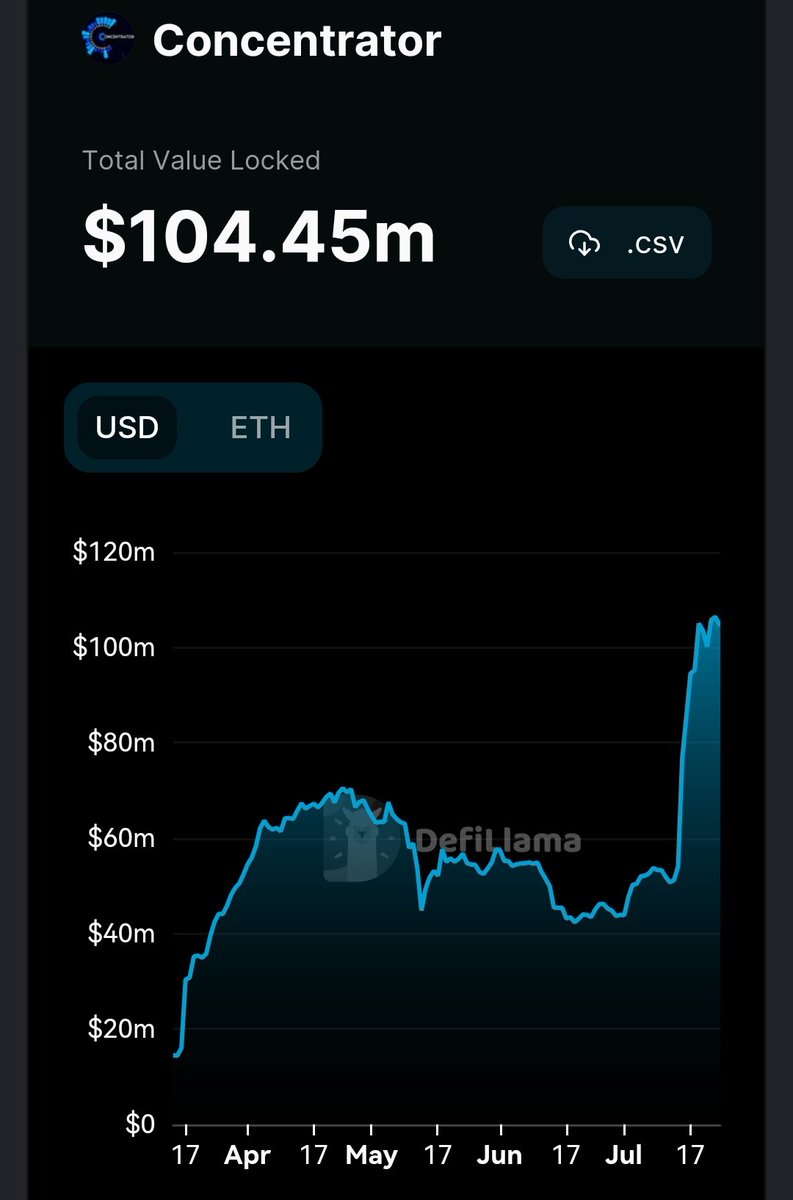

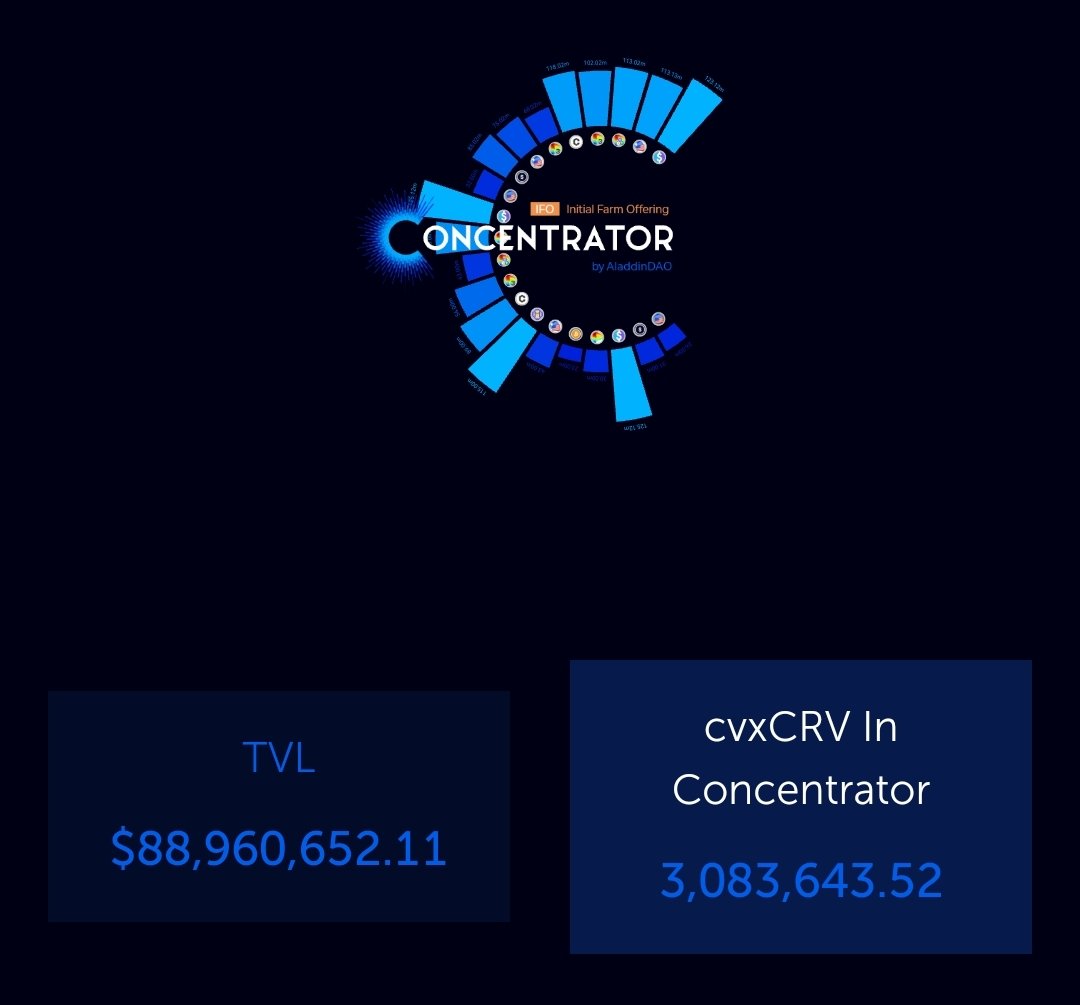

2/7 TVL decreased to around 89m$, from 105m$ at beg. of August. Since the market and especially $CRV crashed by -30%, it's actually a pretty confident and positive figure. 4,7m $cvxCRV are now deposited on the protocol.

3/7 Farmed $CTR during the #IFO achieved the 1st cap of 1/3 of the emission during this offering period, cumulating 930k $CTR. According to my Maths, end of the IFO is still planned to mid-November. So 2,5 months from now.

The $WOM TGE is now very close at hand. ⏳

We're thrilled to see the fruition of the #StableswapV2, and here's what you should know about our $WOM token🧵

We're thrilled to see the fruition of the #StableswapV2, and here's what you should know about our $WOM token🧵

2/ Wombat Exchange is a next-gen multi-chain #stableswap native to the @BNBCHAIN.

Swap stablecoins at hyper-efficient rates w/ minimal slippage & earn massive yield via our single-staking pools with stableswap 2.0 model. We bring innovation to the #BNBChain & to #DeFi at large.

Swap stablecoins at hyper-efficient rates w/ minimal slippage & earn massive yield via our single-staking pools with stableswap 2.0 model. We bring innovation to the #BNBChain & to #DeFi at large.

Looking to get a grasp of what Wombat does? Watch this video and to know us better in less than 1 minute!

🔗

🔗

1/11 how much does it cost to farm on @0xconcentrator, to receive their new token $CTR ? What is the minimum amount of your deposit to get your ROI at the end of their IFO ? When could the IFO end ? All the answers in this 🧵here 👇

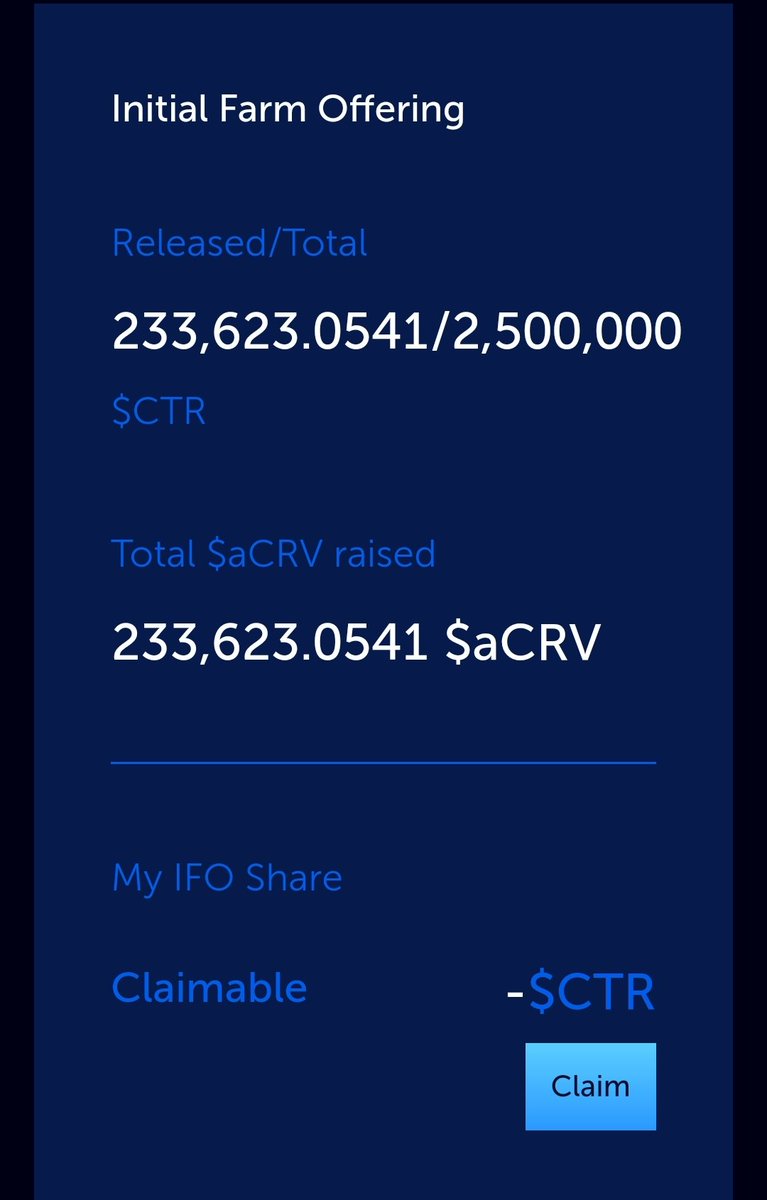

2/11 So as today, 233k $CTR has been raised out of the targeted 2,5millions of tokens. So, a projection shows an end of their IFO in about 3,5months, so around mid-November at same TVL.

3/11 @0xconcentrator can now be tracked on defillama and succeeded one big milestone, reaching the 100m$ + of TVL and entering the top list on #Ethereum! Congrat's!!

1/11 You don't like IMPERMANENT LOSS, here are some Yield Farming Strategy on stable assets on @0xconcentrator during their #IFO, i.e earning their brand new token $CTR. First, TVL has gone +66% since IFO launches on 14/07. APY are subject to $CTR price and LP prices. 🧵👇💪

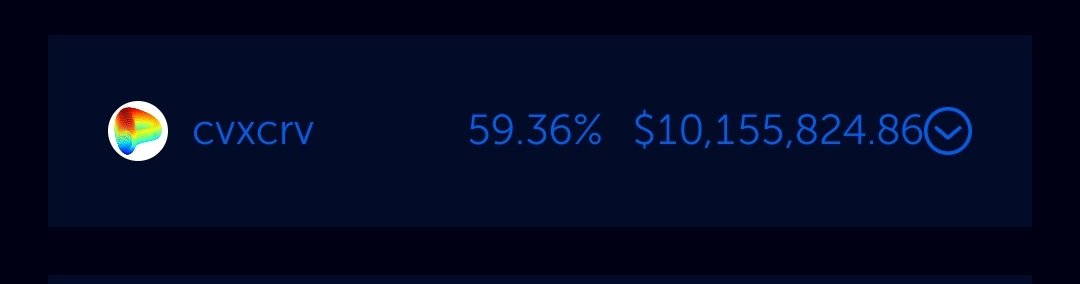

2/11 Token from @CurveFinance : $cvxCRV is pegged to $CRV. LP cvxCRV/CRV, 59% APY

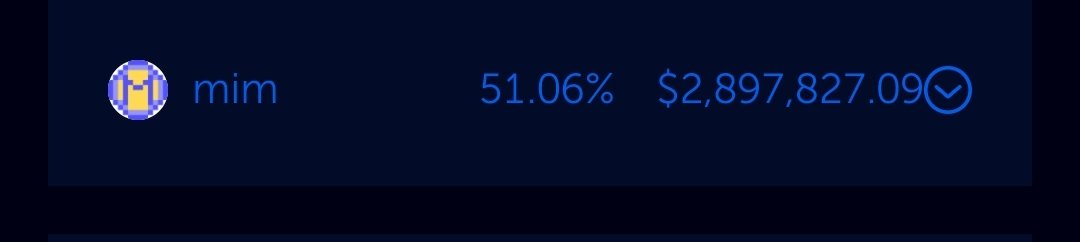

3/11 Token from @MIM_Spell : LP $MIM / $3CRV, 51% APY

Hafta başında yoğun bir ekonomik veri gündeminin bizleri beklediğine dikkat çekmiştim. Bunlardan bir iki tanesine bakalım:

1) ABD tarafında tüketici harcamaları oldukça kuvvetli geldi. Bunun tatil haftasında artarak devamı bekleniyor.

1) ABD tarafında tüketici harcamaları oldukça kuvvetli geldi. Bunun tatil haftasında artarak devamı bekleniyor.

2) İlgiyle beklenen diğer bir veri ise işsizlik konusundaydı ve buradaki gerçekleşme tahminlerin çok altında olduğu için pozitif fiyatlandı. Ancak bu düşüşün mevsimsel faktörler nedeniyle farklılaşacağını belirtmek isterim.

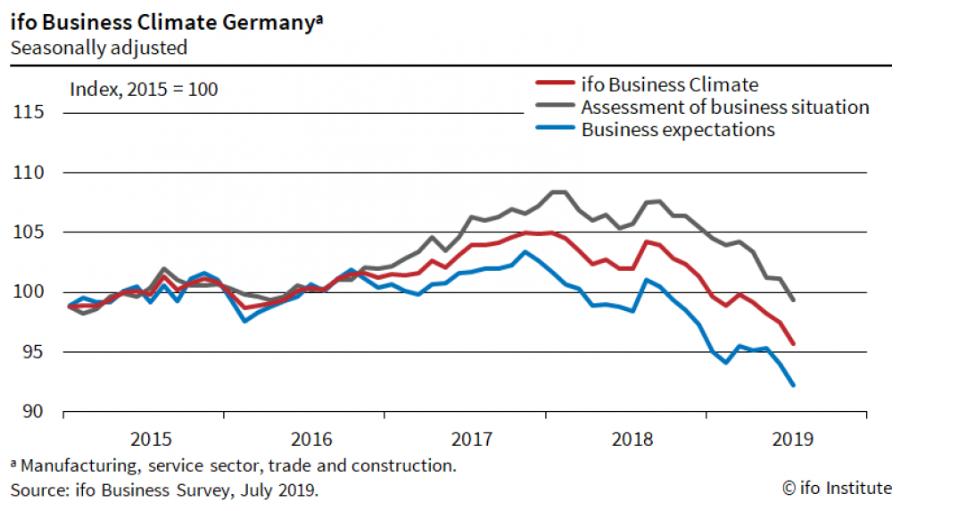

3) Almanya tarafında işler iyi gitmiyor. #IFO Endeksi iş dünyasının nabzını ölçüyor ve gerek covid kaynaklı gerekse de tedarik sorunları nedeniyle durum kötüleşiyor. Özellikle de enerji ve güvenlik sorunları ön planda.

1) Sayfamı takip edenlerin bildiği gibi artık bir klasik olan, geçen haftanın olaylarına ve önümüzdeki hafta öne çıkabilecek gelişmelere odaklanan, David Westin’in sunduğu #WallStreetWeek program özeti hazır.

Bir kahve içimi vakit ile buyrun başlayalım.

Bir kahve içimi vakit ile buyrun başlayalım.

2) Öncelikle bizleri dolu dolu bir hafta bekliyor.📝✅

En azından açıklanacak ekonomik veriler açısından öyle. Diğer taraftan da alışveriş ve tatil dönemi başladığı için de bu hafta biraz kısa olacak. Bunların detaylarına şirketler ve haftanın programı bölümünde değineceğim.

En azından açıklanacak ekonomik veriler açısından öyle. Diğer taraftan da alışveriş ve tatil dönemi başladığı için de bu hafta biraz kısa olacak. Bunların detaylarına şirketler ve haftanın programı bölümünde değineceğim.

3) #Enflasyon konusu en çok tartışılan tema oldu. Teknoloji, inovasyon ve verimlilik artışının iş gücünün katılımındaki kaybı karşılayarak büyümeye destek verdiği belirtiliyor. Benzer şekilde tüketicilerin yüksek harcamalarının etkisi de verilere ve hisse fiyatlarına yansıyor.

Die gestern vermeldete Studie des #ifo-Instituts zum Stand schulischen Lernens während #Corona hat einige kontroverse Rückmeldungen erzeugt. Einige Ergebnisse & Anmerkungen auch zur allgemeinen Studienlage: /1 ifo.de/publikationen/…

Ludger #Wößmann et al. ermitteln die Zeit, die Schüler_innen mit schulischen Aktivitäten vor Corona verbracht haben, mit 7,4 h/Tag (Durchschnitt) & stellen dem 4,3 h „Lernzeit“ Anfang 2021 gegenüber. Dies ist mehr als Anfang 2020 (damals 3,6 h). Von den 4,3 h entfällt ca. 1 h /2

auf schulischen Unterricht im engeren Sinne. Die Differenzen sind erheblich, 23% der SuS haben sich maximal 2 h/Tag mit Schule befasst, 58% max. 4 h. Der Vergleich zu Zahlen vor Corona ist m. E. zurecht kritisiert worden: Er droht, die Effizienz des Präsenzunterrichts /3

Die geschönten Prognosen des @ifo_Institut

Zunächst die IST Situation. Der wichtigste Indikator, das #BIP, ist im 2. Quartal auf ein historisches Tief von -10,1% zum Vorquartal oder gar -11,7% zum Vorjahr gefallen.

Das war der stärkste Rückgang seit 1970 lt. Destatis.

Zunächst die IST Situation. Der wichtigste Indikator, das #BIP, ist im 2. Quartal auf ein historisches Tief von -10,1% zum Vorquartal oder gar -11,7% zum Vorjahr gefallen.

Das war der stärkste Rückgang seit 1970 lt. Destatis.

Nicht besser sind die Zahlen von #arbeitsmarkt. 2,91 Mio #Arbeitslose, 635.000 mehr als im Vorjahr das ist ein Anstieg von 28%, den höchsten Anstieg hat Bayern mit fast 50%.

Dazu kommen 12 Mio Anzeigen an #Kurzarbeit, von denen im Mai 2020 tatsächlich

arbeitsagentur.de/presse/2020-36…

Dazu kommen 12 Mio Anzeigen an #Kurzarbeit, von denen im Mai 2020 tatsächlich

arbeitsagentur.de/presse/2020-36…

6,7 Mio mit Kurzarbeit abgerechnet wurden mit Arbeitszeitausfall von fast 50% im Durchschnitt, also 20% aller sozialversicherungspflichtig Beschäftigten. Das sind optimistisch gesehen mindestens 1 Mio weitere, potenzielle Arbeitslose.

Der #Export ist im Mai um 30% eingebrochen.

Der #Export ist im Mai um 30% eingebrochen.

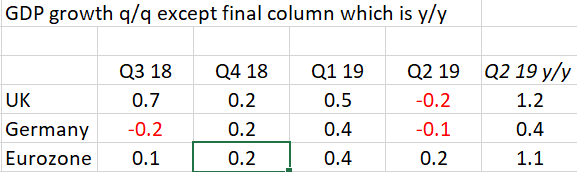

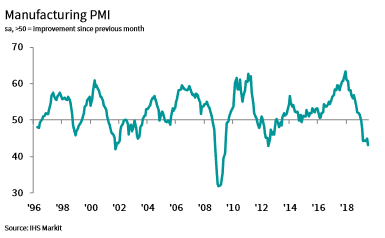

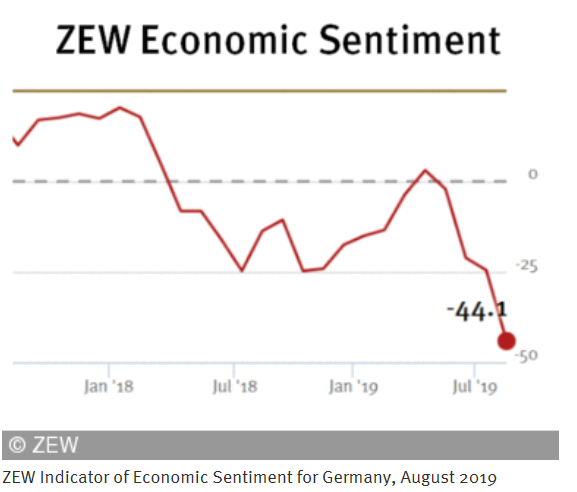

Confirmed: German #GDP also fell in Q2, by 0.1% q/q. Indeed, German GDP is now only 0.4% higher than a year ago, compared to growth of 1.2% in the UK. The equivalent figure of 1.1% for the euro zone as a whole is now likely to be revised down too... (1/4)