Discover and read the best of Twitter Threads about #PMIs

Most recents (11)

Hello Tuesday!

The $USD 🎳 continues to tick 🔺 vs the $GBP +0.3% an vs. $CNY +0.22% even as #Bitcoin back > 27000

Let's dig into the market 🧮!

The $USD 🎳 continues to tick 🔺 vs the $GBP +0.3% an vs. $CNY +0.22% even as #Bitcoin back > 27000

Let's dig into the market 🧮!

The Asian ♉️ takes a hit ↘️

$NIKK 209578 -0.4%

$SSEC 3246 -1.5%

$TWII 16188 +0.05%

$HSI 19416 -1.35%

$KOSPI 2567 +0.4%

$IDX 6746 +0.25%

Australia ↔️

$ASX 7260 -0.05%

India ↗️

$BSE 62187 +0.35%

$NIKK 209578 -0.4%

$SSEC 3246 -1.5%

$TWII 16188 +0.05%

$HSI 19416 -1.35%

$KOSPI 2567 +0.4%

$IDX 6746 +0.25%

Australia ↔️

$ASX 7260 -0.05%

India ↗️

$BSE 62187 +0.35%

Europe mostly ↘️ on ↔️ #PMIs

$DAX 16205 -0.1%

$FTSE 7778 +0.1%

$CAC 7416 -0.85%

$AEX 676 -0.05%

$IBEX 9296 -0.1%

$MIB 27245 -0.25%

$SMI 11544 -0.1%

$MOEX 2625 -0.3%

$VSTOXX 16.44 🔺

$DAX range = 15920 - 16380 ♉️

$DAX 16205 -0.1%

$FTSE 7778 +0.1%

$CAC 7416 -0.85%

$AEX 676 -0.05%

$IBEX 9296 -0.1%

$MIB 27245 -0.25%

$SMI 11544 -0.1%

$MOEX 2625 -0.3%

$VSTOXX 16.44 🔺

$DAX range = 15920 - 16380 ♉️

Hello Thursday!

Santa 🎅 came and went, leaving $SPX holder +0.8% over the last 6 trading days of the year 🎁

🐫 also showed up, robbing $DBC holders -4.14% and $DBA holders -2.28%. $CRB under pressure -4.89% in 2 trading days.

Let's dig into the market 🧮!

Santa 🎅 came and went, leaving $SPX holder +0.8% over the last 6 trading days of the year 🎁

🐫 also showed up, robbing $DBC holders -4.14% and $DBA holders -2.28%. $CRB under pressure -4.89% in 2 trading days.

Let's dig into the market 🧮!

Asia closed mostly ↗️ save 🇮🇩

$NIKK 25821 +0.4%

$SSEC 3155 +1.0%

$TWII 14301 +0.7%

$HSI 21052 +1.25%

$KOSPI 2265 +0.4%

$IDX 6654 -2.35% 🇮🇩

Australia ↔️

$ASX 7064 +0.05%

India ↘️

$BSE 60353 -0.5%

$NIKK 25821 +0.4%

$SSEC 3155 +1.0%

$TWII 14301 +0.7%

$HSI 21052 +1.25%

$KOSPI 2265 +0.4%

$IDX 6654 -2.35% 🇮🇩

Australia ↔️

$ASX 7064 +0.05%

India ↘️

$BSE 60353 -0.5%

Europe ↔️ after $FEZ +4.25% to start the year

$DAX 14483 -0.05%

$FTSE 7612 +0.35%

$CAC 6765 +0.15%

$AEX 717 +0.05%

$IBEX 8589 +0.35%

$MIB 24879 +0.05%

$SMI 11091 -0.45%

$MOEX 2159 -0.45%

$VSTOXX 19.23 🔻

$DAX range = 13723 - 14511 ♉️

$DAX 14483 -0.05%

$FTSE 7612 +0.35%

$CAC 6765 +0.15%

$AEX 717 +0.05%

$IBEX 8589 +0.35%

$MIB 24879 +0.05%

$SMI 11091 -0.45%

$MOEX 2159 -0.45%

$VSTOXX 19.23 🔻

$DAX range = 13723 - 14511 ♉️

Hello Monday!

Post #opex

Post #NFP

With #PMIs and 3 Fed speakers beginning with Brainard on Tuesday and Bullard 🦅 on Thursday, today may be the quietest day of the week.

Let's dig into the 🧮!

Post #opex

Post #NFP

With #PMIs and 3 Fed speakers beginning with Brainard on Tuesday and Bullard 🦅 on Thursday, today may be the quietest day of the week.

Let's dig into the 🧮!

Asia started the week 💪↗️

$NIKK 27736 +0.25%

$SSEC 3283 +0.95%

$TWII 17626 -0.4% 🔻

$HSI 22509 +2.15% ⬅️

$KOSPI 2758 +0.65%

$IDX 7116 +0.55%

Australia ↗️

$ASX 7514 +0.25%

India 💪↗️

$BSE 60408 +1.9%

Good move to cover your 🩳

$NIKK 27736 +0.25%

$SSEC 3283 +0.95%

$TWII 17626 -0.4% 🔻

$HSI 22509 +2.15% ⬅️

$KOSPI 2758 +0.65%

$IDX 7116 +0.55%

Australia ↗️

$ASX 7514 +0.25%

India 💪↗️

$BSE 60408 +1.9%

Good move to cover your 🩳

Europe trading ↔️ at the open

$DAX 14397 -0.35%

$FTSE 7554 +0.2%

$CAC 6677 -0.1%

$AEX 732 +0.6%

$IBEX 25127 -0.15%

$MIB 25132 -0.1%

$SMI 12288 +0.9% ⬅️

$MOEX 2773 +0.5% 🪆

$VSTOXX 28.50

$DAX 14397 -0.35%

$FTSE 7554 +0.2%

$CAC 6677 -0.1%

$AEX 732 +0.6%

$IBEX 25127 -0.15%

$MIB 25132 -0.1%

$SMI 12288 +0.9% ⬅️

$MOEX 2773 +0.5% 🪆

$VSTOXX 28.50

A few months ago, #markets expected U.S. #inflation to peak by mid-2022 at around 7% to 8% at the headline level and then anticipated that generalized #price gains would decline into year end, closing the year around 4%.

However, the tragic war now unfolding with Russia’s attack upon Ukraine has not only sent #energy prices skyrocketing but it has led to much greater uncertainty over #economic growth and #MonetaryPolicy reaction functions, in Europe and indeed around the world.

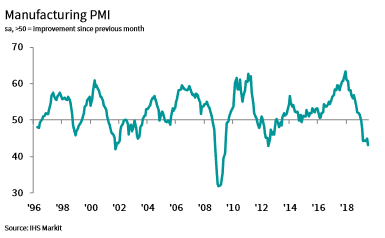

(1/n) The #inflation data just keeps coming in hot. Today it was the #Markit #PMIs that showed input prices rising to a record...by a long shot.

(2/n) Earlier in the week it was the core PPI data, which came in at 2%, fully twice the #WallSt estimates.

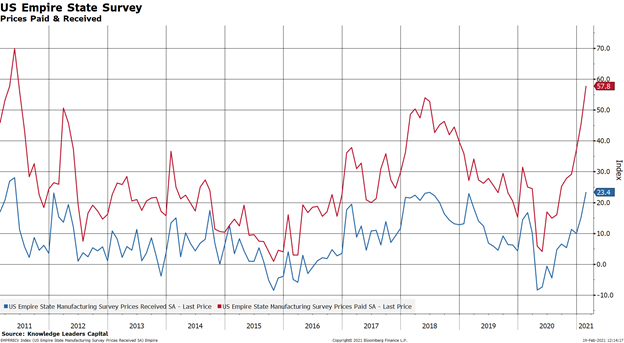

(3/n) On Monday the #Fed's Empire State manufacturing survey showed prices paid at the highest level in 10 years.

1/

#PedsICU conversations

Just out our paper in @PedCritCareMed led by the fabulous @AnnaZanin_MD 🇮🇹 on the Live Tweeting the Discovery of #COVID19 related Syndrome in Children (#PIMS #MISC)

Nuestro artículo sobre descubrimiento Sínd niños y @Twitter

journals.lww.com/pccmjournal/Ci…

#PedsICU conversations

Just out our paper in @PedCritCareMed led by the fabulous @AnnaZanin_MD 🇮🇹 on the Live Tweeting the Discovery of #COVID19 related Syndrome in Children (#PIMS #MISC)

Nuestro artículo sobre descubrimiento Sínd niños y @Twitter

journals.lww.com/pccmjournal/Ci…

2/

Doctors have discussed clinical cases since its inception, COnversations among peers and sharing is key for medicine knowledge advancements

Los médicos siempre conversaron entre ellos y así la medicina avanza

(Rembrandt) #historicmedtwitter

smarthistory.org/rembrandt-anat…

Doctors have discussed clinical cases since its inception, COnversations among peers and sharing is key for medicine knowledge advancements

Los médicos siempre conversaron entre ellos y así la medicina avanza

(Rembrandt) #historicmedtwitter

smarthistory.org/rembrandt-anat…

3/

These conversations abled naming of diseases, etc. Unfortunately, many of those inventions/discoveries remained in silos, and massive global dissemination was impossible in real time. Moreover, tracking the origins and giving merits was difficult.

These conversations abled naming of diseases, etc. Unfortunately, many of those inventions/discoveries remained in silos, and massive global dissemination was impossible in real time. Moreover, tracking the origins and giving merits was difficult.

September 2020 flash PMI in one thread, in following order

#US 🇺🇸

#UK 🇬🇧

#EuroZone 🇪🇺

#Germany 🇩🇪

#France 🇫🇷

#Japan 🇯🇵

#Australia 🇦🇺

+Note on diffusion indexes like the purchasing managers indexes, or #PMIs.

#economy #recession #recovery

#US 🇺🇸

#UK 🇬🇧

#EuroZone 🇪🇺

#Germany 🇩🇪

#France 🇫🇷

#Japan 🇯🇵

#Australia 🇦🇺

+Note on diffusion indexes like the purchasing managers indexes, or #PMIs.

#economy #recession #recovery

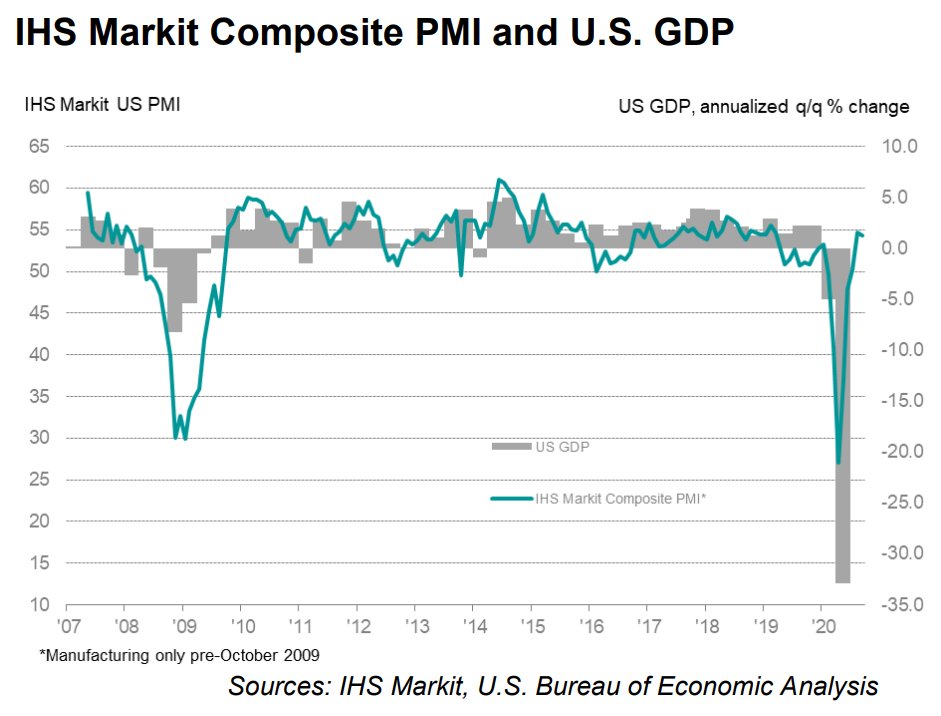

🇺🇸 #US #PMI September 2020 (August)

Solid rise in private sector business activity in September

Composite Output 54.4 (54.6)

Services Business Activity 54.6 (55.0)

Manufacturing PMI 53.5 (53.1)

Manufacturing Output 53.3 (52.7)

markiteconomics.com/Public/Home/Pr…

Solid rise in private sector business activity in September

Composite Output 54.4 (54.6)

Services Business Activity 54.6 (55.0)

Manufacturing PMI 53.5 (53.1)

Manufacturing Output 53.3 (52.7)

markiteconomics.com/Public/Home/Pr…

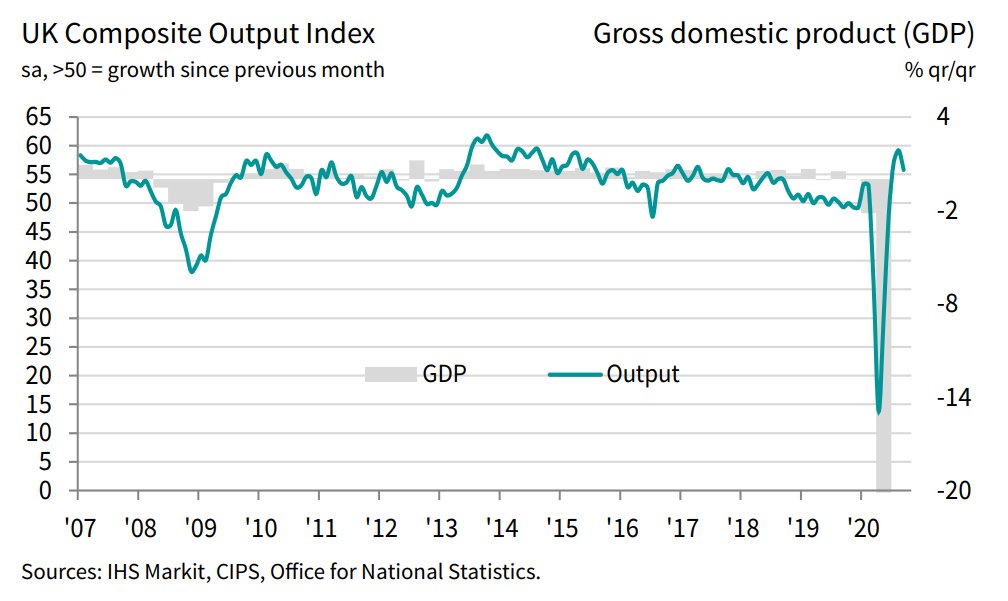

🇬🇧 #UK #PMI September 2020 (August)

Recovery loses momentum and business outlook drops to its weakest since May

Composite Output 55.7 (59.1)

Services Business Activity 55.1 (58.8)

Manufacturing Output 59.3 (61.0)

Manufacturing PMI 54.3 (55.2)

markiteconomics.com/Public/Home/Pr…

Recovery loses momentum and business outlook drops to its weakest since May

Composite Output 55.7 (59.1)

Services Business Activity 55.1 (58.8)

Manufacturing Output 59.3 (61.0)

Manufacturing PMI 54.3 (55.2)

markiteconomics.com/Public/Home/Pr…

The "mysterious pediatric coronavirus illness" resembling Kawasaki Disease (KD) and toxic shock syndrome (TSS) has been in the news recently. From a current pediatrics resident and soon-to-be #PedsICU fellow, let's talk a little bit about it. (Thread).

nytimes.com/2020/05/09/hea…

nytimes.com/2020/05/09/hea…

First, what's KD? It's an inflammatory disease that can cause problems with the coronary arteries, which supply the heart muscle. Its cause is unknown, but a viral trigger is one idea. It's also more common than you'd think - every pediatrician has seen it more than once.

Second, what's TSS? It's the effect of an infection (classically staph on the skin) producing a toxin that can make patients really sick and sometimes need an ICU to help keep their blood pressure up. Again, somewhat rare but more common than you'd think.

Real-time #economic and #market indicators will translate into a stunning series of (lagged) economic data points in the weeks to come, with Friday’s #JobsReport likely being a key first glimpse of what we’re in store for: eg. jobless claims 5X more than the next largest decline.

When all is said and done, the #unemployment rate might exceed the 2008 high, and the second quarter #GDP decline could be -10% (or worse), before we begin to recover.

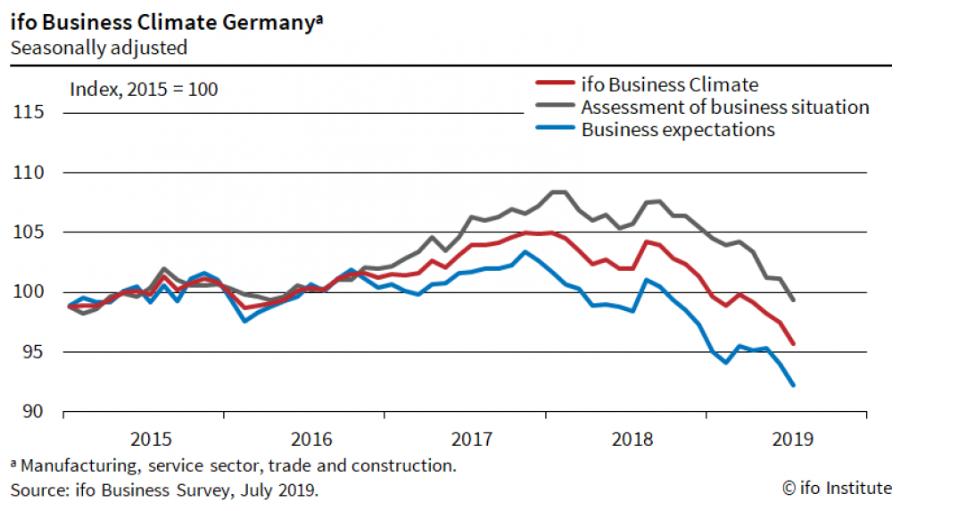

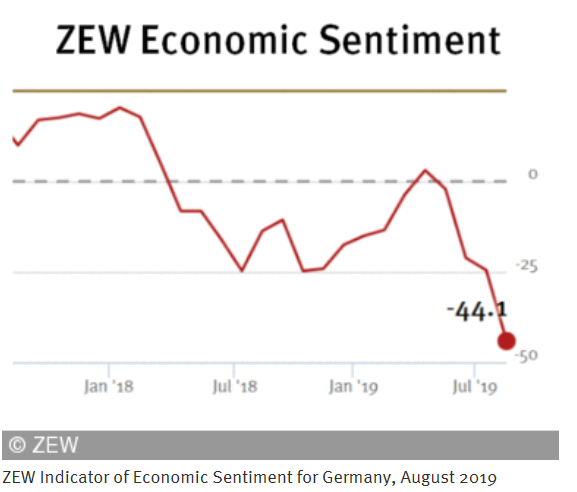

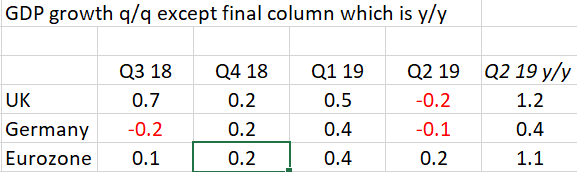

Confirmed: German #GDP also fell in Q2, by 0.1% q/q. Indeed, German GDP is now only 0.4% higher than a year ago, compared to growth of 1.2% in the UK. The equivalent figure of 1.1% for the euro zone as a whole is now likely to be revised down too... (1/4)

Good morning all! 🙂 Morning in Copenhagen - listening to Ludovico while I'm updating analyses and family sleeps. Fantastic piece of music: #AllisGood

Time for some #HZupdates. Let's take a look at the market from the way I see it. Where is that deflation, I have been forecasting? Did CBs succeed to do their magic and eliminate that threat? What about the Kondratiev's winter - over/done? Stay tuned! 🙂

AUDUSD is inflation gauge. Rally=inflation up; Decline=inflation down. LT perspective looks like this. Decline in 2008 = wave A. Rally up to 2011 = wave B. We have since been in wave C. Wave 5 will take us to ~0.5. Note the horizontal line. When this goes -->free fall #HZupdates