Discover and read the best of Twitter Threads about #PaycheckProtectionProgram

Most recents (24)

1/💩ton

OK we have text of the new Stimulus bill... combined w/ a WHOLE lot of other legislation.

In all the PDF version of the full bill clocks in at 5593 pages. Can be found: docs.house.gov/floor/404-main…

Buckle up. This is gonna be a LONG ride!

OK we have text of the new Stimulus bill... combined w/ a WHOLE lot of other legislation.

In all the PDF version of the full bill clocks in at 5593 pages. Can be found: docs.house.gov/floor/404-main…

Buckle up. This is gonna be a LONG ride!

2/x

But before we dive into the bill, a quick note from my soap box… This whole process is absurd. They JUST released a 5k+ page bill, and they are going to vote on it TODAY.

They aren't even pretending to have time to read what they're voting on anymore.

*Steps off soap box*

But before we dive into the bill, a quick note from my soap box… This whole process is absurd. They JUST released a 5k+ page bill, and they are going to vote on it TODAY.

They aren't even pretending to have time to read what they're voting on anymore.

*Steps off soap box*

3/x

Ok... on to the meat. Let's start by answering the question that so many are already asking... “Will I be getting another #stimulus check?”

The answer, like last time, is “Maybe.”

Notably, the maximum stimulus amount per person this time around is $600.

Ok... on to the meat. Let's start by answering the question that so many are already asking... “Will I be getting another #stimulus check?”

The answer, like last time, is “Maybe.”

Notably, the maximum stimulus amount per person this time around is $600.

Despite weeks of stalled negotiations, Congress seems poised to agree on a #COVID19 relief package in the coming days. The deal would likely provide additional disaster funding for #smallbiz, including targeted relief for restaurants, hotels, theaters, and the airlines . . .

. . . as well as another opportunity for #PaycheckProtectionProgram loans. Individuals may also see extended unemployment benefits and possibly another stimulus check. There’s also separate legislation extending #CARESAct subsidies Keep an eye out for more signs of compromise!

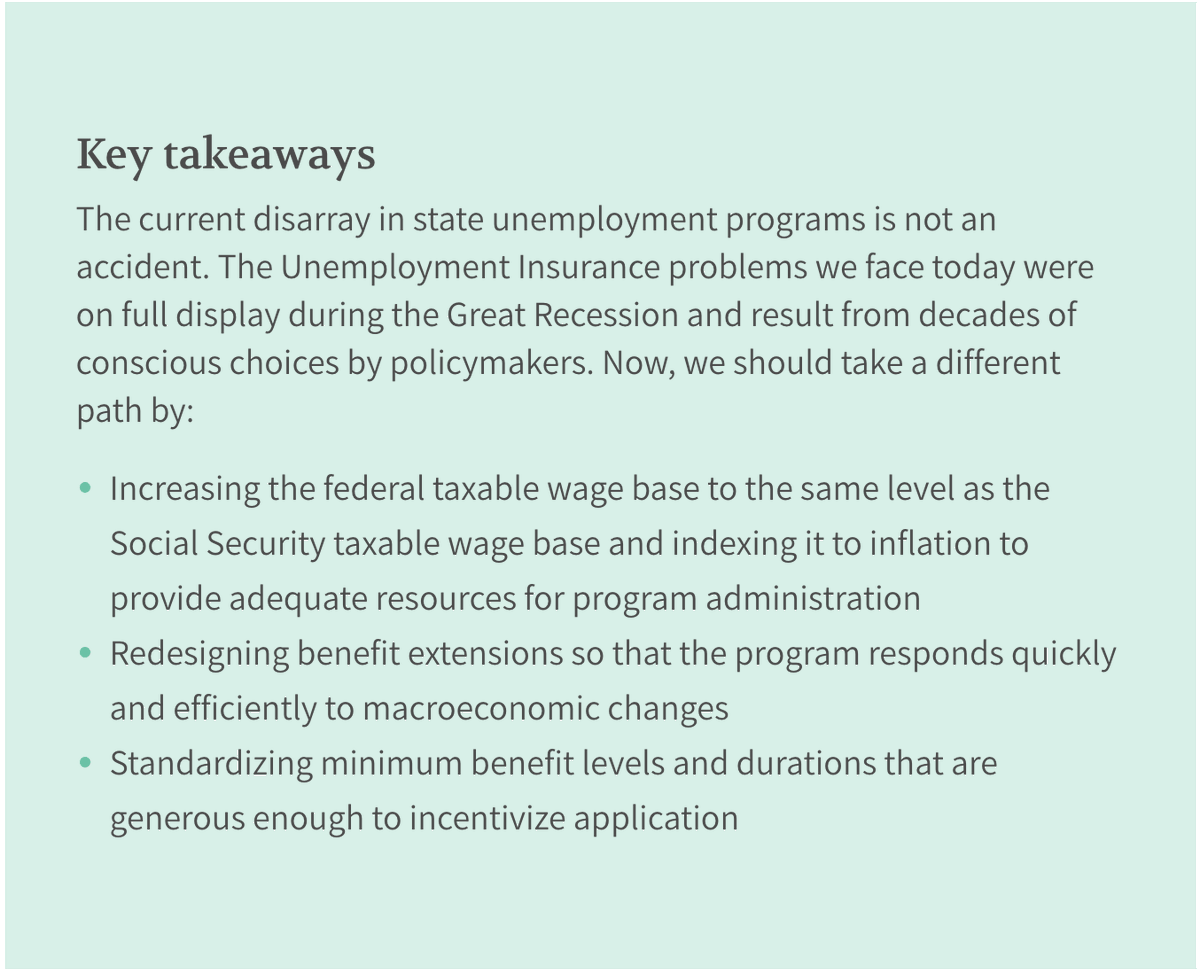

The federal government *CAN* help the economy recover and ensure that recovery is broad-based and equitable. @equitablegrowth's @dsmitch28 lists 21 actionable policy recommendations to combat the #coronavirus #recession 👇equitablegrowth.org/twenty-one-pol… (1/x)

1. We need #UnemploymentBenefits! UI helps workers weather an economic crisis while keeping demand for goods and services from plummeting. The emphasis on work disincentives reflects racist biases against low-income workers of color. equitablegrowth.org/factsheet-unem… (2/x)

2. We need to make #UnemploymentBenefits better, by addressing structural flaws in the system, as @alixgouldwerth writes: equitablegrowth.org/fool-me-once-i… (3/x)

A “mastermind in the field of #cyber espionage” will be awarded a lifetime achievement by the state of #Israel in September.

by @hijodelcuervo

mintpressnews.com/israel-dystopi… #Israeli #AI #cybersecurity #AI #IoT #technology #tech #surveillance #spying #mondaythoughts #MondayVibes

by @hijodelcuervo

mintpressnews.com/israel-dystopi… #Israeli #AI #cybersecurity #AI #IoT #technology #tech #surveillance #spying #mondaythoughts #MondayVibes

#Israel is believed to be behind several recent acts of sabotage against #Iranian civilian and #military #infrastructure, including a #hospital, that have taken the lives of at least 19 people.

by @hijodelcuervo

mintpressnews.com/israel-involve… #Israeli #mondaythoughts #MondayVibes #Iran

by @hijodelcuervo

mintpressnews.com/israel-involve… #Israeli #mondaythoughts #MondayVibes #Iran

The FIDF’s loan was filed under the category of “religious organization” in the SBA’s #PaycheckProtectionProgram (#PPP) loan data, despite the #NPO being listed as a Y12 organization

by @hijodelcuervo

mintpressnews.com/friends-of-isr… #Israeli #Israel #IDF #mondaythoughts #MondayBlues

by @hijodelcuervo

mintpressnews.com/friends-of-isr… #Israeli #Israel #IDF #mondaythoughts #MondayBlues

THREAD: A small syringe company, Retractable Technology Inc., left lawmakers and industry insiders wondering: how can you be a small biz in need of PPP AND a manufacturer able to land a major contract?

In late March, the Dept. of Health and Human Services began drafting a $83.8 MILLION order of roughly 330 million syringes and needles from RTI for a future COVID vaccine campaign.

On April 17th, RTI secured a $1.4 million loan under the #PaycheckProtectionProgram meant for struggling small businesses.

On May 1, the nearly $84 million government contract came through.

On May 1, the nearly $84 million government contract came through.

As we continue to battle #COVID19, we know the #PaycheckProtectionProgram is saving jobs and keeping businesses open in Oklahoma. Rural electric cooperatives deliver an essential service – providing power and keeping the lights on for families and businesses in rural America.

Despite interruptions #COVID19 is placing on their operations, they have continued to provide these services and they deserve access to this job-saving program. That’s why I was glad to hear that the Trump admin has clarified that rural electric co-ops are eligible for the PPP.

It is clear that this administration continues to prioritize the needs of rural communities, and I look forward to working with them to support all communities across Oklahoma.

Nancy Pelosi this morning: "Mitch McConnell likes to say that we delayed the bill. No, he delayed the bill...So he was the one wasting time."

Pelosi two days ago admitted that she was the hold up for more funding for the #PaycheckProtectionProgram.

Pelosi can't rewrite history.

Pelosi two days ago admitted that she was the hold up for more funding for the #PaycheckProtectionProgram.

Pelosi can't rewrite history.

Video: Asked "what has been the hold up" on refunding the #PaycheckProtectionProgram, Nancy Pelosi admits it was her.

Video of Pelosi this morning.

THREAD:

11 days ago, Democrats denied additional funding for the #PaycheckProtectionProgram.

And 4 days ago, it ran out of funding.

Every job lost until this crisis has passed is because of job-killing Democrats.

11 days ago, Democrats denied additional funding for the #PaycheckProtectionProgram.

And 4 days ago, it ran out of funding.

Every job lost until this crisis has passed is because of job-killing Democrats.

In Nancy Pelosi's backyard, in San Francisco, CA, the owner of a small graphic design firm “is doing what she can to keep her employees paid but just found out the $349 billion stimulus fund called the #PaycheckProtectionProgram is already out of money.”

nbcbayarea.com/news/local/san…

nbcbayarea.com/news/local/san…

In Columbus, OH, a hair salon “applied for the #PaycheckProtectionProgram to keep their workers on payroll and pay other bills. The problem is, the $350 billion dollar program has run out of money.”

That's because of Democrats in Congress. myfox28columbus.com/news/local/pay…

That's because of Democrats in Congress. myfox28columbus.com/news/local/pay…

🚨THREAD: Nancy & Chuck are using small businesses as leverage to promote their far left agenda.

Joe Biden is standing with them - not workers.

Now, small businesses are speaking up and asking Democrats to stop playing politics with their paychecks.

republicanwhip.gov/ppp-obstructio…

Joe Biden is standing with them - not workers.

Now, small businesses are speaking up and asking Democrats to stop playing politics with their paychecks.

republicanwhip.gov/ppp-obstructio…

From a small business in Harvey, Louisiana:

“We don't know what else to do. I'm tired of crying myself to sleep every night...The Democrats need to stop playing games with peoples lives from their million dollar homes…”

“We don't know what else to do. I'm tired of crying myself to sleep every night...The Democrats need to stop playing games with peoples lives from their million dollar homes…”

From a small business in Athens, Georgia:

Without the #PaycheckProtectionProgram “I will cut 4 jobs of people who have worked for me for years. Our staff is like a family and it crushes me to make this decision.”

Without the #PaycheckProtectionProgram “I will cut 4 jobs of people who have worked for me for years. Our staff is like a family and it crushes me to make this decision.”

THREAD ON #PaycheckProtectionProgram :

Yes, Congress needs to get more money in.

But, GET READY for it to be gone in a heartbeat.

The loopholes are so big that accountants and tax specialists are parading down 5th Ave signing their clients up...WHY?

Yes, Congress needs to get more money in.

But, GET READY for it to be gone in a heartbeat.

The loopholes are so big that accountants and tax specialists are parading down 5th Ave signing their clients up...WHY?

ANSWER:

- Not because they need it

- Not because they are at risk of going out of business

They are applying because they are eligible, it’s free money, and their accountants figured it out in a hot minute.

- Not because they need it

- Not because they are at risk of going out of business

They are applying because they are eligible, it’s free money, and their accountants figured it out in a hot minute.

There are advisory firms offering webinars to teach people how #PPP works - almost like you are doing taxes and need the answer to “how to pay the lowest amount of taxes.”

Except this is disaster relief! And it’s not unlimited.

Except this is disaster relief! And it’s not unlimited.

⚠️THREAD: President Trump's #PaycheckProtectionProgram helps small businesses keep employees on the payroll.

But Nancy Pelosi & Chuck Schumer refused to provide additional funding to the program.

The Democrats' partisan games mean Americans won't hear these stories anymore⬇️

But Nancy Pelosi & Chuck Schumer refused to provide additional funding to the program.

The Democrats' partisan games mean Americans won't hear these stories anymore⬇️

The Blue Marlin in South Carolina received a loan through the paycheck protection program, allowing the business to hire back half its staff.

Nancy Pelosi and Chuck Schumer want to use their paychecks as political "leverage."

Nancy Pelosi and Chuck Schumer want to use their paychecks as political "leverage."

Five West and The Loop in Minnesota received loans through the paycheck protection program, allowing the businesses to bring back staff.

Nancy Pelosi and Chuck Schumer want to use their paychecks as "leverage."

Nancy Pelosi and Chuck Schumer want to use their paychecks as "leverage."

SBA partnered with nearly 5,000 community banks and lenders to distribute emergency capital through the #PaycheckProtectionProgram. If you have applied for a PPP loan, be sure to work with your lender to ensure your funds are quickly disbursed.

In 14 days, @SBAgov guaranteed emergency loans provided by the #CARESact. So borrowers know—when a lender submits a loan application to SBA, they receive a loan guarantee number for your loan.

Once the loan guarantee number is generated, lenders should continue working diligently to close these loans as quickly as possible and ensure America's small businesses receive #PaycheckProtectionProgram funds to make payroll and support their employees.

Some Thoughts on the #PPPloans and other small business stimulus now that the funds have dried up (hopefully temporarily). Some overriding thoughts I have are 1. The method and some of the issues of getting funds out, 2. The purpose of the funds, and 3. Where we go from here. 1/x

On the methodology of the #PaycheckProtectionProgram I know given the data out there that loans seemed skewed towards larger "small" businesses. I think that stems from a number of reasons. The first being just how banks work. 2/x

Banks are generally fairly conservative, risk adverse institutions- particularly post the banking collapse in 2008/2009. Having worked in that industry during that time period, I got to see the impact of this collapse and how banks changed as a result. 3/x

Nancy Pelosi claims she doesn’t have enough "data" to "support” the #PaycheckProtectionProgram as the program runs out of money.

Well Nancy Antoinette, here are some data points:

Well Nancy Antoinette, here are some data points:

Lubbock, Texas.

Harrisburg, Pennsylvania.

The #PaycheckProtectionProgram is on track to exhaust its $350B funding from Congress this morning.

I'll be breaking down what that means on @Morning_Joe COMING UP

I'll be breaking down what that means on @Morning_Joe COMING UP

THREAD: #ICYMI, here’s our discussion from this morning on what happens next for businesses that need financial assistance from the government.

.@realDonaldTrump has fought for the American worker since Day 1.

The #PaycheckProtectionProgram is saving millions of jobs & local businesses, but funding is close to running out.

Tell Pelosi, Schumer & Dems in Congress to stop blocking more aid from passing!

⬇️ THREAD ⬇️

The #PaycheckProtectionProgram is saving millions of jobs & local businesses, but funding is close to running out.

Tell Pelosi, Schumer & Dems in Congress to stop blocking more aid from passing!

⬇️ THREAD ⬇️

@realDonaldTrump In Wilmington, NC, the #PaycheckProtectionProgram allowed a local coffee shop to save all their employees’ jobs.

In Amarillo, TX, the #PaycheckProtectionProgram is “really, really helping our friends & neighbors," and already saving 15,000 jobs in the Amarillo metro area alone.

Every day, every hour, every minute, heroic frontline healthcare workers—and the legion of support staff that enable them—are risking their health&lives while responding to the deadly #COVID19 pandemic. Congress *must* prioritize delivering support to these brave heroes ASAP. 1/5

Senate Democrats, Senate Republicans AND the Trump administration all support adding an additional $250 billion to the @SBAgov’s #PaycheckProtectionProgram. There is *no* debate over helping small businesses… 2/5

…but funding must go to community lenders that will get dollars to the #SmallBusinesses that need it most but have been left behind by the big banks. We want to work across the aisle, but Republicans continue to block efforts to help those on the front lines of this crisis. 3/5

🚨SBA just released its new "affiliate rule" for the #CARESAct #PaycheckProtectionProgram & only made one change:

Faith-based organizations are exempt.

That's it.

Zero relief for Main Street & VC-backed firms.

Here's the full Interim Final Rule:

1/

home.treasury.gov/system/files/1…

Faith-based organizations are exempt.

That's it.

Zero relief for Main Street & VC-backed firms.

Here's the full Interim Final Rule:

1/

home.treasury.gov/system/files/1…

SBA also released this two-page press release, which has no force of law and is easy to misinterpret. All it does is restate existing rules & statute.

Next up: a quick restatement of the restatement for non-lawyers...

2/

home.treasury.gov/system/files/1…

Next up: a quick restatement of the restatement for non-lawyers...

2/

home.treasury.gov/system/files/1…

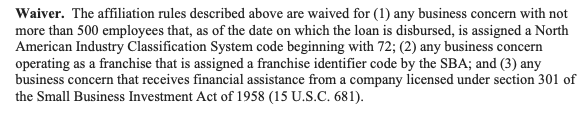

(a) If you are a restaurant or hotel, a franchisee, or an SBIC-backed company, *no affiliation rules apply to you,* because Congress said so.

It doesn't matter if your parent company has a zillion employees; as long as your entity has <500 employees, you can get a #PPPloan.

3/

It doesn't matter if your parent company has a zillion employees; as long as your entity has <500 employees, you can get a #PPPloan.

3/

.@realDonaldTrump's #PaycheckProtectionProgram (PPP) is a lifeline for small businesses during this time of uncertainty.

It is a ~$350 billion program to provide eight weeks of cash-flow assistance to small businesses that maintain their payroll.

It is a ~$350 billion program to provide eight weeks of cash-flow assistance to small businesses that maintain their payroll.

@realDonaldTrump The #PaycheckProtectionProgram is a forgivable loan.

If the employer maintains its payroll, then the portion of the PPP loan used would be forgiven.

These grants are retroactive to Feb. 15, 2020—which will help bring workers who have already been laid off back onto payrolls.

If the employer maintains its payroll, then the portion of the PPP loan used would be forgiven.

These grants are retroactive to Feb. 15, 2020—which will help bring workers who have already been laid off back onto payrolls.

@realDonaldTrump The more than 30 MILLION small businesses in America are the backbone of our nation—and this pandemic has hit them hard.

That's why @realDonaldTrump's #PaycheckProtectionProgram is the lifeline these businesses—and the Americans they employ—need in these unpredictable times.

That's why @realDonaldTrump's #PaycheckProtectionProgram is the lifeline these businesses—and the Americans they employ—need in these unpredictable times.

Quick message to our great small businesses

Please use the #PaycheckProtectionProgram that starts today. It is here for you. Go to sba.gov/coronavirus

We will get through this together. It is the great innovative spirit of people like you that make our country great 🇺🇸

Please use the #PaycheckProtectionProgram that starts today. It is here for you. Go to sba.gov/coronavirus

We will get through this together. It is the great innovative spirit of people like you that make our country great 🇺🇸

Restaurants, salons, dry cleaners, independent contractors, charities, any small business with less than 500 employees can participate in the #PaycheckProtectionPlan

Here is the application, it's just 2 pages to fill out!

sba.gov/sites/default/…

Here is the application, it's just 2 pages to fill out!

sba.gov/sites/default/…

1/🤷♂️

#Breaking: Treasury has released Interim Regulations for the #PaycheckProtectionProgram

I'm about to review and break them down, but before doing so, I just want to quickly mention how incredible it is that @USTreasury got these out before tomorrow "Opening Day".

So👏

#Breaking: Treasury has released Interim Regulations for the #PaycheckProtectionProgram

I'm about to review and break them down, but before doing so, I just want to quickly mention how incredible it is that @USTreasury got these out before tomorrow "Opening Day".

So👏

2/

Note these Regs provide an IMMEDIATE INTERIM RULE, which means they are effective right away, despite not having undergone a (normally-required) comment period.

As a result, these are Regs which CAN be immediately relied on, but comments ARE requested for a 30-day period...

Note these Regs provide an IMMEDIATE INTERIM RULE, which means they are effective right away, despite not having undergone a (normally-required) comment period.

As a result, these are Regs which CAN be immediately relied on, but comments ARE requested for a 30-day period...

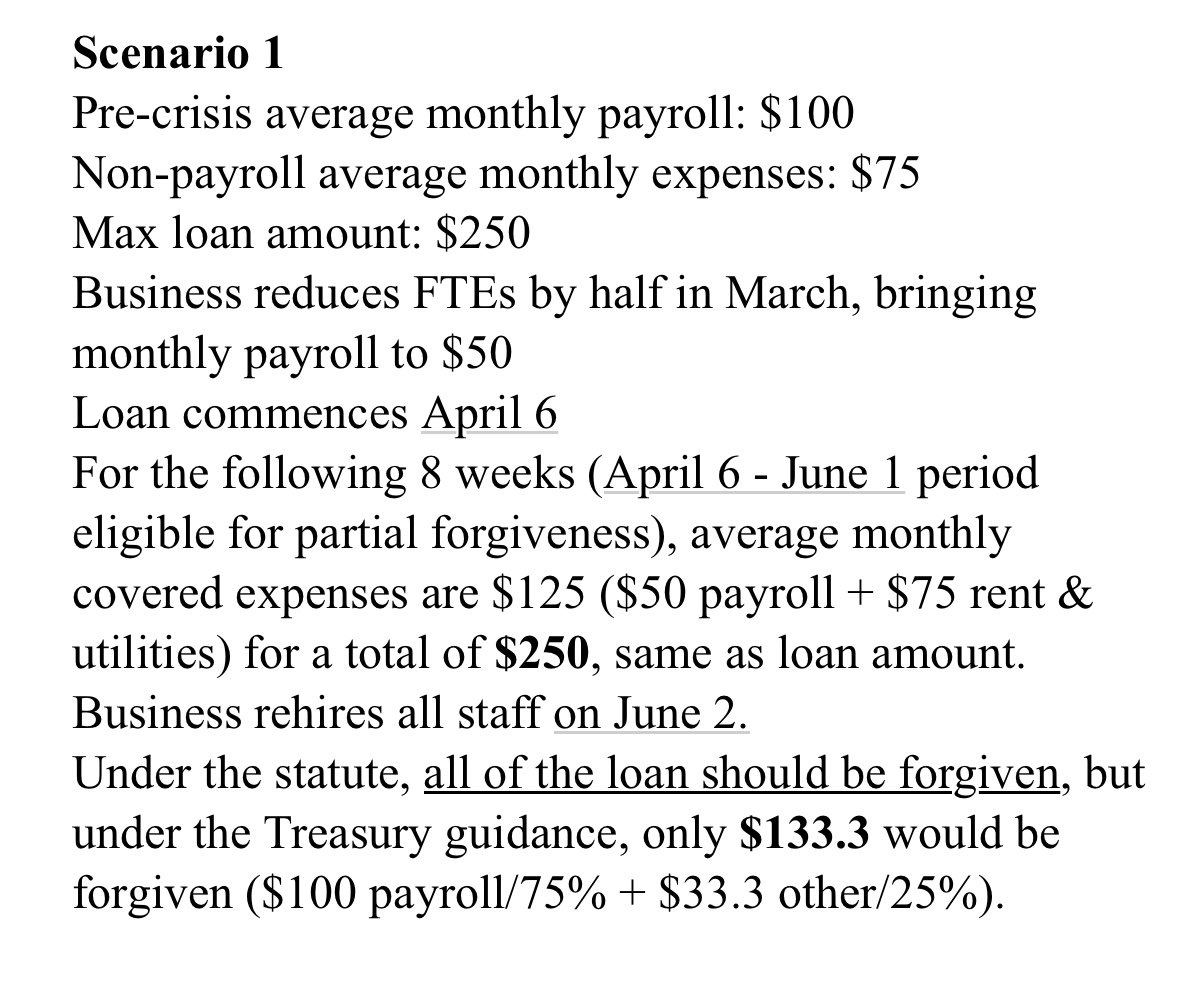

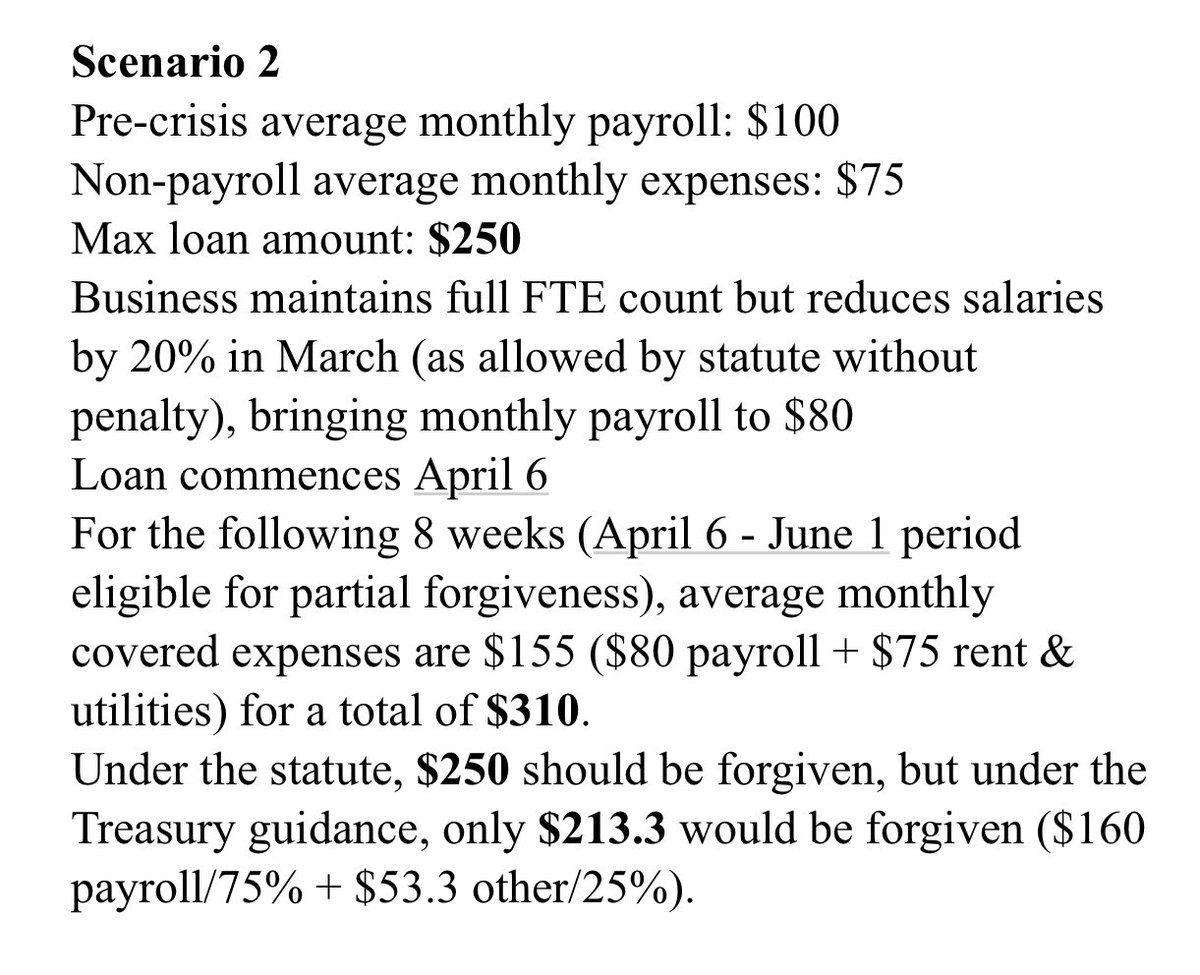

Some have asked why this cap on non-payroll related loan forgiveness is a big deal under the #PaycheckProtectionProgram, so I’m going to do a quick thread explaining how the 25% cap changes the math dramatically for small businesses.

1/

1/

T-minus #1Day until the U.S. Small Business Administration opens the doors to the #PaycheckProtectionProgram.

As #smallbiz prepare their applications, they should make sure to consider:

sba.gov/funding-progra…

As #smallbiz prepare their applications, they should make sure to consider:

sba.gov/funding-progra…

What is my primary #NAICS code?

Is 500 employees the right #sizestandard for my business?

I voted to pass the bipartisan #CARESAct & create the #PaycheckProtectionProgram (PPP) to provide nearly $350 BILLION in forgivable loans to help #SmallBusinesses pay employees during the #COVID19 pandemic. PPP Info & application form are now online: home.treasury.gov/policy-issues/… (1/5)

Illinois #SmallBusiness & sole proprietorships can begin applying for PPP loans from approved lenders THIS FRIDAY (4/3). Independent contractors & the self-employed can begin on 4/10. Get a head start on filling out the online application form here: home.treasury.gov/system/files/1… (2/5)

Any #PaycheckProtectionProgram loans spent over the 8 week period after receiving the loan will be forgiven *if* spent on maintaining your staff & payroll; mortgage interest; and rent & utility payments. Loan $ spent on *other* costs must be paid back in 2 years. (3/5)