Discover and read the best of Twitter Threads about #Results

Most recents (24)

#Finland #ParliamentaryElections2023 and #Scytl the #SmokingGun

- #Officially #LostVotes total: 156,037, (~11 seats)

@UN_HRC

@anticorruption

@vpkivimaki

@Finland_OSCE

@oikeusmin

@CoeGreco

@osce_odihr

- Differences of persons #EntitledToVote: 267,956.

- #Officially #LostVotes total: 156,037, (~11 seats)

@UN_HRC

@anticorruption

@vpkivimaki

@Finland_OSCE

@oikeusmin

@CoeGreco

@osce_odihr

- Differences of persons #EntitledToVote: 267,956.

@UN_HRC @anticorruption @vpkivimaki @Finland_OSCE @oikeusmin @CoeGreco @osce_odihr #Investigation #request to the #Finnish police #SUPO.

@vpkivimaki @Suojelupoliisi:

#Finland #ParliamentaryElections2023.

- #Officially #LostVotes total: 156,037.

- "Gross #falsification of the number of #eligiblevoters'.

Data:

1. Link

2. Link

3. Link

@vpkivimaki @Suojelupoliisi:

#Finland #ParliamentaryElections2023.

- #Officially #LostVotes total: 156,037.

- "Gross #falsification of the number of #eligiblevoters'.

Data:

1. Link

2. Link

3. Link

@UN_HRC @anticorruption @vpkivimaki @Finland_OSCE @oikeusmin @CoeGreco @osce_odihr @Suojelupoliisi #NATO-#CIA-#Finland

List of #RegisteredParties (16) | 26.4.2023

- #Officially #LostVotes in #ParliamentaryElections2023 total: 156,037.

Minor parties:

vaalit.fi/en/list-of-reg…

List of #RegisteredParties (16) | 26.4.2023

- #Officially #LostVotes in #ParliamentaryElections2023 total: 156,037.

Minor parties:

vaalit.fi/en/list-of-reg…

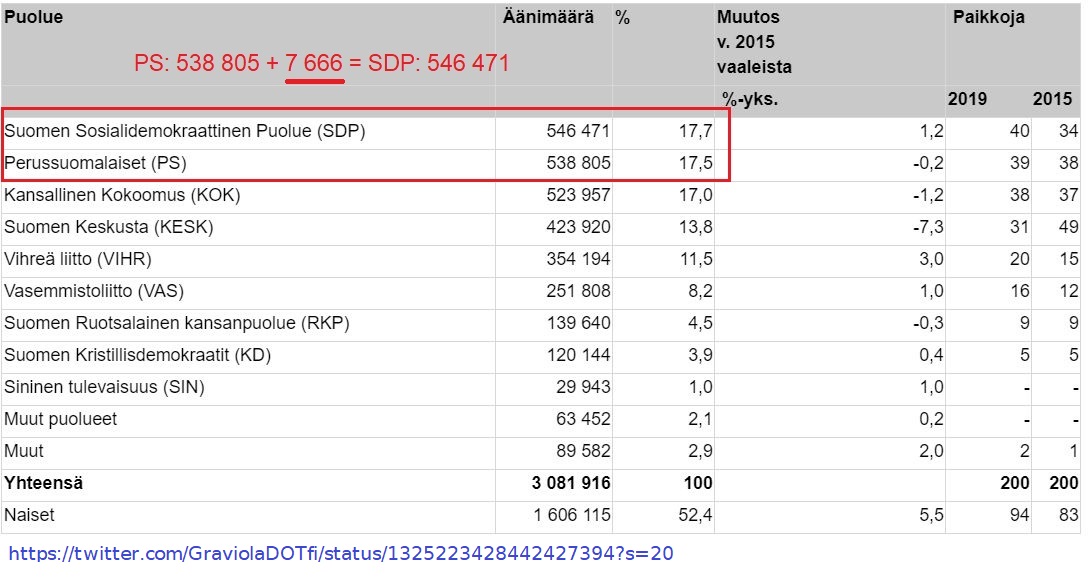

@SarasvuoJari @MarinSanna #Demarit-#Maanpetos-#GreatReset.

@MarinSanna @AnttiRinnepj

Yli 30 miljardin vahingot suomalaisille aiheuttanut #WEF-#Marxist-#YGLs -#NATO -vallankumous -agentti, olisi pitänyt vangita väärennetyn #Eduskuntavaalt +7666 ääntä #InsAllah -tuloksen selvittyä.

@MarinSanna @AnttiRinnepj

Yli 30 miljardin vahingot suomalaisille aiheuttanut #WEF-#Marxist-#YGLs -#NATO -vallankumous -agentti, olisi pitänyt vangita väärennetyn #Eduskuntavaalt +7666 ääntä #InsAllah -tuloksen selvittyä.

@SarasvuoJari @MarinSanna @AnttiRinnepj THREAD 10 - #Äänestäminen.

Saved at Wayback Machine

FROM: @ JariTervo1 Venäjän naapurivaltiossa on erityisen tärkeää äänestää aina | Apr 2, 2023

TO: Video. #Masonic #WomensDay 2021 in #Finland | 8.3.2021

Saved at Wayback Machine

FROM: @ JariTervo1 Venäjän naapurivaltiossa on erityisen tärkeää äänestää aina | Apr 2, 2023

TO: Video. #Masonic #WomensDay 2021 in #Finland | 8.3.2021

@SarasvuoJari @MarinSanna @AnttiRinnepj #Investigation request to the #Finnish police #SUPO.

@SuomenPoliisi @vpkivimaki @Suojelupoliisi

#Finland #ParliamentaryElections2023. - Gross #falsification of the number of #eligible #voters:

@SuomenPoliisi @vpkivimaki @Suojelupoliisi

#Finland #ParliamentaryElections2023. - Gross #falsification of the number of #eligible #voters:

1. A/B testing can significantly improve your copywriting results. By testing different variations of your copy, you can determine what works best for your audience and optimize your content accordingly. #copywriting #ABtesting

2. A/B testing allows you to make data-driven decisions about your copy. Instead of relying on guesswork, you can use actual user data to determine which copy resonates with your audience and drives more conversions. #data #copywriting

@HennaVirkkunen @Kokoomusmepit cc: @ EvaKBartlett

Another tragic day for the people of the #Donbass. More #Ukrainian #warcrimes, #slaughtering 9 #civilians in Donetsk yesterday, including 1 #child, and #injuring at least 16 more when Ukraine rained munitions down on #residential areas,

Another tragic day for the people of the #Donbass. More #Ukrainian #warcrimes, #slaughtering 9 #civilians in Donetsk yesterday, including 1 #child, and #injuring at least 16 more when Ukraine rained munitions down on #residential areas,

@HennaVirkkunen @Kokoomusmepit cc: @ WoodyW00dlegger

"-Ostin älykkyyttä lisääviä pillereitä, haluatko kokeilla?"

"-No mikä ettei", kaveri otti ja nielaisi.

"-Ei kyllä tunnu yhtään älykkäämmältä"

"-Jos ei heti tehoa, ota lisää". Kaveri napsi toisen ja kolmannen.

"-Ostin älykkyyttä lisääviä pillereitä, haluatko kokeilla?"

"-No mikä ettei", kaveri otti ja nielaisi.

"-Ei kyllä tunnu yhtään älykkäämmältä"

"-Jos ei heti tehoa, ota lisää". Kaveri napsi toisen ja kolmannen.

@HennaVirkkunen @Kokoomusmepit The fate of #NATO membership | 8 Mar, 2023

- The #Hungarian delegation that visited #Finland on Wed hopes that Finland will show more #respect for Hungary. @TyttiTup @EeroHeinaluoma @TuomiojaErkki @HennaVirkkunen @jyrkikatainen

- The #Hungarian delegation that visited #Finland on Wed hopes that Finland will show more #respect for Hungary. @TyttiTup @EeroHeinaluoma @TuomiojaErkki @HennaVirkkunen @jyrkikatainen

@JariTervo1 #Finland's #PresidentialElections 2018.

- #Niinistö with '#NorthKorea's' numbers, 62,7%, to victory. The matter seems clear, except the #result was #fake and known to the elite in advance.

The Myth of '#Esli' = 627, #GoldmanSachs #LuckyNumber.

- #Niinistö with '#NorthKorea's' numbers, 62,7%, to victory. The matter seems clear, except the #result was #fake and known to the elite in advance.

The Myth of '#Esli' = 627, #GoldmanSachs #LuckyNumber.

@JariTervo1 #Finland's sc. '#PresidentialElections2018 and the #GoldmanSachs #HolyGrail

- QAnon published the correct final presidential election results in Finland, 22 days BEFORE the '#elections'.

#GoldmanSachs #LuckyNumber: 627 #ESLI

Some Samples: #ColdwellBanker

- QAnon published the correct final presidential election results in Finland, 22 days BEFORE the '#elections'.

#GoldmanSachs #LuckyNumber: 627 #ESLI

Some Samples: #ColdwellBanker

@JariTervo1 #ParliamentaryElections2019 were held in #Finland on 14 April 2019.

- QAnon released the exact correct results: on March 23, 2019, three (3) weeks before this #criminal TV farce.

- QAnon released the exact correct results: on March 23, 2019, three (3) weeks before this #criminal TV farce.

@niinisto Nothing is more insulting for a 'jew' than the #Truth.

cc: @ BlokkiMedia

Piti tehdä lyhyt analyysi #BenZyskowicz kohdistuneesta "hyökkäyksestä".

#antisemitic #vaalit #demokratia #vaalirauha

cc: @ BlokkiMedia

Piti tehdä lyhyt analyysi #BenZyskowicz kohdistuneesta "hyökkäyksestä".

#antisemitic #vaalit #demokratia #vaalirauha

@niinisto #Vaalit2023 #kokoomus-#Nato-#Warcriminals #VoteTheOutOfTheOffice

#ESLI=627 (62.7%) #GoldmanSachs #LuckyNumber

#Finland's sc. Pres #Elections 2018 and the #GoldmanSachs #HolyGrail

- #QAnon published the correct #results 22 days #before the elections.

#ESLI=627 (62.7%) #GoldmanSachs #LuckyNumber

#Finland's sc. Pres #Elections 2018 and the #GoldmanSachs #HolyGrail

- #QAnon published the correct #results 22 days #before the elections.

@vpkivimaki @kokoomus @PiaKauma @oikeuskansleri

#GoldmanSachs on tuottanut sovitut vaalitulokset #Scytl laskennalla, alkaen 10/2007, jolloin #ETYJ sai porttikiellon Suomessa vaalien tuloslaskentaan, koska liikesalaisuus.

Eduskuntavaalien tulokset etukäteen tiedossa

web.archive.org/web/2019041605…

#GoldmanSachs on tuottanut sovitut vaalitulokset #Scytl laskennalla, alkaen 10/2007, jolloin #ETYJ sai porttikiellon Suomessa vaalien tuloslaskentaan, koska liikesalaisuus.

Eduskuntavaalien tulokset etukäteen tiedossa

web.archive.org/web/2019041605…

@vpkivimaki @kokoomus @PiaKauma @oikeuskansleri #Vaalit #DEMOKRATIAA? | 25.1.2008

Electronic Frontier Finland ry:n (#Effi) kertoo, että #OM: n vaalijohtaja #Jääskeläinen kieltäytyi antamasta järjestölle tietoja, miten lokakuun kunnallisvaaleissa koekäytettävä sähköinen äänestysjärjestelmä on toteutettu

is.fi/digitoday/tiet…

Electronic Frontier Finland ry:n (#Effi) kertoo, että #OM: n vaalijohtaja #Jääskeläinen kieltäytyi antamasta järjestölle tietoja, miten lokakuun kunnallisvaaleissa koekäytettävä sähköinen äänestysjärjestelmä on toteutettu

is.fi/digitoday/tiet…

@vpkivimaki @kokoomus @PiaKauma @oikeuskansleri Critical U.S. #ElectionSystems Have Been Left Exposed #Online Despite Official Denials | Aug 8, 2019

An ES&S documents clearly shows the #modem #transmission of #votes from the company's #DS200 optical scan voting machines going over the #internet.

vice.com/en/article/3kx…

An ES&S documents clearly shows the #modem #transmission of #votes from the company's #DS200 optical scan voting machines going over the #internet.

vice.com/en/article/3kx…

WHAT I LEARNED

1. Time/schedule management

2. Consistency

3. Recovery

4. Body weight exercise > weight lifting

RESULTS

5. Vascularity

6. Density

7. Diet

1. Time/schedule management

2. Consistency

3. Recovery

4. Body weight exercise > weight lifting

RESULTS

5. Vascularity

6. Density

7. Diet

WHAT I LEARNED

1. Time Management

The most crucial part to completing the push-ups was allocating enough time.

The total amount of time 1000 push-ups took me each day was around 90-120 minutes.

Now, busting out 1000 in a row would’ve been ideal but it’s also unrealistic..

1. Time Management

The most crucial part to completing the push-ups was allocating enough time.

The total amount of time 1000 push-ups took me each day was around 90-120 minutes.

Now, busting out 1000 in a row would’ve been ideal but it’s also unrealistic..

#Best_AgroLife

Equity: 24Cr💚

FV: 10💚

Debts: 265Cr

CashnEquiv % toTotalAssets:

4%

Current Ratio: 1.4

Expected:

PAT Margins: 9%

ROCE: 61%💚

Np2Eq: 10💚

Expected EPS Fy23: 68💚

1 Yr Forward PE: 16💚

CMP: 1105

#Highly_Undervalued

Equity: 24Cr💚

FV: 10💚

Debts: 265Cr

CashnEquiv % toTotalAssets:

4%

Current Ratio: 1.4

Expected:

PAT Margins: 9%

ROCE: 61%💚

Np2Eq: 10💚

Expected EPS Fy23: 68💚

1 Yr Forward PE: 16💚

CMP: 1105

#Highly_Undervalued

Incorporated in 1992, #BestAgrolife has been servicing agrochemical industry of India n international mkts, wth niche product offerings

Research-driven Co offer high-quality, innovative, effective crop-protection n food safety solutions to farmer n serve d globe thru agriculture

Research-driven Co offer high-quality, innovative, effective crop-protection n food safety solutions to farmer n serve d globe thru agriculture

Investor #ashishkacholia picks stake in #BestAgroLife n Stock hits 20 percent upper circuit yesterday.

#BulkDeals

#BestAgrolife

#BulkDeals

#BestAgrolife

🚨 Less than usual proportion of cos are beating earnings estimates. 👇

#earnings #stocks #STR #estimates

$SPY $QQQ $WMT $TSLA $GME

#earnings #stocks #STR #estimates

$SPY $QQQ $WMT $TSLA $GME

International Conveyors Ltd Q4 FY22 Earnings Concall Insights

#INTLCONV #INTLCONVQ4 #InternationalConveyors #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#INTLCONV #INTLCONVQ4 #InternationalConveyors #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

Q&A Insights: Nitin Gandhi of @KifsTrade asked about reason for volatility in EBITDA margin. Udit S Director said it's because of demand supply imbalance due to COVID for last couple of qtrs. The volatility is expected to continue for a while, though a bit of moderation is seen.

Q&A Insights: Nitin Gandhi of @KifsTrade also asked about nature of huge loans extended in 2022. Udit Sethia Director said that these are loans given by INTLCONV under the respective approvals and are given under market ICD rate, which will give market rate return to the company.

Zee Entertainment Enterprises Limited Q4 FY22 Earnings Concall Insights

#ZEEL #ZEELQ4 #ZeeEntertainment #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#ZEEL #ZEELQ4 #ZeeEntertainment #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

Q&A Insights: Vivek Subbaraman of Ambit Capital asked if company's current balance sheet allows it to bid for IPL at all. Punit Goenka MD replied that it does and ZEEL can participate on its own. ZEEL has zero debt and has qualification to participate in the tender.

Q&A Insights: Vivek Subbaraman of Ambit Capital also enquired if ZEEL is contemplating taking on debt to bid for IPL rights. Punit Goenka MD said it's currently studying all options. There is no need to pay a large sum upfront. Only when the rights start, it will have to pay.

Clean Science and Technology Limited Q4 FY22 Earnings Concall Insights

#CLEAN #CLEANQ4 #CleanScienceandTechnology #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#CLEAN #CLEANQ4 #CleanScienceandTechnology #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

Q&A Insights: Harsh Shah of @lntmutualfund asked about full year revenue growth breakdown in terms of volume and value. Pratik Bora CFO said most of the growth came from volume. For BHA, the most margin-accretive product in portfolio, witnessed around 50% volume growth.

Q&A Insights: Harsh Shah of @lntmutualfund enquired about overall client additions. Siddharth Sikchi ED said it first added 2 new products; para benzoquinone and TBHQ. In products like BHA, added some new customers in LatAm.

Aether Industries Ltd Q4 FY22 Earnings Concall Insights

#AETHER #AETHERQ4 #AetherIndustries #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#AETHER #AETHERQ4 #AetherIndustries #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

Q&A Insights: Gagan Thareja of @ASK_WM asked if growth would get constrained due to lack of capacity for first 3 qtrs of FY23. Rohan D Director said it is currently at 80% utilization and is constantly debottlenecking plants to increase capacity. Expects to reach 90-92% in FY23.

Q&A Insights: Gagan Thareja of @ASK_WM enquired about breakdown of sales growth into volume growth and price of sales mix for FY22. Rohan Desai Director replied that price increased by only 1.5-2% on an avg. overall, therefore whole growth in FY22 was due to volume.

Titagarh Wagons Limited Q4 FY22 Earnings Concall Insights

#TWL #TWLQ4 #TitagarhWagons #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#TWL #TWLQ4 #TitagarhWagons #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

TWL said the company backed the highest ever wagon order placed in the history of Indian Railways for a basic value of about INR7800 crore and a total value of INR9000 crore plus, taking the order backlog to INR10,00 crore for the Indian operation.

Q&A Insights: Abhijeet Dey of Equentis enquired about the avg. blended margins over 3 years for the Indian Railways order. Umesh Chowdhary MD said that avg. blended margin at EBITDA level in TWL’s business is 8-10%. And with the Indian Railways order, it expects the same guidance

Arvind Fashions Ltd Q4 FY22 Earnings Concall Insights

#ARVINDFASN #ARVINDFASNQ4 #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

#ARVINDFASN #ARVINDFASNQ4 #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #markets

🧵

Despite two COVID waves, AFL grew revenues 32%, and reduced net debt by more than INR525 crores in the year. Expects retail and online channels to continue to drive growth and account for 60% to 65% of overall sales.

Q&A Insights: Nishit Rathi of CWC asked if US Polo, Tommy, Arrow, and Flying Machine, those will reach double-digit. Shailesh Chaturvedi MD said AFL’s guidance is that it should hit total portfolio double-digit pre-IndAS EBITDA in 12 to 18 months.

महाराष्ट्र राज्य माध्यमिक व उच्च माध्यमिक शिक्षण मंडळातर्फे मार्च-एप्रिल २०२२ मध्ये आयोजित करण्यात आलेल्या माध्यमिक शाळांत प्रमाणपत्र (इ.१० वी) परीक्षेचा निकाल मंडळाच्या कार्यपद्धतीनुसार उद्या दि. १७ जून,२०२२ रोजी दु. १:०० वा.ऑनलाईन जाहीर होईल.

#SSC #results

@CMOMaharashtra

#SSC #results

@CMOMaharashtra

पुणे, नागपूर, औरंगाबाद, मुंबई, कोल्हापूर, अमरावती, नाशिक, लातूर आणि कोकण या नऊ विभागीय शिक्षण मंडळांमार्फत परीक्षेसाठी नोंदणी केलेल्या विद्यार्थ्यांचे विषयनिहाय संपादित केलेले गुण पुढील अधिकृत संकेतस्थळांवर उद्या दुपारी १ नंतर उपलब्ध होतील.

@msbshse @MahaDGIPR

@msbshse @MahaDGIPR

Page Industries Ltd Q4 FY22 Earnings Concall Insights

#PAGEIND #PAGEINDQ4 #PageIndustries #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#PAGEIND #PAGEINDQ4 #PageIndustries #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

Q&A Insights: Gaurav Jogani with @AXIS_Capital asked if the company took any price increase beyond the price increase announced in Dec. VS Ganesh CEO replied that the company didn’t have any further price increase other than the one it had in Dec.

Q&A Insights: Gaurav J of @AXIS_Capital asked that given the raw material stock PAGEIND has, if further price increase will be needed given the higher cotton prices. VS Ganesh CEO said it is closely monitoring the situation. If there is a need, PAGEIND will be touching the prices

Muthoot Finance Limited Q4 FY22 Earnings Concall Insights

#MUTHOOTFIN #MUTHOOTFINQ4 #MuthootFinance #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#MUTHOOTFIN #MUTHOOTFINQ4 #MuthootFinance #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

MUTHOOTFIN said it expects borrowing costs to go up gradually during FY23. Gold AUM grew by 11% in FY22 and the company expects a growth of 12-15% for FY23.

Q&A Insights: Abhijit Tibrewal of @MotilalOswalLtd asked about weak gold loan demand in core customer segments of 40,000-60,000 ticket size. George Muthoot MD replied that that ticket size has gone up to much higher levels due to economic growth. People now are borrowing more.

Kolte-Patil Developers Ltd Q4 FY22 Earnings Concall Insights

#KOLTEPATIL #KOLTEPATILQ4 #KoltePatilDevelopers #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#KOLTEPATIL #KOLTEPATILQ4 #KoltePatilDevelopers #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

KOLTEPATIL said that further from a new business development perspective, the company is focusing on newer micro markets in Pune.

Q&A Insights: Prithvi R of @unificapital asked what kind of price hikes was taken across projects and geographies. Rahul Talele CEO said wherever it got the opportunity of price rise, it has taken it. KOLTEPATIL has hiked price in range of 5-8% in Pune, Mumbai and Bangalore areas

Torrent Pharmaceuticals Ltd Q4 FY22 Earnings Concall Insights

#TORNTPHARM #TORNTPHARMQ4 #TorrentPharmaceuticals #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#TORNTPHARM #TORNTPHARMQ4 #TorrentPharmaceuticals #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

Q&A Insights: Anubhav A of @CreditSuisse asked about Brazil market, how much the 5 launches the company did in 4Q22 contributed as a percentage of sales. Sanjay Gupta ED said it showed a growth of about 21% and roughly about 13-14% of that is the contribution from new launches.

Q&A Insights: Anubhav A of @CreditSuisse asked how Brazil sales growth is expected in FY23. Sanjay Gupta ED replied that Brazilian GDP growth was about 4-4.5% and next year forecast is less than 1%. So assuming market grows at 8-10%, the company should be well above that.

InterGlobe Aviation Limited Q4 FY22 Earnings Concall Insights

#INDIGO #INDIGOQ4 #InterGlobeAviation #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#INDIGO #INDIGOQ4 #InterGlobeAviation #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

INDIGO said it swung from a profitable 3Q22 to a loss-making 4Q22 because of about 15% higher fuel prices and on 11% lower capacity due to Omicron and a lower RASK of 2.9%.

In 1Q23, INDIGO expects the capacity to rebound at almost 2.5 times the capacity deployed in 1Q22.

Rupa & Company Limited Q4 FY22 Earnings Concall Insights

#RUPA #RUPAQ4 #RupaCompany #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#RUPA #RUPAQ4 #RupaCompany #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

Q&A Insights: Rohit Ohri of @progressiveshar asked about any growth capex plan related to property at Bangladesh. Vikash President said that due to COVID in last 2, 3 years, it was unable to take off, but RUPA is hopeful it will be able to start some business activity in FY22.

Q&A Insights: Rohit Ohri from @progressiveshar also asked about the turnover expectation from the Bangladesh property. Vikash Agarwal President answered that it’s difficult to comment but anywhere between INR50-100 crores is quite achievable. RUPA is looking for some partners.

Steel Authority of India Ltd Q4 FY22 Earnings Concall Insights

#SAIL #SAILQ4 #SteelAuthorityofIndia #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

#SAIL #SAILQ4 #SteelAuthorityofIndia #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch #finance #stockmarket #Markets

🧵

SAIL said it clocked its best ever production and sales during FY22. The sales have been the highest ever at 16.15 million tonnes as compared to 14.94 million tonnes in FY21. For the first time in history of SAIL, the company crossed revenues from operation of INR1 lakh crores.

Q&A Insights: Amit Dixit of @EdelweissFin asked about coking coal cost in 4Q22 in dollar terms and how it’s expected to change in 1Q23. Anil Tulsiani ED said it is likely to go up substantially. In Q4 it was in range of INR28,000-29,000 and it is expected to be up 10-12% in 1Q23.