Discover and read the best of Twitter Threads about #STRADDLE

Most recents (9)

Before starting to trade straddles, I went thru the TL of the master, @ap_pune, to look for gems of his wisdom. Following is a compilation enough to inspire a lot of ideas. Hope it helps fellow traders like it did to me. @Definedge

#pointandfigure #straddle #tradepoint #Opstra

#pointandfigure #straddle #tradepoint #Opstra

Price + Open Interest (OI) + Volume = Deadly Combo

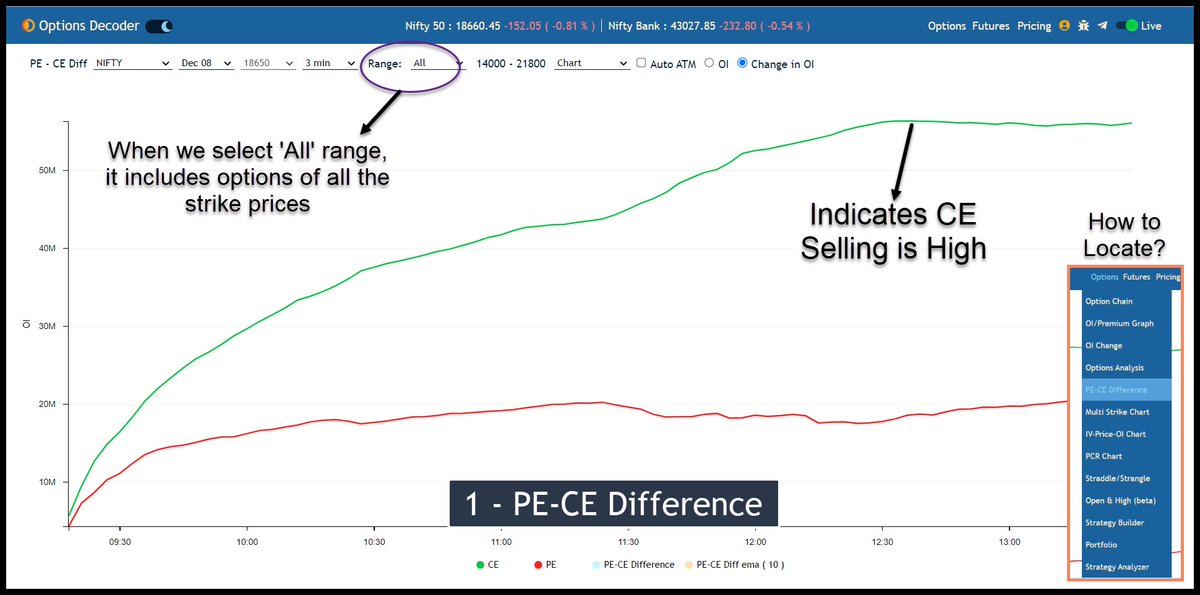

There are many tools for Open Interest. Options Decoder from @TrueData2 is one of the simple yet powerful tools on options and OI.

Below are the 10 Powerful Features of Options Decoder

Thread 🧵🧵

(1/N)

There are many tools for Open Interest. Options Decoder from @TrueData2 is one of the simple yet powerful tools on options and OI.

Below are the 10 Powerful Features of Options Decoder

Thread 🧵🧵

(1/N)

#GM!

1/ #Atlantic Straddles is the latest options product from @dopex_io. Compared to normal options, Atlantic has many advantages. Join us to dive deeper into the bottom of the Atlantic.

#DeFi #Cryptocurrency #Ethereum #Arbitrum #Options #Trading #Dopex $ETH $DPX $rDPX

1/ #Atlantic Straddles is the latest options product from @dopex_io. Compared to normal options, Atlantic has many advantages. Join us to dive deeper into the bottom of the Atlantic.

#DeFi #Cryptocurrency #Ethereum #Arbitrum #Options #Trading #Dopex $ETH $DPX $rDPX

2/ This thread has received generous inputs, thanks to @tztokchad and a superb breakdown video from @The_Babylonians!

@Tetranode

@witherblock

@SalomonCrypto

@RNR_0

@DAOJonesOptions

@PlutusDAO_io

@cobie

@0xsaitama_

@DeFi_Dad

@ethersole

@TheCryptoDog

@TaikiMaeda2

@Tetranode

@witherblock

@SalomonCrypto

@RNR_0

@DAOJonesOptions

@PlutusDAO_io

@cobie

@0xsaitama_

@DeFi_Dad

@ethersole

@TheCryptoDog

@TaikiMaeda2

#Straddle Explained

This #strategy involves two options of same strikes price & same expiry, A long straddle is created by buying a call and a put of same strike & same expiry whereas a short straddle is created by shorting a call & put option of same strike & same expiry

1/n

This #strategy involves two options of same strikes price & same expiry, A long straddle is created by buying a call and a put of same strike & same expiry whereas a short straddle is created by shorting a call & put option of same strike & same expiry

1/n

Let us say a #stock is trading at Rs 6,000 and premiums for ATM call and put options are 257 and 136 respectively.

Long #Straddle

If you buys both a call & a put at these prices, then his maximum loss will be equal to the sum of these two premiums paid, which is equal to 393

2/n

Long #Straddle

If you buys both a call & a put at these prices, then his maximum loss will be equal to the sum of these two premiums paid, which is equal to 393

2/n

And, price movement from here in either direction would first result in that person recovering his premium and then making profit. This position is undertaken when trader’s view on price of the underlying is uncertain but he thinks that in whatever direction the market moves

3/n

3/n

Want to understand what makes #USDINR interesting from an individual #option trader perspective.

Let's try to understand this in this thread. USDINR has both weekly and monthly options contract which are fairly liquid. Today was weekly expiry.

Let's try to understand this in this thread. USDINR has both weekly and monthly options contract which are fairly liquid. Today was weekly expiry.

Weekly options expire every Friday at 12:30 pm and monthly options at 2 days prior to last working day of the month. Margin applicable in USDINR is normally between 2.5% to 3% depending upon volatility.

Margin for one lot of USDINR #straddle (74.50 July 30 expiry - weekly contract) is roughly Rs. 2600/2700 and premium received is around 35p, which on one lot comes to Rs. 350 ($1000*0.35).

A short thread on #Nifty #Straddle

If you like to do a strangle on Nifty, then I recommend that you do #IronCondor and not straddle. At the start of new week, on Friday or Thursday a Nifty Straddle has collective premium of 250 to 300 points. Based on Vix it is coming down. 1/n

If you like to do a strangle on Nifty, then I recommend that you do #IronCondor and not straddle. At the start of new week, on Friday or Thursday a Nifty Straddle has collective premium of 250 to 300 points. Based on Vix it is coming down. 1/n

Buy in same quantity a 500 point away call and put. It will bring your premium collection down from 250-300 points to may be 200-250 points, but your RR will be close to 1:1. 2/n

Now you dont have to put a stoploss as it is already 1:1 hedged. Thats a max risk of 19000 per lot.

Spread your legs to the extent you can bear a loss. Or put a stoploss. But dont go for naked straddle without a worst case scenario.

Spread your legs to the extent you can bear a loss. Or put a stoploss. But dont go for naked straddle without a worst case scenario.

#Straddles vs #Strangles ( Sell only )

These are the most common #Options strategies when one would start with #OptionsTrading.

Let’s understand from a broader perspective what’s the difference between these two.

These are the most common #Options strategies when one would start with #OptionsTrading.

Let’s understand from a broader perspective what’s the difference between these two.

Would not like to discuss the construction difference between them if you don’t know stop trading #options

#Straddles

You get higher premium so pnl would be higher compared to #strangles

But from where are you getting higher premiums is that your selling 0.5 #delta.

#Straddles

You get higher premium so pnl would be higher compared to #strangles

But from where are you getting higher premiums is that your selling 0.5 #delta.

So probability of one going wrong is always 50% so to simply put one side is goin to get stuck in a #straddle but then market tends to #flucuate a lot so there is always the case of #meanreversion if you have selected the #strike rightly.

#Option #Greeks Simplified

#Options are definitely more complicated than equity or futures.

Their prices don’t just go up and down.

They also fluctuate based on things like #time, #implied #volatility and #underlying stock movements.

#Options are definitely more complicated than equity or futures.

Their prices don’t just go up and down.

They also fluctuate based on things like #time, #implied #volatility and #underlying stock movements.

#Options #Greeks Are Simply Mathematical Shortforms

Most of you would remember from school that mathematical formulas sometimes were #Greek letters like Pi and #Delta. The same is true for options.

Don’t let them overwhelm you or scare you.

Most of you would remember from school that mathematical formulas sometimes were #Greek letters like Pi and #Delta. The same is true for options.

Don’t let them overwhelm you or scare you.

They’re simply #mathematical words to explain some very basic principles.

#Greeks Describe the Behavior of #Individual #Options

Each #greek can help predict how it will behave under different circumstances and how options prices would change.

#Greeks Describe the Behavior of #Individual #Options

Each #greek can help predict how it will behave under different circumstances and how options prices would change.