Discover and read the best of Twitter Threads about #USDINR

Most recents (18)

The Rupee is in a free fall against the US Dollar.

However, the RBI is intervening to cushion INR's fall.

Ever wonder how the RBI does it?

Let's learn it here:

#USDINR #USD #forex #India #Rupee

However, the RBI is intervening to cushion INR's fall.

Ever wonder how the RBI does it?

Let's learn it here:

#USDINR #USD #forex #India #Rupee

First, let's understand why RBI intervenes to defend the rupee in the first place.

A weak currency worsens our fiscal deficit, fuels inflation and slows down international trade.

Clearly, RBI has a mandate to improve the situation on behalf of the GoI and the citizens of India.

A weak currency worsens our fiscal deficit, fuels inflation and slows down international trade.

Clearly, RBI has a mandate to improve the situation on behalf of the GoI and the citizens of India.

Forex market is highly volatile and a breeding ground for speculators. This is why the FX market is the most liquid in the world with around $7.5 trillion (with a T!) in daily turnover.

So, RBI has to control speculation in the USDINR segment to ensure stability of the Rupee.

So, RBI has to control speculation in the USDINR segment to ensure stability of the Rupee.

Sachichanand Shukla, Mahindra group's chief economist doesn't rule out the possibility of #USDINR touching 85 due to 3 reasons :-

#Recession #StockMarketCrash

#StockMarket #StockMarketIndia #Stocks

(1/4)

#Recession #StockMarketCrash

#StockMarket #StockMarketIndia #Stocks

(1/4)

First, Dollar will be prone to sudden spikes due to inflation or FED.

(2/4)

(2/4)

Second, Oil prices may rise after US November midterm polls.

(3/4)

(3/4)

RBI is playing with FIRE abt intervention in the FWD USDINR market…. Your sins with come back to haunt you … unlike Equities which can be manipulated for years, you can’t do that same with FX and RATES

@RBI EXTENT Of Forward Intervention is #MindBoggling in one #CHART. You can see INR 2yr & 3yr Implied Forward Premium is 7.8% & 7.59% Respectively

& has Actually Increased while the near term 12 Month INR forward is just 2.5%. This kind of DIVERGENCE is SCARY.#RETWEET #MUSTREAD

& has Actually Increased while the near term 12 Month INR forward is just 2.5%. This kind of DIVERGENCE is SCARY.#RETWEET #MUSTREAD

Look, Honestly what I think about the current market situation #NIFTY & # SENSEX >> thread [1/n] 👇

mostly in history, I saw every time #USDINR price come upside and the market also show correction on big timeframes same time, #usdinr continuously going upside after July but our index was also going upside in June, July, and Aug after 15,183 Low

#NIFTY sustained upside to this trendline for more than two to three weeks, which was a sign of continuing bull run, and targets of 19k and 20k, in fact, all TV anchors were giving long-term and shorterm trades, all big channels, and Twitter handles were started posting 20k chart

Top countries where FII have invested📊

🇺🇸 USA 39%

🇲🇺 Mauritius 11%

🇱🇺 Luxembourg 7%

🇸🇬 Singapore 7%

🇬🇧 UK 5%

🇮🇪 Ireland 5%

🇨🇦 Canada 3%

🇯🇵 Japan 3%

🇳🇴 Norway 2%

🇳🇱 Netherlands 2%

#FII

🇺🇸 USA 39%

🇲🇺 Mauritius 11%

🇱🇺 Luxembourg 7%

🇸🇬 Singapore 7%

🇬🇧 UK 5%

🇮🇪 Ireland 5%

🇨🇦 Canada 3%

🇯🇵 Japan 3%

🇳🇴 Norway 2%

🇳🇱 Netherlands 2%

#FII

The data is taken from CDSL for April 2022 based on Equity Assets under custody of FPI (FPIs include FIIs, Sub Accounts & QFIs)

Indian market is volatile because of FIIs selling.

But Why do FIIs investments impact the stock market?🤔

Indian market is volatile because of FIIs selling.

But Why do FIIs investments impact the stock market?🤔

Because:

• They are the source of capital in markets

• They are Major Investors

• They Aid in economic development

#StockMarket #investors

• They are the source of capital in markets

• They are Major Investors

• They Aid in economic development

#StockMarket #investors

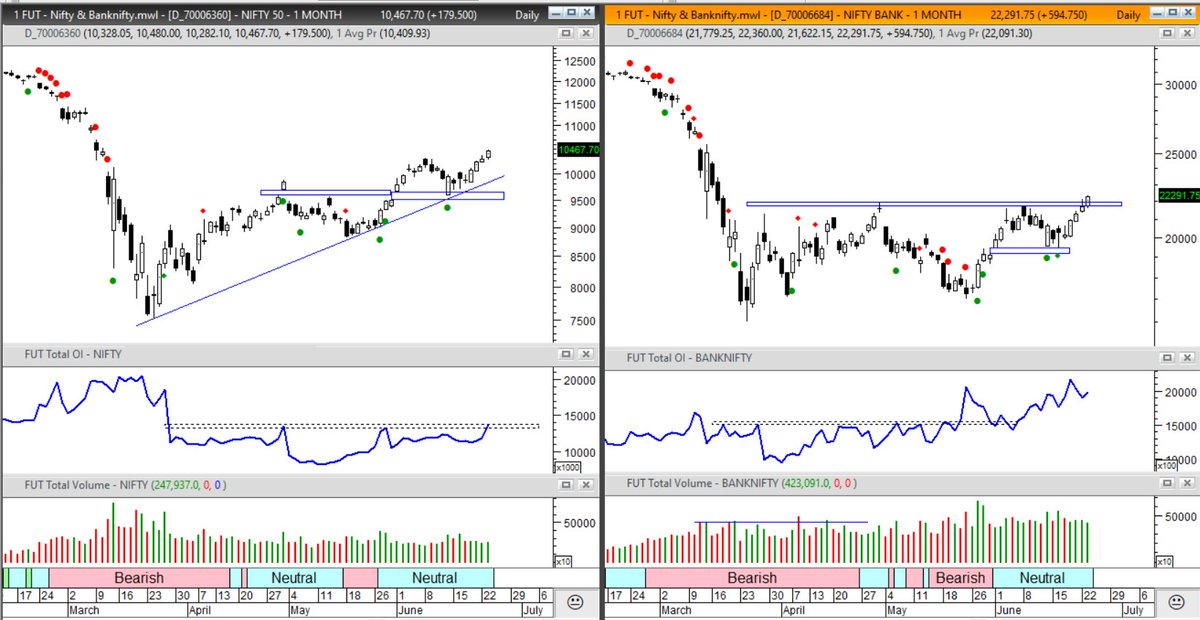

#Nifty #BankNifty are in final phase of the prolonged last 6 months, where they've been busy separating very few men out of so many boys in #Markets 1/n

#FII selling of record numbers didnt break the market much beyond say 10% decline on the #Indices indicating longer term strength still 2/n

Yet in the shorter term #GreatResults from every blue chip met with an immediate trading top. Hmm... good news is not impacting... 3/n

IPO season is going on and a lot of people asked to explain how IPO related flows impact local currency and what's the difference between bringing dollar on outright basis vs on hedged basis. Here's an attempt by us at @kotaksecurities.

There are two parts to any IPO - anchor book, which opens one day prior to IPO (Nov 3) and second is, book building portion (Nov 8-10), when IPO goes live. These dates are for Paytm IPO.

In case of Paytm IPO, it is India's largest IPO at 18.9K crs and so is the anchor book, which is approx 8.5k crs. Since 1/3rd of anchor book to be allocated to MFs, net anchor book for FPIs is 5.7k crs. All these numbers are calculated at higher price of the range - 2150.

Want to understand what makes #USDINR interesting from an individual #option trader perspective.

Let's try to understand this in this thread. USDINR has both weekly and monthly options contract which are fairly liquid. Today was weekly expiry.

Let's try to understand this in this thread. USDINR has both weekly and monthly options contract which are fairly liquid. Today was weekly expiry.

Weekly options expire every Friday at 12:30 pm and monthly options at 2 days prior to last working day of the month. Margin applicable in USDINR is normally between 2.5% to 3% depending upon volatility.

Margin for one lot of USDINR #straddle (74.50 July 30 expiry - weekly contract) is roughly Rs. 2600/2700 and premium received is around 35p, which on one lot comes to Rs. 350 ($1000*0.35).

#USDINR

Thread..

Pros:

1. Multifold Inflows ~= Outflows (of Tr Def & CA def).

2. RBI appetite for reserves reducing

3. Weak DXY

4. Hand of God levels (73-74)

Cons:

1. Crude 73+

2. Inflation > 6% yet MPC stance accommodative

3. GDP growth 🤞 (8-9% over 2020 which is ~ to 2019)

Thread..

Pros:

1. Multifold Inflows ~= Outflows (of Tr Def & CA def).

2. RBI appetite for reserves reducing

3. Weak DXY

4. Hand of God levels (73-74)

Cons:

1. Crude 73+

2. Inflation > 6% yet MPC stance accommodative

3. GDP growth 🤞 (8-9% over 2020 which is ~ to 2019)

4. Tr def, CA def.

5. Fiscal deficit

6. Rising commodity prices headwind for govt spending

Thoughts:

1. Reserves of over $150 Bn added within 24m

2. Avg cost 72-73

3. Appreciation contained, however one off one time Depn is tolerated

4. inflation counter by keeping ₹ stable?

5. Fiscal deficit

6. Rising commodity prices headwind for govt spending

Thoughts:

1. Reserves of over $150 Bn added within 24m

2. Avg cost 72-73

3. Appreciation contained, however one off one time Depn is tolerated

4. inflation counter by keeping ₹ stable?

5. Are we forming base at 73 for the next band at 75-78 from current band of 73-75 levels if,

Crude > 73

DXY > 92 (taper)

Inflation > 6 (with accom)

Growth < 9%

Fisc > 8%

6. Conversely, 73 is difficult to hold if,

FED shrugs taper

Inflation is transitory

Fisc ~ 7-8

Crude > 73

DXY > 92 (taper)

Inflation > 6 (with accom)

Growth < 9%

Fisc > 8%

6. Conversely, 73 is difficult to hold if,

FED shrugs taper

Inflation is transitory

Fisc ~ 7-8

1 new chart everyday, it could be from any space ~ equities / commodities / crypto / forex / bonds , etc

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

#INR Macro check

▪️ #USDINR last 74.35 => ~1.4% off 75.35 highs => RBI's persistent #USD selling above 75.00 => with soft DXY, s/t consolidation in 74.00-75.35?

▪️ Risk Reversals, good gauge of nervousness, off highs (+1.6=>+0.9 vol) => less demand for USD Calls

1/11

▪️ #USDINR last 74.35 => ~1.4% off 75.35 highs => RBI's persistent #USD selling above 75.00 => with soft DXY, s/t consolidation in 74.00-75.35?

▪️ Risk Reversals, good gauge of nervousness, off highs (+1.6=>+0.9 vol) => less demand for USD Calls

1/11

▪️ Various economists revised India's GDP forecast lower

▪️ Good summary by @latha_venkatesh below

▪️ RBI GDP Projection +10.5% yoy FY 21/22 (Apr MPC)

▪️ Chart below: graphical overview of GDP trajectory - not that bad but whether worse yet to come?

2/11

▪️ Good summary by @latha_venkatesh below

▪️ RBI GDP Projection +10.5% yoy FY 21/22 (Apr MPC)

▪️ Chart below: graphical overview of GDP trajectory - not that bad but whether worse yet to come?

2/11

#USDINR #Optionselling

Few lessons from last week Fiasco.

1. IV will go from low levels to higher levels increasing premiums suddenly

2. Market is cyclic in nature; What goes up will come down: What goes down will come up

++

Few lessons from last week Fiasco.

1. IV will go from low levels to higher levels increasing premiums suddenly

2. Market is cyclic in nature; What goes up will come down: What goes down will come up

++

3. Hold on your losses until expiry; if it continues roll-in-time

4. Adjust your position until the short strangle becomes a short straddle & then all you have to do is to wait for the market to do its job.

5. last & Important - DO NOT P A N I C; Emotional control matters

++

4. Adjust your position until the short strangle becomes a short straddle & then all you have to do is to wait for the market to do its job.

5. last & Important - DO NOT P A N I C; Emotional control matters

++

These lessons doesn't seem to be a new one for me r U

But the thing is, these lessons went in air, when there was a huge spike in MTM loss & emotions took control of my mind

Tho such ocurence has redcd signfcantly from past, dis incident showd me wher I need to improve myself.

++

But the thing is, these lessons went in air, when there was a huge spike in MTM loss & emotions took control of my mind

Tho such ocurence has redcd signfcantly from past, dis incident showd me wher I need to improve myself.

++

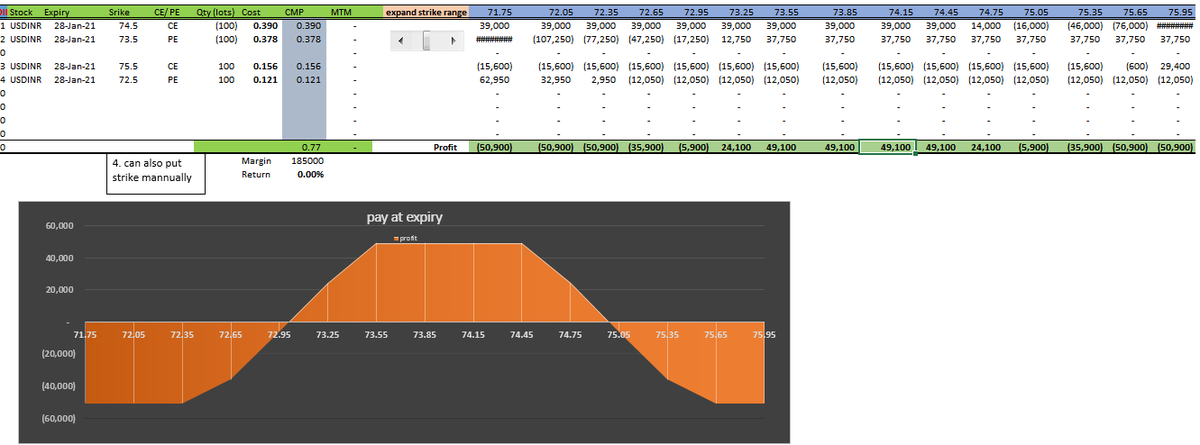

Thread on USDINR Trading:

Part of my capital i trade in USDINR - non-directional.

Past few months it traded in very narrow band - which is paradise for non-direction trading.

check chart.. last 3 months in just 2 Rs. Range

Today will share my December 2020 trade in USDINR

(1/4)

Part of my capital i trade in USDINR - non-directional.

Past few months it traded in very narrow band - which is paradise for non-direction trading.

check chart.. last 3 months in just 2 Rs. Range

Today will share my December 2020 trade in USDINR

(1/4)

Popular advice, don't watch TV

My take,

Obviously if u are algo or systems guy, u should not watch TV or even your fluctuating MTM on screen

For everyone else, TV is the biggest free tool u can use for your trading.

Obviously trading calls/advice is useless but that's just

My take,

Obviously if u are algo or systems guy, u should not watch TV or even your fluctuating MTM on screen

For everyone else, TV is the biggest free tool u can use for your trading.

Obviously trading calls/advice is useless but that's just

1% of TV.

what about rest of it?

How many of us know about LTRO or OMO?

Watch TV everyday esp events like RBI policy and within few months all terms will start making sense to u.

Oh u don't need these terms for ur banknifty straddle. Is it?

Sooner u realize that every thing

what about rest of it?

How many of us know about LTRO or OMO?

Watch TV everyday esp events like RBI policy and within few months all terms will start making sense to u.

Oh u don't need these terms for ur banknifty straddle. Is it?

Sooner u realize that every thing

Is interconnected, better off u will be as a discretionary trader.

Entire giant financial machine is interconnected with butterfly effect

In every dealing room /treasury /fund house there are many TVs visible to all dealers.

Many of the CFOs in corporate world have TV

Entire giant financial machine is interconnected with butterfly effect

In every dealing room /treasury /fund house there are many TVs visible to all dealers.

Many of the CFOs in corporate world have TV

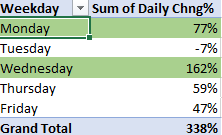

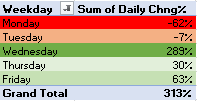

Did some analysis of #Nifty Historical Daily %Change from 1996 till date to get an idea how our market has behaved over the last 25 years or so.

Data source: Investing.com

Observations:

1. Daily changes have been the best on 'Wednesdays' and worst on 'Monday's

..(1/n)

Data source: Investing.com

Observations:

1. Daily changes have been the best on 'Wednesdays' and worst on 'Monday's

..(1/n)

#Fed #FederalReserve #FedData #Fedgov #Dollar #USD #USDINR

While many people talk about cheap money supply and liquidity , the reality is these are both very different concepts

While many people talk about cheap money supply and liquidity , the reality is these are both very different concepts

While the term money simply refers to the supply of money, the term liquidity relates to the interplay between the supply and the demand for money

People demand money primarily in order to facilitate trade. Money offers the holder a greater purchasing power than any other good

People demand money primarily in order to facilitate trade. Money offers the holder a greater purchasing power than any other good

Money enables an individual to secure a greater variety of goods than any other good could do i.e. it has a much greater purchasing power

Therefore, when people seek more money they do not want more money in their pockets but rather more purchasing power

Therefore, when people seek more money they do not want more money in their pockets but rather more purchasing power

Lesson from recent past.

BALAKOT Airstrike did not trouble market much, I am confident that Indo-China border tussle may not too.

Note: 20 day Average True Range for #NIFTY is 260pts (CMP 9914)

Hence, will maintain 9600 as trigger level to change stance. #NIFTY

BALAKOT Airstrike did not trouble market much, I am confident that Indo-China border tussle may not too.

Note: 20 day Average True Range for #NIFTY is 260pts (CMP 9914)

Hence, will maintain 9600 as trigger level to change stance. #NIFTY

Update on #Nifty chart

4th Higher High formation

No weakness in volume to assist divergence

20Day ATR now 250pts (ATR falling means low volatile zone in an Uptrend which is bread butter for Trend Followers)

My view: Bullish as there is no sign of weakness yet.

TREND is UP

4th Higher High formation

No weakness in volume to assist divergence

20Day ATR now 250pts (ATR falling means low volatile zone in an Uptrend which is bread butter for Trend Followers)

My view: Bullish as there is no sign of weakness yet.

TREND is UP

Update on #Nifty and #Banknifty chart.

I cannot see any sign of weakness externally or internally anywhere.

Prices are rising hence TREND is up.

It is as simple right now.

Current view: Bullish

(Nifty is UP +557pts since Indo-China tussle)

I cannot see any sign of weakness externally or internally anywhere.

Prices are rising hence TREND is up.

It is as simple right now.

Current view: Bullish

(Nifty is UP +557pts since Indo-China tussle)

The mother of all QEs is here - @federalreserve has announced:

a. Interest rate cut by 100bps to 0% - 0.25%

b. Emergency lending rate cut by 125 basis points to 0.25%,

c. Increased the emergency lending term of loans to 90 days.

#USD #FEDrate

#QE5

(1/n)

a. Interest rate cut by 100bps to 0% - 0.25%

b. Emergency lending rate cut by 125 basis points to 0.25%,

c. Increased the emergency lending term of loans to 90 days.

#USD #FEDrate

#QE5

(1/n)

d. Buying of $500 BN of Treasurys and $200 BN of agency-backed mortgage securities.

e. Pushed major banks to use the equity + liquid buffers ($1.3 TN + $2.9 TN) for lending and manage credit expansion.

e. Pushed major banks to use the equity + liquid buffers ($1.3 TN + $2.9 TN) for lending and manage credit expansion.

Instantly, eight largest U.S. banks (Bank of America, Bank of New York Mellon, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street, and Wells Fargo) have suspended share buybacks program to support the Fed's idea of credit expansion.

#bankofamerica #CITIBANK

#bankofamerica #CITIBANK