Discover and read the best of Twitter Threads about #StrandedAssets

Most recents (18)

#HSBC contributes to the destruction of ecosystems, communities, Earth's biosphere

#Greenwashing

#Gaslighting

#ProfitBeforePeopleAndPlanet

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#ClimateAndEcologicalCrisis

#SixthMassExtinction

bbc.co.uk/news/science-e…

#Greenwashing

#Gaslighting

#ProfitBeforePeopleAndPlanet

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#ClimateAndEcologicalCrisis

#SixthMassExtinction

bbc.co.uk/news/science-e…

HSBC breaks green pledge with $340m coalmine loan

Bank had said it would ‘seek to withdraw’ from fossil fuels

thetimes.co.uk/article/hsbc-d…

Bank had said it would ‘seek to withdraw’ from fossil fuels

thetimes.co.uk/article/hsbc-d…

Banks still investing heavily in fossil fuels despite net zero pledges – study

Financial institutions signed up to GFANZ initiative accused of acting as ‘climate arsonists’

theguardian.com/environment/20…

Financial institutions signed up to GFANZ initiative accused of acting as ‘climate arsonists’

theguardian.com/environment/20…

With footloose petrodollars, every story is an oil story.

Silicon Valley Tech bubble? Oil

Twitter buyout? Oil

Credit Suisse meltdown? you guessed it, oil.

Our newsletter on how the West is now outsourcing even the energy transition to the Gulf Kingdoms phenomenalworld.org/analysis/stran…

Silicon Valley Tech bubble? Oil

Twitter buyout? Oil

Credit Suisse meltdown? you guessed it, oil.

Our newsletter on how the West is now outsourcing even the energy transition to the Gulf Kingdoms phenomenalworld.org/analysis/stran…

Theres not just unburnable pvt owned Oil - Exxon etc - but National Oil. Companies like Aramco are tied to countries Sov funds,fiscal budgets & jobs. 2 Carbon crash scenarios w different politics:#StrandedAssets & #StrandedCountries

phenomenalworld.org/analysis/stran…

phenomenalworld.org/analysis/stran…

3/ National Oil Companies represent the un-burnable wealth of nations. Western greens must differentiate politics of #StrandedNations & world-order from that of private #StrandedAssets

We wrote about @jimcust @DaveManleyRocks paper

phenomenalworld.org/analysis/stran…

We wrote about @jimcust @DaveManleyRocks paper

phenomenalworld.org/analysis/stran…

Barclays, biggest funder, in Europe, of fossil fuels.

#Walsall

#ClimateAndEcologicalCrisis

#SixthMassExtinction

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#Bankruptcy

#Sharklays

#Barclies

#BetterWithoutBarclays

#BreakUpWithBarclays

#ExtinctionRebellion

#Walsall

#ClimateAndEcologicalCrisis

#SixthMassExtinction

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#Bankruptcy

#Sharklays

#Barclies

#BetterWithoutBarclays

#BreakUpWithBarclays

#ExtinctionRebellion

@threadreaderapp unroll

Barclays, the biggest funder, in Europe, of fossil fuels.

#ClimateAndEcologicalCrisis

#SixthMassExtinction

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#Bankruptcy

#Sharklays

#Barclies

#BetterWithoutBarclays

#BreakUpWithBarclays

#ExtinctionRebellion

#ClimateAndEcologicalCrisis

#SixthMassExtinction

#FossilFuels > #StrandedAssets > #FossilFuelCrash

#PoorInvestments

#Bankruptcy

#Sharklays

#Barclies

#BetterWithoutBarclays

#BreakUpWithBarclays

#ExtinctionRebellion

@mattp_eti @MetPoliceEvents @metpoliceuk You will notice that our laws are extremely biased in favour of corporations and the Billionaire Class and against the best interests of the mass of society.

Maybe read:

Captive State, by @GeorgeMonbiot, When Money Talks, by @DerekCressman,

The Climate Book by @GretaThunberg

Maybe read:

Captive State, by @GeorgeMonbiot, When Money Talks, by @DerekCressman,

The Climate Book by @GretaThunberg

[📊Report] The 60 largest banks are exposed to $1.35tn in fossil fuel assets whose value will drop in the transition to #netzero.

If we treated them as 'higher risk' under #Basel3, the banks' capital increase would take 3-5 months of retained profits without reducing lending

1/9

If we treated them as 'higher risk' under #Basel3, the banks' capital increase would take 3-5 months of retained profits without reducing lending

1/9

Using the annual reports of 60 of the world biggest banks, we have estimated their exposures to fossil fuel assets - indisputably #StrandedAssets. We found levels similar to the 2008 banks exposures to #subprime mortgages. The threat of a #fossilsubprimes crisis is a reality

2/9

2/9

Until bank capital rules reflect it, this risk will increasingly threaten financial stability, leaving taxpayers exposed to shouldering new bailouts. Fossil fuel assets should be treated as “higher risk” and assigned a risk weight of 150% in line with the #BaselFramework.

3/9

3/9

Our new report: 'Unburnable #Carbon - 10 Years On' finds global stock markets 🏦 are financing energy companies which are sitting on 3x more #coal, #oil & #gas reserves than can be burned without breaking the 1.5°C Paris climate target carbontracker.org/reports/uburna… #CarbonBubble

🧵Despite growing urgency to tackle #ClimateChange, 'Unburnable #Carbon' reveals “embedded #emissions” in the #FossilFuel🛢️reserves of companies listed on stock exchanges – the CO2 released if they’re extracted & burned – has grown by nearly 40% since 2012 carbontracker.org/reports/uburna…

@CarolineLucas @EdwardJDavey @Ed_Miliband @MichaelEMann @CFigueres @AnnPettifor @billmckibben @martinwolf_ @AlokSharma_RDG The report warns that 90% of all known #FossilFuel🛢️reserves & resources held by companies must stay in the ground as 'unburnable #carbon' to limit global warming to 1.5°C🌡️🛑carbontracker.org/reports/uburna… #KeepItInTheGround

Australia was just singled out as a climate "holdout" by UN secretary General @antonioguterres . It's rare to see him single a country out like this. What does he mean? 🧵⬇️

👏 Many G20 developed economies have announced meaningful #emissionsreduction targets for 2030.

👎 Not Australia. Scott Morrison still took Tony Abbott's 26-28% emissions target to COP26. This targets is 6 years old.

👎 Not Australia. Scott Morrison still took Tony Abbott's 26-28% emissions target to COP26. This targets is 6 years old.

🥵The COP26 conference was focussed on improved 2030 targets and a rapid phaseout of coal (by 2030). Australia refused, making us a loner among developed countries & a "holdout" on climate.

1/ In one corner of the #COP26 forest, we launched a joint statement committing signatories to end international public #fossilfuelfinance by the Dec 2022 and to prioritise $ for the #cleanenergytransition.

ukcop26.org/statement-on-i…

ukcop26.org/statement-on-i…

2/ This should shift $24bn that has been going into international public support and subsidy for fossil fuels into clean energy. Critically, this will leverage and redirect many $billions more in private finance, delivering clean power to markets around the world...

3/ It's an #inclusive agenda. It’s not just rich nations, but also emerging economies - signalling they want cheap clean power, and to create jobs & investment and avoid #strandedassets. #Gabon #Zambia #Gambia #SouthSudan #Ethiopia #Fiji #MarshallIslands #SriLanka #ElSalvador...

.@JanetYellen at Senate Finance Committee hearing in response to @SenWhitehouse on #climatechange: "I will look to appoint someone at a very senior level to lead our efforts and to create a hub within @USTreasury in which we particularly focus on ... (1/4)

... financial system-related risks and #taxpolicy incentives toward climate change. I think we need to seriously look at assessing the risks to the financial system from climate change. The @federalreserve has recently said that they would be joining the @NGFS_ They are ... (2/4)

... developing methodologies to do that and we'll focus on that. ... climate change is an existential threat, and both the impact of climate change itself and policies to address it could have major impacts creating ... (3/4)

Serviler Kotau der @NdsLandesReg | #EXXON #Shell #NEORT #NorthEuropeanOilRoyaltyTrust #Oil #Gas #oott | No #ClimateAction in #Niedersachsen ndr.de/nachrichten/ni…

The Trust is administered by five Trustees. The purpose of the Trust is to collect, hold and verify #royalties paid into the Trust by the operating companies, German subsidiaries of the #Exxon Mobil Corporation and the Royal Dutch/#Shell Group of Companies neort.com/about.html

Absurd: Die @NdsLandesReg subventioniert mit drastischer Senkung der Abgabenquote auf #Öl und #Gas-Förderung und 10-jährigen Dumping-Garantieverträgen die #strandedassets der Branche. Und wer zahlt die Zeche? | #ClimateAction in #Niedersachsen | #OiL #EXXON #Shell #NEORT #OOTT

#SriAgenda underway 🔘 #Sep9

#GRASFI "@susfinalliance | #Day2 of 4

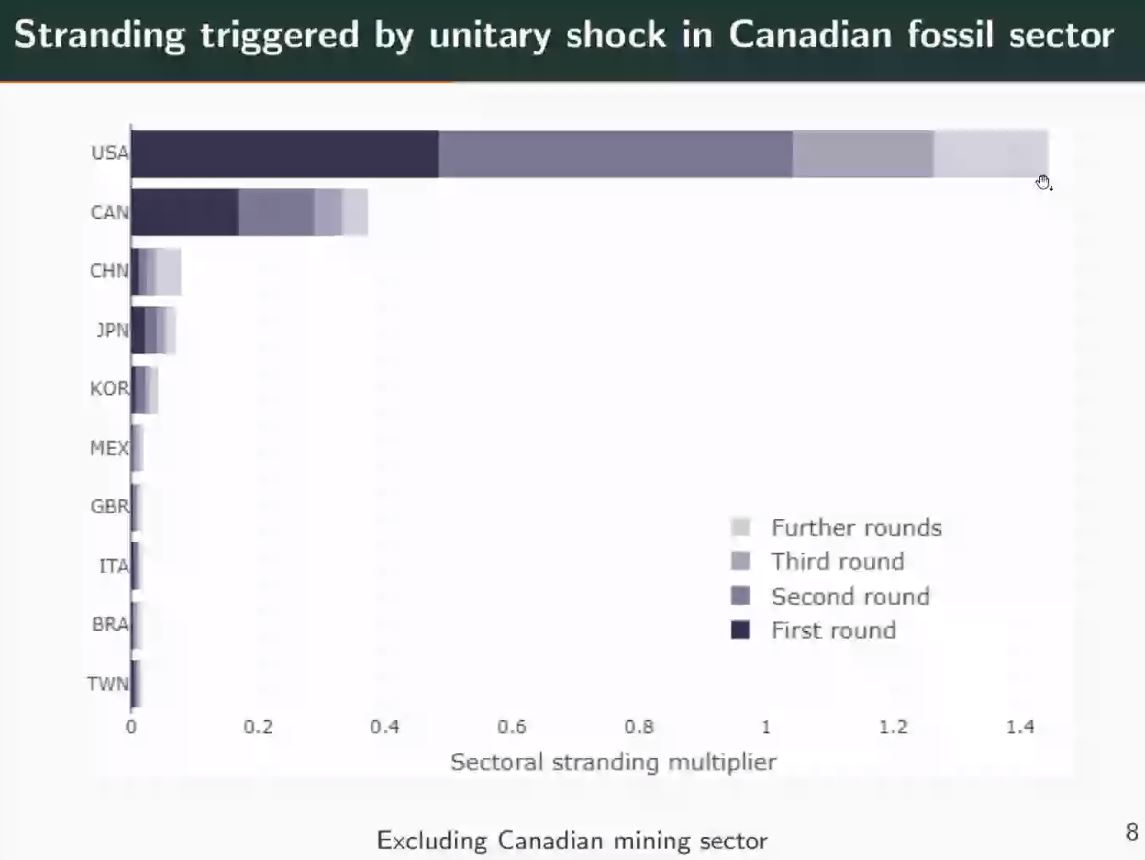

Capital stranding cascades: The impact of #decarbonisation on productive asset utilisation "@emacampiglio

#sustainablefinance #strandedassets @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit

#GRASFI "@susfinalliance | #Day2 of 4

Capital stranding cascades: The impact of #decarbonisation on productive asset utilisation "@emacampiglio

#sustainablefinance #strandedassets @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit

@susfinalliance @emacampiglio @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit conclusions "@emacampiglio

#sustainablefinance #strandedassets

#GRASFI "@susfinalliance

#sustainablefinance #strandedassets

#GRASFI "@susfinalliance

@susfinalliance @emacampiglio @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit New developments in #ClimateLitigation over financial risk "@ColomEsmeralda

#climaterisks #responsibleinvestment #sustainablefinance #climatecrisis #BizHumanRights #sri #esg @UiBCET @ColumbiaLaw @urgenda @canclimatelaw @ColumbiaClimate @MichaelGerrard

#GRASFI "@susfinalliance

#climaterisks #responsibleinvestment #sustainablefinance #climatecrisis #BizHumanRights #sri #esg @UiBCET @ColumbiaLaw @urgenda @canclimatelaw @ColumbiaClimate @MichaelGerrard

#GRASFI "@susfinalliance

#SriAgenda in 30min | #June30 at 2:30pm CEST

Breaking the #climatefinance doom-loop

finance-watch.org/event/webinar-…

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance @SRI_Natives @SriEvent_It @andytuit

Breaking the #climatefinance doom-loop

finance-watch.org/event/webinar-…

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance @SRI_Natives @SriEvent_It @andytuit

@SRI_Natives @SriEvent_It @andytuit #SriAgenda just started 💥

welcome speech and opening remarks by @pilitaclark

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance "@forfinancewatch "@CarbonBubble

welcome speech and opening remarks by @pilitaclark

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance "@forfinancewatch "@CarbonBubble

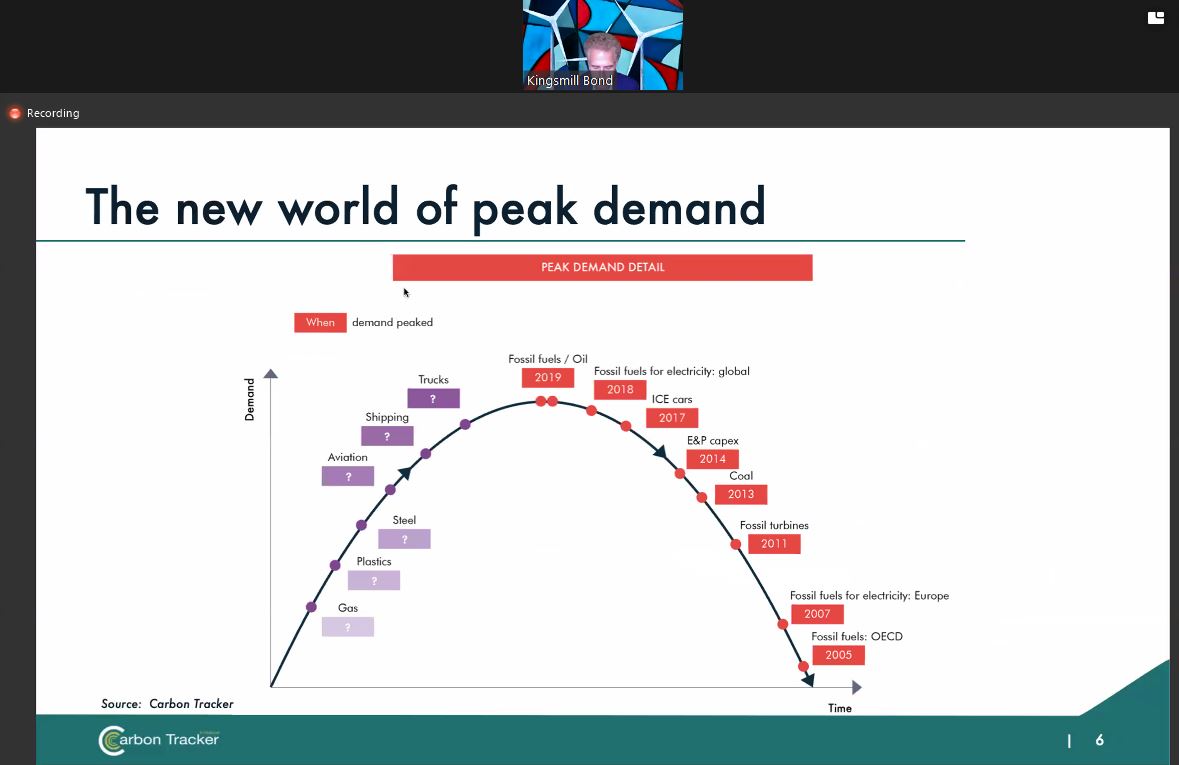

@SRI_Natives @SriEvent_It @andytuit @pilitaclark @forfinancewatch @CarbonBubble now @KingsmillBond going deeply into the 'Decline and Fall' (that's the name of the report by @CarbonBubble) of #fossilfuels: the system is being rapidly disrupted, he says

#fossifuel #sustainablefinance #climaterisks #disruption @CampanaleMark @arhobley @fossiltreaty @andytuit

#fossifuel #sustainablefinance #climaterisks #disruption @CampanaleMark @arhobley @fossiltreaty @andytuit

#SriAgenda in 15min 🔔 #June29 at 6pm CEST

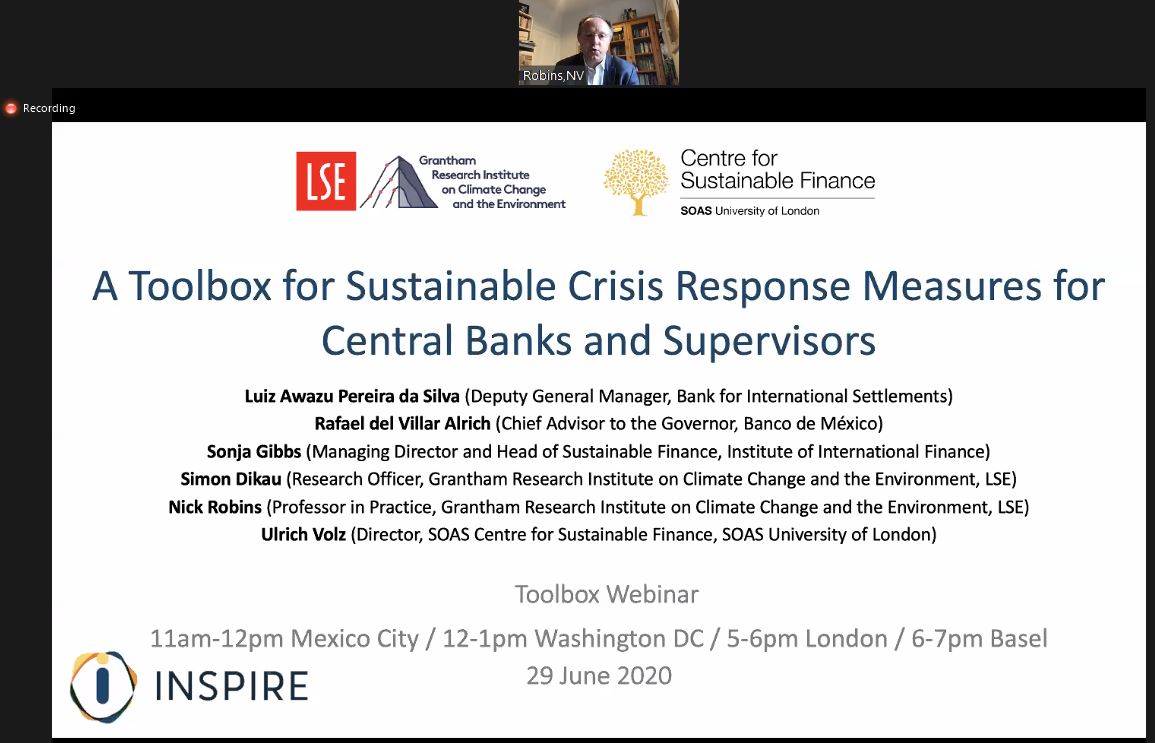

A Toolbox for Sustainable Crisis Response Measures for #CentralBanks and Supervisors "@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes

soas.ac.uk/centre-for-sus…

#sustainablefinance #sustainablerecovery #sri #esg

A Toolbox for Sustainable Crisis Response Measures for #CentralBanks and Supervisors "@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes

soas.ac.uk/centre-for-sus…

#sustainablefinance #sustainablerecovery #sri #esg

@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes #SriAgenda just started 💥

welcome speech by @NVJRobins1

#sustainablefinance #CentralBanks #sustainablerecovery #sri #esg @GRI_LSE @FC4SNetwork @NGFS_

welcome speech by @NVJRobins1

#sustainablefinance #CentralBanks #sustainablerecovery #sri #esg @GRI_LSE @FC4SNetwork @NGFS_

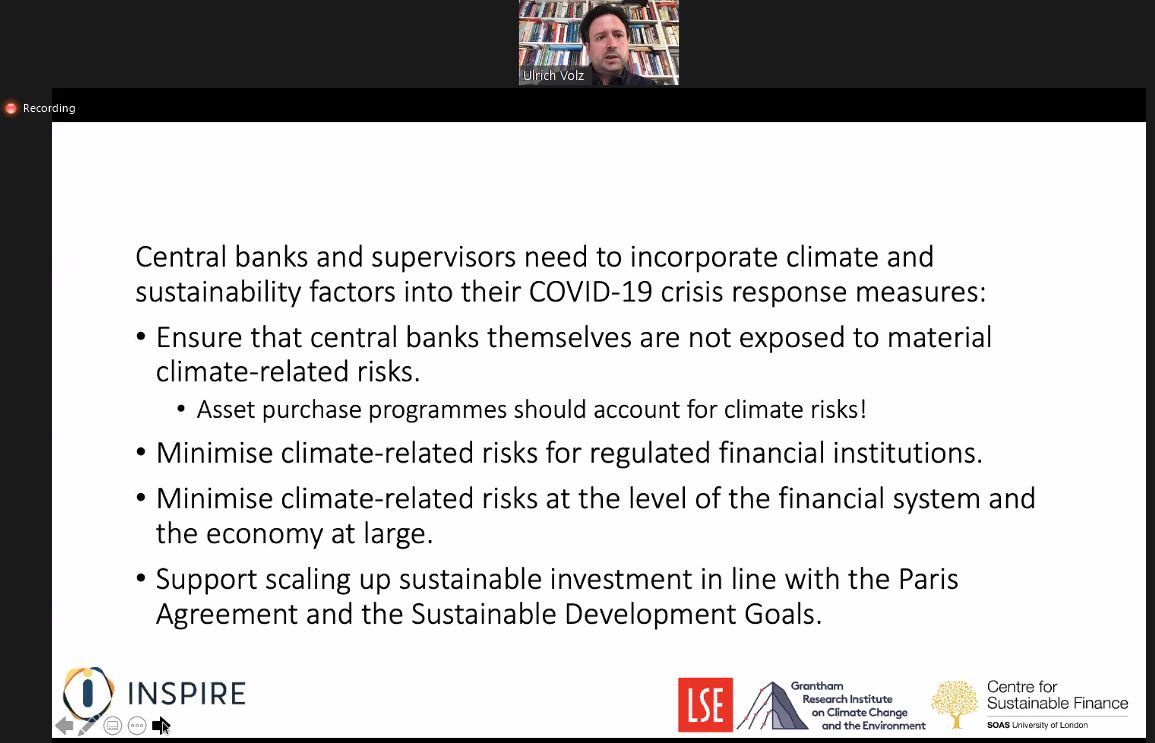

@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes @NVJRobins1 @GRI_LSE @FC4SNetwork @NGFS_ the 4 reasons for #CentralBanks and supervisors to incorporate #climate and #sustainability factors now being explained by @UliVolz

#sustainablefinance #sustainablerecovery #sri #esg #climaterisks #climatecrisis @CSF_SOAS

#sustainablefinance #sustainablerecovery #sri #esg #climaterisks #climatecrisis @CSF_SOAS

#SriAgenda abt to start 🔔 #May21 at 5:30pm CEST

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

bit.ly/3e6gxNs

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri @andytuit @SRI_Natives

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

bit.ly/3e6gxNs

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri @andytuit @SRI_Natives

@CFASocietyDC @andytuit @SRI_Natives #SriAgenda just started 💥 #May21

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri

@CFASocietyDC @andytuit @SRI_Natives the real question today is not what is the future of ESG, the question is:

Is there a future w/out the #ESG?, say Catherine Banat @rbcgamnews introducing the panel

(a very good, visionary start! 👍)

#ESG2020 @onegoodchart @CampanaleMark @GThoumiCFA @CFASocietyDC @CFAinstitute

Is there a future w/out the #ESG?, say Catherine Banat @rbcgamnews introducing the panel

(a very good, visionary start! 👍)

#ESG2020 @onegoodchart @CampanaleMark @GThoumiCFA @CFASocietyDC @CFAinstitute

On Thursday, the @EIB board (Member States, @EU_Commission) decides whether funding #gas infrastructure is still in the public interest.

I shuffled through the extraordinary amount of voices saying "no, we've got better things to fund" and put them in this THREAD.

@AMcDowell

I shuffled through the extraordinary amount of voices saying "no, we've got better things to fund" and put them in this THREAD.

@AMcDowell

30 businesses, investment groups and scientific institutions including @WMBtweets @cisl_cambridge @PIK_Klima @ClubOfRome @climatebonds

clubofrome.org/2019/10/07/sup…

clubofrome.org/2019/10/07/sup…

Economist Prof. @CKemfert clearly tells us that we're setting us up for another badly managed transition with #strandedassets if we use public funding for #fossilfuels as renewables and efficiency will undercut the market for gas. euractiv.de/section/energi… @OlafScholz

Sara Parrott @Suncorp #climatechange is an existential threat to the insurance industry. Suncorp will not underwite thermal coal projects from 2025. $39 billion in assets they can invest in for a better future #strandedassets #sustainablefinance #wftebrisbane

Moving from fear of #climatechange and concern over backlash or sticking your neck out, to seeing it as a strategic risk, giving staff permission to engage can create massive organisational cultural shift. Suncorp started on its journey only 2-3 yrs ago #wftebrisbane

.@NeridaBradley Corporate Australia is changing, recognising it needs to embrace change and supporting individuals to drive this change #wftebrisbane