Discover and read the best of Twitter Threads about #UPL

Most recents (22)

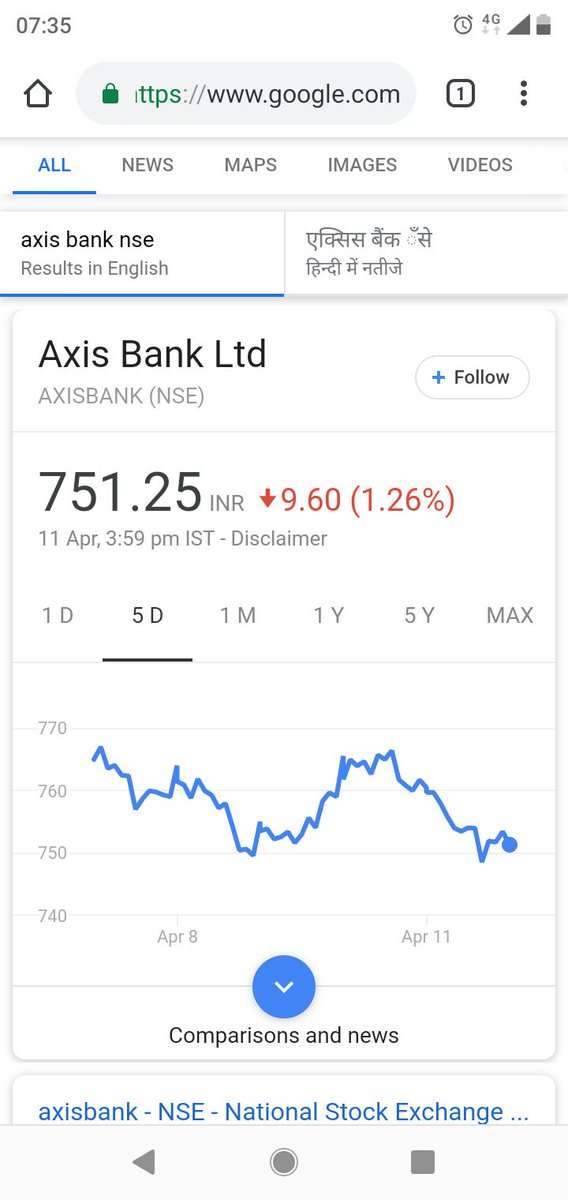

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

My Long term equity investment setup

1. Identifying quality stock in watchlist

2. Selections amongst those for final watchlist

3. Final trigger to buy the stock in portfolio

4. Adding or pyramiding

(will explain this in detail step-by-step in this thread , so keep glued)

1. Identifying quality stock in watchlist

2. Selections amongst those for final watchlist

3. Final trigger to buy the stock in portfolio

4. Adding or pyramiding

(will explain this in detail step-by-step in this thread , so keep glued)

Some consideration kept in mind before following this setup

- this is a regular sip investment plan

- for 10-20 years of wealth creation

- cannot be used for trading or speculation

- not useful for those who want to allocate all the money at once

- this is a regular sip investment plan

- for 10-20 years of wealth creation

- cannot be used for trading or speculation

- not useful for those who want to allocate all the money at once

🌟Top 3( high growth +strong business) companies of my favorite😍 sectors for long term.

1⃣chemical sector - #deepaknr #balajiamines #tatachemical

2⃣power - #adanitransmissons #tatapower #adanipower

3⃣Fmcg - #ltfoods #hindustanfoods #hatsun

1⃣chemical sector - #deepaknr #balajiamines #tatachemical

2⃣power - #adanitransmissons #tatapower #adanipower

3⃣Fmcg - #ltfoods #hindustanfoods #hatsun

4⃣cement - #jklakshmi #birlacement #prism

5⃣ packaging - #polyplex #jindalpoly #cosmofilms

6⃣textiles - #luxind #srf #welspun

7⃣ fertilizers - #fact #gnfc #rcf

5⃣ packaging - #polyplex #jindalpoly #cosmofilms

6⃣textiles - #luxind #srf #welspun

7⃣ fertilizers - #fact #gnfc #rcf

1⃣ sugar sector -#renukasugar #dalmiabharat #Uttamsugar

2⃣ agrochemical - #piind #upl #paushak

3⃣ beverage sector - #radico #globus #ifbagro

If you love ❤ & like 💞 ,then share more sectors companies.

2⃣ agrochemical - #piind #upl #paushak

3⃣ beverage sector - #radico #globus #ifbagro

If you love ❤ & like 💞 ,then share more sectors companies.

1 new chart everyday, it could be from any space ~ equities / commodities / crypto / forex / bonds , etc

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

Weekly NIFTY50 analysis thread.

September Week4.

All posts are for educational purposes.

September Week4.

All posts are for educational purposes.

#BrokerageRecos 25th September 2020

#ANUP The Anup Engineering

Stocks for 17/09/20 Intraday

#BHARTIARTL

#BANDHANBNK

#JSWSTEEL

#BPCL

#TECHM

#UPL

#VOLTAS

#GRANULES

#PVR

#TATACONSUM

Based on NR7, Volume and Volatility concepts

#BHARTIARTL

#BANDHANBNK

#JSWSTEEL

#BPCL

#TECHM

#UPL

#VOLTAS

#GRANULES

#PVR

#TATACONSUM

Based on NR7, Volume and Volatility concepts

Results of the Day : 3/10 Stocks gave tradeable moves

Pretty average Day for me But Lots of Learning too

1/3 : #TECHM : LOSS : -0.3R

All details on Chart

LEARNING: I could have Maybe waited for pullback since Stock went up +2.65% with that huge candle

Good that I cut it Early

Pretty average Day for me But Lots of Learning too

1/3 : #TECHM : LOSS : -0.3R

All details on Chart

LEARNING: I could have Maybe waited for pullback since Stock went up +2.65% with that huge candle

Good that I cut it Early

2/3 : #TATACONSUM : PROFIT : +0.8R

Price rejected from previous highs and formed Bearish candles

Some have asked me about use of VWAP. I use it for trades like these. Here price bounced at VWAP which was not good for Short trade, hence closed

Price rejected from previous highs and formed Bearish candles

Some have asked me about use of VWAP. I use it for trades like these. Here price bounced at VWAP which was not good for Short trade, hence closed

Stocks for 11/09/20 Intraday

#ZEEL

#SUNPHARMA

#M&M

#UPL

#AUROPHARMA

#TCS

#HINDUNILVR

#INDIGO

#McDOWELL_N

Based on NR7, Volume and Volatility concepts

#ZEEL

#SUNPHARMA

#M&M

#UPL

#AUROPHARMA

#TCS

#HINDUNILVR

#INDIGO

#McDOWELL_N

Based on NR7, Volume and Volatility concepts

Results of the Day : 3/9 stocks gave tradeable moves

1/3 : #TCS : PROFIT : +2R

After suffering a loss as posted in the morning, it again gave a good entry. Closed it for 2R as I didn't want to hold it anymore

1/3 : #TCS : PROFIT : +2R

After suffering a loss as posted in the morning, it again gave a good entry. Closed it for 2R as I didn't want to hold it anymore

2/3 : #McDOWELL_N : PROFIT : +2R

Back to back in my watchlist and back to back profits.

It once again got rejected from the same resistance block as yesterday and gave a Entry as detailed.

Exited before EOD

Back to back in my watchlist and back to back profits.

It once again got rejected from the same resistance block as yesterday and gave a Entry as detailed.

Exited before EOD

Will be posting TA of all #nifty50 stocks in this thread. Any comments, suggestions are welcome!

Stocks for 29/08/20 Intraday

#LICHSGFIN

#LUPIN

#UPL

#AMBUJACEM

#UJJIVAN

#SBILIFE

#CUMMINSIND

#AMARJABAT

#INDIGO

Based on NR7, Volume and Volatility concepts

#LICHSGFIN

#LUPIN

#UPL

#AMBUJACEM

#UJJIVAN

#SBILIFE

#CUMMINSIND

#AMARJABAT

#INDIGO

Based on NR7, Volume and Volatility concepts

Results of the Day : 4/9 Stocks gave tradeable moves

1/4 : #UPL : PROFIT : +2R

Price broke through previous resistance with good volumes

Bullish bias was decreasing due to decreasing Volumes. Exited after formation of bearish structure

1/4 : #UPL : PROFIT : +2R

Price broke through previous resistance with good volumes

Bullish bias was decreasing due to decreasing Volumes. Exited after formation of bearish structure

2/4 : #INDIGO : PROFIT : +1.7R

After a Bullish start of the Day, price formed Double top and a Bearish structure.

Exit was done after it bounced with good volumes and a long tail

After a Bullish start of the Day, price formed Double top and a Bearish structure.

Exit was done after it bounced with good volumes and a long tail

There were no Good stocks using NR7 Yesterday, hence I didn't take any Intraday trades today.

Stocks for 27/08/20 Intraday

#TATASTEEL

#JSWSTEEL

#BPCL

#SUNPHARMA

#CIPLA

#UJJIVAN

#UPL

#AMBUJACEM

#AUROPHARMA

#BHARATFORG

Based on NR7, Volume and Volatility concepts

Stocks for 27/08/20 Intraday

#TATASTEEL

#JSWSTEEL

#BPCL

#SUNPHARMA

#CIPLA

#UJJIVAN

#UPL

#AMBUJACEM

#AUROPHARMA

#BHARATFORG

Based on NR7, Volume and Volatility concepts

Late Results of the Day! 5/10 stocks gave tradeable moves

1/5: #CIPLA: PROFIT: +0.9R

Same Stuff as I posted in market hours:

-Price breaks resistance with strong candles and Volume: BUY

-Price shows weakness by wicks and Bearish candles with Volume: EXIT

1/5: #CIPLA: PROFIT: +0.9R

Same Stuff as I posted in market hours:

-Price breaks resistance with strong candles and Volume: BUY

-Price shows weakness by wicks and Bearish candles with Volume: EXIT

2/5 : #AUROPHARMA : BREAKEVEN

Again, price reacted strongly at Support : Went LONG

Seeing weakness : EXIT

Details on chart

Again, price reacted strongly at Support : Went LONG

Seeing weakness : EXIT

Details on chart

Stocks for 18/08/20 Intraday

#SUNPHARMA

#CONCOR

#TATACONSUM

#TITAN

#TCS

#UPL

#GRANULES

#DIVISLAB

#IOLCP

#DRREDDY

Based on NR7, Volume and Volatility concepts

#SUNPHARMA

#CONCOR

#TATACONSUM

#TITAN

#TCS

#UPL

#GRANULES

#DIVISLAB

#IOLCP

#DRREDDY

Based on NR7, Volume and Volatility concepts

Results of the Day : Very Good Day for me.

4/10 Stocks gave tradeable moves.

1/4 : #TITAN

Price broke previous session's resistance with Volume and Good VWAP Structure. Got out of the trade since momentum was getting weak.

+3.7R profits booked

4/10 Stocks gave tradeable moves.

1/4 : #TITAN

Price broke previous session's resistance with Volume and Good VWAP Structure. Got out of the trade since momentum was getting weak.

+3.7R profits booked

Stocks for 14/08/20 Intraday

#RELIANCE

#HDFCBANK

#BPCL

#BAJFINANCE

#UPL

#LUPIN

#UJJIVAN

#GLENMARK

#ASIANPAINT

#PEL

#ULTRACEMCO

Based on NR7, Volume and Volatility concepts

#RELIANCE

#HDFCBANK

#BPCL

#BAJFINANCE

#UPL

#LUPIN

#UJJIVAN

#GLENMARK

#ASIANPAINT

#PEL

#ULTRACEMCO

Based on NR7, Volume and Volatility concepts

Results of the Day : 3/11 Stocks gave tradeable moves. A great day for me since there was a lot of Volatility and I read the price action well.

1/3 : #RELIANCE

My best price action read today :

Price started Bullish but found resistance at 11th Aug high. Short trade taken after bearish confirmation and Exited as per my rules.

Tip #2 in pinned tweets was KEY in securing higher profits

+4.5R profits booked

My best price action read today :

Price started Bullish but found resistance at 11th Aug high. Short trade taken after bearish confirmation and Exited as per my rules.

Tip #2 in pinned tweets was KEY in securing higher profits

+4.5R profits booked

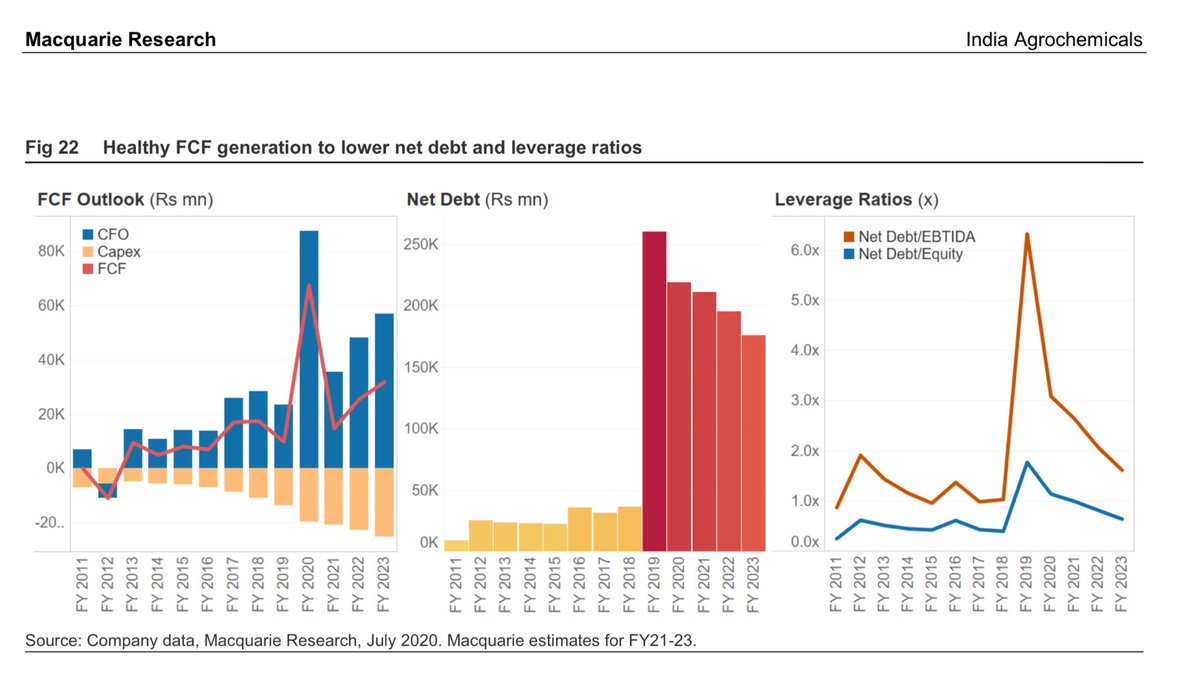

#UPL #Basics

-5th largest agrochem. company in the world (Mark. Cap: 34,699 Cr.)

-ROCE: 10.36 %

-ROE: 14.87 %

-D/E: 1.52

-Trading at a discounted price based on both P/S ratio (0.97) and Trailing P/E

@saketreddy @unseenvalue @caniravkaria @nid_rockz @ThetaVegaCap @DhanValue

-5th largest agrochem. company in the world (Mark. Cap: 34,699 Cr.)

-ROCE: 10.36 %

-ROE: 14.87 %

-D/E: 1.52

-Trading at a discounted price based on both P/S ratio (0.97) and Trailing P/E

@saketreddy @unseenvalue @caniravkaria @nid_rockz @ThetaVegaCap @DhanValue

-Profit growth 5Years: 12.18

-MF increased their holding last month

-Wider footprint and extensive product portfolio to drive growth

-Arysta merger synergies to improve margins

-Long term revenue based on the company’s robust R&D initiatives on several new products

#Macquarie

-MF increased their holding last month

-Wider footprint and extensive product portfolio to drive growth

-Arysta merger synergies to improve margins

-Long term revenue based on the company’s robust R&D initiatives on several new products

#Macquarie

++Some inputs from the #Macquarie research regarding the UPL debt concerns.

-UPL is expected to generate healthy cumulative FCF of Rs72bn over the next 3 years.

-Leverage to decline. Healthy FCF generation to support deleveraging for UPL.

-UPL is expected to generate healthy cumulative FCF of Rs72bn over the next 3 years.

-Leverage to decline. Healthy FCF generation to support deleveraging for UPL.

Weekend views on all my 35 f&o stocks will be given on this thread.

Stay connected😊😊

Stay connected😊😊

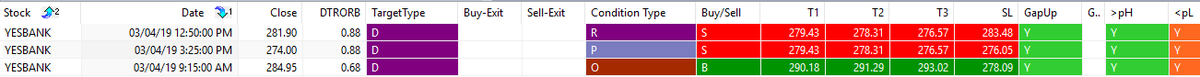

#fakeparadise

I have posted few graphs of fake paradise trades happened in recent past below.

If anyone has still any doubts can ask on the same thread once i post few recent charts of fake paradise (only some standard stocks which i follow).

(1/n)

I have posted few graphs of fake paradise trades happened in recent past below.

If anyone has still any doubts can ask on the same thread once i post few recent charts of fake paradise (only some standard stocks which i follow).

(1/n)

#FakeParadise

#ReversalSetup

Before i share this setup, let me tell you this is not a easy setup to trade without deep understanding.

So let's discuss the setup and what does it mean!!

(1/n)

#ReversalSetup

Before i share this setup, let me tell you this is not a easy setup to trade without deep understanding.

So let's discuss the setup and what does it mean!!

(1/n)

Rules For Sell

1. New 20 period high should have been made today.

2. Previous 20 period high should have been made minimum 3/4 days before.

3. Close above previous 20 day high or not is optional.

(2/n)

1. New 20 period high should have been made today.

2. Previous 20 period high should have been made minimum 3/4 days before.

3. Close above previous 20 day high or not is optional.

(2/n)

How to implement?

1. Once we get new 20 period high stock, on same day/ next day we place sell stoploss order few ticks below previous 20 period high.

2. Stoploss : few tick above Latest high

3. Target : 1:5 R:R achievable (trail stop after 1:2 R:R)

(3/n)

1. Once we get new 20 period high stock, on same day/ next day we place sell stoploss order few ticks below previous 20 period high.

2. Stoploss : few tick above Latest high

3. Target : 1:5 R:R achievable (trail stop after 1:2 R:R)

(3/n)

An interestin Bollinger Band squeeze breakout condidate #UPL

Wil b interestin once it crosses 196. @JainSumeetS

Wil b interestin once it crosses 196. @JainSumeetS