Discover and read the best of Twitter Threads about #nifty50

Most recents (24)

Jaykay Enterprises Ltd

Here is a thread on Jaykay Enterprises Ltd, a part of the diversified JK Group

#Multibagger #nseindia

@kuttrapali26 @KommawarSwapnil @caniravkaria @AdeptMarket @drprashantmish6 @stockguruindian @manojgupta1979 #BSE #bseindia #stockmarkets #Jaykay #nifty50

Here is a thread on Jaykay Enterprises Ltd, a part of the diversified JK Group

#Multibagger #nseindia

@kuttrapali26 @KommawarSwapnil @caniravkaria @AdeptMarket @drprashantmish6 @stockguruindian @manojgupta1979 #BSE #bseindia #stockmarkets #Jaykay #nifty50

Jaykay Enterprise Ltd is a small-cap company listed on the Bombay Stock Exchange. The company is engaged in the manufacturing of construction materials, such as bricks, tiles, and cement.

#constructionindustry #Construction

#constructionindustry #Construction

The company was founded in 1985 and is headquartered in Ahmedabad, Gujarat. Jaykay Enterprise has a market capitalization of ₹1.5 billion and a track record of profitability.

#gujrat

#gujrat

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50 #prsunder

* Not Financial Advice* Just Analysis of A Share

Stock Name: Tyche industries

Mirco Cap

looking Fundamentals Good

Read Full Article Here

1. Company Overview

* Not Financial Advice* Just Analysis of A Share

Stock Name: Tyche industries

Mirco Cap

looking Fundamentals Good

Read Full Article Here

1. Company Overview

2. Company Data: Tyche is a leading manufacturer of APIs & Advanced Intermediates of API’s for anti-retroviral, anti-depression, anti-arthritic, anti-diarrheal, anti-psychotic etc.

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50

#orchidpharma #stockstobuy #breaoutstocks Long term Invest - Catch me if u can kind of setup with sky as the limit... Its buy n forget #rsistudy #stockstudy #nifty50 #investing #sensex #trading #nse #stocks #stockstotrade #stockmarket #marketing #investing #zerodha

Wkly & Daily BB Blast, Daily EMA COnvergence, Daily Golden Crossover, RSI ND failure has validated PR & Price has closed abv Resistance wth a strong vol candle. There is no res in sight. Still it cud fail so manage position size according to SL.

Rise cud be as furious as the fall n it has potential to be a multibagger - 2650 is the ATH. Funda - ROCE is positive after 5 Yrs for 2 consecutive FY n current is higher then previous/ OPM is Good/ Low Float, Check PE & DE or talk to ur advisor

#stockstobuy #breaoutstocks Long term Invest - Catch me if u can kind of setup with sky as the limit... Its buy n forget #rsistudy #stockstudy #nifty50 #investing #sensex #trading #nse #stocks #stockstotrade #stockmarket #marketing #investing #zerodha

Wkly & Daily BB Blast, Daily EMA COnvergence, Daily Golden Crossover, RSI ND failure has validated PR & Price has closed abv Resistance wth a strong vol candle. There is no res in sight. Still it cud fail so manage position size according to SL.

Rise cud be as furious as the fall n it has potential to be a multibagger - 2650 is the ATH.

Funda - ROCE is positive after 5 Yrs for 2 consecutive FY n current is higher then previous/ OPM is Good/ Low Float, Check PE & DE or talk to ur advisor

Funda - ROCE is positive after 5 Yrs for 2 consecutive FY n current is higher then previous/ OPM is Good/ Low Float, Check PE & DE or talk to ur advisor

#stockstobuy #breaoutstocks #cashbaskettrading - Wil try to post charts later on the stocks in my watchlist #rsistudy #stockstudy #nifty50 #investing #sensex #trading #nse #stocks #stockstotrade #stockmarket #marketing #investing #zerodha

#eimcoeleco - PDH Break #justdial - PDH Break #carerating - PFH Break #GLS - PDH Break #jaibalaji - IB Break #hudco - PDH Break #akzoindia - PDH Break, #zensar - IB Break, #dynamatech - IB Break, #BLKashyap - PDH Break

Why is Nifty Falling? (Price action Analysis):

Black line is weekly open for 6 march. Market came back for pull back up till the open of 6th March

#ictconcept #nifty50

Black line is weekly open for 6 march. Market came back for pull back up till the open of 6th March

#ictconcept #nifty50

Ran through liquidity with displacement creating FVG and breaking old lows.

Reaching day equal lows to rebalance the imbalance.

Nifty 50

1:7

Reaching day equal lows to rebalance the imbalance.

Nifty 50

1:7

Always refer to higher timeframe to build a context for your trading ideas!

This is my personal view; others' opinions may differ.

Follow @_srdash to learn more Smart Money Concepts & ICT Rules for Indian Markets.

This is my personal view; others' opinions may differ.

Follow @_srdash to learn more Smart Money Concepts & ICT Rules for Indian Markets.

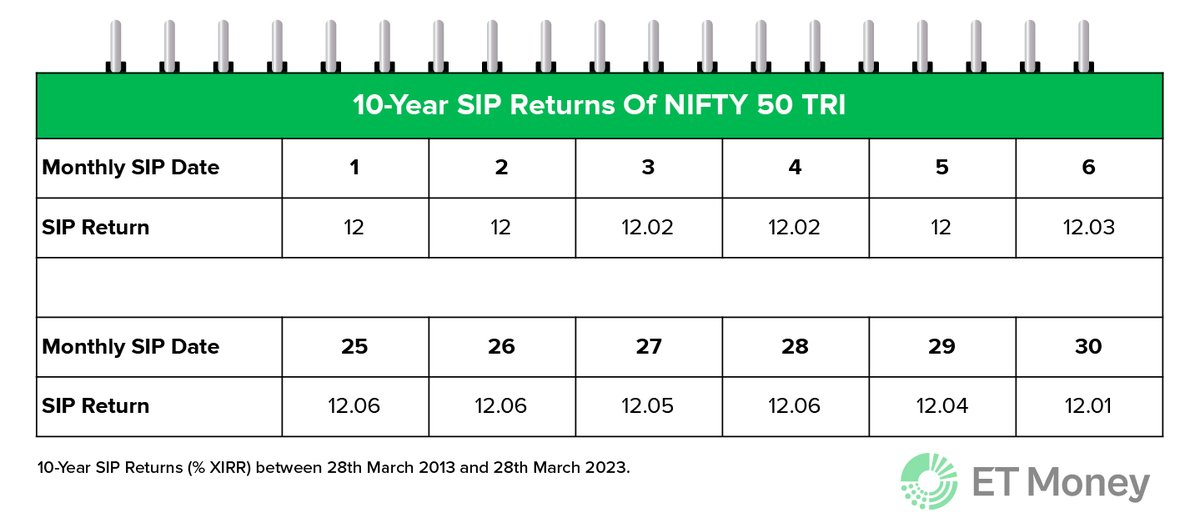

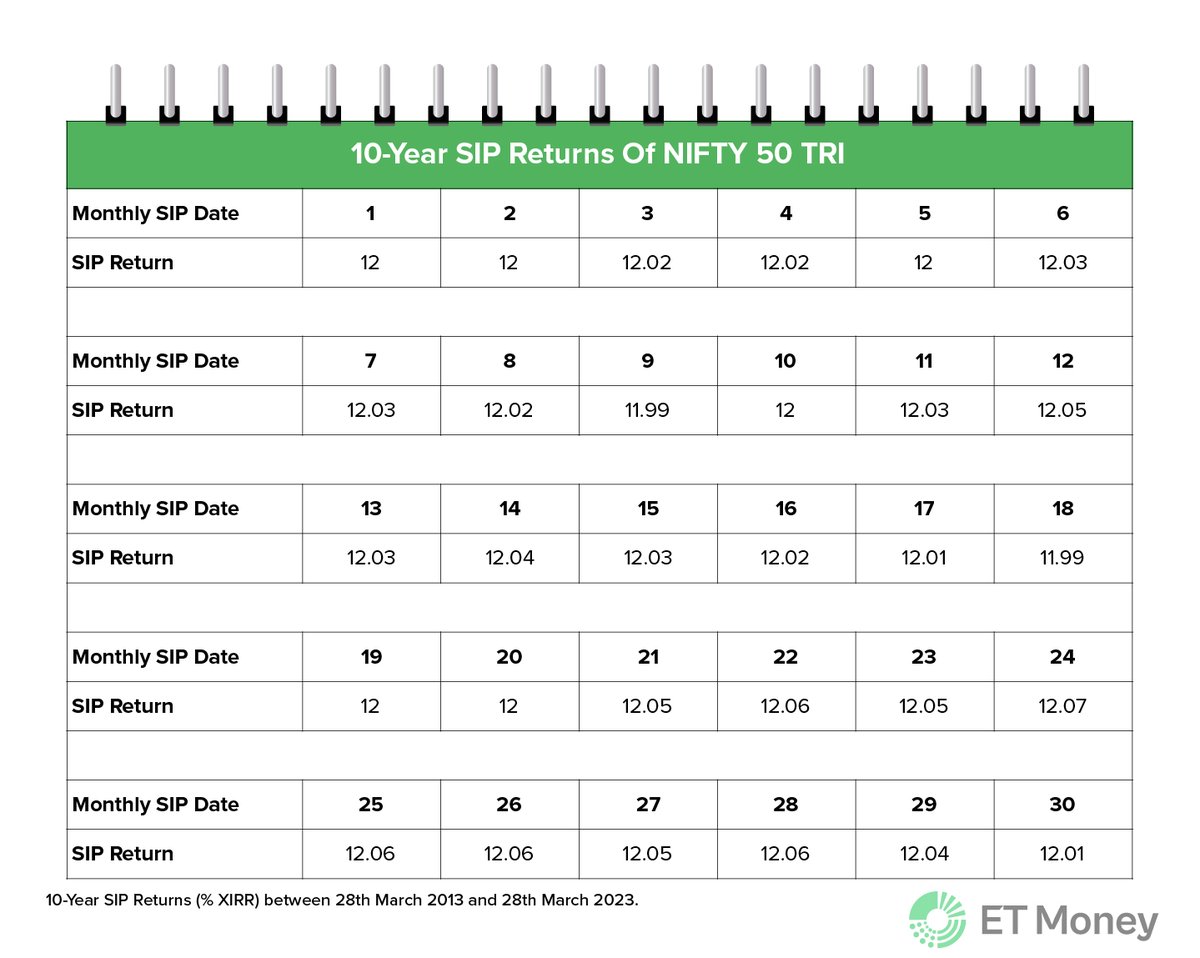

Which date of the month is the best to do your SIP?

Some say it’s the start of the month.

Some say it’s the last Thu of the month, as markets are volatile due to F&O settlements.

We checked data for the first & last week. The returns were similar.

Is there a better date? A 🧵

Some say it’s the start of the month.

Some say it’s the last Thu of the month, as markets are volatile due to F&O settlements.

We checked data for the first & last week. The returns were similar.

Is there a better date? A 🧵

We looked at the #NIFTY50 TRI returns for the last 10 years

Over the last decade, there was hardly any difference in SIP returns scheduled on different dates of the month.

Details in the image. 👇

Over the last decade, there was hardly any difference in SIP returns scheduled on different dates of the month.

Details in the image. 👇

The highest return was 12.07% (on the 24th of every month)

The lowest returns turned out to be 11.99% (9th & 18th)

Overall, there was not much difference, irrespective of the date you picked.

But what about mid-cap & small-cap indices that are more volatile than large-caps?

The lowest returns turned out to be 11.99% (9th & 18th)

Overall, there was not much difference, irrespective of the date you picked.

But what about mid-cap & small-cap indices that are more volatile than large-caps?

Set a reminder for my upcoming Space! twitter.com/i/spaces/1kvJp…

We are going live in 5!

Follow the thread below for slides!

#nifty50 #NiftyBank #corporateindia

We are going live in 5!

Follow the thread below for slides!

#nifty50 #NiftyBank #corporateindia

#SIP or lumpsum - Which is better?

Probably, most people will vote in favour of SIP.

But, that’s not entirely true.

On many occasions, lumpsum has given better results than SIP.

So, where do you make higher returns?

We analysed the data. Here’s what we found.

A 🧵

Probably, most people will vote in favour of SIP.

But, that’s not entirely true.

On many occasions, lumpsum has given better results than SIP.

So, where do you make higher returns?

We analysed the data. Here’s what we found.

A 🧵

We compared SIP and lumpsum returns in #nifty50 over different time horizons.

Consider this example

One person invested Rs 6 lakh 10 years ago.

Another one starts a monthly SIP of Rs 5,000 at the same time (5,000 X 120 months).

Who earns better returns?

Consider this example

One person invested Rs 6 lakh 10 years ago.

Another one starts a monthly SIP of Rs 5,000 at the same time (5,000 X 120 months).

Who earns better returns?

MOVING AVERAGES:

1/n

In this thread,I am sharing about moving averages,its key strategies,entry,exit,target everything..

These strategies are scalable to all timeframes,instruments etc

Simple thinks works in the market.

#Nifty50 #StockMarketindia #banknifty #movingaverage

1/n

In this thread,I am sharing about moving averages,its key strategies,entry,exit,target everything..

These strategies are scalable to all timeframes,instruments etc

Simple thinks works in the market.

#Nifty50 #StockMarketindia #banknifty #movingaverage

2/n

MOVING AVERAGES:

Moving average is simplest method to understand and trade.Most common moving average is SMA,which totals close price over a certain period,then divides this total by number of period.Ex:10 SMA would calculate close price of last 10 period and divide sum by 10

MOVING AVERAGES:

Moving average is simplest method to understand and trade.Most common moving average is SMA,which totals close price over a certain period,then divides this total by number of period.Ex:10 SMA would calculate close price of last 10 period and divide sum by 10

3/n

EXPONENTIAL MOVING AVERAGES:

I prefer EMA,as it put more weight on recent price data when calculating moving average. It will react quicker than to sma.

What ema I use

13-short trend

34-intermediate trend

55-long trend

EXPONENTIAL MOVING AVERAGES:

I prefer EMA,as it put more weight on recent price data when calculating moving average. It will react quicker than to sma.

What ema I use

13-short trend

34-intermediate trend

55-long trend

Instrument:Finnifty

REVERSAL SETUP COMBINED WITH SQUEEZE:

Open=High candle broken

W pattern in bollinger band

Divergence in moment

TIGHT SQUEEZE

Let's see will hit 1:2 RR.

I'm just forward testing and sharing.

Not trade recommdation

#Nifty50

#Finnifty

#StockMarketindia

REVERSAL SETUP COMBINED WITH SQUEEZE:

Open=High candle broken

W pattern in bollinger band

Divergence in moment

TIGHT SQUEEZE

Let's see will hit 1:2 RR.

I'm just forward testing and sharing.

Not trade recommdation

#Nifty50

#Finnifty

#StockMarketindia

Trailed sl to cost now

Sl hit...

Loss-0 points

Loss-0 points

THREAD ABOUT HOW I USE BOLLINGER BAND SYSTEM:

LIKE ,RETWEET AND YOUR INPUTS HELPS

Basics:

Bollinger bands are used to determine whether the price are high or low on relative basis.Bollinger bands use 20sma and 2 standard deviation of it.

I use three setup combined with RSI

LIKE ,RETWEET AND YOUR INPUTS HELPS

Basics:

Bollinger bands are used to determine whether the price are high or low on relative basis.Bollinger bands use 20sma and 2 standard deviation of it.

I use three setup combined with RSI

1/n

This bollinger system is suitable for intraday traders,swing traders and even for long term players.

Top down approach increases accuracy.

Only the timeframe changes ,system remains constant.

%b indicator and bollinger bandwidth can be used to code this system

This bollinger system is suitable for intraday traders,swing traders and even for long term players.

Top down approach increases accuracy.

Only the timeframe changes ,system remains constant.

%b indicator and bollinger bandwidth can be used to code this system

Everybody wants to sell options, but no one knows where we can learn everything for free?

Here i'm sharing 5 youtube channels where you can learn everything about Option trading from complete scratch to advance levels including strategies, concepts and adjustments.

A Thread👇

Here i'm sharing 5 youtube channels where you can learn everything about Option trading from complete scratch to advance levels including strategies, concepts and adjustments.

A Thread👇

1- @tastyliveshow

Tasty trade is a financial media company that offers educational content on options trading, futures trading, and other financial topics.

But here i'm sharing a playlist where @TraderMikeyB have covered everything from basic to advance.

youtube.com/playlist?list=…

Tasty trade is a financial media company that offers educational content on options trading, futures trading, and other financial topics.

But here i'm sharing a playlist where @TraderMikeyB have covered everything from basic to advance.

youtube.com/playlist?list=…

2- Project Finance

If you want to learn option concepts in depth, it's a must watch channel

youtube.com/@projectfinance

If you want to learn option concepts in depth, it's a must watch channel

youtube.com/@projectfinance

5 Confirmations for better trade entries ::

#StockMarket #nifty50 #investing

1️⃣ Restest/Pullback after at a Breakout Level

Retest after a breakout might not happen all the time; you can at least wait for a pullback and continuation in those cases.

#StockMarket #nifty50 #investing

1️⃣ Restest/Pullback after at a Breakout Level

Retest after a breakout might not happen all the time; you can at least wait for a pullback and continuation in those cases.

#AdaniGroup vs #Hindenburg

A short seller attack in a week that Adani Enterprises launched a $2.5 billion additional share sale.

$51 billion in market value wiped out across group stocks.

Here's what happened...

It started with India's biggest FPO.

bloomberg.com/news/articles/…

A short seller attack in a week that Adani Enterprises launched a $2.5 billion additional share sale.

$51 billion in market value wiped out across group stocks.

Here's what happened...

It started with India's biggest FPO.

bloomberg.com/news/articles/…

The night before the anchor book opened, #hindenburgresearch, a U.S. based activist short seller published a report making wide ranging allegations against #Adani.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

#AdaniGroup said the allegations were baseless and that it was considering legal action against #Hindenburg

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

Our ace chartist @bbrijesh posts the Index chart in his video. Let us understand on how he creates this index in Tradingview to analyze the charts. #Index #TechnicalAnalysis #charting

#Learning

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Use below mentioned parameters at your charting platform (tradingview).

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

Yearbook 2023 | Indian economy: An oasis in the desert 🏝️

Published by @hdfcmf

Here's a summary 👇🏼

1/n

Published by @hdfcmf

Here's a summary 👇🏼

1/n

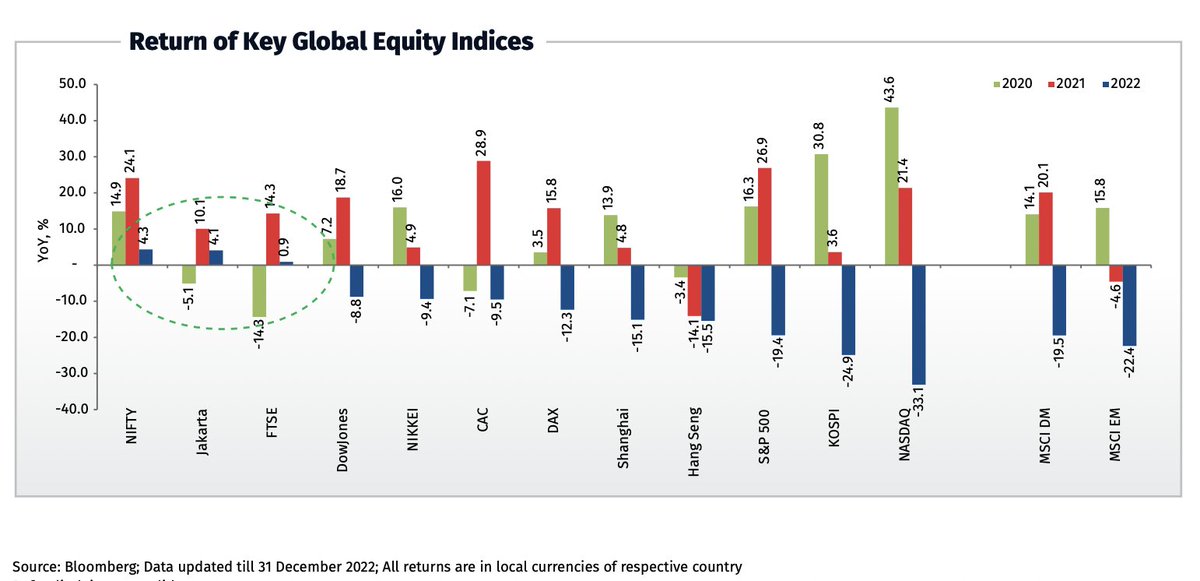

2022: A year of challenging returns

👉 Rising inflation & interest rates + growth concerns + rollback of COVID monetary stimulus + geopolitical events = pressure on returns

👉 Most asset classes delivered negative returns, except💲, Oil🛢️ & agricultural commodities🌾

2/n

👉 Rising inflation & interest rates + growth concerns + rollback of COVID monetary stimulus + geopolitical events = pressure on returns

👉 Most asset classes delivered negative returns, except💲, Oil🛢️ & agricultural commodities🌾

2/n

2022: A year of challenging returns

Global Equities: #NIFTY outperforms 😇as most global indices struggle 😢

India 🇮🇳 & Indonesia 🇮🇩 among the few markets to deliver +ve returns.

3/n

Global Equities: #NIFTY outperforms 😇as most global indices struggle 😢

India 🇮🇳 & Indonesia 🇮🇩 among the few markets to deliver +ve returns.

3/n

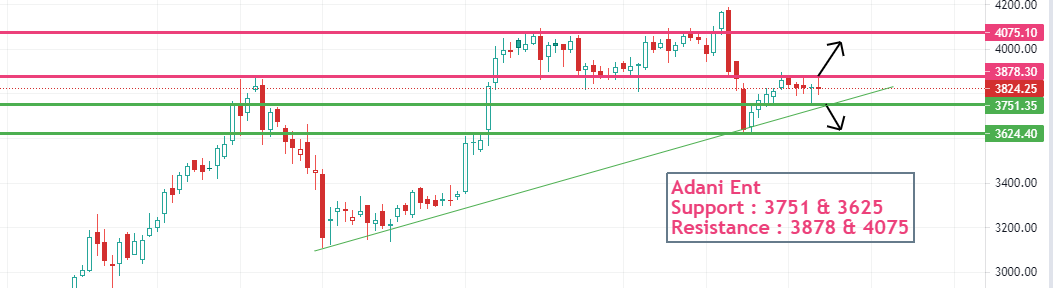

#Nifty50 stock chart

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

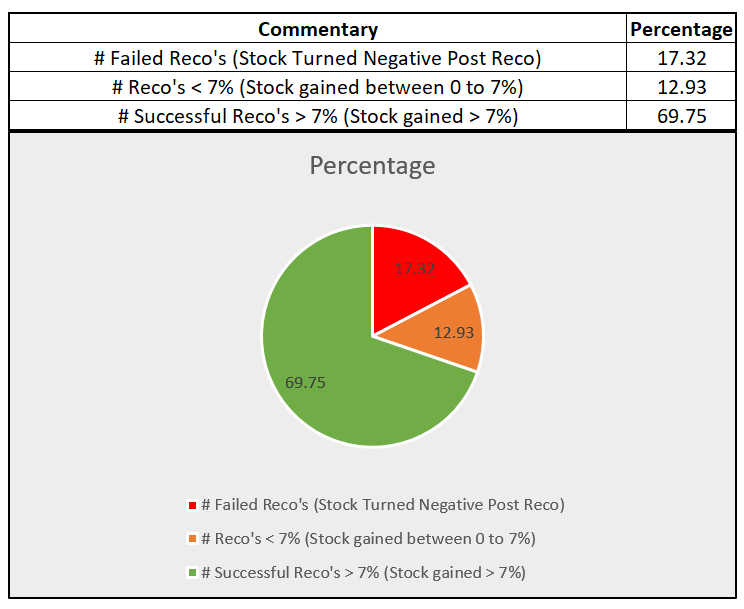

Stocks Suggestions Performance - 2022

Strategy & Objective: Is to identify cash market stock ideas having potential upside with minimum 7%, which is usually what Bank gives on a FD. We recommend booking profits after 7% and be ready for next opportunity.

Strategy & Objective: Is to identify cash market stock ideas having potential upside with minimum 7%, which is usually what Bank gives on a FD. We recommend booking profits after 7% and be ready for next opportunity.

Stop Loss: We recommend taking delivery of stocks with a stop loss of 5% from the reco price on closing basis.

Risk Management: We recommend, not to invest more than 10% of your capital in single stock, there by addressing concerns of position sizing and risk management.

Risk Management: We recommend, not to invest more than 10% of your capital in single stock, there by addressing concerns of position sizing and risk management.

Market prediction 2023

Indian economy, global outlook, investment & stock market

After a roller coaster ride in 2022

Let's welcome & rock 2023

For market enthusiasts

This thread for Indian markets & stocks

#Nifty

#Nifty50

#NiftyIT

#NiftyMetal

#BankNifty

#IndianStockMarket

Indian economy, global outlook, investment & stock market

After a roller coaster ride in 2022

Let's welcome & rock 2023

For market enthusiasts

This thread for Indian markets & stocks

#Nifty

#Nifty50

#NiftyIT

#NiftyMetal

#BankNifty

#IndianStockMarket

2023 will be the most Tricky year in markets

While Indian markets are de linked & decoupled from US markets in 2022

In 2023 the stage will be different & amazing

(No?

US markets are 5% away from 52 week low, Indian markets are 5% away from 52 weeks high) says a lot

While Indian markets are de linked & decoupled from US markets in 2022

In 2023 the stage will be different & amazing

(No?

US markets are 5% away from 52 week low, Indian markets are 5% away from 52 weeks high) says a lot

After FED rate hikes & regular Hawkish commentary by them, US markets have failed to show promise to investors

From every rise being sold, from every fly landing Crash, from every buy being Trap

US have eaten up Trillion of dollars in loss by investors!

& will continue to do so

From every rise being sold, from every fly landing Crash, from every buy being Trap

US have eaten up Trillion of dollars in loss by investors!

& will continue to do so

Thread🧵of Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

2⃣ NIFTY 50

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

Thread🧵of Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil @caniravkaria

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil @caniravkaria

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

2⃣ NIFTY 50

An inverted head and shoulder pattern was seen on chart few days back. If the index comes to retest and gives a strong bullish setup, we are looking for a strong upside move in nifty in coming months.

#Nifty #Nifty50 #TechnicalAnalysis

An inverted head and shoulder pattern was seen on chart few days back. If the index comes to retest and gives a strong bullish setup, we are looking for a strong upside move in nifty in coming months.

#Nifty #Nifty50 #TechnicalAnalysis

I have lost a lot of money in my life:

Here are specific reasons why.

[A thread...]

Here are specific reasons why.

[A thread...]

(1) I did not learn about equity investing:

- As a result, I kept on investing in Mutual Funds via Mutual Fund agents.

- Every time, I invested: I lost commissions not just to Mutual Fund managers but also to Mutual Fund agents, who sold me these products.

- As a result, I kept on investing in Mutual Funds via Mutual Fund agents.

- Every time, I invested: I lost commissions not just to Mutual Fund managers but also to Mutual Fund agents, who sold me these products.

How to avoid: while individual equity investing is tough, anyone could invest in passive mutual funds (eg. any #NIFTY50 Index).