Discover and read the best of Twitter Threads about #VCs

Most recents (24)

Una cronología del 2do colapso bancario más grande en la historia de EEUU. Las redes están a full con publicaciones sobre #SiliconValleyBank, y la historia es difícil de seguir. Acá un hilo 🧵con un poquito de research para intentar entender mejor cómo se llegó a esta situación

El miércoles pasado, Silicon Valley Bank $SIVB tenía $212 billones en activos y una capitalización de mercado de $16bn. 48 horas después, el banco quebró. ¿CÓMO SE LLEGÓ HASTA ESTA SITUACIÓN CRÍTICA?

La raíz del problema empezó en 2021 cuando las firmas, mayoría #startups respaldadas por #venturecapital, recaudaron $330bn (el doble que el año anterior). Todo esto en un mundo en donde sobraba liquidez, con Fed fund rates de 0,25 %, T-Bonds a 10 años al 1% e inflación de 1,4%

2022 was more of a body blow than a knockout punch to #Founders and #VCs.

Most Founders will stagger to their feet and strategize with their Investors.

So while the next 12 months will feel like 12 more rounds, it’s a fight that can be won.

8 predictions for 2023: 🧵👇

Most Founders will stagger to their feet and strategize with their Investors.

So while the next 12 months will feel like 12 more rounds, it’s a fight that can be won.

8 predictions for 2023: 🧵👇

2023 Prediction #1: Many important macros will stabilize

“You have to learn the rules of the game and then you have to play better than anyone else.” – Albert Einstein

Uncertainty freezes markets. Certainty liberates them.

“You have to learn the rules of the game and then you have to play better than anyone else.” – Albert Einstein

Uncertainty freezes markets. Certainty liberates them.

It’s highly likely that we’ll see the end to rate increases by mid-2023.

It’s highly likely that the drivers of inflation will flatten and/or start to improve by mid-2023.

It’s highly likely that housing prices will settle into a new norm by mid-2023.

It’s highly likely that the drivers of inflation will flatten and/or start to improve by mid-2023.

It’s highly likely that housing prices will settle into a new norm by mid-2023.

Cerita Sex - Janda Muda di Kantin SMA

Kedai gerah, kedai yang paling rame diserbu murid-murid setiap jam istirahat. Kalian tau kenapa? karena yang jualannya itu janda muda, namanya Mbak Lani.

#SANGE_AAAAAAAAAAH #SANGE_AAAAAAAAA #chatseks #vcs #moancewe #chatsekscerita

Kedai gerah, kedai yang paling rame diserbu murid-murid setiap jam istirahat. Kalian tau kenapa? karena yang jualannya itu janda muda, namanya Mbak Lani.

#SANGE_AAAAAAAAAAH #SANGE_AAAAAAAAA #chatseks #vcs #moancewe #chatsekscerita

Semua yang sering ke kedai gerah pasti udah tau latar belakangnya Mbak Lani, suaminya divonis 15 taun penjara, jadi dia mutusin buat cerai aja. Nah, semenjak jadi janda banyak banget yg deketin dia, mulai dari guru cowok yang masih bujangan sampe guru cowok yang udah punya istri.

“Beb mie acehnya satu yaa”.

“Mbak Lani kalau beli jus dikasih topping buku nikah sama mbak berapa ya?”.

“Mbak jus nya jangan pake gula lagi ya, soalnya manisnya udah ada disenyuman mbak”.

“Mbak Lani kalau beli jus dikasih topping buku nikah sama mbak berapa ya?”.

“Mbak jus nya jangan pake gula lagi ya, soalnya manisnya udah ada disenyuman mbak”.

General Partners (GP) are the showrunners of a #VC firm. If they perform well, they can make big money. But if they lose, their career is over.

A 🧵on how do VCs make money…

A 🧵on how do VCs make money…

#VCs make money in 2 ways:

1️⃣ Management Fee - typically 2% per annum of the total corpus across the fund lifecycle (10 years)

2️⃣ Carry - usually 20% of the profits generated after returning the initial capital of the investors

Let’s take the recent example of #IndiaQuotient👇

1️⃣ Management Fee - typically 2% per annum of the total corpus across the fund lifecycle (10 years)

2️⃣ Carry - usually 20% of the profits generated after returning the initial capital of the investors

Let’s take the recent example of #IndiaQuotient👇

The Bangalore based VC firm returned its first fund of ₹32 Cr with a net multiple of 5.9x to its investors. Took them 9 years.

So 𝗳𝗼𝗿 𝗲𝘃𝗲𝗿𝘆 𝗜𝗡𝗥 𝟭 𝗖𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗲𝗱 𝗶𝗻 𝘁𝗵𝗲 𝗳𝘂𝗻𝗱, 𝘁𝗵𝗲𝘆 𝗿𝗲𝘁𝘂𝗿𝗻𝗲𝗱 𝗜𝗡𝗥 𝟱.𝟵 𝗖𝗿 𝘁𝗼 𝘁𝗵𝗲𝗶𝗿 𝗟𝗣𝘀 🔥

👇

So 𝗳𝗼𝗿 𝗲𝘃𝗲𝗿𝘆 𝗜𝗡𝗥 𝟭 𝗖𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗲𝗱 𝗶𝗻 𝘁𝗵𝗲 𝗳𝘂𝗻𝗱, 𝘁𝗵𝗲𝘆 𝗿𝗲𝘁𝘂𝗿𝗻𝗲𝗱 𝗜𝗡𝗥 𝟱.𝟵 𝗖𝗿 𝘁𝗼 𝘁𝗵𝗲𝗶𝗿 𝗟𝗣𝘀 🔥

👇

1/ Talk about #proofofreserves /liabilities/solvency as the solution to @FTX_Official misses the surrounding parts which could make crypto a viable alternative to the fiat system. Join as we journey through:

☑️ Quality of reserves

💸 Capital &💧liquidity

💰 Collateral

#FTX

☑️ Quality of reserves

💸 Capital &💧liquidity

💰 Collateral

#FTX

2/

🧾 Transaction histories and 💳 Credit scores

% Fractional banking

🪙 New money creation

with a little bit of:

🆔 @w3c Verifiable Credentials #W3C

to build consumer protection and stop this happening again🛑. It's going to be a long one, strap in!

#FTXScandal

🧾 Transaction histories and 💳 Credit scores

% Fractional banking

🪙 New money creation

with a little bit of:

🆔 @w3c Verifiable Credentials #W3C

to build consumer protection and stop this happening again🛑. It's going to be a long one, strap in!

#FTXScandal

3/ Let's start with ☑️ Quality of Reserves. This is covered excellently by the @FT below so pulling out the key pieces from FTX 👇

#cryptosignals #ftxbankruptcy #ftxwithdrawal

#cryptosignals #ftxbankruptcy #ftxwithdrawal

Founders are busy re-structuring their operating plans to reduce burn.

A reduction in burn almost always slows growth which #VCs will interpret as a negative signal.

The result is confusion and loads of bad advice.

Is this a solvable problem? 🧵👇

A reduction in burn almost always slows growth which #VCs will interpret as a negative signal.

The result is confusion and loads of bad advice.

Is this a solvable problem? 🧵👇

Initially, a startup is merely an idea and the goal of a Founder is to learn every day and adjust their startup’s operating plan based on these learnings.

If they’re right they’ll build something special.

If they’re wrong they’ll lose their Investors’ money.

If they’re right they’ll build something special.

If they’re wrong they’ll lose their Investors’ money.

A big piece of the Founder’s job is to answer the following questions:

👉How much can I learn for how much money?

👉How quickly can I learn what I need to learn?

👉What is the cost to scale into independence?

👉How high is up?

The answers to these questions matter a lot.

👉How much can I learn for how much money?

👉How quickly can I learn what I need to learn?

👉What is the cost to scale into independence?

👉How high is up?

The answers to these questions matter a lot.

Gigantic businesses can be created when an amazing Founding team focuses its attention on a rock-solid business idea that’s perfectly aligned with an emerging mega trend.

This is what #Founders and #VCs live for.

Curious what this looks like for a 15-month-old company?

This is what #Founders and #VCs live for.

Curious what this looks like for a 15-month-old company?

The Problem Statement

The pandemic has taught the world that it’s possible to effectively work remotely. One result of this discovery is that many knowledge workers are interested in occasionally working from “destination locations” that allow them to mix work with fun.

The pandemic has taught the world that it’s possible to effectively work remotely. One result of this discovery is that many knowledge workers are interested in occasionally working from “destination locations” that allow them to mix work with fun.

But there hasn’t been a great way to find rentals in vacation destinations where being able to work remotely is a requirement.

On sites like Airbnb, what you see and what you get varies wildly. Reliable high-speed internet and dedicated work zones are rarely “as advertised.”

On sites like Airbnb, what you see and what you get varies wildly. Reliable high-speed internet and dedicated work zones are rarely “as advertised.”

#VCs and #startups are dealing with the reality that today’s environment is brutal compared to what it’s been like over the past few years.

The reason for the abrupt shift is that Darwin went on vacation for a few years but has finally returned.

This changes EVERYTHING! 🧵👇

The reason for the abrupt shift is that Darwin went on vacation for a few years but has finally returned.

This changes EVERYTHING! 🧵👇

It’s undeniable that the VC and startups ecosystems feel different in 2022 than they did in 2020 and 2021.

For years, money was flowing freely from LPs to VCs and from VCs to startups. Many startups went public or were sold and the returned liquidity added fuel to the fire.

For years, money was flowing freely from LPs to VCs and from VCs to startups. Many startups went public or were sold and the returned liquidity added fuel to the fire.

But today’s markets aren’t behaving like they did in recent years.

Worsening macro conditions short circuited a long bull run and Investors are shifting from risk-on to risk-off mode. Public stocks adjusted first but the ripple effect is starting to impact the private markets.

Worsening macro conditions short circuited a long bull run and Investors are shifting from risk-on to risk-off mode. Public stocks adjusted first but the ripple effect is starting to impact the private markets.

What is Ergo?

Ergo is a programmable PoW #blockchain like #Ethereum, without gas fees and builds upon #Bitcoin's UTXO model.

#Ergo serves as an efficient, decentralized and secure, smart contract platform, with optional privacy.

🧵👇 Let's Explore

Ergo is a programmable PoW #blockchain like #Ethereum, without gas fees and builds upon #Bitcoin's UTXO model.

#Ergo serves as an efficient, decentralized and secure, smart contract platform, with optional privacy.

🧵👇 Let's Explore

Fair launch, no pre-mine no #VCs

"#Cryptocurrency should provide tools to enrich ordinary people. Small businesses that are struggling to make ends meet, not big depersonalized financial capital. This is what inspired me. This is my dream"

@chepurnoy

ergoplatform.org/en/blog/2021-0…

"#Cryptocurrency should provide tools to enrich ordinary people. Small businesses that are struggling to make ends meet, not big depersonalized financial capital. This is what inspired me. This is my dream"

@chepurnoy

ergoplatform.org/en/blog/2021-0…

Another great feature of @fraser_again on @TechNative discussing why #NFTs & #SBTs aren’t the best solutions for digital identity. Read the thread 👇

technative.io/why-nfts-and-s…

technative.io/why-nfts-and-s…

What a week!

We’re proud to be listed on @LBank_Exchange.🥳

LBank is one of the leading crypto exchanges in the world. This adds another option for cheqmates to help us in the fight to get back full ownership and control of our data.

cheq it out:👇

We’re proud to be listed on @LBank_Exchange.🥳

LBank is one of the leading crypto exchanges in the world. This adds another option for cheqmates to help us in the fight to get back full ownership and control of our data.

cheq it out:👇

Partners can now create and manage did:cheqd #DIDs more easily, and for the first time on cheqd issue and verify Verifiable Credentials (#VCs) and Verifiable Presentation (#VPs)

Don’t forget to cheq out our latest blog for all the juicy details

cheqd.link/jru5

👇

Don’t forget to cheq out our latest blog for all the juicy details

cheqd.link/jru5

👇

We’re pleased you’ve pitched some ideas. We're looking for more ideas on #DEX pairs specifically.

Please take the opportunity to gather more thoughts and have your say by Sunday 28th August 2300 UTC +1. Please use the hashtag #cheqdPair @cheqd_io, and we’ll collect ideas.

👇

Please take the opportunity to gather more thoughts and have your say by Sunday 28th August 2300 UTC +1. Please use the hashtag #cheqdPair @cheqd_io, and we’ll collect ideas.

👇

Always at the forefront of technological innovation, the online casino industry was among the first to recognize the advantages of Ethereum. Even though Bitcoin remains the world’s largest and arguably the most popular cryptocurrency, more and more slot #HOBIPALOOZA #RHOA #VCS

megaslot.onepage.website players make ETH their preferred payment method. Prized for its incredible versatility, the Ethereum network provides for almost limitless possibilities, but hassle-free and easy deposits are the main reason why many gamblers have switched to Ether.

tree.taiga.io/project/agente… The great news is funding your player account with the second-largest digital currency just got even easier thanks to a wallet called MetaMask. Regardless of whether you are new to the universe of digital assets or an old hand at crypto gaming, after

#AfricaTech #Reflections and the importance (plus issues) with how some think about #TAM (Total Addressable Market) in our ecosystem. Here we go 👇🧵:

1/ We(#VCs) care a lot about TAM. If it’s not big enough, it makes our ability to imagine a large enough exit problematic. What is large enough exit? One where our share at exit (say 5-12% post dilution in future rounds) is a fund returner. On $150m fund – you can do the math.

2/ Africa has many ‘large problem’ or ‘large verticals’. #Agri, #Health, #Education, #Logistics, #Agri and many more. There are also horizontal ones such as access to payments, and B2B ones. While data is thin, many get the part of how big is the overall market somewhat right.

I spoke to a class of @KauffmanFellows #VCs on managing through a crisis, and here are some takeaways from our thoughtful discussion. (thread) 1/

First, don’t believe the doomsayers. Recall that after Black Monday (Oct 1987), pundits were eulogizing @Microsoft & @Apple. But there is an art & craft – for VCs and their companies – to managing a downturn. /2

Lessons from past crises:

1) Now is the time to extend venture debt lines; if markets continue tanking terms will degrade sooner than you expect.

1) Now is the time to extend venture debt lines; if markets continue tanking terms will degrade sooner than you expect.

We’re excited to share that the @cheqd_io DID resolver is now publicly available on our @github.

We’re big fans of #OpenSourcing all that we can, and this is an exciting opportunity to share our work!

github.com/cheqd/did-reso…

But what does this mean?

Read on 🧵

We’re big fans of #OpenSourcing all that we can, and this is an exciting opportunity to share our work!

github.com/cheqd/did-reso…

But what does this mean?

Read on 🧵

A #DID (#DecentralisedIdentifier) is a unique identifier that doesn't require a centralised registration authority because it is registered with a distributed ledger technology or other form of registry.

This is known as a Verifiable Data Registry.

w3.org/TR/did-core/

This is known as a Verifiable Data Registry.

w3.org/TR/did-core/

#DIDs are the cornerstone of #SSI and work closely with #VCs (#VerifiableCredentials)

Learn more in our example below which neatly uses James Bond's Aston Martin

learn.cheqd.io/overview/intro…

Learn more in our example below which neatly uses James Bond's Aston Martin

learn.cheqd.io/overview/intro…

I've been studying @blknoiz06 for the last week.

Here are the top things I've learned from him. 🚀

A thread 🧵 👇 "imagine letting n***** outwork you"

Here are the top things I've learned from him. 🚀

A thread 🧵 👇 "imagine letting n***** outwork you"

1. His background

He's a trader, researcher, analyst and shares his profound views on Substack and #Twitter @blknoiz06

Held #Altcoins when they crashed during the last cycle and wasn't all in crypto afterwards, until he realized how much money he was leaving on the table. 💰

He's a trader, researcher, analyst and shares his profound views on Substack and #Twitter @blknoiz06

Held #Altcoins when they crashed during the last cycle and wasn't all in crypto afterwards, until he realized how much money he was leaving on the table. 💰

He missed the #DeFi summer, because he wasn't paying attention in Bear🐻. As he saw the 2017 cycle, he wanted to fully take advantage of the next bull run🐂.

He nailed all the trades in 2021: @AxieInfinity, @solana, @avalancheavax, @harmonyprotocol, @terra_money

He nailed all the trades in 2021: @AxieInfinity, @solana, @avalancheavax, @harmonyprotocol, @terra_money

To reserve or not to reserve, that is the question… and a question we are asked frequently by #VCs.

The answer? It depends on your investing strategy, but TBD on results.

😉

The answer? It depends on your investing strategy, but TBD on results.

😉

#VCs take a couple different approaches in their initial check vs follow on strategies. Here’s what we see in our database ➡️

#OpenLP

#OpenLP

First off - what is the rationale for optimizing for initial dollars into a company vs saving follow on dollars in ‘reserve’?

There's a carbon rush currently going on in the #Pacific. All sorts of shady characters are being drawn to countries such as #PNG in search of striking gold in the form of 'green' and 'blue' carbon offsets generated by the regions vast forests and oceans...🧵

The sudden demand for carbon credits appears to be at least partly due to the Australian government's continuing support for the gas industry, and the need for cheap carbon offsets to greenwash their image and claim #NetZero emissions.

There’s a lot of strong opinions about VC’s from fellow #startups .

I don’t contribute much as my business is very young.

But here are some recent learnings that have really help me with #vcs

👇👇👇

I don’t contribute much as my business is very young.

But here are some recent learnings that have really help me with #vcs

👇👇👇

1) It’s competitive for VC’s

They are all looking for great #startups

We look for VC’s in predictable places, but they have to scour the world looking everywhere for us

A VC from another continent used a data scientist to find me this year. What?! 🔎

They are all looking for great #startups

We look for VC’s in predictable places, but they have to scour the world looking everywhere for us

A VC from another continent used a data scientist to find me this year. What?! 🔎

2) Understand what you need

Is it capital, networking or domain specific skills?

If it’s anything other than capital to scale, have a hard think about your team.

VC’s don’t build businesses, they invest in them.

We’re the experts of our businesses. 💪

Is it capital, networking or domain specific skills?

If it’s anything other than capital to scale, have a hard think about your team.

VC’s don’t build businesses, they invest in them.

We’re the experts of our businesses. 💪

Crypto funds looking to transition into #RIAs:

• @a16z, @Sequoia & other VCs have gone from ERA to RIA

• Registration is costly & time consuming but not end-all

• If your fund is valued >$150m this year, you must register by March/June next year.

More on this issue 🧵 1/x

• @a16z, @Sequoia & other VCs have gone from ERA to RIA

• Registration is costly & time consuming but not end-all

• If your fund is valued >$150m this year, you must register by March/June next year.

More on this issue 🧵 1/x

2/ Crypto fund formations are often costly because of compliance

• In CA, the 'retail buyer fund' exception requires qualified clients—$2.2m net worth—to charge carry

• Federally, if your funds grow >$150m you must register.

But how does it work?

• In CA, the 'retail buyer fund' exception requires qualified clients—$2.2m net worth—to charge carry

• Federally, if your funds grow >$150m you must register.

But how does it work?

3/ As a CA-based investment adviser, your crypto fund will have regs you won't know about.

CA State non-VC ERAs require:

• PPM/disclosures

• Audits

• Qualified Clients

These regs won't bite until an LP receives a distribution YEARS down the road.😳

CA State non-VC ERAs require:

• PPM/disclosures

• Audits

• Qualified Clients

These regs won't bite until an LP receives a distribution YEARS down the road.😳

Hey GPs - In the last few weeks I’ve had multiple asks about emerging manager benchmarks/what we are seeing for 2019 (and other recent) vintages.

So here’s a quick 🧵 breaking down what we see in the case of 2019 venture funds and the greater LP context…

#OpenLP

So here’s a quick 🧵 breaking down what we see in the case of 2019 venture funds and the greater LP context…

#OpenLP

Key point: 2019 funds, emerging or otherwise, are *really* new.

Stating the obvious here, but it’s worth reiterating.

In the olden days of venture, asking about benchmarks on funds <2 years old wasn’t a thing.

Stating the obvious here, but it’s worth reiterating.

In the olden days of venture, asking about benchmarks on funds <2 years old wasn’t a thing.

Cambridge specifically caveats that “research shows that most funds take at least six years to settle into their final quartile ranking.”

But what the heck...welcome to 2021! 😂

But what the heck...welcome to 2021! 😂

#InvArch is an intellectual property & decentralized development network for #web3. InvArch is not just new to the @Polkadot ecosystem, but also a novel project throughout the entire #blockchain community.

This thread serves as a brief introduction to the project.

1/24

This thread serves as a brief introduction to the project.

1/24

First, it is important to understand the three (3) key focuses of the network:

1.) Allow users to tokenize their ideas (intellectual property #IP).

2.) Provide a secure environment where ideas can be shared.

3.) Foster a network for collaboration and partnership forming.

2/24

1.) Allow users to tokenize their ideas (intellectual property #IP).

2.) Provide a secure environment where ideas can be shared.

3.) Foster a network for collaboration and partnership forming.

2/24

It’s September - time for the annual run to raise/close out #VC funds before the end of the year. For many #GPs - this means reaching out to an LP who passed on a previous fund.

This thread deep dives into what to keep in mind as you circle back and reach out to #LPs that passed in the past (which I *do* recommend doing btw)👇

#OpenLP

#OpenLP

(Note: Drawing inspiration from this wonderful thread by @dunkhippo33 on a similar dynamic when entrepreneurs are turned down by #VCs:)

Are #Startup valuation any way justified?

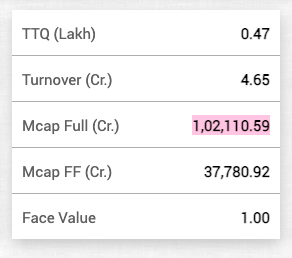

Closing price of #Zomato on #BSE today was Rs. 132.60 at this price, Market cap of Zomato (Total valuation of Company) is at Rs. 1,04,027 Crores. Which means #Zomato is already in top 50 Companies of India market cap wise (1/n)

Closing price of #Zomato on #BSE today was Rs. 132.60 at this price, Market cap of Zomato (Total valuation of Company) is at Rs. 1,04,027 Crores. Which means #Zomato is already in top 50 Companies of India market cap wise (1/n)

#GodrejConsumer which was listed on 18-06-2001 and having a track record of giving constant profit for atleast 10 years (screener.in/company/GODREJ…) is valued just below #Zomato. despite comparatively much stronger performance and track record of Profit and Dividend (2/n)

On the other hand #Zomato has accumulated loss of 56,00,30,00,000 INR (Source: Zomato RHP - in INR Million) as on 31/3/21 and still it is valued at such a higher price. Zomato is valued higher than #TataMotors #Britannia #BergerPaints to name few (3/n)

moneycontrol.com/stocks/marketi…

moneycontrol.com/stocks/marketi…