Discover and read the best of Twitter Threads about #jacksonhole

Most recents (15)

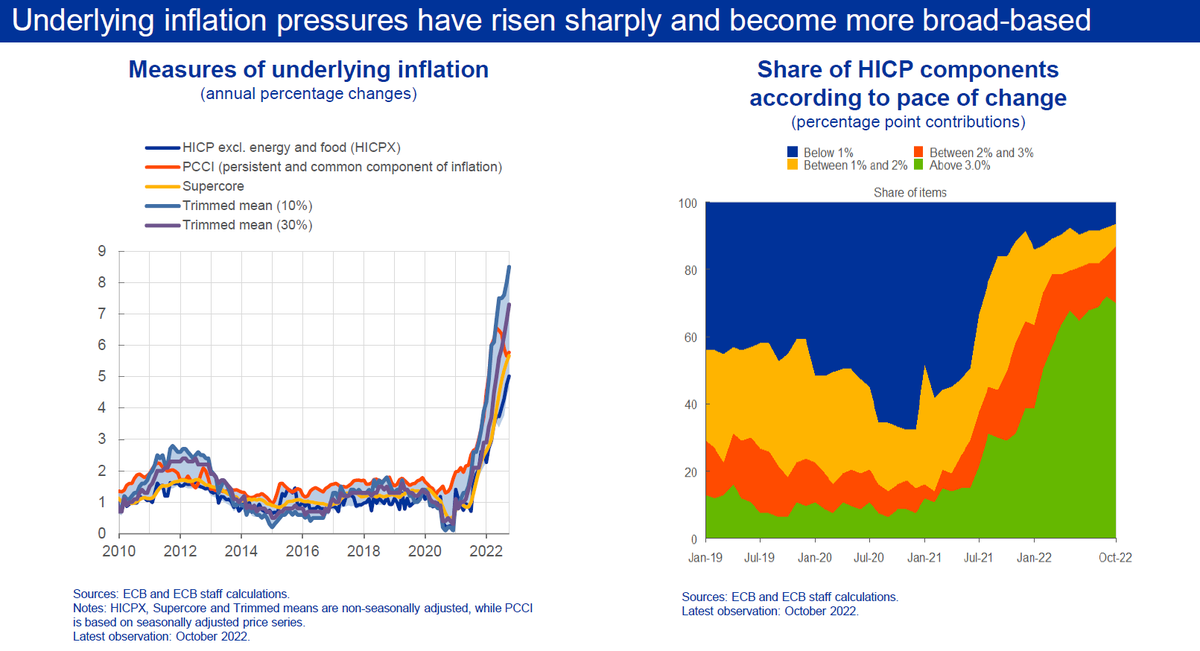

2022 was another challenging year for the @ecb. My personal review of the year collects some of my speeches and a few striking charts. All speeches and accompanying slides can be found on the @ecb’s website. A special thanks goes to #ECBstaff for their continuous support! 1/19

The speech “Looking through higher energy prices? Monetary policy and the green transition” (8 Jan 2022) argued that monetary policy cannot afford to look through higher energy prices if they pose a risk to medium-term price stability. #ClimateChange 2/19 ecb.europa.eu/press/key/date…

#Chart US shale oil production has been responding more slowly to rising oil prices, as fossil investments may no longer prove profitable to investors over the medium term. 3/19

In my speech “Finding the right mix: monetary-fiscal interaction at times of high inflation” at the Bank of England Watchers’ conference I explained why I see a risk that monetary and fiscal policies are pulling in opposite directions, leading to a suboptimal policy mix. 1/19

In his @federalreserve #JacksonHole speech #ChairPowell stated emphatically that the #FOMC’s “overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy.”

In other words, we take his statement today to mean that the #Fed won’t be easily swayed into reversing rate #hikes next year, and will stay with the elevated Funds rate for a long time.

The #Fed has clearly been (appropriately) rushing to get to a destination of #inflation-denting restrictive rate (and #liquidity) policy in order to break extremely high levels of inflation, while hopefully not thrusting the economy into a deep #recession.

🇺🇸 #JacksonHole | Since July #Fed meeting, data point to GDP weakness, housing recession, inflation peak but also lower unemployment rate

1/ GDP: Towards downward revisions

*GDP fell for a 2nd straight quarter in 2Q

*Aug. Composite PMI crashed to 45, lowest since May 2020 ⚠

1/ GDP: Towards downward revisions

*GDP fell for a 2nd straight quarter in 2Q

*Aug. Composite PMI crashed to 45, lowest since May 2020 ⚠

*Atlanta Fed expects 3Q GDP to be close to 1.5% in 3Q

*Taking into account these figures, it seems that 4Q21/4Q22 GDP growth will be close to 0%

*In June, Fed expected 1.7% growth so there could be a significant downward revision in Sep.

*Taking into account these figures, it seems that 4Q21/4Q22 GDP growth will be close to 0%

*In June, Fed expected 1.7% growth so there could be a significant downward revision in Sep.

2/ Housing: a key downside risk to GDP projections

*Refinancing index hit the lowest since 2001

*Existing and new home sales fell by >20% YoY

*Inventory rebounded (especially for new home sales)

*Refinancing index hit the lowest since 2001

*Existing and new home sales fell by >20% YoY

*Inventory rebounded (especially for new home sales)

As we approach the @federalreserve’s monetary policy conference at #JacksonHole this week, a question we’ve been asking ourselves is whether the abundance of survey-based, and goods-oriented, #economic data may be overstating the weakness in the #economy as a whole?

Without question, many broad-based surveys, including those focused on #ConsumerConfidence and small #business optimism, are painting a very bleak picture of the #economic trajectory.

This must be telepathy...Last night I watched "Trainwreck: Woodstock 99" () and then I read that @LukeGromen compares Powell to Limp Bizkits' Fred Durst at Woodstock99:

"For the uninitiated, in 1999, concert planners hosted 250,000+ concertgoers for a 3-day music festival on a closed US Air Force base in Rome, NY. Between the near-100-degree temperatures, the complete lack of shade (it was an airstrip), the exorbitant prices for tickets and..

concessions (including water), wanton drug and alcohol use, insufficient bathrooms, showers, fresh water, sleep, and woefully inadequate security, the conditions were ripe for a riot...

Important court ruling with wide-ranging implications for the future #Chineseculture #workersrights @NewsHour @NPR

@WSJ @BBCBreaking @AP

@WSJ @BBCBreaking @AP

Also: @washingtonweek tonight

#WashWeekPBS 8/7c @PBS

@JaneFerguson5 discussing the situation in #afghanistan

#WashWeekPBS 8/7c @PBS

@JaneFerguson5 discussing the situation in #afghanistan

Beyond immediate inflationary pressure and quarterly corporate profits abroad, the counterintuitive shift strengthens producers leverage in the supply-chain as well as creating potential trade/socio-economic instability #uncertainty #Fed #business #dollarindex

It was 73 degrees and sunny in #JacksonHole, Wyoming, today; a perfect day for all those who were there….

Yet, there were no #monetary policy officials present at the traditional location of the @KansasCityFed’s late-summer #economic policy symposium, since they were conducting a “virtual symposium.”

That symposium provided #ChairPowell the opportunity to lay out a reasonably sunny perspective on the U.S. #economy, but also one that was not out of the woods yet, in terms of Covid variant risk and a maximum #employment target still to be achieved.

Taper is coming soon but I definitely see no indication from #FOMC minutes that taper is coming as soon as #JacksonHole 1/5

The uncertainty on the taper timing is quickly shrinking to zero, so it’s not clear to me why there would be any drama left when it happens. 3/5

.@PhRMA spox to me just now: "We are not aware of any meeting."'

So, what was that Trump was saying today ...

#DrugPrices #DrugPricing #pharma #biotech

So, what was that Trump was saying today ...

#DrugPrices #DrugPricing #pharma #biotech

Recall when all those industry executives exited Trump's advisory committees after #Charlottesville, with CEO one of the last to exit.

Since then, many CEOs, including J&J, have returned to White House, attended Trump events.

Given his recent remarks, are they still eager?

Since then, many CEOs, including J&J, have returned to White House, attended Trump events.

Given his recent remarks, are they still eager?

.@PhRMA @steveubl recently was in #JacksonHole with Ivanka & Jared fundraising for Republicans in midst of #COVID19 #pandemic.

What are the optics risks now for #pharma when any Trump event is a wildcard?

What do CEOs think about Trump's recent remarks about #KyleRittenhouse?

What are the optics risks now for #pharma when any Trump event is a wildcard?

What do CEOs think about Trump's recent remarks about #KyleRittenhouse?

The @federalreserve’s #JacksonHole Policy Symposium has typically been thought of as an event of #academic contemplation, rather than of active #policy innovation, but 2020’s event proved to be the exception to the rule.

That’s because #Fed #ChairPowell surprised many by introducing the #FOMC’s Statement on Longer-Run Goals and Monetary Policy Strategy, which was not expected until later in the year.

Speculation is mounting that Powell will use the annual Jackson Hole conference to announce a revamp of how monetary policy is set. The speech, scheduled for the first day of the economic symposium later today, could outline a shift by the Fed towards average inflation targeting.

If the yields on long-dated Treasury notes shoot higher after the speech, likely lifting the $ up as well, that would imply..

...investors don’t think Fed has gone far enough in reassuring markets that i/r will remain low for a very long period of time if they anticipate that the new policy would push up inflation in the long run.

#jacksonhole #jeromepowell

The possible era of #deflation in a fight against #inflation

Despite Zero or low Interest rates central banks have had a hard time reaching their inflation targets. But now it seems confirmed that it’s not low central bank policy rate which causes...

The possible era of #deflation in a fight against #inflation

Despite Zero or low Interest rates central banks have had a hard time reaching their inflation targets. But now it seems confirmed that it’s not low central bank policy rate which causes...

low inflation , but rather the low real interest rate

Ever since central banks embarked on their near zero interest rate policies and large scale asset purchase programme , Reality has proved them wrong , we have seen trends towards deflation rather than inflationary pressures

Ever since central banks embarked on their near zero interest rate policies and large scale asset purchase programme , Reality has proved them wrong , we have seen trends towards deflation rather than inflationary pressures

Post 2020, what we are seeing is loss of jobs and low employment levels , in case there is severe declines in demand side , and If employers are unwilling or unable to reduce wages they will have to reduce the number of employees,

Thus far, the #Fed Symposium at #JacksonHole, Wyoming, and Chair Powell’s morning speech, hasn’t provided much new information, and we think investors need to focus now on Frankfurt, where #ECB President Mario Draghi is expected to unveil significant policy stimulus next month.

On current policy: Chair Powell cites three factors of concern: “slowing global growth, #trade policy uncertainty, and muted #inflation,” which were the reasons behind the July rate cut, and now look to be the justification for the next one at September #FOMC meeting.

A brief discussion of how we are prepared for today's #FOMC minutes and Friday's #JacksonHole conference. 1/

First, know that #FOMC minutes are dramatically edited versions of transcripts so there is meaning beyond the last meeting. In the intermeeting period FINANCIAL CONDITIONS HAVE WEAKENED. 2/