Discover and read the best of Twitter Threads about #ppploans

Most recents (24)

More #Rethuglicans who cried foul on PPP loans got their own forgiveable loans, & even applied to have them forgiven!

GOP Chairman Frank Eathorne told WyoFile earlier in 2022 he regretted accepting fed agricultural subsidies totaling $109,000 for the yrs 2001-2005. #hypocrite

GOP Chairman Frank Eathorne told WyoFile earlier in 2022 he regretted accepting fed agricultural subsidies totaling $109,000 for the yrs 2001-2005. #hypocrite

2/“Since then, I have learned that gov handouts are not for me,” the Wyoming GOP chair Eathorne said. “They don’t fit my political ideology. If a private business can’t remain in business on its own, it probably shouldn’t be asking for gov help.”

#PPPLoanForgiveness

#PPPLoanForgiveness

3/In January 2021, however, Eathorne was approved for a $20,883 PPP loan — the max amt that a sole proprietor or self-employed individual could borrow. The loan, taken out under his full name, “William Eathorne,” retained 1 job, according to the record.

#PPPLoans

#PPPLoans

This week on @reveal, we talk about how business owners in majority White areas got approved for Paycheck Protection Program loans at much higher rates than those in majority Black, Latinx and Asian areas.

revealnews.org/article/rampan…

revealnews.org/article/rampan…

When #COVID19 shut down Annie Graham's clothing stores in Inglewood, she applied for a repayable government loan for small businesses during emergencies, but was denied based on her credit record. (📸by @jamesbernalfoto)

She also applied for a forgivable #ppploan, but didn’t get approved because a bank mistakenly told her she had to prove she had staff on payroll. But she didn’t have staff. Many small businesses never get big enough to afford having staff.

1/ The Paycheck Protection Program, one of the largest bailouts since the Great Depression, promised to help small businesses.

Yet our analysis of more than 5 million #ppploans found widespread racial disparities in where those loans were given out. revealnews.org/article/rampan…

Yet our analysis of more than 5 million #ppploans found widespread racial disparities in where those loans were given out. revealnews.org/article/rampan…

2/ The disparities were visible across the nation.

We found that in almost every metro area with a population of 1 million or more, the rate of lending to majority White areas was higher than the rates for majority Latinx, Black or Asian areas. revealnews.org/article/which-…

We found that in almost every metro area with a population of 1 million or more, the rate of lending to majority White areas was higher than the rates for majority Latinx, Black or Asian areas. revealnews.org/article/which-…

3/ Businesses in majority White areas received loans at about twice the rate as those in majority Latinx areas in multiple major metro areas including New York, Dallas, Phoenix, San Francisco, San Diego and Las Vegas.

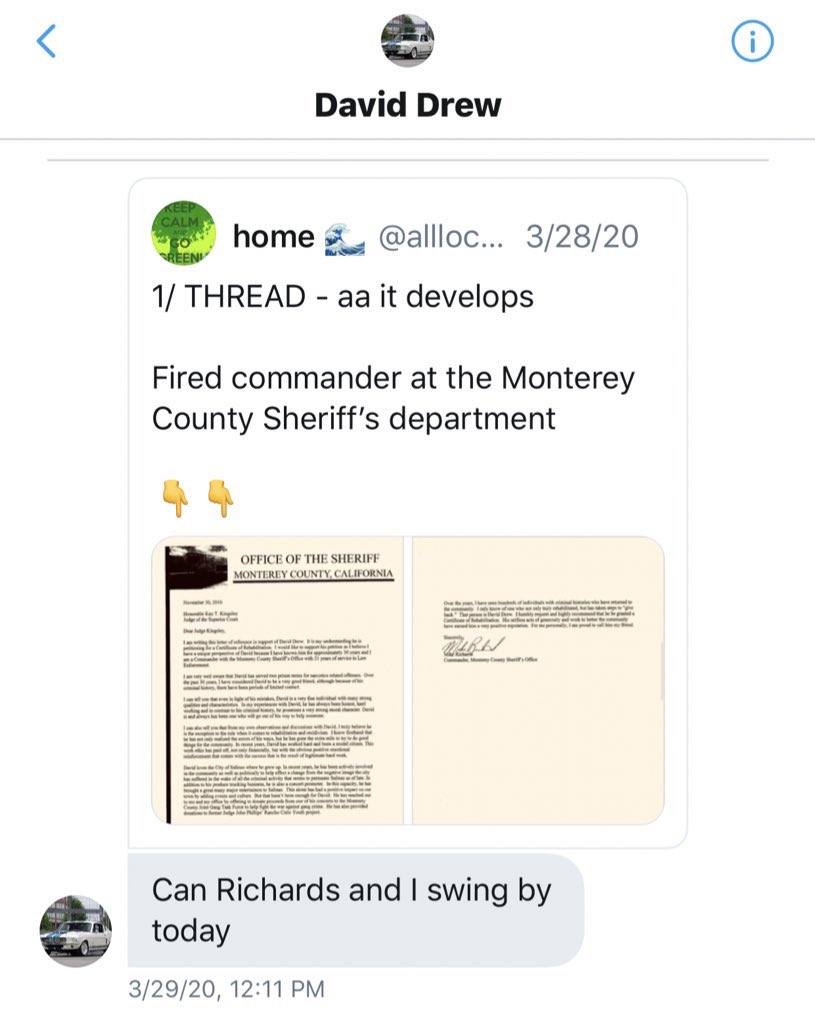

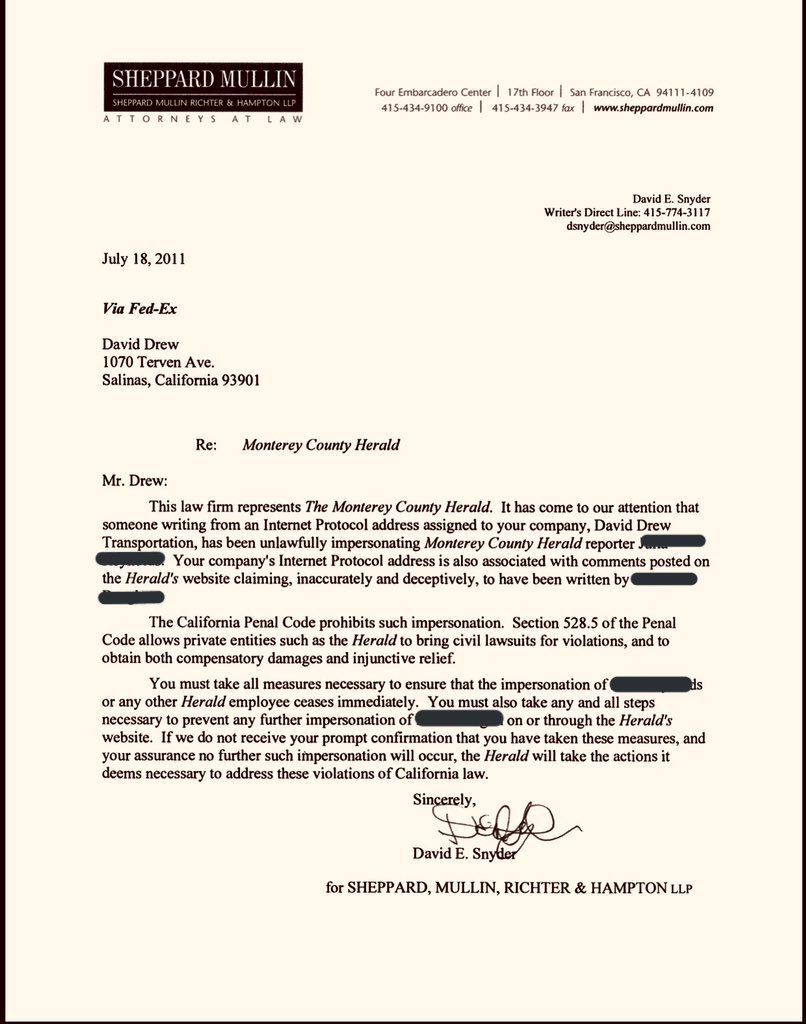

With a functioning news media this isn’t hard.

We no longer have news, just media.

Citizen journalism is what is breaking news. My advice: stick to politicians and public figures. They are the problem. Not your neighbor on NextDoor.

Who paid @JerryBrownGov? @GavinNewsom?

We no longer have news, just media.

Citizen journalism is what is breaking news. My advice: stick to politicians and public figures. They are the problem. Not your neighbor on NextDoor.

Who paid @JerryBrownGov? @GavinNewsom?

2/

the dude got $1.7 million in #PPP #ppploans from the Government while little mom and pop’s didn’t qualify for anything.

What’s wrong with this picture @mcgreevy99 ?

1. Multiple felonies

2. CA Supreme Court approval required

3. Continued on a negative path in community

the dude got $1.7 million in #PPP #ppploans from the Government while little mom and pop’s didn’t qualify for anything.

What’s wrong with this picture @mcgreevy99 ?

1. Multiple felonies

2. CA Supreme Court approval required

3. Continued on a negative path in community

The MEA teachers union, private prep schools and colleges, the businesses of @JohnJamesMI and @SenMikeShirkey and the @detroitzoo, @newhollandbrew, @BellsBrewery and @KewadinCasinos were among the recipients of #PPP loans in Michigan.

crainsdetroit.com/small-business…

crainsdetroit.com/small-business…

#PPPloans data is a little messy: @HonigmanLaw says it returned its $5M-$10M loan before the safe harbor deadline in mid-May but got on @SBAgov's list.

@855mikewins returned its $2M PPP loan before safe harbor deadline and that law firm wasn't listed.

@855mikewins returned its $2M PPP loan before safe harbor deadline and that law firm wasn't listed.

My colleague @nickrmanes reported in May on personal injury attorney Mike Morse returning his $2M #PPP loan, saying he could "weather this storm" without government assistance.

crainsdetroit.com/coronavirus/mo…

crainsdetroit.com/coronavirus/mo…

my friend @lolitataub asked for a #founders #startup guide on #legalissues & @paulbz tweeted about how founders often overlook tax issues in early days. So, here's a thread of things I've published in (far reaches of) @WSJ @Forbes & via my #VentureCapital class @Columbia_Biz

2) Let's start with #StockOptions: #VestingOptions for #startups in @WSJ Accelerators (might have paywall) - esp for grants to advisors blogs.wsj.com/accelerators/2…

3) Vesting stock grants & #Section83b #83bElections for founders & others (with detailed math + tax law) #restrictedStock

forbes.com/sites/edwardzi…

forbes.com/sites/edwardzi…

1) "Federal Reserve developed the #MainStreetLending Program to help credit flow to small and medium-sized businesses that were in sound financial condition before the pandemic."

2) after initial announcement of #MainStreetLending Program, Fed Reserve expanded it to: Create a 3rd loan option, w/increased risk sharing by lenders for borrowers with greater leverage &

Lowered the minimum loan size for certain loans to $500,000

federalreserve.gov/newsevents/pre…

Lowered the minimum loan size for certain loans to $500,000

federalreserve.gov/newsevents/pre…

3) this resulted in 3 loan (🍕) options: plain, pepperoni & mushroom: "termed new, priority, & expanded" 4 year loans:

New: $500K Minimum Loan Size

Priority: Ditto

Expanded: $10M Minimum Loan Size & up to a TON!

New: $500K Minimum Loan Size

Priority: Ditto

Expanded: $10M Minimum Loan Size & up to a TON!

Turns out that Brentwood School, which Steven Mnuchin & Michael Milken's kids attend has rec'd PPP $.

Who could have told them to apply

Who could possibly have made sure this happened..

#SaturdayMorning

latimes.com/california/sto…

Who could have told them to apply

Who could possibly have made sure this happened..

#SaturdayMorning

latimes.com/california/sto…

Late yesterday, after this story broke, Mnuchin tweeted:

“It has come to our attention that some private schools with significant endowments have taken #PPP loans. They should return them. @SBAgov #CARESAct #PPPLoans”

Can't make this stuff up!

“It has come to our attention that some private schools with significant endowments have taken #PPP loans. They should return them. @SBAgov #CARESAct #PPPLoans”

Can't make this stuff up!

And then Trump chimed in...

He's worried that his base will, for once rightly, take offense at the rich people associated w his admin getting preferential treatment while they struggle.

#SaturdayMorning politico.com/news/2020/05/0…

He's worried that his base will, for once rightly, take offense at the rich people associated w his admin getting preferential treatment while they struggle.

#SaturdayMorning politico.com/news/2020/05/0…

STARTING NOW: Join our hour-long #SolarTownHall for #Solar #GreenBuildings professionals! Today we are talking #PPPloans—the financial implications, what you need to do to receive full forgiveness, and how to maximize the benefits to your company. Join us: zoom.us/webinar/regist…

As always, @BayWareSolar_US CEO @boazsoifer opens our weekly #SolarTownHall with a welcome, as well as relevant insights from the @BWRE_Global global lens—one advantage of being part of an international family of companies. Join our live call right now: zoom.us/webinar/regist…

Our first speaker is GLYNT.ai CEO Martha Amram. She has been bringing insightful analysis from an economist's perspective on our #SolarTownHall events, assessing #COVID19 impacts to #solar professionals here in the United States. Join now: zoom.us/webinar/regist…

1/7: Despite challenges that come from being a massive new program less than 3 weeks old #PPP has:

-1.6 million #PPPloans averaging $206000

-74% for less than $150000

-Has helped save approximately 30 MILLION jobs

On thread below just a few examples:

lancasteronline.com/business/local…

-1.6 million #PPPloans averaging $206000

-74% for less than $150000

-Has helped save approximately 30 MILLION jobs

On thread below just a few examples:

lancasteronline.com/business/local…

US Senate has agreed to additional CARES Act funding & is adding an incremental $75B to the original $100B for #hospitals & #physicians —resolving any doubt—“language remains the same as CARES Act”—allocation to rural hospitals & “hot zones” presumably TBD by @HHSGov —vote soon.

2/ SBA’s #PPPloans program slated to receive an additional $250B unrestricted + $60B for smaller banks + $50Bin EIDL loans + $10B in EIDL grants + $2.1B in SBA administrative expenses—really? Who wants to bid w/ me that we can administer this program for a paltry $1.9B? Who....

3/ said famously “a billion here, a billion there, and pretty soon you’re talking real money,”? Senator Everett Dirksen (R-IL) who has a Senate office Bldg. named for him in DC—how in the world do we plan to pay for all of this very necessary spending?

This week is the projected peak of the illness in our state. What the people of Alabama are doing is working, & we need to keep at it! As a reminder, our current #StayAtHome order stays in effect until April 30. #TogetherAL @ALPublicHealth 1/6

The Exec Committee of my Coronavirus Task Force has been hard at work reviewing recommendations to safely reopen AL. I’m as eager as anyone to get our economy spinning on all cylinders again, but we must make sure we’re doing it in a smart & productive way. #TogetherAL 2/6

My office & I have been in touch with our Congressional delegation because we want to see Congress replenish the funds in the Paycheck Protection Program. This program is absolutely critical right now, especially to our small businesses. #PPPLoans #alpolitics #TogetherAL 3/6

#HedgeFundScams #TheyGotCaught #PPPloans

Shake Shack, owned by Hedge Fund Leonard Green and partners... some 'small business'

linkedin.com/pulse/shake-sh…

Shake Shack, owned by Hedge Fund Leonard Green and partners... some 'small business'

linkedin.com/pulse/shake-sh…

Who else is involved with Leonard Green? #blackstone of course! nytimes.com/2017/07/10/bus…

Three messages this morning based on questions I received over the weekend:

1. When will #PPP start again

1. When will #PPP start again

3. When and how should we re-open our economy again?

Some Thoughts on the #PPPloans and other small business stimulus now that the funds have dried up (hopefully temporarily). Some overriding thoughts I have are 1. The method and some of the issues of getting funds out, 2. The purpose of the funds, and 3. Where we go from here. 1/x

On the methodology of the #PaycheckProtectionProgram I know given the data out there that loans seemed skewed towards larger "small" businesses. I think that stems from a number of reasons. The first being just how banks work. 2/x

Banks are generally fairly conservative, risk adverse institutions- particularly post the banking collapse in 2008/2009. Having worked in that industry during that time period, I got to see the impact of this collapse and how banks changed as a result. 3/x

#PPP UPDATE 1/7:

I continue to see lots of misinformation reported & repeated on PPP.

This program is new to everyone,so not claiming its intentional.

But we can’t address the problems if we don’t understand how to distinguish between what WAS a problem & what IS a problem.

I continue to see lots of misinformation reported & repeated on PPP.

This program is new to everyone,so not claiming its intentional.

But we can’t address the problems if we don’t understand how to distinguish between what WAS a problem & what IS a problem.

#PPP UPDATE 2/7:

1st: Yes lots of confusion early on . Because no one on earth had ever done a #PPPloan until 11 days ago.

But lenders received clear guidance on the most important open questions last Thursday from Treasury & last Friday from Federal Reserve.

1st: Yes lots of confusion early on . Because no one on earth had ever done a #PPPloan until 11 days ago.

But lenders received clear guidance on the most important open questions last Thursday from Treasury & last Friday from Federal Reserve.

#PPP UPDATE 3/7:

2nd:Main reason some #smallbusiness having trouble getting into PPP is banks are overwhelmed with applications. Even the biggest banks are struggling with the level of demand.

One of the characteristics of crisis is that demand is greater than initial capacity.

2nd:Main reason some #smallbusiness having trouble getting into PPP is banks are overwhelmed with applications. Even the biggest banks are struggling with the level of demand.

One of the characteristics of crisis is that demand is greater than initial capacity.

1) On Friday @IRSnews issued NEW #FAQs resolving whether an employer that receives a #PPP #Loan may defer Employer portion of #socialSecurityTaxes under #CARESAct irs.gov/newsroom/defer…

2) Employers receiving #PPPloans may not defer the deposit&payment of the Employer share of #SocialSecurity tax "otherwise due AFTER the employer receives a decision from the lender that the loan was forgiven." #IRSFAQ #1

3) The deferral applies to deposits&payments of an Employer's share of #SocialSecurity #tax that would otherwise be required to be made during the "Payroll Tax Deferral Period" (March 27 through December 31, 2020). #CARES #Section2302 @IRSnews #FAQ 2

#PPP UPDATE 1/7:

As of 2:30pm yesterday we had:

=Over 480000 #PPPloans made

=Over $124 billion approved

=Covers an estimated 12 million jobs

Despite early challenges over 35% of funds have been committed in first 5 days.

Why we need more 💴 for PPP ASAP

As of 2:30pm yesterday we had:

=Over 480000 #PPPloans made

=Over $124 billion approved

=Covers an estimated 12 million jobs

Despite early challenges over 35% of funds have been committed in first 5 days.

Why we need more 💴 for PPP ASAP

#PPP UPDATE 2/7:

Status of issues still being reported in the media.

Banks Only Lending To Existing Customers:Treasury released non-bank lender application to approve new non-bank lenders into PPP. Will allow businesses without existing customer relationships to access PPP

Status of issues still being reported in the media.

Banks Only Lending To Existing Customers:Treasury released non-bank lender application to approve new non-bank lenders into PPP. Will allow businesses without existing customer relationships to access PPP

#PPP UPDATE 3/7:

Lender Liquidity:

-@federalreserve announced further details for its lending facility to create a secondary market for #PPPloans on Thursday

-@FDICgov relaxed regulations on banks’ leverage ratio for all PPP loans on Thursday.

Lender Liquidity:

-@federalreserve announced further details for its lending facility to create a secondary market for #PPPloans on Thursday

-@FDICgov relaxed regulations on banks’ leverage ratio for all PPP loans on Thursday.

#PPP NOTES 1/3:

Community banks have made the overwhelming % of #PPPloans so far.

Most big banks haven’t even started.

Democratic leaders say they want 1/2 the new money in #PPP for community banks but community banks are going to make WAY MORE than just 1/2 the loans as is.

Community banks have made the overwhelming % of #PPPloans so far.

Most big banks haven’t even started.

Democratic leaders say they want 1/2 the new money in #PPP for community banks but community banks are going to make WAY MORE than just 1/2 the loans as is.

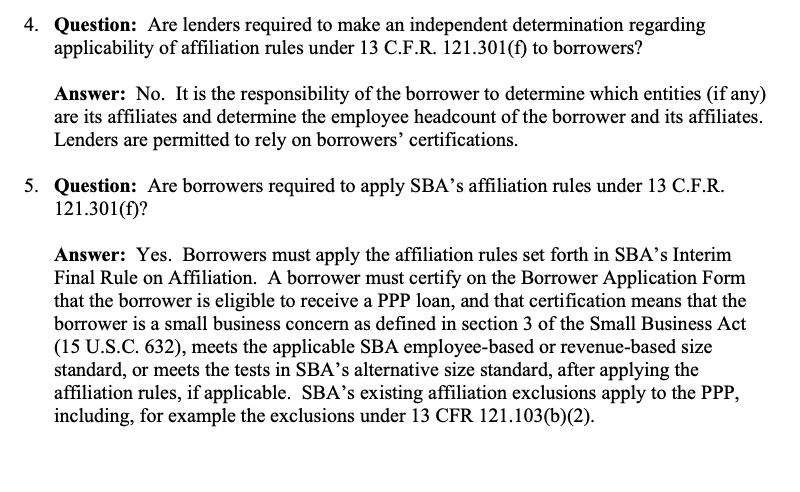

Key resources for small businesses & startups applying for #PPPloans:

First, here's everything that Treasury/SBA have published so far, including the Monday night FAQ on affiliation rules:

1/

home.treasury.gov/policy-issues/…

First, here's everything that Treasury/SBA have published so far, including the Monday night FAQ on affiliation rules:

1/

home.treasury.gov/policy-issues/…

Second, here's a helpful memo from @nvca with step-by-step instructions on how #PPPloan applicants need to accommodate investors with a 20-49.999% stake & stay eligible for #PPP in the first place:

2/

nvca.org/wp-content/upl…

2/

nvca.org/wp-content/upl…

Fri ~11pm: Treasury/SBA release first guidance on #PPPloans, helping large religious orgs & not small businesses.

Mon ~11pm: Second guidance just dropped. There's a typo in the URL ("Frequenty Asked Questions"). Not a good sign?

Let's dive in...

1/

home.treasury.gov/system/files/1…

Mon ~11pm: Second guidance just dropped. There's a typo in the URL ("Frequenty Asked Questions"). Not a good sign?

Let's dive in...

1/

home.treasury.gov/system/files/1…

Startups, small businesses, & investors were pleading for a bright-line rule for "affiliation," since eligibility for a #PPPloan may hinge on it.

Bright side: Banks can rely on the loan applicant's certifications, which should speed things up & keep SBA getting bogged down…

2/

Bright side: Banks can rely on the loan applicant's certifications, which should speed things up & keep SBA getting bogged down…

2/

UPDATE on #PPP in thread below:

1/7: Several large FinTech companies are ready to join as lenders as soon as @USTreasury releases their nonbank lender form. This is very important as it will expand lending capacity dramatically especially for #SmallBusinesses locked out by bank

1/7: Several large FinTech companies are ready to join as lenders as soon as @USTreasury releases their nonbank lender form. This is very important as it will expand lending capacity dramatically especially for #SmallBusinesses locked out by bank

#PPP UPDATE 2/7: Still waiting for @SBAgov & @USTreasury to release a program guide for #PPPloans which would provide clarity on a number of questions still holding back some lenders. We need this NOW.

#PPP UPDATE 3/7: @federalreserve announced today it will help clear up more space on lender balance sheets to issue #PPPloans by either making #PPP more attractive to secondary market buyers, or by buying #PPP loans from lenders directly. Details this week.

Yet another source of confusion about #PPPloans & the SBA affiliation rules:

The official @USGPO e-regulation site is out of date.

To see the rules that are actually binding right now, here's the @waybackmachine:

1/

web.archive.org/web/2017061902…

The official @USGPO e-regulation site is out of date.

To see the rules that are actually binding right now, here's the @waybackmachine:

1/

web.archive.org/web/2017061902…

Do *not* rely solely on the e-CFR site from @USGPO. The following reg text on @SBAgov affiliation criteria is no longer operative (I'll explain why in a moment):

2/

ecfr.gov/cgi-bin/text-i…

2/

ecfr.gov/cgi-bin/text-i…

Coincidentally, the SBA last updated its affiliation rules on Feb. 20 (see link below).

But tucked into the CARES Act, signed into law a month later, is a provision that wipes out that Feb. 20 update.

(If anyone knows the backstory, please speak!)

3/

federalregister.gov/documents/2020…

But tucked into the CARES Act, signed into law a month later, is a provision that wipes out that Feb. 20 update.

(If anyone knows the backstory, please speak!)

3/

federalregister.gov/documents/2020…

Guide to #PPPloans & SBA affiliation rules for the perplexed…

Here's the full SBA compliance guide, which neither Congress nor Treasury/SBA have changed in the least:

sba.gov/sites/default/…

I've crossed out the parts that *don't* apply to #PPP borrowers (and never did).

1/

Here's the full SBA compliance guide, which neither Congress nor Treasury/SBA have changed in the least:

sba.gov/sites/default/…

I've crossed out the parts that *don't* apply to #PPP borrowers (and never did).

1/

Here's the rub:

"SBA will deem a minority shareholder to be in control, if that individual or entity has the ability, under the concern's charter, by-laws, or shareholder's agreement, to prevent a quorum or otherwise block action by the board of directors or shareholders."

2/

"SBA will deem a minority shareholder to be in control, if that individual or entity has the ability, under the concern's charter, by-laws, or shareholder's agreement, to prevent a quorum or otherwise block action by the board of directors or shareholders."

2/

Startups & investors are scrambling to figure out if they need to change their agreements to clear up this ambiguity—or if that's even possible.

And it's way more complicated than it looks, as explained in this memo via @nvca:

3/

nvca.org/wp-content/upl…

And it's way more complicated than it looks, as explained in this memo via @nvca:

3/

nvca.org/wp-content/upl…