Discover and read the best of Twitter Threads about #AXISBank

Most recents (24)

Credit Cards added by #AxisBank💳

Oct'22 2,61,367

Nov'22 2,07,825

Dec'22 1,49,006

Jan'23 1,42,238

Feb'23 2,00,545

Mar'23 23,41,372

11x growth of Axis Bank Credit Cards after the Citi Deal.🚀

Here are top 5 AxisBank cards that you should get now👇

Oct'22 2,61,367

Nov'22 2,07,825

Dec'22 1,49,006

Jan'23 1,42,238

Feb'23 2,00,545

Mar'23 23,41,372

11x growth of Axis Bank Credit Cards after the Citi Deal.🚀

Here are top 5 AxisBank cards that you should get now👇

1. Axis Bank Ace Credit Card

• Joining Fee: ₹499

• Annual Fee: ₹499

• Best For: Cashback💸

What you'll love⤵

• 5% Cashback on Bill Payments.

• 4% on Swiggy, Zomato & Ola.

• 2% on all other spends.

• No Upper Limit on Cashback.

• Joining Fee: ₹499

• Annual Fee: ₹499

• Best For: Cashback💸

What you'll love⤵

• 5% Cashback on Bill Payments.

• 4% on Swiggy, Zomato & Ola.

• 2% on all other spends.

• No Upper Limit on Cashback.

2. Flipkart Axis Bank Credit Card

• Joining Fee: ₹500

• Annual Fee: ₹500

• Best For: Cashback💸

What you'll love⤵

• 5% Cashback on Flipkart & Myntra

• 4% on Preferred Merchants.

• 1.5% on all other spends.

• Joining Fee: ₹500

• Annual Fee: ₹500

• Best For: Cashback💸

What you'll love⤵

• 5% Cashback on Flipkart & Myntra

• 4% on Preferred Merchants.

• 1.5% on all other spends.

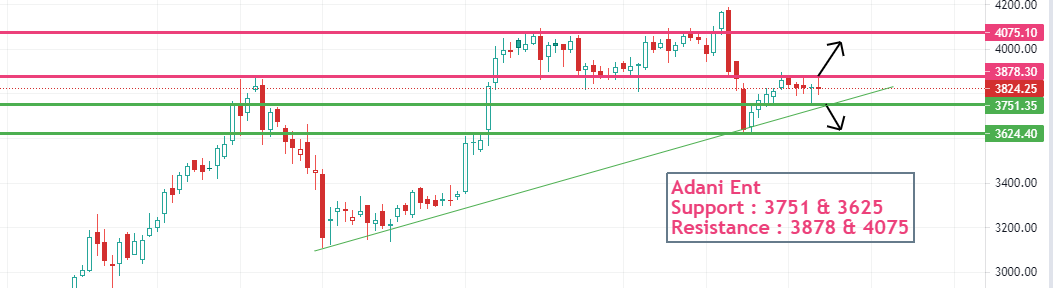

#Nifty50 stock chart

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

👉🏻Support and resistance levels.

👉🏻It can be helpful if you are stucked in any of the following stock.

🔀Retweet- Let the needful can get support.

You can also post your stock charts below.

#StockMarketindia #trading @kuttrapali26

In last 4 Months I have suggested 40 Stocks. Here, I am trying to figure out how much money💸💸 would have become by Investing Rs 1 lakh in each of the 40 stocks.

@StocksTreasures @itsqfa @farirf07 @kuttrapali26 @nakulvibhor @JakeraChoudhury

@StocksTreasures @itsqfa @farirf07 @kuttrapali26 @nakulvibhor @JakeraChoudhury

➡️Recommendation Date of #FMCG Stocks is 3 July

➡️#vbl #ITC #RadicoKhaitan #unitedspirits #ubl #emami #hindustanunilever #nestle #tataconsumer

➡️TOTAL INVESTMENT9,00,000

➡️TOTAL VALUE AS PER HIGH11,26,228

➡️%RETURN ON INVESTMENT25.13%

➡️PROFIT2,26,228

➡️#vbl #ITC #RadicoKhaitan #unitedspirits #ubl #emami #hindustanunilever #nestle #tataconsumer

➡️TOTAL INVESTMENT9,00,000

➡️TOTAL VALUE AS PER HIGH11,26,228

➡️%RETURN ON INVESTMENT25.13%

➡️PROFIT2,26,228

➡️Recommendation Date of #Financial Stocks is 9 July

➡️#sbin #ICICIBank #HDFCBank #shriramtransportfinance #mahindrafinance #BajajFinance #KOTAKBANK #AxisBank

➡️TOTAL INVESTMENT8,00,000

➡️TOTAL VALUE AS PER HIGH9,90,458

➡️%RETURN ON INVESTMENT23.80%➡️PROFIT1,90,458

➡️#sbin #ICICIBank #HDFCBank #shriramtransportfinance #mahindrafinance #BajajFinance #KOTAKBANK #AxisBank

➡️TOTAL INVESTMENT8,00,000

➡️TOTAL VALUE AS PER HIGH9,90,458

➡️%RETURN ON INVESTMENT23.80%➡️PROFIT1,90,458

1/Quick review of Banking stocks:

#HDFCBANK: BO of the range

#ICICIBANK: Fresh ATH

#SBIN: Fresh ATH

#KOTAKBANK: Nearing BO level

#HDFCBANK: BO of the range

#ICICIBANK: Fresh ATH

#SBIN: Fresh ATH

#KOTAKBANK: Nearing BO level

2/ Rest of the banks:

#AXISBANK: Although nearing BO, it might consolidate a bit before continuing the trend.

#PSUBANK: BO on monthly TF so good returns on this sector as a whole can be expected.

#AXISBANK: Although nearing BO, it might consolidate a bit before continuing the trend.

#PSUBANK: BO on monthly TF so good returns on this sector as a whole can be expected.

3/ATH in #BANKNIFTY

From the above charts we can see all the banks are either near ATH or already trading at ATH.

Infact even the PSU Bank sector has given a BO on monthly TF.

From the above charts we can see all the banks are either near ATH or already trading at ATH.

Infact even the PSU Bank sector has given a BO on monthly TF.

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

Axis Bank Ltd Q4 FY22 Earnings Concall Insights

#AXISBANK #AXISBANKQ4 #AxisBankLtd #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch

🧵

#AXISBANK #AXISBANKQ4 #AxisBankLtd #concall #concalls #insights #results #stocks #TrendingStocks #earnings #stockmarketindia #StockToWatch

🧵

Q&A Insights: Mahrukh Adajania from @EdelweissFin asked about transfer of standard assets to ARC. Puneet Sharma CEO said AXISBANK has not transferred standard assets to ARC. There was only one transfer, which was an NPA of INR 215.78 crores, that was sold to an ARC in 4Q.

Q&A Insights: Rohan Mandora from @EquirusGroup enquired about the segments where the bank will look to grow faster. Puneet Sharma CEO replied that the focus segments would be the mid-corporate segment and commercial banking segment.

Major Credit Card Players in India 💳

Cards Issued (Lakhs)

HDFC 163

SBI 135

ICICI 128

Axis 86

RBL 36

Kotak 30

#Citibank 26

How will Axis-Citi take over impact this? ⤵️

Cards Issued (Lakhs)

HDFC 163

SBI 135

ICICI 128

Axis 86

RBL 36

Kotak 30

#Citibank 26

How will Axis-Citi take over impact this? ⤵️

Axis Bank will takeover loans, credit cards, wealth management and retail banking operations of Citibank.

Post this deal, Axis bank’s Cards balance sheet is expected to grow by 57% with making it one of the top 3 Cards businesses in the country!

#AxisBank #StocksInFocus

#AxisBank #StocksInFocus

Macd is the simplest & most reliable indicators available. Macd uses Moving Averages & turn them into momentum indicator by subtracting longer MA from shorter MA. The subtracted value when plotted forms a line that oscillates above & below zero, without any upper/ lower limits.

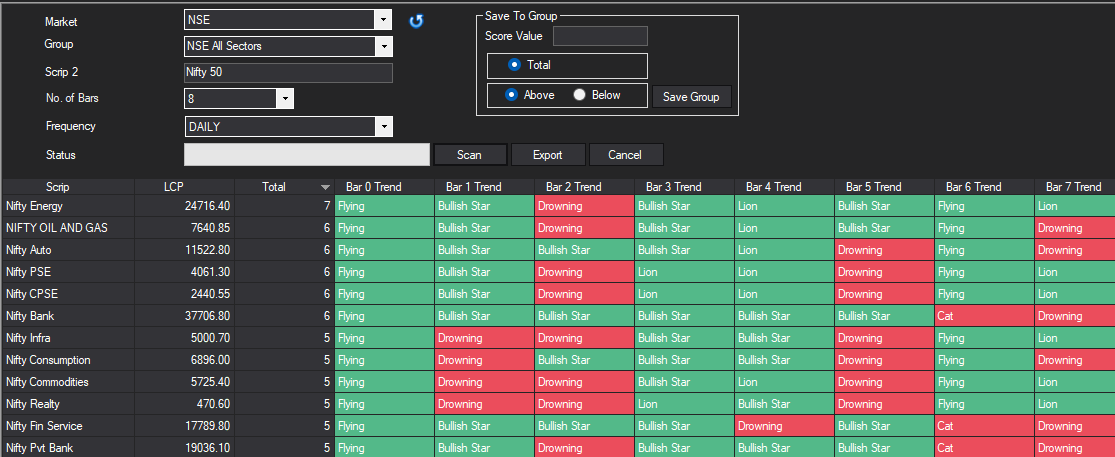

A Thread on Ratio analysis and respective charts

No need to grab a coffee,Chai will do😄

The idea is to identify relatively stronger sectors & stocks when breadth is weak

Breadth=DT 1% (No of stocks in Double top buy on 1% PnF chart)

Breadth started falling from 14th Jan 2022

No need to grab a coffee,Chai will do😄

The idea is to identify relatively stronger sectors & stocks when breadth is weak

Breadth=DT 1% (No of stocks in Double top buy on 1% PnF chart)

Breadth started falling from 14th Jan 2022

So we need to identify sectors which remained resilient when market breadth was falling.

We will look back 8 trading sessions and any score above or equal to 5 is bullish (63% of times Sector outperformed benchmark)

We will look back 8 trading sessions and any score above or equal to 5 is bullish (63% of times Sector outperformed benchmark)

Mean reversals are best suited for current market breadth scenario. Once we have identified the sector the next step is to identify stocks in same fashion.

However the idea is to pick only stocks which are taking support near 50 or 200 EMA

Let us begin with first sector 👇

However the idea is to pick only stocks which are taking support near 50 or 200 EMA

Let us begin with first sector 👇

Option selling strategy thread 🧵

*Capital must be above 6lac

*Target only banknifty (weekly expiry)

* Target 1/2% per week

* combine premium should above 100

Two types of strategy normally i use

⚡ directional

⚡Non directional (strangle)

*Capital must be above 6lac

*Target only banknifty (weekly expiry)

* Target 1/2% per week

* combine premium should above 100

Two types of strategy normally i use

⚡ directional

⚡Non directional (strangle)

⚡Direction - when banknifty & out of 5 major banking stocks 2 given breakout or breakdown.

(5 major banks 🏦 - #hdfcbank #icicibank #kotakbank #sbi #axisbank)

(5 major banks 🏦 - #hdfcbank #icicibank #kotakbank #sbi #axisbank)

✨Breakout - when #banknifty gives breakout & 2/3 banks looking strong.

Then mark swing low of #banknifty & start selling 200 points down strike puts and add more at support line.

If swing support broken then exit.

(Trending upmove)

Then mark swing low of #banknifty & start selling 200 points down strike puts and add more at support line.

If swing support broken then exit.

(Trending upmove)

The speed with which big Banks adapt to change in environment is commendable

Smaller banks and NBFCs either cant do that (because of regulation or lack of strategy)

#HDFCBank had a retail heavy book for last 20 yrs, now corporate book is bigger and expanding fast (53% now)

+

Smaller banks and NBFCs either cant do that (because of regulation or lack of strategy)

#HDFCBank had a retail heavy book for last 20 yrs, now corporate book is bigger and expanding fast (53% now)

+

as HDFC Bank sees that, fintech riding on ponzi scheme of valuation and VC money, will eat away CASA, will eat away fee income related to retail

but regulation will not allow fintech to even look at corporate loans, so not only hedged, but double down with AT1 of USD 1 billion

but regulation will not allow fintech to even look at corporate loans, so not only hedged, but double down with AT1 of USD 1 billion

#AXISBank has closed all foreign subsidiaries except UK, these subsidiaries are not easy, as in china you have to have 5 yrs of Rep office then only you can apply for a licence and once surrendered, you cant re-apply , so big shift in strategy

After #HDFCBANK now #AXISBANK

is raising USD 1 BILLION in AT1 BONDS

Pls note Hdfcbk raised same amount for the first time ever.

All big banks are expecting tsunami of credit offtake and preparing dry powder

This govt pushed infra led growth will give unbelievable valuation

+

is raising USD 1 BILLION in AT1 BONDS

Pls note Hdfcbk raised same amount for the first time ever.

All big banks are expecting tsunami of credit offtake and preparing dry powder

This govt pushed infra led growth will give unbelievable valuation

+

To big banks and NBFCs, who are in a position to raise cheap capital n have good rating

While smaller banks like #RBL, #BANDHANBNK, #ujjivan n nbfc like ibulhsgfin will have tough time

While smaller banks like #RBL, #BANDHANBNK, #ujjivan n nbfc like ibulhsgfin will have tough time

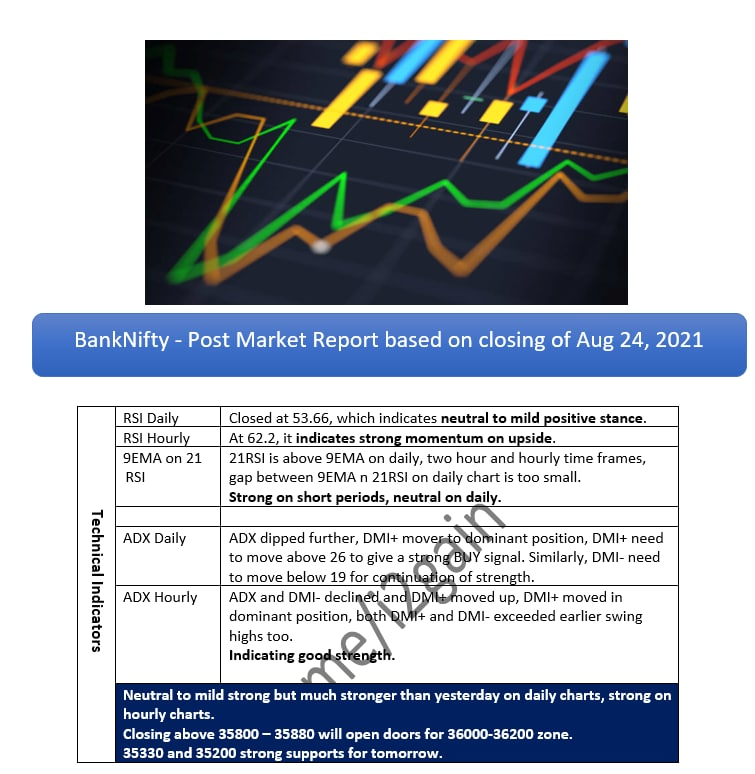

#BankNifty outperformed broader #Nifty after a long time, looking at the momentum today, we may see it touching much higher levels in next few days. Please refer to following quantitative and technical post market reports for details.

#HDFCBank #icicibank and #SBIN led the rally today, look at #KOTAKBANK #AXISBANK & #indusind too.

Important levels are mentioned in following note.

Subscribe for Free : t.me/i2gain

@vivbajaj

Important levels are mentioned in following note.

Subscribe for Free : t.me/i2gain

@vivbajaj

@threadreaderapp "unroll"

Spate of Q4FY21 results showcase #Economy is on track

#ICICIBank reported Profit of Rs4402Cr,a 260% jump YoY,with NII up a solid 16.8% at 10431Cr

Tech companies have done well,with #TechMahindra reporting Dollar Revenue growth of 1.6% QoQ &Margins up 10bps at 16%

#Modinomics💪

#ICICIBank reported Profit of Rs4402Cr,a 260% jump YoY,with NII up a solid 16.8% at 10431Cr

Tech companies have done well,with #TechMahindra reporting Dollar Revenue growth of 1.6% QoQ &Margins up 10bps at 16%

#Modinomics💪

#HCLTech also reported good numbers with Dollar Revenue up 3% QoQ

IT&Business Services segment grew 4.4% QoQ

Even for #MarutiSuzuki,while Profit fell,it managed to have Gross Margins at 26%,Vs 27.5% QoQ

Margin above 25% despite challenges thrown by Pandemic,is good

#Modinomics

IT&Business Services segment grew 4.4% QoQ

Even for #MarutiSuzuki,while Profit fell,it managed to have Gross Margins at 26%,Vs 27.5% QoQ

Margin above 25% despite challenges thrown by Pandemic,is good

#Modinomics

In Banking space,besides great results by #HDFCBank& #ICICIBank, #AxisBank too reported good results, with Profit at Rs2677Cr,Vs loss of 1388Cr,YoY

While Gross&Net NPAs of Axis rose 15%&52% YoY,with Provisions down 28%,good news is NII is up 11% at Rs7555Cr

#Economy #Modinomics

While Gross&Net NPAs of Axis rose 15%&52% YoY,with Provisions down 28%,good news is NII is up 11% at Rs7555Cr

#Economy #Modinomics

Many social media users are sharing a post claiming that ICICI bank, HDFC bank and Axis bank were all government banks earlier, which were later privatised when Late PV Narasimha Rao was PM and Manmohan Singh was Finance Minister.

#Factcheck #TLIFactcheck #HDFC #Axisbank #ICICI

#Factcheck #TLIFactcheck #HDFC #Axisbank #ICICI

The Logical Indian checked for history of each bank separately and found claim to be misleading.

ICICI was formed in 1955 with objective to create private sector development financial institution for providing medium-term and long-term project financing to Indian businesses.

ICICI was formed in 1955 with objective to create private sector development financial institution for providing medium-term and long-term project financing to Indian businesses.

According to history of HDFC, it was earlier set up by Hasmukh Parekh in 1977 without any financial assistance from government with intent of providing housing finances. In 1994, it received approval to set up a private sector bank. In the year 1995, it received banking license.

Weekly NIFTY50 analysis thread.

September Week4.

All posts are for educational purposes.

September Week4.

All posts are for educational purposes.

Stocks for 18/09/20 Intraday

#ICICIBANK

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BHARTIARTL

#BPCL

#BAJFINANCE

#SRTRANSFIN

#HINDUNILVR

#ESCORTS

Based on NR7, Volume and Volatility concepts

#ICICIBANK

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BHARTIARTL

#BPCL

#BAJFINANCE

#SRTRANSFIN

#HINDUNILVR

#ESCORTS

Based on NR7, Volume and Volatility concepts

Results of the Day: 3/10 Stocks gave tradeable moves

1/3 : #SRTRANSFIN : PROFIT : +1.6R

Price was going towards previous highs with declining volumes and increasing wicks. Rejected by forming strong Bearish candle

Exit after successive Bullish candles came in

1/3 : #SRTRANSFIN : PROFIT : +1.6R

Price was going towards previous highs with declining volumes and increasing wicks. Rejected by forming strong Bearish candle

Exit after successive Bullish candles came in

2/3: #ESCORTS : PROFIT : +0.6R

Broke out of Day's high forming Very strong candles. Not too convinced because Volumes were lacking.

Exit after price couldn't get past next resistance

Broke out of Day's high forming Very strong candles. Not too convinced because Volumes were lacking.

Exit after price couldn't get past next resistance

Stocks for 14/09/20 Intraday

#ZEEL

#AXISBANK

#BHARTIARTL

#GRASIM

#SUNPHARMA

#CHOLAFIN

#M&M

#ESCORTS

#LICHSGFIN

#HAVELLS

Based on NR7, Volume and Volatility concepts

#ZEEL

#AXISBANK

#BHARTIARTL

#GRASIM

#SUNPHARMA

#CHOLAFIN

#M&M

#ESCORTS

#LICHSGFIN

#HAVELLS

Based on NR7, Volume and Volatility concepts

Results of the Day : 2/10 Stocks gave tradeable moves

1/2 : #ZEEL : PROFIT : +2R

Gave Entry very early in the day but was very slow. However it didn't show any bullishness throughout.

Closed @ 2:25 at first target of 2R because of how slow it was

1/2 : #ZEEL : PROFIT : +2R

Gave Entry very early in the day but was very slow. However it didn't show any bullishness throughout.

Closed @ 2:25 at first target of 2R because of how slow it was

2/2 : #ESCORTS : PROFIT : +2R

A very reliable stock, the day started by a rejection for the 5th time from the same Supply zone. It eventually closed above and gave a long Entry.

Exited at +2R because despite good Volumes, range of candles were small hence momentum was weak

A very reliable stock, the day started by a rejection for the 5th time from the same Supply zone. It eventually closed above and gave a long Entry.

Exited at +2R because despite good Volumes, range of candles were small hence momentum was weak

Will be posting TA of all #nifty50 stocks in this thread. Any comments, suggestions are welcome!

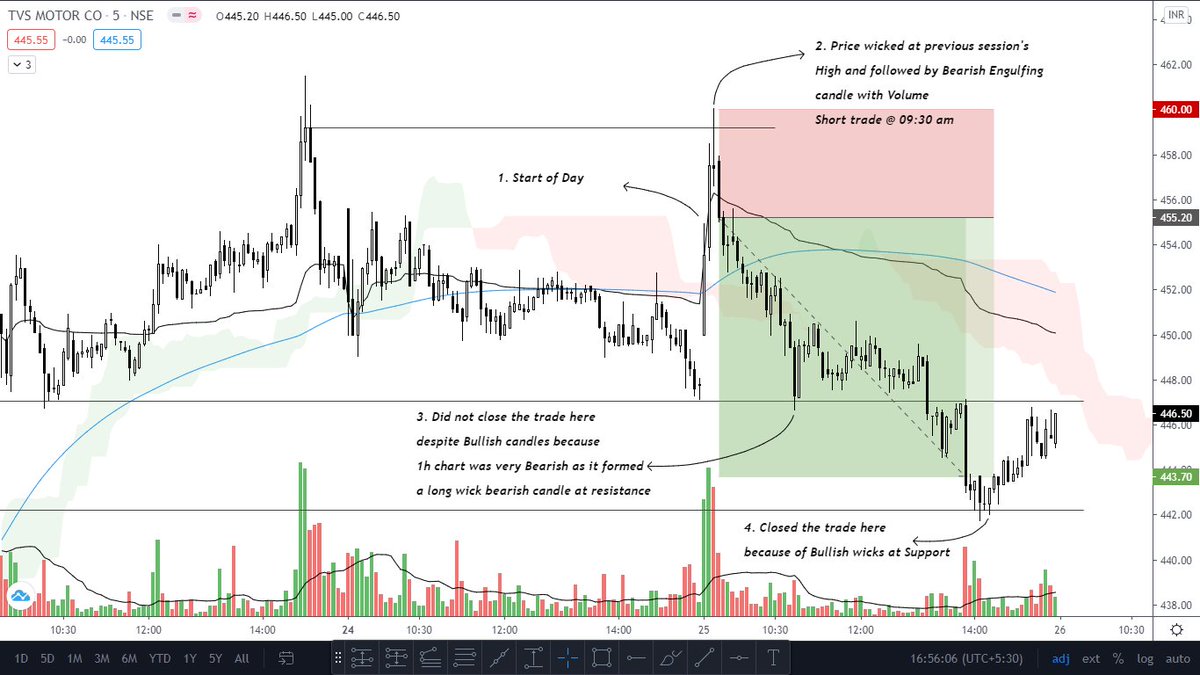

Stocks for 25/08/20 Intraday

#AXISBANK

#BANDHANBNK

#JSWSTEEL

#CHOLAFIN

#BPCL

#TVSMOTOR

#AMBUJACEM

#SRTRANSFIN

#TATACONSUM

#VOLTAS

#IOLCP

#CUMMINSIND

Based on NR7, Volatility and Volume concepts

#AXISBANK

#BANDHANBNK

#JSWSTEEL

#CHOLAFIN

#BPCL

#TVSMOTOR

#AMBUJACEM

#SRTRANSFIN

#TATACONSUM

#VOLTAS

#IOLCP

#CUMMINSIND

Based on NR7, Volatility and Volume concepts

Results of the Day : 2/12 stocks gave tradeable moves

1/2 : #JSWSTEEL : PROFIT : +2.6R

Price wicked at previous session high multiple times and finally gave a bearish engulfing strong candle with Volume.

Exit was done after price went to support and gave bullish candles

1/2 : #JSWSTEEL : PROFIT : +2.6R

Price wicked at previous session high multiple times and finally gave a bearish engulfing strong candle with Volume.

Exit was done after price went to support and gave bullish candles

2/2 : #TVSMOTOR : PROFIT : +2.4R

Similar reasons to JSWSTEEL, price wicked at previous session high resistance and formed Long wick candle and a Bearish engulfing candle

Final Exit was at HTF Support where Price started forming Bullish candles

Kindly❤️ / Retweet if it's Useful

Similar reasons to JSWSTEEL, price wicked at previous session high resistance and formed Long wick candle and a Bearish engulfing candle

Final Exit was at HTF Support where Price started forming Bullish candles

Kindly❤️ / Retweet if it's Useful

Stocks for 20/08/20 Intraday

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BANDHANBNK

#TATASTEEL

#JSWSTEEL

#IBULHSGFIN

#SUNPHARMA

#HCLTECH

#TATACONSUM

#M_M

#TITAN

Based on NR7, Volume and Volatility concepts

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BANDHANBNK

#TATASTEEL

#JSWSTEEL

#IBULHSGFIN

#SUNPHARMA

#HCLTECH

#TATACONSUM

#M_M

#TITAN

Based on NR7, Volume and Volatility concepts

Results of the Day : 4/12 stocks gave tradeable moves

1/4 : #SUNPHARMA

As most of the trades happen on a Wide Gap Down days, Price went up and got rejected at previous session high and formed reversal signs

+1.2R profits booked

1/4 : #SUNPHARMA

As most of the trades happen on a Wide Gap Down days, Price went up and got rejected at previous session high and formed reversal signs

+1.2R profits booked

2/4 : #IGL

This stock stood out by breaking through previous session Resistance with Very high Volumes coming in.

Entry was after bullish confirming Long tail candles.

Exit was when the price showed a decrease in Momentum

+2.7R profits booked

This stock stood out by breaking through previous session Resistance with Very high Volumes coming in.

Entry was after bullish confirming Long tail candles.

Exit was when the price showed a decrease in Momentum

+2.7R profits booked

#AxisBank has raised 10000Cr via #QIP,at Rs 420.10,which is 5% discount to lower end of band

15000Cr,recently raised by #YesBank

In last 6 months,52000Cr raised by #Banks--#CapitalAdequacy will be key in dealing with post #Covid stress

Great move by banks to shore up Capital💪

15000Cr,recently raised by #YesBank

In last 6 months,52000Cr raised by #Banks--#CapitalAdequacy will be key in dealing with post #Covid stress

Great move by banks to shore up Capital💪

#ICICIBank wanted to raise 15000Cr but got bids worth 62000Cr today at floor price of 351.36/-

Within few hours of opening,due to huge oversubscription,#QIP was closed

Clearly,there is no dearth of liquidity in the markets

90000Cr raked in by #DebtFunds in July'20

#GreenShoots

Within few hours of opening,due to huge oversubscription,#QIP was closed

Clearly,there is no dearth of liquidity in the markets

90000Cr raked in by #DebtFunds in July'20

#GreenShoots

Lot has been written about #BoB's loss of 864Cr in June qtr,from 710Cr profit,YoY

Like i have been saying,most Banks now focus on #AssetQuality¬ just Profits

BoB hiked #Provisions by 54% on standard loans,to cover for future losses

In 2013,Banks were doing the opposite😑

Like i have been saying,most Banks now focus on #AssetQuality¬ just Profits

BoB hiked #Provisions by 54% on standard loans,to cover for future losses

In 2013,Banks were doing the opposite😑