Discover and read the best of Twitter Threads about #Circle

Most recents (24)

In #Crypto, everything happens at lightning speed, and sometimes we miss very important news that could affect our portfolio.

So, here is a list of all the important news of the past week, which I have compiled 📰🗞️

🧵👇

#CryptoNews #cryptocrash

So, here is a list of all the important news of the past week, which I have compiled 📰🗞️

🧵👇

#CryptoNews #cryptocrash

🚨Nigeria regulator says local Binance operations 'illegal'.

🔔 #TUSD temporarily stopped issuing TUSD through Prime Trust.

🔔 #Robinhood will no longer support #Solana, #Polygon and #Cardano after June 27, 2023.

🔔 #TUSD temporarily stopped issuing TUSD through Prime Trust.

🔔 #Robinhood will no longer support #Solana, #Polygon and #Cardano after June 27, 2023.

1/ Affected by the #SEC suing #Binance, there is a lot of #FUD in the market.

However, we have noticed that some institutions, whales, and SmartMoney seem to be buying from the bottom.

👇

However, we have noticed that some institutions, whales, and SmartMoney seem to be buying from the bottom.

👇

2/ After the news of #SEC suing #Binance, Cumberland withdrew 67.9M $USDC from #Circle and deposited 67.1M $USDC to #Coinbase.

etherscan.io/token/0xa0b869…

FalconX received 37M $USDC from #Circle and deposited 29.5M $USDC to #Binance.

etherscan.io/token/0xa0b869…

etherscan.io/token/0xa0b869…

FalconX received 37M $USDC from #Circle and deposited 29.5M $USDC to #Binance.

etherscan.io/token/0xa0b869…

#Bitcoin Back Above $29k After #MtGox False Alert

📰Let’s dive into your weekly digest of specially curated reads by #Matrixport 📰

What’s #trending in #cryptocurrency? ⬇️⬇️⬇️

📰Let’s dive into your weekly digest of specially curated reads by #Matrixport 📰

What’s #trending in #cryptocurrency? ⬇️⬇️⬇️

1️⃣ #Bitcoin Slumped and Rebounded in Hours amid False Alarm on #US Government Dump

2️⃣ #Circle Launches Cross-Chain #USDC Transfer Protocol for #Ethereum, #Avalanche

3️⃣ Binance.US Calls off $1.3bn Deal for #Voyager’s #Assets, Citing a “Hostile Environment”

2️⃣ #Circle Launches Cross-Chain #USDC Transfer Protocol for #Ethereum, #Avalanche

3️⃣ Binance.US Calls off $1.3bn Deal for #Voyager’s #Assets, Citing a “Hostile Environment”

4️⃣ #Arbitrum #Blockchain #Airdrops $120m-worth #ARB #Tokens to Projects in its Ecosystem

5️⃣ #Visa Shares Plans for ‘Ambitious’ #Crypto Product Regarding #Stablecoin #Payments

READ OUR #NEWSLETTER IN FULL:

bit.ly/42h7rGO

5️⃣ #Visa Shares Plans for ‘Ambitious’ #Crypto Product Regarding #Stablecoin #Payments

READ OUR #NEWSLETTER IN FULL:

bit.ly/42h7rGO

#LayerZero 🧶⤵️

What about the VCs?

Over $170 million has been raised, funds include:

Binance Labs, Sequoia Capital, a16z, Coinbase Ventures, FTX, Uniswap, PayPal Ventures, Sino Global Capital and others.

And there are a lot of activities here 😎

1/23

What about the VCs?

Over $170 million has been raised, funds include:

Binance Labs, Sequoia Capital, a16z, Coinbase Ventures, FTX, Uniswap, PayPal Ventures, Sino Global Capital and others.

And there are a lot of activities here 😎

1/23

Lets start with discord, go to the link (discord-layerzero.netlify.app/discord), pass the captcha, turn off notifications except channel for announcements.

Since, as I said, there are a lot of activities and need to test them all, I will divide them into two categories, Bridges and DeFi

2/23

Since, as I said, there are a lot of activities and need to test them all, I will divide them into two categories, Bridges and DeFi

2/23

#BRIDGE 🌉:

1. #Stargate @StargateFinance (stargate.finance/transfer)

This is a BASE, use it as often as possible, not just because they have the same team, but because it's really a quality platform

3/23

1. #Stargate @StargateFinance (stargate.finance/transfer)

This is a BASE, use it as often as possible, not just because they have the same team, but because it's really a quality platform

3/23

Wednesday Top Crypto News

Everything you need to know in one short thread…

Everything you need to know in one short thread…

In case you missed it, check out yesterdays thread on crypto market microstructure 👇🏼

Onto the news…In an interview with Bloomberg, Cathie Wood said the current banking crisis, which will only “attract more institutions” to the #BTC market over time.

1/8 Witness the intriguing parallel between USDC insolvency concerns & Marriner Eccles's strategy during the Great Depression. Both emphasize trust in financial systems. #stablecoin #financialhistory

USDC issuers, led by Circle, hit pause on withdrawals to gather capital in response to insolvency concerns. They took a page from history to handle the crisis. #cryptocurrency #crisismanagement

Historical context: Marriner Eccles, a prominent banker during the Great Depression, used a clever strategy to control teller cash payouts, restoring confidence in the banking system. #GreatDepression #banking

1/ Durante a crise do USDC + SVB, vários players notáveis se posicionaram com transações on-chain. Vamos ver como cada um deles se posicionou:

2/ @VitalikButerin comprou USDC 🤯

Trocou 500 ETH por 150k $RAI e depois por 400k USDC e 27k DAI, aproveitando o desconto pelo depeg

debank.com/profile/0xd8da…

Trocou 500 ETH por 150k $RAI e depois por 400k USDC e 27k DAI, aproveitando o desconto pelo depeg

debank.com/profile/0xd8da…

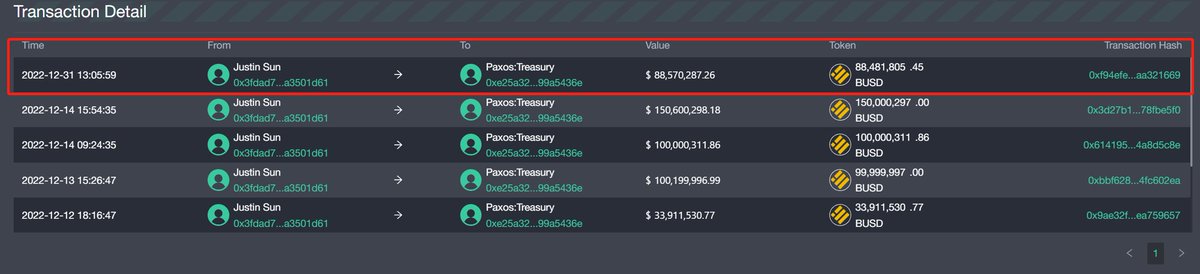

3/ @justinsuntron Justin Sun trocou USDC por DAI 😆

Retirou 127mi $USDC e trocou por for 126,96mi $DAI

etherscan.io/address/0x9f84…

Retirou 127mi $USDC e trocou por for 126,96mi $DAI

etherscan.io/address/0x9f84…

#SVB Bankruptcy and $USDC Unpegged Incident

1/7 #Circle, an issuer of $USDC, announced on Mar 10th that #SVB, where they held their funds, had gone bankrupt. This leaves $3.3B collateralized in $USDC locked up. Upon this news, $USDC plunged more than 10%.

1/7 #Circle, an issuer of $USDC, announced on Mar 10th that #SVB, where they held their funds, had gone bankrupt. This leaves $3.3B collateralized in $USDC locked up. Upon this news, $USDC plunged more than 10%.

2/7: However, #Circle had previously disclosed the amount of reserve it held in $USDC, and currently, only 8.2%($3.3B out of $40B) was tied up in #SVB.

3/7: By using the #FDIC recovery process as a guide, it's expected that the payout rate will be around 94%, indicating an estimated loss of approximately $200M.

Dost lidí stále nechápe důvody a následky kolapsu $SIVB

Banka s obrovským množstvím peněz velkých hráčů a startupů, jejíž následky mohou být dlouhé!

Pojďme si o této události něco říct i ze strany velkých hráčů, které jsem dosud poznal.

Příjemné čtení😊

1/21

Banka s obrovským množstvím peněz velkých hráčů a startupů, jejíž následky mohou být dlouhé!

Pojďme si o této události něco říct i ze strany velkých hráčů, které jsem dosud poznal.

Příjemné čtení😊

1/21

2/21

V minulém roce byla $SIVB označena za jednu z nejlepších amerických bank s existencí přes 40 let.

Bylo to uložiště bezmála poloviny světových startupů, které se např. jen za poslední 3 roky ztrojnásobily.

Jejich aktiva sahala do výše cca. 212 mld. USD.

V minulém roce byla $SIVB označena za jednu z nejlepších amerických bank s existencí přes 40 let.

Bylo to uložiště bezmála poloviny světových startupů, které se např. jen za poslední 3 roky ztrojnásobily.

Jejich aktiva sahala do výše cca. 212 mld. USD.

3/21

Nyní se jedná o největší krach banky od r. 2008 a druhý největší v historii USA.

Investoři do této banky ukládali miliony USD přes startupy s nimiž jednoduše $SIVB potřebovala něco udělat.

Toto byl zásadní špatný krok, který vedl ke krachu👇

Nyní se jedná o největší krach banky od r. 2008 a druhý největší v historii USA.

Investoři do této banky ukládali miliony USD přes startupy s nimiž jednoduše $SIVB potřebovala něco udělat.

Toto byl zásadní špatný krok, který vedl ke krachu👇

Petit point sur la journée de demain

Une journée qui va être chargée en termes de volatilité et aussi en congestion de réseau pendant "quelques" heures suite à l'affaire #USDC.

Regardons ça de plus près et comment se protéger.

Une journée qui va être chargée en termes de volatilité et aussi en congestion de réseau pendant "quelques" heures suite à l'affaire #USDC.

Regardons ça de plus près et comment se protéger.

Concrètement, tout va se jouer sur la capacité de #Circle à honorer le redeem des #USDC en dollar suite à l'annonce.

Pour faire simple, cette opération consiste simplement à envoyer des USDC à Circle, qui vont les détruire et vous verser l'équivalent en USD sur votre compte.

Pour faire simple, cette opération consiste simplement à envoyer des USDC à Circle, qui vont les détruire et vous verser l'équivalent en USD sur votre compte.

À partir du moment où ce processus se passe correctement, certains vont faire de l'arbitrage et tirer le prix de l'USDC vers le haut jusqu'à atteindre le peg des 1$.

On retrouvera de gros investisseurs ainsi que des plateformes d'échanges (#Binance, Justin Sun etc...)

On retrouvera de gros investisseurs ainsi que des plateformes d'échanges (#Binance, Justin Sun etc...)

🧐#CIRCLE ... WELL PLAYED INDEED

I know... you will be surprised by my guess

Let's suppose #CIRCLE have about 6bln $ seized in Shady banks : 3.3bln$ in #SVB (confirmed) and about 3bln $ #SI (not confirmed)

For 2 time their minimum liquidity was 6bln$

Now what? Let's guess...🔻

I know... you will be surprised by my guess

Let's suppose #CIRCLE have about 6bln $ seized in Shady banks : 3.3bln$ in #SVB (confirmed) and about 3bln $ #SI (not confirmed)

For 2 time their minimum liquidity was 6bln$

Now what? Let's guess...🔻

With about 6bln$ seized over 43bln$ #USDC you know... They cannot be baked 1:1, because 14% are not available (seized).

What if they managed to spread FUD looking for a way to push whales and retails on converting #USDC for #USDT or other stablecoins?

Let's check 🔻

What if they managed to spread FUD looking for a way to push whales and retails on converting #USDC for #USDT or other stablecoins?

Let's check 🔻

So, #USDC market cap dumped from 43.3bln$ to 37.2bln$

Look at it... exactly 6bln$

Did someone see any type of #USDC burn anywhere? I've missed something...or there was a realtime swap with another #stablecoin

Let's check #USDT🔻

Look at it... exactly 6bln$

Did someone see any type of #USDC burn anywhere? I've missed something...or there was a realtime swap with another #stablecoin

Let's check #USDT🔻

How will Funds respond to the $USDC depegging?

Panic selling $USDC or buying $USDC at the bottom?

1.🧵

Here are the operations of Funds👇

Hope it can be helpful to you.

Panic selling $USDC or buying $USDC at the bottom?

1.🧵

Here are the operations of Funds👇

Hope it can be helpful to you.

2.

Jump Trading, Wintermute Trading, Genesis Trading and BlockTower Capital redeemed $USDC for USD cash via #Circle and #Coinbase ahead of the weekend bank break.

Vitalik.eth, @worthalter and Taureon Capital bought $USDC at the bottom.

Jump Trading, Wintermute Trading, Genesis Trading and BlockTower Capital redeemed $USDC for USD cash via #Circle and #Coinbase ahead of the weekend bank break.

Vitalik.eth, @worthalter and Taureon Capital bought $USDC at the bottom.

3.

Justin Sun, IOSG Ventures, Kyber Ventures, Chain Capital, Hashed, Spartan Group, Signum Capital, Infinity Ventures Crypto, LD Capital, LedgerPrime, Dokia capital and Alpha Citadel Ventures exchanged $USDC for $DAI, $USDT, $USDP, BUSD and $ETH.

Justin Sun, IOSG Ventures, Kyber Ventures, Chain Capital, Hashed, Spartan Group, Signum Capital, Infinity Ventures Crypto, LD Capital, LedgerPrime, Dokia capital and Alpha Citadel Ventures exchanged $USDC for $DAI, $USDT, $USDP, BUSD and $ETH.

🚨

$USDC to nie $UST

#Circle to nie #TerraFormLabs

Kilka suchych faktów dlaczego w.w. sytuacje są od siebie całkowicie różne.

Zostaw ♥️ i zapraszam do lektury ⬇️

$USDC to nie $UST

#Circle to nie #TerraFormLabs

Kilka suchych faktów dlaczego w.w. sytuacje są od siebie całkowicie różne.

Zostaw ♥️ i zapraszam do lektury ⬇️

1⃣ Różnica w działaniu.

🌑Jak wszyscy dobrze pamiętamy $UST było stablecoinem algorytmicznym, podpartym koszykiem różnych aktywów jak stable, $LUNA, $BTC czy $ETH.

🔵 $USDC jest tokenem podpartym prawdziwym dolarem, wyemitowanym przez podmiot regulowany przez SEC.

🌑Jak wszyscy dobrze pamiętamy $UST było stablecoinem algorytmicznym, podpartym koszykiem różnych aktywów jak stable, $LUNA, $BTC czy $ETH.

🔵 $USDC jest tokenem podpartym prawdziwym dolarem, wyemitowanym przez podmiot regulowany przez SEC.

2⃣ FUD

🌑FUD w kwestii $UST obracał się wokół podparcia niestabilnymi aktywami oraz nadmiernym napływem supply przez #AnchorProtocol

🔵Cały dzisiejszy FUD wokół $USDC opiera się o upadłość banku, w którym #Circle posiadało niecałe ~5% zabezpieczenia dla swojego stablecoina.

2/

🌑FUD w kwestii $UST obracał się wokół podparcia niestabilnymi aktywami oraz nadmiernym napływem supply przez #AnchorProtocol

🔵Cały dzisiejszy FUD wokół $USDC opiera się o upadłość banku, w którym #Circle posiadało niecałe ~5% zabezpieczenia dla swojego stablecoina.

2/

简单解释一下稳定币 $USDC $BUSD 和 $DAI 今日为啥都会脱锚?

在美联储开启疯狂加息节奏下,美元利率上涨导致债券价格下跌,在本周硅谷银行和银门银行接连因不同但相似的期限错配问题导致关闭。两家银行在遇到用户提款带来的挤兑问题时,不得不亏损出售其在2022年之前购入的长期债券。

在美联储开启疯狂加息节奏下,美元利率上涨导致债券价格下跌,在本周硅谷银行和银门银行接连因不同但相似的期限错配问题导致关闭。两家银行在遇到用户提款带来的挤兑问题时,不得不亏损出售其在2022年之前购入的长期债券。

$USDC 是在2018年由 #Circle 和 #Coinbase 联合推出的稳定币,根据官网显示其有435亿美元的储备,其中持有324亿美元的短期美国国债和111亿美元现金托管在银行。根据Circle在2023年1月份的证明报告中显示托管在7家银行,每家银行的分配比例未公布,

7家银行分别是Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank (a division of Flagstar Bank, N.A.), Signature Bank, Silicon Valley Bank and Silvergate Bank,最后两家就是本周爆雷的银行。

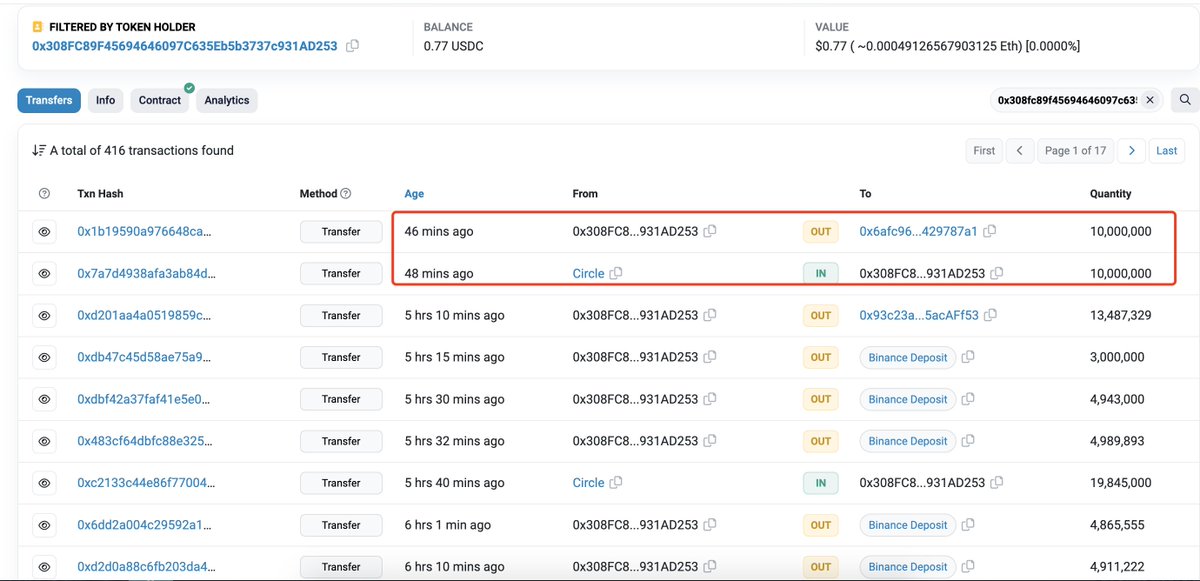

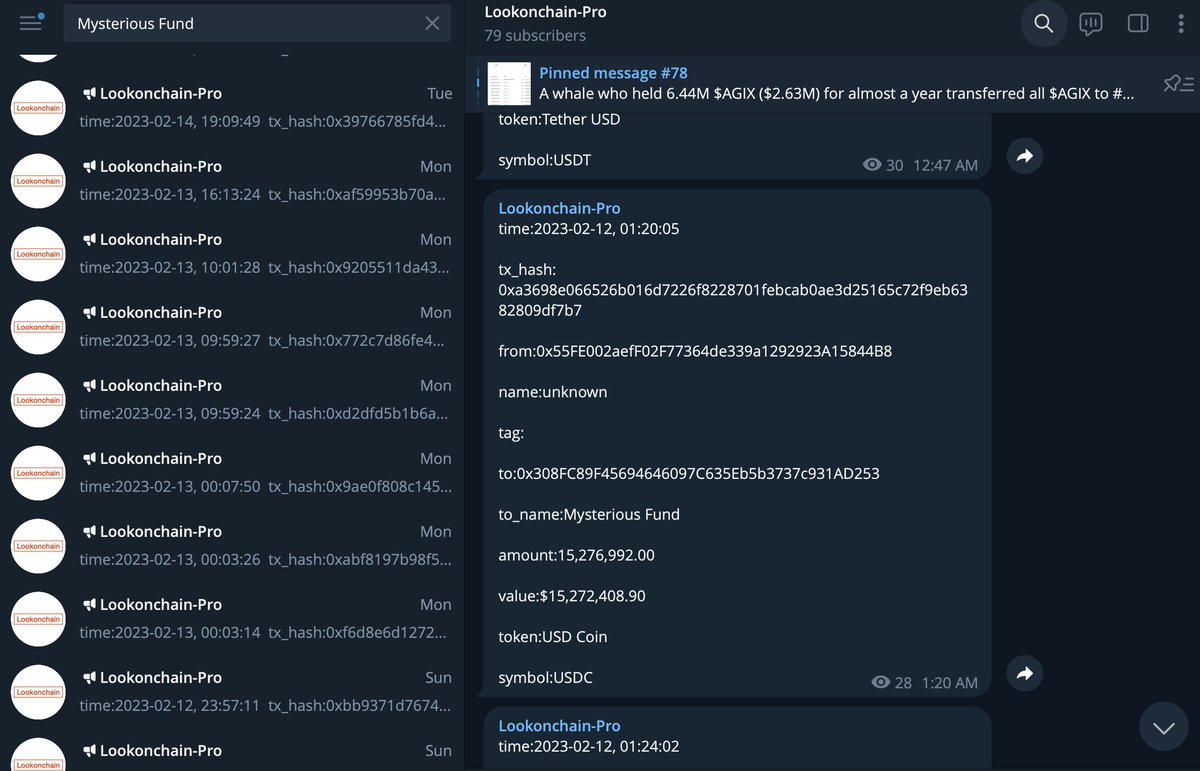

1/ With the crash of #Silvergate, the crypto market plummeted, and the price of $ETH dropped by 5%.

Before $ETH plummeted, the price had a slight increase.

The mysterious fund withdrew 312M $USDC from #Circle and transferred to exchanges during the 8 hours of the uptick.

Before $ETH plummeted, the price had a slight increase.

The mysterious fund withdrew 312M $USDC from #Circle and transferred to exchanges during the 8 hours of the uptick.

2/ #Coinbase tweeted that it would no longer accept or initiate payments with #Silvergate 14 hrs ago.

13 hrs ago, the fund started to withdraw $USDC from #Circle and transfer to exchanges, then stop 5 hrs ago.

The price of $ETH has increased by 2% during this period.

13 hrs ago, the fund started to withdraw $USDC from #Circle and transfer to exchanges, then stop 5 hrs ago.

The price of $ETH has increased by 2% during this period.

3/ The fund withdrew 10M $USDC from #Circle and transfer to exchanges again 40 mins ago.

According to the data on the chain, the behavior of this mysterious fund is very strange.

According to the data on the chain, the behavior of this mysterious fund is very strange.

🚨Rosso Silvergate, il colore del 2023?🚨

La banca "Crypto apre oggi con un -45%.

Se lo stato di salute del mondo #Crypto lo deducessimo da un asset come #Silvergate cosa ci direbbe sul futuro del settore?

⚠️ Problemi per USDC? Vediamo 🧵⬇️

La banca "Crypto apre oggi con un -45%.

Se lo stato di salute del mondo #Crypto lo deducessimo da un asset come #Silvergate cosa ci direbbe sul futuro del settore?

⚠️ Problemi per USDC? Vediamo 🧵⬇️

1/ #Silvergate è in ritardo nell'invio della dichiarazione annuale ⏰

Ha comunicato di non riuscire a presentare la dichiarazione entro la data di scadenza prevista a causa di difficoltà nel completare la dichiarazione. Qui la notifica della #SEC 👇

ir.silvergate.com/sec-filings/se…

Ha comunicato di non riuscire a presentare la dichiarazione entro la data di scadenza prevista a causa di difficoltà nel completare la dichiarazione. Qui la notifica della #SEC 👇

ir.silvergate.com/sec-filings/se…

New Thread🧵⛓

#numerology and #Numbers

Focusing on #Gann #Natural, Secret Numbers

#Cycles that help in #trading #price and #time

Sacred numbers, #Astrology and #Astronomy

First Number 360 (#Circle)

All can post views ,if good

will combine and post here

#stocks #stockmarket (1)

#numerology and #Numbers

Focusing on #Gann #Natural, Secret Numbers

#Cycles that help in #trading #price and #time

Sacred numbers, #Astrology and #Astronomy

First Number 360 (#Circle)

All can post views ,if good

will combine and post here

#stocks #stockmarket (1)

Circle is 360

Planets Circling, elliptical, waves,

Electrons , Nature many are in spirals or circles

Circle with in Circles

360 has 24 divisors

(From 1 to 10)

/10=36

/9=40

/8=45

/7=51.428(not divisible)

/6=60

/5=72

/4=90

/3=120

/2=180

All the numbers are important cycles! (2)

Planets Circling, elliptical, waves,

Electrons , Nature many are in spirals or circles

Circle with in Circles

360 has 24 divisors

(From 1 to 10)

/10=36

/9=40

/8=45

/7=51.428(not divisible)

/6=60

/5=72

/4=90

/3=120

/2=180

All the numbers are important cycles! (2)

360

3600

36 its all the same

6x6 = 36 , 6 square

6x6x6 =216 (666 beast cycle bible)

360-216=144(Fibonacci)

(144/2=72)

216 -72 = 108

108(36x3)

holy trinity 3x3x3 =27

27x4 =108x2=216

9,18,36,72,144,288,(360),576 etc.

360/24 (hours a day)=15

we live in cycle of 144,360 etc (3)

3600

36 its all the same

6x6 = 36 , 6 square

6x6x6 =216 (666 beast cycle bible)

360-216=144(Fibonacci)

(144/2=72)

216 -72 = 108

108(36x3)

holy trinity 3x3x3 =27

27x4 =108x2=216

9,18,36,72,144,288,(360),576 etc.

360/24 (hours a day)=15

we live in cycle of 144,360 etc (3)

1/ Why did the price of $BTC/$ETH suddenly rise today?

We found that several funds/institutions poured nearly $1.6B into the crypto market since Feb 10!👇

We found that several funds/institutions poured nearly $1.6B into the crypto market since Feb 10!👇

2/

We analyzed the data on $USDC deposits and withdrawals on #Circle from February 10th to today.

As can be seen from the figure below, several funds/institutions withdrew ~1.6B $USDC from #Circle and only deposited ~0.2B $USDC.

We analyzed the data on $USDC deposits and withdrawals on #Circle from February 10th to today.

As can be seen from the figure below, several funds/institutions withdrew ~1.6B $USDC from #Circle and only deposited ~0.2B $USDC.

3/

The mysterious fund shared before didn't stopped pouring money into crypto market as BTC/ETH drops.

His address "0x308F" has withdrawn 155M $USDC from #Circle and transferred to exchanges since Feb 10.

If you join our channel, you will be notified.

The mysterious fund shared before didn't stopped pouring money into crypto market as BTC/ETH drops.

His address "0x308F" has withdrawn 155M $USDC from #Circle and transferred to exchanges since Feb 10.

If you join our channel, you will be notified.

1/ A mysterious fund started pouring money into the crypto market ahead of this year's small #BullMarket.

The fund started withdrawing $USDC from #Circle on Dec 7, 2022 and has over 10B $USDC as of today.

Then exchanged for $USDT via 5 addresses, and deposited to exchanges.

The fund started withdrawing $USDC from #Circle on Dec 7, 2022 and has over 10B $USDC as of today.

Then exchanged for $USDT via 5 addresses, and deposited to exchanges.

2/

Every time the fund started withdrawing $USDC from #Circle and transferring to exchanges, the price of $ETH will rise.

It appears that the rise in cryptocurrency prices has something to do with this fund.

Every time the fund started withdrawing $USDC from #Circle and transferring to exchanges, the price of $ETH will rise.

It appears that the rise in cryptocurrency prices has something to do with this fund.

🚨 The @justinsuntron is super active on #Tron today.

Here's what he did:

1. Withdraw 62M USDT on #Justlend

2. Buy 2M USDD using 2M USDT on #Sun

3. Withdraw 6M USDC on #JustLend and transferred out

4. Transfer 60M USDT to @binance

tronscan.org/#/address/TPyj…

Here's what he did:

1. Withdraw 62M USDT on #Justlend

2. Buy 2M USDD using 2M USDT on #Sun

3. Withdraw 6M USDC on #JustLend and transferred out

4. Transfer 60M USDT to @binance

tronscan.org/#/address/TPyj…

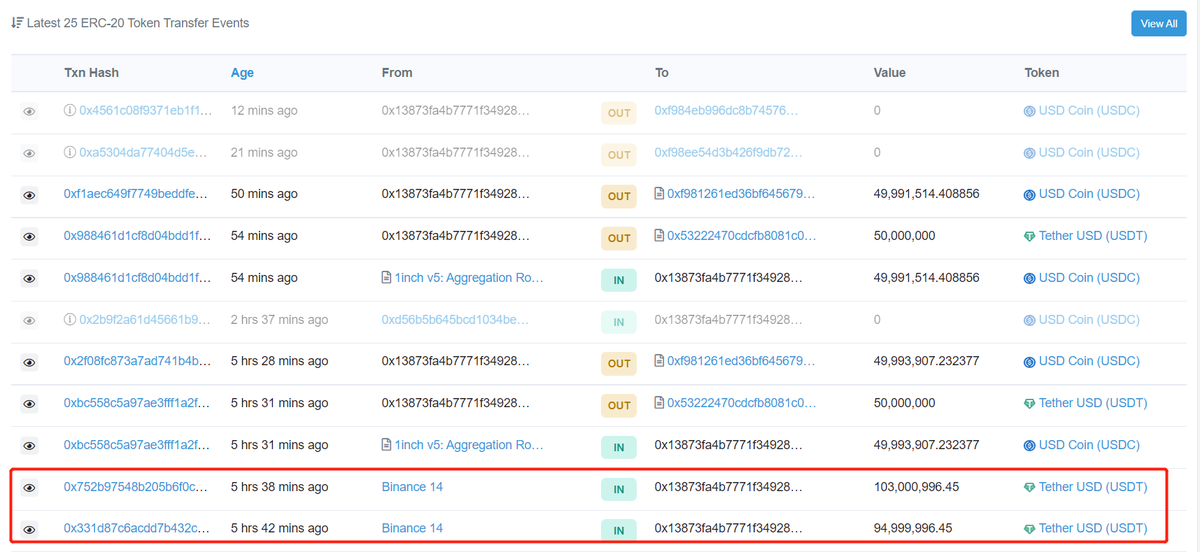

Five hours ago, the crypto industry lost another 200 million USD in liquidity. A giant whale withdrew 200 million $USDT from #binance, of which 100 million USDT was sold into $USDC, and 100 million USD was exchanged from Circle, completing the withdraw money.

What gift to buy for #Christmas costs 200 million US dollars🤣🤣.@cz_binance

etherscan.io/address/0x1387…

etherscan.io/address/0x1387…

Through further chain analysis, it is found that this address has four associated addresses, and the withdrawal of 1061593301.6 USD has been completed through #Circle.

breadcrumbs.app/reports/0xeeaf…

breadcrumbs.app/reports/0xeeaf…

1/ $USDD is not safe!

#USDD has been depegged since Nov 9 and has not returned to the peg!

#USDD reserves decreased by 548M $USDC

Justin Sun used the 350M $USDC in the reserve to repay the loan in #Justlend.

The real Collat. Ratio is only 50%!

Here is some evidence.👇

#USDD has been depegged since Nov 9 and has not returned to the peg!

#USDD reserves decreased by 548M $USDC

Justin Sun used the 350M $USDC in the reserve to repay the loan in #Justlend.

The real Collat. Ratio is only 50%!

Here is some evidence.👇

2.

#USDD has been depegged since Nov 9 and has not returned to the peg!

Now the trading price is $0.9812.

And #USDD accounts for 81.25% of the Curve USDD/3CRV pool.

#USDD has been depegged since Nov 9 and has not returned to the peg!

Now the trading price is $0.9812.

And #USDD accounts for 81.25% of the Curve USDD/3CRV pool.

3.

On Nov 10, #TRON still had 990M $USDD in its reserves, and now there is only 442M $USDC left.

548M $USDC disappeared? @justinsuntron

On Nov 10, #TRON still had 990M $USDD in its reserves, and now there is only 442M $USDC left.

548M $USDC disappeared? @justinsuntron

2.

5 Ethereum wallets and 6 BTC wallets of Crypto.com hold a total of $2.68B assets.

Including:

- 51,836 $BTC($857M)

- 58T $SHIB($531M)

- 364,969 $ETH($446M)

- 184M $USDT

- 88M $USDC

- 1.2B $CRO($80M)

...

5 Ethereum wallets and 6 BTC wallets of Crypto.com hold a total of $2.68B assets.

Including:

- 51,836 $BTC($857M)

- 58T $SHIB($531M)

- 364,969 $ETH($446M)

- 184M $USDT

- 88M $USDC

- 1.2B $CRO($80M)

...

3.

Crypto.com holds 58T $SHIB($531M), surpassing $ETH and accounting for nearly 20% of total assets.

And Crypto.com also holds 1.2B $CRO($80M), accounting for 3% of the total assets.

Crypto.com holds 58T $SHIB($531M), surpassing $ETH and accounting for nearly 20% of total assets.

And Crypto.com also holds 1.2B $CRO($80M), accounting for 3% of the total assets.