Discover and read the best of Twitter Threads about #Silvergate

Most recents (21)

🔒 Binance Allegedly Mixed Customer and Company Funds 🔍

@binance, one of the largest cryptocurrency exchanges, allegedly mixed customer and company funds between 2020 and 2021.

These questionable activities have raised concerns over internal controls.

@binance, one of the largest cryptocurrency exchanges, allegedly mixed customer and company funds between 2020 and 2021.

These questionable activities have raised concerns over internal controls.

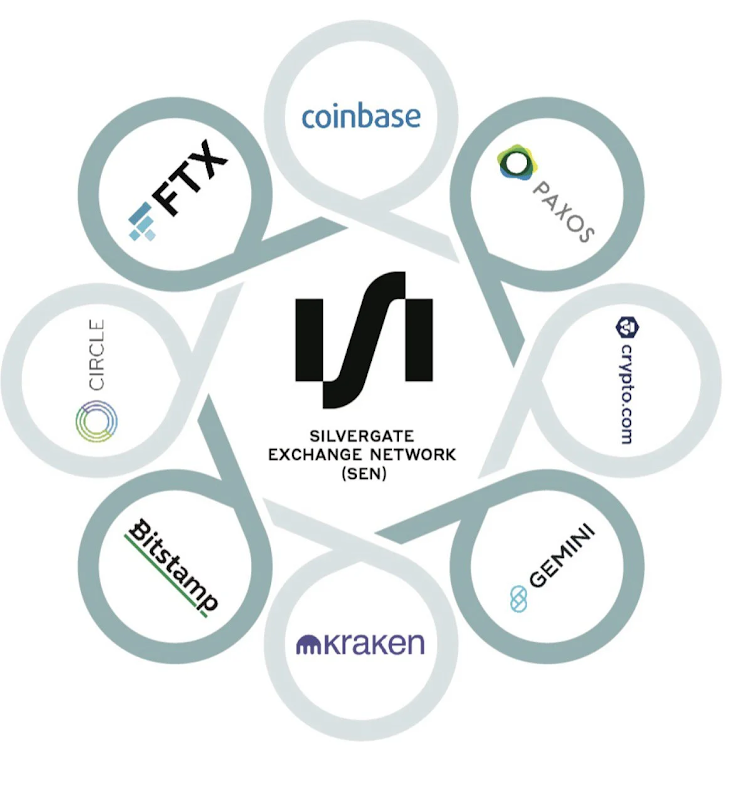

@binance Reports suggest that @binance used @silvergatebank as a central fixture in its financial operations, combining customer funds with company revenues into a third Silvergate account.

This account was then converted into the Binance USD (#BUSD) token.

This account was then converted into the Binance USD (#BUSD) token.

@binance @silvergatebank The situation becomes more complex as the U.S. Commodity Futures Trading Commission (CFTC) has charged Binance with "structuring" transactions to evade U.S. financial regulations.

US banks witness $126B withdrawal by March 22, with the top 25 shedding $90B in current financial unrest! 🚨

A thread 🧵:

#banks #svb #silvergate #crisis

A thread 🧵:

#banks #svb #silvergate #crisis

(1/6) Post Silicon Valley Bank & Signature seizures, smaller banks rebound by reclaiming $6B (seasonally adjusted) 💪

(2/6) Total industry deposits at lowest since July 2021, now at $17.3T 😲

💥 The Domino Effect: Signature Bank, #SiliconValleyBank, and Silvergate Collapse – What You Need to Know #BankingCrisis

1/ 🚨 Recent events have seen the collapse of Signature Bank, #SiliconValleyBank, and #Silvergate, sending shockwaves throughout the financial industry. In this thread, we'll explore the factors leading to their downfall and the broader implications.

2/ 📉 A combination of factors such as mismanagement, excessive risk-taking, and exposure to toxic assets has led to these banks' demise. Their failure has amplified fears surrounding the general insolvency present in banks.

Tuesday Top Crypto News.

Everything you need to know in one short thread…

Everything you need to know in one short thread…

According to the Wall Street Journal (#WSJ) Coinbase Global (#COIN) told clients on Monday it’s no longer supporting #Signet, the real-time payments network of failed #SignatureBank.

The biggest banking collapse since 2008 explained. And how it will impact the crypto markets.

Thread 👇

Thread 👇

#SiliconValleyBank ('SVB') was the 16th biggest bank in the US.

Primarily servicing US technology startups.

Primarily servicing US technology startups.

🔎 ANÁLISE QUEBRADEIRA DOS BANCOS🔎

#svb #silvergate #signature #usdc

Eu enxergo DUAS GRANDES TESES do porque estamos testemunhando esses colapsos.

Aqui está o que cada uma delas SIGNIFICA PARA O FUTURO EM CRIPTO, e como você pode SE POSICIONAR.

Interessado? Segue a 🧵...

#svb #silvergate #signature #usdc

Eu enxergo DUAS GRANDES TESES do porque estamos testemunhando esses colapsos.

Aqui está o que cada uma delas SIGNIFICA PARA O FUTURO EM CRIPTO, e como você pode SE POSICIONAR.

Interessado? Segue a 🧵...

1) O assunto me chamou a atenção desde que fiz a primeira thread sobre o Silvergate no dia 03/mar, explicando as dificuldades que o banco enfrentava, e os possíveis impactos em cripto.

2) Desde então outros bancos passaram por stress e foram intervidos pelo FDIC (tipo o FGC dos EUA), como o Silicon Valley Bank (SVB) .

O medo da intervenção contagiou a Circle/USDC, levando até a um DEPEG momentâneo no preço de tela de USDC.

O medo da intervenção contagiou a Circle/USDC, levando até a um DEPEG momentâneo no preço de tela de USDC.

I’m don't post often on social media, but I can’t help but say something about the bank failures this week of #SVB and #Silvergate (yes I consider that a failure as well) and why regulators' focus on bank exposure to #Bitcoin and #Crypto misses the mark. A thread...

[1/10]

[1/10]

Others have discussed the risk management failures that led to these collapses, but what I think is worth pointing out is the incongruence of the federal and state banking regulators’ guidance and regulatory priorities.

[2/10]

[2/10]

It’s no secret that I am a former regulator. I also work for a #Bitcoin company. @unchainedcap take our responsibility to our clients seriously: never taking custody of our clients’ bitcoin, no rehypothecation, no lending client funds to others to chase yields.

[3/10]

[3/10]

Le ultime 24h son state un colpo duro per mercati azionari e crypto. Il settore finanziario è capitolato e fa paura, Tra SI, SVB, Biden, Letitia James, Un terremoto di cattive notizie ci ha portato in consolidazione mensile.

Ci tocca threddare!

Ci tocca threddare!

1/25

Be sure to read each part of this thread it wont be short! hmm how to start some of the many thoughts I have on current matters...

Be sure to read each part of this thread it wont be short! hmm how to start some of the many thoughts I have on current matters...

2/25

Think I will start with an experience I had in 2016 into 2018 where I found myself following a guy that gained a lot of traction his name was clif high.

Think I will start with an experience I had in 2016 into 2018 where I found myself following a guy that gained a lot of traction his name was clif high.

3/25

He created a monthly report on crypto and vast topics called Alta report (web bots) that were claimed to be from things called spider bots that scanned the web for how humans were interacting with it via key words bit like google trends but would pull back data sets on each.

He created a monthly report on crypto and vast topics called Alta report (web bots) that were claimed to be from things called spider bots that scanned the web for how humans were interacting with it via key words bit like google trends but would pull back data sets on each.

It's always worth digging into the depths of a company's accounts. Here, from the September 2022 filing, is the solution to the mystery of #Silvergate's repayment of FHLB advances. FHLB advances in December 2022 totalled $4.3bn, far above Silvergate's maximum borrowing capacity.

Why did FHLB demand repayment of the entire borrowing, not just the overlimit amount? Couple of possible reasons. By Dec 2022, the value of Silvergate's asset base had reduced significantly due to fire sales and asset reclassification. And also, this is a covenant breach.

btw the FHLB appears to impose mammoth haircuts on collateral. Silvergate's reported FHLB borrowing as at 30 September 2022 was $700m.

🚨🚨Bybit suspende los pagos en dólares $USD a través de transferencias bancarias🏦.🚨🚨 Crees que esto será a consecuencia de #Silvergate ?? #hispacripto #Crypto #Silvergate #Bitcoin #Ethereum #META #USD #Bybit #cryptonews

Sigue el hilo y te contamos un poco más 👇

Sigue el hilo y te contamos un poco más 👇

El intercambio de criptomonedas Bybit está suspendiendo los depósitos y retiros denominados en dólares estadounidenses a través de transferencias bancarias, incluidos los pagos SWIFT.

Los depósitos en dólares se han suspendido temporalmente y los retiros se detendrán el 10 de marzo, dijo la plataforma en su sitio web, citando "interrupciones del servicio de nuestro socio de procesamiento de punto final".

🧵 THREAD - Panique à bord de #Silvergate

La "banque du #bitcoin " pourrait entraîner tout le système dans sa chute.

Que se passe t-il ? 👇

La "banque du #bitcoin " pourrait entraîner tout le système dans sa chute.

Que se passe t-il ? 👇

1/ With the crash of #Silvergate, the crypto market plummeted, and the price of $ETH dropped by 5%.

Before $ETH plummeted, the price had a slight increase.

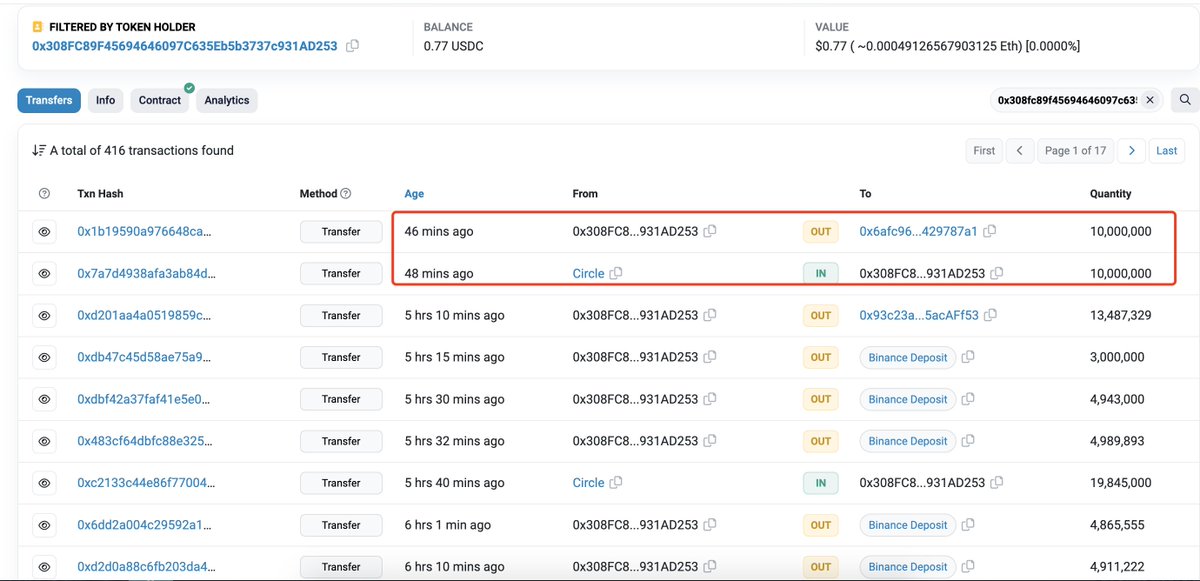

The mysterious fund withdrew 312M $USDC from #Circle and transferred to exchanges during the 8 hours of the uptick.

Before $ETH plummeted, the price had a slight increase.

The mysterious fund withdrew 312M $USDC from #Circle and transferred to exchanges during the 8 hours of the uptick.

2/ #Coinbase tweeted that it would no longer accept or initiate payments with #Silvergate 14 hrs ago.

13 hrs ago, the fund started to withdraw $USDC from #Circle and transfer to exchanges, then stop 5 hrs ago.

The price of $ETH has increased by 2% during this period.

13 hrs ago, the fund started to withdraw $USDC from #Circle and transfer to exchanges, then stop 5 hrs ago.

The price of $ETH has increased by 2% during this period.

3/ The fund withdrew 10M $USDC from #Circle and transfer to exchanges again 40 mins ago.

According to the data on the chain, the behavior of this mysterious fund is very strange.

According to the data on the chain, the behavior of this mysterious fund is very strange.

🚨Rosso Silvergate, il colore del 2023?🚨

La banca "Crypto apre oggi con un -45%.

Se lo stato di salute del mondo #Crypto lo deducessimo da un asset come #Silvergate cosa ci direbbe sul futuro del settore?

⚠️ Problemi per USDC? Vediamo 🧵⬇️

La banca "Crypto apre oggi con un -45%.

Se lo stato di salute del mondo #Crypto lo deducessimo da un asset come #Silvergate cosa ci direbbe sul futuro del settore?

⚠️ Problemi per USDC? Vediamo 🧵⬇️

1/ #Silvergate è in ritardo nell'invio della dichiarazione annuale ⏰

Ha comunicato di non riuscire a presentare la dichiarazione entro la data di scadenza prevista a causa di difficoltà nel completare la dichiarazione. Qui la notifica della #SEC 👇

ir.silvergate.com/sec-filings/se…

Ha comunicato di non riuscire a presentare la dichiarazione entro la data di scadenza prevista a causa di difficoltà nel completare la dichiarazione. Qui la notifica della #SEC 👇

ir.silvergate.com/sec-filings/se…

🚨🧵1/Ω

#BankOfLithuania has published its inspection and review targets for 2023. Guess who's targeted at the very top of the list?

@RevolutApp and @Swedbank, for money laundering and terrorist financing.

#BankOfLithuania has published its inspection and review targets for 2023. Guess who's targeted at the very top of the list?

@RevolutApp and @Swedbank, for money laundering and terrorist financing.

🚨🧵2/Ω

Guess who's at the top of the "Electronic money and payment institutions"? #Contis.

What does #Contis do?

They are the issuer of the #Binance Visa card.

#GuruPay, #PhoenixPayments, @RebellionPay also make appearances.

Guess who's at the top of the "Electronic money and payment institutions"? #Contis.

What does #Contis do?

They are the issuer of the #Binance Visa card.

#GuruPay, #PhoenixPayments, @RebellionPay also make appearances.

🚨🧵3/Ω

On the 3rd page I was surprised to see that a company named #Silvergate appears. #UABSilvergateLT, specifically. Any relation to $SI?

There's also #MajesticFinancial and #Maneuver.

On the 3rd page I was surprised to see that a company named #Silvergate appears. #UABSilvergateLT, specifically. Any relation to $SI?

There's also #MajesticFinancial and #Maneuver.

🧵1/Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

🧵2/Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

🧵3/Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

🧵1/Ω

It should surprise no one that @Bullish, an offshore exchange backed by the #EOS scammers at Block.One, uses $SI for banking.

It should surprise no one that @Bullish, an offshore exchange backed by the #EOS scammers at Block.One, uses $SI for banking.

🧵2/Ω

Nor would it surprise anyone to know that as of Nov. 24th a little over 1/6th of $SI (16.73%) was owned by #B1 CEO #BrendanBlumer and @B1 itself.

b1.com/press/b1-acqui…

Nor would it surprise anyone to know that as of Nov. 24th a little over 1/6th of $SI (16.73%) was owned by #B1 CEO #BrendanBlumer and @B1 itself.

b1.com/press/b1-acqui…

#Huobi seems to be melting down in real time, possibly along with His Excellency #JustinSun's fortune...

Shut down all intra-employee IMs etc, maybe fired a bunch of people. Employees now angry (or Sun is ruggin') @HuobiGlobal @justinsuntron

Shut down all intra-employee IMs etc, maybe fired a bunch of people. Employees now angry (or Sun is ruggin') @HuobiGlobal @justinsuntron

@HuobiGlobal @justinsuntron Apparently #JustinSun tried to dissolve the company (which would presumably leave all the employees unemployed).

Remember just yesterday it was reported that #JustinSun had tried to pay #Huobi employees in $USDT and/or $USDC... #Tether (h/t @crasl7 for non machine translation)

Remember just yesterday it was reported that #JustinSun had tried to pay #Huobi employees in $USDT and/or $USDC... #Tether (h/t @crasl7 for non machine translation)

Community banks have long been targets by bad actors.

With limited resources and capabilities bad actors Trojan their way into the bank to launder their cash.

#communityone #ponzi #communitybank #fraud

With limited resources and capabilities bad actors Trojan their way into the bank to launder their cash.

#communityone #ponzi #communitybank #fraud

with crypto the bad actors waltz in the front door under the guise of digital transformation.

So imagine the world of pain a little community bank will find itself in when its not just suspect accounts they may have inadvertently laundered.

So imagine the world of pain a little community bank will find itself in when its not just suspect accounts they may have inadvertently laundered.

But the great white knight of their local bank thats been part of the community for 100 years is the biggest fraud of them all.

🧵1/Ω

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

🧵2/Ω

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.