Discover and read the best of Twitter Threads about #Debtceiling

Most recents (24)

🚨BREAKING NEWS

1/7

The bipartisan debt-limit deal, brokered between the White House and House Republican leadership, is progressing. The House Rules Committee has voted 7-6 to advance the bill towards a full House vote on Wednesday evening. #DebtLimit #USCongress

1/7

The bipartisan debt-limit deal, brokered between the White House and House Republican leadership, is progressing. The House Rules Committee has voted 7-6 to advance the bill towards a full House vote on Wednesday evening. #DebtLimit #USCongress

2/7

However, the deal did not go unopposed. All Democrats on the committee voted against the advance. Two conservative Republicans, Reps. Chip Roy of Texas and Ralph Norman of South Carolina, also opposed. Both are members of the House Freedom Caucus, which has criticized the… twitter.com/i/web/status/1…

However, the deal did not go unopposed. All Democrats on the committee voted against the advance. Two conservative Republicans, Reps. Chip Roy of Texas and Ralph Norman of South Carolina, also opposed. Both are members of the House Freedom Caucus, which has criticized the… twitter.com/i/web/status/1…

3/7

The pressure is high as Congress races to pass the deal to suspend the debt ceiling before June 5. If not, the US could default on its obligations. Leaders from both parties face opposition from members critical of the concessions made in the compromise. #DebtCeiling… twitter.com/i/web/status/1…

The pressure is high as Congress races to pass the deal to suspend the debt ceiling before June 5. If not, the US could default on its obligations. Leaders from both parties face opposition from members critical of the concessions made in the compromise. #DebtCeiling… twitter.com/i/web/status/1…

1/14 - 🚨WHAT HAPPENS IF THE US DEFAULTS⁉️

A default on the US debt ceiling would have profound implications. This historic event could trigger economic shocks and disrupt global financial stability. Let’s talk about it!#DebtCeilingDefault #GlobalFinancialStability

A default on the US debt ceiling would have profound implications. This historic event could trigger economic shocks and disrupt global financial stability. Let’s talk about it!#DebtCeilingDefault #GlobalFinancialStability

2/14

History teaches us that financial crises can affect military readiness and operations. A default could hamper US strategic alliances, similar to the effects of the Great Depression. #HistoricalLessons #MilitaryReadiness

History teaches us that financial crises can affect military readiness and operations. A default could hamper US strategic alliances, similar to the effects of the Great Depression. #HistoricalLessons #MilitaryReadiness

3/14

A default could also jeopardize trust in US Treasury bonds, a cornerstone of the global economy. The result? Skyrocketing interest rates and a weakened dollar. #TrustInBonds #DebtCeiling

A default could also jeopardize trust in US Treasury bonds, a cornerstone of the global economy. The result? Skyrocketing interest rates and a weakened dollar. #TrustInBonds #DebtCeiling

Why #JoeBiden Will Get the #NobelPeacePrize - a thread 🧵

The #UkraineWar might be a blessing for the world in disguise by bringing about lasting world peace.

And, for this, we will have to thank the @POTUS

(1/)

The #UkraineWar might be a blessing for the world in disguise by bringing about lasting world peace.

And, for this, we will have to thank the @POTUS

(1/)

How? Because, no matter what the cost, Western countries are determined to supply more and more weapons and ammunition to Ukraine to fight #Russia.

#Biden has said that #American support for #Ukraine will continue "as long as it takes."

(2/)

#Biden has said that #American support for #Ukraine will continue "as long as it takes."

(2/)

#Russia has been steadily destroying all this ammunition and these weapons, so much so that it is already summer (beginning of June) and the "spring #counteroffensive" of #Ukraine hasn't yet started, because they have no weapons to start any offensive.

(3/)

(3/)

Congress must act quickly to reach a #DebtCeiling agreement and avoid a catastrophic default, which would harm the economy and disproportionately hurt low-income households. No #DefaultOnAmerica

The #DebtCeiling deal announced over the weekend shows some progress BUT contains some very damaging provisions that would harm public health and well-being and the environment, especially in frontline communities and communities of color.

➡️docs.house.gov/billsthisweek/…

➡️docs.house.gov/billsthisweek/…

Congress should reject the egregious provision to move forward the Mountain Valley Pipeline, a project that would expand climate-damaging methane gas, pollute the local environment, and eliminate important legal protections for communities' health. #StopMVP

1/13

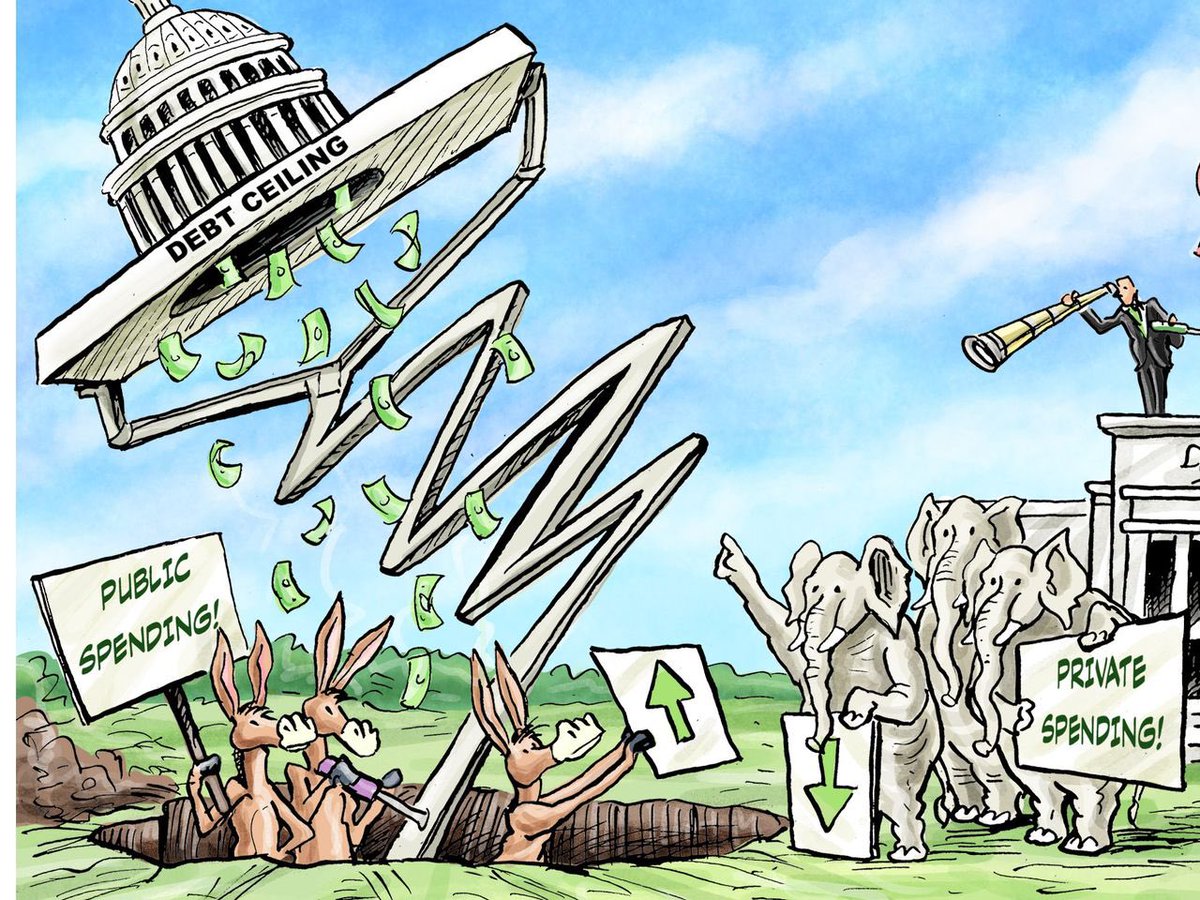

📣 Thread on the recent debt ceiling deal between President Biden and Speaker Kevin McCarthy. The agreement brings new details to light. Do you agree or disagree with the deal? Here's a non-biased breakdown of the key components. 👇 #DebtCeiling #Biden #McCarthy

📣 Thread on the recent debt ceiling deal between President Biden and Speaker Kevin McCarthy. The agreement brings new details to light. Do you agree or disagree with the deal? Here's a non-biased breakdown of the key components. 👇 #DebtCeiling #Biden #McCarthy

2/13

The cornerstone of the agreement is a two-year suspension of the debt ceiling, allowing the government to continue borrowing and pay its bills on time, if Congress passes the agreement by June 5th. #DebtCeiling #Congress

The cornerstone of the agreement is a two-year suspension of the debt ceiling, allowing the government to continue borrowing and pay its bills on time, if Congress passes the agreement by June 5th. #DebtCeiling #Congress

3/13

In exchange for suspending the limit, Republicans demanded policy concessions from Mr. Biden, such as limits on federal discretionary spending growth and new work requirements for certain food stamps and Temporary Aid for Needy Families program recipients. #PolicyChanges

In exchange for suspending the limit, Republicans demanded policy concessions from Mr. Biden, such as limits on federal discretionary spending growth and new work requirements for certain food stamps and Temporary Aid for Needy Families program recipients. #PolicyChanges

Palantir $PLTR and $SOFI have freakishly similar charts, as well as some similar fundamental catalysts.

1. They both hit their all time highs roughly 840 days ago.

2. They both dropped between 84.5-87% from their all time highs.

3. The RSI and MACD's, for both charts, are… twitter.com/i/web/status/1…

1. They both hit their all time highs roughly 840 days ago.

2. They both dropped between 84.5-87% from their all time highs.

3. The RSI and MACD's, for both charts, are… twitter.com/i/web/status/1…

The next thing to look at is the specific technical setup for $SOFI, then we'll talk about my options play and what kind of returns could be yielded by my purchase on Friday.

First off, we're up almost 6% today because of the recent Student loan deferment news, which will… twitter.com/i/web/status/1…

First off, we're up almost 6% today because of the recent Student loan deferment news, which will… twitter.com/i/web/status/1…

It seems to me that most people who complain about the federal budget have probably never looked at it.

It’s available online. Everyone can see it. You should look at it before expressing strong opinions about things like the #DebtCeiling debate.

It’s available online. Everyone can see it. You should look at it before expressing strong opinions about things like the #DebtCeiling debate.

There is no secret Woke Fund. Most of our spending goes to the things that most of us don’t want to see cut - Social Security, Medicare, Medicaid, Defense, Veteran’s Benefits and Interest on the Debt.

And if you look at what we take in versus what we spend, the idea of even balancing the budget so that we stop borrowing and deepening the National Debt is a hard. Why problem.

And a nearly impossible one if your stance is that no taxes should be raised on anyone ever.

And a nearly impossible one if your stance is that no taxes should be raised on anyone ever.

#Debtceiling deal includes permitting reforms. People familiar w/the provisions, who spoke on condition of anonymity, said the language includes review timelines + a lead agency charged with shepherding a project’s #environmental review. eenews.net/articles/debt-…

1) The bipartisan agreement includes language to ease transmission deployment and address storage for renewable energy development, but the particulars remain under wraps.

2) Democrats, for their part, are circulating talking points about the White House not giving in on judicial reviews for energy projects and protecting key portions of the National Environmental Policy Act and other landmark laws.

THREAD: There are members of the GOP claiming Democrats got nothing from the “deal.” Oh really? 1) An uncapped debt ceiling with an expiration date - worth approximately $4 trillion…? 2) basically no cuts - a freeze at bloated 2023 spending level? #DebtCeiling (1/3)

…3) ZERO claw back of the $1.2 Trillion “inflation reduction act” crony giveaways to elite leftists for grid-destroying unreliable energy…? 4) 98% of the IRS expansion left fully in place…? 5) no work requirements for Medicaid? - & only age adjustments for TANF/SNAP…? (2/3)

…6) no REINS act statutory requirement for congress to approve huge regulations - just an “administrative” paygo that the administration will get to enforce? 7) No border security!! - & a deal allowing them to avoid policy riders in the fall… 8) more… (3/3) /end

THREAD: Turns out this chart is basically accurate. Will fill it in tomorrow more fully… but to best of our current understanding with NO text… 1) Debt ceiling set til 1/1/2025 - which means unknown debt increase - but $4 Trillion is a good estimate... (1/10)

…2) Debt Ceiling “Deal” totally scraps the $131BB in cuts to return bureaucracy to pre-COVID levels in favor of what appears to be effectively flat spending (down or up a little) - at the bloated 2023 Omnibus spending level, jammed through in a rush in December… (2/10)

3) Debt Ceiling “Deal” abandons work requirements for Medicaid (3/10)

Thread: concerns based on emerging reports about #DebtCeiling bill. Before we dive in, important to remember, we shouldn't be here to begin with. House Rs have used the debt ceiling to hold the nation’s economy hostage to demands for damaging policies.

While the #DebtCeiling agreement appears to be much improved over the radical House bill, that’s not the bar.

Based on reports, the agreement appears to put #SNAP benefits at risk for people ages 50-54 who count on them – a group with high rates of health problems. We can’t fully assess until details are released, but this risks increasing poverty among this group.

Rough Summer Ahead?

#Team42, I joined @APompliano earlier this week to discuss the #DebtCeiling , #recession , Global #Liquidity , and more.

EVERY investor will want to review the following six highlights from the interview:

#Team42, I joined @APompliano earlier this week to discuss the #DebtCeiling , #recession , Global #Liquidity , and more.

EVERY investor will want to review the following six highlights from the interview:

1) We expect the Debt Limit Crisis to negatively impact global liquidity.

The US government will return to the international capital markets to borrow more money (after resolving the crisis).

The US government will return to the international capital markets to borrow more money (after resolving the crisis).

Is it legal for Congress to #default on the US #NationalDebt? It depends on who you ask. There are a ton of good legal arguments for and against, so perhaps it comes down to what the (degraded, corrupt, illegitimate, partisan) #SupremeCourt says?

nytimes.com/2023/05/04/opi…

1/

nytimes.com/2023/05/04/opi…

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/26/min…

2/

pluralistic.net/2023/05/26/min…

2/

House Republicans have tried to make those who can’t afford food, rent, or health care pawns in their debt-ceiling hostage-taking scheme. @POTUS and members of Congress must not go along.

.@POTUS has repeatedly committed to reject any legislation that increases poverty or would negatively impact people’s health. Now is the moment to deliver on those commitments. #DebtCeiling

New data: Of the 1 million kids at risk of losing cash assistance under the House R bill, more than half would be pushed into deep poverty or even further into deep poverty than they already are if their families lose TANF. #DebtCeiling #KidsNotCuts

More than 100,000 children in families that are in poverty would be at risk of losing #TANF cash assistance and being pushed into deep poverty, meaning with incomes below 50% of the poverty line (about $1,000 a month for a family of 3).

About another 400,000 children in families who are already in deep poverty would be at risk of losing #TANF cash assistance and being pushed further into deep poverty.

No one in the thread has asserted there will not be spillover effects into other asset classes, in an event where the US equity market has a 40% draw-down, but that will not "destroy America," as some snowflakes assert.

A 40% decline in equities will not destroy America.

The Lyin' Ted account is attempting to induce a debate on an assertion not made, and I'll entertain it.

Let's look at the relation between equities and commodities.

Side-Note: Even up markets see draw-downs in S&P 500.

The Lyin' Ted account is attempting to induce a debate on an assertion not made, and I'll entertain it.

Let's look at the relation between equities and commodities.

Side-Note: Even up markets see draw-downs in S&P 500.

For long-term investors, a key issue is whether there exists a long-term relation between the prices of commodity and equity investment even though these prices may diverge in the short term (Kasa, 1992).

NEXT WEEK

The Bear's take:

•Unresolved Debt ceiling

•Friday's negative day and bearish candlesticks

• Several neg. divergences

•Leading stocks reversed

• #VVIX bullish engulfing candle and #VIX1D daily higher highs higher lows points to more vol ahead

•GDP maybe ↓

$SPX

The Bear's take:

•Unresolved Debt ceiling

•Friday's negative day and bearish candlesticks

• Several neg. divergences

•Leading stocks reversed

• #VVIX bullish engulfing candle and #VIX1D daily higher highs higher lows points to more vol ahead

•GDP maybe ↓

$SPX

NEXT WEEK

The Bull's take

• Indices up week on high volume

•Buy the dip: Bullish action

•Volatility indicators are subdued

• $NDX, $FAANG, $SMH in good health

• $SPX, $NDX higher highs and higher lows

•Market broke out above resistance

•Breadth thrust last Wednesday

#SPX

The Bull's take

• Indices up week on high volume

•Buy the dip: Bullish action

•Volatility indicators are subdued

• $NDX, $FAANG, $SMH in good health

• $SPX, $NDX higher highs and higher lows

•Market broke out above resistance

•Breadth thrust last Wednesday

#SPX

There's been much talk about the U.S. Debt Ceiling Crisis the past week. It's come to my attention many are aware about it, but don't know what it is.

🧵Let's explore what a DEBT CEILING actually is, its causes, options to resolve it, current actions, and future implications:👇

🧵Let's explore what a DEBT CEILING actually is, its causes, options to resolve it, current actions, and future implications:👇

1/ The debt ceiling crisis is a political and economic crisis that occurs when the United States government reaches its maximum limit on how much money it can borrow. This limit is set by Congress, and it has been raised 78 times since 1960.

2/ The current debt ceiling is $31.4 trillion. The United States government has been running a budget deficit for many years. This means that the government is spending more money than it is receiving.

Okay, so while I'm waiting around for Congress to do its job and raise the #DebtCeiling, hoping that their screwing around doesn't cost me my 401(k), I decided to fact check the GOP talking points.

Here's how we got our huge national debt. Broken out by year and party control.

Here's how we got our huge national debt. Broken out by year and party control.

First of all, here's a refresher on the deficit, the debt and how they relate to one another.

Now let's dig into the numbers.

Now let's dig into the numbers.

Today's Twitter threads (a Twitter thread).

Inside: Venture predation; and more!

Archived at: pluralistic.net/2023/05/19/fak…

#Pluralistic

1/

Inside: Venture predation; and more!

Archived at: pluralistic.net/2023/05/19/fak…

#Pluralistic

1/

Tomorrow I'm at @GburgBookFest with *Red Team Blues*:

gaithersburgbookfestival.org/featured_autho…

Mon (5/22), I'm at @publicknowledge's Emerging Tech in #DC:

eventbrite.com/e/emerging-tec…

On 5/23, it's #Toronto for #WEPFest, w/@hockeyesque @RonDeibert & @DrNancyOlivieri:

westendphoenix.com/shop/wepfest-s…

2/

gaithersburgbookfestival.org/featured_autho…

Mon (5/22), I'm at @publicknowledge's Emerging Tech in #DC:

eventbrite.com/e/emerging-tec…

On 5/23, it's #Toronto for #WEPFest, w/@hockeyesque @RonDeibert & @DrNancyOlivieri:

westendphoenix.com/shop/wepfest-s…

2/

THREAD on #DebtCeiling. The @HouseGOP passed #HR2811 - the Limit, Save, Grow Act - that raises the debt ceiling $1.5 Trillion or until 3/31/24, for sensible, purposeful non-political reforms. Those reforms should NOT be abandoned - because they matter… (1/10)

…Purposeful reform #1: Cut the federal bureaucracy to pre-COVID levels by limiting total discretionary 2024 spending to 2022 levels ($1.471 TR) -which constrains woke bureaucrats to help spur growth & freedom, & re-sets spending to save $131BB now, & 3.5TR over 10 years… (2/10)

…Purposeful reform #2: Cut the so-called “inflation reduction act” tax credit give-aways to rich, white, elites (90%+ corp subsidies go to $1BB+ corps, 80% of EV go to $100K+ people) to save $1.2 TR, keep reliable power, & end increases to the cost of gas/electricity… (3/10)

📈 Se la #recessione sarà dura come si comporterà il nostro amato #bitcoin? 📉

Abbiamo affrontato la questione nell'ultimo #CryptoPub insieme a @AlexOttaBTC 🍻

Qui il link per il Podcast👇

open.spotify.com/episode/1GvF3Y…

Vediamo un po' di riflessioni a questo riguardo 🧵🔥

Abbiamo affrontato la questione nell'ultimo #CryptoPub insieme a @AlexOttaBTC 🍻

Qui il link per il Podcast👇

open.spotify.com/episode/1GvF3Y…

Vediamo un po' di riflessioni a questo riguardo 🧵🔥

1/ La famiglia reale di Abu Dhabi è pesantemente short sull'azionario USA 🩸

@markets ha riportato la notizia che il fondo della Famiglia Reale è fortemente ribassista nei confronti del mercato USA.

bloomberg.com/news/articles/…

@markets ha riportato la notizia che il fondo della Famiglia Reale è fortemente ribassista nei confronti del mercato USA.

bloomberg.com/news/articles/…

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇