Discover and read the best of Twitter Threads about #yields

Most recents (24)

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

#ChartStorm: 1/17

🗓️ March Performance of ...

🇺🇸 #SPX #IXIC #DJI 🇯🇵 #NI225 🇩🇪 #DAX 🇹🇷 #XU100

#DXY #EURUSD #GBPUSD #CADUSD #JPYUSD #TRYUSD

#TreasuryBills #GovernmentBonds #Yields

🗓️ March Performance of ...

🇺🇸 #SPX #IXIC #DJI 🇯🇵 #NI225 🇩🇪 #DAX 🇹🇷 #XU100

#DXY #EURUSD #GBPUSD #CADUSD #JPYUSD #TRYUSD

#TreasuryBills #GovernmentBonds #Yields

2) Here I'll cover 6 stock market indices in 4 countries:

In order to compare the relative performances, I've chosen a pre-pandemic basis, which is 31/12/2019 closing values.

As Nasdaq, S&P500 and DJI are denominated in US dollars, but the others not, returns are misleading.

In order to compare the relative performances, I've chosen a pre-pandemic basis, which is 31/12/2019 closing values.

As Nasdaq, S&P500 and DJI are denominated in US dollars, but the others not, returns are misleading.

3) I have adjusted the data, and now all are denominated in US dollars.

#BIST returns are still amazing with its 30.4%, but not striking as above. Besides it is positive only after Sep'22. #Nasdaq is leading with 36.2% return. #Nikkei225 is the only index below pandemic level.

#BIST returns are still amazing with its 30.4%, but not striking as above. Besides it is positive only after Sep'22. #Nasdaq is leading with 36.2% return. #Nikkei225 is the only index below pandemic level.

Thanks to @GeoffCutmore & @steve_sedgwick for the chat on #SquawkBox this morning!

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

First of all, it's #ValentinesDay and SOMEONE is going to get massacred today when the #CPI is released, so naturally:-

2/x

2/x

Roses are red, violets are blue,

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

1/ #GM

Let’s talk DeFi yield. What are the types (and sources) of yields in DeFi? How we are headed towards a more sustainable model, with #realyield. In this #visualthread, we will discuss all you need to know about DeFi yield.

#Blockchain #Crypto #Bitcoin #Ethereum $ETH $BTC

Let’s talk DeFi yield. What are the types (and sources) of yields in DeFi? How we are headed towards a more sustainable model, with #realyield. In this #visualthread, we will discuss all you need to know about DeFi yield.

#Blockchain #Crypto #Bitcoin #Ethereum $ETH $BTC

2/ Disclaimers.

Before we move forward, please note that this thread merely aims to share our understanding of the topic, and should not be taken as financial advice.

Before we move forward, please note that this thread merely aims to share our understanding of the topic, and should not be taken as financial advice.

3/ Patron and Support

We also would like to say appreciation and thanks to our patron, @Candlestick_io analytics platform.

If you want to join, you can use this link to get $25 discount

candlestick.io/?referral=5e54…

We also would like to say appreciation and thanks to our patron, @Candlestick_io analytics platform.

If you want to join, you can use this link to get $25 discount

candlestick.io/?referral=5e54…

In the world of #DeFi yield protocols, developers and users typically need to make a choice:

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

🍏In most existing leveraged yield farms, higher yield comes from higher leverage and higher risk.

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

#Duration works both ways!

#Austria's '100-year' bond, maturing in 2120, with a duration of 46 years, is down a whopping 72% since late 2020 when global yields bottomed.

short thread 1/9

#Austria's '100-year' bond, maturing in 2120, with a duration of 46 years, is down a whopping 72% since late 2020 when global yields bottomed.

short thread 1/9

This also answers the many questions about why the value of (UK) #liability-driven investment funds, used by pension funds to match the #duration of their #liabilities, has plummeted. 2/9

Theoretically, since pension fund #liabilities and #assets both drop when #yields rise - it is not called liability matching for nothing - there shouldn't be a problem, right? 3/9

#PCE #Core #Inflation keeps rising.

Main indicator for the #FederalReserve when judging whether or not to continue raising #interestrates.

#Powell was quite clear in his speeches that they will continue raising "into pain" as long as price stability is not achieved.

🧵

Main indicator for the #FederalReserve when judging whether or not to continue raising #interestrates.

#Powell was quite clear in his speeches that they will continue raising "into pain" as long as price stability is not achieved.

🧵

By "into pain", they are primarily referring to their dual mandate of price stability (#inflation) and maximum #Employment.

But there is not much pain showing up in the job market.

Last weekly jobless claims hit a 5-month low.

reuters.com/markets/us/us-…

But there is not much pain showing up in the job market.

Last weekly jobless claims hit a 5-month low.

reuters.com/markets/us/us-…

So to summarize, #TheFed has 2 jobs:

1. Reduce #inflation (not done)

2. Maximize #employment (done)

And they've been adamant about raising #rates until 1. is done, even at temporary setbacks to 2.

Unless they plan on pulling a #BoE, anything short of #75bps/#100bps is hopium.

1. Reduce #inflation (not done)

2. Maximize #employment (done)

And they've been adamant about raising #rates until 1. is done, even at temporary setbacks to 2.

Unless they plan on pulling a #BoE, anything short of #75bps/#100bps is hopium.

What really causes inflation? 🧵

[a thread for normies - like me]

[a thread for normies - like me]

2/ The problem with #inflation is that it's a very personal experience.

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

3/ Price inflation and monetary inflation have different definitions:

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

Did someone warn you of the current #inflation, #recession, and #bearmarket in equities? Did you get out or reallocate in time? Breaking even? Maybe even profit?

Did you pay a subscription for those warnings late last year?

I started warning friends about it in 2016.

Read on🧵

Did you pay a subscription for those warnings late last year?

I started warning friends about it in 2016.

Read on🧵

When I said that I was warning my friends about it in 2016, I did so because it was clear that #Trump would not be a good president for the US & world #economy long-term, and would increase the odds of #inflation and rising #interestrates.

Late 2016 DMs in Norwegian to a friend:

Late 2016 DMs in Norwegian to a friend:

Reflections on the morning after - and especially the markets… 🧵

It may well take some time for the dust to settle on #KwasiKwarteng’s first #Budget (yes, 'Budget’: if it looks like a duck, walks like a duck and quacks like a duck, then it’s fair to call it a duck)...

It may well take some time for the dust to settle on #KwasiKwarteng’s first #Budget (yes, 'Budget’: if it looks like a duck, walks like a duck and quacks like a duck, then it’s fair to call it a duck)...

The initial reaction from most economic commentators and in the financial markets has been a loud boo! There are some things I would have done differently. But the overall strategy is sound, and sentiment should recover as the economic benefits become clearer...

There are two aspects I particularly liked. One is the emphasis on breaking the ‘doom loop’ of weak economic growth and rising taxes, both with tax cuts and – at least as importantly – structural reforms on the supply-side...

Non Fungible Token Design: The Structure of Yield Generating Tokens.

My Tutor, @SamuelXeus always said to his community "Never research a tree, but rather, research what makes the tree stand"

Lately, NFT Yield tokens have been mooning, how do they exist to moon?

Follow up 👇

My Tutor, @SamuelXeus always said to his community "Never research a tree, but rather, research what makes the tree stand"

Lately, NFT Yield tokens have been mooning, how do they exist to moon?

Follow up 👇

🚨GR15 / LIST OF 20 PROJECTS YOU MUST SUPPORT - PART 2

#GR15 has already begun, the biggest funding event in #web3, GR15 runs until Sept 22

We support the projects we love and help to build and shape web3/if you haven't been following here is PART1

🧵🕵️⚡️

#GR15 has already begun, the biggest funding event in #web3, GR15 runs until Sept 22

We support the projects we love and help to build and shape web3/if you haven't been following here is PART1

🧵🕵️⚡️

1/

gitcoin.co/grants/5688/je…

@JediSwap

#JediSwap is a fully composable and #permissionless #AMM that enables users to #swap assets and earn #yields on their assets instantly in a #gasless manner.

JediSwap is built on #StarkNet and is an entirely community-driven project.

gitcoin.co/grants/5688/je…

@JediSwap

#JediSwap is a fully composable and #permissionless #AMM that enables users to #swap assets and earn #yields on their assets instantly in a #gasless manner.

JediSwap is built on #StarkNet and is an entirely community-driven project.

2/

gitcoin.co/grants/5414/en…

@ensvision

ENS.Vision is a page, where you can bulk search and bulk register ENS #domain names. Our page provides a free, simple-to-use interface to find domains.

Their next goal is to create an exclusive #marketplace for #ENS

gitcoin.co/grants/5414/en…

@ensvision

ENS.Vision is a page, where you can bulk search and bulk register ENS #domain names. Our page provides a free, simple-to-use interface to find domains.

Their next goal is to create an exclusive #marketplace for #ENS

#Fragmentation

1) Son toplantıda öne çıkan bu kelimeyi daha sık duyacağız gibi.🤔

Avrupa Merkez Bankası Yönetim Konseyi bugün "mevcut piyasa koşullarını tartışma" amacına özgü bir toplantı kararı aldı. Takvimde daha önce yer almayan bu görüşme yakından izleniyor.

1) Son toplantıda öne çıkan bu kelimeyi daha sık duyacağız gibi.🤔

Avrupa Merkez Bankası Yönetim Konseyi bugün "mevcut piyasa koşullarını tartışma" amacına özgü bir toplantı kararı aldı. Takvimde daha önce yer almayan bu görüşme yakından izleniyor.

2) Öncelikle #fragmentation kavramının ne anlama geldiğine bakalım o hâlde:

Türkçe olarak "parçalarına ayrılma, bölünme" şeklinde ifade edebileceğimiz bu kavram #ECB açısından para politikasının aktarım mekanizmasında bozulma işaretidir ki bu da politikanın etkisini azaltabilir.

Türkçe olarak "parçalarına ayrılma, bölünme" şeklinde ifade edebileceğimiz bu kavram #ECB açısından para politikasının aktarım mekanizmasında bozulma işaretidir ki bu da politikanın etkisini azaltabilir.

For all the blithe talk about #EnergyTransition, the blunt truth is that civilisation runs on hydrocarbons. Remove the latter and the former falls, too.

2/n

2/n

Even the food we eat requires them. We have not improved the living standards of all our teeming billions on the quasi-Neolithic methods of farming so beloved of the ignorant #Green metromarxists.

3/n

3/n

If you intend to hold AVAX for the long term and believe in the completion of the existing ecosystem as well as the need for subnets to thrive in the future, you've probably had to decide where to stake your AVAX.

You should read this thread!

#AvaxholicInsights #CSSADT #AVAXDT

You should read this thread!

#AvaxholicInsights #CSSADT #AVAXDT

1/ What will be covered in this thread:

1⃣ Why do we need @BenqiFinance's Liquid Staking?

2⃣ What is BenQI's Liquid Staking?

3⃣ How does it work?

4⃣ BenQI plays an integral role in the Subnet Economy.

5⃣ veQI - Curve Wars on BenQI

6⃣ Potential of BenQI

1⃣ Why do we need @BenqiFinance's Liquid Staking?

2⃣ What is BenQI's Liquid Staking?

3⃣ How does it work?

4⃣ BenQI plays an integral role in the Subnet Economy.

5⃣ veQI - Curve Wars on BenQI

6⃣ Potential of BenQI

2/ As we all know, for a Proof-of-Stake #Blockchain like @avalancheavax, consensus is achieved by validators running hardware and locking up $AVAX collateral to secure the network.

A Thread on Debt to GDP Ratio 🧵

The debt-to-GDP ratio compares a country's debt to its total economic output measure by GDP for the year.

This ratio tells how the economy is doing and allows comparison.

Lets Look at where the world stands

@sahilkapoor @dugalira

The debt-to-GDP ratio compares a country's debt to its total economic output measure by GDP for the year.

This ratio tells how the economy is doing and allows comparison.

Lets Look at where the world stands

@sahilkapoor @dugalira

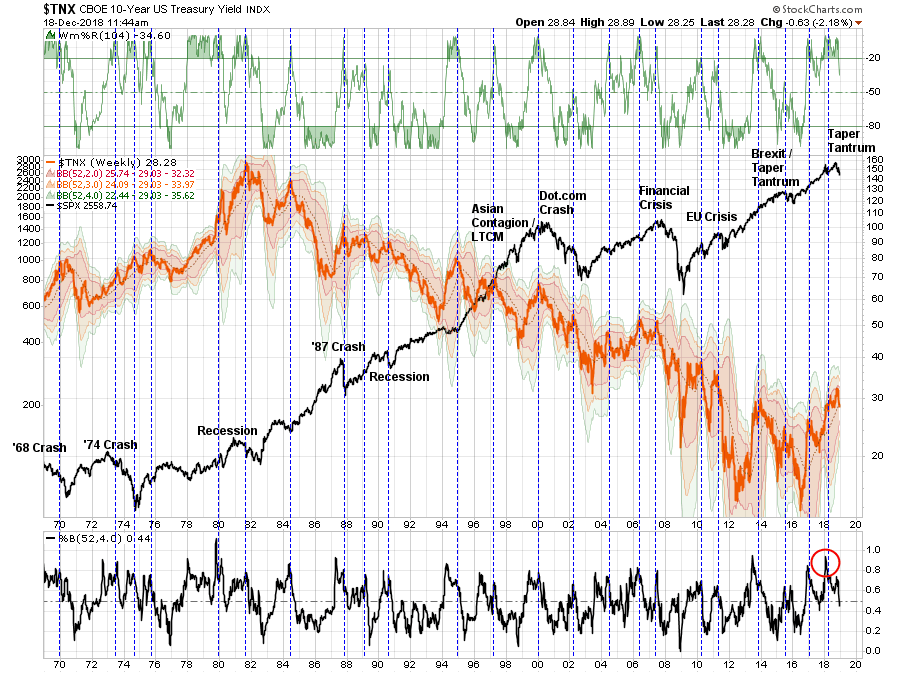

A significant #bond #buying opportunity is approaching.

As bond yields surge, history and #techncial analysis suggest that we should look at bonds for both #capital appreciation and a #risk hedge.

realinvestmentadvice.com/surge-in-bond-…

As bond yields surge, history and #techncial analysis suggest that we should look at bonds for both #capital appreciation and a #risk hedge.

realinvestmentadvice.com/surge-in-bond-…

In Dec 2018, we wrote why Jeff Gundlach was likely incorrect about 6% yields.

“Rates are at levels that historically led to some sort of event either economic, financial, or both, When that occurs, rates will go to 1.5% and closer to Zero.“

We got to 0.5%

realinvestmentadvice.com/surge-in-bond-…

“Rates are at levels that historically led to some sort of event either economic, financial, or both, When that occurs, rates will go to 1.5% and closer to Zero.“

We got to 0.5%

realinvestmentadvice.com/surge-in-bond-…

The surge in 2-year #bond #yields is unprecedented. Historically, such a surge in short-term yields coincides with either #recessions or #market events. With yields now 4-std deviations above its 52-week moving average, such has denoted peaks previously.

realinvestmentadvice.com/surge-in-bond-…

realinvestmentadvice.com/surge-in-bond-…

Thanks to @GeoffCutmore, @cnbcKaren & the #SquawkBox team for having me on this morning's show.

We discussed #bonds & #centralbanks, touched on #supplychains & talked of #Growth's vulnerability, #commodities' appeal.

Slide deck follows:-

1/14

We discussed #bonds & #centralbanks, touched on #supplychains & talked of #Growth's vulnerability, #commodities' appeal.

Slide deck follows:-

1/14

Is your box still backed up in port? How much does the onward haulage cost? What happens to #freight rates after #LNY/#Beijing2022?

2/14

2/14

Everyone wants those huge #gains, but not everyone knows where to look.

Did you know that the highest #yields usually come from smaller chains? Being early in #DeFi is very important!

So how does one navigate their way across the different networks?

Find out more below! 🧵👇🏻

Did you know that the highest #yields usually come from smaller chains? Being early in #DeFi is very important!

So how does one navigate their way across the different networks?

Find out more below! 🧵👇🏻

To move assets across different #networks, we would a bridge!

Bridging can be confusing and costly. But don't let that stop you from exploring beyond your comfort zone.

Here are some ways I've found to bridge assets across any #blockchain!

$LUNA $ETH $FTM $NEAR $ONE $ROSE $SOL

Bridging can be confusing and costly. But don't let that stop you from exploring beyond your comfort zone.

Here are some ways I've found to bridge assets across any #blockchain!

$LUNA $ETH $FTM $NEAR $ONE $ROSE $SOL

For most, using CEXs such as @binance, @FTX_Official, @kucoincom, @gate_io, etc is often most convenient way to their bridge assets.

They allow asset transfers between multiple chains, while giving users the freedom to trade tokens with a small platform fee.

They allow asset transfers between multiple chains, while giving users the freedom to trade tokens with a small platform fee.

Daily Bookmarks to GAVNet 12/21/2021 greeneracresvaluenetwork.wordpress.com/2021/12/21/dai…

Organizations’ system noise creates errors in decision making | McKinsey

mckinsey.com/business-funct…

#SystemNoise, #DecisionMaking, #CognitiveBias

mckinsey.com/business-funct…

#SystemNoise, #DecisionMaking, #CognitiveBias

The crypto-congressional complex - Robert Reich

robertreich.substack.com/p/crypto

#cryptocurrencies, #regulations, #speculation, #profiteering

robertreich.substack.com/p/crypto

#cryptocurrencies, #regulations, #speculation, #profiteering

Wie ich es mit #Krypto schaffe...die unendlichen Möglichkeiten des Web 4.0!

Viele fragen mich nach dem nächsten Tenbagger - #Shitcoin, dem nächsten Hype-#NFT oder generell...DEM nächsten Ding. Dabei kann jeder es schaffen. Selbstständig. Wie?

1/9

Viele fragen mich nach dem nächsten Tenbagger - #Shitcoin, dem nächsten Hype-#NFT oder generell...DEM nächsten Ding. Dabei kann jeder es schaffen. Selbstständig. Wie?

1/9

Die Möglichkeiten sind praktisch unendlich. Stellt euch das Internet in den 90ern vor. Dies ist die nächste Chance. Jedoch befreit von allen Kontrollen und Zensur, frei vom Einfluss des Kapitals. Freie Ideen und Gedanken in die Blockchain gegossen.

2/9

2/9

Es ist erst einmal schwer zu glauben: #Adaption ist ein Prozess. Vor 100 Jahren glaubte man nicht, dass man am offenen Herzen operieren, Frauen wählen oder kleine Bildschirme unser Leben bestimmen würden. Und nun sind wir hier.

3/9

3/9

Daily Bookmarks to GAVNet 11/20/2021 greeneracresvaluenetwork.wordpress.com/2021/11/20/dai…

When All The Media Narratives Collapse andrewsullivan.substack.com/p/when-all-the…

#media #narratives #collapse #FakeNews #journalism

#media #narratives #collapse #FakeNews #journalism

Scientists create artificial neural networks that detect symmetry and patterns techxplore.com/news/2021-11-s…

#NeuralNetworks #artificial #symmetry #patterns #MachineLearning #ResearchResults

#NeuralNetworks #artificial #symmetry #patterns #MachineLearning #ResearchResults

As expected, the @federalreserve’s Federal Open Market Committee continued to discuss its plans to reduce, or #taper, the pace of its #AssetPurchase program at yesterday’s meeting.

While the details of this discussion were fairly sparse, the Committee statement did state that: “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

Further, at the recent #Fed conference in Jackson Hole, Wyo., and at the press conference, Fed #ChairPowell emphasized that both he and most Committee participants now consider the test of “substantial further progress” toward the #inflation mandate to be largely satisfied.

Bridge your assets to @SecretNetwork and get earning on these juicy rewards! 💦

Bridges to BSC, ETH, & XMR LIVE! More under construction 🏗️

Use the bridges🌉

bridge.scrt.network

Learn more 🧐

docs.secretswap.io/secretswap/pro…

Get earning with 🤑

app.secretswap.io/earn

Bridges to BSC, ETH, & XMR LIVE! More under construction 🏗️

Use the bridges🌉

bridge.scrt.network

Learn more 🧐

docs.secretswap.io/secretswap/pro…

Get earning with 🤑

app.secretswap.io/earn

SEFI - sXMR

191% APY

$1,327,606.67 TVL

$XMR @monero #Monero #XMR $SEFI #SecretFinance #YieldFarm #LiquidityMining

191% APY

$1,327,606.67 TVL

$XMR @monero #Monero #XMR $SEFI #SecretFinance #YieldFarm #LiquidityMining