Discover and read the best of Twitter Threads about #Disinvestment

Most recents (7)

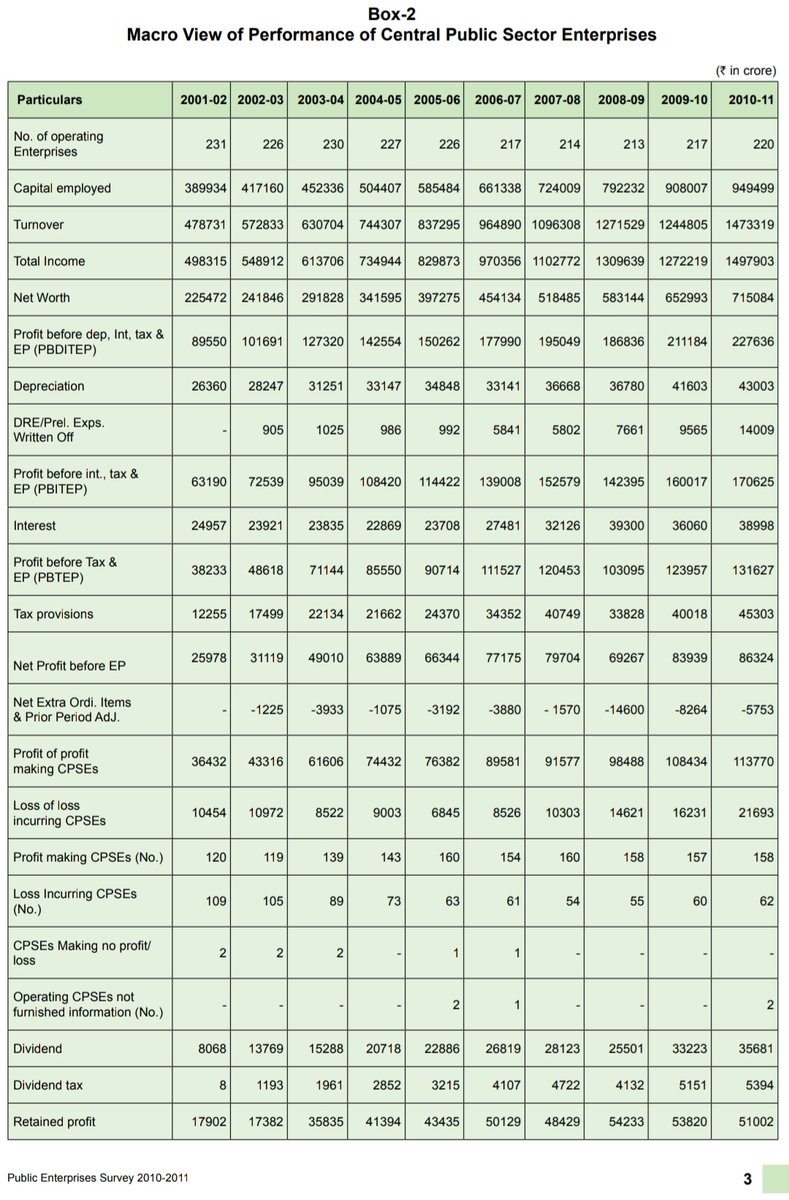

Central Public Sector Enterprises (CPSEs) as on 31.03.2021 (2020-21)

" 255 operational CPSE

Total turnover - Rs 24,26,045 crore

Total profit of 177 CPSE - Rs 1,89,320 crore

(The total profit of profit making CPSEs has increased by 37.53%)

#மத்திய_அரசு_பொதுத்துறை_நிறுவனங்கள்

" 255 operational CPSE

Total turnover - Rs 24,26,045 crore

Total profit of 177 CPSE - Rs 1,89,320 crore

(The total profit of profit making CPSEs has increased by 37.53%)

#மத்திய_அரசு_பொதுத்துறை_நிறுவனங்கள்

The big event begins! Track all the latest on #Budget2022 right here with @ETNOWlive

@FinMinIndia @nsitharaman kicks off talking about #disinvestment. Completion of #AirIndia, Neelachal Ispat and #LICIPO #Budget2022

Excellent #Budget2021 by @narendramodi govt

16.5 lakh Cr Agri Credit allocation&Rs 1.18 lakh Cr for roads

Massive 34.5% rise Capital Spending at 5.54 lakh Cr

137% rise in Health budget

Income Tax scrutiny reduced from 6 to 3 yrs;No Double taxation of NRIs

#Growth,the focus

16.5 lakh Cr Agri Credit allocation&Rs 1.18 lakh Cr for roads

Massive 34.5% rise Capital Spending at 5.54 lakh Cr

137% rise in Health budget

Income Tax scrutiny reduced from 6 to 3 yrs;No Double taxation of NRIs

#Growth,the focus

Hike in Insurance #FDI from 49% to 74%,pro #Reforms💪

#Dividend income invested In InvITs &REITs,tax free

No advance tax liability on Dividend income

#LIC IPO--BIG

#Disinvestment of BPCL,Pawan Hans,Air India,Concor,IDBI,Beml, Shipping Corp--BIG

64180Cr #Healthcare budget-BIG

#Dividend income invested In InvITs &REITs,tax free

No advance tax liability on Dividend income

#LIC IPO--BIG

#Disinvestment of BPCL,Pawan Hans,Air India,Concor,IDBI,Beml, Shipping Corp--BIG

64180Cr #Healthcare budget-BIG

5 Mega #Fishing harbours

7 Mega #Textile Parks

Agri Infra Fund to be available to #APMCs

Voluntary #VehicleScrapping policy

20000Cr #Recapitalisation of PSBs

#ARC to take over stressed assets

7 Port projects to be developed via PPP

18000Cr for Bus Transport

#Modinomics💪

7 Mega #Textile Parks

Agri Infra Fund to be available to #APMCs

Voluntary #VehicleScrapping policy

20000Cr #Recapitalisation of PSBs

#ARC to take over stressed assets

7 Port projects to be developed via PPP

18000Cr for Bus Transport

#Modinomics💪

#Nomura says,India will be fastest growing Asian economy in FY22,with GDP growth of 9.9;GDP growth to be 32.4% in 1QFY22&10.2% in 2QFY22

Fee weeks back #GoldmanSachs had upgraded India's GDP growth forecast from 10% to 13% for FY22

#IMF is at 8.8%& #Moody's at 8.6%

#Modinomics

Fee weeks back #GoldmanSachs had upgraded India's GDP growth forecast from 10% to 13% for FY22

#IMF is at 8.8%& #Moody's at 8.6%

#Modinomics

Few

@narendramodi govt's decision to sell 20% in IRCTC at base price of Rs 1367,via #OFS tomr,is a great move

1367 is,15.5% discount to Wednesday's closing of Rs1618;52 week high&low is Rs 1995 &775

#IRCTC got listed last yr&was subscribed a whopping 112x

GoI owns 87.4% stake

1367 is,15.5% discount to Wednesday's closing of Rs1618;52 week high&low is Rs 1995 &775

#IRCTC got listed last yr&was subscribed a whopping 112x

GoI owns 87.4% stake

Well, doing Video is a lot time consuming, and I wish to add two shares in the #MultiBaggers 👇🏿 as I believe 3-5x over next couple of years in these, if not before ...

1. Yes Bank Ltd.

2. J&K Bank Ltd.

Disclaimer: I am or have been invested in all the shares recommended ⬇️⬆️

1. Yes Bank Ltd.

2. J&K Bank Ltd.

Disclaimer: I am or have been invested in all the shares recommended ⬇️⬆️

Going further than above, ☝️ Bought #VishalFabrics today at the LC @ ₹101.70. Company is back into profit in Q-II 2020 ... 52W High is ₹372 and 3Y High is ₹703 .... And Coy announced 1:2 Bonus on 4/12/2020 with record date of 16/12/2020 😇 #HopeIAmRight 😊

Bought #JumpNetwork today on #LC #LowerCircuit @ ₹16.80 ... Coy showed profits for last two quarters after significant losses last year. Can hope a #Turnaround here ... #HopeIAmRight 😇 (Disclaimer: #InvestAsMuchYouCanAffordToLose in any stock) 😊

History of #Disinvestment in India

1) The IPOs-1990-1998

2) CPSE to CPSE cross holdings/ Privatization– 1999-2004

3) Golden Opportunity Missed -2004-2009

4) Disinvestment Back again through OFS/FPO- 2009-2014

5) All out -Buybacks,CPSE to CPSE , ETF , OFS -2014-2019

2019-2024?

1) The IPOs-1990-1998

2) CPSE to CPSE cross holdings/ Privatization– 1999-2004

3) Golden Opportunity Missed -2004-2009

4) Disinvestment Back again through OFS/FPO- 2009-2014

5) All out -Buybacks,CPSE to CPSE , ETF , OFS -2014-2019

2019-2024?

History of #Disinvestment in India - Through Numbers.

6) 2020 - #Disinvestment Target = 1.05 lakh crores.

Until now only 12357.49 cr done through 10000 cr from CPSE ETF, 475 cr from RVNL and 1881 cr from Enemy Shares Sale. The disinvestment left is 92643 cr to be completed in 7 months.

Until now only 12357.49 cr done through 10000 cr from CPSE ETF, 475 cr from RVNL and 1881 cr from Enemy Shares Sale. The disinvestment left is 92643 cr to be completed in 7 months.

Despite having a monopolistic situation in many businesses, many #PSUcompanies haven't generated attractive #returns for their #shareholders. More than for #investors, the govt. is likely to benefit by the provision of allowing 80C deduction on #investments. #Budget2019

PSU #ETFs have a high portfolio concentration & single sectoral exposure. For eg. CPSE ETF holds over 60% of portfolio in energy sector & top 4 stocks constitutes over 75% of portfolio. Similarly, Bharat-22 holds 55% of portfolio in top 5 stocks. #Budget2019 @TheEconomist

#Investors having primary objective to #savetax, cannot ignore the performance of #ELSS #mutualfunds. Fund manager, considers number of factors like macroeconomic indicators, financial strength of a company & its competitive advantage etc. while constructing portfolio.#Budget2019