Discover and read the best of Twitter Threads about #returns

Most recents (24)

1/ AI is already impacting the financial industry in a big way, and the same goes for hedge funds. It has the potential to provide insights that are not possible with human analysis, making it an essential tool for the hedge fund industry.

A Thread 🧵

👇👇👇

A Thread 🧵

👇👇👇

2/ Hedge funds can use AI to identify patterns and make predictions that were not possible before. This is important in a market where every second counts, and a slight edge can make all the difference. #DataScience #MachineLearning #HedgeFunds @KirkDBorne

@KirkDBorne 3/ One of the ways Photons Hedge is leveraging AI is by using natural language processing to analyze news and social media sentiment. This helps the fund to understand how the market is reacting to news and events, enabling them to make better-informed trades. #SentimentAnalysis

The 1-year US Treasury paper returns are nearly 5% (see image).

Add 3%-4% rupee depreciation (against the dollar) to this.

Investors could make an 8%-9% return

To let investors make use of this opportunity, @bandhanmutual has launched a new fund

Is it worth investing in?

A🧵

Add 3%-4% rupee depreciation (against the dollar) to this.

Investors could make an 8%-9% return

To let investors make use of this opportunity, @bandhanmutual has launched a new fund

Is it worth investing in?

A🧵

Bandhan MF (erstwhile known as IDFC MF) has launched a new scheme.

The new fund - Bandhan US Treasury Bond 0-1 year Fund of Fund - is now open for subscription & will close on March 23.

Here’s how the fund works 👇

The new fund - Bandhan US Treasury Bond 0-1 year Fund of Fund - is now open for subscription & will close on March 23.

Here’s how the fund works 👇

When you buy units of this fund, the fund house takes your money (in rupees) and invests it in overseas funds (after converting it to dollars).

The overseas #funds, in turn, invest in one-year US Treasury bonds.

Where will Bandhan Mutual Fund invest your money? 👇

The overseas #funds, in turn, invest in one-year US Treasury bonds.

Where will Bandhan Mutual Fund invest your money? 👇

1/10 Have you read our recently published #whitepaper?

The Art of #Stock Picking #Returns

Highlights below ⬇

The Art of #Stock Picking #Returns

Highlights below ⬇

2/10 “We’ve had 40+ years where all the money went into broadband, or internet, or #Netflix or the cloud and no money went into basic productive capacity…”

–Robert Friedland, CEO, Ivanhoe group of companies

–Robert Friedland, CEO, Ivanhoe group of companies

3/10 What follows is KCR’s attempt to create a simple walk-through of the #risks and #opportunities offered today. We believe both the structure and implications of this paper are easy to grasp.

1/19 @ttmygh of the wonderful Things That Make You Go HMMMM newsletter just wrote a scathing piece on the emerging #pension fund disaster in lagged marks from private #equity.

loom.ly/YyomXW4

loom.ly/YyomXW4

2/19 As he explains:

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

3/19 The “solution” appears to be PE firms building funds to buy #assets from themselves at possibly fraudulent valuations set by themselves.

1/14 This piece from @latimes @hiltzikm about the #southwest meltdown is a must-read ⬇

Southwest’s meltdown was born in America’s cheapskate corporate culture

loom.ly/wzy4k30

Southwest’s meltdown was born in America’s cheapskate corporate culture

loom.ly/wzy4k30

2/14 "The short answer is their underinvestment in preparation and planning. For decades, Big Business has been squandering its resources…instead of spending on workers and infrastructure. There’s not enough give in the system, so when crisis comes, it doesn’t bend, but breaks."

3/14 $LUV gross profit for the twelve months ending September 30, 2022 was $5.928B, a 53.81% increase year-over-year.

What in the damn world is this conglomerate that is happening called @HydroWhalesClub? #Hydrowhales is constantly adding more and more #value with real #nftutility. Let's cover some things real quick so you can #DYOR and see why this #opportunity is like none other.

Begin 🧵

Begin 🧵

1/ @HydroWhalesClub has #minted out and has built one of the strongest #NFTCommunities I've seen in #web3. They don't get involved with the #drama in this #space and always stay #professional. Hop into #Hydrowhales #discord and see how much of a #family this #community is.

2/ While the #NFTcommunity is one of the most important things to me, #Hydrowhales #nftutility is quite astonishing. #HWMC started with 305 #BTC #miners to provide steady #cashflow to this #NFTProject. Of course these #asicminers are held at a hydroelectric power plant.

Employee joins a company after serving 3 months notice period

Manager: #ನಟಭಯಂಕರ

Manager: #ನಟಭಯಂಕರ

🐦 1

#Technical #Analysis #LongTerm #Investment

#Retweet for maximum reach!

Today I will show you how to pick #MultiBagger(2-10x) stocks #Technically

Disclaimer -

If the company isn't liquid enough, I can't give guarantee on the output. Also let us backtest it further.

#Technical #Analysis #LongTerm #Investment

#Retweet for maximum reach!

Today I will show you how to pick #MultiBagger(2-10x) stocks #Technically

Disclaimer -

If the company isn't liquid enough, I can't give guarantee on the output. Also let us backtest it further.

🐦 2

You have to assess the liquiduity and fundamentals then apply this #strategy.

Please go through the series of tweets THOROUGHLY to understand the strategy, I have tried to explain it in the simplest way possible.

Pre-requisites :

* #RSI

* #Volume

* #Patience

You have to assess the liquiduity and fundamentals then apply this #strategy.

Please go through the series of tweets THOROUGHLY to understand the strategy, I have tried to explain it in the simplest way possible.

Pre-requisites :

* #RSI

* #Volume

* #Patience

🐦 3

What NOT to expect from this strategy?

* Instant return!

* "Becoming Millionaire" in 1 Month

What to expect from this strategy?

* #Guaranteed #MultiBagger #ALERTS

* 2-10x #RETURNS over 2-5 Years

* #Conviction

* Good Sleep @ Night

What NOT to expect from this strategy?

* Instant return!

* "Becoming Millionaire" in 1 Month

What to expect from this strategy?

* #Guaranteed #MultiBagger #ALERTS

* 2-10x #RETURNS over 2-5 Years

* #Conviction

* Good Sleep @ Night

If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck!

The duck test, which shows how apparent things can be, fails when it comes to data.📊

A 🧵 on dealing with #MutualFund numbers, so you don’t commit financial mistakes.👇

The duck test, which shows how apparent things can be, fails when it comes to data.📊

A 🧵 on dealing with #MutualFund numbers, so you don’t commit financial mistakes.👇

1⃣ Same returns from different funds don’t mean the similar performance

Say, 2 funds have delivered 10% average annual returns in the past 10 years.

If you would pick a fund on these numbers, there are 50% chances of you going wrong.❌

The chart explains the difference. 👇

Say, 2 funds have delivered 10% average annual returns in the past 10 years.

If you would pick a fund on these numbers, there are 50% chances of you going wrong.❌

The chart explains the difference. 👇

A volatile fund would have some phases of high performance and extended periods of underperformance. 📈📉

It doesn’t make sense to go for the volatile fund, as it would pose problems when you want to exit the fund.

Also, you are taking unnecessary risks to get the same returns.

It doesn’t make sense to go for the volatile fund, as it would pose problems when you want to exit the fund.

Also, you are taking unnecessary risks to get the same returns.

It was evident. Interest rates would rise as #inflation started spiralling.

To ride through the rate hike cycle⬆️, #FloaterFunds were touted as an ideal #investment option.

But, so far, they haven’t done well.

A 🧵on why #FloatingRateFunds haven’t delivered yet.

To ride through the rate hike cycle⬆️, #FloaterFunds were touted as an ideal #investment option.

But, so far, they haven’t done well.

A 🧵on why #FloatingRateFunds haven’t delivered yet.

First, some basics.

When #InterestRates rise📈, bond #prices fall📉. Why? Investors would rather buy new papers at a higher rate than old ones with lower yields.

#FloaterFunds are not impacted by interest rate movement. There’s a simple explanation.👇

When #InterestRates rise📈, bond #prices fall📉. Why? Investors would rather buy new papers at a higher rate than old ones with lower yields.

#FloaterFunds are not impacted by interest rate movement. There’s a simple explanation.👇

As the #InterestRates rise, the yields on floating-rate bonds also increase.⬆️

So, #investors don’t need to sell them to buy new papers offering higher interest rates.

But the converse is true, too. So, when interest rates fall📉, #FloaterFunds become unattractive.

So, #investors don’t need to sell them to buy new papers offering higher interest rates.

But the converse is true, too. So, when interest rates fall📉, #FloaterFunds become unattractive.

Numbers don’t lie, but they can be deceiving.

A good salesperson can sell you a poor product by using numbers🔢to his advantage.

And you really won’t notice unless you ask the right questions.

A 🧵 on how you can be fooled with data when buying #insurance policies.👇

A good salesperson can sell you a poor product by using numbers🔢to his advantage.

And you really won’t notice unless you ask the right questions.

A 🧵 on how you can be fooled with data when buying #insurance policies.👇

▪️ Number Game In #Annuity or #Pension Plans

The sales pitch goes like this:

If you invest Rs 10 lakh now, you will start getting around Rs 1 lakh a year after a decade--a 10% assured return on your #investment.

But there’s a catch.👇

The sales pitch goes like this:

If you invest Rs 10 lakh now, you will start getting around Rs 1 lakh a year after a decade--a 10% assured return on your #investment.

But there’s a catch.👇

It’s not 10% #returns. Here’s why.👇

For the first 10 years, there will be no payout. During this time, your #money will earn interest and grow.📈

Even if you invest in FD and earn a 5.5% #InterestRate , your money will grow to Rs 17 lakh in a decade.

For the first 10 years, there will be no payout. During this time, your #money will earn interest and grow.📈

Even if you invest in FD and earn a 5.5% #InterestRate , your money will grow to Rs 17 lakh in a decade.

It's weekend and it's the end of the month. The #markets are closed.

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

The #momentum of the markets are one of the most powerful forces in the evolution of the #asset #prices.

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

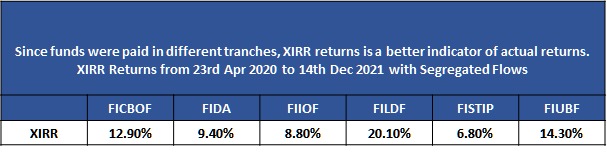

Stupendous #returns in various schemes of 6 wound up schemes including flows from segregated portfolios. I do not think anyone in their wildest dreams had thought of such an outcome a year back. #XIRR is the right way to gauge returns as payments were recd in different tranches.

Also, give credit where it is due. All this has happened only due to sale of the so called quote-unquote, #ILLIQUID, #LOWQUALITYDEBT. These were sold at huge premiums within a span of 12 months (6-8 months were wasted in court cases, voting for winding up etc).

These securities were sold seamlessly by another Fund House due to Court Order. This was possible only because underlying securities, structures, quality, etc was good to start with created by the #FundManager of @FTIIndia

IPOs have been all the rage this year. We’ve seen 98 IPOs from January 2021 till date. Are they worth this hype? Let’s take a closer look.

#IPO #IPOUpdate

2/11

#IPO #IPOUpdate

2/11

Also known as ‘Going Public’. An IPO is when a company invites the public to invest in its shares. This is usually followed by a lot of fanfare.

#stocks #ipoallotment #markets

3/11

#stocks #ipoallotment #markets

3/11

Why gold should be the asset to focus on for the next few years?

#gold #investing #wealthcreation

A Thread!

1/13

#gold #investing #wealthcreation

A Thread!

1/13

M2 which is a broad measure of money supply, has grown 81% in the last 7yrs to nearly $20Trn. An increase in the supply of money typically lowers interest rates, which generates more investment and puts more money in the hands of consumers. Hence stimulating spending.

#gold

2/13

#gold

2/13

Bonds struggled during the last major stagflationary period, in the late 1960s. Rise in oil prices,unemployment, loose monetary policy pushed the core CPI Index to a high of 13.5%. The Fed had to raise interest rates by nearly 20%.

#gold #bonds #interestrates

3/13

#gold #bonds #interestrates

3/13

Daily Bookmarks to GAVNet 07/27/2021 greeneracresvaluenetwork.wordpress.com/2021/07/27/dai…

100 Mental Models

wisdomtheory.gumroad.com/l/100MM

#MentalModels #CriticalThinking #DecisionMaking #RealityMapping #BookPromotion

wisdomtheory.gumroad.com/l/100MM

#MentalModels #CriticalThinking #DecisionMaking #RealityMapping #BookPromotion

The World’s Cascade of Disasters Is Not a Coincidence

bloomberg.com/opinion/articl…

#disasters #patterns #history #OpEd

bloomberg.com/opinion/articl…

#disasters #patterns #history #OpEd

Daily Bookmarks to GAVNet 02/01/2021 greeneracresvaluenetwork.wordpress.com/2021/02/01/dai…

Lindsay Simmons on Twitter and ThreadReader

threadreaderapp.com/thread/1355230…

#PartisanPolitics #corporations #investments #stakeholders #elections #legislation #returns #democracy #participation

threadreaderapp.com/thread/1355230…

#PartisanPolitics #corporations #investments #stakeholders #elections #legislation #returns #democracy #participation

Recently, Dr. Shiller suggested that #valuations really aren't that high once you fall in the #Fed trap of using #earnings #yields and #low #rates to justify it. The problem is it is a #rationalization to justify overpaying for #assets.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

The main problem in using low-interest rates as a rationalization to overpay for assets is that you have to also discount #future #cashflows for lower inflation and rates as well.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

"As low-interest rates went lower, the dynamic changed from using debt productively to using debt for non-productive purposes such as dividend issuance, share buybacks, and, in some cases, offsetting negative cash flows."

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

What can we teach #children about #financialindependence?

What is the right #assetallocation strategy?

Someone asked me what could a company objectives be other than to declare profit and share dividends?

I laughed. Making money is different from declaring profit and sharing dividends.

Let me try to explain. #thread.

#Investing #DPS #ROI #ROE #ROCE #TSR #Returns #WO 1/16

I laughed. Making money is different from declaring profit and sharing dividends.

Let me try to explain. #thread.

#Investing #DPS #ROI #ROE #ROCE #TSR #Returns #WO 1/16

#Straddles vs #Strangles ( Sell only )

These are the most common #Options strategies when one would start with #OptionsTrading.

Let’s understand from a broader perspective what’s the difference between these two.

These are the most common #Options strategies when one would start with #OptionsTrading.

Let’s understand from a broader perspective what’s the difference between these two.

Would not like to discuss the construction difference between them if you don’t know stop trading #options

#Straddles

You get higher premium so pnl would be higher compared to #strangles

But from where are you getting higher premiums is that your selling 0.5 #delta.

#Straddles

You get higher premium so pnl would be higher compared to #strangles

But from where are you getting higher premiums is that your selling 0.5 #delta.

So probability of one going wrong is always 50% so to simply put one side is goin to get stuck in a #straddle but then market tends to #flucuate a lot so there is always the case of #meanreversion if you have selected the #strike rightly.

#Options vs #Futures

Although both are #derivatives, Futures and Options are entirely different in terms of their potential #risk and #return , #leverage and how they work.

How different are futures and options?

Although both are #derivatives, Futures and Options are entirely different in terms of their potential #risk and #return , #leverage and how they work.

How different are futures and options?

#Rights vs #Obligations

In #Futures Trading, both the buyer & the seller are #obligated to settle the contracts on or before expiry ie cover shorts or longs or rollover to next contract, regardless of how the underlying asset price moves.

In #Futures Trading, both the buyer & the seller are #obligated to settle the contracts on or before expiry ie cover shorts or longs or rollover to next contract, regardless of how the underlying asset price moves.

With #Options the buyer has the #Right, but not the #Obligation, to buy (call option) or sell (put option) on underlying asset. The option seller is #passive and must comply with whatever the option buyer does.

#TweetStorm - Expensive or deserves to be Expensive ? 1)One thumb rule for screening expensive companies is Market Cap to Sales or Enterprise Value to Sales. A 10x or more is generally expensive unless the company can grow sales rapidly or has extremely high Net Profit Margins.

2)Another way to look at expensive is if the Market Cap is equal to the Total Sales of the Addressable Market Size. This would lead to company having to launch different products in the future.

3)May not be the approach to take a Sell Decision or a Short Sell Decision. Very few companies can command such high valuations. Thumb Rule is just to review the investment thesis and the quality of the business. If doubts on quality , get out.

#US #InvertedYieldCurve & panic

On wed, #DowJones, #nasdaq & #SP500 saw more than 3% fall, highest in year so far

Reason? #10YearTreasuryYield < #2YearTreasuryYield, #spread being 0.04%, lowest since 2007

- Treasury notes are #USGovernment securities issued for 2, 3, 5 & 10 year

On wed, #DowJones, #nasdaq & #SP500 saw more than 3% fall, highest in year so far

Reason? #10YearTreasuryYield < #2YearTreasuryYield, #spread being 0.04%, lowest since 2007

- Treasury notes are #USGovernment securities issued for 2, 3, 5 & 10 year

Starting with basics first.

1. #InterestRate & #BondPrices have #InverseRelationship, meaning if interest rises bond prices fall & vice versa

1. #InterestRate & #BondPrices have #InverseRelationship, meaning if interest rises bond prices fall & vice versa

Why? eg. if currently #Coupon rate on a bond is 6% & int rate is also 6% & face value of bond is rs. 100. Meaning buyer of bond is willing to pay more or less complete face value of rs. 100