Discover and read the best of Twitter Threads about #Dividend

Most recents (24)

Almost every millennial aspires to retire early. But most of the time, this goal seems almost impossible to achieve.

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

So, what is FIRE?

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

Can you achieve FIRE in India?

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

If you are looking for an efficient investment to save tax in India, this is for YOU!

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

Every year in March, as the financial quarter comes to an end, there is a rush to invest in tax-saving funds.

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

What is ELSS Fund?

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

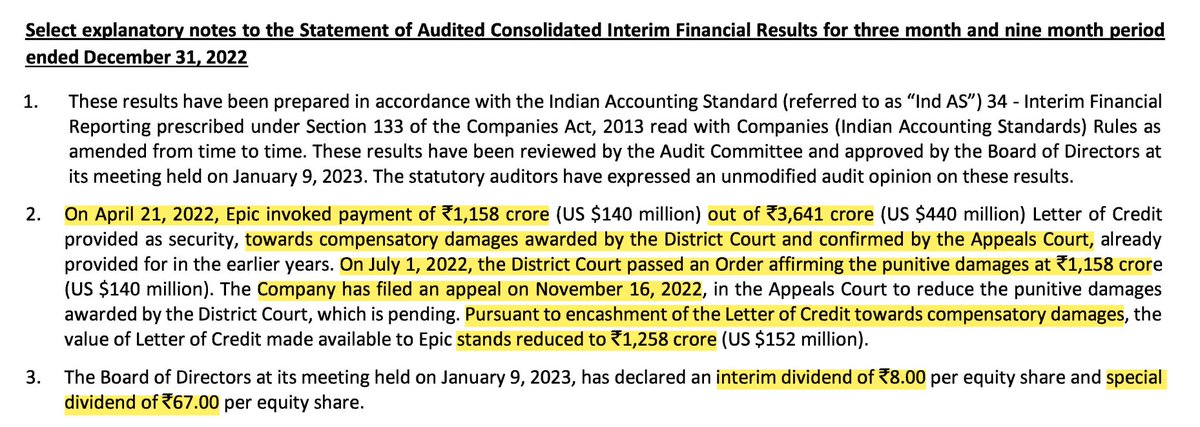

#TCS

Tata Consultancy Services Ltd

#Dividend ₹8 + Special Dividend ₹67 = Total Dividend ₹75 (record Date Jan, 17 and paid by Feb, 03)

#Q3Results #Q3FY23 #FY23Results

Please LIKE & Retweet

Tata Consultancy Services Ltd

#Dividend ₹8 + Special Dividend ₹67 = Total Dividend ₹75 (record Date Jan, 17 and paid by Feb, 03)

#Q3Results #Q3FY23 #FY23Results

Please LIKE & Retweet

In India, 🏦 Bank FDs will give interest rates of Just 6.25%.

While Investing in PSU 💹 Stocks can be 1.5 X your Investment.

Here are 6 dividend-paying PSU stocks that have paid at least a 9% dividend.

A Thread👇

(1/9)

While Investing in PSU 💹 Stocks can be 1.5 X your Investment.

Here are 6 dividend-paying PSU stocks that have paid at least a 9% dividend.

A Thread👇

(1/9)

(1/6) - NMDC

• Current Price - Rs 121.85

• Dividend yield - 11.7%

• Last 6 Months - Gained 15%

• Last 1 Yrs - Gained 12%

(2/9)

• Current Price - Rs 121.85

• Dividend yield - 11.7%

• Last 6 Months - Gained 15%

• Last 1 Yrs - Gained 12%

(2/9)

(2/6) - REC

• Current Price - Rs 125.70.

• Dividend yield - 10.8%

• Last 6 Months - Gained 27%

• Last 1 Yrs - Gained 21%

(3/9)

• Current Price - Rs 125.70.

• Dividend yield - 10.8%

• Last 6 Months - Gained 27%

• Last 1 Yrs - Gained 21%

(3/9)

My son is 6 years old 👴 and this is his #dividend portfolio.

I started the portfolio for him in 2015.

The first deposit was $4,105 and no more money has been put into the portfolio since then.

The current value of the portfolio is $9,096 (+121%)

These are his 6 holdings 🧵👇

I started the portfolio for him in 2015.

The first deposit was $4,105 and no more money has been put into the portfolio since then.

The current value of the portfolio is $9,096 (+121%)

These are his 6 holdings 🧵👇

I have been investing since 2014. Here is my dividend income year by year from 2018 to 2022.

I will be very happy if you follow me on my journey to financial freedom 🐼❤️

#Dividend #Investing

2018:

I will be very happy if you follow me on my journey to financial freedom 🐼❤️

#Dividend #Investing

2018:

July Passive Income Report

Final numbers received, happy with the results. #thankful

Dividends - $3,581.04

Options - $2,492.23 (Covered calls and Cash Secured Puts)

Total - $6,073.27

#Dividends and Selling #Options is a powerful #income combination!

Here are the details 👇

Final numbers received, happy with the results. #thankful

Dividends - $3,581.04

Options - $2,492.23 (Covered calls and Cash Secured Puts)

Total - $6,073.27

#Dividends and Selling #Options is a powerful #income combination!

Here are the details 👇

Dividends received:

AMT58.56

APLE1.24

AQN180.8

BCE144.29

BDJ60.06

BEPC25.91

BME112.43

BMEZ36.25

BST240.28

BSTZ38.4

CAH61.53

CSCO68.52

DIVO101.45

FDX12.04

FXAIX73.77

IIPR114.15

IRM123.7

JEPI217.92

JPM122.3

KMB115.21

KO25.73

LAND22.8

LEG83.46

MPW87

AMT58.56

APLE1.24

AQN180.8

BCE144.29

BDJ60.06

BEPC25.91

BME112.43

BMEZ36.25

BST240.28

BSTZ38.4

CAH61.53

CSCO68.52

DIVO101.45

FDX12.04

FXAIX73.77

IIPR114.15

IRM123.7

JEPI217.92

JPM122.3

KMB115.21

KO25.73

LAND22.8

LEG83.46

MPW87

Dividends Received, cont. -

MRK118.61

MSM54.81

NTAP65.03

NUSI21.62

O135.73

QQQ105.48

QQQX103.24

STAG29.37

TLT22.69

UTF9.26

UTG223.28

VICI72.77

VZ94.53

WPC396.82

Grand Total$3581.04

#dividends

MRK118.61

MSM54.81

NTAP65.03

NUSI21.62

O135.73

QQQ105.48

QQQX103.24

STAG29.37

TLT22.69

UTF9.26

UTG223.28

VICI72.77

VZ94.53

WPC396.82

Grand Total$3581.04

#dividends

Below is an on-going list of DD I have written. Each subject is organized into general topics with more DD tweeted and linked respectively. Any and all of my future analysis and research will be added to this pin.

The DD is never done.

#suckmyballshedgies

The DD is never done.

#suckmyballshedgies

$GME Cycles:

7/6/21: reddit.com/r/Superstonk/c…

7/7/21: reddit.com/r/Superstonk/c…

7/8/21: reddit.com/r/Superstonk/c…

8/1/21: reddit.com/r/Superstonk/c…

8/9/21:

reddit.com/r/Superstonk/c…

7/6/21: reddit.com/r/Superstonk/c…

7/7/21: reddit.com/r/Superstonk/c…

7/8/21: reddit.com/r/Superstonk/c…

8/1/21: reddit.com/r/Superstonk/c…

8/9/21:

reddit.com/r/Superstonk/c…

The #Algorithm. The Ouroboros: Characterizing #GameStop share price and reverse engineering #HFT #algos.

10/4/21: Part 1

reddit.com/r/DDintoGME/co…

11/18/21 Part 2

reddit.com/r/Superstonk/c…

10/4/21: Part 1

reddit.com/r/DDintoGME/co…

11/18/21 Part 2

reddit.com/r/Superstonk/c…

Dividend yield of some #stocks is inversely proportional to price (in case the #Dividend value remains constant). At times the #yield becomes so high that at some levels prices don't fall further.

RT for max reach. Will reveal 5/6 good names tonight.

#StocksToBuy

#HighDividend

RT for max reach. Will reveal 5/6 good names tonight.

#StocksToBuy

#HighDividend

What is Dividend Yield of a Stock. Please Understand.

#Dividend #dividends #dividendyield #highdividendstocks

#Dividend #dividends #dividendyield #highdividendstocks

#Dividend #dividends #dividendyield #highdividendstocks #powergrid

High Dividend Yield Stocks 1: Power Grid CMP 191.1.

PE Ratio: 8.2 (Price Affordable)

Market Cap in Crore Rs: 133300.9

Dividend Yield at CMP: 9.7%👍👍👍

High Dividend Yield Stocks 1: Power Grid CMP 191.1.

PE Ratio: 8.2 (Price Affordable)

Market Cap in Crore Rs: 133300.9

Dividend Yield at CMP: 9.7%👍👍👍

Making money from #STOCKMARKET is a most BORING REPITITVE JOB..

One just need to keep it simple, Boring & need to repeat it every day, week, month, year.

And in this #Thread will try to explain how to do it in such way..

You can Start it with 3lk-30lk-3cr..

It's up to u.. 🤗🙏

One just need to keep it simple, Boring & need to repeat it every day, week, month, year.

And in this #Thread will try to explain how to do it in such way..

You can Start it with 3lk-30lk-3cr..

It's up to u.. 🤗🙏

Divide your Capital in 3 parts..

1-1-1 lakhs or 10-10-10 lakhs or 1-1-1 crore respectively..

Let's name them

Part 1 : Fix Income Source

Part 2 : Make money with market

Part 3 : Wealth creation by Compounding

Below is the description of all 3 parts.. 👇

1-1-1 lakhs or 10-10-10 lakhs or 1-1-1 crore respectively..

Let's name them

Part 1 : Fix Income Source

Part 2 : Make money with market

Part 3 : Wealth creation by Compounding

Below is the description of all 3 parts.. 👇

Part 1 : FIX INCOME SOURCE

We all know that stock market is uncertain & beyond anyone's control. So if we enter in it as a Full Time Job then 1st thing we must do is to fix our earnings for our family's daily livelihood.

So for that we need to make our Fix Income Source from it.

We all know that stock market is uncertain & beyond anyone's control. So if we enter in it as a Full Time Job then 1st thing we must do is to fix our earnings for our family's daily livelihood.

So for that we need to make our Fix Income Source from it.

#Gazprom, the Russian #gas giant, could make record profits and generate 15% dividend yield over current price. #ONGT $GAZP $OGZD $OGZPY

Thread 🧵👇

Thread 🧵👇

On Monday, $GAZP will publish 3Q financials, which will be highest in company's history.

Record profit = record dividend:

RUB 50 - dividend per share at the end of 2021, 15% per annum (RDV calculations).

RUB 110 - amount of #dividends for 2 years - 33% of current value of shares.

Record profit = record dividend:

RUB 50 - dividend per share at the end of 2021, 15% per annum (RDV calculations).

RUB 110 - amount of #dividends for 2 years - 33% of current value of shares.

Record reporting by #Gazprom may trigger a rise in shares above historic highs.

According to the calculations of the RDV source, the fair price of Gazprom shares is 455 rubles, the growth potential is +44%.

$GAZP $OGZD $OGZPY

According to the calculations of the RDV source, the fair price of Gazprom shares is 455 rubles, the growth potential is +44%.

$GAZP $OGZD $OGZPY

💸 Is hyperinflation a reality? How to protect yourself?

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

• In the #US, inflation has already accelerated to 6.2%

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

Populist views are capturing the minds of monetary authorities, which only fuels #inflation. This was the case in the #USA in the 1970s: prices almost tripled.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

1. Better headline: "Will Common Prosperity Make Japan Great Again?" MJGA!😂 We have deep expertise and top indexes on Japanese equity, particularly currency hedging. Below is the list of some under appreciated things of Japanese equity.

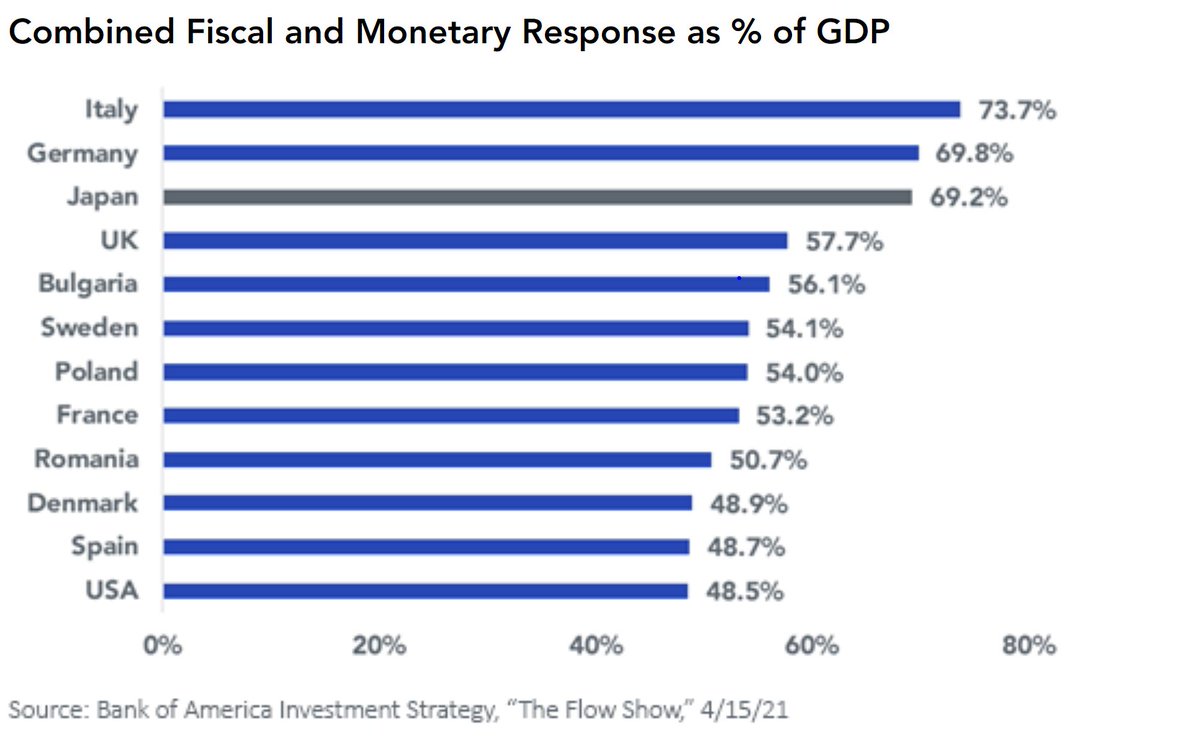

2. Underappreciated: If US fiscal/monetary response to the pandemic is large, Japan's is even a larger share of GDP. Lay person language: money money money for the economy.

3. Our colleague reviewed how Warren Buffet's Japanese investment last September has turned out. Following Mr. Buffet, global investors have been putting money there quietly for a while. wisdomtree.com/blog/2021-05-0…

How to buy #dividend-paying Stocks

If you’re looking to collect #dividends from your #stock purchases, it's safe to be thinking of large corporations

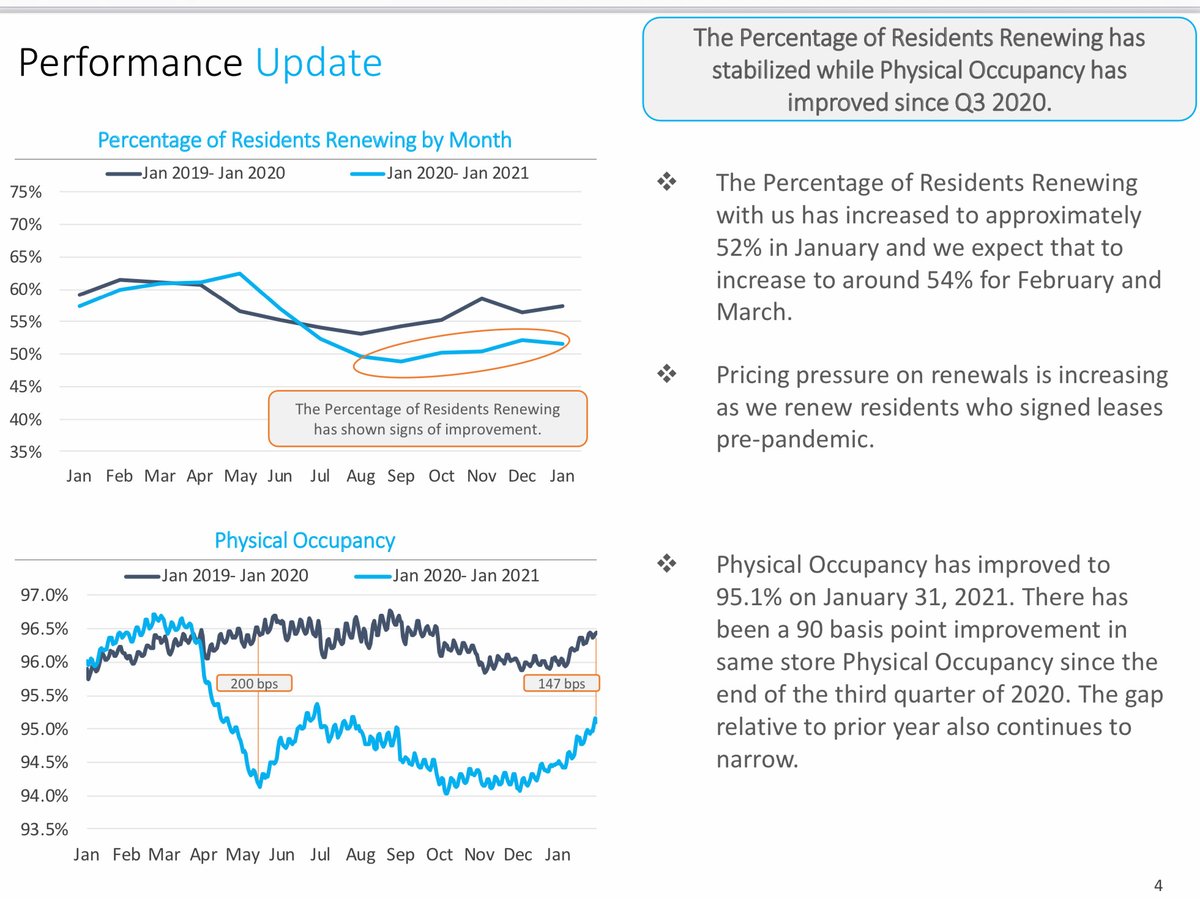

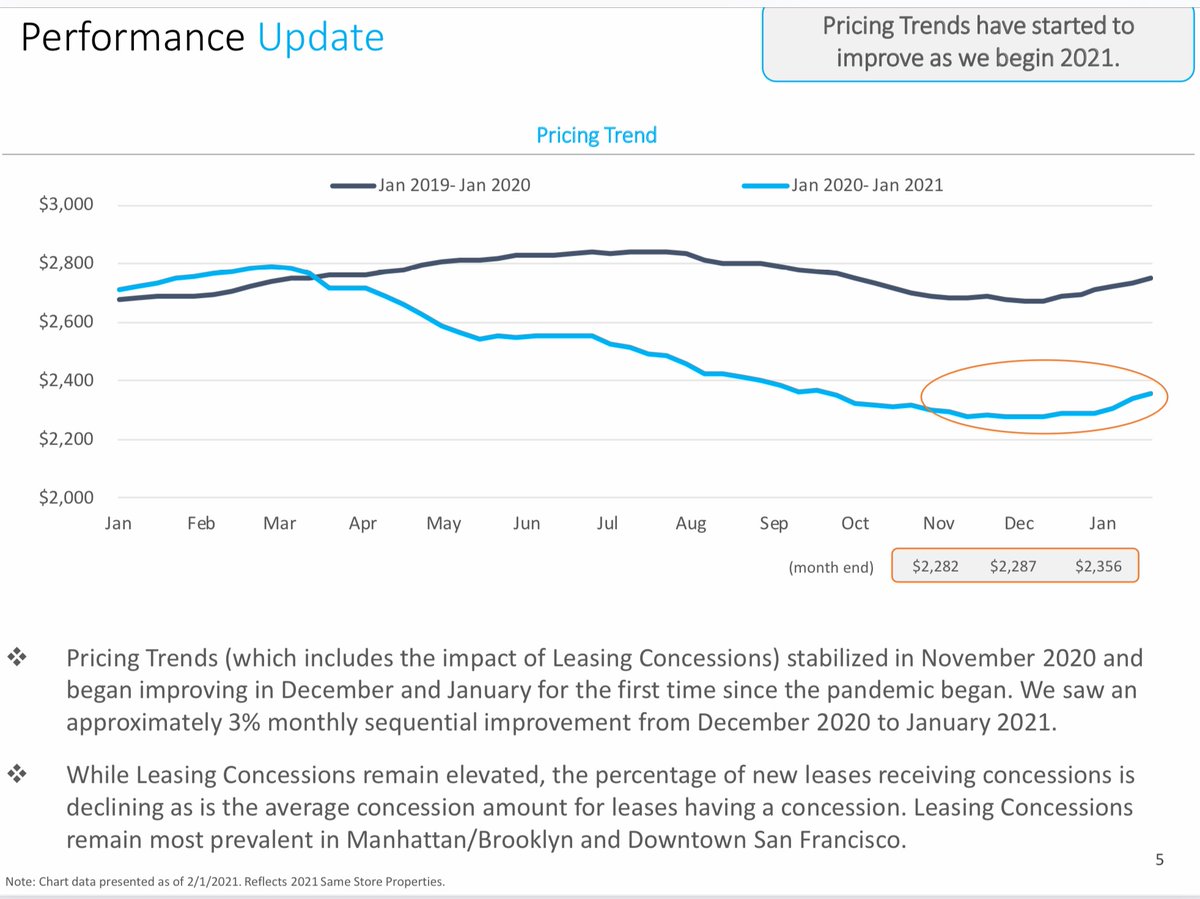

$EQR results as expected. 2021 NOI guide -12-15% so peak (2019) to trough (2021) decline in NOI expected to be -17-20%. I'd been thinking -20% after 3Q#s. Like at $AVB, $ESS, $UDR rents stabilizing/occupancy increasing. #reits $VNQ #dividend #cre #investing $TLT

No longer crazy cheap but reasonably attractive vs. private market/alternatives $SPY $IWM $MDY $TLT $GLD $BTC. I assume NOI recovers to 2019 levels by ~2024 and stock has fair value of $80-85 at that time. Coupled w/ divvies received this produces a 4 year IRR of ~8-9%.

Commentary post 3Q: privateeyecapital.com/3q20-updates-f…

What is Equity #Portfolio #Risk Management?

If I understand your question correctly, the Equity Portfolio Risk Management should be primarily be concerned with managing the market and liquidity risk of Equity or akin linked Securities.

@GARP_Risk @CQFInstitute @icmacentre @ICMA

If I understand your question correctly, the Equity Portfolio Risk Management should be primarily be concerned with managing the market and liquidity risk of Equity or akin linked Securities.

@GARP_Risk @CQFInstitute @icmacentre @ICMA

Other Portfolio Investment Management Risks might include =>

1.Transactional Risk

2.Price and Fair Value Modelling Risk

3.Financial Reporting Risks

4.Trading Microstructure Risks

5.Legal Risk

6.Hedging Risk using Risk Financing Methods

1.Transactional Risk

2.Price and Fair Value Modelling Risk

3.Financial Reporting Risks

4.Trading Microstructure Risks

5.Legal Risk

6.Hedging Risk using Risk Financing Methods

Investments and/or trades in the Equity Securities aka company issued shares generally falls into three-segmented and specialized market categories =>

Daily Bookmarks to GAVNet 02/05/2021 greeneracresvaluenetwork.wordpress.com/2021/02/05/dai…

Oil: Shell reports sharp drop in full-year profit, raises dividend

cnbc.com/2021/02/04/oil…

#oil #dividend #profit

cnbc.com/2021/02/04/oil…

#oil #dividend #profit

The need for the U.S. to improve data on the COVID pandemic

usatoday.com/story/opinion/…

#pandemic #COVID19

usatoday.com/story/opinion/…

#pandemic #COVID19

Excellent #Budget2021 by @narendramodi govt

16.5 lakh Cr Agri Credit allocation&Rs 1.18 lakh Cr for roads

Massive 34.5% rise Capital Spending at 5.54 lakh Cr

137% rise in Health budget

Income Tax scrutiny reduced from 6 to 3 yrs;No Double taxation of NRIs

#Growth,the focus

16.5 lakh Cr Agri Credit allocation&Rs 1.18 lakh Cr for roads

Massive 34.5% rise Capital Spending at 5.54 lakh Cr

137% rise in Health budget

Income Tax scrutiny reduced from 6 to 3 yrs;No Double taxation of NRIs

#Growth,the focus

Hike in Insurance #FDI from 49% to 74%,pro #Reforms💪

#Dividend income invested In InvITs &REITs,tax free

No advance tax liability on Dividend income

#LIC IPO--BIG

#Disinvestment of BPCL,Pawan Hans,Air India,Concor,IDBI,Beml, Shipping Corp--BIG

64180Cr #Healthcare budget-BIG

#Dividend income invested In InvITs &REITs,tax free

No advance tax liability on Dividend income

#LIC IPO--BIG

#Disinvestment of BPCL,Pawan Hans,Air India,Concor,IDBI,Beml, Shipping Corp--BIG

64180Cr #Healthcare budget-BIG

5 Mega #Fishing harbours

7 Mega #Textile Parks

Agri Infra Fund to be available to #APMCs

Voluntary #VehicleScrapping policy

20000Cr #Recapitalisation of PSBs

#ARC to take over stressed assets

7 Port projects to be developed via PPP

18000Cr for Bus Transport

#Modinomics💪

7 Mega #Textile Parks

Agri Infra Fund to be available to #APMCs

Voluntary #VehicleScrapping policy

20000Cr #Recapitalisation of PSBs

#ARC to take over stressed assets

7 Port projects to be developed via PPP

18000Cr for Bus Transport

#Modinomics💪

Well, doing Video is a lot time consuming, and I wish to add two shares in the #MultiBaggers 👇🏿 as I believe 3-5x over next couple of years in these, if not before ...

1. Yes Bank Ltd.

2. J&K Bank Ltd.

Disclaimer: I am or have been invested in all the shares recommended ⬇️⬆️

1. Yes Bank Ltd.

2. J&K Bank Ltd.

Disclaimer: I am or have been invested in all the shares recommended ⬇️⬆️

Going further than above, ☝️ Bought #VishalFabrics today at the LC @ ₹101.70. Company is back into profit in Q-II 2020 ... 52W High is ₹372 and 3Y High is ₹703 .... And Coy announced 1:2 Bonus on 4/12/2020 with record date of 16/12/2020 😇 #HopeIAmRight 😊

Bought #JumpNetwork today on #LC #LowerCircuit @ ₹16.80 ... Coy showed profits for last two quarters after significant losses last year. Can hope a #Turnaround here ... #HopeIAmRight 😇 (Disclaimer: #InvestAsMuchYouCanAffordToLose in any stock) 😊

When we do our preferred share research, we also provide a common share recommendation. One company we cover where the common shares look interesting is AltaGas. $ALA.TO #dividend #CPSR

Many investors were burned by AltaGas in 2018 when it was forced to cut its dividend in half, which has led to the common shares being overlooked.

The stock was highly owned by retail investors, and the emotional scars from the dividend cut have caused the common shares to be ignored.

#Subex is setting the market abuzz with many brokers talking of relisting above 20 Rs - which is across a major 8 year breakout level of around 18.50

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity

Will be see a dream run in #Subex post relisting given fundamentals are fast improving for both business operations and balance sheet

See embedded thread for brief history of its turnaround.

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity #CyberSecurity

See embedded thread for brief history of its turnaround.

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity #CyberSecurity

Typo-plz read “Will be” as “Will we”

I think we will 😊-next 2yrs at #Subex should be similar or better to what #TanlaPlatforms achieved in same time since #Karix acquisition in Aug2018

Cash books are ringing at Subex with good visibility

So watch this space for M&A/BuyBack!!

I think we will 😊-next 2yrs at #Subex should be similar or better to what #TanlaPlatforms achieved in same time since #Karix acquisition in Aug2018

Cash books are ringing at Subex with good visibility

So watch this space for M&A/BuyBack!!

#DBL #DilipBuildcon

Dilip Buildcon Ltd. is an India-based company engaged in the business of #infrastructure facilities on engineering procurement and construction (#EPC) basis for #roads #Bridges #Irrigation & #UrbanProjects.

@srslysaurabh @avinashmehta123 @Agarwal_Ishu

Dilip Buildcon Ltd. is an India-based company engaged in the business of #infrastructure facilities on engineering procurement and construction (#EPC) basis for #roads #Bridges #Irrigation & #UrbanProjects.

@srslysaurabh @avinashmehta123 @Agarwal_Ishu

Why should one look into this? And does this deserve a place in my portfolio. Here’s my rational below.

#DBL started as a #Road Construction company for the western region and now has diversified into multiple segments and the co. has covered almost all the states in #India.

#DBL started as a #Road Construction company for the western region and now has diversified into multiple segments and the co. has covered almost all the states in #India.

#DBL has secured orders worth INR 10703 Cr. In FY 21 and the total order book stands at approximately INR 26115 Cr. Orders are balanced between state govt. and central govt. entities. The company has successfully reduced risk on all parameters as far as business is concerned.

The average #dividend yield of a typical dividend #Portfolio is 4% (non US citizens are taxed 30% on Dividends) this means as Nigerians we need to have a 6% yielding portfolio for a 4% yield (6%*70%=4%).

This is achievable by investing in a Portfolio of #diversified stocks

This is achievable by investing in a Portfolio of #diversified stocks

How much #investments to get paid monthly dividends

Parameters:

#Dividend #yield 6%(4% after tax)

Dividend #tax rate 30% (non US)

#Dividendgrowth rate 6%

#Share #price growth 8%

Duration #10yrs

1. #100k/mnth - #10million

2. #500k/mnth- #60million

3. #1million/mnth #116million

Parameters:

#Dividend #yield 6%(4% after tax)

Dividend #tax rate 30% (non US)

#Dividendgrowth rate 6%

#Share #price growth 8%

Duration #10yrs

1. #100k/mnth - #10million

2. #500k/mnth- #60million

3. #1million/mnth #116million

How many years invested to reach goal

with Monthly payments + #reinvested #Dividends

1.#100k/mnth - invest #50k/mnth for 10yrs

2. #500k/mnth - invest #250k/mnth for 10yrs

3. #1million/mnth invest #500k/month for 10yrs.

#onaijainvestor #dividendincome #naija #passiveincome

with Monthly payments + #reinvested #Dividends

1.#100k/mnth - invest #50k/mnth for 10yrs

2. #500k/mnth - invest #250k/mnth for 10yrs

3. #1million/mnth invest #500k/month for 10yrs.

#onaijainvestor #dividendincome #naija #passiveincome

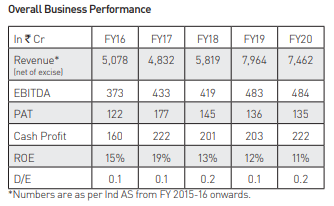

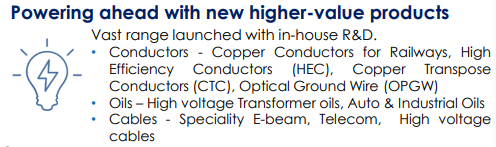

#AparIndustries

#Apar Industries is one among the best established companies in India, operating in the diverse fields of #electrical and #metallurgical #engineering.

@Raunak_Bits @Sachsharma12 @srslysaurabh @Agarwal_Ishu @Random_Gyan @drprashantmish6

#Apar Industries is one among the best established companies in India, operating in the diverse fields of #electrical and #metallurgical #engineering.

@Raunak_Bits @Sachsharma12 @srslysaurabh @Agarwal_Ishu @Random_Gyan @drprashantmish6

Raw materials:

Crude #oil & #Steel

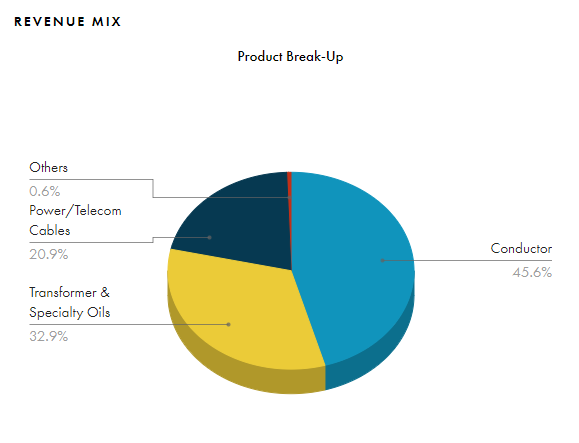

There are 3 segments: #Conductors, Transformer and speciality #oils & Power/Telecom #Cable. The revenue breakup is in the screenshot attached

Crude #oil & #Steel

There are 3 segments: #Conductors, Transformer and speciality #oils & Power/Telecom #Cable. The revenue breakup is in the screenshot attached

Domestic revenues decline 52% YoY with lockdown in April, lower scale of operations in May-June; #Exports up 11% YoY. Management focus is on improving revenue generation from high value products. Long time consolidation in financial parameters