Discover and read the best of Twitter Threads about #Ecb

Most recents (24)

#REEF

Şimdi bir arkadaş mail atmış abi reef ne olur diye ?

32 den aldım 22 ye düştü. Arkadaşlar; teknik orada

enstrüman yalıyor mu kırmızı çizgiyi ? Tam Nisandan beri yalıyor. Önünü açmıyorlar ki, açacak ki enstrüman yürüsün. Yürüyemezse düşmek zorunda kalıyor.

Şimdi bir arkadaş mail atmış abi reef ne olur diye ?

32 den aldım 22 ye düştü. Arkadaşlar; teknik orada

enstrüman yalıyor mu kırmızı çizgiyi ? Tam Nisandan beri yalıyor. Önünü açmıyorlar ki, açacak ki enstrüman yürüsün. Yürüyemezse düşmek zorunda kalıyor.

Neden düşmek zorunda kalıyor ?

Enstrümana bazen teknik orta yol bırakmaz.

Der ki; ya düşeceksin, ya çıkacaksın. Bu bölgede fiyat olaraktan yatamazsın.

Enstrüman da yukarı kırmaya çalışıyor ama, negatif haber basıyorlar. BTC ETH boynunu büküyor.

Bunun elinden bir şey gelmez ki.

Enstrümana bazen teknik orta yol bırakmaz.

Der ki; ya düşeceksin, ya çıkacaksın. Bu bölgede fiyat olaraktan yatamazsın.

Enstrüman da yukarı kırmaya çalışıyor ama, negatif haber basıyorlar. BTC ETH boynunu büküyor.

Bunun elinden bir şey gelmez ki.

Elinden bir şey gelmeyince sürüne sürüne tutunmaya çalışıyor çaresiz. Bu sebeple bu işlere bulaşacaksanız riskinizi bileceksiniz. Bir önceki twette anlattım mal canın yongasıdır. Adam malını korumaya çalışıyor.

Teknik sıkıntıyı görüyor bunları kim koruyacak ?

Teknik sıkıntıyı görüyor bunları kim koruyacak ?

1) #bundesbank #ecb #banklendingsurvey Zur Beurteilung der geldpolitischen Transmssion über das Bankensystem ist der Bank Lendig Survey eine wichtige Quelle. Dies gilt angesichts der raschen Zinswende gegenwärtig in besonderem Maße.

2) Aber auch weil infolge der Bankenturbulenzen in den USA eine wichtige Frage war, ob daraus ein zusätzlicher Straffungsimpuls resultiert. Für Deutschland erlauben die heute veröffentlichten Zahlen des Bank Lending Survey einen ersten Blick bundesbank.de/content/905900

#NASDAQ BÜYÜK RESİM..

Piyasalar da büyük durgunluk yapıyorlar. Sadece çok doğru yerlerde ve bunun vadesini ayarlaya ayarlaya gidiyorlar. Genelde haftalar aylar bazın da grafiklere bakınız, aslında hiç bir şeyin bir yere gittiği yoktur.

25 Ocak 2022

25 Ocak 2022

Enstrümanlar da M.B larını ilgilendiren büyük kanallar vardır. Bu kanalların dışına taştığı an dünyada

hacimler artar. Bu kanalların içinde dünyayı tutuyorlar.

Bir kaç örnek;

#nasdaq 10 K altı dünya hacme girerdi sınırdan çevirdiler tam 10 K dan döndü.

hacimler artar. Bu kanalların içinde dünyayı tutuyorlar.

Bir kaç örnek;

#nasdaq 10 K altı dünya hacme girerdi sınırdan çevirdiler tam 10 K dan döndü.

[1/🧵] "#ISO20022 is bigger than you think"

You've probably heard that term a few times and wondered what it meant. 🤔

In case you are curious now:

A brief explanation of everything important.

There will be nothing complicated ahead, so don't worry. 🧵👇

You've probably heard that term a few times and wondered what it meant. 🤔

In case you are curious now:

A brief explanation of everything important.

There will be nothing complicated ahead, so don't worry. 🧵👇

[2/24] — Outline —

🔹 Origin & Timeline

🔹 What's the big deal?

🔹 Details regarding the transformation

🔹 Migration Approaches

🔹 Relations to #Crypto (#DTI)

🔹 @Ripple & #JSON formats

🔹 Origin & Timeline

🔹 What's the big deal?

🔹 Details regarding the transformation

🔹 Migration Approaches

🔹 Relations to #Crypto (#DTI)

🔹 @Ripple & #JSON formats

[3/24] — Origin & Timeline —

The #ISO 20022 standardization efforts began very early on. Indeed, you may be wondering how you missed it until this date. 😅

The #ISO 20022 standardization efforts began very early on. Indeed, you may be wondering how you missed it until this date. 😅

GOLDMAN: Stocks have “largely treated the recent events as a surgical strike on a specific cohort of stocks .. I find that a bit remarkable, especially when you confront the inconvenient truth that central banks are in a very different position today ..” (con’t)

- Pasquariello

- Pasquariello

2.

“.. US regional banks: to my eye, now this is less a story of creditworthiness, and more a story of the degradation of forward earnings power. .. it’s very hard for me to see how this impingement of credit availability isn’t problematic for the heart of the US economy.” $KRE

“.. US regional banks: to my eye, now this is less a story of creditworthiness, and more a story of the degradation of forward earnings power. .. it’s very hard for me to see how this impingement of credit availability isn’t problematic for the heart of the US economy.” $KRE

3.

With the “stunning drop in front end yields, there was kindling for the type of short-term, counter-sentiment rally that we’ve seen this week. .. remember, S&P closed HIGHER the immediate week after $LEH fell (.. recall the #ECB hiked just one month prior to that).”

With the “stunning drop in front end yields, there was kindling for the type of short-term, counter-sentiment rally that we’ve seen this week. .. remember, S&P closed HIGHER the immediate week after $LEH fell (.. recall the #ECB hiked just one month prior to that).”

1/ Pausen, Zinserhöhungen und Rezessionen - ein Blick auf die vergangenen Zyklen der Zinserhöhungen und die daraus gezogenen Lehren. Ein Thread 🧵

#FED #Zins #Fintwit #Aktien #EZB #ECB #Wirtschaft

#FED #Zins #Fintwit #Aktien #EZB #ECB #Wirtschaft

2/ In den letzten zwei Jahrzehnten gab es drei Zinserhöhungsszyklen, von denen alle von Rezessionen begleitet wurden. Betrachten wir zunächst die Dotcom-Blase, die kurz nach einer Zinspause der FED im März 2000 platzte. (Abb.1)

3/ Die FED stoppte darauf hin im Mai 2000 ihre Zinserhöhungen, was zu einer Pause von 10 Monaten führte. Der Nasdaq verlor in der Folge 78% seines Höchststands bis Oktober 2002.

Birazda makro taraftaki son dakika ve sıcak gelişmelerin odağındaki 1 trilyon dolar varlığı yöneten #CreditSuisse Bank" bahsedelim.Kelime anlamını inceleyecek olursak "Credit (Kredi)" - Suisse "İsviçre'nin Fransızca adıdır" = İsviçre Kredisi manasına geliyor.

+++🧵

+++🧵

Peki neden bir İsviçre bankası,Fransızca bir kelime kullanıyor ? Credit Suisse, İsviçre merkezli bir banka olsa da, kökeni İsviçre'deki Fransızca konuşan bölgeye dayanmaktadır.

+++🧵

+++🧵

Bankanın öncüllerinden biri olan Banque Cantonale de Lausanne, İsviçre'nin Fransızca konuşan Vaud kantonunda yer almaktaydı ve Credit Suisse'nin temelleri bu bankaya dayanmaktadır.

+++🧵

+++🧵

#FederalReserve is the largest central bank in the world.

Citizen vs. State: If you look at the original founding principle objectives of the federal reserve, you can’t find a single one which benefits the citizen. The fifth objective is clearly a great lie we’ve all been… twitter.com/i/web/status/1…

Citizen vs. State: If you look at the original founding principle objectives of the federal reserve, you can’t find a single one which benefits the citizen. The fifth objective is clearly a great lie we’ve all been… twitter.com/i/web/status/1…

Here’s a prev 🧵 on #FederalReserve

But broader acceptance of the idea that the neutral rate — known in economics circles as “r-star” — has gone up would have adverse implications for a #Treasury_market nursing back-to-back down years. A higher neutral rate should raise yields across the curve, led by rising

short-term rates along with some restoration of a term premium for owning longer-dated Treasuries. “The 2 percentage point drop in estimates of r* following the global financial crisis rests on shaky ground,” Matthew Raskin, the head of US rates strategy at Deutsche Bank

#Securities in New York, wrote in a Feb. 10 note. “If growth and the labor market remain resilient,” then investors can expect Fed officials to upgrade their estimates, which “would have big implications for longer-run rates,” he said. But if interest rates were to revert to the

The global business cycle is forecastable around 4-5mo ahead and the provision of liquidity into the financial markets is forecastable around 2-3mo ahead, currently.

The onset of economic crises is much more cumbersome and uncertain to forecasts.

A short 🧵on what's coming. 1/6

The onset of economic crises is much more cumbersome and uncertain to forecasts.

A short 🧵on what's coming. 1/6

The flow of aggregate financing in China sputtered in October and fell of a 'cliff' in Nov/Dec. This implied that

1) This month will see first signs of a renewed decline in econ. indicators.

2) Decline will deepen in March and April.

Details. 👇

2/

1) This month will see first signs of a renewed decline in econ. indicators.

2) Decline will deepen in March and April.

Details. 👇

2/

Global liquidity has been driven by China especially during this year with the onset of QT:s by the #FederalReserve and the #ECB.

The slump in October was followed by a massive increase in November, which lifted the markets. 3/

The slump in October was followed by a massive increase in November, which lifted the markets. 3/

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Macro Review 🧵

02/05/2023

1/9

The #macro market has been hyper focused on growth and inflation dynamics

We got a slew of data showing inflation under control.

Yet one data point on Friday raised havoc with my portfolio.

Let’s dig into the 🧮!

Macro Review 🧵

02/05/2023

1/9

The #macro market has been hyper focused on growth and inflation dynamics

We got a slew of data showing inflation under control.

Yet one data point on Friday raised havoc with my portfolio.

Let’s dig into the 🧮!

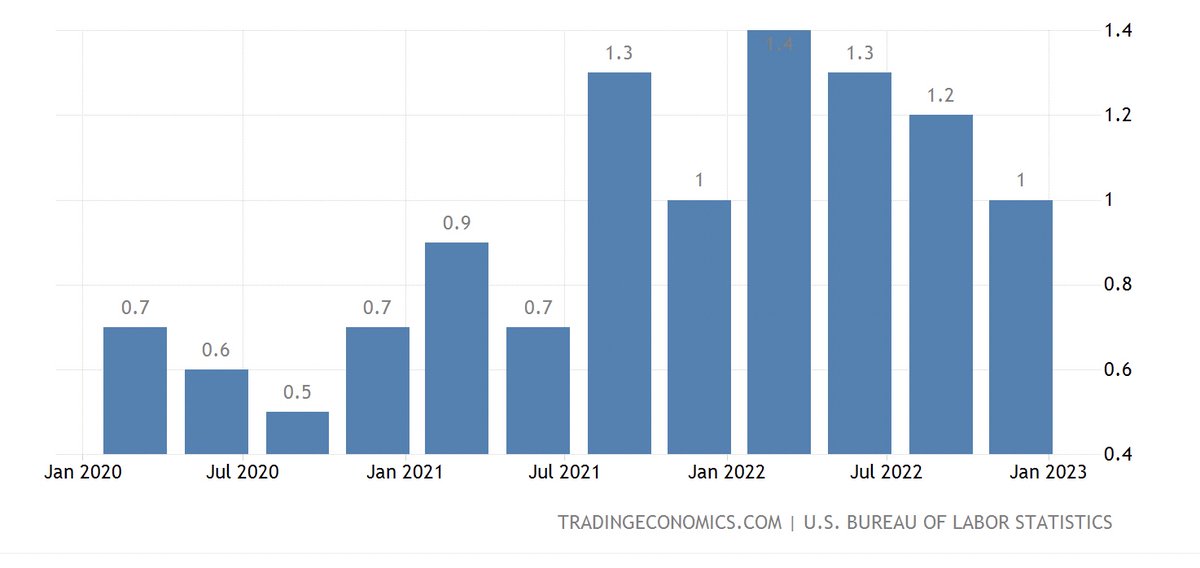

2a/9

The Employment Cost Index #ECI came out on Tuesday, just prior to the #FOMC meeting

#ECI +1% Q/Q represented a deceleration in employment costs

#Inflation 🔻

The Employment Cost Index #ECI came out on Tuesday, just prior to the #FOMC meeting

#ECI +1% Q/Q represented a deceleration in employment costs

#Inflation 🔻

2b/9

Home prices were also out on Tuesday.

At +8.2% y/y, housing costs continue to decline on an ROC basis

#Inflation 🔻

Home prices were also out on Tuesday.

At +8.2% y/y, housing costs continue to decline on an ROC basis

#Inflation 🔻

Morning update:

Yesterday, we got a lot of important economic data and ever since the release, many analysts are wondering what happened. The data we good was far from expectations and is signaling that the #economy is very strong🤔

Yesterday, we got a lot of important economic data and ever since the release, many analysts are wondering what happened. The data we good was far from expectations and is signaling that the #economy is very strong🤔

According to the reported data, #unemployment dropped to 3,4%, the lowest since 1969. Meanwhile, big corporations continue to lay off thousands of employees😂

Recent layoffs:

Amazon: 18,000

Google: 12,000

Sales Force: 8,000

IBM: 3,900

Goldman Sachs: 3,200

SAP: 2,800

3M: 2,500

Pay Pal: 2,000

Wayfair 1,750

Kraken: 1,200

Coinbase: 950

Spotify: 600

Hubspot: 500

And those are just some that we can think of😉 #layoffs2023

Amazon: 18,000

Google: 12,000

Sales Force: 8,000

IBM: 3,900

Goldman Sachs: 3,200

SAP: 2,800

3M: 2,500

Pay Pal: 2,000

Wayfair 1,750

Kraken: 1,200

Coinbase: 950

Spotify: 600

Hubspot: 500

And those are just some that we can think of😉 #layoffs2023

Para Politikası kapsamında #FED, #ECB ve #TCMB toplantılarında alınan kararlarla #enflasyon ve politika #faizi için son verileri grafiklere aktardım.

İyi bir Şubat ayı dilerim.🙏🏻🙋🏻♂️

ergununutmaz.com/para-politikas…

İyi bir Şubat ayı dilerim.🙏🏻🙋🏻♂️

ergununutmaz.com/para-politikas…

As the #FED has increased the policy rate by 25 bp at the latest meeting, recent situation for #FederalFundsRate and #inflation are as below.

Following the #BOE, today the #ECB also has increased the policy rate by 50 bp. Recent situation for #PolicyRate and #inflation are as below.

Dün ABD seansında #EUR yukarı gidiyordu ve birden bire #ECB den 50 değil 25 baz puan faiz arttırabiliriz diye haber servis ettiler. #EUR aşağı geldi #DXY yukarı verdi. Yani ABD #EUR da kar yaptı düşüşle.

Bugün gün içi #ECB den Avrupa seansın da açıklama geldi 25 değil 50 masada

Bugün gün içi #ECB den Avrupa seansın da açıklama geldi 25 değil 50 masada

Avrupalı #EUR satmak istese de yukarı verdi.

ABD seansı açıldı #EUR düştü.

İki haber gün içine bakınca kime yaradı ?

İkisinde de ABD tepeden sattı #EUR saatlik..

ABD seansı açıldı #EUR düştü.

İki haber gün içine bakınca kime yaradı ?

İkisinde de ABD tepeden sattı #EUR saatlik..

Şirketi görüyor musunuz ?

Dün ABD seansında 50 değil 25 baz faiz artışı yapabiliriz diye haber servis ediliyor ve ABD EUR yu 1.0870 den 1.0770 kadar satıyor kar ediyor.

Dün ABD seansında 50 değil 25 baz faiz artışı yapabiliriz diye haber servis ediliyor ve ABD EUR yu 1.0870 den 1.0770 kadar satıyor kar ediyor.

ABD borsaları 2022 Mayıstan beri aynı bölgededir.

100 puan aşağı, 100 puan yukarı. #SP500

Kapatıp gitseydiniz daha iyiydi.

100 puan aşağı, 100 puan yukarı. #SP500

Kapatıp gitseydiniz daha iyiydi.

The @ecb has published its second progress report on the investigation phase of a #digitaleuro. The report elaborates on #design and #distribution options for its #CBDC and gives an outlook for remainder of the investigation phase and afterwards.

Some observations 👇(1/12)

Some observations 👇(1/12)

🤝 Collaboration: The #ECB stresses that a collaborative approach is key to the preparation and eventual success of a digital euro. Further, it was stressed to continue to actively engage with a large number of stakeholders. (2/12)

As the @DigiEuro, we are one of the civil society associations in contact with the ECB and had one exchange seminar in 2022. During 2023, we hope to be involved in more discussions around essential design options for the digital euro. (3/12)

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Global Macro Review 🧵

1/14

Much will be written about 2022 full-year performance, so let’s take a look at the last 3 months of the year to see if we can discern anything from a price momentum perspective.

(T) = Trend = 3-month price momentum

Global Macro Review 🧵

1/14

Much will be written about 2022 full-year performance, so let’s take a look at the last 3 months of the year to see if we can discern anything from a price momentum perspective.

(T) = Trend = 3-month price momentum

PREPARE FOR HIGHER VOLATILITY:

Important 🧵:

We’ve had a bear mkt rally which has now failed and partially unwound. Brief Santa rally or not, the following chart pack tells a clear story of impending volatility:

#macro #stocks $SPY $QQQ

Important 🧵:

We’ve had a bear mkt rally which has now failed and partially unwound. Brief Santa rally or not, the following chart pack tells a clear story of impending volatility:

#macro #stocks $SPY $QQQ

Financial conditions:

This chart isn’t a mirror image - it’s the GS Fin Cond index against the #SPX. I’ve been tweeting updates on this for 6 mths because when conditions tighten, #stocks roll. Once again the Fed and now BoJ have triggered the tightening needed for inflation 🧯

This chart isn’t a mirror image - it’s the GS Fin Cond index against the #SPX. I’ve been tweeting updates on this for 6 mths because when conditions tighten, #stocks roll. Once again the Fed and now BoJ have triggered the tightening needed for inflation 🧯

Yields:

10 year yields are on the rise again with added fuel from the BoJ pivot yesterday. As the benchmark the risk free rate, this is negative for #SPX in the near term

10 year yields are on the rise again with added fuel from the BoJ pivot yesterday. As the benchmark the risk free rate, this is negative for #SPX in the near term

Lagarde getting testy 😂 #ECB

“We are in for a long game”

“*sigh* comparisons are odious ….” I do love the French 😂🙏

#China will now open up and ramp up its #economic output and send #commodities higher. Likely many will make new highs in the next couple years. Their are also going to support for their #housing #market. twitter.com/i/web/status/1…

The USA and Canada are bother going to continue to see housing market weakness and along with Europe banks will begin to struggle with bad loans. Companies like $CS are in trouble and the #FED and #ECB are will have to slow rate hikes and reverse course next year

The western economies are going to need central bank liquidity injections to prevent implosion. Negative wealth effect combined with increased interest rate expenses take a few months to trickle through. And trust me they pain is coming.

#ECB VS #BTC

1/n

Per una Banca Centrale degna di tale nome le cose che più contano sono l'autorevolezza e la capacità di fare previsioni sul futuro andamento dei mercati. La correttezza delle previsioni serve per prendere le giuste decisioni mentre l'autorevolzza serve perché

1/n

Per una Banca Centrale degna di tale nome le cose che più contano sono l'autorevolezza e la capacità di fare previsioni sul futuro andamento dei mercati. La correttezza delle previsioni serve per prendere le giuste decisioni mentre l'autorevolzza serve perché

2/n queste siano incisive. Tutti ci ricordiamo il "Whatever it takes" di Mario Draghi e l'enorme impatto di quelle parole sui mercati. Appare evidente dunque come sia stupido azzardare una previsione del genere su Bitcoin a prescindere dal fatto che sia corretta, infatti se

3/n questa previsione dovesse rivelarsi corretta Bitcoin continuerebbe la sua presunta strada verso l'irrilevanza ma la BCE non ne trarrebbe alcun vantaggio, sarebbero pochissimi a ricordarsi anche solo l'esistenza di questo post. Se invece questa previsione dovesse, come credo,

1) #TheEconomist 26/11/2022

Kapak resminde Türkiye’nin, Avrupa haritasında gösterilmesi içerikten daha çok dikkat çektiği hâlde söz konusu makalede Türkiye üzerine hiçbir yorum bulunmamaktadır.

➡️ Ancak #enerji krizi ve sert #kış şartları önemli olduğundan buradan başlayalım.

Kapak resminde Türkiye’nin, Avrupa haritasında gösterilmesi içerikten daha çok dikkat çektiği hâlde söz konusu makalede Türkiye üzerine hiçbir yorum bulunmamaktadır.

➡️ Ancak #enerji krizi ve sert #kış şartları önemli olduğundan buradan başlayalım.

2) Ukrayna’ya desteği ile hayranlık uyandıran #Avrupa için madalyonun diğer yüzünde ekonomik daralma görülmektedir.

Sorun sadece ekonomik de değildir. Putin’in enerji silahı ve soğuk hava şartları Avrupa’da 100.000 ilave ölüme işaret etmektedir.

Sorun sadece ekonomik de değildir. Putin’in enerji silahı ve soğuk hava şartları Avrupa’da 100.000 ilave ölüme işaret etmektedir.

3) Şirketler açısındansa artan enerji maliyetleri üretim bakımından yeni arayışlara neden olmaktadır. Avrupa’nın yatırımları çekmek bir yana elindekileri kaybetme riski ise hiç istenmeyen bir durumdur.

Teşvik ve desteklerse ilave yük anlamına gelecektir.

Teşvik ve desteklerse ilave yük anlamına gelecektir.

1990: “Plan Balcerowicz leidt tot verrassende resultaten”.

Deze “schoktherapie” leidde echter tot dramatische instabiliteit en armoede voordat economische groei werd herwonnen.

Zijn de monetized oligarchen nu Schoktherapie 2.0 aan het uitvoeren? 🧵

1/

fd.nl/frontpage/Prin…

Deze “schoktherapie” leidde echter tot dramatische instabiliteit en armoede voordat economische groei werd herwonnen.

Zijn de monetized oligarchen nu Schoktherapie 2.0 aan het uitvoeren? 🧵

1/

fd.nl/frontpage/Prin…

Balcerowics was bij lancering plan (1989) minister van Financiën van Polen en zat samen in commissie met oa George Soros en Jeffrey Sachs.

In 2001 werd Balcerowics president van de Centrale Bank in Polen.

2/

nl.frwiki.wiki/wiki/Plan_Balc…

In 2001 werd Balcerowics president van de Centrale Bank in Polen.

2/

nl.frwiki.wiki/wiki/Plan_Balc…

Balcerowics bezocht in 2001 de “WEF primeur”:

“The World Economic Forum's European Economic Summit 2001 is the Foundation's sixth meeting [..], but the first to involve all of Europe in an integrated discussion of the major issues facing the continent.”

web.worldbank.org/archive/websit…

“The World Economic Forum's European Economic Summit 2001 is the Foundation's sixth meeting [..], but the first to involve all of Europe in an integrated discussion of the major issues facing the continent.”

web.worldbank.org/archive/websit…