Discover and read the best of Twitter Threads about #GrayScale

Most recents (15)

👏 @WhatBitcoinDid calling out @Sonnenshein, #Grayscale, @DCGco, and #EmperorShillbertine for the frauds they are. Recall they used #GeminiEarn customer money to pay themselves and prop up their fraudcoins like $GBTC...

Ω👇Ω

Ω👇Ω

Bitcoin ed Eth sono scesi insieme alle altre,dopo un take profit di STH. Polkadot ha visto la perdita più grande. Le azioni statunitensi hanno avuto un martedì misto tra la guida sugli earnings deboli da parte di Microsoft e il PMI a 46,6. Anche se questo supera le aspettative.

Claims that DCG Grayscale's $btc / $eth trust are ponzis and/or on the verge of collapse is FUD from #crypto twitter void of facts and rational thought.

🧵 I outline why grayscale's $gbtc is positioned for a 100% annualized return in the next 12 months:

Data below.

🧵 I outline why grayscale's $gbtc is positioned for a 100% annualized return in the next 12 months:

Data below.

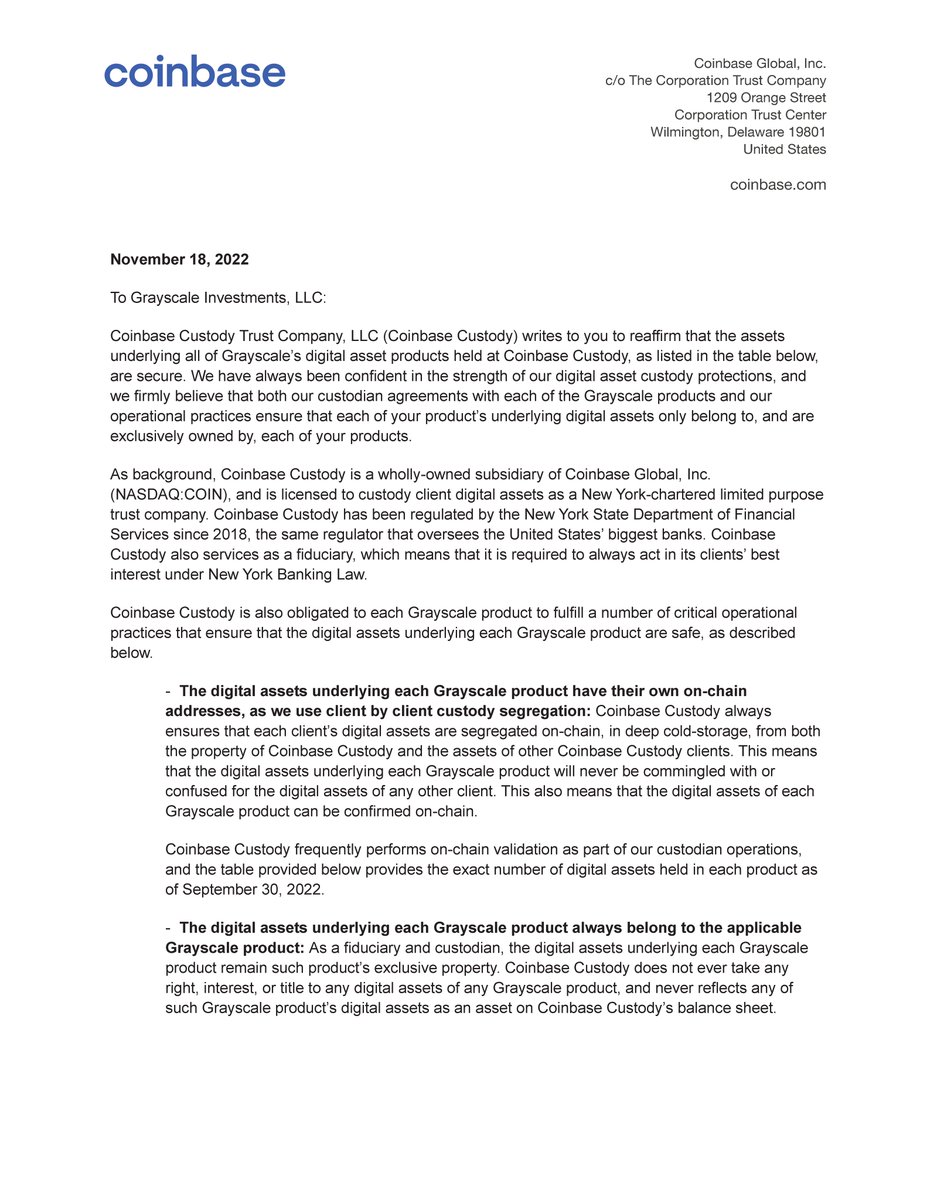

/1 #grayscale funds are safe

#Coinbase Custody Trust is the custodian of Grayscale’s bitcoin, who reaffirmed that #DCG's Grayscale’s bitcoin assets are secured and not used as collateral in a manner similar to FTX:

#Coinbase Custody Trust is the custodian of Grayscale’s bitcoin, who reaffirmed that #DCG's Grayscale’s bitcoin assets are secured and not used as collateral in a manner similar to FTX:

/2 Why?

US-domiciled public crypto exchanges under US regulatory supervision are solvent. All exchange catastrophes we’ve witnessed have been a byproduct of unregulated off-shore crypto firms domiciled in The Bahamas, Antigua, Hong-Kong or some other far-away land ....

US-domiciled public crypto exchanges under US regulatory supervision are solvent. All exchange catastrophes we’ve witnessed have been a byproduct of unregulated off-shore crypto firms domiciled in The Bahamas, Antigua, Hong-Kong or some other far-away land ....

🚨.@GenesisTrading laid off 30% of its employees and is "considering" filing for bankruptcy according to @WSJ.

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

Now, Who is #Genesis?

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

But #Genesis is not independent, it is under the control of @DCGco and @BarrySilbert.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

Apparently 4 months ago #DCG and #Grayscale / $GBTC were suddenly "actively searching" for a Security Architect specifically for "cloud security standards" and "risk assessment"...

curiously tagged with #CISSP (computer security designer) and not, for instance, #compliance.

🚩

curiously tagged with #CISSP (computer security designer) and not, for instance, #compliance.

🚩

👆 maybe I'm projecting but that looks to me like the job listing I might post at the moment I was scrambling to recover from a security breach #DCG #Grayscale $GBTC

Here's some reasons about the wording used, the timing, and a couple other things made me at least raise my eyebrows: reddit.com/r/AskNetsec/co…

1/4 Get ready for a potentially bumpy ride this week, #Bitcoin, #Ethereum and #altcoin traders! Here are 3 reasons why:

🧵A thread by @esatoshiclub

🧵A thread by @esatoshiclub

2/4Tensions are rising as #Winklevoss, co-founder of #Gemini, calls out #DCG founder Barry Silbert over $900 million in locked customer funds. Crypto Twitter is speculating about potential liquidity issues at #DCG and the impact on #GBTC and #ETHE positions held by #Grayscale.

3/4 Fear is high and #liquidity is low as we continue to see drama unfold between DCG and Gemini. Sentiment in the #crypto market remains down, with most market participants not feeling bullish and hesitant to take on risk. The current index sits at 26 out of 100.

🔴 ¿NOS DEBERIA PREOCUPAR? ⚠️

Durante estas semanas mucho se ha hablado sobre algunas empresas crypto que podrían estar a punto de caer. Pero ¿Realmente podrían caer o es puro FUD?

En este hilo veremos la situación sobre algunas de las empresas más importantes 🧵👇

(1/12)

Durante estas semanas mucho se ha hablado sobre algunas empresas crypto que podrían estar a punto de caer. Pero ¿Realmente podrían caer o es puro FUD?

En este hilo veremos la situación sobre algunas de las empresas más importantes 🧵👇

(1/12)

Son dos de las empresas más importantes del sector:

🔹 GRAYSCALE: ofrecen GBTC, un instrumento de inversión que posee cerca de 635.000 #BTC

🔹 GENESIS TRADING: el crypto lender más grande.

Genesis está cerca de quebrar... PERO ¿Grayscale también está en peligro?

(2/12)

🔹 GRAYSCALE: ofrecen GBTC, un instrumento de inversión que posee cerca de 635.000 #BTC

🔹 GENESIS TRADING: el crypto lender más grande.

Genesis está cerca de quebrar... PERO ¿Grayscale también está en peligro?

(2/12)

🚨 GRAYSCALE

Durante la semana pasada, mucho se dudó sobre si realmente poseían la cantidad de #Bitcoin que decían tener, pues se negaron a mostrar sus reservas que están bajo la Custodia de Coinbase.

Sin embargo, Coinbase ya ha validado las reservas sobre estos BTC.

(3/12)

Durante la semana pasada, mucho se dudó sobre si realmente poseían la cantidad de #Bitcoin que decían tener, pues se negaron a mostrar sus reservas que están bajo la Custodia de Coinbase.

Sin embargo, Coinbase ya ha validado las reservas sobre estos BTC.

(3/12)

Die #FTX-Pleite hat den gesamten Markt erschüttert. Die neue BlingBling-Ausgabe beschäftigt sich mit der Frage, welche Projekte jetzt wackeln und wann #Bitcoin einen Boden bildet 🧵👇

1⃣ Das #FTX-Massaker geht weiter und angesichts mancher Überschriften in den Leitmedien kann sich fragen, ob der Boden nicht langsam erreicht ist.

Why @Grayscale is unlikely to be a scam, despite the FUD revolving CT:

1. There is SEC supervision and audits every quarter. The audit of #Grayscale is way too simple, hence difficult to fake.

1. There is SEC supervision and audits every quarter. The audit of #Grayscale is way too simple, hence difficult to fake.

2. The probability of #Coinbase cooperating with fraud and presenting a false asset certificate to #Grayscale is very low.

3. If #Grayscale is fraudulent, #Coinbase should have the obligation to actively disclose or report directly to the regulatory agency at this time, otherwise it will be in default.

FYI #Grayscale has 2 funds with $ADA in it. The first is their Digital Large Cap Fund that holds $161.6 mil USD of assets, 2.25% of which is $ADA. The second is their Smart Contract Platform Ex-Ethereum Fund that holds $1.3 mil USD of assets, 28.89% of which is $ADA. 1/n

2/n That is ~$375,570 of $ADA (~1,251,900 $ADA) in the Large Cap Fund and ~$3,636,000 of $ADA (~12,120,000 $ADA) in the Ex-ETH Fund. Together it's less than 14 million $ADA. It's really not that much so their potential collapse is more a problem for the general market

I'm going to start this thread about #Qredo by listing many things @QredoNetwork has

- Security

- Speed

- Siloed Liquidity

- Reporting for institutions

- Unmatched privacy

- Blockchain interoperability

Let's discuss them further...

/1

- Security

- Speed

- Siloed Liquidity

- Reporting for institutions

- Unmatched privacy

- Blockchain interoperability

Let's discuss them further...

/1

Let's discuss security firstly.

To understand the uniqueness of $QRDO you need to understand what lies in the core of #mpc

So how would we best define MPC?

/2

To understand the uniqueness of $QRDO you need to understand what lies in the core of #mpc

So how would we best define MPC?

/2

Defining MPC.

Multi party computation is a cryptographic tool that allows multiple individuals to make calculations using their combined data.

This is without ever revealing their individual input.

#QREDO uniqueness lies in its decentralised MPC

/3

Multi party computation is a cryptographic tool that allows multiple individuals to make calculations using their combined data.

This is without ever revealing their individual input.

#QREDO uniqueness lies in its decentralised MPC

/3

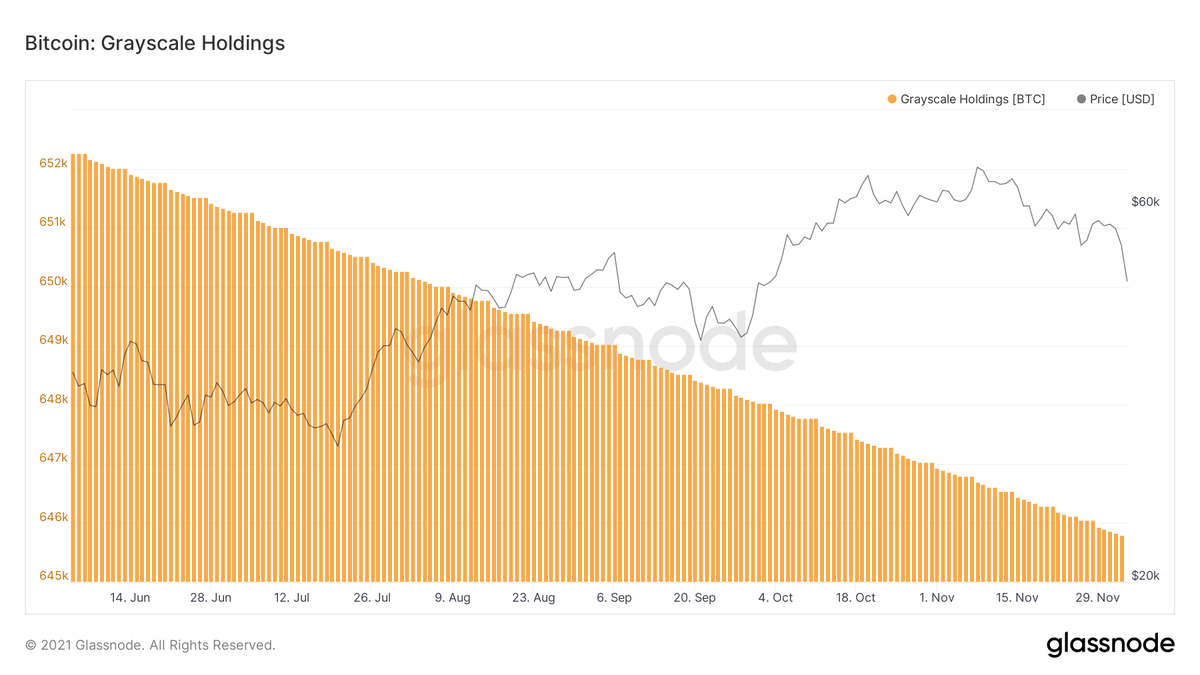

Due to the @Grayscale trust discount, #Grayscale had been selling their #Bitcoin bit by bit for almost 10 months now, on average selling 30-50 #BTC a week.

In contrast, last December, #Grayscale was buying BTC aggressive due to their trust premium.

For example, from #Bitcoin's $20k to $40k move from Dec 2020 to Feb 2021, @Grayscale played an instrumental role, they purchased 60,240 #BTC during that period ($1.8B USD worth of BTC).

For example, from #Bitcoin's $20k to $40k move from Dec 2020 to Feb 2021, @Grayscale played an instrumental role, they purchased 60,240 #BTC during that period ($1.8B USD worth of BTC).

Similar story for #ETH, Grayscale had been selling on average 200-250 $ETH per week for months now.

The sooner #Grayscale trust be can be turned into ETF, the sooner will they start buying #BTC and ETH again.

They could become the largest spot ETF in the world, if SEC approves.

The sooner #Grayscale trust be can be turned into ETF, the sooner will they start buying #BTC and ETH again.

They could become the largest spot ETF in the world, if SEC approves.

DeFi-DeX Merkeziyetsiz Finans Nedir?

''Günümüzün 'Bankacılık Sektörünün' yerini alacak Merkeziyetsiz borsa (DEX), iki taraf arasında doğrudan kripto para işlemlerine olanak sağlayan eşler arası (P2P) hizmettir.

Bu sektöre hizmet eden #altcoin hangileri?⬇️

''Günümüzün 'Bankacılık Sektörünün' yerini alacak Merkeziyetsiz borsa (DEX), iki taraf arasında doğrudan kripto para işlemlerine olanak sağlayan eşler arası (P2P) hizmettir.

Bu sektöre hizmet eden #altcoin hangileri?⬇️

#Grayscale Nedir? Coinbase ile bağlantısı nedir?

Neden Yakından takip etmeliyiz?

Kripto varlıklara yatırım yapan, Nasdaq, S&P500, Londra’da yönetilen büyük para fonlarının Kurumsal Firmaların hangi kripto varlıklara, yatırım yaptığını ve hangileri ilgilendiğini gösteren kaynak.

Neden Yakından takip etmeliyiz?

Kripto varlıklara yatırım yapan, Nasdaq, S&P500, Londra’da yönetilen büyük para fonlarının Kurumsal Firmaların hangi kripto varlıklara, yatırım yaptığını ve hangileri ilgilendiğini gösteren kaynak.

1-) #grayscale Nedir?

@BarrySilbert tarafından kurulan , kripto para birimlerine yatırım yapan ''Büyük Kurumsal Şirketlerin''

Fonlarının yönetimini üstlenen şirkettir.

@BarrySilbert tarafından kurulan , kripto para birimlerine yatırım yapan ''Büyük Kurumsal Şirketlerin''

Fonlarının yönetimini üstlenen şirkettir.

2-) #grayscale Dünyanın en büyük bitcoin fonu ve finansal bilgileri düzenli olarak ABD Menkul Kıymetler ve Borsa Komisyonu’na (SEC) rapor eden türünün ilk yatırım aracıdır. Kurumsal firmalar mevcutta bulunan kripto para borsalarından alım satım yapmaz!

The price of the world’s most popular #cryptocurrency recently surpassed $25,000, reaching a new milestone of $25,199.50 on #FTX exchange and surpassing the Gross Domestic Product of any country in #Africa