Discover and read the best of Twitter Threads about #HelicopterMoney

Most recents (7)

NEW: The Executive has agreed a £338m package of Covid-19 support. It includes £213m for businesses.

Another £150m has been set aside for a potential extended rates holiday for businesses from April.

Another £150m has been set aside for a potential extended rates holiday for businesses from April.

The £213m package for businesses includes:

• Additional £55m for rates-based grant scheme (£90m total) – extended to include non-essential retail, leisure and ents businesses required to close for two weeks

• £95m high street voucher scheme (via a pre-paid card)

• Additional £55m for rates-based grant scheme (£90m total) – extended to include non-essential retail, leisure and ents businesses required to close for two weeks

• £95m high street voucher scheme (via a pre-paid card)

Significant: £20m has been allocated for a scheme for company directors (previously excluded from support)

The #deficit #myth #deficitmyth by @StephanieKelton #MMT modern monetary theory

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 2: #deficit is evidence of #overspending

#RealityCheck: look to #inflation for evidence of over spending

#RealityCheck: look to #inflation for evidence of over spending

The purpose of #taxes is not to pay for #government expenditures but to help rebalancing the #wealth distribution #MMT

The @ecb response to #COVID19.

My new blog (link below) and a thread on what #centralbanks should do to face the crisis

(1/9)

My new blog (link below) and a thread on what #centralbanks should do to face the crisis

(1/9)

In short

- Households & firms need massive emergency #credit to cope with #COVID19

- #centralbanks are critically accommodating credit markets

- CBs must guarantee sustainable credit conditions

- CBs must ensure that credit go where it's needed

- #HelicopterMoney is option

(2/9)

- Households & firms need massive emergency #credit to cope with #COVID19

- #centralbanks are critically accommodating credit markets

- CBs must guarantee sustainable credit conditions

- CBs must ensure that credit go where it's needed

- #HelicopterMoney is option

(2/9)

#fiscalpolicy is crucial to ensure most vulnerable get the help needed. Ambitious fiscal plans have been pledged.

Volume and price countries get on markets is key to scale-up public response to #COVID19 and for #sustainability of sovereign debt.

(3/9)

Volume and price countries get on markets is key to scale-up public response to #COVID19 and for #sustainability of sovereign debt.

(3/9)

Reading all these calls for ‘stimulus’, one wonders, if Constantine XI had had a ‘technology we call the printing press’ would his city not have fallen to the besieging Ottomans in 1453.

Shame he hadn’t heard of Gutenberg’s newly invented gizmo...

#Fed #UST #coronavirus #ECB

Shame he hadn’t heard of Gutenberg’s newly invented gizmo...

#Fed #UST #coronavirus #ECB

“The bad news, Tommy, iss for your ze war iss over. Ze good is, your RAF has parachuted in a packet of £5 notes to ease your captivity”

#coronavirus #stimulus #centralbanks #HelicopterMoney

#coronavirus #stimulus #centralbanks #HelicopterMoney

Imagine if, during the Berlin Airlift, General Lucius Clay had not bothered flyng in food and fuel, but had just dropped Greenbacks.

You think Stalin might have chuckled?

#stimulus #coronavirus #COVID2019 #centralbanks #fiscal

You think Stalin might have chuckled?

#stimulus #coronavirus #COVID2019 #centralbanks #fiscal

14 countries have so far used some form of #castransfer and #basicincome program as #coronavirus response.

Here is what we know:

1. #Australia: one-time cash payment $750 to seniors, veterans and low-income people

Here is what we know:

1. #Australia: one-time cash payment $750 to seniors, veterans and low-income people

2. #China: expanding Dibao program’s value and coverage for affected families

3. #Hong-Kong: one-off cash injection to all 7M adult residents

4. #Indonesia: expansions of e-food vouchers by 33% for 6 months

3. #Hong-Kong: one-off cash injection to all 7M adult residents

4. #Indonesia: expansions of e-food vouchers by 33% for 6 months

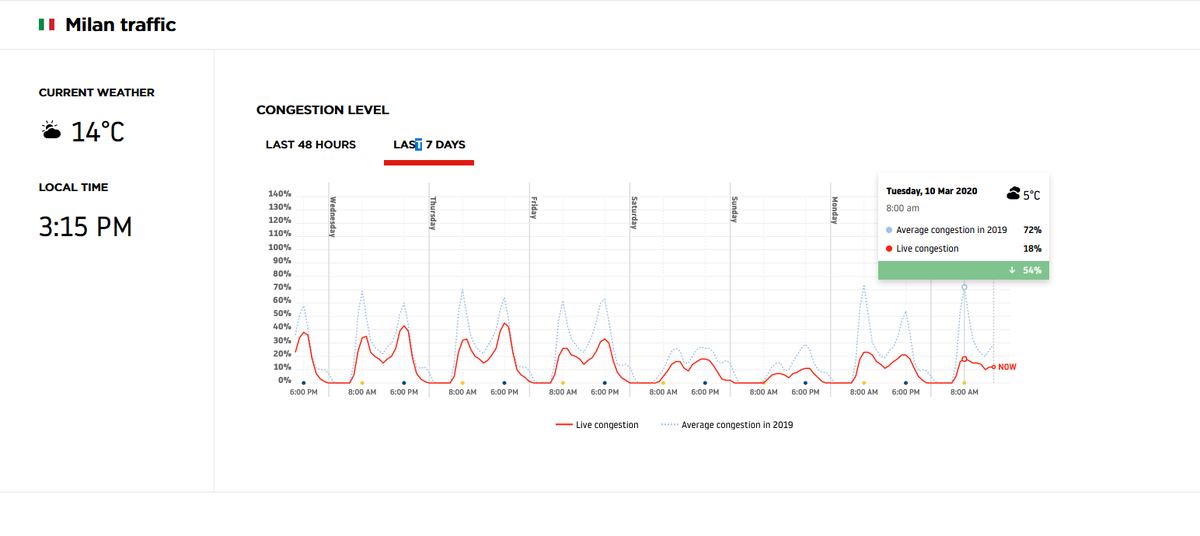

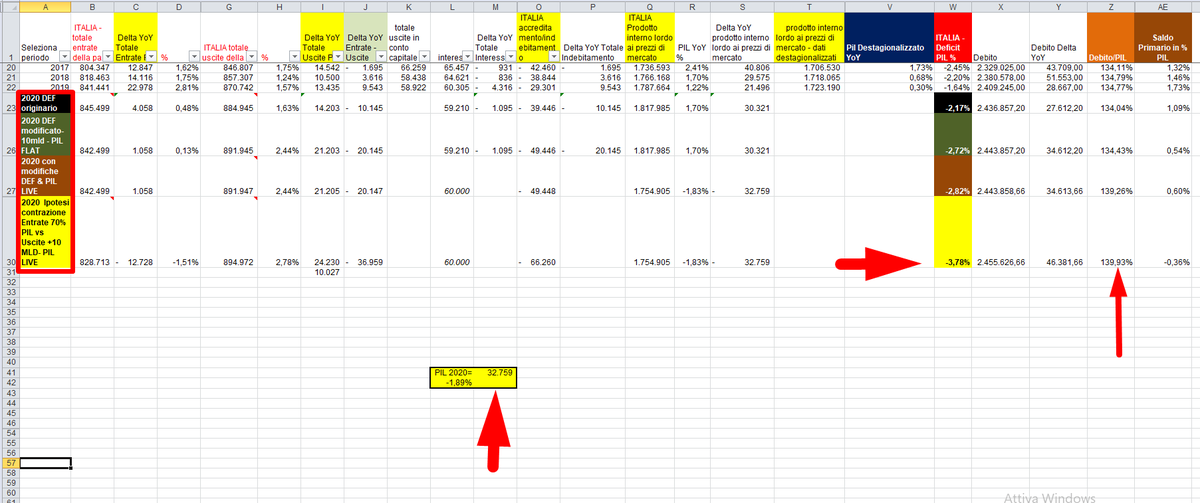

Paese congelato da ieri

delta rispetto al Picco di Congestione del Traffico mattutino superiore al 50% sia a Milano che a Roma

Worst Case ad oggi

-32mld di PIL2020

Deficit/PIL =

-2.82% con +10mld deficit [+7mldUsc vs -3mldEnt]

-3,78% con Entrate ridotte di 12mld vs 2019

AD OGGI

delta rispetto al Picco di Congestione del Traffico mattutino superiore al 50% sia a Milano che a Roma

Worst Case ad oggi

-32mld di PIL2020

Deficit/PIL =

-2.82% con +10mld deficit [+7mldUsc vs -3mldEnt]

-3,78% con Entrate ridotte di 12mld vs 2019

AD OGGI

Ad oggi il maggior indebitamento in qualunque ipotesi con una contrazione così importante del PIL, porterebbe il rapporto debito/PIL italiano vicino al 140%...facendo scattare tutti gli alert di ristrutturazione del debito pubblico...sia Ex-Ante [#MES2] che EX-Post [MES attuale]

Vacation time 🙂I'm currently in beautiful Oregon, US. Been flying, rafting, hiking, eating and playing with the kids - great time! Now - small break to update myself on the markets. Stay tuned for some #HZupdates

Where the #USD goes, rest of the market follows! Getting the direction of USD right is key. This is how I see #DXY short term. Further downside to develop - with target ~95.0. This is likely a major bottom - before DXY explodes higher #HZupdates

Following the ST weakness in #DXY, I think we will see much higher levels coming , as the shortage of USDs in the financial system becomes very clear. The target remains 107-109 - pot. higher to be reached some time around Mid-2020 #HZupdates