Discover and read the best of Twitter Threads about #Palladium

Most recents (21)

Since knee-jerk price collapse, $gato.to was up as much as 140% if you were buying when other were fearful.

Same for $rio.v.

$air.v next? Not a lot of developed/developing pge deposits out there in safe jurisdictions. For small caps, there's like 5-6 in the world?

$fme.ax

Same for $rio.v.

$air.v next? Not a lot of developed/developing pge deposits out there in safe jurisdictions. For small caps, there's like 5-6 in the world?

$fme.ax

whether it's a slow decline, or a sudden 50% off, both these these #platinum #palladium deposits are being priced like the supply of these critical and rare metals is secure for the next 30 years, and gas/diesels cars are already phased out.

$fme.ax

$fme.ax

Probably one of the best pencil drawings I've ever done. Lt.Cmdr. Amanda May Lusenkya of the Seekers, an offshoot of the Interplanetary Space Exploration Service. The space-stranded astronaut survivors after WW3 nearly completely obliterated life on Earth. Seekers were all born

and raised among the ramshackle space stations, asteroid colonies and rundown ships of the ISES survivors. Trained since birth, in a quite literal military dormitory, the Seekers would be the first humans to finish developing and then use experimental Wormholes drives to travel

Beyond the Sol System. Nearly All the Seekers are born psychics who would use their powers to ensure the survival of their race And to explore the Ancient Alien and First Humans relics and artifacts found scattered across both the Sol and Alpha Cee systems. The tunnels of Luna

🧵Macro prediction for #OIL

Everyone in the world currently has a stressful moment visiting gas stations, they'll be delighted to hear, that for a few months forward this situation will get better as $OIL will be getting cheaper

However that will only apply for a while 👇

1/14

Everyone in the world currently has a stressful moment visiting gas stations, they'll be delighted to hear, that for a few months forward this situation will get better as $OIL will be getting cheaper

However that will only apply for a while 👇

1/14

4 RICO not suave

#JPMorgan traders

go on trial today🧵

Wait?!

US DoJ claims PM mkts 'were' criminal

JPMorgan still dominates US precious metals derivative mkt share

This topic is way deeper than mere greed

- bloom.bg/3Pf2W97 -

2 Bloomberg reporters tagged below

#JPMorgan traders

go on trial today🧵

Wait?!

US DoJ claims PM mkts 'were' criminal

JPMorgan still dominates US precious metals derivative mkt share

This topic is way deeper than mere greed

- bloom.bg/3Pf2W97 -

2 Bloomberg reporters tagged below

IRONIC TIMING:

💣former London gold trader

precious metals mkt makers increasingly use unsecured derivatives to subvert mkt forces, now decades running:

reaction.life/dont-forget-th…

"Once investors swallowed this stupefying pill it was easy to sell them gold that simply didn’t exist."

💣former London gold trader

precious metals mkt makers increasingly use unsecured derivatives to subvert mkt forces, now decades running:

reaction.life/dont-forget-th…

"Once investors swallowed this stupefying pill it was easy to sell them gold that simply didn’t exist."

Gap fill on $GDXJ & $SILJ last week, but no such luck with $GDX. Stopped dead at the gap now may be rolling over. (Upside, GDX held lows while GDXJ & SILJ broke them & recovered)

There are a few things concerning me here with miners that seem a bit reminiscent of last summer/

There are a few things concerning me here with miners that seem a bit reminiscent of last summer/

Spot #palladium rises about 3%. $XPD

Spot #palladium rises nearly 6%, topping $2,400/oz. $XPD

LONDON PLATINUM AND PALLADIUM MARKET SAYS SUSPENDS RUSSIAN REFINERIES FROM ITS GOOD DELIVERY LISTS.

#Palladium $XPD

#Palladium $XPD

Spot #palladium falls 10.7% on day at $2,518.25/oz, spot #gold extends losses to 1.3%. $XPD $XAU

Spot #palladium falls below $2,500/oz, down 12.4% on day. $XPD

[Thread in 8: Poo-Tins #Rohstoffwaffen]

Kurzfassung: Öl, Gas, Bienenhonig, Holz, Weizen, Zucker, Zinn, Aluminium, Kupfer, Diamanten, Nickel, Kubalt, Palladium, Sonnblumenöl

All das wird teurer.

Durch den #Ukrainekrieg sind auch allerhand Agrarprodukte betroffen (s.o.).

1/8

Kurzfassung: Öl, Gas, Bienenhonig, Holz, Weizen, Zucker, Zinn, Aluminium, Kupfer, Diamanten, Nickel, Kubalt, Palladium, Sonnblumenöl

All das wird teurer.

Durch den #Ukrainekrieg sind auch allerhand Agrarprodukte betroffen (s.o.).

1/8

Russlands Wirtschaft ist extrem von Rohstoffen abhängig. Rund 75 aller russischen Exporte beruhen auf Rohstoffen oder Rohstoff-Produkten.

Der Rest sind Waffenexporte...

(OK: Das ist eine kleine Übertreibung)

Ein Problem ist: Auch wir sind von diesen Rohstoffen abhängig.

2/8

Der Rest sind Waffenexporte...

(OK: Das ist eine kleine Übertreibung)

Ein Problem ist: Auch wir sind von diesen Rohstoffen abhängig.

2/8

Unser Kohleausstieg erweist sich in diesem Zusammehang als Glückfall, denn ein erheblicher Teil unserer Steinkohleimporte kommen aus #Russland!

Man könnte es so sagen:

#Sonnenenergie und #Windräder dienen der Freiheit!

3/8

Man könnte es so sagen:

#Sonnenenergie und #Windräder dienen der Freiheit!

3/8

🇷🇺🇪🇺 To what extent does #Europe depend on Russian raw materials?

Policymakers fear the bloc is less prepared than Moscow. EU anti-Russian sanctions - shot yourself in the knee.

ft.com/content/26d7e3…

Policymakers fear the bloc is less prepared than Moscow. EU anti-Russian sanctions - shot yourself in the knee.

ft.com/content/26d7e3…

• about 40% of natural #gas imports;

• almost a third of crude #oil imports.

Eurozone gas inventories are below historical levels and prices have risen sharply in recent months, giving #Russia additional leverage over #Europe.

#OOTT #ONGT

• almost a third of crude #oil imports.

Eurozone gas inventories are below historical levels and prices have risen sharply in recent months, giving #Russia additional leverage over #Europe.

#OOTT #ONGT

• about 40% of #palladium imports, which are needed for emission control catalysts; #greeneconomy

• about 30% of #titanium imports, which are critical for #EU aerospace industry - #Airbus supplies about half of its titanium from #Russia. $AIR

• about 30% of #titanium imports, which are critical for #EU aerospace industry - #Airbus supplies about half of its titanium from #Russia. $AIR

UBS expects #platinum prices to rise to $1,150/oz by end 2022 (revised up from $1,100/oz previously), potentially even higher thereafter.

$XPT

$XPT

UBS expects a recovery in #palladium prices to $2,000/oz, before leveling off at the end of the year and likely beyond.

$XPD

$XPD

UBS: See a rebound in PGM demand due to expected easing of auto supply chain constraints, including shortage. Expect #palladium market to be balanced in 2022. Expect #platinum market to be slightly undersupplied by around 100,000 ounces or 1.3% of annual demand in 2022.

$XPT $XPD

$XPT $XPD

💸 Is hyperinflation a reality? How to protect yourself?

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

• In the #US, inflation has already accelerated to 6.2%

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

Populist views are capturing the minds of monetary authorities, which only fuels #inflation. This was the case in the #USA in the 1970s: prices almost tripled.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

As we must look forever forward; with the current corrections i did a *little* bit of work (don't expect more) to find more deep value.

Now that #Uranium's gone up, and hopefully #Silver is next in a flight to safety;

With #Palladium correcting, #Platinum's becoming VERY cheap.

Now that #Uranium's gone up, and hopefully #Silver is next in a flight to safety;

With #Palladium correcting, #Platinum's becoming VERY cheap.

The last times it was below $900, was in 2020 (panic), 2018 (bear market), 2016 (double bottom), 2008 (panic), and 2005/2004 (bull market).

Meanwhile, the outlook for #platinum is far more positive now:

- ICE cars being phased out before 2075 *is a pipedream*.

Meanwhile, the outlook for #platinum is far more positive now:

- ICE cars being phased out before 2075 *is a pipedream*.

When 1 or 2 smallish countries try to transition fully, sure, it can happen.

When the entire world tries to do so at the same time, which includes China, NONE of the battery metal industries are ready for that scale.

Nickel, Lithium, Cobalt, Copper, Rare Earths. None are ready.

When the entire world tries to do so at the same time, which includes China, NONE of the battery metal industries are ready for that scale.

Nickel, Lithium, Cobalt, Copper, Rare Earths. None are ready.

Palladium production may decline in 2021 by 20% because of an accident at the mines of #Nornickel, major #palladium producer in the world. Regardless of how the situation at the mines will be resolved, the market may experience a price shock.

Part 1/1 Nornickel is the major world’s #palladium and high-quality #nickel producer and also a major producer of #platinum and #copper. The company produced a total of 2,826 thousand ounces of palladium (80115 kg) in 2020, that accounts for 40% of palladium world production.

1/2 On 24/02/21 it became known that operations at Oktyabrsky and Taimyrsky were suspended due to flooding by groundwater. These 2mines are largest copper-nickel deposits and key assets of $GMKN, with a combined production of 9.5 mn tons of ore per year- 36% of all output in 2020

By driving down silver, by selling even more paper silver, they only bought a weeks more time.

But the problem is now even LARGER. More people want to buy the shiny white stuff now it’s even cheaper.

So they are cornered and that’s why they need an emergency meeting imho

But the problem is now even LARGER. More people want to buy the shiny white stuff now it’s even cheaper.

So they are cornered and that’s why they need an emergency meeting imho

Sometime central bankers are trapped.

Example: you can’t print your way out of inflation (CB’s trapped)

Ex 2: you can’t print metals. Palladium prices exploded in 2019, after the physical demand overwhelmed paper supply.

The same is happening now in this #silvershortsqueeze

Example: you can’t print your way out of inflation (CB’s trapped)

Ex 2: you can’t print metals. Palladium prices exploded in 2019, after the physical demand overwhelmed paper supply.

The same is happening now in this #silvershortsqueeze

In 2011, just like 1980, Wall Steer almost lost control over the silver market, when prices jumped to $50

By changing the rules (1980) and/or bombarding the market with paper silver (remember the nightly raid May 1st in 2011?) they succeeded to stay in control.

What’s next???

By changing the rules (1980) and/or bombarding the market with paper silver (remember the nightly raid May 1st in 2011?) they succeeded to stay in control.

What’s next???

A few tweets on one of my favorite under the radar junior explorers tonight...... Bitterroot Resources $BTT.V has projects in Michigan and Nevada. Tonight I'm focusing on the LM Project located in Michigan's Upper Peninsula.... #copper #metals #mining #nickel #palladium #platinum

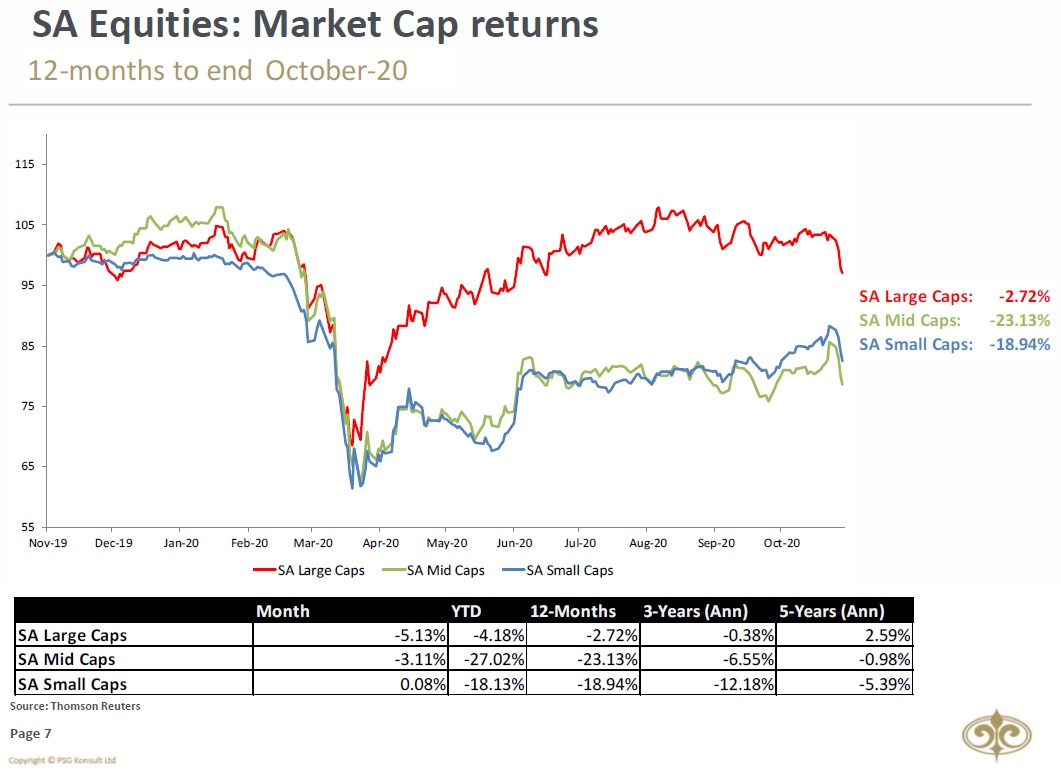

UPDATE ON MARKETS: With flareup of #COVID19 globally & many countries moving back into hard lockdown, #markets reacted. FTSE/JSE All Share contracted by further 4.7% during October, following 1.6% September decline. Another horrible month for Local Property stocks dropping 8.5%.

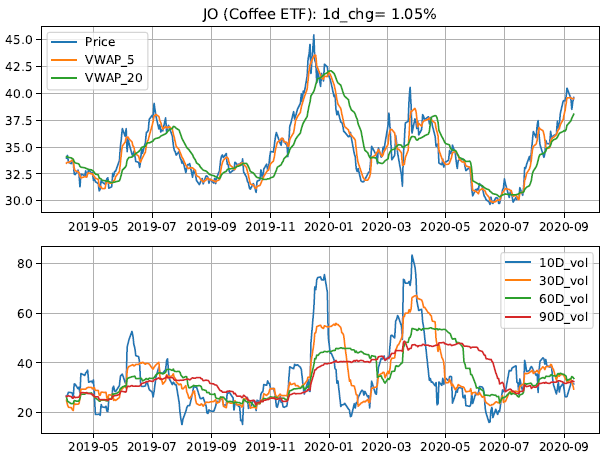

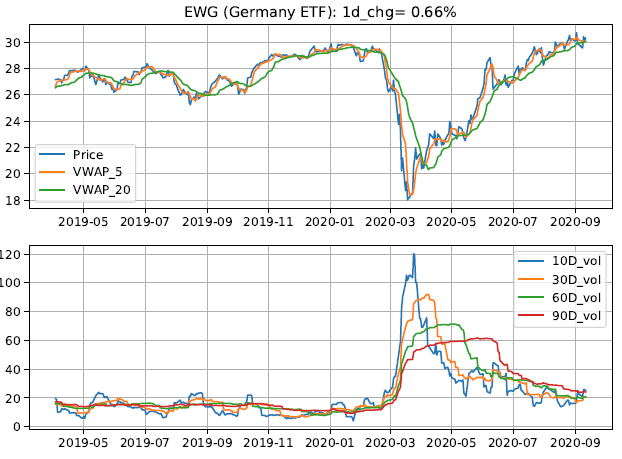

As #tech sold off in the last 2 weeks, there were still places that were resilient during this time period. Whether tech gets through the consolidation phase or breaks lower, time will tell.

Meanwhile few ideas on longs and shorts going forward. 1/

Meanwhile few ideas on longs and shorts going forward. 1/

On the long side, equity exposure in #transports, #materials and int'l mkts like #Germany and #Korea worked well. Exposure in these areas continues to stay bullish.

Vols are showing upticks as well, so should stay careful.

$IYT $XLB $EWG $EWY

2a/

Vols are showing upticks as well, so should stay careful.

$IYT $XLB $EWG $EWY

2a/

Interesting overview on 'Great power resource competition in a changing climate' from @NewAmerica with plenty of #FoodForThought: newamerica.org/resource-secur… Some takeaways..(1/16)

2/16 Key findings - #US & #China resource competition in a world in flux...#GlobalTrends #GeoStrategy #Energy #Agriculture #ClimateChange #NationalSecurity

3/16 Overview of 'Key metal and mineral resources in the #US & #China competition...#StrategicMaterials #Lithium #Cobalt #Palladium #Niobium #Rhodium #RareEarths

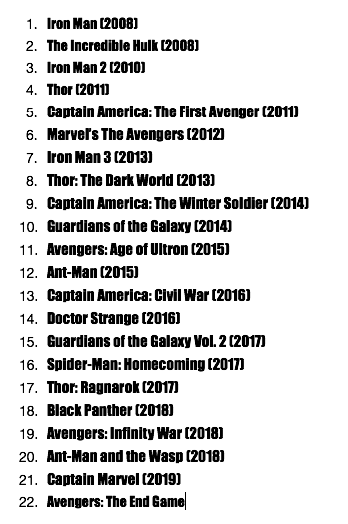

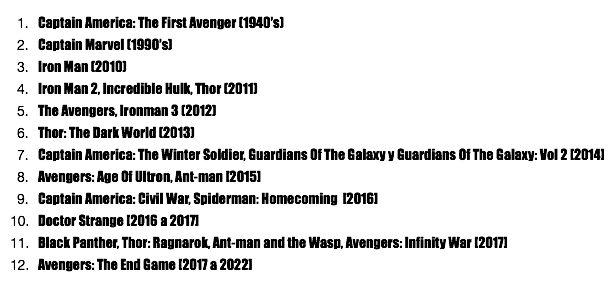

Sería muy interesante armar el maratón de #MCU alrededor de #Avengers, pero acomodando todas las escenas de todas las películas en una sola línea temporal. No incluyo las series por que sería sumamente largo y complicado.

Abro #hilo y me explico.

#AvengersElHilo

Abro #hilo y me explico.

#AvengersElHilo

Actualmente hay dos formas (bueno hay un chingo) en que puedes ver todas las películas del Universo Cinematográfico de Marvel:

1.- En el orden cronológico de lanzamiento, es decir comenzar con #IronMan (2008), hasta llegar a #AvengersEndgame (2019).

1.- En el orden cronológico de lanzamiento, es decir comenzar con #IronMan (2008), hasta llegar a #AvengersEndgame (2019).

2.- Viéndolas en orden cronológico de tiempo de los eventos, es decir, comenzar con lo que sucedió primero con #CaptainAmerica: The First Avenger y terminando con #AvengersEndgame. Esto sin contar los "flashbacks" con los que comienzan algunas como #GuardiansOfTheGalaxy

Precious Metals: There was one big topic at the @lbmaexecutive biannual dinnner last night - #Palladium. The remarkable rise of this precious metals and concerns about availability of metal dominated conversations.

Many have noted that palladium was (yesterday) more expensive than #gold, but as this chart shows, that's happened before when palladikum surged on auto demand and a lack of Russian sales in the late 1990s.

With slowing car sales in some important regions vs. an apparent shortage of metal immediately available, further volatility in palladium looks assured.