Discover and read the best of Twitter Threads about #RIL

Most recents (24)

1/ Here’s all you need to know about the #Budget2023: Finance Minister Nirmala Sitharaman’s final Budget before General Elections 2024

A thread 🧵 #BudgetSession2023

A thread 🧵 #BudgetSession2023

Sunday Stocks catch up with Janak.. Let's go 🧵

Disc: Not a reco

Disc: Not a reco

(1/N) Auto industries focused, #KPIT Technologies’ Q2 profits surged 28%. The Company has guided for yearly profits to be higher by around 32%.

(2/N) #RIL’s Q2 profit was flat despite a 32% rise in revenue. Jio business going strong thought

A thread🧵 on Why gross refining margins (GRM) are at multi year high & what it means for refining stocks

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

GRM is difference between value of crude based products & value of crude oil.

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

Why GRMs are multi year high?

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

@Kassandra_1909 @JoernLinnertz @Puettmann_Bonn @51Zuschauer

Dann würde ich mich mal informieren über:

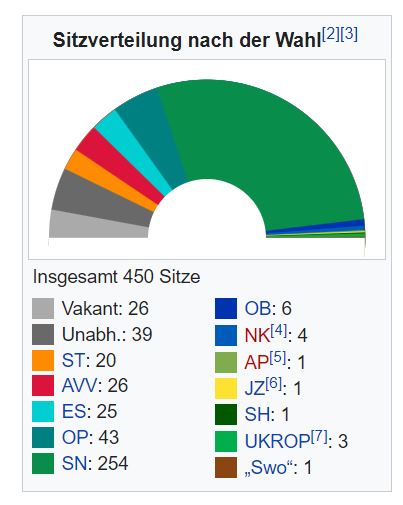

- Parlamentswahlen 2019 in Ukraine

- Über #Azov bei @ColborneMichael: belltower.news/interview-zur-…

- (Neo)nazis sind wir alle im Westen nach Putins Propaganda

@LtTimMcMillan:

threadreaderapp.com/thread/1528686…

Dann würde ich mich mal informieren über:

- Parlamentswahlen 2019 in Ukraine

- Über #Azov bei @ColborneMichael: belltower.news/interview-zur-…

- (Neo)nazis sind wir alle im Westen nach Putins Propaganda

@LtTimMcMillan:

threadreaderapp.com/thread/1528686…

@Kassandra_1909 @JoernLinnertz @Puettmann_Bonn @ColborneMichael @LtTimMcMillan @51Zuschauer

Ja, es gibt Neonazis in der Ukraine, wie in jedem Land.

Bevor man auf die Ukraine mit Fingern zeigt, zuerst mal vor der eigenen Haustür kehren:

rnd.de/politik/deutsc…

Ja, es gibt Neonazis in der Ukraine, wie in jedem Land.

Bevor man auf die Ukraine mit Fingern zeigt, zuerst mal vor der eigenen Haustür kehren:

rnd.de/politik/deutsc…

@JoernLinnertz @Puettmann_Bonn @CharlesMichel

Nach #TerrorGruppenListe #EU gesucht. #Buergerfreundlich? Zero!

Endl. gefunden:

eur-lex.europa.eu/legal-content/… Anhang II

#RIM Russian Imperial Movement &

#RIL Russian Imperial League: NICHT in EU-Liste gefunden.

#RIL: Русское Имперское Движение

de.wikipedia.org/wiki/Russische…

Nach #TerrorGruppenListe #EU gesucht. #Buergerfreundlich? Zero!

Endl. gefunden:

eur-lex.europa.eu/legal-content/… Anhang II

#RIM Russian Imperial Movement &

#RIL Russian Imperial League: NICHT in EU-Liste gefunden.

#RIL: Русское Имперское Движение

de.wikipedia.org/wiki/Russische…

സ്വാനുഭവം ഉള്ളതുകൊണ്ട് പറയാം..

എന്തുകൊണ്ടാണ് ബുൾ മാർക്കറ്റ് ആയതെന്നും/ ബെർ മാർക്കറ്റിലേക്ക് മാറിയതെന്നും മുന്നേ തന്നെ പറഞ്ഞിട്ടുണ്ട് ടെക്നിക്കൽ മാത്രല്ല.

മാർക്കറ്റ് അനലൈസ് ചെയ്യുന്ന ആരെയും കണ്ണടച്ച് വിശ്വസിക്കരുത്, സ്വന്തമായി ചെയ്യണം ട്രേഡ് ചെയ്യുന്നുണ്ടേൽ.. 🧵1/n

എന്തുകൊണ്ടാണ് ബുൾ മാർക്കറ്റ് ആയതെന്നും/ ബെർ മാർക്കറ്റിലേക്ക് മാറിയതെന്നും മുന്നേ തന്നെ പറഞ്ഞിട്ടുണ്ട് ടെക്നിക്കൽ മാത്രല്ല.

മാർക്കറ്റ് അനലൈസ് ചെയ്യുന്ന ആരെയും കണ്ണടച്ച് വിശ്വസിക്കരുത്, സ്വന്തമായി ചെയ്യണം ട്രേഡ് ചെയ്യുന്നുണ്ടേൽ.. 🧵1/n

ഞാൻ കുറച്ചു മാർക്കറ്റ് മൂവ്മൻറ്റ് ഷെയർ ചെയ്യാം.. 2/n

ലിക്വിഡിറ്റി എങ്ങനെ മാർക്കറ്റിനെ സ്വാധീനിക്കുന്നത് എന്ന് താഴത്തെ ലിങ്കിൽ ഉണ്ട്.. 3/n

CGD companies are facing huge problems which are affecting their profitability

~ Higher domestic gas prices from producers ( $2.9 to $6.1)

~ Not getting fully from domestic supplier, have to import which are 6X costly

#GAIL #ONGC #GUJRATAGAS #ADANITOTAL #ADANIGAS #ATGL #RIL

~ Higher domestic gas prices from producers ( $2.9 to $6.1)

~ Not getting fully from domestic supplier, have to import which are 6X costly

#GAIL #ONGC #GUJRATAGAS #ADANITOTAL #ADANIGAS #ATGL #RIL

~ Govt has not allocated supplies from domestic supplier to CGD since April-21

Companies which will affect Adani Total Gas, Mahanagar Gas, Indraprasth Gas, Gujarat Gas

google.com/amp/s/energy.e…

Companies which will affect Adani Total Gas, Mahanagar Gas, Indraprasth Gas, Gujarat Gas

google.com/amp/s/energy.e…

While producer like RIL & ONGC will benefit from recent gas price increase

Natural Gas price increased from $2.9 mBtu to $6.10 mBtu

This will increase earings of ONGC by ₹23000cr & of RIL by ₹15000cr

m.economictimes.com/industry/energ…

Natural Gas price increased from $2.9 mBtu to $6.10 mBtu

This will increase earings of ONGC by ₹23000cr & of RIL by ₹15000cr

m.economictimes.com/industry/energ…

Analysis below are for RIL, ODEL, ASIY, TAFL, CIC

Not IA, Do ur own DD and make the trade ur own

Do u guys have any of these?

#stocks #StockMarket #investing

Not IA, Do ur own DD and make the trade ur own

Do u guys have any of these?

#stocks #StockMarket #investing

#RIL - Need to see a breakout for confirmation. Volume needs to follow through on the move with prices closing above resistance

#ASIY - Same sort of price action, no confirmation so getting in now is just speculating a breakout which might be costly. Volume + close is required for confirmation

➡️Demergers unlock significant value for shareholders.

Recent examples:

#Jubilant Lifesciences

#CESC

#Arvind

#TataCommunicaitons

#Strides

➡️ Sharing 10 very interesting 'Potential Demergers' which can create some serious #wealth !!

~ ~ Short Thread ~ ~

Recent examples:

#Jubilant Lifesciences

#CESC

#Arvind

#TataCommunicaitons

#Strides

➡️ Sharing 10 very interesting 'Potential Demergers' which can create some serious #wealth !!

~ ~ Short Thread ~ ~

1. #GHCL (Gujarat Heavy Chemicals Ltd)

→Demerging the Chemicals & Textile business is on the cards.

Possibility in 2 quarters.

→Demerging the Chemicals & Textile business is on the cards.

Possibility in 2 quarters.

2. Piramal Enterprises (#PEL)

→Three way Demerger possible :

~ RealEstate

~ Pharma(CDMO)

~ NBFC

Possibility in 2 to 3 quarters.

→Three way Demerger possible :

~ RealEstate

~ Pharma(CDMO)

~ NBFC

Possibility in 2 to 3 quarters.

Tata kehte hain TCS bada naam karega!

#Tata Sons is one of the biggest #business conglomerates in India and around the world. Its reliance on the IT-specialisation wing, TCS has only increased.

[1/4]

#Tata Sons is one of the biggest #business conglomerates in India and around the world. Its reliance on the IT-specialisation wing, TCS has only increased.

[1/4]

In FY19, TCS’ contribution to Tata’s revenue increased from 70% the year before to 90%. Contribution of non-@TCS companies shrunk by 23%.

#TCS is among the top three most valued #IT brands, but Tata’s reliance on the subsidiary may be risky.

[2/4]

#TCS is among the top three most valued #IT brands, but Tata’s reliance on the subsidiary may be risky.

[2/4]

It has been solely responsible for the consolidation of all its digital businesses. Ratan Tata’s decision to not go public with the company may have been another factor for TCS’ operations.

Over one week, TCS lost its top place to @reliancegroup in terms of market cap.

[3/4]

Over one week, TCS lost its top place to @reliancegroup in terms of market cap.

[3/4]

Against market expectations of 753Cr loss,#YesBank reports profit of Rs 151Cr,with NII growth of solid 31%

Gross NPAs down 8.6% QoQ

Net NPAs down 12.8%

What a brilliant turnaround,thx to timely action by @narendramodi govt

Note:Yes reported Profit despite Provisions up by 85%

Gross NPAs down 8.6% QoQ

Net NPAs down 12.8%

What a brilliant turnaround,thx to timely action by @narendramodi govt

Note:Yes reported Profit despite Provisions up by 85%

#TataMotors reports highest ever PV sales in Dec'20 qtr,in 33 quarters

Ditto with #JSWSteel,which,despite input inflation,recorded highest ever Q3 sales,in its history

#Infosys recently reported Constant Currency growth of 5.3%,in Dec qtr,highest ever in 8 yrs

#EconomicRecovery

Ditto with #JSWSteel,which,despite input inflation,recorded highest ever Q3 sales,in its history

#Infosys recently reported Constant Currency growth of 5.3%,in Dec qtr,highest ever in 8 yrs

#EconomicRecovery

#JSWSteel numbers are pretty interesting

Profit at 2669Cr in Dec Qtr,up a massive 1327% YoY

Revenue up 21%,with Ebitda/tonne in excess of Rs13000

Ebitda at 5946Cr,up a solid 143%

Margins at 27.2%,up a whopping 1360bps

And all this,despite global headwinds

#EconomicRecovery💪

Profit at 2669Cr in Dec Qtr,up a massive 1327% YoY

Revenue up 21%,with Ebitda/tonne in excess of Rs13000

Ebitda at 5946Cr,up a solid 143%

Margins at 27.2%,up a whopping 1360bps

And all this,despite global headwinds

#EconomicRecovery💪

As promised I am now posting details on #RIL #JIO stack. I shall discuss some advantage that #JIO stack has over peers. Pl do not take this as reco to buy stock. This is purely for information purpose

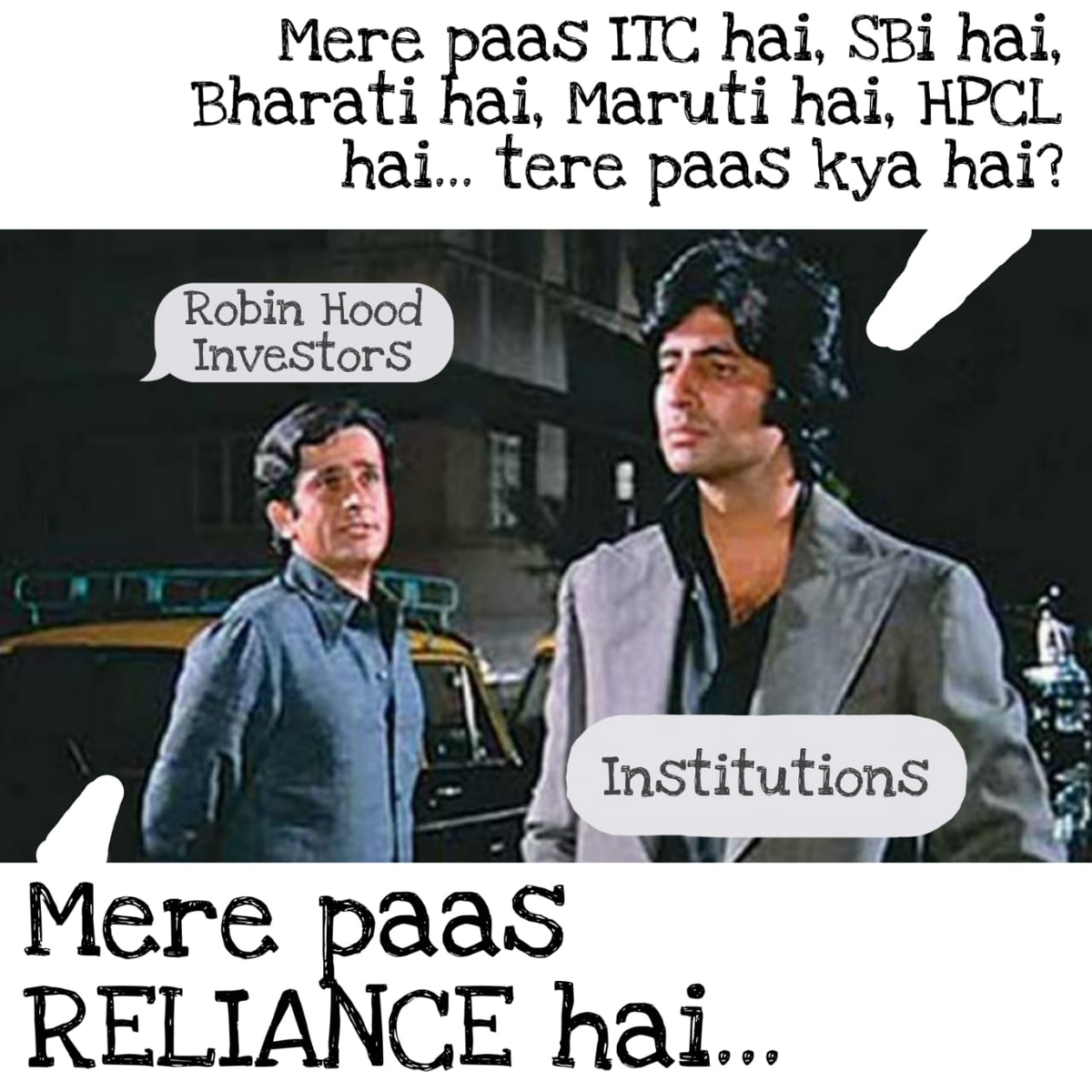

Unfortunately, majority of market participants only see the deal value #RIL has managed to clock & there is entire segment of investors who hate #RIL stock.

Those who understand the technical/business depth of #RIL #JIO #RelianceRetail know the scale and future ahead

Those who understand the technical/business depth of #RIL #JIO #RelianceRetail know the scale and future ahead

Why did SEBI fined Mukesh Ambani?

A detailed thread. 🧶

A detailed thread. 🧶

On January 1st SEBI ordered billionaire Mukesh Ambani and his conglomerate Reliance Industries Ltd. to pay a combined penalty of Rs 40 crores for alleged manipulative and fraudulent trading in the month of November 2007.

#mukeshambani #SEBI #RIL #Reliance

#mukeshambani #SEBI #RIL #Reliance

During the first week of November 2007, 12 entities — all connected to Reliance Industries Limited decided to bet against Reliance Petroleum limited.

The12 agents decided to bet against RPL using what is called a futures contract.

The12 agents decided to bet against RPL using what is called a futures contract.

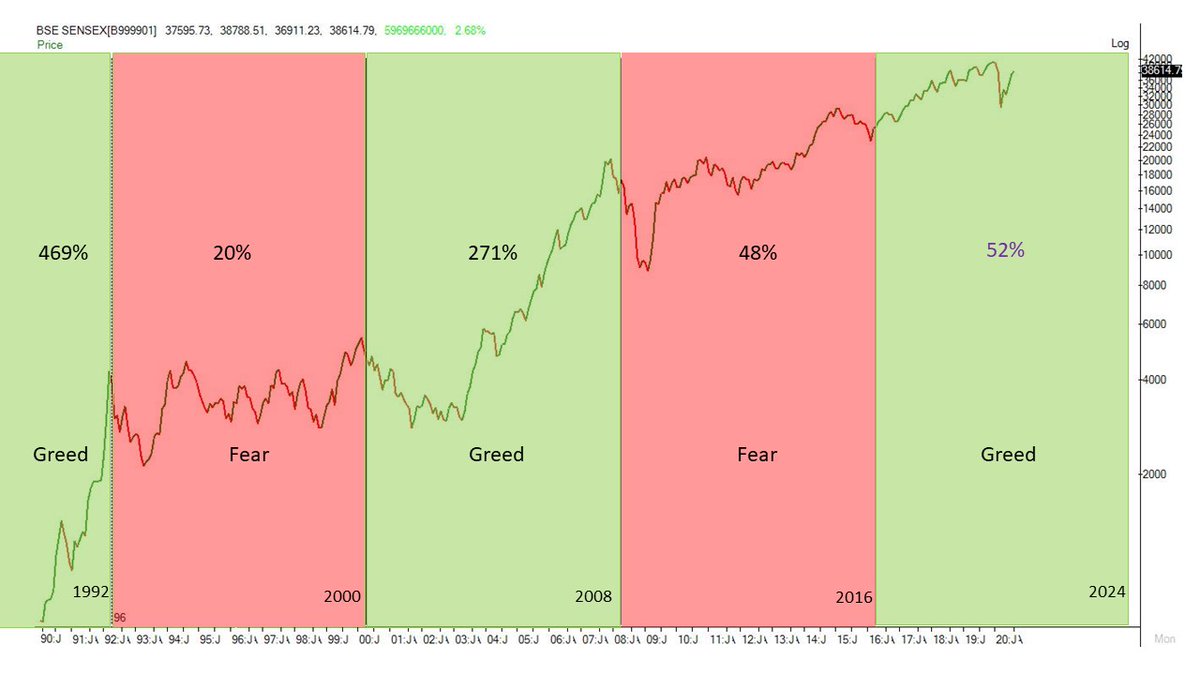

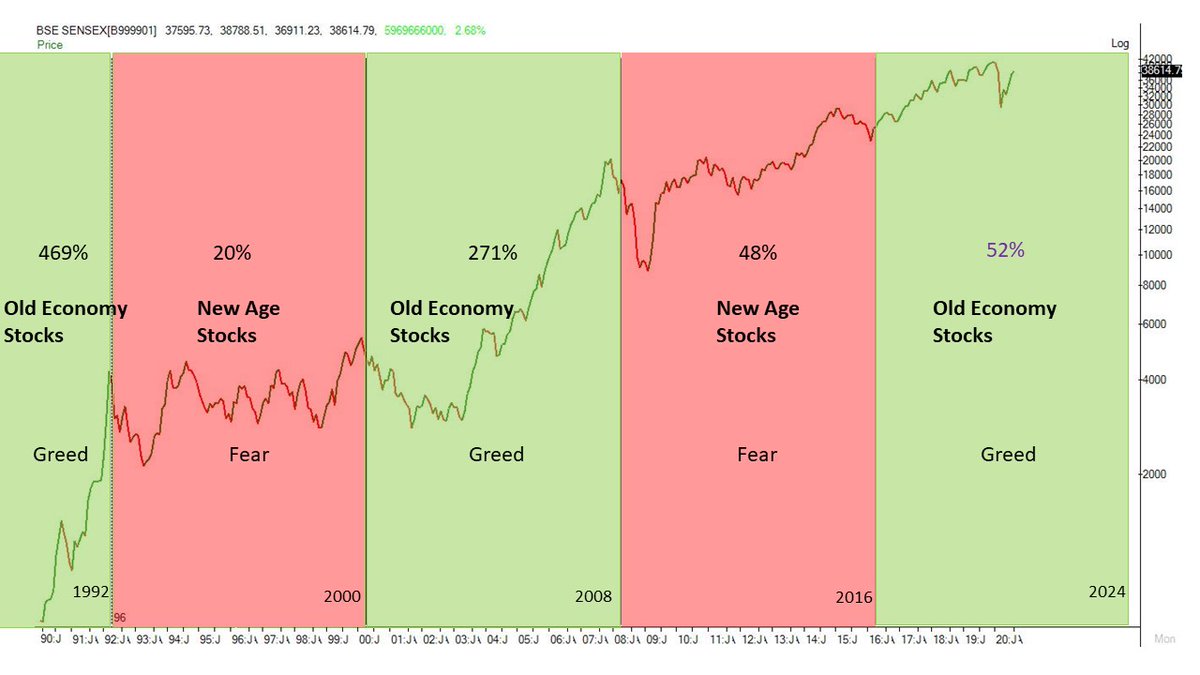

Do you believe #markets are #cyclical in nature?

Do you think #history #rhymes, if not #repeats?

Do you agree #greed and #fear are two main forces in the market?

If answer of above Q's is yes then following tweets will solidify ur view if its a no then they will change ur view.

Do you think #history #rhymes, if not #repeats?

Do you agree #greed and #fear are two main forces in the market?

If answer of above Q's is yes then following tweets will solidify ur view if its a no then they will change ur view.

Above is a monthly chart of #Sensex. It goes through an alternating #greedandfear cycle of 8 years. Sensex moves up in greed phase and consolidates in fear phase. It was up 469% in greed phase of 1992. was up only 20% from 1992 to 2000. From 2000 to 2008 it was up 271%.

In fear phase of 2008 to 2016 it was up only 48%. #Sensex has entered greed phase in 2016 and will stay there till 2024. So far its up more than 50%. But the story doesnt end there. The sectors which move up during these phases also go through a cycle.

German GDP down 10% in June qtr

France down 14%

Singapore minus 41%

#USGDP minus 32.9%,as per advance estimates

#COVID has inflicted universal damage--fall in India will be relatively lower&cushioned by good agri growth

Even when March qtr GDP grew 3.1%,#AgriGrowth was 5.9%

France down 14%

Singapore minus 41%

#USGDP minus 32.9%,as per advance estimates

#COVID has inflicted universal damage--fall in India will be relatively lower&cushioned by good agri growth

Even when March qtr GDP grew 3.1%,#AgriGrowth was 5.9%

Besides Farm sector,thx to Banking clean-up,by @narendramodi govt, #Banks are doing well too

#SBI reported 81% jump in net profit at Rs 4189Cr

Yes,there was one time gain of 1540Cr--But even without this,profit grew by 15%& #NII by 19%

#GrossNPAs fell from 6.15% to 5.44% QoQ💪

#SBI reported 81% jump in net profit at Rs 4189Cr

Yes,there was one time gain of 1540Cr--But even without this,profit grew by 15%& #NII by 19%

#GrossNPAs fell from 6.15% to 5.44% QoQ💪

#NetNPAs of #SBI fell from 2.23%,to 1.88%,in June2020 qtr

Improvement in #AssetQuality of SBI is good news&this,despite providing for #COVID19India related losses

SBI made Covid related provisions worth 1836Cr inJune qtr

Total provisions against Covid related losses are 3008Cr

Improvement in #AssetQuality of SBI is good news&this,despite providing for #COVID19India related losses

SBI made Covid related provisions worth 1836Cr inJune qtr

Total provisions against Covid related losses are 3008Cr

#Option Chain

#Option trading

# ATM CE position built up... Strong resistance

# ATM PE position built up... Strong support.

# Far OTM position built up on call side...Strong bullish

# Far OTM CE position built up... Strong bearish....

I couldn't find it so simple.

#Option trading

# ATM CE position built up... Strong resistance

# ATM PE position built up... Strong support.

# Far OTM position built up on call side...Strong bullish

# Far OTM CE position built up... Strong bearish....

I couldn't find it so simple.

Mostly, what I learned is this presumption is a very easy way to misguide the masses by using the option chain.

On many occasions I have taken absolutely opposite stand and got good hit ratio.

On many occasions I have taken absolutely opposite stand and got good hit ratio.

Apart from the position built up, if one pays attention to futures position, traded value in cash and delivery% along with the traded value at the each strike price of respective option, this may give much stronger insight of bias, since, bigger money at stake.

RECORDS by Reliance Ind today

Highest market cap by Indian co: INR 1.45 Lakh crore

Highest Increase in m cap in a day: INR 59.7K crore

Highest traded value: INR 12.46K crore

(NSE: INR 11.8K crore + BSE INR 0.6K crore)

#RelianceJio #RelianceRetail #RIL #MukeshAmbani #Ambani

Highest market cap by Indian co: INR 1.45 Lakh crore

Highest Increase in m cap in a day: INR 59.7K crore

Highest traded value: INR 12.46K crore

(NSE: INR 11.8K crore + BSE INR 0.6K crore)

#RelianceJio #RelianceRetail #RIL #MukeshAmbani #Ambani

"An Indian tech giant" is what CNBC and foreign media are calling Reliance Industries

cnbc.com/2020/07/16/jio…

cnbc.com/2020/07/16/jio…

Reliance seen emerging as bigger threat for U.S. firms like Amazon, Walmart

Zoom faces competition from Reliance's video conferencing tool

in.investing.com/news/reliance-…

Zoom faces competition from Reliance's video conferencing tool

in.investing.com/news/reliance-…

From Samsung,to Foxconn& #Google's $10bn fund--India under @narendramodi is gaining traction,even as China's expansionism,is isolating it

From producing 8000 #PPE kits in March,to over 4.5 lakh kits daily now,#Modinomics is blending global&local

My Oped

dnaindia.com/blogs/column-s…

From producing 8000 #PPE kits in March,to over 4.5 lakh kits daily now,#Modinomics is blending global&local

My Oped

dnaindia.com/blogs/column-s…

1. RIL’s New Vision is ‘To build a New Reliance for a New India’. Our Mission is to ‘Grow India and Grow with India’. #RIL recognises the aspirations of new #India and #Consumer & #Technology are its two mantras to meet those aspirations #NayeIndiaKaNayaJosh #RelianceAR

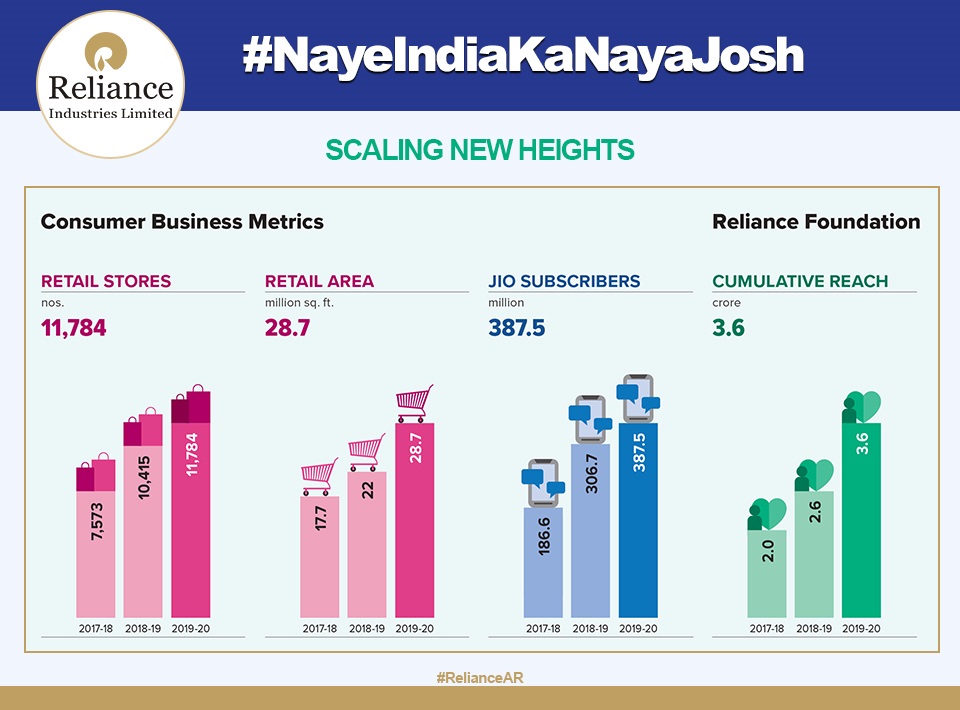

2. In line with its aim to serve more and more Indians in a strongly inclusive way, #RIL continues to extend reach to consumers and communities!

#NayeIndiaKaNayaJosh #RelianceAR

bit.ly/RILannualrepor…

#NayeIndiaKaNayaJosh #RelianceAR

bit.ly/RILannualrepor…

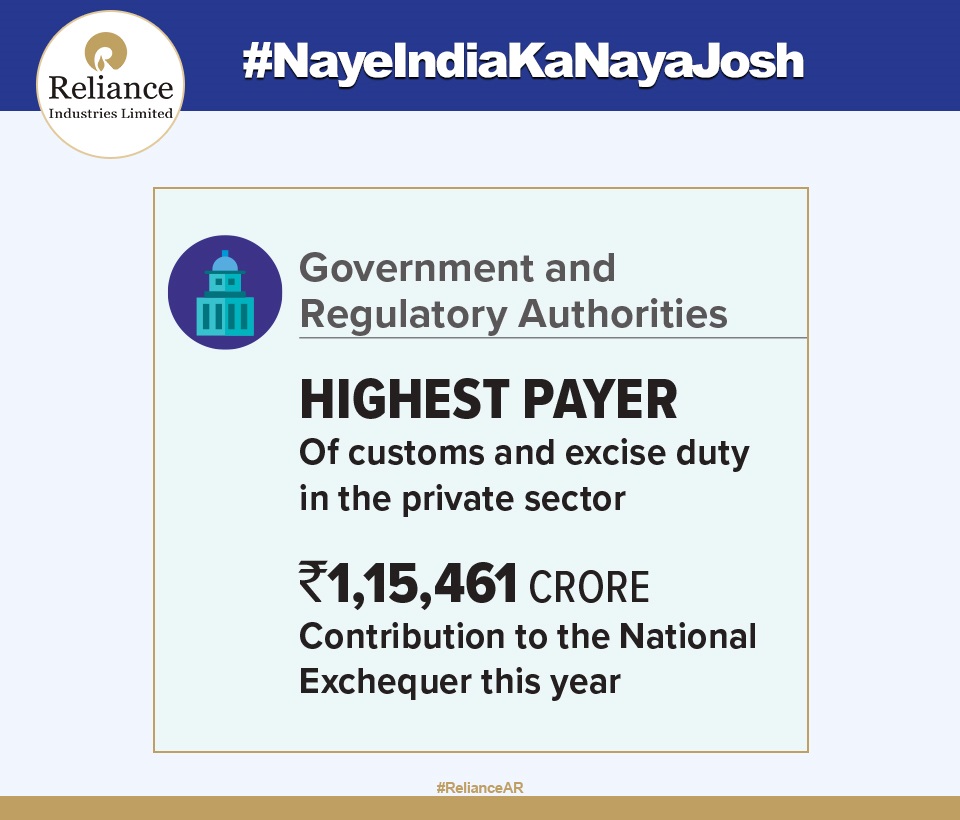

3. #RIL is the highest private sector contributor to the national exchequer… continues its commitment to the nation’s growth!

#NayeIndiaKaNayaJosh #RelianceAR

bit.ly/RILannualrepor…

#NayeIndiaKaNayaJosh #RelianceAR

bit.ly/RILannualrepor…

Reliance Industries Ltd.

First and ONLY company in Indian stock markets to cross

USD 150 billion market cap!

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio #RelianceIndustries #MukeshAmbani #ambanikafacebook #Ambani #RIL

First and ONLY company in Indian stock markets to cross

USD 150 billion market cap!

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio #RelianceIndustries #MukeshAmbani #ambanikafacebook #Ambani #RIL

very impressive as 2nd highest market cap in India

is TCS at USD 101 billion

#RelianceIndustries is 33% larger than #TCS

3rd highest HDFC bank at USD 73 billion; #RIL is 2x!

take a bow #MukeshAmbani!!

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio

is TCS at USD 101 billion

#RelianceIndustries is 33% larger than #TCS

3rd highest HDFC bank at USD 73 billion; #RIL is 2x!

take a bow #MukeshAmbani!!

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio

If you think investing is easy

or predictable

RIL did NOTHING for 10 years (2007-2017)

and then up 3 x in 3 years

Growth/profit is NOT linear

#RelianceIndustries #RIL #MukeshAmbani

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio

or predictable

RIL did NOTHING for 10 years (2007-2017)

and then up 3 x in 3 years

Growth/profit is NOT linear

#RelianceIndustries #RIL #MukeshAmbani

#JioPlatforms #JioMart #Jio #jiodigitallife #Reliance #RelianceJio

Yes--#Reliance is now #DebtFree

#Jio raised Rs 1.16 lakhCr from #Facebook,Silver Lake,Vista Equity, General Atlantic,KKR, Mubadala, ADIA,TPG,L.Catterton&PIF

7000Cr raised,via 49% stake sale in fuel retail venture,to #BP

53124Cr raised via #Rights

Debt was Rs 1.63 lakhCr

#RIL

#Jio raised Rs 1.16 lakhCr from #Facebook,Silver Lake,Vista Equity, General Atlantic,KKR, Mubadala, ADIA,TPG,L.Catterton&PIF

7000Cr raised,via 49% stake sale in fuel retail venture,to #BP

53124Cr raised via #Rights

Debt was Rs 1.63 lakhCr

#RIL

That RIL is #NetDebtFree is big,but bigger news is,Rs 1.69 lakhCr was raised in 58 days,flat

#SaudiArabia's Sovereign Wealth Fund,#PIF's 2.32% stake in #Jio has #EnterpriseValue of 5.16 lakhCr& equity valuation of Rs4.9 lakhCr

Great going for #RIL,with 9.23% weightage in #Nifty

#SaudiArabia's Sovereign Wealth Fund,#PIF's 2.32% stake in #Jio has #EnterpriseValue of 5.16 lakhCr& equity valuation of Rs4.9 lakhCr

Great going for #RIL,with 9.23% weightage in #Nifty

Most interesting bit about the massive fund raising exercise by #Reliance,is the serious money committed by #Arab world, including,AbuDhabi based, #Mubadala

With 10 lakhCr+ in market cap,#RIL is a story that showcases,size &scale,matter

Jio& #RelianceRetail to be listed in 5yrs

With 10 lakhCr+ in market cap,#RIL is a story that showcases,size &scale,matter

Jio& #RelianceRetail to be listed in 5yrs

My vision is to provide the latest telecommunication facilities to every Indian at the price of a post card - Dhirubhai Ambani (early 2000's)

Gave the slogan:

"Karlo Duniya Mutthi Mein"

(Get the world in your hand)

2016:

Mukesh Ambani launched Jio

Slogan:

Data is the New Oil

Gave the slogan:

"Karlo Duniya Mutthi Mein"

(Get the world in your hand)

2016:

Mukesh Ambani launched Jio

Slogan:

Data is the New Oil

2020:

One can have the whole world in his hand by having a smartphone topped with good data plan

Not to forget,

Reliance Telecommunications

Failed

Jio is succeeding

Wealth creation takes immense

amount of Time, Patience, Guts & Determination

One can have the whole world in his hand by having a smartphone topped with good data plan

Not to forget,

Reliance Telecommunications

Failed

Jio is succeeding

Wealth creation takes immense

amount of Time, Patience, Guts & Determination

One can call Mukesh Ambani

whatever he want:

Visionary.

Intelligent Fanatic.

Rich class second generation

Entrepreneur.

In world history, only JIO provided free voice call with free data for almost one year & wipped out the competition & raise the standard for telecom industry

whatever he want:

Visionary.

Intelligent Fanatic.

Rich class second generation

Entrepreneur.

In world history, only JIO provided free voice call with free data for almost one year & wipped out the competition & raise the standard for telecom industry

@piyushchaudhry This chart justifies levels of 700-900 for #RIL in next 12 months. Also, FB - RIL deal of 9.9% stake sale will not pass the regulators due to upcoming Data Protection & Privacy law for India on lines of EU’s #GDPR.

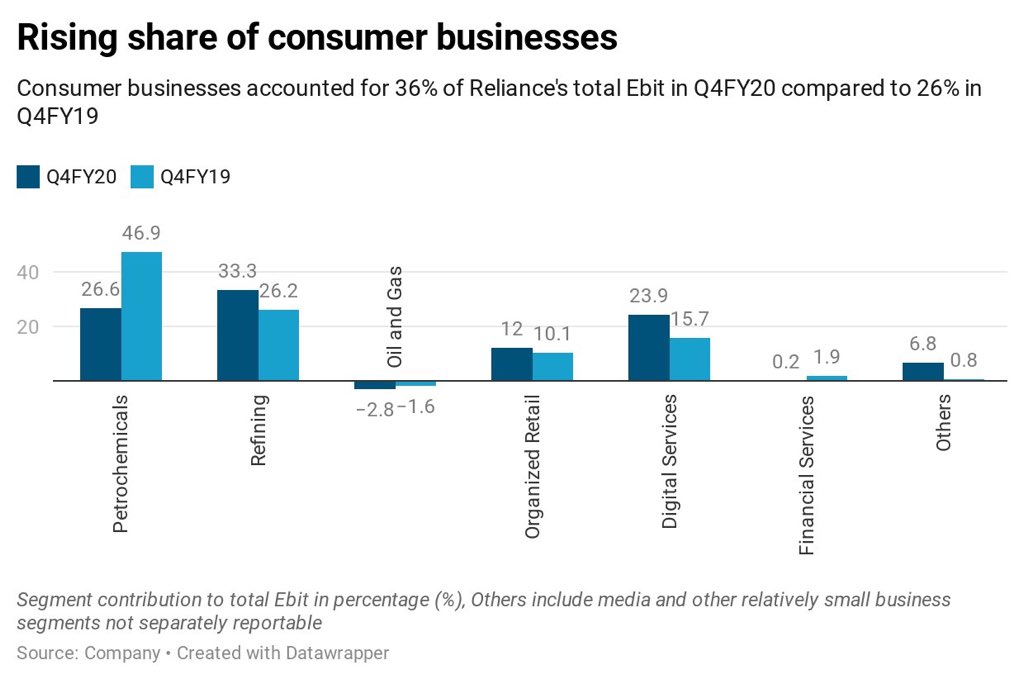

@piyushchaudhry The whole strategy of #RIL to adopt O2C strategy (Oil to Chemicals) and hence selling stake to Aaudi Aramco seem to be under serious challenge seeing the drop in Petrochemicals business in Q4, FY20. Don’t ignore the #EV Tech replacing fuel ⛽️ consumption going forward. Serious !

@piyushchaudhry #RIL ‘s major capital is deployed in Oil & Gas/Petrochemicals Business, JIO being 2nd. % Returns from traditional Petroleum business for RIL will be less going forward. JIODigital business though depends on buying abilities of the market constituents having low per capita income.

Reliance Industries head Mukesh Ambani has decided to forego his entire compensation. #RIL (1/n)

Reliance Industries' board of directors, including executive directors, executive committee members and senior leaders, will forgo 30-50% of their compensation. #RIL (2/n)