Discover and read the best of Twitter Threads about #Realestate

Most recents (24)

1/

@blok_project is a decentralised real estate investment platform, aiming to make #RealEstate liquid using an SPV financed by a token on @MultiversX

They have already announced the first investment property in Orleans, near Paris.

Let’s spotlight what they are building!

🧵👇

@blok_project is a decentralised real estate investment platform, aiming to make #RealEstate liquid using an SPV financed by a token on @MultiversX

They have already announced the first investment property in Orleans, near Paris.

Let’s spotlight what they are building!

🧵👇

2/

To achieve their purpose, @blok_project uses two tokens, one for utility ($BLK) & one as a security/bonds ($BLOK)

To acquire real estate, they use a Special Purpose Vehicle (SPV) to be financed by offering a sale of $BLOK tokens as obligations.

👇

To achieve their purpose, @blok_project uses two tokens, one for utility ($BLK) & one as a security/bonds ($BLOK)

To acquire real estate, they use a Special Purpose Vehicle (SPV) to be financed by offering a sale of $BLOK tokens as obligations.

👇

3/

An overview of the $BLOK token, potential earnings and its use cases is available at:

Both tokens are presented on their Whitepaper, together with all the other details, like the Team, roadmap and more:

drive.google.com/file/d/1UMlYYO…

👇

#DYOR

An overview of the $BLOK token, potential earnings and its use cases is available at:

Both tokens are presented on their Whitepaper, together with all the other details, like the Team, roadmap and more:

drive.google.com/file/d/1UMlYYO…

👇

#DYOR

🔺 Real Estate Giant Defaults on over $1.1B in Debt 🔺

Brookfield, a major real estate firm, is facing huge losses in its Downtown L.A. office portfolio, defaulting on over $1.1B in related debt. #RealEstate #LosAngeles

Brookfield, a major real estate firm, is facing huge losses in its Downtown L.A. office portfolio, defaulting on over $1.1B in related debt. #RealEstate #LosAngeles

🏢 The company has lost two prominent assets, the Gas Company Tower and EY Plaza, to court-appointed receivers as the pandemic continues to challenge the office real estate market. #Pandemic #RemoteWork

📉 #Brookfield's Downtown L.A. office portfolio saw occupancy drop to 77.2% at the end of 2021, and around 30% of all office space in the area is now vacant. #OfficeSpace

1/14 - 🚨WHAT HAPPENS IF THE US DEFAULTS⁉️

A default on the US debt ceiling would have profound implications. This historic event could trigger economic shocks and disrupt global financial stability. Let’s talk about it!#DebtCeilingDefault #GlobalFinancialStability

A default on the US debt ceiling would have profound implications. This historic event could trigger economic shocks and disrupt global financial stability. Let’s talk about it!#DebtCeilingDefault #GlobalFinancialStability

2/14

History teaches us that financial crises can affect military readiness and operations. A default could hamper US strategic alliances, similar to the effects of the Great Depression. #HistoricalLessons #MilitaryReadiness

History teaches us that financial crises can affect military readiness and operations. A default could hamper US strategic alliances, similar to the effects of the Great Depression. #HistoricalLessons #MilitaryReadiness

3/14

A default could also jeopardize trust in US Treasury bonds, a cornerstone of the global economy. The result? Skyrocketing interest rates and a weakened dollar. #TrustInBonds #DebtCeiling

A default could also jeopardize trust in US Treasury bonds, a cornerstone of the global economy. The result? Skyrocketing interest rates and a weakened dollar. #TrustInBonds #DebtCeiling

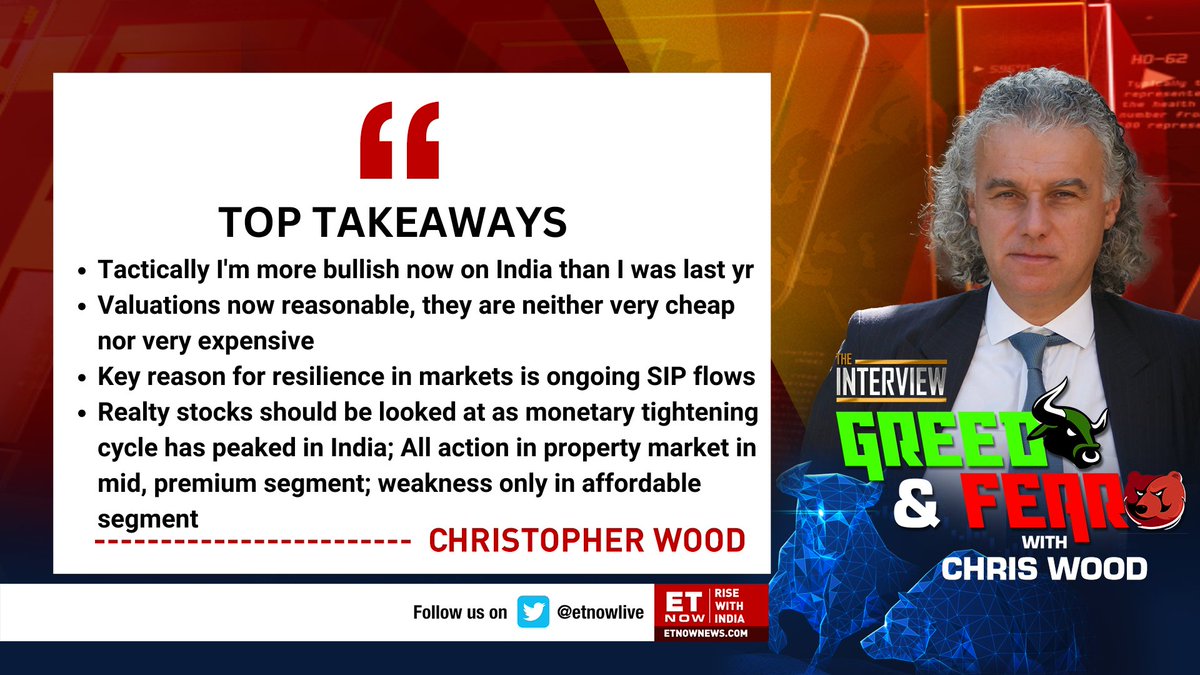

Mega Exclusive | Greed & Fear with Chris Wood

Banks vs IT - What is Chris Wood betting on?

Listen to his views on the Indian stock market, real estate and more

@nikunjdalmia #GreedandFear #ChrisWood @Jefferies twitter.com/i/broadcasts/1…

Banks vs IT - What is Chris Wood betting on?

Listen to his views on the Indian stock market, real estate and more

@nikunjdalmia #GreedandFear #ChrisWood @Jefferies twitter.com/i/broadcasts/1…

Mega Exclusive | Greed & Fear with Chris Wood

Here's what Chris Wood said on him being comparatively more bullish towards India this year

#GreedandFear #ChrisWood @Jefferies `

Here's what Chris Wood said on him being comparatively more bullish towards India this year

#GreedandFear #ChrisWood @Jefferies `

Greed & Fear with Chris Wood | Chris Wood on financials, crude price and Chat GPT

#GreedandFear #ChrisWood @Jefferies

#GreedandFear #ChrisWood @Jefferies

#ES flirted with 4,115 again after that great intraday $HYG reversal portended downside #volatility when cyclicals didn‘t really point higher.

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

2. #tech upswing invited selling interest, while #value and especially $IWM turned strongly south.

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

Now some company #earnings

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

2. relatively well $XLY is still doing. Therefore, I‘m looking for especially $WMT beat on profits, less so on revenue (if volume sales are taken into account) and darkening guidance – these earnings won‘t send #ES lower while $TGT effect would be more neutral.

3. As for $HD, this one could be weaknest out of the three tickers mentioned, no matter how well $XHB is doing. I‘m looking for the relative calm in #realestate to go as it‘s impossible to the supply to be brought into the market when favorable #mortgage rates

#LoanOfficers and #Realtors continue to butcher the #TaxSavings conversation regarding having a mortgage. When they do, they usually make it appear bigger than it really is which misleads the buyer.

You might want to bookmark this!

Here is how the calculation really works:

You might want to bookmark this!

Here is how the calculation really works:

The Standard Deduction means you do NOT pay income tax on the first $13,850 earned as a single taxpayer or $27,700 for a married couple.

If your write-offs exceed those limits, you receive an additional tax refund, as your payroll providers do not consider this.

If your write-offs exceed those limits, you receive an additional tax refund, as your payroll providers do not consider this.

An easy way to calculate the mortgage deduction is to deduct the SALT (State and Local Tax) limit of $10k from the standard deduction. SALT is essentially your state income tax and property tax. In high-cost markets, you can assume the $10k will be met with those two fees.

Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

A better solution doesn't exist, but here is a short 🧵on why looking at "Average Mortgage Rates" can be misleading in today's world.

#HomeBuyers or wanna-be #HomeSellers - pay close attention! Don't get discouraged running payments on your computer...talk to a professional!

#HomeBuyers or wanna-be #HomeSellers - pay close attention! Don't get discouraged running payments on your computer...talk to a professional!

Conventional Loans are tough to price out these days. The #FHFA has a complicated pricing grid that requires points (upfront $$ - one point = 1% of your loan amount in a cash fee) to be collected based on certain loan parameters, LTV, Credit Score, etc

singlefamily.fanniemae.com/media/9391/dis…

singlefamily.fanniemae.com/media/9391/dis…

These fees are historically absorbed in modestly higher rates. However, the mortgage bond market is not trading well these days so the profit in higher rates to absorb those fees doesn't exist. As a result, "Zero Point" loans can be quite high!

Met some foreign investors last evening, it was the 1st visit to SL for one of them, the other had come 15+yrs ago, I met them 4hrs after they landed, first impression was "it's very different from what we expected", I asked why? "what we saw in the news vs the ground reality"

They went on to lament the fact that SL is losing out because not enough is being done to educate foreign investors about opportunities or investments channels in SL, govt websites are dated, embassies unhelpful, so how exactly does SL get it's "pitch" out into the world?

SL needs to do a better job in positioning itself to foreign capital, we need a proper PR strategy & a national "brand" in order to have better control on our own narrative, there's a view that SL has "bottomed out" & this is a positive, our embassies need to tow this line

"In Marlborough, #Near #independent small business cost reduction services company "Brian Plain at Schooley Mitchell", 01752 is in #demand (and picking up quickly), based on #homeprices, #inventory and days on the #market: schooleymitchell.com/jgifford/ g.co/kgs/oW5Tbw #housing"

Marlborough MA area #HomeSellers, check out Gary Kelley a #local REALTOR® at Lamacchia Realty, Inc. in

#Marlborough, #Massachusetts, United States · #REALTOR® · #LamacchiaRealtyInc:

g.co/kgs/cePKsB

lamacchiarealty.com/team_members/g…

#Marlborough #MA #RealEstate #LocalAgentGaryKelly"

#Marlborough, #Massachusetts, United States · #REALTOR® · #LamacchiaRealtyInc:

g.co/kgs/cePKsB

lamacchiarealty.com/team_members/g…

#Marlborough #MA #RealEstate #LocalAgentGaryKelly"

"Learn more #about local small business cost reduction & #savings #opportunities, #online at:

Schooley Mitchell: Brian Plain & Joe Gifford

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814 g.co/kgs/oW5Tbw

schooleymitchell.com/jgifford/

google.com/mymaps/viewer?…"

Schooley Mitchell: Brian Plain & Joe Gifford

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814 g.co/kgs/oW5Tbw

schooleymitchell.com/jgifford/

google.com/mymaps/viewer?…"

#WeeklyRecap: Markets Remain Unstable Amidst Encouraging and Concerning Economic Data

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

Mixed data created uncertainty for investors. Inflation may be moderating, but retail sales contraction raises concerns for a potential recession. The Fed may pause its rate hike cycle, which could positively impact the stock market. #Investing #Economy #MarketVolatility

📈 Major benchmarks defy recession concerns, posting weekly gains. DJI up 1.34%, SPX up 1.42%, NDX up 1.18%. #stockmarket #investing

🧵#Canada's politicians have been talking a lot about #affordablehousing.

But, to quote @ronmortgageguy "All Levels Of Government Talk About AFFORDABLE Housing But None Of Them Will Ever Say Houses Prices Must Come DOWN"

Why is this? Could there be a conflict of interest?

But, to quote @ronmortgageguy "All Levels Of Government Talk About AFFORDABLE Housing But None Of Them Will Ever Say Houses Prices Must Come DOWN"

Why is this? Could there be a conflict of interest?

Below is a list of #Ontario politicians that meet 1 or more of the following criteria:

1) #residentialrental property that they earn an income from

2) residential rental property without disclosing any income

3) non-residential property

4) other involvement in #realestate

1) #residentialrental property that they earn an income from

2) residential rental property without disclosing any income

3) non-residential property

4) other involvement in #realestate

1/ What is the Tokenization of RWAs?

The process of RWA tokenization involves representing physical & traditional financial assets (land, gold, property rights) as digital tokens on a blockchain.

Here's an excellent resource to get started:

The process of RWA tokenization involves representing physical & traditional financial assets (land, gold, property rights) as digital tokens on a blockchain.

Here's an excellent resource to get started:

2/ Why Tokenization Matters?

Tokenization has the power to revolutionize the financial landscape ‒ intrinsically changing how investments are managed, used, and monetized.

Nowhere is this more apparent than in the world’s most important and largest asset class - real estate.

Tokenization has the power to revolutionize the financial landscape ‒ intrinsically changing how investments are managed, used, and monetized.

Nowhere is this more apparent than in the world’s most important and largest asset class - real estate.

Voy a hacer un poco de nudismo inmobiliario con una operación que hice para mi, en la que será mi vivienda habitual.

👇🏻Dentro hilo👇🏻

👇🏻Dentro hilo👇🏻

Compré esta casa en marzo del 2021 por 180.000 euros.

Datos de operación:

-Entrada: 99K

-Notario: 0€ (es amigo)

-ITP: 9K (5% menor 30 años)

-Gestoria: 423€

-Registro: 185€

-Hipoteca: 81K al 1,6% fijo (ING) 25 años.

Valor de tasación a reformar: 330K

Datos de operación:

-Entrada: 99K

-Notario: 0€ (es amigo)

-ITP: 9K (5% menor 30 años)

-Gestoria: 423€

-Registro: 185€

-Hipoteca: 81K al 1,6% fijo (ING) 25 años.

Valor de tasación a reformar: 330K

Se encuentra en un municipio de Tramuntana en Mallorca.

El municipio ha tenido una revalorización media del 18%

Aunque es para mi, un alquiler en esta zona para una casa como esta deja unos 2.000-2.500€ mensuales en alquiler tradicional. Perfil extranjero.

El municipio ha tenido una revalorización media del 18%

Aunque es para mi, un alquiler en esta zona para una casa como esta deja unos 2.000-2.500€ mensuales en alquiler tradicional. Perfil extranjero.

Office Buildings: Navigating out of the Bermuda Triangle. 🤔

Tenants are fundamentally reevaluating ‘why’ they need office space, how much space they ‘need’ and what kind of buildings they ‘want’ to be in. 👇

A thread 🧵 … 👇

#realestate #markets linkedin.com/posts/davewald…

Tenants are fundamentally reevaluating ‘why’ they need office space, how much space they ‘need’ and what kind of buildings they ‘want’ to be in. 👇

A thread 🧵 … 👇

#realestate #markets linkedin.com/posts/davewald…

2/.

‘Best in Class’ and ‘Flight to Quality’ are being redefined.

The race is on to find the new ‘formula’ to attract and retain office tenants.

The winners will survive.

The losers will be converted, abandoned or demolished.

‘Best in Class’ and ‘Flight to Quality’ are being redefined.

The race is on to find the new ‘formula’ to attract and retain office tenants.

The winners will survive.

The losers will be converted, abandoned or demolished.

3/.

‘Work from home’ is here to stay.

Employees and management like it because it improves their quality of life.

Owners like it because it reduces fixed operating costs without reducing productivity.

‘Work from home’ is here to stay.

Employees and management like it because it improves their quality of life.

Owners like it because it reduces fixed operating costs without reducing productivity.

Are you a Senior Citizen looking to secure your Retirement and generate regular income?

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

As we grow older, it's important to plan for retirement and consider investment options that offer stability and security.

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

#1 Senior Citizen Savings Scheme (SCSS)

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

1/ What is the Tokenization of RWAs?

The process of RWA tokenization involves representing physical & traditional financial assets (land, gold, property rights) as digital tokens on a blockchain.

Here's an excellent resource to get started:

The process of RWA tokenization involves representing physical & traditional financial assets (land, gold, property rights) as digital tokens on a blockchain.

Here's an excellent resource to get started:

2/ Why Tokenization Matters?

Tokenization has the power to revolutionize the financial landscape ‒ intrinsically changing how investments are managed, used, and monetized.

Nowhere is this more apparent than in the world’s most important and largest asset class - real estate.

Tokenization has the power to revolutionize the financial landscape ‒ intrinsically changing how investments are managed, used, and monetized.

Nowhere is this more apparent than in the world’s most important and largest asset class - real estate.

The #AdaniGroups Saga- For Naive #Investors. A thread

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

So there are 12 chips left in the market. Out of these, #Funds like #LIC buys 9 chips. 3 chips are now left on the open market.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

Are you tired of watching your #savings lose value over time? Here's why you might be losing #money by keeping it in the #bank, and what you can do to beat #inflation and make your money work harder for you $QUACK. #RichQUACK

THREAD 🧵👇

THREAD 🧵👇

1/ If you're keeping your money in a savings account, you may not be earning enough interest to keep up with inflation. In fact, the average interest rate for savings accounts is only about 0.05%, which is well below the current inflation rate. $QUACK

2/ This means that your money is actually losing value over time, as the cost of goods and services increases faster than the interest you're earning. So, what can you do to beat inflation and make your money work harder for you? $QUACK

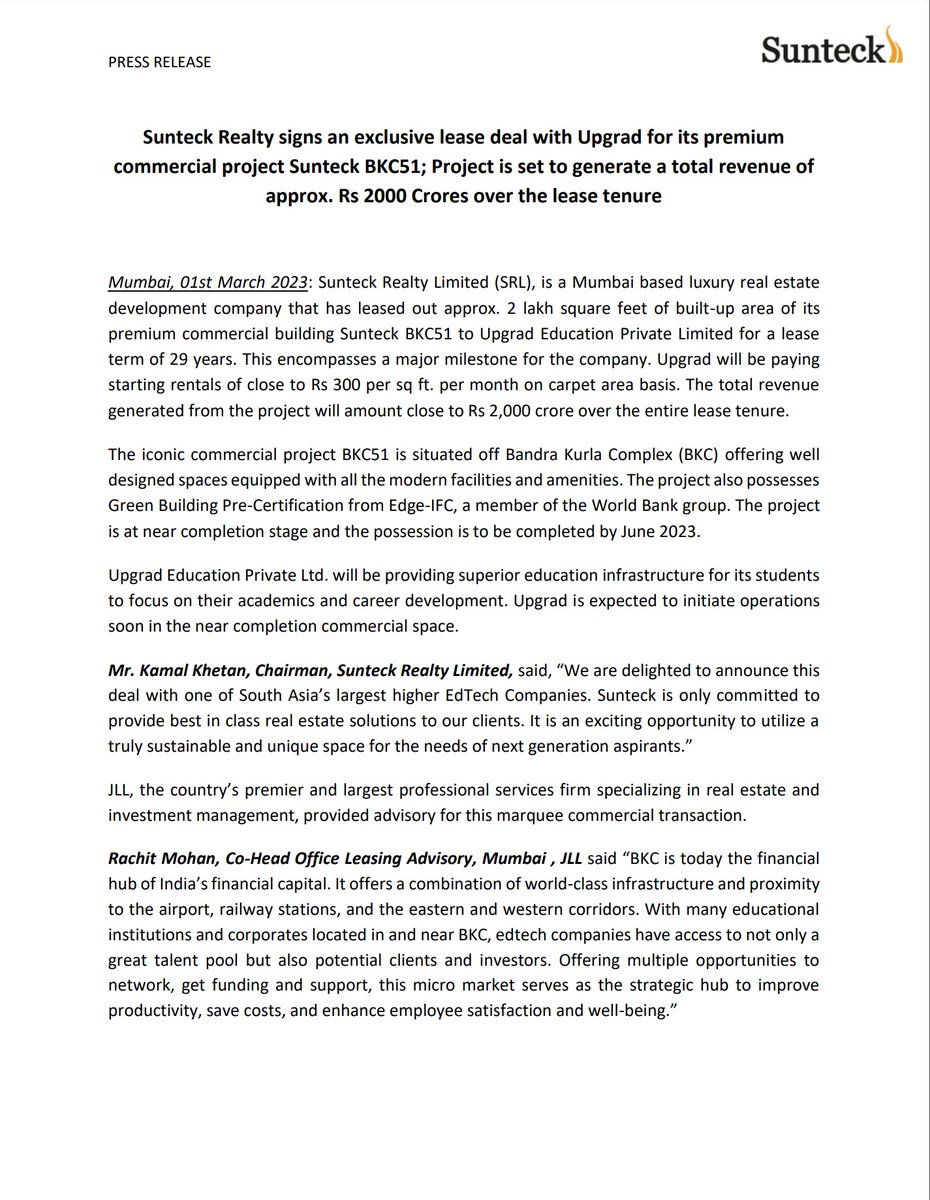

Exclusive lease deal signed between Sunteck Realty and Upgrad for premium commercial project Sunteck BKC51, set to generate revenue of Rs 2000 Crores over lease tenure. #SunteckRealty #Upgrad #SunteckBKC51 #LeaseDeal #RealEstate #revenue

Sunteck Realty signs a 29-year exclusive lease deal with Upgrad Education Private Limited for its luxurious commercial project, Sunteck BKC51. The project, located off Bandra Kurla Complex (BKC), is expected to generate revenue of Rs 2000 Crores over the lease tenure. (1/3)

The carpet area-based rental is close to Rs 300 per sq ft. per month. The project is equipped with modern amenities and is Green Building Pre-Certified by Edge-IFC, a member of the World Bank group. (2/3)

Almost every millennial aspires to retire early. But most of the time, this goal seems almost impossible to achieve.

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

So, what is FIRE?

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

Can you achieve FIRE in India?

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

1/21 We spent much of last week highlighting yield.

In this thread we’re back to fundamentals with a deep dive into one of the key features of #RealUSD: Minting on gains

Here we’ll take a detailed look into how $USDR optimizes collateralization by minting against system gains.

In this thread we’re back to fundamentals with a deep dive into one of the key features of #RealUSD: Minting on gains

Here we’ll take a detailed look into how $USDR optimizes collateralization by minting against system gains.

2/ This approach responsibly maximizes yield for $USDR holders while hardening the system from volatility of the underlying assets.

Before we jump in, if you haven’t already, check out our thread on the benefits to backing a stablecoin with real estate:

Before we jump in, if you haven’t already, check out our thread on the benefits to backing a stablecoin with real estate:

3/ There are three benefits to minting on gains:

1️⃣ $USDR’s advantage is its real estate backing, which should be optimally leveraged

2️⃣ $TNGBL gains are returned to users via yield

3️⃣ Higher yields drive customer acquisition

1️⃣ $USDR’s advantage is its real estate backing, which should be optimally leveraged

2️⃣ $TNGBL gains are returned to users via yield

3️⃣ Higher yields drive customer acquisition

As #RealUSD's market cap grows, so too does our #realestate portfolio.

Over the past week:

✅ Eight new properties added

✅ Locations in both England and Scotland

✅ Added nearly $900k in new #RealWorldAssets backing our stablecoin $USDR

Check below for some property images.

Over the past week:

✅ Eight new properties added

✅ Locations in both England and Scotland

✅ Added nearly $900k in new #RealWorldAssets backing our stablecoin $USDR

Check below for some property images.