Discover and read the best of Twitter Threads about #SPR

Most recents (13)

We say Spiral DAO was designed to be the most efficient DAO in the space. 🚀

🔎 This is a thread where we'll dive deeper into our vision, use cases, and prospects for future DAO development.

To learn more: medium.com/spiral-dao/spi…

Thread🧵

🔎 This is a thread where we'll dive deeper into our vision, use cases, and prospects for future DAO development.

To learn more: medium.com/spiral-dao/spi…

Thread🧵

🌽New Yield Standard

Higher yields, always growing yields, and maintaining exposure to the DeFi blue-chip basket will make #SPR the preferred choice for users seeking yield in the form of tokens.

The more users — the higher the backing of SPR and the bigger the Treasury is.

Higher yields, always growing yields, and maintaining exposure to the DeFi blue-chip basket will make #SPR the preferred choice for users seeking yield in the form of tokens.

The more users — the higher the backing of SPR and the bigger the Treasury is.

🎁 Bribes Market Irrationality

By leveraging bribes arbitrage, Spiral DAO achieves higher yields for the ecosystem and gains access to discounted tokens while also keeping the necessary exposure without any sell pressure. This leads to an additional yield of ~$3–6mln annually.

By leveraging bribes arbitrage, Spiral DAO achieves higher yields for the ecosystem and gains access to discounted tokens while also keeping the necessary exposure without any sell pressure. This leads to an additional yield of ~$3–6mln annually.

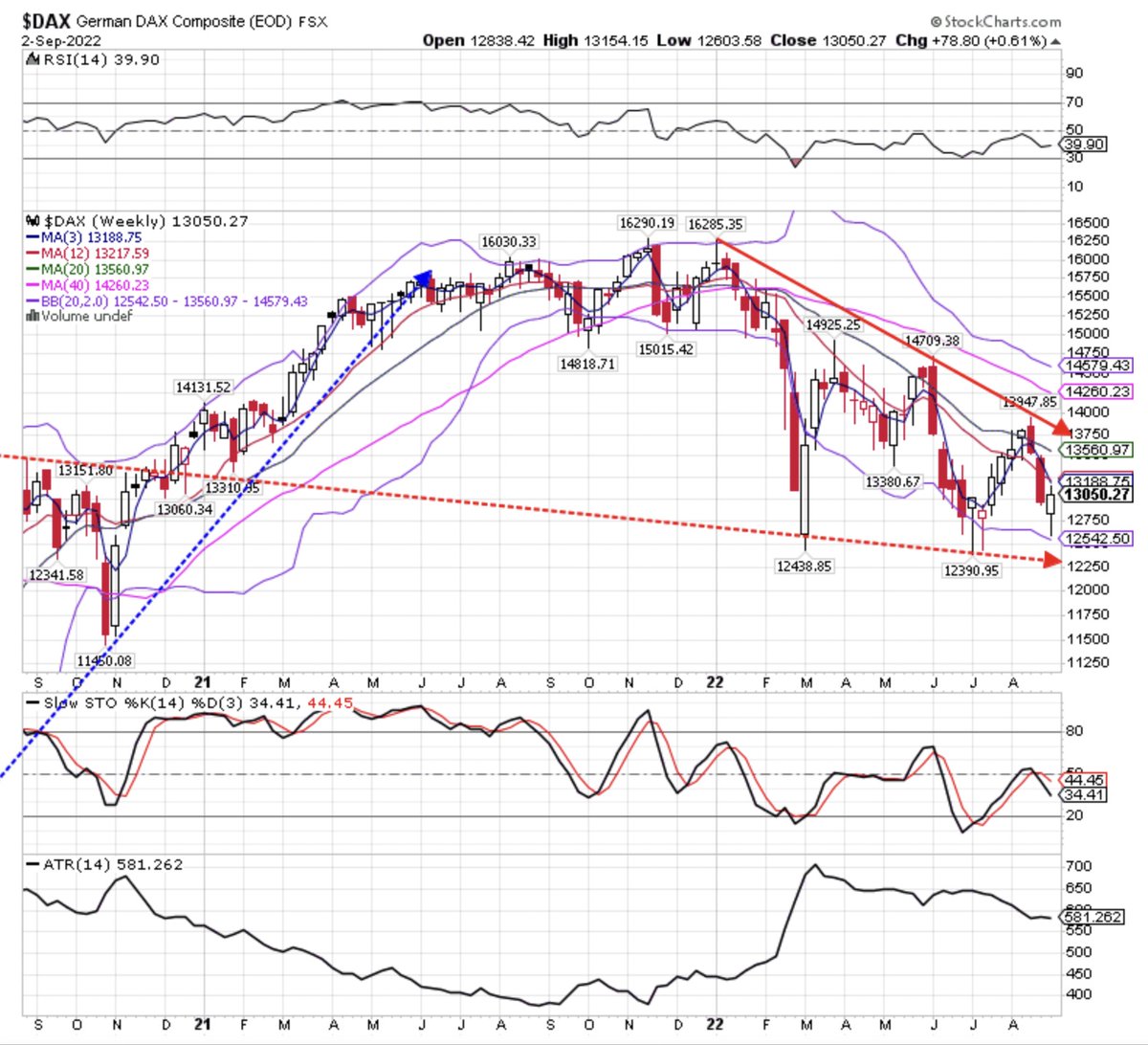

Hello Friday and the week to date

$USD +1.51%

$GOLD +0.82%

$GBP -1.49%

$TLT +3.74%

$HYG +1.14%

$TNX -1.52%

$DAX +3.68%

$SSEC +2.23%

$NIKK -0.46%

$SPX -0.81%

#Bitcoin +1.37%

$COPPER +0.26%

$SILVER -2.58%

$WTIC -8.22%

$NATGAS -16.78%

Let's dig into the market 🧮!

$USD +1.51%

$GOLD +0.82%

$GBP -1.49%

$TLT +3.74%

$HYG +1.14%

$TNX -1.52%

$DAX +3.68%

$SSEC +2.23%

$NIKK -0.46%

$SPX -0.81%

#Bitcoin +1.37%

$COPPER +0.26%

$SILVER -2.58%

$WTIC -8.22%

$NATGAS -16.78%

Let's dig into the market 🧮!

#ADP private payrolls rose to +230,000 in December.

The initial response in the bond market was to push both the short and long end higher

Realizing job strength = FOMC higher for longer = eventual recession, the long end recovered with the big lower high in $TNX intact.

The initial response in the bond market was to push both the short and long end higher

Realizing job strength = FOMC higher for longer = eventual recession, the long end recovered with the big lower high in $TNX intact.

Asia finished the week mostly ↗️

$NIKK 25974 +0.6%

$SSEC 3158 +0.1%

$TWII 14373 +0.5%

$HSI 20992 -0.3% ⬅️

$KOSPI 2290 +1.1%

$IDX 6685 +0.45%

Australia ↗️

$ASX 7110 +0.65%

India ↘️

$BSE 59900 -0.75%

$NIKK 25974 +0.6%

$SSEC 3158 +0.1%

$TWII 14373 +0.5%

$HSI 20992 -0.3% ⬅️

$KOSPI 2290 +1.1%

$IDX 6685 +0.45%

Australia ↗️

$ASX 7110 +0.65%

India ↘️

$BSE 59900 -0.75%

.

Bears & bulls in $WTI $BRENT here's a list of catalysts that flip #oil markets green & RED in the next 90 days.

.

Bears & bulls in $WTI $BRENT here's a list of catalysts that flip #oil markets green & RED in the next 90 days.

.

ON the - SIDE

=

=

I have just re-read Zoltan's piece called "Oil, Gold, and LCLo(SP)R"....Here's my little summary:

Regardless of fundamentals, global banking reserves are not in danger of a liquidity crunch or default. This is because there are enough emergency backstops in place to essentially bail out anyone that gets into trouble by printing more reserves.

This is not the case in energy markets. Global demand for oil exceeds supply. The US and OPEC+ do not produce enough oil to supply the west. The Biden administration has been relying on the SPR to artificially lower oil prices and meet demand.

SPRに関する大統領の方針と理由

1 バレルあたり約 67 ドルから 72 ドルかそれ以下の場合、原油を買い戻す意向である

SPRの補充を確実にするため、DOEは、将来の日付で提供される製品の競争入札プロセスを通じて固定価格契約を締結できるようにする

(続く)

whitehouse.gov/briefing-room/…

1 バレルあたり約 67 ドルから 72 ドルかそれ以下の場合、原油を買い戻す意向である

SPRの補充を確実にするため、DOEは、将来の日付で提供される製品の競争入札プロセスを通じて固定価格契約を締結できるようにする

(続く)

whitehouse.gov/briefing-room/…

多くの石油業界関係者は、今日の高価格でさえ、将来価格が下がること可能性のため投資を心配している。

買い戻しは、原油の将来の需要について確実性を生み出す。

企業は今すぐ生産に投資するようになり、米国のエネルギー安全保障を改善する。

(続く)

#OOTT

買い戻しは、原油の将来の需要について確実性を生み出す。

企業は今すぐ生産に投資するようになり、米国のエネルギー安全保障を改善する。

(続く)

#OOTT

🔥Thread on the costs of Strategic Petroleum Reserves (SPR)! (simplified calculations)

1- In 3 years, between the start of 1979 & the end of 1981, 168 mb of crude oil were added to the SPR at an average cost of about $32/b. That is about $125/b in Today's money!

#Oil #OOTT #SPR

1- In 3 years, between the start of 1979 & the end of 1981, 168 mb of crude oil were added to the SPR at an average cost of about $32/b. That is about $125/b in Today's money!

#Oil #OOTT #SPR

2- The fixed cost incurred by the taxpayer to prepare the caverns was around $4 billion. That translates to about $6/b assuming 650 mb existed from day one in 1977 (of course that was not the case, but I am trying to use the low numbers). $6 in 1977 equals about $29.40/b today!

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Global Macro Review

September 5, 2022

Hello Labor Day 🇺🇸!

Other than the $USD, very little that was in the green long side last week. This morning, commodities are bouncing but equities ↘️

Let’s review the week and the real-time 🧮!

🧵

Global Macro Review

September 5, 2022

Hello Labor Day 🇺🇸!

Other than the $USD, very little that was in the green long side last week. This morning, commodities are bouncing but equities ↘️

Let’s review the week and the real-time 🧮!

🧵

Thread on the impact of the #SPR releases/end on oil prices

#Oil #OOTT #COM

1-9 At first, they prevented prices from increasing. Since the demand was not rising proportionally to the increase in supplies, prices started declining, especially since the releases replaced imports

#Oil #OOTT #COM

1-9 At first, they prevented prices from increasing. Since the demand was not rising proportionally to the increase in supplies, prices started declining, especially since the releases replaced imports

2-9 As a result, the "demand" for the SPR started declining & will continue to decline gradually until it stops, probably before the whole amount is sold!

In other words, it remains to be seen if the whole amount is sold. If it does, it is mostly because #Crude_Quality_Matters

In other words, it remains to be seen if the whole amount is sold. If it does, it is mostly because #Crude_Quality_Matters

3-9 Therefore, the idea of an abrupt stop and loss of about 800 kbd may not happen, and therefore, the idea that oil prices will rise sharply as a result of ending withdrawals may not happen. Being bullish based on the idea of an abrupt loss of 800 kbd is a dangerous strategy.

Thread: What are the Biden Administration’s choices to reduce oil and fuel prices? #OOTT #Oil

1- What has been done?

Asked OPEC members, US oil producers & refiners to increase production. All failed.

OPEC members were not interested. US producers & refiners cannot do so.

1- What has been done?

Asked OPEC members, US oil producers & refiners to increase production. All failed.

OPEC members were not interested. US producers & refiners cannot do so.

2- What are the current choices?

a- Restrict crude oil exports

b- Restrict fuel exports

c- Suspend environmental regulations temporarily

d- Suspend federal fuel tax

e- Remove sanctions on Iran & Venezuela

f- Resurrect relations with Saudi Arabia

g- Withdraw more from the SPR

a- Restrict crude oil exports

b- Restrict fuel exports

c- Suspend environmental regulations temporarily

d- Suspend federal fuel tax

e- Remove sanctions on Iran & Venezuela

f- Resurrect relations with Saudi Arabia

g- Withdraw more from the SPR

3- None of the choices above can reduce shortages or lower prices meaningfully before the US mid-term elections. Only a recession would reduce fuel prices and allow for inventories to rise.

Regardless, a recession might flip both houses to republicans. Democrats are stuck!

Regardless, a recession might flip both houses to republicans. Democrats are stuck!

#SwissPolicyResearch (#SPR), founded in 2016, an independent nonprofit research group.

⬇️

about

#Coronavaccines

#CovidVaccines

#mRNAvaccines ⬇️

⬇️

swprs.org/covid-vaccines…

⬇️

about

#Coronavaccines

#CovidVaccines

#mRNAvaccines ⬇️

⬇️

swprs.org/covid-vaccines…

about #AdversEvents

#Coronavaccines

#CovidVaccines

#mRNAvaccines ⬇️

swprs.org/covid-vaccine-…

#VaccineSideEffects

#VaccineDeaths

#Coronavaccines

#CovidVaccines

#mRNAvaccines ⬇️

swprs.org/covid-vaccine-…

#VaccineSideEffects

#VaccineDeaths

#Vaccines:

Successes and Controversies

swprs.org/vaccines-succe…

A. Documentaries about the success of vaccines

B. Documentaries about #vaccinesafety concerns

#Vaxxed1 #Vaxxed2

Successes and Controversies

swprs.org/vaccines-succe…

A. Documentaries about the success of vaccines

B. Documentaries about #vaccinesafety concerns

#Vaxxed1 #Vaxxed2

As a team of scientists from @scrippsresearch @karolinskainst @UniBonn @UniklinikBonn @IIIBonn @uni_tue @Illinois_Alma, we identified four potent neutralizing camelid nanobodies ...

Solved the #Xray structure of all four #nanobodies in complex with #SARSCoV2 spike #RBD @wchnihcholas and Ian Wilson ...

Used #CryoEM to determine that VHH E stabilizes the 3-up conformation of trimeric #SARSCoV2 spike @BMartinHallberg ...

#WTI #CrudeOil futures for May,expiring tomorrow,tanked 57%,to $7.98 per barrel

June contract,expiring on 19thMay, traded@ $26.62/barrel

July futures,traded@ $28/barrel

And all this,despite #OPEC's decision to cut supply by 9.7 million barrels a day,wef 1st May2020

#OilCrash

June contract,expiring on 19thMay, traded@ $26.62/barrel

July futures,traded@ $28/barrel

And all this,despite #OPEC's decision to cut supply by 9.7 million barrels a day,wef 1st May2020

#OilCrash

1/ Salah satu daripada 10 penyelewengan SPR adalah kerana tidak memberi akreditasi kepada pihak2 yang layak.

#bersih #KeluarMengundi #KalahkanPencuri

#bersih #KeluarMengundi #KalahkanPencuri

2/ BERSIH 2.0 meminta semua warganegara Malaysia membantah pilihan raya yang TIDAK BERSIH dan TIDAK ADIL dengan berpakaian kuning.

3/ Kesemua pemantau pilihan raya yang telah dijemput oleh SPR tidak boleh dikategorikan sebagai PEMANTAU PILIHAN RAYA kerana mereka hanya datang ke Malaysia 3 hari sebelum hari mengundi.

Itu seakan-akan program lawatan dan bukan pemantauan pilihan raya.

Itu seakan-akan program lawatan dan bukan pemantauan pilihan raya.