Discover and read the best of Twitter Threads about #SunPharma

Most recents (24)

let me post some 100 #fibbonaci number wonders on long term chart.

Post your chart too with #fibbonaci, make sure chart is clean.

Post your chart too with #fibbonaci, make sure chart is clean.

this is number 1 in list

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

the very same stock took eyeball again few months back -- people went gaga

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

Earnings With ET NOW | Sun Pharma offers to acquire all Taro shares in cash

What is the rationale behind the move?

C Muralidharan, the CFO of the co, speaks on the offer, Q4 results, R&D spending and more

@Ajaya_buddy @_anishaj @SunPharma_Live

What is the rationale behind the move?

C Muralidharan, the CFO of the co, speaks on the offer, Q4 results, R&D spending and more

@Ajaya_buddy @_anishaj @SunPharma_Live

#OnETNOW | Here's what CS Muralidharan of Sun Pharma has to say on the co's offer to acquire remaining stake in Taro

@SunPharma_Live #SunPharma #Taro

@SunPharma_Live #SunPharma #Taro

#OnETNOW | CS Muralidharan of Sun Pharma speaks on pricing pressures in US, margins and Halol facility

@SunPharma_Live #SunPharma #Taro

@SunPharma_Live #SunPharma #Taro

🚑Sun Pharma Makes Strategic Investment in Agatsa Software and Remidio Innovation

[THREAD🧵] to Understand Both These Companies

Agatsa Software:

1) Sun Pharma bought 26.09% stake in Agatsa Software worth 30 Cr.

#SunPharma #acquisition

[THREAD🧵] to Understand Both These Companies

Agatsa Software:

1) Sun Pharma bought 26.09% stake in Agatsa Software worth 30 Cr.

#SunPharma #acquisition

2) Agatsa is a healthcare technology company solving for early detection of hearth attacks.

3) They have developed a ECH monitoring device, SanketLife, which works by touch, totally leadless which means no leads of gel/electrodes is required to measure ECG.

3) They have developed a ECH monitoring device, SanketLife, which works by touch, totally leadless which means no leads of gel/electrodes is required to measure ECG.

Remidio Innovative Solutions:

1) Sun Pharma has acquired 27.39% of stake in Remidio for 149.9 Cr

2) Remidio solves the problem of vision impairment by enabling access to early detection of eye diseases.

1) Sun Pharma has acquired 27.39% of stake in Remidio for 149.9 Cr

2) Remidio solves the problem of vision impairment by enabling access to early detection of eye diseases.

Time for some fun.

Instead of mocking others, let's do some self mocking.

This is the "best collection" of stocks.

I'm going #equalweight.

Just Ten MostBoring Stocks.

All-in-one Hall of fame list.

Presenting

The #BoringStocks of 2023.

Feel free to track & ridicule.

Here we go.

Instead of mocking others, let's do some self mocking.

This is the "best collection" of stocks.

I'm going #equalweight.

Just Ten MostBoring Stocks.

All-in-one Hall of fame list.

Presenting

The #BoringStocks of 2023.

Feel free to track & ridicule.

Here we go.

#HDFC. The mother of all boring stocks. Soon to be #hdfcbank.

Should do better simply because the expectations have never run so low.

1/10

Should do better simply because the expectations have never run so low.

1/10

#COALINDIA. No less boring. Much hated. Much bitched on WhatsApp. Everybody loves to abuse." Dividend play that's a widow stock" is what #BAAP Moghuls will call it on TV.

Most "intelligent investors" feel the same way about its owner as they do about their own mother-in-law.2/10

Most "intelligent investors" feel the same way about its owner as they do about their own mother-in-law.2/10

According to extensive research from @CreditSuisse, Family-owned businesses has overperformed massively over time.

We will in this thread highlight 8 interesting family-run businesses. Let's dive in 👇

We will in this thread highlight 8 interesting family-run businesses. Let's dive in 👇

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

US markets have given a break-down from Head & Shoulders pattern

Most of the Indian sectors too look vulnerable

THREAD: Technical Analysis for US market & 10 Indian sectors🧵

Collaborated with @AdityaTodmal

Most of the Indian sectors too look vulnerable

THREAD: Technical Analysis for US market & 10 Indian sectors🧵

Collaborated with @AdityaTodmal

#SunPharma Q3 FY22 concall highlights 💊

Like & retweet for better reach !

1. Revenues for the quarter were ₹9814 Cr (11% growth YoY). Material cost as a percentage of revenues was 27%. Staff cost was up by 8% YoY and stands at 18.9% of revenues.

Like & retweet for better reach !

1. Revenues for the quarter were ₹9814 Cr (11% growth YoY). Material cost as a percentage of revenues was 27%. Staff cost was up by 8% YoY and stands at 18.9% of revenues.

Other expenses were up 13% YoY and stands at 28.1% of revenues. The increase is attributed towards higher selling & distribution and traveling expenses while in Q3 of last year, these expenses were lower on account of COVID.

2. Specialty R&D accounted for approximately 22% of total R&D spend for the quarter. Forex loss for the quarter was ₹10.6 Cr compared to a gain of ₹71.6 Cr for Q3 last year.

𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐚𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐟𝐨𝐫 𝐚𝐥𝐥 𝐒𝐞𝐜𝐭𝐨𝐫𝐬 🧵

Detailed 🧵 on each sector covering index heavy weight stocks 📊

Detailed 🧵 on each sector covering index heavy weight stocks 📊

#NIFTYAUTO #CNXAUTO

Cup & Handle formation in weekly charts, awaiting a BO

The leaders of this sector are also on the verge of BO

Cup & Handle formation in weekly charts, awaiting a BO

The leaders of this sector are also on the verge of BO

𝐓𝐞𝐜𝐡𝐧𝐢𝐜𝐚𝐥 𝐚𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐟𝐨𝐫 𝐚𝐥𝐥 𝐒𝐞𝐜𝐭𝐨𝐫𝐬

Detailed 🧵on each sector covering index heavy weight stocks📊

Detailed 🧵on each sector covering index heavy weight stocks📊

Thread On Industrial Progress Of Andhra Pradesh In Last 2.5 Years

#HBDCMYSJagan #HBDYSJagan

#HBDManOfMassesYSJagan

#HBDCMYSJagan #HBDYSJagan

#HBDManOfMassesYSJagan

కొప్పర్తి సెజ్ - రాయలసీమకు పారిశ్రామిక మణిహారం !

6914 ఎకరాల్లో కొప్పర్తి ఇండస్ట్రియల్ హబ్ ని నిర్మిస్తుండగా.. 3155 ఎకరాల్లో మౌలిక వసతుల నిర్మాణం పనులు శరవేగంగా పూర్తయ్యాయి

ఈ నెల 23న కొప్పర్తి సెజ్ ను ప్రారంభించనున్న సీఎం

#HBDYSJagan #HBDCMYSJagan

#HBDManOfMassesYSJagan

6914 ఎకరాల్లో కొప్పర్తి ఇండస్ట్రియల్ హబ్ ని నిర్మిస్తుండగా.. 3155 ఎకరాల్లో మౌలిక వసతుల నిర్మాణం పనులు శరవేగంగా పూర్తయ్యాయి

ఈ నెల 23న కొప్పర్తి సెజ్ ను ప్రారంభించనున్న సీఎం

#HBDYSJagan #HBDCMYSJagan

#HBDManOfMassesYSJagan

🔸 విశాఖలో రూ. 2500 కోట్ల తో నిర్మిస్తున్న ATG Tyres మానుఫ్యాక్చరింగ్ ప్లాంట్ పనులు శరవేగంగా సాగుతున్నాయి

★ 2014 రాష్ట్ర విభజన తర్వాత ఉత్తరాంధ్రలో నిర్మిస్తున్న అతి పెద్ద ప్రాజెక్ట్ ఇదే

#HBDYSJagan #HBDCMYSJagan

#HBDManOfMassesYSJagan

#HBDManOfMassesYSJagan

★ 2014 రాష్ట్ర విభజన తర్వాత ఉత్తరాంధ్రలో నిర్మిస్తున్న అతి పెద్ద ప్రాజెక్ట్ ఇదే

#HBDYSJagan #HBDCMYSJagan

#HBDManOfMassesYSJagan

#HBDManOfMassesYSJagan

Nifty 50(w) structure

At RSI front Index given continue some weakness but still we respected 17700 and Monday if some panic same can move towards 17570-17600..

Next weekly closing below 17570 will put more pressure of consolidation.

At RSI front Index given continue some weakness but still we respected 17700 and Monday if some panic same can move towards 17570-17600..

Next weekly closing below 17570 will put more pressure of consolidation.

If we try to observe Nifty 50 stock wise charts most of counters give comfort that we should hold & respect the 17600-17700 zone once as solid support.

Further looking on same chart clear visible that same consolidation may take more time till we not break 18300 towards high.

Further looking on same chart clear visible that same consolidation may take more time till we not break 18300 towards high.

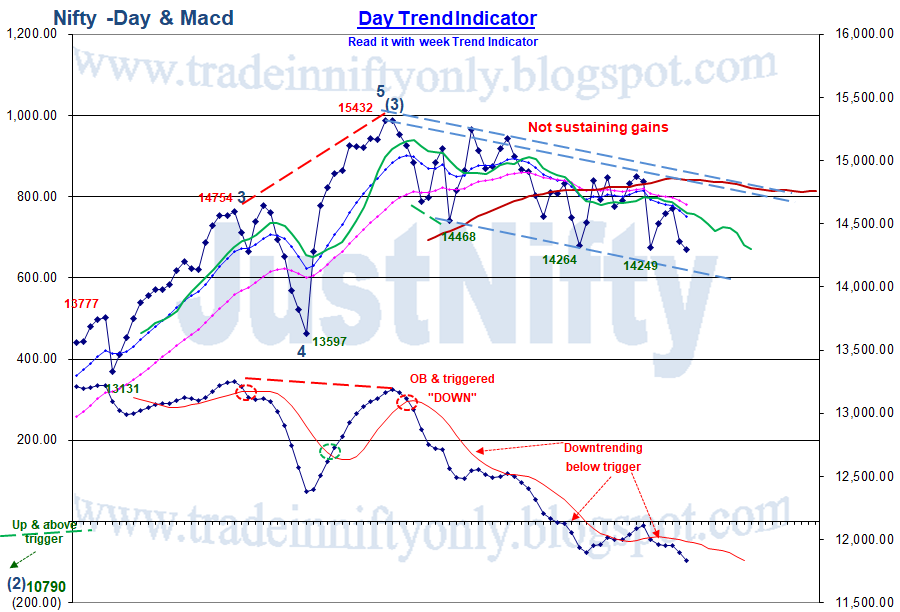

This Tech. tool keeps you on the right side. Take trades once this gives the go ahead. Until then, don't enter.

SLOW MACD(12,26,9) is a trend & momentum indicator.

S.MACD provides clear buy & sell signals using either "Turning dn or up & Triggering" as well as divergences.

SLOW MACD(12,26,9) is a trend & momentum indicator.

S.MACD provides clear buy & sell signals using either "Turning dn or up & Triggering" as well as divergences.

With the Bull run taking a halt in Crypto trading, back to Stocks!

Stocks for 27/11/20 Intraday

#RELIANCE

#BHARTIARTL

#BPCL

#SUNPHARMA

#TECHM

#SRTRANSFIN

#HDFC

#VOLTAS

Based on NR4, Volume and Volatility concepts

Stocks for 27/11/20 Intraday

#RELIANCE

#BHARTIARTL

#BPCL

#SUNPHARMA

#TECHM

#SRTRANSFIN

#HDFC

#VOLTAS

Based on NR4, Volume and Volatility concepts

Results of the Day : 3/8 Stocks gave tradeable moves

1/3 : #RELIANCE : PROFIT : +3R

After a Liquidity hunt on the downside, price went up and came back to test that same zone as support which gave strong Bullish Reaction for a Long trigger

Exit at resistance zone

1/3 : #RELIANCE : PROFIT : +3R

After a Liquidity hunt on the downside, price went up and came back to test that same zone as support which gave strong Bullish Reaction for a Long trigger

Exit at resistance zone

2/3 : #SUNPHARMA : PROFIT : +3R

As I posted:

Price was doing a double S/R flip which is s strong Setup, supported by good volumes coming in, for a Long trigger

Exit at resistance zone using a predefined target

As I posted:

Price was doing a double S/R flip which is s strong Setup, supported by good volumes coming in, for a Long trigger

Exit at resistance zone using a predefined target

Weekly NIFTY50 analysis thread.

September Week4.

All posts are for educational purposes.

September Week4.

All posts are for educational purposes.

Stocks for 14/09/20 Intraday

#ZEEL

#AXISBANK

#BHARTIARTL

#GRASIM

#SUNPHARMA

#CHOLAFIN

#M&M

#ESCORTS

#LICHSGFIN

#HAVELLS

Based on NR7, Volume and Volatility concepts

#ZEEL

#AXISBANK

#BHARTIARTL

#GRASIM

#SUNPHARMA

#CHOLAFIN

#M&M

#ESCORTS

#LICHSGFIN

#HAVELLS

Based on NR7, Volume and Volatility concepts

Results of the Day : 2/10 Stocks gave tradeable moves

1/2 : #ZEEL : PROFIT : +2R

Gave Entry very early in the day but was very slow. However it didn't show any bullishness throughout.

Closed @ 2:25 at first target of 2R because of how slow it was

1/2 : #ZEEL : PROFIT : +2R

Gave Entry very early in the day but was very slow. However it didn't show any bullishness throughout.

Closed @ 2:25 at first target of 2R because of how slow it was

2/2 : #ESCORTS : PROFIT : +2R

A very reliable stock, the day started by a rejection for the 5th time from the same Supply zone. It eventually closed above and gave a long Entry.

Exited at +2R because despite good Volumes, range of candles were small hence momentum was weak

A very reliable stock, the day started by a rejection for the 5th time from the same Supply zone. It eventually closed above and gave a long Entry.

Exited at +2R because despite good Volumes, range of candles were small hence momentum was weak

#AVWAP For Multibaggers

Rather Than Revealing All Small Secrets, Posting Some Weekly Charts In This Thread

Some Multibaggers, Some Duds, Some Great Companies But In Downtrend Currently

Common Theme - AVWAP Plotted From Last x Yrs High Candle

Many Will Figure It Out

Rather Than Revealing All Small Secrets, Posting Some Weekly Charts In This Thread

Some Multibaggers, Some Duds, Some Great Companies But In Downtrend Currently

Common Theme - AVWAP Plotted From Last x Yrs High Candle

Many Will Figure It Out

Stocks for 11/09/20 Intraday

#ZEEL

#SUNPHARMA

#M&M

#UPL

#AUROPHARMA

#TCS

#HINDUNILVR

#INDIGO

#McDOWELL_N

Based on NR7, Volume and Volatility concepts

#ZEEL

#SUNPHARMA

#M&M

#UPL

#AUROPHARMA

#TCS

#HINDUNILVR

#INDIGO

#McDOWELL_N

Based on NR7, Volume and Volatility concepts

Results of the Day : 3/9 stocks gave tradeable moves

1/3 : #TCS : PROFIT : +2R

After suffering a loss as posted in the morning, it again gave a good entry. Closed it for 2R as I didn't want to hold it anymore

1/3 : #TCS : PROFIT : +2R

After suffering a loss as posted in the morning, it again gave a good entry. Closed it for 2R as I didn't want to hold it anymore

2/3 : #McDOWELL_N : PROFIT : +2R

Back to back in my watchlist and back to back profits.

It once again got rejected from the same resistance block as yesterday and gave a Entry as detailed.

Exited before EOD

Back to back in my watchlist and back to back profits.

It once again got rejected from the same resistance block as yesterday and gave a Entry as detailed.

Exited before EOD

Will be posting TA of all #nifty50 stocks in this thread. Any comments, suggestions are welcome!

There were no Good stocks using NR7 Yesterday, hence I didn't take any Intraday trades today.

Stocks for 27/08/20 Intraday

#TATASTEEL

#JSWSTEEL

#BPCL

#SUNPHARMA

#CIPLA

#UJJIVAN

#UPL

#AMBUJACEM

#AUROPHARMA

#BHARATFORG

Based on NR7, Volume and Volatility concepts

Stocks for 27/08/20 Intraday

#TATASTEEL

#JSWSTEEL

#BPCL

#SUNPHARMA

#CIPLA

#UJJIVAN

#UPL

#AMBUJACEM

#AUROPHARMA

#BHARATFORG

Based on NR7, Volume and Volatility concepts

Late Results of the Day! 5/10 stocks gave tradeable moves

1/5: #CIPLA: PROFIT: +0.9R

Same Stuff as I posted in market hours:

-Price breaks resistance with strong candles and Volume: BUY

-Price shows weakness by wicks and Bearish candles with Volume: EXIT

1/5: #CIPLA: PROFIT: +0.9R

Same Stuff as I posted in market hours:

-Price breaks resistance with strong candles and Volume: BUY

-Price shows weakness by wicks and Bearish candles with Volume: EXIT

2/5 : #AUROPHARMA : BREAKEVEN

Again, price reacted strongly at Support : Went LONG

Seeing weakness : EXIT

Details on chart

Again, price reacted strongly at Support : Went LONG

Seeing weakness : EXIT

Details on chart

Stocks for 20/08/20 Intraday

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BANDHANBNK

#TATASTEEL

#JSWSTEEL

#IBULHSGFIN

#SUNPHARMA

#HCLTECH

#TATACONSUM

#M_M

#TITAN

Based on NR7, Volume and Volatility concepts

#AXISBANK

#INDUSINDBK

#HDFCBANK

#BANDHANBNK

#TATASTEEL

#JSWSTEEL

#IBULHSGFIN

#SUNPHARMA

#HCLTECH

#TATACONSUM

#M_M

#TITAN

Based on NR7, Volume and Volatility concepts

Results of the Day : 4/12 stocks gave tradeable moves

1/4 : #SUNPHARMA

As most of the trades happen on a Wide Gap Down days, Price went up and got rejected at previous session high and formed reversal signs

+1.2R profits booked

1/4 : #SUNPHARMA

As most of the trades happen on a Wide Gap Down days, Price went up and got rejected at previous session high and formed reversal signs

+1.2R profits booked

2/4 : #IGL

This stock stood out by breaking through previous session Resistance with Very high Volumes coming in.

Entry was after bullish confirming Long tail candles.

Exit was when the price showed a decrease in Momentum

+2.7R profits booked

This stock stood out by breaking through previous session Resistance with Very high Volumes coming in.

Entry was after bullish confirming Long tail candles.

Exit was when the price showed a decrease in Momentum

+2.7R profits booked