Discover and read the best of Twitter Threads about #Tradingtips

Most recents (24)

*UPDATED*

Here is a cheat sheet on when to expect low probability/S&D conditions👇

I recommend printing this and having it in front of you

Being able to forecast unfavorable conditions is one of the most important skills to have as a trader💎

Examples below🧵

#TRADINGTIPS

Here is a cheat sheet on when to expect low probability/S&D conditions👇

I recommend printing this and having it in front of you

Being able to forecast unfavorable conditions is one of the most important skills to have as a trader💎

Examples below🧵

#TRADINGTIPS

The day after a large range day example⬇️

indices not in sync example ⬇️

The New Week Opening Gap is a strong price magnet🧲

Draw it out every week onto your charts in a separate template

(Friday closing price to Sunday open price)

Here is some more info👇

Draw it out every week onto your charts in a separate template

(Friday closing price to Sunday open price)

Here is some more info👇

NWOG indicator⬇️

1/31

Breakout (B/O) Nasıl Onaylanır ?

Öncelikle belirtmem gerekir ki bu konu başlığı altında anlatılacak bilgiler yatay destek-dirençlerin kırılımı için hazırlanmıştır. Diyagonal trend çizgilerinin kırılımlarında da bu bilgilerden faydalanılabileceğiniz gibi, diyagonal

Breakout (B/O) Nasıl Onaylanır ?

Öncelikle belirtmem gerekir ki bu konu başlığı altında anlatılacak bilgiler yatay destek-dirençlerin kırılımı için hazırlanmıştır. Diyagonal trend çizgilerinin kırılımlarında da bu bilgilerden faydalanılabileceğiniz gibi, diyagonal

2/31

çizgilerin trade edilmesi farklı aksiyonlar da gerektirmektedir. Benim fokuslandığım alan yatay çizgi kırılımları olduğu için diyagonal trend kırılım detaylarından bu yazıda çok fazla bahsetmeyeceğim. Anlatılacaklar farklı finansal enstrümanlar (hisse, fx, kripto) için++

çizgilerin trade edilmesi farklı aksiyonlar da gerektirmektedir. Benim fokuslandığım alan yatay çizgi kırılımları olduğu için diyagonal trend kırılım detaylarından bu yazıda çok fazla bahsetmeyeceğim. Anlatılacaklar farklı finansal enstrümanlar (hisse, fx, kripto) için++

3/31

uygulanabilir yöntemlerdir ancak en nihayetinde teknik analiz sınırları içerisinde kalacaktır ve teknik analiz size altın tepsi içinde kesin yargılar sunmayacaktır. Her zamanki gibi bazı objektif ve subjektif teknik analiz yöntemlerinden ve belirli kabullerden bahsedeceğim.

uygulanabilir yöntemlerdir ancak en nihayetinde teknik analiz sınırları içerisinde kalacaktır ve teknik analiz size altın tepsi içinde kesin yargılar sunmayacaktır. Her zamanki gibi bazı objektif ve subjektif teknik analiz yöntemlerinden ve belirli kabullerden bahsedeceğim.

Thread on Trading Psychology🧵 #TradingTips

New traders worry about hitting profit goals while experienced traders worry about following their system & managing risk.

🧡&🔁

New traders worry about hitting profit goals while experienced traders worry about following their system & managing risk.

🧡&🔁

STOP setting daily, weekly, or even monthly profit goals.

Setting profit goals in dollar amounts or percentage wise is the wrong mindset.

When you do this, you will force unnecessary trades to meet your profit goals.

Setting profit goals in dollar amounts or percentage wise is the wrong mindset.

When you do this, you will force unnecessary trades to meet your profit goals.

What you should be focused on instead is simply executing your trading plan/system & improving your edge.

Stay disciplined and wait patiently for A+ setups and executing when they form.

It sounds so simple yet so many traders cannot be disciplined enough to do it.

Stay disciplined and wait patiently for A+ setups and executing when they form.

It sounds so simple yet so many traders cannot be disciplined enough to do it.

Qu'appel t-on appel spread/ liquidité, comment se déplace le prix ?

🚨On entend souvent dire que le prix augmente car il y a plus d'acheteur que de vendeur sur le marché...

Cette affirmation est fausse ! 🚨

Thread ⬇️

#Crypto #trading #TRADINGTIPS #cryptocurrency

#Bitcoin

🚨On entend souvent dire que le prix augmente car il y a plus d'acheteur que de vendeur sur le marché...

Cette affirmation est fausse ! 🚨

Thread ⬇️

#Crypto #trading #TRADINGTIPS #cryptocurrency

#Bitcoin

Vous le savez, pour qu'il y ai vente, il faut quelqu'un qui achète (donc quand vous vendez, c'est qu'il y a quelqu'un qui est près à acheter au même prix... à mediter)

La clé du mouvement de prix est l'attitude des intervenants adoptent sur le marché (agressive ou passive)

La clé du mouvement de prix est l'attitude des intervenants adoptent sur le marché (agressive ou passive)

If you are

👉Overtrading

👉Struggling to find high probability setups

👉Lost in intraday price action

here’s what I recommend⬇️

🧵🧵🧵

#TRADINGTIPS

👉Overtrading

👉Struggling to find high probability setups

👉Lost in intraday price action

here’s what I recommend⬇️

🧵🧵🧵

#TRADINGTIPS

STRICTLY focus on Daily and Weekly levels for your setups.

Once price hits these levels drop into your lower time frames (LTF) and find your specific entry model 🔎

Once price hits these levels drop into your lower time frames (LTF) and find your specific entry model 🔎

You will often find these areas have the cleanest/smoothest price action with the highest probability movements.

Price delivery is often quick and trades are low stress ✅

Below are a few examples of what these type of trades look like⬇️

Price delivery is often quick and trades are low stress ✅

Below are a few examples of what these type of trades look like⬇️

1/ 🚀 $SOL: Trendline broken to the upside, gaining bullish momentum.

Follow the thread👇🧵

#SOL #Crypto #TechnicalAnalysis #Solana #altcoins

Follow the thread👇🧵

#SOL #Crypto #TechnicalAnalysis #Solana #altcoins

2/ 🎯 Next Target: $SOL is aiming for the gray $26.80 resistance level. Given its strength, entering a long trade now would require a stop loss below $19.50 (with a bad risk reward ratio) #SOL #Crypto #Trading

3/ 🚫 No Trade: With the current setup, I don't see a trade offering a favorable risk-reward ratio. In trading, it's crucial to wait for the right opportunity that aligns with your strategy. #SOL #Crypto #TRADINGTIPS

1/ 🚀 $TRU: Wedge & resistance broken! Mastering wedges is essential for successful trading with #technicalanalysis.

Details in the thread🧵👇

#Crypto #truefi #altcoins

Details in the thread🧵👇

#Crypto #truefi #altcoins

2/ 📐 Descending Wedge: $TRU's wedge persisted for a few days, and we finally got a breakout. The price is now above both the wedge's top trendline and the gray resistance level. #TRU #Crypto #Trading

3/ 🎯 Short-term Targets: I'm bullish on $TRU and expect an initial test of the blue resistance at $0.0821, followed by green resistance at $0.90. As long as we stay above the gray $0.74 support, the bullish view stands. #TRU #Crypto #TradingTips

1/ 🚀 $ICX Technical Analysis: Bullish Wave Count in play. ICX could be starting a new uptrend as price didn't reach the previous all-time low.

Details. Follow. Thread. Now.🙃👇

#ICX #Crypto #TechnicalAnalysis #altcoins

Details. Follow. Thread. Now.🙃👇

#ICX #Crypto #TechnicalAnalysis #altcoins

2/ 🌊 Wave analysis: My primary count suggests we're currently in blue wave 5 of black wave 3. This could mean we're in for more upside in the short term. #ICX #Crypto #ElliottWave

1/ 🚀 $DYDX Technical Analysis: Next step broken, and we're looking bullish! Details in the thread.👇

#DYDX #DeFi #Crypto #TechnicalAnalysis #altcoins

#DYDX #DeFi #Crypto #TechnicalAnalysis #altcoins

Here are my favorite macros to trade👁️

💎9:50-10:10 am

💎1:30pm Judas

💎3:15-3:45pm "Sweet Spot"

Everyday I usually see a setup form in at least one of these windows of time.

I have 3 chances to catch a high probability play any given day✅

Examples below⬇️🧵

#TRADINGTIPS

💎9:50-10:10 am

💎1:30pm Judas

💎3:15-3:45pm "Sweet Spot"

Everyday I usually see a setup form in at least one of these windows of time.

I have 3 chances to catch a high probability play any given day✅

Examples below⬇️🧵

#TRADINGTIPS

9:50-10:10 AM Example 1 👁️

9:50-10:10 AM Example 2 👁️

Okay, I shared @I_Am_The_ICT weekly profiles.

But for futures traders, we got daily profiles to run in conjunction with them 📝

$NQ $YM $ES

🧵🧵🧵

#TRADINGTIPS

#tradingstrategy

#TradingOpportunity

But for futures traders, we got daily profiles to run in conjunction with them 📝

$NQ $YM $ES

🧵🧵🧵

#TRADINGTIPS

#tradingstrategy

#TradingOpportunity

This is probably the most slept on @I_Am_The_ICT concept there is 🫠

I'm guilty of sleeping on these but not anymore, I used to use them when I was at peak for my game 📸

Weekly profile templates 💎

🧵🧵

$ES $NQ $YM

$USD $EUR

#TRADINGTIPS

#tradingstrategy

I'm guilty of sleeping on these but not anymore, I used to use them when I was at peak for my game 📸

Weekly profile templates 💎

🧵🧵

$ES $NQ $YM

$USD $EUR

#TRADINGTIPS

#tradingstrategy

These will play into W/D/4H PD array.

Look for then on a 1H TF 📝

Look for then on a 1H TF 📝

Are we heading toward a Bull Run?🐮

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

2/ Bull Run: The price of an asset generally increases, typically for several weeks or months. Traders expect prices to continue to rise & increase in value for the foreseeable future. 📈 This can be an exciting time for investors if they exit before prices start to decline.

3/ ➡️Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals to benefit from market volatility & accumulate assets over time. It spreads out risk, allowing traders to benefit from the bull market without taking on too much risk.

ICT GEM💎

There are 6 Daily Index Templates👁️

Two Session Up Close

Two Session Down Close

AM Rally PM Reversal

AM Decline PM Reversal

Consolidation AM Rally PM decline

Consolidation AM Decline PM rally

Below you will find when to expect them + examples⬇️

🧵🧵

#TRADINGTIPS

There are 6 Daily Index Templates👁️

Two Session Up Close

Two Session Down Close

AM Rally PM Reversal

AM Decline PM Reversal

Consolidation AM Rally PM decline

Consolidation AM Decline PM rally

Below you will find when to expect them + examples⬇️

🧵🧵

#TRADINGTIPS

ICT GEM💎

There are ONLY 4 conditions in the market place:

Expansion

Retracment

Reversal

Consolidation

This is exactly what you need to look for in price when in one of these conditions🔍👇:

🧵🧵

#TRADINGTIPS

There are ONLY 4 conditions in the market place:

Expansion

Retracment

Reversal

Consolidation

This is exactly what you need to look for in price when in one of these conditions🔍👇:

🧵🧵

#TRADINGTIPS

ICT GEM💎

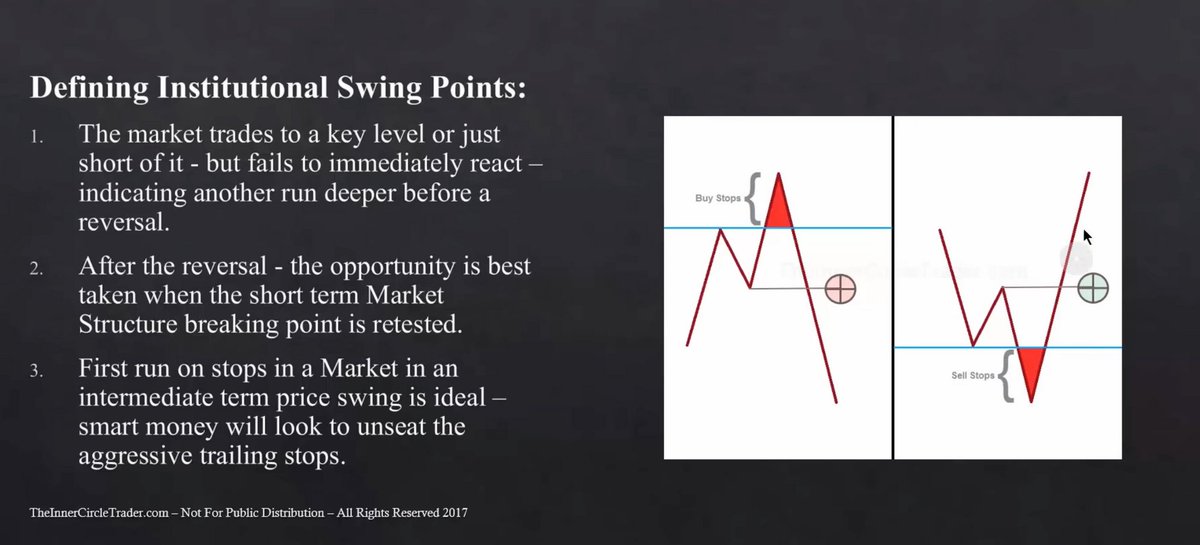

There is ONLY 2 real ways the market will turn around🔄:

1) A Breaker where they run stops

2) A failure swing.

The breaker swing point is the IDEAL scenario. You want to be looking for it all the time on any time frame🔍

#TRADINGTIPS

There is ONLY 2 real ways the market will turn around🔄:

1) A Breaker where they run stops

2) A failure swing.

The breaker swing point is the IDEAL scenario. You want to be looking for it all the time on any time frame🔍

#TRADINGTIPS

We're not trying to get a daily bias every day🙅♂️

We are trying to determine the direction of the WEEKLY expansion↕️

We are trying to determine the direction of the WEEKLY expansion↕️

🔹Does price want to run to an old low?

🔹Does it look like its gonna run to an old high?

🔹Is it running to an imbalance below or above the market price?

🔹Is it likely not to move because there is no data for it that week ?

🔹Does it look like its gonna run to an old high?

🔹Is it running to an imbalance below or above the market price?

🔹Is it likely not to move because there is no data for it that week ?

ICT GEM💎

Understanding Intermediate Term Highs/Lows🧠⬇️

-Every single time price rebalances an old imbalance, that swing high or low should be immediately labeled as an ITH/ITL

-If we break beneath an ITH/ITL, we have a significant break in market structure👁️

#Tradingtips

Understanding Intermediate Term Highs/Lows🧠⬇️

-Every single time price rebalances an old imbalance, that swing high or low should be immediately labeled as an ITH/ITL

-If we break beneath an ITH/ITL, we have a significant break in market structure👁️

#Tradingtips

ITHs/ITLs have TWO classifications:

1⃣) ITH that has a lower STH to the left of it and lower STH to the right of it (flip logic around for ITL)

2⃣)Trades back up to an imbalance to rebalance

1⃣) ITH that has a lower STH to the left of it and lower STH to the right of it (flip logic around for ITL)

2⃣)Trades back up to an imbalance to rebalance

1/10 VWAP (Volume Weighted Average Price) is a popular trading indicator that helps traders understand the average price of an asset based on its volume. #TradingStrategy #VWAP

2/10 To use VWAP as a trading strategy, traders should first plot the indicator on their chart to track the average price of the asset. #VWAP #TradingTips

3/10 Traders can then look for trends in the VWAP line to identify buying and selling opportunities. If the price is above the VWAP line, it suggests that the asset is being bought at a premium, indicating a potential selling opportunity. #VWAP #TradingAnalysis

If you say something like "this trade looks risky" or "I took this risky trade." This is an obvious indication that you have no idea operating in that market environment. #trading #forextips #TRADINGTIPS

THREAD... 🧵

THREAD... 🧵

This approach is more rational : "I don't know how to operate in this condition, so I'm at sidelines and not taking any trade, until this/that happens."

You should always be studying the conditions you don't know how to operate, regardless of whether you're profitable trader.

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵