Discover and read the best of Twitter Threads about #TradingStrategy

Most recents (24)

1/ Hey traders! Today, let's dive into a discussion about a time-based option selling strategy and its effectiveness in the current market scenario.

Spoiler alert: It may be losing its edge due to evolving market dynamics. Let's explore why. #TradingStrategy

Spoiler alert: It may be losing its edge due to evolving market dynamics. Let's explore why. #TradingStrategy

2/ Time-based option selling has been a popular strategy among traders for a while. The premise is simple: Sell options with a short expiration timeframe and aim to profit from the rapid time decay. It has worked well in the past, but is it still a reliable approach? 🤔

3/ Market conditions are constantly evolving, and what worked in the past doesn't always guarantee success in the present. With recent shifts in market dynamics, time-based option selling is facing new challenges that make it less effective than before. Let's uncover why.

Basics OF Swing Trading

1.

"Master the art of #SwingTrading and ride the waves of short-term price movements in financial markets! 📈💰 #TradingStrategies #FinancialMarkets"

1.

"Master the art of #SwingTrading and ride the waves of short-term price movements in financial markets! 📈💰 #TradingStrategies #FinancialMarkets"

2.

"Capture profits in the swing of things with #SwingTrading! 📉📈 Spot potential price swings, time your entries and exits, and make the most of short-term market movements. #ProfitOpportunities #TradeSmart"

"Capture profits in the swing of things with #SwingTrading! 📉📈 Spot potential price swings, time your entries and exits, and make the most of short-term market movements. #ProfitOpportunities #TradeSmart"

3.

"Ready to swing into action? 🕺💹 Learn the ins and outs of #SwingTrading and discover how to navigate short-term price fluctuations like a pro. #TradingSkills #MarketSwings"

"Ready to swing into action? 🕺💹 Learn the ins and outs of #SwingTrading and discover how to navigate short-term price fluctuations like a pro. #TradingSkills #MarketSwings"

📶Systematic StopLoss using

#SuperTrend Indicator

✅ Technical Analysis Simplified

A Learning Thread 📚

🚀 Telegram openinapp.co/qriva

#trading #StockMarket #tradingstrategy #PriceAction

@kuttrapali26 @KommawarSwapnil @sunilgurjar01 @caniravkaria @Stockstudy8

#SuperTrend Indicator

✅ Technical Analysis Simplified

A Learning Thread 📚

🚀 Telegram openinapp.co/qriva

#trading #StockMarket #tradingstrategy #PriceAction

@kuttrapali26 @KommawarSwapnil @sunilgurjar01 @caniravkaria @Stockstudy8

I started trading 4 years ago by buying options.

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

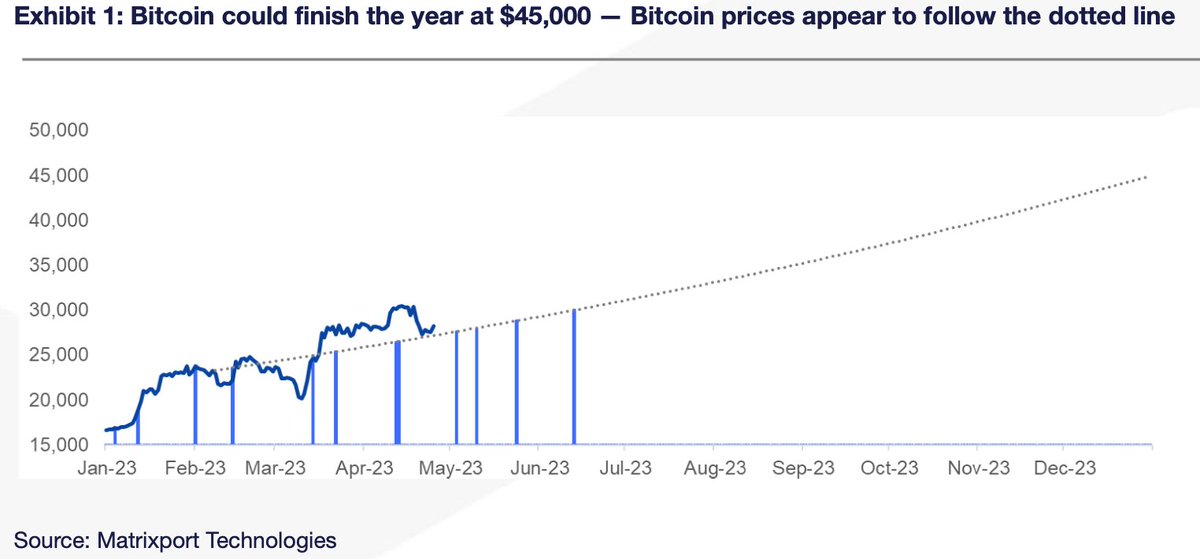

#Bitcoin prices set to reach $45,000 this year, says report - Follow the 'fair value' roadmap for optimal #tradingstrategy ⬇️🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

1/10: Despite recent #volatility, #Bitcoin prices are where they should be according to our #CPI/#FOMC roadmap laid out in Feb.

2/10: Based on the Jan. Effect, #Bitcoin could finish the year around $45k, which seemed optimistic at $22k, but is now achievable.

Okay, I shared @I_Am_The_ICT weekly profiles.

But for futures traders, we got daily profiles to run in conjunction with them 📝

$NQ $YM $ES

🧵🧵🧵

#TRADINGTIPS

#tradingstrategy

#TradingOpportunity

But for futures traders, we got daily profiles to run in conjunction with them 📝

$NQ $YM $ES

🧵🧵🧵

#TRADINGTIPS

#tradingstrategy

#TradingOpportunity

This is probably the most slept on @I_Am_The_ICT concept there is 🫠

I'm guilty of sleeping on these but not anymore, I used to use them when I was at peak for my game 📸

Weekly profile templates 💎

🧵🧵

$ES $NQ $YM

$USD $EUR

#TRADINGTIPS

#tradingstrategy

I'm guilty of sleeping on these but not anymore, I used to use them when I was at peak for my game 📸

Weekly profile templates 💎

🧵🧵

$ES $NQ $YM

$USD $EUR

#TRADINGTIPS

#tradingstrategy

These will play into W/D/4H PD array.

Look for then on a 1H TF 📝

Look for then on a 1H TF 📝

Study 1 📝

Note the 90 min cycle...

Why 90 mins... 24 hours ÷ 4 = 6Hr

6Hr ÷ 4 = 90 mins...

Q1 = Accumulation

Q2 = Manipulation

Q3 = Distribution

Note - Macros seems to start the phase.

MMXM cycles 🤔

$ES $NQ $YM

#tradingstrategy

#TradingStrategies

Note the 90 min cycle...

Why 90 mins... 24 hours ÷ 4 = 6Hr

6Hr ÷ 4 = 90 mins...

Q1 = Accumulation

Q2 = Manipulation

Q3 = Distribution

Note - Macros seems to start the phase.

MMXM cycles 🤔

$ES $NQ $YM

#tradingstrategy

#TradingStrategies

Also note - ICT said you won't see Macros on a trending day... ask yourself why...

Sometimes studying @I_Am_The_ICT concepts I sit and think this can't be real 🤯

Just backtesting $ES and $DXY between 8.30-11 am NY (mainly 9.30-11 am)

This be real crazy...

Would need hardly any bias by looks of it.

🧵🧵

#tradingstrategy

#TradingView

#trading

Just backtesting $ES and $DXY between 8.30-11 am NY (mainly 9.30-11 am)

This be real crazy...

Would need hardly any bias by looks of it.

🧵🧵

#tradingstrategy

#TradingView

#trading

Keep seeing where I started post.

So here's mine;

Binary options (was wild fast money if you know you know)

"EMAS as a magnet" (learnt from emasdontlie raja pal when he was wicksdontlie)

Support and resistance

Channels

$EUR $USD $GBP

#tradingstrategy

So here's mine;

Binary options (was wild fast money if you know you know)

"EMAS as a magnet" (learnt from emasdontlie raja pal when he was wicksdontlie)

Support and resistance

Channels

$EUR $USD $GBP

#tradingstrategy

Visual aid watching $MES $ES price print.

Liquidity

Imbalance

Order blocks

MMXM

(like stated in previous post you don't need more "we have jade in our hands")

PO3 example below

Orderflow examples below

$NQ $YM

#TradingView

#tradingstrategy

Liquidity

Imbalance

Order blocks

MMXM

(like stated in previous post you don't need more "we have jade in our hands")

PO3 example below

Orderflow examples below

$NQ $YM

#TradingView

#tradingstrategy

Hey Twitter fam! Are you looking for ways to improve your crypto investment or trading strategy? In this thread, we'll be sharing tips and tricks we learned that you can apply to your strategy this month. Let's dive in! #crypto #investmenttips $QUACK #CryptoTwitter

Thread 🧵👇

Thread 🧵👇

1. Don't chase the hype. While it may be tempting to invest in the latest buzzworthy coin, it's important to do your research and make informed decisions based on the coin's fundamentals and long-term potential. #DYOR #investmentstrategy $QUACK

2. Consider dollar-cost averaging. This is a strategy where you invest a fixed amount of money at regular intervals, regardless of the coin's price. This can help reduce the impact of market volatility and potentially lead to better returns over time. #DCA $QUACK

🧵5 Hey crypto traders, I've got a HOT🔥TAKE for you today. Sometimes it's easy to get bogged down in technical analysis and overthink. But right now, I think there's a simple play that could work well 🚀

#BTC #Bitcoin #trading #tradingstrategy #HODL #crypto #CryptoNews

#BTC #Bitcoin #trading #tradingstrategy #HODL #crypto #CryptoNews

1/5 I've been swinging almost any asset and working strictly from the long side as long as $BTC is above $21,600.

#crypto #tradingstrategy #takeprofits #bitcoin #hodl #BTC

#crypto #tradingstrategy #takeprofits #bitcoin #hodl #BTC

1/10 VWAP (Volume Weighted Average Price) is a popular trading indicator that helps traders understand the average price of an asset based on its volume. #TradingStrategy #VWAP

2/10 To use VWAP as a trading strategy, traders should first plot the indicator on their chart to track the average price of the asset. #VWAP #TradingTips

3/10 Traders can then look for trends in the VWAP line to identify buying and selling opportunities. If the price is above the VWAP line, it suggests that the asset is being bought at a premium, indicating a potential selling opportunity. #VWAP #TradingAnalysis

1/23 It's easy to find bullish and bearish elements in the charts to fit you bias, but being a maxi can be risky. Remember:

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

3/23 The #GoldenCross printed and the #DeathCross between the 200 & 50 WMA's is coming on the next candle. Knowing why we have conflicting signals isn't as critical as knowing how price will react, but if I had to guess, I'd say, short term manipulation.

#Learning

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Use below mentioned parameters at your charting platform (tradingview).

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

(1/6) Are you looking to get into #trading but don't know where to start? Here is an overview of the longer-time frame trading strategy which is one of the widely recognized strategies! 🧵

Read more at medium.com/zignaly/llts65…

Read more at medium.com/zignaly/llts65…

(2/6) Understand what the longer-time frame #tradingstrategy is - it uses charts with a more significant time frame from one hour to one day and has slower price changes. 📈⏳

(3/6) Benefits of #trading this way - you don't have to spend the entire trading day in front of a computer and it helps control emotions as you can make better trading decisions when not as emotional. 🤯

Stocks crashing after your entry?

Try these 5 conformation rules for trading entries.

A Thread🧵

A like and a retweet would help :)

#trading #TRADINGTIPS #tradingstrategy #StockMarket #stocks #TradingSignals #stockmarkets

@kuttrapali26 @Curious_Indian_ @JayneshKasliwal

Try these 5 conformation rules for trading entries.

A Thread🧵

A like and a retweet would help :)

#trading #TRADINGTIPS #tradingstrategy #StockMarket #stocks #TradingSignals #stockmarkets

@kuttrapali26 @Curious_Indian_ @JayneshKasliwal

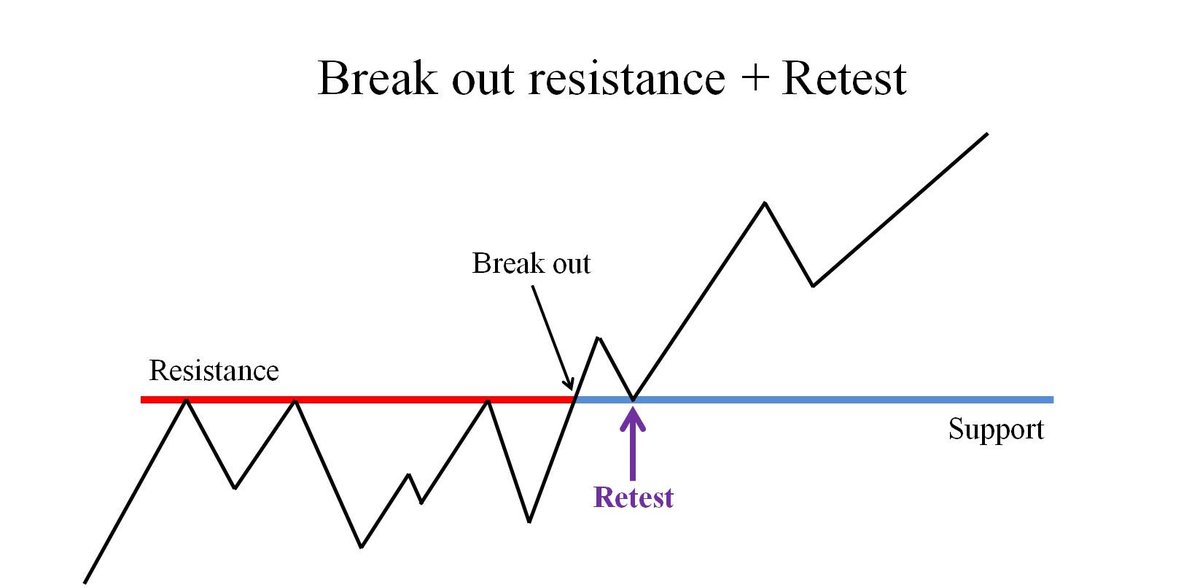

Losing money in breakout?

Try going for the stocks which have retested

Below in the thread🧵is detailed explanation with examples

#Nifty #trading #tradingstrategy #strategies #nseindia #StockMarketindia #StockMarket #stocks #sharemarket

@kuttrapali26 @JayneshKasliwal @VCPSwing

Try going for the stocks which have retested

Below in the thread🧵is detailed explanation with examples

#Nifty #trading #tradingstrategy #strategies #nseindia #StockMarketindia #StockMarket #stocks #sharemarket

@kuttrapali26 @JayneshKasliwal @VCPSwing

When a stock gives a breakout but fails to go in the direction and complete its target then it is called as failed breakout or a fakeout. In this type of situation stock either consolidates or goes in the opposite direction. Refer to the images for better understanding.

[2/6]

[2/6]

#retest

whenever a stock trails back to the resistance after a breakout and bounces off from support and starts moving towards the target that time it is called as a retest entry. This is one of the best approaches for breakouts.

[3/6]

whenever a stock trails back to the resistance after a breakout and bounces off from support and starts moving towards the target that time it is called as a retest entry. This is one of the best approaches for breakouts.

[3/6]

New #TradingStrategy: 𝐀𝐜𝐜𝐫𝐮𝐚𝐥 𝐀𝐧𝐨𝐦𝐚𝐥𝐲

In 1996 Researchers found a very interesting relation between a company's accrual and its stock performance.

YOU can use it to make PROFIT.

A Thread 🧵👇

In 1996 Researchers found a very interesting relation between a company's accrual and its stock performance.

YOU can use it to make PROFIT.

A Thread 🧵👇

But first what is Accruals?

When a company sells some goods to customers, customers may pay them immediately (in cash) or in the future (receivables).

In the accrual systems of accounting, we register them as earning.

So, earning = cash + accruals

(2/n)

When a company sells some goods to customers, customers may pay them immediately (in cash) or in the future (receivables).

In the accrual systems of accounting, we register them as earning.

So, earning = cash + accruals

(2/n)

As you see, not all earnings are same.

Example, company X and Y both have earning = $10. But their earning components could be very different. E.g.

EPS Cash Accrual

Comp X $10 $6 $4

Comp Y $10 $2 $8

(3/n)

Example, company X and Y both have earning = $10. But their earning components could be very different. E.g.

EPS Cash Accrual

Comp X $10 $6 $4

Comp Y $10 $2 $8

(3/n)

How to use mean reversion in time series.

#Thread 🧵

#trading #trading #stockmarket #trader #stockmarketindia #strategy #rsi #tradingstrategy #algotrading #career

#Thread 🧵

#trading #trading #stockmarket #trader #stockmarketindia #strategy #rsi #tradingstrategy #algotrading #career

Pivotes: Soportes y Resistencias.

Una herramienta básica que tenes que tener en tu arsenal de AT es la capacidad de identificar soportes y resistencias, o como les digo yo, pivotes.

Vamos a ver que es cada uno y algunos trucos para identificarlos!

⬇️⬇️⬇️

Una herramienta básica que tenes que tener en tu arsenal de AT es la capacidad de identificar soportes y resistencias, o como les digo yo, pivotes.

Vamos a ver que es cada uno y algunos trucos para identificarlos!

⬇️⬇️⬇️

¿Que es un pivote?

Un pivote se define como un area de apoyo o de rechazo. Es una zona del grafico a la que el grafico ha reaccionado de un modo otro.

Fijate como me refiero a un "area": Un pivote JAMAS tiene un valor exacto.

Un pivote se define como un area de apoyo o de rechazo. Es una zona del grafico a la que el grafico ha reaccionado de un modo otro.

Fijate como me refiero a un "area": Un pivote JAMAS tiene un valor exacto.

🎯11 Momentum Stocks🎯

In this thread, scanned some interesting momentum stocks from Technical & Fundamental aspects, which could be worth a look.

.

As per Nimblr TA

.

#Stocks #Watchlist #investing #StockMarketindia

In this thread, scanned some interesting momentum stocks from Technical & Fundamental aspects, which could be worth a look.

.

As per Nimblr TA

.

#Stocks #Watchlist #investing #StockMarketindia

1⃣Orient Abrasives Ltd

✅CMP - 36.35

.

✍️Note:

Best Buy @ 33.85 / 33.05 SL 28.30 TGTS 45.60 / 49.40 / 53.20 from 1 / 2 / months

.

Technical Indicator CCI 34 Daily > 100 provides Buy.

.

#OrientABrasives #Stocks #watchlist #StocksInFocus

✅CMP - 36.35

.

✍️Note:

Best Buy @ 33.85 / 33.05 SL 28.30 TGTS 45.60 / 49.40 / 53.20 from 1 / 2 / months

.

Technical Indicator CCI 34 Daily > 100 provides Buy.

.

#OrientABrasives #Stocks #watchlist #StocksInFocus

2⃣ Balaji Telefilms Limited

✅CMP - 72.90

✍️Note:

Best Buy @ 70 SL 57 TGTS 87/101/130/148 Period 1/2/5/8 months.

Technical Indicator CCI 34 Weekly > 100 provides Buy

.

#Balaji #Stocks #watchlist #StocksInFocus

✅CMP - 72.90

✍️Note:

Best Buy @ 70 SL 57 TGTS 87/101/130/148 Period 1/2/5/8 months.

Technical Indicator CCI 34 Weekly > 100 provides Buy

.

#Balaji #Stocks #watchlist #StocksInFocus