Discover and read the best of Twitter Threads about #VIX

Most recents (24)

1/ Markets are down and the Vix is...down.

Why is the Vix sub-14? And what is the Vix?

Debrief from my convo with a equity volatility options trader.

What happens from here?

Charts below.

#VIX #volatility #nvidia

Why is the Vix sub-14? And what is the Vix?

Debrief from my convo with a equity volatility options trader.

What happens from here?

Charts below.

#VIX #volatility #nvidia

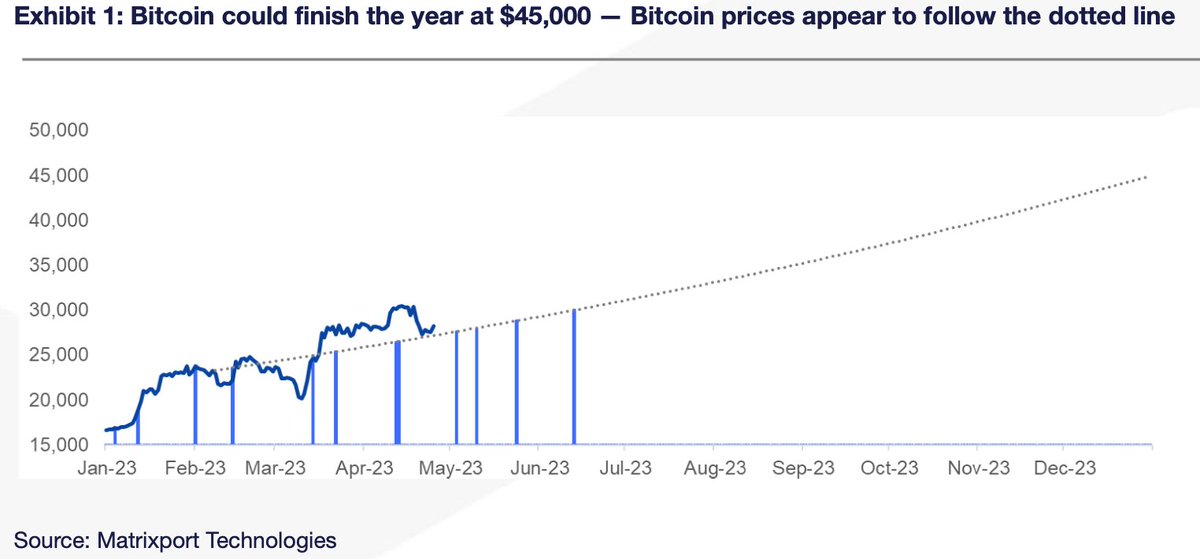

#Bitcoin prices set to reach $45,000 this year, says report - Follow the 'fair value' roadmap for optimal #tradingstrategy ⬇️🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

1/10: Despite recent #volatility, #Bitcoin prices are where they should be according to our #CPI/#FOMC roadmap laid out in Feb.

2/10: Based on the Jan. Effect, #Bitcoin could finish the year around $45k, which seemed optimistic at $22k, but is now achievable.

This is the start of Drip Drops Knowledge!

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

The first official Knowledge Drop. $GME reported earnings last night and is up over 50% this morning. A short float of 24% (as reported by #Ortex) might have something to do with that. Breakdown in slide, follow me for weekly Knowledge Drops!

#GME #ShortSqueeze

#GME #ShortSqueeze

Last week, I discussed the concept of a “short squeeze.” This week let’s look at the dynamics of dealer hedging and the concept of a “gamma squeeze.”

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

Somehow our pinned tweet disappeared, so here it is again

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

Przegląd Tygodnia.

- Indeks dolara

- VIX

- S&P500, NASDAQ

- USD/PLN

- Złoto, Ropa, Gaz

- BTC, ETH

- WIG20

Proszę udostępnij ten wpis, jeśli ten przegląd Ci się spodobał.

Dziękuje.💚

- Indeks dolara

- VIX

- S&P500, NASDAQ

- USD/PLN

- Złoto, Ropa, Gaz

- BTC, ETH

- WIG20

Proszę udostępnij ten wpis, jeśli ten przegląd Ci się spodobał.

Dziękuje.💚

🚨Discorso di #Powell all'Economic Club di Washington🚨

Fra una ventina di minuti zio Powell tornerà a parlare dopo il recente #FOMC.

Seguiamo #live il discorso per capire se la #FED confermerà la sua posizione o se verrà in contro ai mercati

LIVE THREAD⬇️🧵

Fra una ventina di minuti zio Powell tornerà a parlare dopo il recente #FOMC.

Seguiamo #live il discorso per capire se la #FED confermerà la sua posizione o se verrà in contro ai mercati

LIVE THREAD⬇️🧵

@crypto_gateway @GatewayMeme @CryptoMeme_Ita @MemeingBitcoin @AFTSDCrypto @hardrockcrypto @MarcheseCrypto @TradingonIt @BitCryptoRepost @financialjuice 1/ Per seguire il discorso ecco qui il link 🔗

@crypto_gateway @GatewayMeme @CryptoMeme_Ita @MemeingBitcoin @AFTSDCrypto @hardrockcrypto @MarcheseCrypto @TradingonIt @BitCryptoRepost @financialjuice 2/ Prima di cominciare è molto interessante l'intervento di ieri di Bostic della FED:

"Se necessario si potrà rivalutare la possibilità di tornare ad almeno un rialzo di 50 bps."

"Se necessario si potrà rivalutare la possibilità di tornare ad almeno un rialzo di 50 bps."

The regular flat grid chart is misleading to retail. The big money uses diamonds. It works on any minute chart and on a daily as well. that is how they communicate/coordinate beating retail. I discovered this 3 -4 month ago and it never fails.

The fight is now on the downward channel the bulls wanted to stop the cycle of down trends pushing it artificially higher to prevent $300. A downtrend channel is inevitable but what channel is the important question. because the next bottom moves higher.

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Przegląd Tygodnia.

- Indeks dolara

- S&P500, NASDAQ

- VIX

- USD/PLN

- Złoto, Ropa, Gaz

- BTC, ETH

- WIG20

Proszę udostępnij ten wpis, jeśli ten przegląd Ci się spodobał.

Dziękuje.💚

- Indeks dolara

- S&P500, NASDAQ

- VIX

- USD/PLN

- Złoto, Ropa, Gaz

- BTC, ETH

- WIG20

Proszę udostępnij ten wpis, jeśli ten przegląd Ci się spodobał.

Dziękuje.💚

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

The Bear's take:

•Recession is just around the corner

• Rates and valuations are high

• Geopolitical tensions

• Friday, stocks rise on low volume

• Earnings will be low

•China Covid shutdown hurt earnings

• Market is overbougth

• #VVIX is rising

#SPX #ES_F $SPX #options

•Recession is just around the corner

• Rates and valuations are high

• Geopolitical tensions

• Friday, stocks rise on low volume

• Earnings will be low

•China Covid shutdown hurt earnings

• Market is overbougth

• #VVIX is rising

#SPX #ES_F $SPX #options

NEXT WEEK

The Bull's take

• Inflation/Commodities/Oil/$ are ↓

• $DJI chart is very bullish. $DJT and $IWM also look good

•Up week on increasing volume

• $VIX and #DXY in strong donwtrend

•Breadth indicators are strong

•Positive divergence from CCI, RSI, ROC, Stochastics

The Bull's take

• Inflation/Commodities/Oil/$ are ↓

• $DJI chart is very bullish. $DJT and $IWM also look good

•Up week on increasing volume

• $VIX and #DXY in strong donwtrend

•Breadth indicators are strong

•Positive divergence from CCI, RSI, ROC, Stochastics

If you haven't read it

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

" #DJT made an excellent breakout and closed above 20 and 100DMA. It closed right at its 50DMA. Bullish action from a leading indicator. $DJT will have to surpass the conjunction of 50DMA and 200DMA next week, in order to validate more upward moves"

It did that yesterday

#ES_F

It did that yesterday

#ES_F

$QQQ

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

🧵

1/

Stocks $SPY off to a strong start so far in 2023, gaining ~2% in first 5 days

- is this important?

- actually, it’s a big deal

1/

Stocks $SPY off to a strong start so far in 2023, gaining ~2% in first 5 days

- is this important?

- actually, it’s a big deal

1/6

1st Week of 2023 - went opposite to what I expected. Oil had a correction while bonds got bought in size, stocks were mostly flat, caught a bid on Friday:

1st Week of 2023 - went opposite to what I expected. Oil had a correction while bonds got bought in size, stocks were mostly flat, caught a bid on Friday:

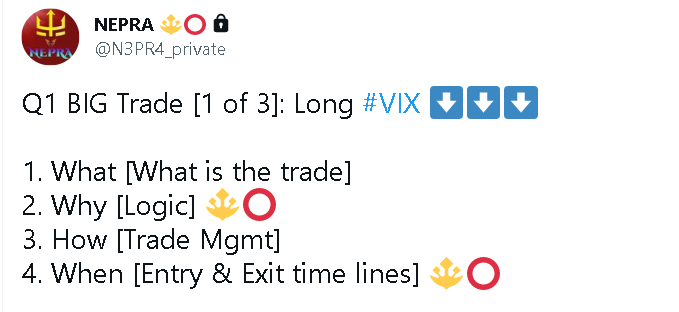

Q1 Big Trade: Long #VIX⬇️⬇️⬇️

HOW [my SOP for swings]

1. Break your standard size into 4.

2. Enter Long on every red day

3. Of the 4 trades, take profit on 2 trades on every green day. Keep the 2 open until exit date.

4. Size reduce to 3 after T1; no adds after T2.

5. If price is below Low Range - don't add

1. Break your standard size into 4.

2. Enter Long on every red day

3. Of the 4 trades, take profit on 2 trades on every green day. Keep the 2 open until exit date.

4. Size reduce to 3 after T1; no adds after T2.

5. If price is below Low Range - don't add

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

TODAY IN THE MARKETS

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$XLF

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

Today in the markets

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$DIA

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

The market today:

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$DIA / $DJI / $YM

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

$QQQ / $NDX / $NQ

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

VIX/WEEKLY

Maksimum 20-20.50 fiyatından yukarı yönlü dönüş bekliyorum.

Bu durum olursa bizlere ayı piyasası rallisinin bittiğini gösterir.

Sonuç olarak #BTC özelinde daha iyi alım yerleri oluşmasını bekliyorum.

#VIX ⬆️ #BTC ⬇️

Maksimum 20-20.50 fiyatından yukarı yönlü dönüş bekliyorum.

Bu durum olursa bizlere ayı piyasası rallisinin bittiğini gösterir.

Sonuç olarak #BTC özelinde daha iyi alım yerleri oluşmasını bekliyorum.

#VIX ⬆️ #BTC ⬇️

Ayı piyasası rallisinde demek istediğim(Nasdaq spx de) yaşanan yükselişlerin bitmesini bekliyorum,btc bazında yükselis zaten olmadı.

Spx ve Nasdaq yükselirken btc yükselemedi,peki ya durum tersine dönerse olası bir Nasdaq düşüsünde btc ne tepki verecek ?

Buradaki odak noktamız VIX olmalı..

Buradaki odak noktamız VIX olmalı..

Learn something new everyday:

Did you know that you cannot buy #vix spot and only #vix futures via $UVXY instrument.

🧵👇

Did you know that you cannot buy #vix spot and only #vix futures via $UVXY instrument.

🧵👇

Furthermore, this instrument calculates options chain of all #vix contracts on a 30d weighted basis.

From CBOE: calculated by using the midpoint of real-time S&P 500® Index (SPX) option bid/ask quotes...cont

From CBOE: calculated by using the midpoint of real-time S&P 500® Index (SPX) option bid/ask quotes...cont

More specifically, the VIX Index is intended to provide an instantaneous measure of how much the market thinks the S&P 500 Index will fluctuate in the 30 days from the time of each tick of the VIX Index.

$SPX

Our usual "NEXT WEEK" is here

"The Bear's take , The Bull's take, Our Take"

Subscribe to our Free newsletter for more info on Gamma, Regression analysis, CL, DXY, FAANG stocks etc

pointblanktrading.substack.com

Our usual "NEXT WEEK" is here

"The Bear's take , The Bull's take, Our Take"

Subscribe to our Free newsletter for more info on Gamma, Regression analysis, CL, DXY, FAANG stocks etc

pointblanktrading.substack.com

NEXT WEEK

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•Bearish weekly candles

•Violation of June lows

#SPX $SPY $ES $SPX #trading

#inflation

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•Bearish weekly candles

•Violation of June lows

#SPX $SPY $ES $SPX #trading

#inflation