Discover and read the best of Twitter Threads about #goldstocks

Most recents (10)

Thought of the day:

We are often wrong....15% for cycle bottoms, but right 85% of the time. Often 50% initial draw downs bag 10x, as the sitting proves out in our favour. We can't be right unless we are wrong in the very short term.

We are often wrong....15% for cycle bottoms, but right 85% of the time. Often 50% initial draw downs bag 10x, as the sitting proves out in our favour. We can't be right unless we are wrong in the very short term.

Theme and Position sizing is key...

Each new asymmetric theme has a 5-7% weighting

Each position within the theme has a 1-2% weighting

Most themes produce 8-13x returns on average

Each new asymmetric theme has a 5-7% weighting

Each position within the theme has a 1-2% weighting

Most themes produce 8-13x returns on average

If we are extremely compelled, which is very irregular, but is aligned with putting the buckets out, we will go to 20% in a theme and up to 5% in a position.

This would be for a repeatable asymmetric theme we have been successful in multiple times in the last 40 years.

This would be for a repeatable asymmetric theme we have been successful in multiple times in the last 40 years.

#Gold

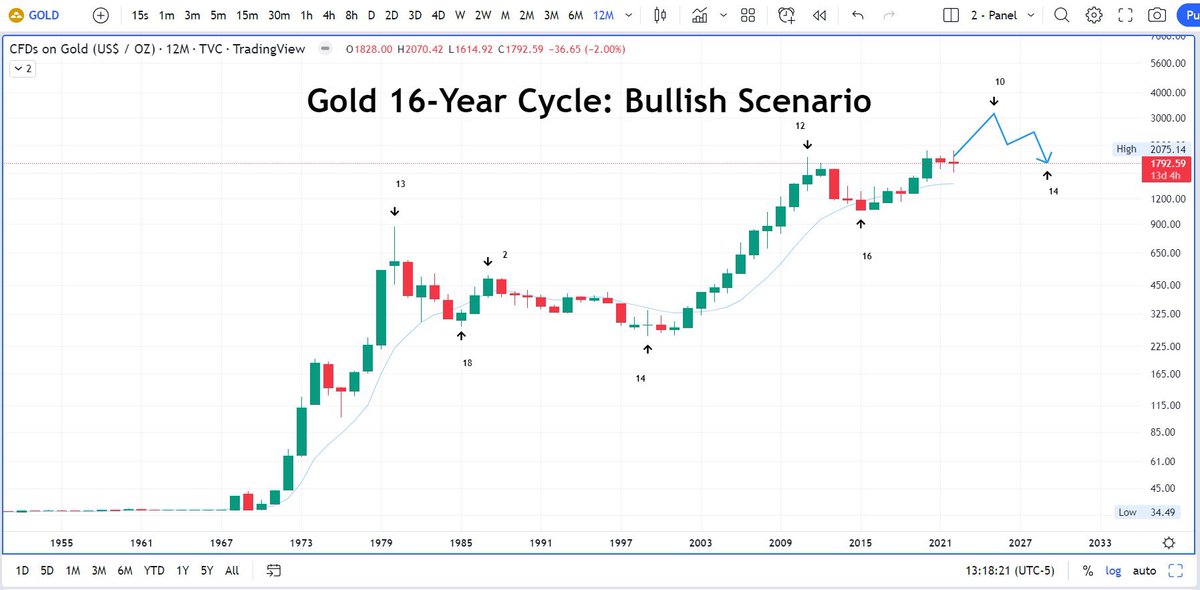

There is a 16 year cycle for gold

The low is expected around 2029

2023 will be year 8 and so far year 5 (2020) is the high

See charts for bullish vs. bearish scenarios

#DXY #USD #goldprice #GOLD #SPX $GLD $SLV #SPX #QQQ $gld $silver #goldstocks #silver #silversqueeze

There is a 16 year cycle for gold

The low is expected around 2029

2023 will be year 8 and so far year 5 (2020) is the high

See charts for bullish vs. bearish scenarios

#DXY #USD #goldprice #GOLD #SPX $GLD $SLV #SPX #QQQ $gld $silver #goldstocks #silver #silversqueeze

#Gold

**30 year cycle**

Video review of the "30 year cycle"

There are 16 year cycles that you need to be paying attention to. Charts in following tweets

#DXY #USD #goldprice #GOLD #SPX $GLD $SLV #SPX #QQQ $gld $silver #goldstocks #silver #silversqueeze

**30 year cycle**

Video review of the "30 year cycle"

There are 16 year cycles that you need to be paying attention to. Charts in following tweets

#DXY #USD #goldprice #GOLD #SPX $GLD $SLV #SPX #QQQ $gld $silver #goldstocks #silver #silversqueeze

As the #commodity stock wreckage mounts up, some gems to focus in on:

A) Negative EV, net cash exceeds cap and the resource is for free

B) 90-95% decliners with no material change in value, just massive expectations de-rating

C) Cap<8% of project NPV (focus > 70% IRRs)

#gold

A) Negative EV, net cash exceeds cap and the resource is for free

B) 90-95% decliners with no material change in value, just massive expectations de-rating

C) Cap<8% of project NPV (focus > 70% IRRs)

#gold

So for #goldstocks, look Cap/oz of less than <US$10 (resources > 1moz), ofcourse negative on an EV/oz basis.

What would this be worth at the next cycle peak? Likely over $70-100/oz assuming $2300+ #gold price peak.

What would this be worth at the next cycle peak? Likely over $70-100/oz assuming $2300+ #gold price peak.

The typical #Commodity or #goldstock graph that tends to interest us if backed up with fundamentals, we would expect 1H 2023 this could bottom at 2c down 50% from current levels (-95%+ from cycle peak), offering 20x returns over the following 48 months.

For fundamentals we would like to see 4-7c of potential annual cashflow 3 years out to back our 20x return.

This is how to create wealth, deployment of capital near a cycle bottom can grow by 10-20x over the following 48 months.

Get in step and alignment with the upcoming cycle bottom - this is the best guidance we can give any investor

#wealthcreation

#investing101

#cyclebottoms

Get in step and alignment with the upcoming cycle bottom - this is the best guidance we can give any investor

#wealthcreation

#investing101

#cyclebottoms

#commodities #uranium

To get in alignment with the incoming bottom, likely 1H 2023 (the pivot on monetary tightening and peak USD), several spots will decline by 30% & high beta related equities by up to 60%. Be prudent in ones scale in, we are using future return as a guide.

To get in alignment with the incoming bottom, likely 1H 2023 (the pivot on monetary tightening and peak USD), several spots will decline by 30% & high beta related equities by up to 60%. Be prudent in ones scale in, we are using future return as a guide.

History indicates 90-95% stock decliners within #commodity sectors often offer interesting recovery returns of 15-20x (all being even), expect this to play out in many cases through 1H 2023.

Where are our bids?

A) where we can obverse Cap/CF <0.5x 3 yrs out

B) Cap < 5% of NPVs

Where are our bids?

A) where we can obverse Cap/CF <0.5x 3 yrs out

B) Cap < 5% of NPVs

How to use future returns as a scale in guide?

For us we are looking for 8x plus returns over 48 months, so to achieve this an ideal buy in is <5% of NPV and/or <0.5x Cap/CF 3yrs out

These often present themselves near cycle bottoms....

#commodities

#cyclicals

#investing101

For us we are looking for 8x plus returns over 48 months, so to achieve this an ideal buy in is <5% of NPV and/or <0.5x Cap/CF 3yrs out

These often present themselves near cycle bottoms....

#commodities

#cyclicals

#investing101

Cycle Bottom rule of thumbs:

A) Do we have multiple asymmetric trades across this new theme?

B) Can we assess the catalysts for the bottoming process over the next 3 to 9 months?

C) Are the bottoming valuations supportive of 10x returns over the next 60 months?

#goldstocks

A) Do we have multiple asymmetric trades across this new theme?

B) Can we assess the catalysts for the bottoming process over the next 3 to 9 months?

C) Are the bottoming valuations supportive of 10x returns over the next 60 months?

#goldstocks

The sort of 20 year plus #goldstock graph that excites us, all positive expectations beaten out and a return to 15-20 year lows, down 90-95%, peaks correlating to #gold sector peaks. This becomes interesting 🤔 in the next 20-30% downside.

Couple this with fundamentals of material ozs in the ground, in accessible locations, a reasonable cash stack. Bonus' are a great low capex NPV with high IRR.

#goldstocks the round trip is incoming, a 15-20 year bottoming is not far out on the horizon.

#gold

#goldstocks the round trip is incoming, a 15-20 year bottoming is not far out on the horizon.

#gold

#goldstocks next asymmetric theme incoming 1H 2023 as the USD peaks and markets bottom, holding time 36-48 months.

Still likely plenty of downside to rock bottom, but many of the 5 baggers with become 10 baggers in the final wash out, scale in slowly, avoid potentially high diluters.

We like high IRR projects with low capex start ups trading below cash backing is an added bonus.

#goldstocks

We like high IRR projects with low capex start ups trading below cash backing is an added bonus.

#goldstocks

Classic signs of #goldstock value and 5-10x returns:

A) funded road to production and trading on less than 0.3x Cashflow 3 years out (near zero dilution potential)

B) healthy in the ground gold resource with good grade, trading on negative EV (cash exceeds cap), Cap/oz < $5

A) funded road to production and trading on less than 0.3x Cashflow 3 years out (near zero dilution potential)

B) healthy in the ground gold resource with good grade, trading on negative EV (cash exceeds cap), Cap/oz < $5

$GMTN heading towards negative EV

1m oz resource at high grade with positive drilling results

65koz low capex production ramp up, NPV 10x cap and expanding

Optimization issues on start up

Accummulation zone incoming 8-18c, below <12c 10x return potential

#goldstocks

1m oz resource at high grade with positive drilling results

65koz low capex production ramp up, NPV 10x cap and expanding

Optimization issues on start up

Accummulation zone incoming 8-18c, below <12c 10x return potential

#goldstocks

It's starting to tick the boxes

A) negative EV

B) free pounds in the ground

C) low capex ramp up

D) nice grade

E) 10x plus NPV upside

F) hated by the market

G) optimization could kick in 3-6 months time

H) cycle bottoming incoming over 4-9 months

I) low dilution risk Vs M&A

A) negative EV

B) free pounds in the ground

C) low capex ramp up

D) nice grade

E) 10x plus NPV upside

F) hated by the market

G) optimization could kick in 3-6 months time

H) cycle bottoming incoming over 4-9 months

I) low dilution risk Vs M&A

Please note any new bottoming theme over the next 3 to 9 months, one should have 5 candidates to mitigate stock specific risk.

If our #gold watchlist falls by 50% from here as the bottoming process kicks in, the average return will likely be 10-15x over the following 3-5 years.

If our #gold watchlist falls by 50% from here as the bottoming process kicks in, the average return will likely be 10-15x over the following 3-5 years.

🚨💥 $SGO $SMOFF Webinar Summary Thread💥🚨

#gold #GoldStocks

Will cover

- Property 🇲🇽

- Approach

- Upcoming 👀

- Financing

- Chart 📈

LINK:

🧐🧠📈🤑😎

$KL $ELD $ABX $LUG $SSL $DPM $AEM $AGI $KDK $ROS $GXS $GL $GLD $NFG $EQX $GBR $RLG $NXS $PAC $TGM

#gold #GoldStocks

Will cover

- Property 🇲🇽

- Approach

- Upcoming 👀

- Financing

- Chart 📈

LINK:

🧐🧠📈🤑😎

$KL $ELD $ABX $LUG $SSL $DPM $AEM $AGI $KDK $ROS $GXS $GL $GLD $NFG $EQX $GBR $RLG $NXS $PAC $TGM

$SGO PROPERTY - Cerro Caliche - Mexico

- Dozen of other mines surrounding them

- 4 high grade zones (slide)

- Great extension work on these zones

- All zones are shallow - mineralization starts at surface down to 80m

- Assays coming in Jan

- Dozen of other mines surrounding them

- 4 high grade zones (slide)

- Great extension work on these zones

- All zones are shallow - mineralization starts at surface down to 80m

- Assays coming in Jan

$SGO APPROACH

- Production to generate cash flow to further expand operations

- Insiders hold 21% of shares = highly motivated

- Looking to advance share price thru fundamentals

Investigated 20% of prospective mineralization = reasonable to assume million ounce resource 👀

- Production to generate cash flow to further expand operations

- Insiders hold 21% of shares = highly motivated

- Looking to advance share price thru fundamentals

Investigated 20% of prospective mineralization = reasonable to assume million ounce resource 👀