Discover and read the best of Twitter Threads about #commodity

Most recents (24)

On Business #Sales

1. While #households create most of the spending in the economy, businesses engage in investment and employment to generate profits. Therefore, sustained #consumption is contingent upon companies using labor to create output.

1. While #households create most of the spending in the economy, businesses engage in investment and employment to generate profits. Therefore, sustained #consumption is contingent upon companies using labor to create output.

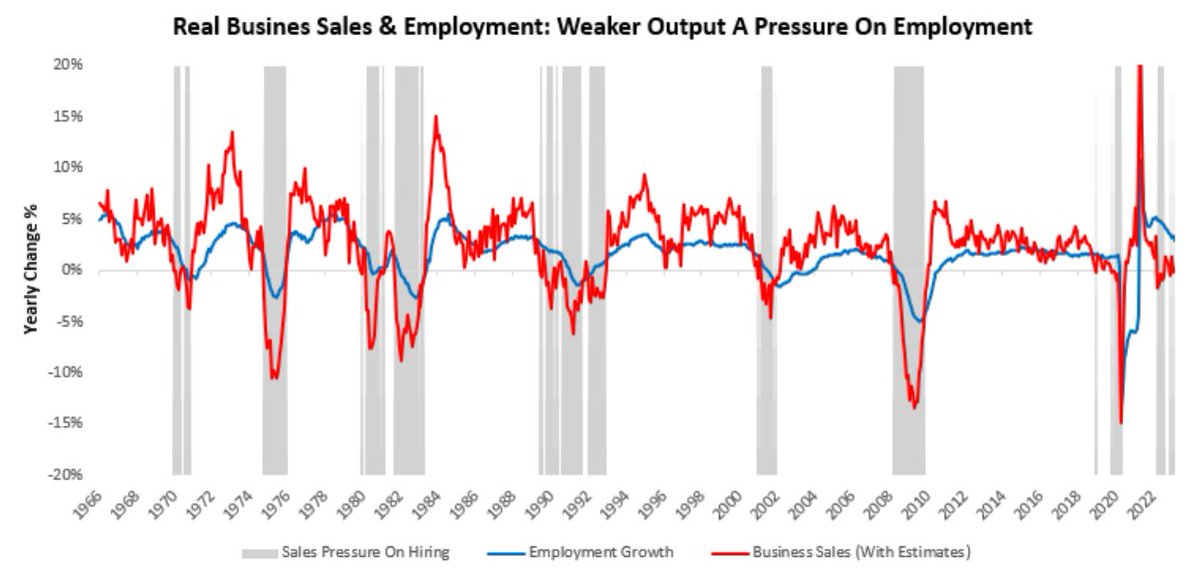

2. Typically, when output has declined, employment has followed suit. We show this in the visualization above.

3. In the visualization presented in 1. we show howe show how periods of decline in real business sales (i.e., business output) create pressure on employment growth. Every period of protracted contraction in real sales has resulted in an eventual contraction in unemployment.

#Commodity sector continues its strong start to June with the Bloomberg Commodity Index trading up 3.5% to a three-week high

Technical perspective: #copper, #gold, #silver are all showing signs of bottoming out with multiple factors adding support (1/5)

home.saxo/content/articl…

Technical perspective: #copper, #gold, #silver are all showing signs of bottoming out with multiple factors adding support (1/5)

home.saxo/content/articl…

Apart from a softer dollar providing a general lift following weeks of strength, we are seeing increased speculation that the Chinese government may step up its support for the economy and some signs that demand is holding up

It's impossible to retweet this too many times.

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

@POTUS @vonderleyen @ZelenskyyUa #Rand Co | Jan 25

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse

No commodity flies in the face of contagion in the wider #commodity space or falling equity markets unless they have a unique short term (< 4m) supply deficit. So if you are calling a bottom now pre-recession and pivot contagion, does yours have that deficit? For #uranium buyers.

So in short,

An average #uranium stock will do 4x from today assuming $100 spot is sustained for 6 months plus

An exceptional player 10x.

At the incoming downleg bottom avg 5x and exceptional 12x.

An average #uranium stock will do 4x from today assuming $100 spot is sustained for 6 months plus

An exceptional player 10x.

At the incoming downleg bottom avg 5x and exceptional 12x.

Are we selling, no, are we buying, on a 25% drop yes as it achieves our threshold of 8x on selected #uranium plays.....

What are we buying?

zero in the top 10 caps

A few explorers (-85%) and pre-production (caps below < US$50m pre ETF entry)

What are we buying?

zero in the top 10 caps

A few explorers (-85%) and pre-production (caps below < US$50m pre ETF entry)

Thought of the day: Recency bias from #commodity peak when everything in the rear vision mirror looks "solid" is an optical illusion, around the bend a cliff is coming into sight a "recession", often stockprices drop 75% plus. Demand can get slaughtered at the margin.

#lithium & #coal are great case studies for those of our followers who don't understand nothing is rare at 80% cash margins and 20% cost.

#cyclicalinvesting101

#cyclicalinvesting101

While balance sheets are materially improved on 2020 levels, so few 95% corrections, but 50-65% are still reality with 75% spot falls from peaks.

PEs < 3x there are hundreds out there in Frontier markets, many growing eps at 20% per year plus. Let alone Fossil fuel stocks.

Remember a < 3x on peak #commodity spots is > 15x on spot lows

#Biden backs strength of #banking system after collapse of #SVB, #SignatureBank | Mar 13

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

#Ukraine-#BanderasBox opened.

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#SVB #SignatureBank #BanderasBox.

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

Hoje completa 1 ano da guerra na #Ucrania, como que está a situação atualmente? A Reuters preparou alguns gráfico bem legais

1) A segurança do #Dollar

A divisa mostrou as razões o porto seguro do mundo! Mesmo após a queda, frente as máximas, subiu 8% desde o início da guerra⤵️

1) A segurança do #Dollar

A divisa mostrou as razões o porto seguro do mundo! Mesmo após a queda, frente as máximas, subiu 8% desde o início da guerra⤵️

2) Custo de #energia

O custo do #naturalgas disparou 400% em duas semanas após a invasão, chegando a 700% em agosto; felizmente o inverno foi + ameno e o bloco encontrou novos fornecedores, trazendo o custo novamente para 50 MWh ⤵️

O custo do #naturalgas disparou 400% em duas semanas após a invasão, chegando a 700% em agosto; felizmente o inverno foi + ameno e o bloco encontrou novos fornecedores, trazendo o custo novamente para 50 MWh ⤵️

3) Alimentos

Os preços das #commodities agrícolas, que já estava em alta desde 2021, dispararam novamente após a invasão. O index de alimentos da ONU disparou 14,3% ano passado e já havia subido 28% em 2021

A pressão está diminuindo, mas o clima tem preocupado a produção⤵️

Os preços das #commodities agrícolas, que já estava em alta desde 2021, dispararam novamente após a invasão. O index de alimentos da ONU disparou 14,3% ano passado e já havia subido 28% em 2021

A pressão está diminuindo, mas o clima tem preocupado a produção⤵️

"Bitcoin is a system based on rules not rulers"

Recently, RBI Governor called for a ban on crypto

But, the promise of Crypto and Bitcoin is stronger than ever 👇👇

#bitcoin #crypto #RBI #money #commodity #banks #gold

cryptobeans.beehiiv.com

Recently, RBI Governor called for a ban on crypto

But, the promise of Crypto and Bitcoin is stronger than ever 👇👇

#bitcoin #crypto #RBI #money #commodity #banks #gold

cryptobeans.beehiiv.com

Let's look at the The History of Money to understand more.

From Barter to Fiat Currency to Cryptocurrency

1/ It all started with the need for trade....

From Barter to Fiat Currency to Cryptocurrency

1/ It all started with the need for trade....

🔸In ancient times, people used the barter system to trade goods and services.

🔸This means that they would directly exchange one item for another without using a medium of exchange, such as money.

2/ But barter is not scalable....

🔸This means that they would directly exchange one item for another without using a medium of exchange, such as money.

2/ But barter is not scalable....

When I get asked for #investing #advice from young people in their 20’s and what they should read etc. Here’s how I typically respond in a thread:

I explain that the first two steps are:

1. figure out what kind of investment style you are best suited for and

2. then try to become as much of an expert at it as you can and find an edge that yields repeatable performance

1. figure out what kind of investment style you are best suited for and

2. then try to become as much of an expert at it as you can and find an edge that yields repeatable performance

One way to attack step one is to moderately acquaint yourself with famous successful investors and then dig down deeper into the ones that you relate most to and find to be similar to you in personality/habits

The November #CPI report is notable in part due to the fact that it displays the second consecutive month of more moderate price pressures, providing some signal that the underlying trend of #inflation is decelerating.

Turning to the data, #coreCPI (excluding volatile food and #energy components) came in at 0.2% month-over-month and rose 6.0% year-over-year.

Meanwhile, #headlineCPI data printed 0.1% month-over-month and came in at 7.1% year-over-year, with declines in #UsedCars, medical care and airline fares contributing to this result. Still, both #shelter costs and the food index rose significantly.

#China will now open up and ramp up its #economic output and send #commodities higher. Likely many will make new highs in the next couple years. Their are also going to support for their #housing #market. twitter.com/i/web/status/1…

The USA and Canada are bother going to continue to see housing market weakness and along with Europe banks will begin to struggle with bad loans. Companies like $CS are in trouble and the #FED and #ECB are will have to slow rate hikes and reverse course next year

The western economies are going to need central bank liquidity injections to prevent implosion. Negative wealth effect combined with increased interest rate expenses take a few months to trickle through. And trust me they pain is coming.

Thought of the day: Price determines our likability of a company, a 95% fall, often changes our view to positive, assuming the fundamentals are considerable, we particularly like <1x cashflow valuations within the next 3 years.

When we accummulated our $AEE position 2018-2020 we paid around:

0.2x 2024/25 Cap/CF

Current Valuation = 0.8x 2024/25 Cap/CF (likely 1.2x fully diluted)

Fair Value 2024 = 5-7x equating to 3-4x upside

Note this excludes Haggen Project which can add 3-5x upside.

#uranium

0.2x 2024/25 Cap/CF

Current Valuation = 0.8x 2024/25 Cap/CF (likely 1.2x fully diluted)

Fair Value 2024 = 5-7x equating to 3-4x upside

Note this excludes Haggen Project which can add 3-5x upside.

#uranium

Achieving a 20-30 bagger generally requires the vision when the stock is trading on <0.2x Cap/CF 3-5 years out. This often couples with #commodity spots below cost curves, which then come into vogue and rise by 3-8x.

1/ What is LandX ($LNDX)? How does it work? How does it bring sustainable yields, and how does it overall increase financial inclusivity? Today’s #visualguide, in collaboration with @landxfinance, will answer all the above questions.

#DeFi #RealYield #RealFi #Agriculture

#DeFi #RealYield #RealFi #Agriculture

2/ You’re probably not that familiar with the problems of traditional farmland financing. The difficulty and opaqueness of the process hinders the farmer’s maximum productivity.

3/ @landxfinance involves three main actors: (1) investors, (2) validators and (3) farmers/landowners. Validators act as a bridge between (1) and (3), investors are those who seek exposure to yield-bearing commodities.

Thought of the day: Locating a 50 bagger for 2023 entry through 2026 exit, likely characteristics, down 95%+ from 2021 peak, volume growth +2-3x, selling price price +1-2x through 2026. Examples: commodity micro cap, a tech turnaround, a crypto token, a REIT or durable goods cap.

#bitcoin miners bottom incoming:

#Bitcoin 12.5k = -30% from here = -93-98.5% = +7-15x

#Bitcoin 10k = -50% from here = -95-99% from peak = +10-20x

#Bitcoin 5k = -75% from here = -97-99.9% from peak = +15-30x

#Survivability test in play, liquidity runway requirements

#Bitcoin 12.5k = -30% from here = -93-98.5% = +7-15x

#Bitcoin 10k = -50% from here = -95-99% from peak = +10-20x

#Bitcoin 5k = -75% from here = -97-99.9% from peak = +15-30x

#Survivability test in play, liquidity runway requirements

#REITs & Durable goods (#USHomebuilders) bottoming likely 2H 2023, where 12 month balance sheet liquidity is under pressure due to frozen credit markets (inability to refinance = elevated default risk)

Very Tight credit conditions = -70% move from here

Frozen Credit = -90% move

Very Tight credit conditions = -70% move from here

Frozen Credit = -90% move

Since #WWII, #USA has used #USdollar hegemony to transfer domestic crises, harvest world #wealth and undermine the economic and financial stability of other countries through armed conflicts, financial wars, and trade wars. To maintain US dollar is to maintain US world hegemony.

Since March 2022, #FederalReserve has raised interest rates 6X. On 2 Nov, its 75-point rate hike and sharp #USdollar appreciation caused global #currency depreciation, capital outflows, rising debt servicing costs, hiked imported inflation and currency/debt crises of countries.

:Collapsed #FTX hit by rogue transactions, analysts saw over $600 million outflows | Nov 12

- suspicious circumstances

m.economictimes.com/tech/technolog…

- suspicious circumstances

m.economictimes.com/tech/technolog…

#UKRAINE "#MILITARYAID" FROM #USA WAS #INVESTED IN CRYPTO "#FTX" BY UKRAINE! | Nov 12

- The sudden collapse of "FTX" and its #Bankruptcy filing today, has revealed that FTX presently suffers from $10-$50 BILLION in liabilities with almost ZERO assets

halturnerradioshow.com/index.php/en/n…

- The sudden collapse of "FTX" and its #Bankruptcy filing today, has revealed that FTX presently suffers from $10-$50 BILLION in liabilities with almost ZERO assets

halturnerradioshow.com/index.php/en/n…

#HeavenlyJerusalem. #FTXbankrupty filing today, has revealed that FTX presently suffers from $10-$50 BILLION in liabilities.

- #Ukraine was receiving money from the US, Ukraine sent it to FTX, Sam #BankmanFried and #FTX sent it to #Democrats

- #Ukraine was receiving money from the US, Ukraine sent it to FTX, Sam #BankmanFried and #FTX sent it to #Democrats

Thought of the day: Fighting #commodity price tops will just result in 75% plus stockprice retracements, #cyclicality music always stops, grab a chair early to avoid serious regrets and portfolio destruction. Easy clue to follow, is 65-80% margins above cost curves are peakish.

Those #commodities that are currently near bottoming (0-20%) for the next up cycle 2H2023-2025....

#tin -65%

#ironore -66%

#nickel -60% (moving up)

#Lumber -72%

#zinc -40%

#HRCSteel -67%

Know where you are in the cycle....

#tin -65%

#ironore -66%

#nickel -60% (moving up)

#Lumber -72%

#zinc -40%

#HRCSteel -67%

Know where you are in the cycle....

1st Quartile candidates for the next cycle...

Having $30T of #debt (us gov) means each 1% increase ultimately adds $300b to the yearly interest expense. So ~3.3% rise in rates adds $1T of interest. US Gov already runs >$1T and when they trigger another recession it will be $2T in a hurry as #tax revenue falls

#Powell and the #fomc are bullshit boogeymen to people that understand the reality of the situation. They will print and print and print, because they must. Trillions of new dollars flooding into the real economy each year. The fomc will continue to grow its balance sheet

Ignore the noise and short term vol when these guys speak. Empty words. They are in a box and we all know what they will do to avoid bank failures and cascading debt defaults. They are cruelly shaking the tree and punishing the most vulnerable amongst us.

One huge macro driver for higher sustained #inflation and much higher #commodity prices is that prices will surely have to rise to make it profitable for both Europe and North America to actually return to mining and general self sufficiency.

Emerging market / 3rd world commodity (mining) production accounts of a huge percentages of production of many key minerals. Add in China and Russia’s production and then look at who’s producing and who’s consuming and you’ll see that change is surely coming

Key countries like Chile, Brazil, Peru in South America as well as many parts of the African continent have their mining work suffering greatly from inflation. The worlds mining giants have taken advantage of low cost workers and weak environmental standards for many decades

🧵 Is the American Dream dead? - a tweetstorm

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

1/ There's no denying that we're in a mess!

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

Os #fertilizantes tiveram mais uma queda de preços esta semana, incluindo os nitrogenados, como #urea e Sulfato de Amônia. #naturalgas também registrou queda de preços, já que estoques na Europa estão, quase, cheios. O problema para a #commodity energética, deverá vir no início⤵️

do próximo ano, muito provavelmente, pulando a sazonalidade baixa, entre fevereiro e abril. Mas o que explicar a queda de preços dos fertilizantes? Simples: a demanda. Sabemos que independe de quão pequena seja uma oferta, se a demanda for menor, os preços caem e é justamente ⤵️

isto que está acontecendo com o mercado de fertilizantes. Todos os produtores, eu inclusive, estão avaliando a redução nas aplicações, buscando usar a reserva de nutrientes do solo, já que em anos anteriores, as aplicações foram normais. A Índia ainda não anunciou nenhum ⤵️

As the #commodity stock wreckage mounts up, some gems to focus in on:

A) Negative EV, net cash exceeds cap and the resource is for free

B) 90-95% decliners with no material change in value, just massive expectations de-rating

C) Cap<8% of project NPV (focus > 70% IRRs)

#gold

A) Negative EV, net cash exceeds cap and the resource is for free

B) 90-95% decliners with no material change in value, just massive expectations de-rating

C) Cap<8% of project NPV (focus > 70% IRRs)

#gold

So for #goldstocks, look Cap/oz of less than <US$10 (resources > 1moz), ofcourse negative on an EV/oz basis.

What would this be worth at the next cycle peak? Likely over $70-100/oz assuming $2300+ #gold price peak.

What would this be worth at the next cycle peak? Likely over $70-100/oz assuming $2300+ #gold price peak.

What really causes inflation? 🧵

[a thread for normies - like me]

[a thread for normies - like me]

2/ The problem with #inflation is that it's a very personal experience.

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

3/ Price inflation and monetary inflation have different definitions:

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.