Discover and read the best of Twitter Threads about #GOLD

Most recents (24)

We're hearing more and more about how the CRE market could crumble soon, and take down some banks with it.

But what exactly is CRE, what's wrong with it, and why is it so important?

Time for a Credit 🧵👇

But what exactly is CRE, what's wrong with it, and why is it so important?

Time for a Credit 🧵👇

🤓 What is CRE?

First of all, what exactly is the Commercial Real Estate or CRE market, and what are its components?

To keep it simple, the CRE market can be divided into six main sectors:

Office, Retail, Industrial, Multi-Family Property, Hospitality, and Special Purpose.

First of all, what exactly is the Commercial Real Estate or CRE market, and what are its components?

To keep it simple, the CRE market can be divided into six main sectors:

Office, Retail, Industrial, Multi-Family Property, Hospitality, and Special Purpose.

To break it down further:

Offices = urban high-rises or suburban offices/campuses

Retail = shopping centers (strip or regional malls) + stand alone stores or big-boxes, like Home Depot or Krogers

Industrial = warehouses, manufacturing, and distribution centers 👇

Offices = urban high-rises or suburban offices/campuses

Retail = shopping centers (strip or regional malls) + stand alone stores or big-boxes, like Home Depot or Krogers

Industrial = warehouses, manufacturing, and distribution centers 👇

Since its inception in 2009, #Bitcoin has gained mainstream recognition & acceptance, therefore the need for a Bitcoin Spot ETF has become increasingly important. A $BTC spot ETF would offer numerous benefits, not just for individual investors but for the overall #crypto market

Throughout the years I've talked to numerous high-net-worth people, and I mean the top tier, like 0,1% type.

Many, if not all, are still very skeptical towards Bitcoin, not because they don't like the tech or the possible returns, but because they don't like the EXTERNAL RISK!

Many, if not all, are still very skeptical towards Bitcoin, not because they don't like the tech or the possible returns, but because they don't like the EXTERNAL RISK!

Wealthy people know that protecting their stack is the best way to stay wealthy. Until now, we haven't seen much of this legacy money, except a few high-risk prop firms or some small hedge funds.

Hmm... A Cayman Islands crypto exchange with no audits seems like a much better bet than Regal Gold doesn't it? 😂

Good News: The debt ceiling is resolved, so the Treasury will not default.

Bad News: The Treasury’s accounts are drained, and must be refilled with over $1T.

Question is, could this break the markets?

Time for a Debt 🧵👇

Bad News: The Treasury’s accounts are drained, and must be refilled with over $1T.

Question is, could this break the markets?

Time for a Debt 🧵👇

😵 The Treasury General Account

Let's start at the top here. What exactly is the Treasury General Account or TGA?

Just like it sounds, this is basically the US Treasury’s checking account

Where it holds cash and pays its bills.

Let's start at the top here. What exactly is the Treasury General Account or TGA?

Just like it sounds, this is basically the US Treasury’s checking account

Where it holds cash and pays its bills.

2023 might be 1936 all over again - beyond the weather 🤔

Yes, I'm a nerd🤓

Spent my entire afternoon looking at El Niño (blue) & La Niña (pink) data for the past century. Stars reflect triple dip La Niña, which we just finished. Might explain our unusually dry weather./thread

Yes, I'm a nerd🤓

Spent my entire afternoon looking at El Niño (blue) & La Niña (pink) data for the past century. Stars reflect triple dip La Niña, which we just finished. Might explain our unusually dry weather./thread

#Commodity sector continues its strong start to June with the Bloomberg Commodity Index trading up 3.5% to a three-week high

Technical perspective: #copper, #gold, #silver are all showing signs of bottoming out with multiple factors adding support (1/5)

home.saxo/content/articl…

Technical perspective: #copper, #gold, #silver are all showing signs of bottoming out with multiple factors adding support (1/5)

home.saxo/content/articl…

Apart from a softer dollar providing a general lift following weeks of strength, we are seeing increased speculation that the Chinese government may step up its support for the economy and some signs that demand is holding up

*Hyperinflation*

With inflation soaring the past two years, this term is being thrown around quite a bit recently.

And people are starting to wonder: Could the USD hyperinflate?

Time for a Currency 🧵👇

With inflation soaring the past two years, this term is being thrown around quite a bit recently.

And people are starting to wonder: Could the USD hyperinflate?

Time for a Currency 🧵👇

🤔 What is hyperinflation?

First, hyperinflation is when a currency experiences extraordinary and accelerating rates of inflation

The currency's value falls so quickly it becomes virtually worthless

So, people resort to using alternative forms of money or bartering.

First, hyperinflation is when a currency experiences extraordinary and accelerating rates of inflation

The currency's value falls so quickly it becomes virtually worthless

So, people resort to using alternative forms of money or bartering.

Though incredibly subjective, the academic definition for hyperinflation is when a country experiences inflation rates above 50% per month. Not before that.

49% = “regular inflation” and 50% = “hyperinflation”

Got it. 🤡

49% = “regular inflation” and 50% = “hyperinflation”

Got it. 🤡

#uranium is consumed each year, while #gold is stored in more &more bars,coins & jewellery since centuries.

=Gold stockpile has been growing since centuries,while the uranium stockpile has been decreasing since early 2018 and reached critical low levels now

(1/8)

#commodities

=Gold stockpile has been growing since centuries,while the uranium stockpile has been decreasing since early 2018 and reached critical low levels now

(1/8)

#commodities

#gold is for protection against value loss of fiat money.

So are all hard assets in LT, with that difference that other hard assets have a use / are consumed in society, while gold not really.

#oil, #uranium…need replacement bc they are consumed,gold not.

(2/8)

#commodities

So are all hard assets in LT, with that difference that other hard assets have a use / are consumed in society, while gold not really.

#oil, #uranium…need replacement bc they are consumed,gold not.

(2/8)

#commodities

Think about it.

#oil, #uranium are used to create energy for💡,heating,transport,industry,… & when it has been used, you need to replace it with new oil & uranium (also see comment about difference between oil & uranium)

#gold on the other hand…(next post)

(3/8)

#commodities

#oil, #uranium are used to create energy for💡,heating,transport,industry,… & when it has been used, you need to replace it with new oil & uranium (also see comment about difference between oil & uranium)

#gold on the other hand…(next post)

(3/8)

#commodities

The 100 Year World Reserve Ritual draws to a close and with it brings social unrest, economic collapse and war.

BUT the new cycle begins with a new #GOLD era of wealth and prosperity!

We are entering magical times my friends #XRP

BUT the new cycle begins with a new #GOLD era of wealth and prosperity!

We are entering magical times my friends #XRP

Under this 100 Year model, we find the final bottom by the end of 2024/early 2025.

It is then #XRP becomes the Pheonix and is reborn as the new World Reserve Currency.

It is then #XRP becomes the Pheonix and is reborn as the new World Reserve Currency.

1/ Hey frends! Have you heard the news? @PythNetwork is now officially live on the @injective #mainnet, bringing a whole new level of possibilities for #dApps and the #Injective community!

Let's dive into what this integration means and how it impacts the world of #DeFi🌐

#INJ

Let's dive into what this integration means and how it impacts the world of #DeFi🌐

#INJ

2/

Pyth is an #oracle network that revolutionizes the way real-world data is brought #onchain

Through its innovative low-latency pull oracle design, Pyth publishes continuous real-world #data, inc. prices, for various markets spanning equities, #commodities, forex pairs & #crypto

Pyth is an #oracle network that revolutionizes the way real-world data is brought #onchain

Through its innovative low-latency pull oracle design, Pyth publishes continuous real-world #data, inc. prices, for various markets spanning equities, #commodities, forex pairs & #crypto

3/

With this integration, #Injective #dApps now have seamless access to #Pyth's #onchain #data, empowering #developers and users alike to leverage real-world #asset information within the #blockchain environment. This is a game-changer for Injective's #ecosystem! 🆙

With this integration, #Injective #dApps now have seamless access to #Pyth's #onchain #data, empowering #developers and users alike to leverage real-world #asset information within the #blockchain environment. This is a game-changer for Injective's #ecosystem! 🆙

We went max gld/gdx/gdxj yesterday as tweeted. 4 main reasons:

1) #GOLD and miners below low end of @Hedgeye risk ranges and bullish trade/trend

2)bond yields at upper risk range

3)@KeithMcCullough went max long(macro pro subs see his pa trades

4) @HedgeyeDC on THE CALL yesterday

1) #GOLD and miners below low end of @Hedgeye risk ranges and bullish trade/trend

2)bond yields at upper risk range

3)@KeithMcCullough went max long(macro pro subs see his pa trades

4) @HedgeyeDC on THE CALL yesterday

Said very little progress was being made on debt talks contrary to what the MSM was saying.

BTW,THE CALL is awesome. Case in point. This am @HedgeyeIndstrls said that Deere's numbers were not as bullish as earnings headlines implied. We shorted DE in our PA at the open at $389

BTW,THE CALL is awesome. Case in point. This am @HedgeyeIndstrls said that Deere's numbers were not as bullish as earnings headlines implied. We shorted DE in our PA at the open at $389

(Above top end of RR) and closed it 2 hours later at the low end of risk range($364) also before debt ceiling news so it wasn't luck. We aren't trying to brag but to show u if u use @Hedgeye tools, you can do this without @KeithMcCullough's hand holding.

How to interpret this? Think that it's very much a case of perspective.

Yes, the Central Bank of Turkey is selling #gold, which is counter to the theme of unprecedented central bank buying.

But...

Yes, the Central Bank of Turkey is selling #gold, which is counter to the theme of unprecedented central bank buying.

But...

#Gold has recovered a litle of thegrounds lost over the past few days and is trading around $1963/oz on Friday just after noon in Europe.

The dollar has slipped a little overnight, which has taken the pressure of #gold for the near term.

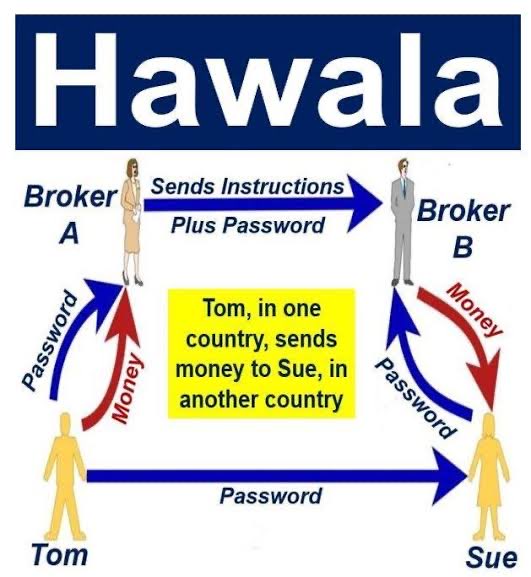

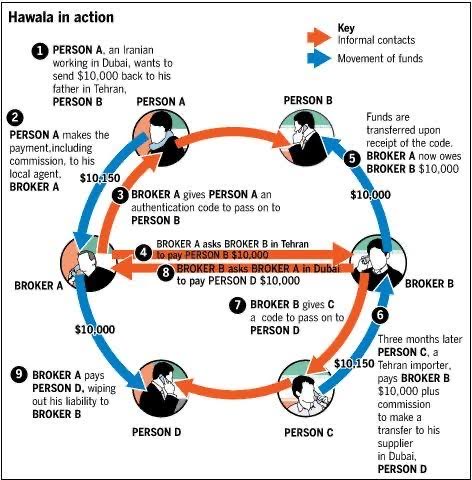

THIS IS #BIG ! #Hawala 2.0 Will EXPLODE in India post JULY 1st. Just My opinion:

By IMPLEMENTING 20% Tax Collected On Source (#TCS) on Foreign Spend (Currency, FX cards, Credit Cards, Debit Cards, Transfers), it becomes Increasingly more Cost Effective to Transfer Via #Hawala

By IMPLEMENTING 20% Tax Collected On Source (#TCS) on Foreign Spend (Currency, FX cards, Credit Cards, Debit Cards, Transfers), it becomes Increasingly more Cost Effective to Transfer Via #Hawala

If you try and BUY #Foreign Currency in the Black, that spread that used to be 2-3%, will now become 10% possibly

Unused Balances of Loaded Forex Cards will Go at a Premium of 10-12%

Unused Balances of Loaded Forex Cards will Go at a Premium of 10-12%

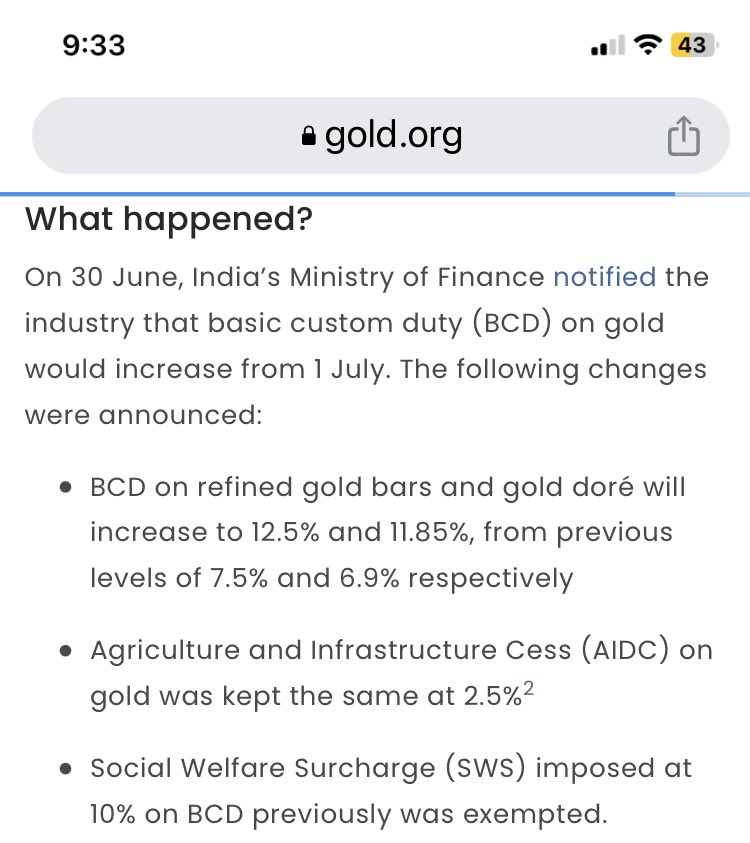

This REMINDS me of what happened in GOLD SMUGGLING in India post June 2022 when @nsitharaman decided to Raise IMPORT duty on GOLD to 12.5% from previous levels of 7.5%

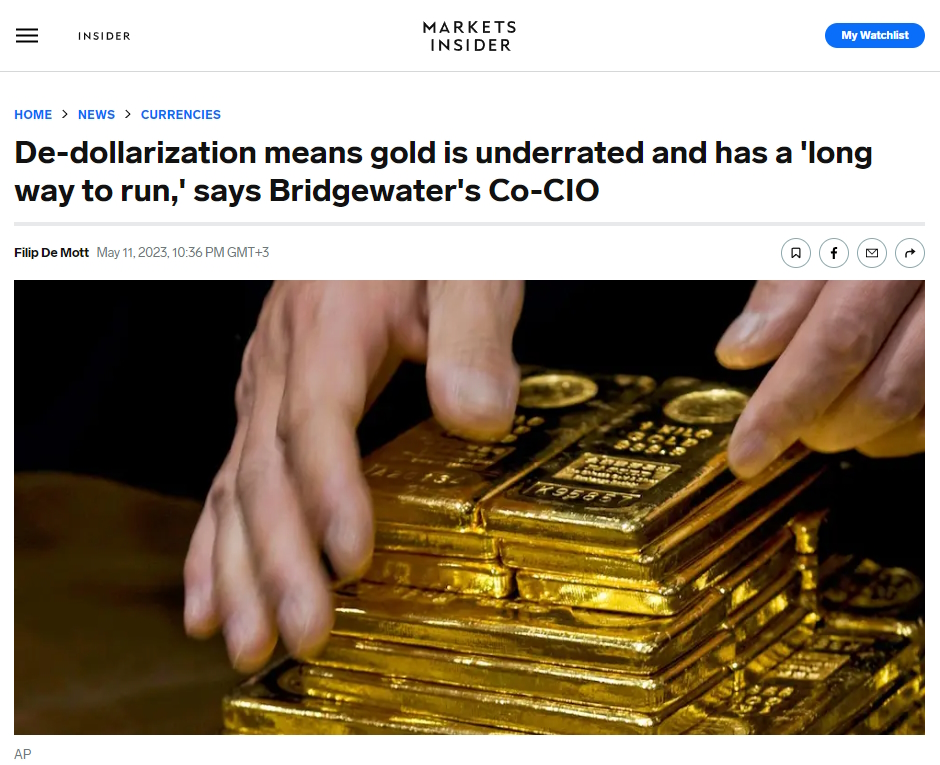

🧵 Gold is underrated and could be pushed up by #Dedollarization, Bridgewater's Co-CIO said.

"This geopolitical turmoil is not going away. This is a slow-moving secular support for #gold," Karen Karniol-Tambour said.

👉 #Inflation will also keep interest in gold elevated as well.

"This geopolitical turmoil is not going away. This is a slow-moving secular support for #gold," Karen Karniol-Tambour said.

👉 #Inflation will also keep interest in gold elevated as well.

#Gold could be at the start of a lasting growth period as global #Dedollarization trends continue, Co-CIO of Bridgewater Associates Karen Karniol-Tambour said.

markets.businessinsider.com/news/currencie…

markets.businessinsider.com/news/currencie…

#Dedollarization is no longer a matter of if, but when, said International Crisis Group cochair Frank Giustra.

A sudden drop in dollar demand could lead to #hyperinflation and a debt crisis, he said.

A sudden drop in dollar demand could lead to #hyperinflation and a debt crisis, he said.

We published a new primer on #gold last week at the same time as #golddemandtrends

"Gold Market Size and Structure"

gold.org/goldhub/resear…

"Gold Market Size and Structure"

gold.org/goldhub/resear…

I'll tweet out some of the highlights from the report for those too lazy to download it.

Above: total stock of #gold above ground is about 209,000t.

Below, the value of this stock.

Above: total stock of #gold above ground is about 209,000t.

Below, the value of this stock.

Note that there are substantial quantities of OTC #gold derivative positions that are not included in this total as this information is not readily or reliably available.

Are you losing sleep over your investments?

Constantly checking prices and worrying?

That’s a sign that you’re probably overexposed and you’ve bitten more than you can chew.

You’ve invested more than you can handle.

These tips are for you 🧵👇

Constantly checking prices and worrying?

That’s a sign that you’re probably overexposed and you’ve bitten more than you can chew.

You’ve invested more than you can handle.

These tips are for you 🧵👇

I need to first make it clear that I’m not a financial advisor but a battle tested, seasoned investor with some life experience!

Rule number 1: Never invest more than you’re willing to lose

But if you have, here are some guidelines…

Rule number 1: Never invest more than you’re willing to lose

But if you have, here are some guidelines…

Reassess Your Risk Tolerance

Before deciding whether to sell or hold, it's important to reassess your risk tolerance. Ask yourself how much risk you're willing to take on and how much you can afford to lose. If you're feeling uneasy about your investment, it may be a sign that… twitter.com/i/web/status/1…

Before deciding whether to sell or hold, it's important to reassess your risk tolerance. Ask yourself how much risk you're willing to take on and how much you can afford to lose. If you're feeling uneasy about your investment, it may be a sign that… twitter.com/i/web/status/1…

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

🪙🪙🪙🚨🚨🚨🚨🚨🚨🪙🪙🪙

❌ Peg #XRP to Gold - Not Possible ❌

✅ Peg #Gold to XRP - Possible ✅

Sounds crazy? Here is how it can be done...

🧵

❌ Peg #XRP to Gold - Not Possible ❌

✅ Peg #Gold to XRP - Possible ✅

Sounds crazy? Here is how it can be done...

🧵

I've expressed before that XRP's value cannot be tied to any particular asset/commodity. A decentralized digital currencies value is determined by the forces of supply and demand. However, what follows is a theoretical and speculative scenario, yet still plausible.

2/18

2/18

First of all, what got me into this train of thought was an article from late last year. Go ahead and read it to grasp some similarities in what I will explain. Essentially its a forced revaluation of gold driven by market oil prices.

3/18

kitco.com/news/2022-12-0…

3/18

kitco.com/news/2022-12-0…

1/7

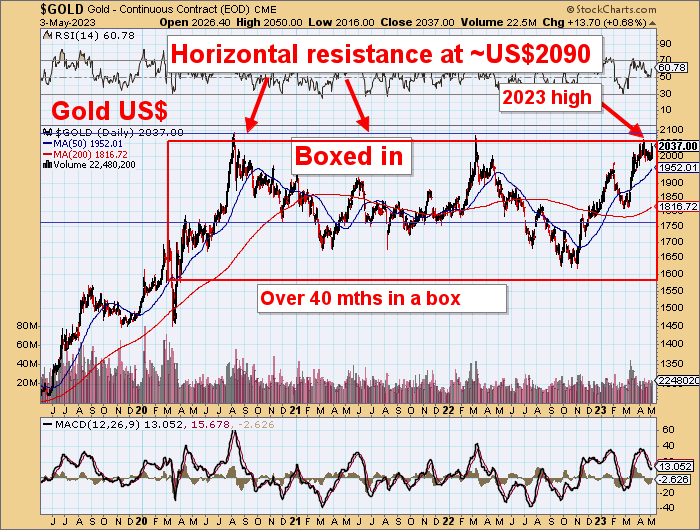

Gold is moving up to test all time highs around US$2089 (basis futures).

The mover higher has been steady so far but should become very active once new highs are achieved.

A Wave 3 is in play and short covering should add zip.

A US$100 intraday move soon?

#gold $XAU $GDX

Gold is moving up to test all time highs around US$2089 (basis futures).

The mover higher has been steady so far but should become very active once new highs are achieved.

A Wave 3 is in play and short covering should add zip.

A US$100 intraday move soon?

#gold $XAU $GDX

2/7

Breaking to new highs should bring about an out-of-the-box move.

Over 40 months in this box so the compression pressure should be very high.

Targets are over US$2500.

Should get that US$100 intraday move soon.

#gold $XAU $GDX

Breaking to new highs should bring about an out-of-the-box move.

Over 40 months in this box so the compression pressure should be very high.

Targets are over US$2500.

Should get that US$100 intraday move soon.

#gold $XAU $GDX

3/7

The long term outlook for gold looks very robust indeed.

That `box' is just a small step in this long journey to a new gold standard.

Gold is being reassessed before it is being revalued.

And revalued much higher.

Expecting over US$3300.

#Gold $XAU $GDX

The long term outlook for gold looks very robust indeed.

That `box' is just a small step in this long journey to a new gold standard.

Gold is being reassessed before it is being revalued.

And revalued much higher.

Expecting over US$3300.

#Gold $XAU $GDX

Today - the most auspicious lunar day - Vaisakha Sukla Dasami, the sacred day Lord #Srinivasa (Venkateswara) married Sri Padmavathi Devi that is reckoned as Sri #PadmavathiSrinivasaKalyana

कल्याणाद्भुतगात्राय कामितार्थप्रदायिने ।

श्रीमद्वेङ्कटनाथाय श्रीनिवासाय ते नमः ॥

कल्याणाद्भुतगात्राय कामितार्थप्रदायिने ।

श्रीमद्वेङ्कटनाथाय श्रीनिवासाय ते नमः ॥

ಕಲ್ಯಾಣಾದ್ಭುತಗಾತ್ರಾಯ ಕಾಮಿತಾರ್ಥಪ್ರದಾಯಿನೇ ।

ಶ್ರೀಮದ್ವೇಂಕಟನಾಥಾಯ ಶ್ರೀನಿವಾಸಾಯ ತೇ ನಮಃ ॥

కల్యాణాద్భుతగాత్రాయ కామితార్థప్రదాయినే ।

శ్రీమద్వేఙ్కటనాథాయ శ్రీనివాసాయ తే నమః ॥

kalyANAdbhutagAtrAya kAmitArthapradAyine |

shrImadve~NkaTanAthAya shrInivAsAya te namaH

🙏🙏🙏

ಶ್ರೀಮದ್ವೇಂಕಟನಾಥಾಯ ಶ್ರೀನಿವಾಸಾಯ ತೇ ನಮಃ ॥

కల్యాణాద్భుతగాత్రాయ కామితార్థప్రదాయినే ।

శ్రీమద్వేఙ్కటనాథాయ శ్రీనివాసాయ తే నమః ॥

kalyANAdbhutagAtrAya kAmitArthapradAyine |

shrImadve~NkaTanAthAya shrInivAsAya te namaH

🙏🙏🙏

Kalyaana means marriage/auspicious. When it is Kalyaana of the Supreme God, the auspiciousness will be in abundance and it will be for the universal welfare and well being of the humanity. +

You may have heard the term BRICS recently, and how this group of countries has taken issue with the USD

But what exactly—or should I say *who* exactly—are the BRICS, and can they really topple the USD?

Time for a US Dollar 🧵👇

But what exactly—or should I say *who* exactly—are the BRICS, and can they really topple the USD?

Time for a US Dollar 🧵👇

🧐 What is BRICS?

First things first, BRICS is just an acronym for a group of countries seeking to form their own economic cooperation

A non-Western-centric bloc, you might say

These countries are currently, Brazil, Russia, India, China, and South Africa

BRICS.

First things first, BRICS is just an acronym for a group of countries seeking to form their own economic cooperation

A non-Western-centric bloc, you might say

These countries are currently, Brazil, Russia, India, China, and South Africa

BRICS.

The term BRIC was originally coined by Goldman Sachs economist Jim O’Neill in 2001, and when South Africa joined in 2010, it became BRICS

See, BRICS wants to break away from the need to hold and transact in USD

They're looking to do this for various reasons, but two are clear:

See, BRICS wants to break away from the need to hold and transact in USD

They're looking to do this for various reasons, but two are clear:

तुमचा सोनार तुमच्याकडून सोन्याचे योग्य पैसे घेतोय का?

काल अक्षय तृतीयेच्या निमित्ताने अनेकांनी सोने खरेदी केली असेलच. जरी केली नसेल तरी भारतीयांचे सोन्याबाबतचे प्रेम पाहता सोने खरेदीला खरे तर मुहूर्ताची गरज नसते. #म #मराठी #gold

काल अक्षय तृतीयेच्या निमित्ताने अनेकांनी सोने खरेदी केली असेलच. जरी केली नसेल तरी भारतीयांचे सोन्याबाबतचे प्रेम पाहता सोने खरेदीला खरे तर मुहूर्ताची गरज नसते. #म #मराठी #gold

This is the path the Roman empire went down. Reduce the metal content of the coins ... make the money worthless.

This is late stage empire type of stuff.

None of own enough #gold and #silver.

Get it while you still can.

This is late stage empire type of stuff.

None of own enough #gold and #silver.

Get it while you still can.

Quarters until 1964 were 90% silver and 10% copper.

Quarters now are 91.67% copper and 8.33% nickel.

So now even that is getting too expensive for them and they want to use even cheaper metals to make our coins.

Next step is just all digital, zero metal.

Worthless currency.

Quarters now are 91.67% copper and 8.33% nickel.

So now even that is getting too expensive for them and they want to use even cheaper metals to make our coins.

Next step is just all digital, zero metal.

Worthless currency.