Discover and read the best of Twitter Threads about #ClimateRisks

Most recents (24)

1/n 📢🧵: The @IPCC_CH launched their new report (WG2-AR6) this week, exploring the impacts of #climate risks, #adaptation & vulnerability. Here are some insights on the key takeaways for #India.🇮🇳🌏♻️

#ClimateReport #IPCC #IPCCReport

🔗Read Asia Ch. 10 ➡️ bit.ly/3twyIVI

#ClimateReport #IPCC #IPCCReport

🔗Read Asia Ch. 10 ➡️ bit.ly/3twyIVI

2/n #India🇮🇳 is at risk of multiple #climaticrisks, many of which are accelerating in frequency & intensity. Rising temp.🌡️are likely to cause severe heat stress in summer, esp. in cities where temp.🌡️can be more than 2℃ warmer than the surroundings due to heat island effects.

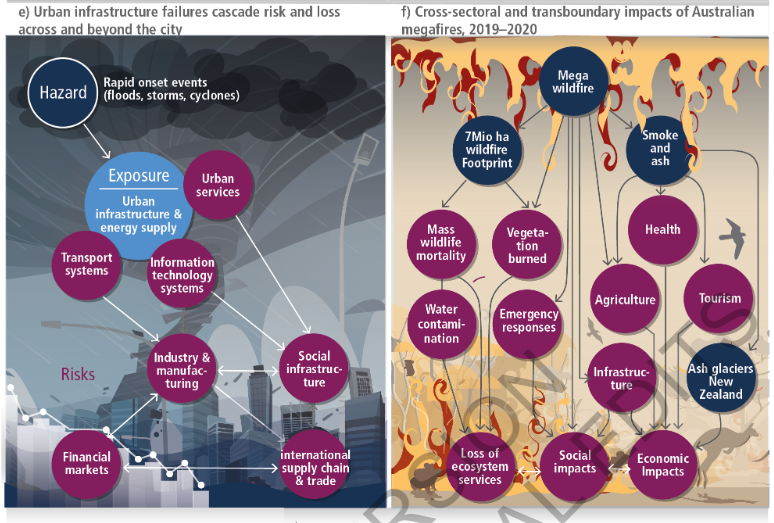

The new #IPCC #ClimateReport has fantastic graphics about a number of Impact Risks faced due to the #ClimateCrisis

Join us in the Collapse Discord for more In-Depth analysis of this (and many other) reports. #Collapse discord.gg/JpB5EW92vN

Join us in the Collapse Discord for more In-Depth analysis of this (and many other) reports. #Collapse discord.gg/JpB5EW92vN

Words we don't want to see in a paper on EU climate impact risks in intl. trade, finance and EU society: Nascent or embryonic research area.

Yet here we are:sciencedirect.com/science/articl… So EU piles up trade agreements, thus expanding risks, but won't request & include risk research?!

Yet here we are:sciencedirect.com/science/articl… So EU piles up trade agreements, thus expanding risks, but won't request & include risk research?!

So what's sciencedirect.com/science/articl…?

It's a grainy ultrasound😁of the embryonic research area. Three teams review existing lit. on #climaterisks in EU society, intl. finance and trade and enrich the findings w/ new data.

FYI: search for #climaterisks only gets 29 hits on Twitter🤯

It's a grainy ultrasound😁of the embryonic research area. Three teams review existing lit. on #climaterisks in EU society, intl. finance and trade and enrich the findings w/ new data.

FYI: search for #climaterisks only gets 29 hits on Twitter🤯

Wrt trade they state

"we align the contribution of imported material with EU27 primary production, i.e. removing any processed material production that may itself depend on imported material"

Dangerously simplified. It makes us blind precisely IN the context of globalised trade:

"we align the contribution of imported material with EU27 primary production, i.e. removing any processed material production that may itself depend on imported material"

Dangerously simplified. It makes us blind precisely IN the context of globalised trade:

#SriAgenda abt to start 💥 #Nov25 10am CET

The 20th anniversary of @ItaSIF: past, present and future of #sustainablefinance | #SettimanaSRI Final Day

finanzasostenibile.it/eventi/20-anni…

@SriEvent Twitter Media Partner

#sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

The 20th anniversary of @ItaSIF: past, present and future of #sustainablefinance | #SettimanaSRI Final Day

finanzasostenibile.it/eventi/20-anni…

@SriEvent Twitter Media Partner

#sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

@ItaSIF @SRI_Natives @SriEvent_It @andytuit getting ready...

#SettimanaSRI Final Day

#Milan @meetcenter @PietroNegri6

#SettimanaSRI Final Day

#Milan @meetcenter @PietroNegri6

@ItaSIF @SRI_Natives @SriEvent_It @andytuit @meetcenter @PietroNegri6 welcome remarks by @sergio_urbani Managing Director @FondCariplo, introduced by moderator @EliSoglio

#SettimanaSRI Final Day @FondCariplo @CorriereBN

#SettimanaSRI Final Day @FondCariplo @CorriereBN

#SriAgenda starting now 💥 #July5 3pm CEST

What it means for corporations | 3rd in a series of 6 webinars (until #July19) by The EU Platform on #SustainableFinance

Hosted by @ClimateBonds

zoom.us/webinar/regist…

#eutaxonomy #sri #esg #climatecrisis @SRI_Natives @andytuit

What it means for corporations | 3rd in a series of 6 webinars (until #July19) by The EU Platform on #SustainableFinance

Hosted by @ClimateBonds

zoom.us/webinar/regist…

#eutaxonomy #sri #esg #climatecrisis @SRI_Natives @andytuit

@ClimateBonds @SRI_Natives @andytuit about 1,500 partcipants registered for today's webinar, says Mr #GreenBonds @seankidney in his opening remarks

#eutaxonomy #corporations #eupsf

#eutaxonomy #corporations #eupsf

@ClimateBonds @SRI_Natives @andytuit @seankidney the recording of the webinar will be soon available on @ClimateBonds' #Youtube channel, notes @seankidney

#eutaxonomy #corporations #eupsf

#eutaxonomy #corporations #eupsf

#SriAgenda today | #Sep22 10am CEST

#SINVEurope part 4 "@Climate_Action_ @UNEP_FI

#sustainablefinance #responsibleinvestment #impinv @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA

#SINVEurope part 4 "@Climate_Action_ @UNEP_FI

#sustainablefinance #responsibleinvestment #impinv @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA

@Climate_Action_ @UNEP_FI @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA #SriAgenda just started 🔘 #Sep22

welcome speech and opening remarks by Professor @bencaldecott

#SINVEurope #Part4 @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #sustainablefinance #climatecrisis #sri #esg #climaterisks #greenfinance #responsibleinvestment

welcome speech and opening remarks by Professor @bencaldecott

#SINVEurope #Part4 @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #sustainablefinance #climatecrisis #sri #esg #climaterisks #greenfinance #responsibleinvestment

@Climate_Action_ @UNEP_FI @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #SINVEurope #Part4

@MartinSpolc talking abt the next steps of #sustainablefinanceEU renewed strategy in conversation w/ @bencaldecott

@EU_Finance @EU_ScienceHub #sustainablefinance @Climate_Action_ @UNEP_FI

@MartinSpolc talking abt the next steps of #sustainablefinanceEU renewed strategy in conversation w/ @bencaldecott

@EU_Finance @EU_ScienceHub #sustainablefinance @Climate_Action_ @UNEP_FI

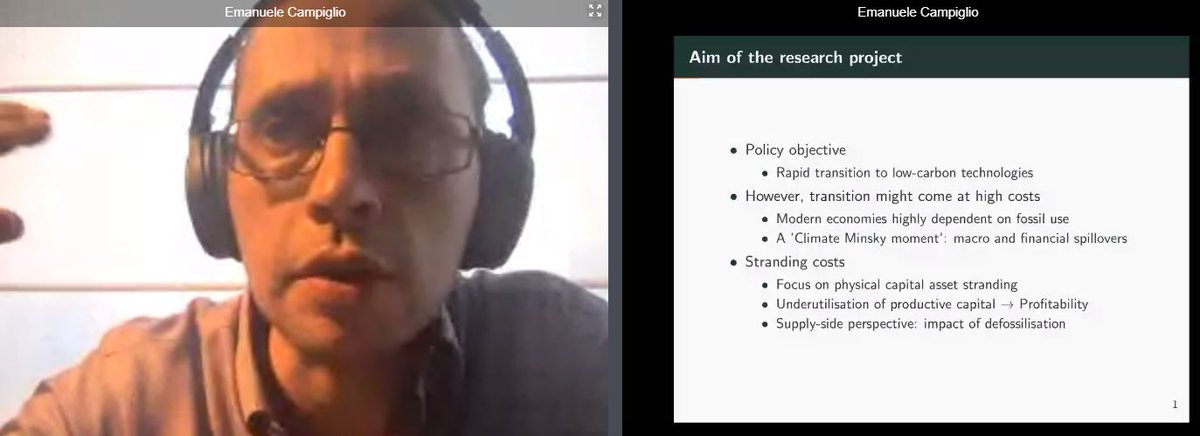

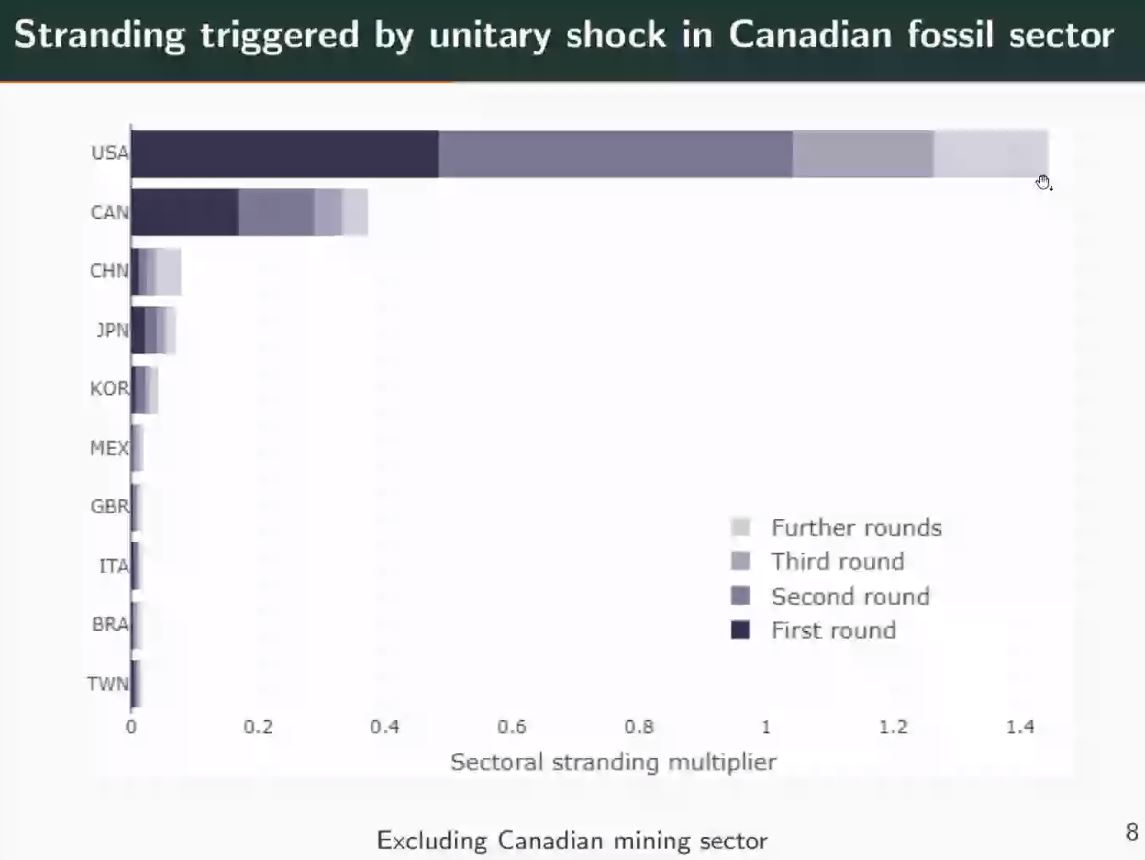

#SriAgenda underway 🔘 #Sep9

#GRASFI "@susfinalliance | #Day2 of 4

Capital stranding cascades: The impact of #decarbonisation on productive asset utilisation "@emacampiglio

#sustainablefinance #strandedassets @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit

#GRASFI "@susfinalliance | #Day2 of 4

Capital stranding cascades: The impact of #decarbonisation on productive asset utilisation "@emacampiglio

#sustainablefinance #strandedassets @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit

@susfinalliance @emacampiglio @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit conclusions "@emacampiglio

#sustainablefinance #strandedassets

#GRASFI "@susfinalliance

#sustainablefinance #strandedassets

#GRASFI "@susfinalliance

@susfinalliance @emacampiglio @IreMonasterolo @GeilanMB @CampanaleMark @niklashoehne @andytuit New developments in #ClimateLitigation over financial risk "@ColomEsmeralda

#climaterisks #responsibleinvestment #sustainablefinance #climatecrisis #BizHumanRights #sri #esg @UiBCET @ColumbiaLaw @urgenda @canclimatelaw @ColumbiaClimate @MichaelGerrard

#GRASFI "@susfinalliance

#climaterisks #responsibleinvestment #sustainablefinance #climatecrisis #BizHumanRights #sri #esg @UiBCET @ColumbiaLaw @urgenda @canclimatelaw @ColumbiaClimate @MichaelGerrard

#GRASFI "@susfinalliance

#SriAgenda underway 🔘 #Sep3

#SummerSchool on #SustainableFinance - Final Day of 3 "@EU_ScienceHub

ec.europa.eu/jrc/en/event/t…

@AndreasHoepner @MBaumgarts @AilaAho @seankidney @MartinSpolc

#sustainablefinanceEU #TaxonomyEU #greenfinance #climatecrisis #climaterisks #sri #esg

#SummerSchool on #SustainableFinance - Final Day of 3 "@EU_ScienceHub

ec.europa.eu/jrc/en/event/t…

@AndreasHoepner @MBaumgarts @AilaAho @seankidney @MartinSpolc

#sustainablefinanceEU #TaxonomyEU #greenfinance #climatecrisis #climaterisks #sri #esg

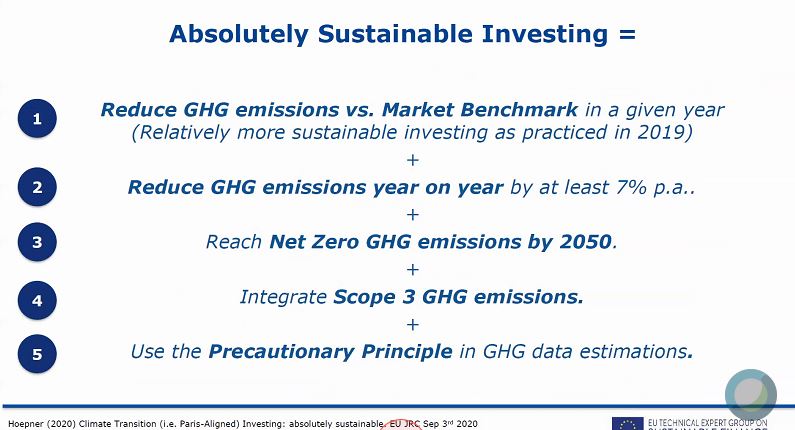

@EU_ScienceHub @AndreasHoepner @MBaumgarts @AilaAho @seankidney @MartinSpolc what 'Absolutely Sustainable Investing' entails

➡ #scope3 integration is key

"@AndreasHoepner

#sustainablefinanceEU #TaxonomyEU #sustainablefinance #sri #esg #greenfinance #climatecrisis #climaterisks #GHG #ParisAgreement @EU_ScienceHub @EU_Finance @MartinSpolc @seankidney

➡ #scope3 integration is key

"@AndreasHoepner

#sustainablefinanceEU #TaxonomyEU #sustainablefinance #sri #esg #greenfinance #climatecrisis #climaterisks #GHG #ParisAgreement @EU_ScienceHub @EU_Finance @MartinSpolc @seankidney

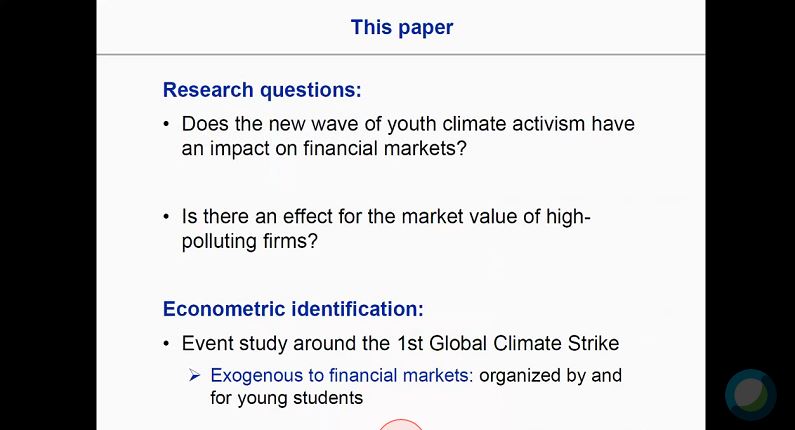

@EU_ScienceHub @AndreasHoepner @MBaumgarts @AilaAho @seankidney @MartinSpolc @EU_Finance Greta Thunberg and the #climatestrike #fridaysforfuture global movement come into the debate

#sustainablefinance #climatecrisis #climateemergency @StefanoRamelli @abarkawi

#sustainablefinance #climatecrisis #climateemergency @StefanoRamelli @abarkawi

#SriAgenda abt to start 💥 #July15 at 3pm CEST

#ResponsibleInvesting - Adrie Heinsbroek Principal RI "@NNIP in conversation w/ Nobel laureate @JosephEStiglitz

nnip.com/en-INT/profess…

#sustainablefinance #sri #esg #responsibleinvestment @SriEvent_It @SRI_Natives @andytuit

#ResponsibleInvesting - Adrie Heinsbroek Principal RI "@NNIP in conversation w/ Nobel laureate @JosephEStiglitz

nnip.com/en-INT/profess…

#sustainablefinance #sri #esg #responsibleinvestment @SriEvent_It @SRI_Natives @andytuit

@NNIP @JosephEStiglitz @SriEvent_It @SRI_Natives @andytuit #SriAgenda just started 💥

#UpsideDownNNIP #sustainablefinance #ResponsibleInvesting

#UpsideDownNNIP #sustainablefinance #ResponsibleInvesting

@NNIP @JosephEStiglitz @SriEvent_It @SRI_Natives @andytuit at #UpsideDownNNIP online event Nobel Laureate Professor @JosephEStiglitz is giving his keynote speech

#ResponsibleInvesting

#ResponsibleInvesting

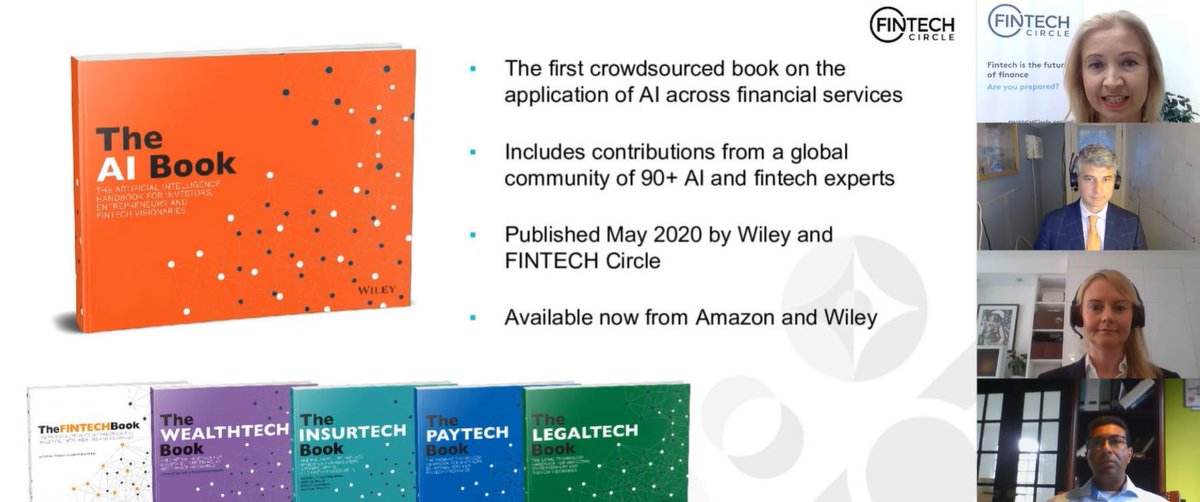

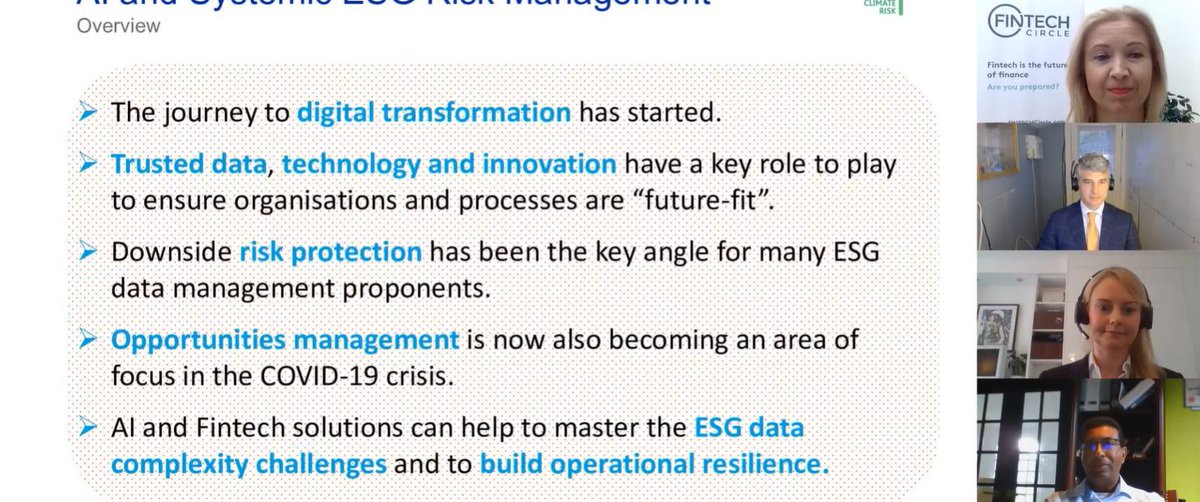

#SriAgenda abt to start 🔔 #July9 3pm CEST

#AI, #Fintech and #ESG Data – Establishing Concepts and Tools for Innovation "@FINTECHCircle & Moody's

bigmarker.com/fintech-circle…

#sustainablefinance #sri #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

#AI, #Fintech and #ESG Data – Establishing Concepts and Tools for Innovation "@FINTECHCircle & Moody's

bigmarker.com/fintech-circle…

#sustainablefinance #sri #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

@FINTECHCircle @SRI_Natives @SriEvent_It @andytuit #SriAgenda just started 💥

welcome speech by @SusanneChishti CEO and Founder @FINTECHCircle

#AI #Fintech #ESG #sustfintech #sustainablefinance #sri #responsibleinvestment @TheAIBook

welcome speech by @SusanneChishti CEO and Founder @FINTECHCircle

#AI #Fintech #ESG #sustfintech #sustainablefinance #sri #responsibleinvestment @TheAIBook

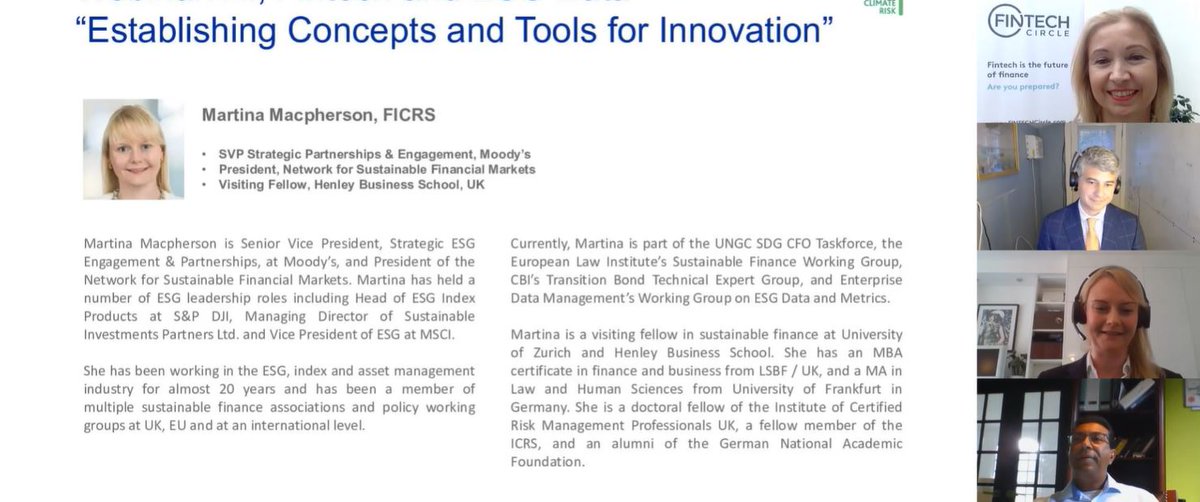

@FINTECHCircle @SRI_Natives @SriEvent_It @andytuit @SusanneChishti @TheAIBook now @MN_Macpherson SVP Strategic Partnerships & #Engagement Moody's presenting herself

#AI #Fintech #ESG #sustfintech #sustainablefinance #sri #responsibleinvestment @MoodysInvSvc @MoodysAnalytics @VigeoEirisItaly @427climaterisk

#AI #Fintech #ESG #sustfintech #sustainablefinance #sri #responsibleinvestment @MoodysInvSvc @MoodysAnalytics @VigeoEirisItaly @427climaterisk

#SriAgenda in 30min | #June30 at 2:30pm CEST

Breaking the #climatefinance doom-loop

finance-watch.org/event/webinar-…

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance @SRI_Natives @SriEvent_It @andytuit

Breaking the #climatefinance doom-loop

finance-watch.org/event/webinar-…

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance @SRI_Natives @SriEvent_It @andytuit

@SRI_Natives @SriEvent_It @andytuit #SriAgenda just started 💥

welcome speech and opening remarks by @pilitaclark

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance "@forfinancewatch "@CarbonBubble

welcome speech and opening remarks by @pilitaclark

#fossifuel #climaterisks #climatecrisis #sustainablefinance #greenfinance "@forfinancewatch "@CarbonBubble

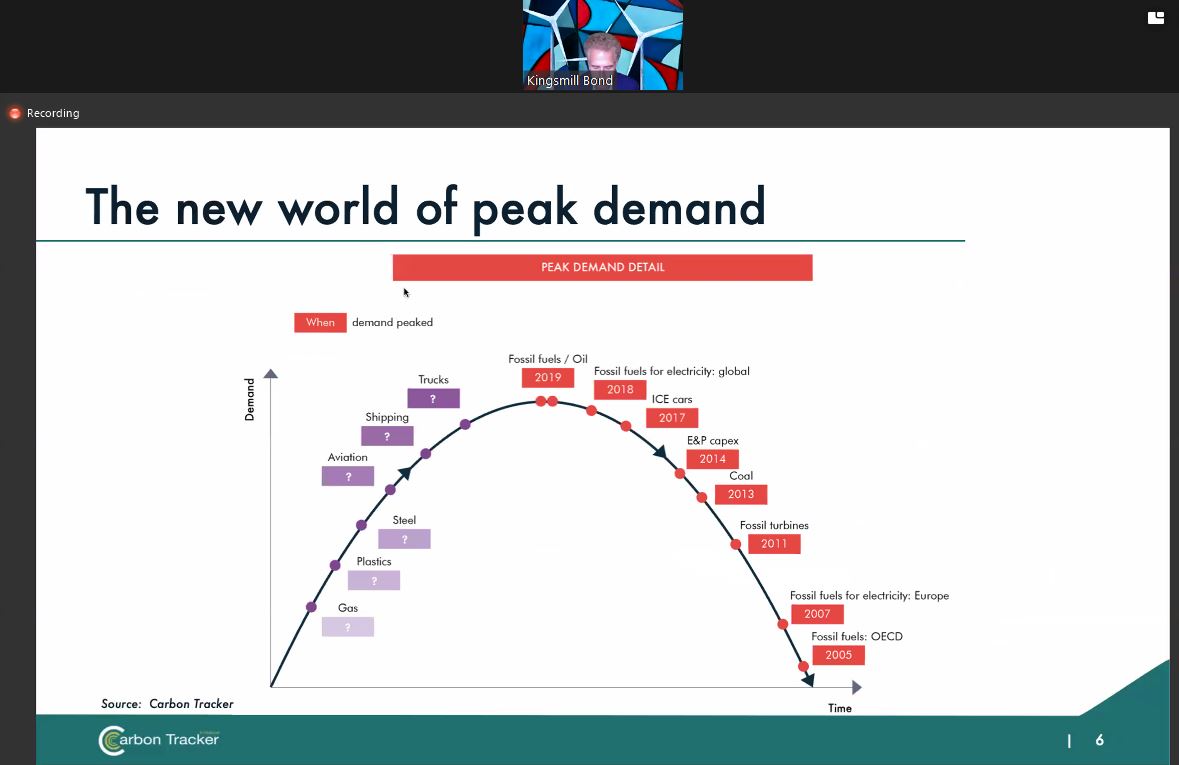

@SRI_Natives @SriEvent_It @andytuit @pilitaclark @forfinancewatch @CarbonBubble now @KingsmillBond going deeply into the 'Decline and Fall' (that's the name of the report by @CarbonBubble) of #fossilfuels: the system is being rapidly disrupted, he says

#fossifuel #sustainablefinance #climaterisks #disruption @CampanaleMark @arhobley @fossiltreaty @andytuit

#fossifuel #sustainablefinance #climaterisks #disruption @CampanaleMark @arhobley @fossiltreaty @andytuit

#SriAgenda in 15min 🔔 #June30 10am CEST

Investors as catalysts of the climate transition | #COP26: Investor action on climate (Webinar 2) "@PRI_News @LSEplc

unpri.org/events/cop26-i…

#sustainablefinance #climatecrisis @SRI_Natives @SriEvent_It @Managers4Future @andytuit

Investors as catalysts of the climate transition | #COP26: Investor action on climate (Webinar 2) "@PRI_News @LSEplc

unpri.org/events/cop26-i…

#sustainablefinance #climatecrisis @SRI_Natives @SriEvent_It @Managers4Future @andytuit

@PRI_News @LSEplc @SRI_Natives @SriEvent_It @Managers4Future @andytuit Investors as catalysts of the #climatetransition - #COP26: Investor action on climate (Webinar 2), just started with a ⚡terrific⚡ line-up of speakers for the 1st panel

#sustainablefinance #climatecrisis @LSEplc @PRI_News @UNEP_FI @GFI_green @GenerationFndt @COP26 @PreCop26ITA

#sustainablefinance #climatecrisis @LSEplc @PRI_News @UNEP_FI @GFI_green @GenerationFndt @COP26 @PreCop26ITA

@PRI_News @LSEplc @SRI_Natives @SriEvent_It @Managers4Future @andytuit @UNEP_FI @GFI_green @GenerationFndt @COP26 @PreCop26ITA #sustainability is at the core of our business, just said David Schwimmer, CEO @LSEplc adding that there's still a lack of #ESG data to work on

#sustainablefinance #climatecrisis #climatetransition @BorsaItalianaIT @PatriziaCelia @barbaralunghi4 @FSB_TCFD @APPGSustFin @GFI_green

#sustainablefinance #climatecrisis #climatetransition @BorsaItalianaIT @PatriziaCelia @barbaralunghi4 @FSB_TCFD @APPGSustFin @GFI_green

#SriAgenda in 15min 🔔 #June29 at 6pm CEST

A Toolbox for Sustainable Crisis Response Measures for #CentralBanks and Supervisors "@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes

soas.ac.uk/centre-for-sus…

#sustainablefinance #sustainablerecovery #sri #esg

A Toolbox for Sustainable Crisis Response Measures for #CentralBanks and Supervisors "@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes

soas.ac.uk/centre-for-sus…

#sustainablefinance #sustainablerecovery #sri #esg

@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes #SriAgenda just started 💥

welcome speech by @NVJRobins1

#sustainablefinance #CentralBanks #sustainablerecovery #sri #esg @GRI_LSE @FC4SNetwork @NGFS_

welcome speech by @NVJRobins1

#sustainablefinance #CentralBanks #sustainablerecovery #sri #esg @GRI_LSE @FC4SNetwork @NGFS_

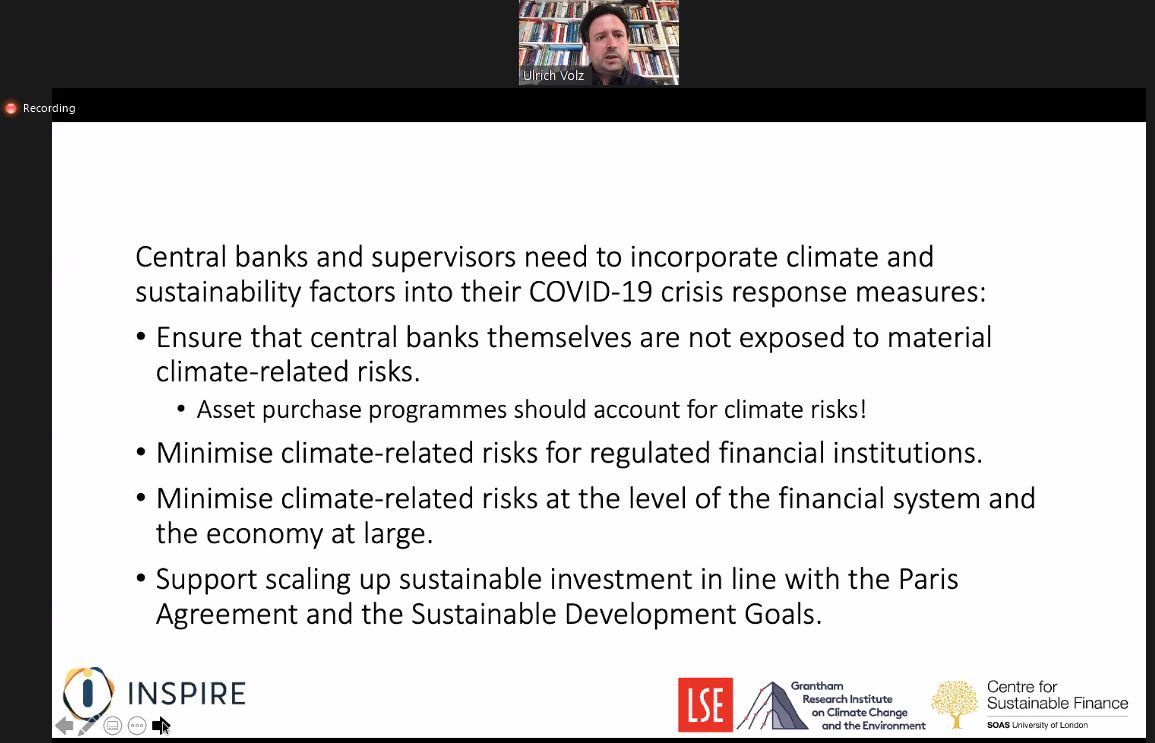

@INSPIRE_sec @e3g @CSF_SOAS @SEACENCentre @BennettInst @SusCriRes @NVJRobins1 @GRI_LSE @FC4SNetwork @NGFS_ the 4 reasons for #CentralBanks and supervisors to incorporate #climate and #sustainability factors now being explained by @UliVolz

#sustainablefinance #sustainablerecovery #sri #esg #climaterisks #climatecrisis @CSF_SOAS

#sustainablefinance #sustainablerecovery #sri #esg #climaterisks #climatecrisis @CSF_SOAS

#SriAgenda abt to start 💥 #June5 3pm CEST

"@NGFS_ Reports: #CentralBanks & #ClimateRisk "@ClimateBonds

w/

🎙@PrashantVaze

🎙#JoPaisley Co-President @GARP_Risk

🎙@despresmorgan

🎙@seankidney

zoom.us/webinar/regist…

#climatefinance #climatecrisis @andytuit @SRI_Natives

"@NGFS_ Reports: #CentralBanks & #ClimateRisk "@ClimateBonds

w/

🎙@PrashantVaze

🎙#JoPaisley Co-President @GARP_Risk

🎙@despresmorgan

🎙@seankidney

zoom.us/webinar/regist…

#climatefinance #climatecrisis @andytuit @SRI_Natives

@NGFS_ @ClimateBonds @PrashantVaze @GARP_Risk @despresmorgan @seankidney @andytuit @SRI_Natives #SriAgenda just started 💥 #June5

"@NGFS_ Reports: #CentralBanks & #ClimateRisk "@ClimateBonds

zoom.us/webinar/regist…

#climatefinance #climatecrisis #sustainablefinance #greenfinance #greenbonds

"@NGFS_ Reports: #CentralBanks & #ClimateRisk "@ClimateBonds

zoom.us/webinar/regist…

#climatefinance #climatecrisis #sustainablefinance #greenfinance #greenbonds

@NGFS_ @ClimateBonds @PrashantVaze @GARP_Risk @despresmorgan @seankidney @andytuit @SRI_Natives we have to acknowledge that we're in the middle of a crisis, says @seankidney opening the debate

#CentralBanks #climaterisk #sustainablefinance #climatefinance #climatecrisis

#CentralBanks #climaterisk #sustainablefinance #climatefinance #climatecrisis

#SriAgenda abt to start 🔔 #May21 at 5:30pm CEST

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

bit.ly/3e6gxNs

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri @andytuit @SRI_Natives

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

bit.ly/3e6gxNs

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri @andytuit @SRI_Natives

@CFASocietyDC @andytuit @SRI_Natives #SriAgenda just started 💥 #May21

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri

#ESG2020 - Virtual #ESG #AssetOwners Summit 2020 (last Webcast) "@CFASocietyDC

#sustainablefinance #sustainableinvesting #responsibleinvestment #greenfinance #sri

@CFASocietyDC @andytuit @SRI_Natives the real question today is not what is the future of ESG, the question is:

Is there a future w/out the #ESG?, say Catherine Banat @rbcgamnews introducing the panel

(a very good, visionary start! 👍)

#ESG2020 @onegoodchart @CampanaleMark @GThoumiCFA @CFASocietyDC @CFAinstitute

Is there a future w/out the #ESG?, say Catherine Banat @rbcgamnews introducing the panel

(a very good, visionary start! 👍)

#ESG2020 @onegoodchart @CampanaleMark @GThoumiCFA @CFASocietyDC @CFAinstitute

#SriAgenda just started 💥 #May14

#EUTaxonomyExplored - as part of Talks with #TEG Experts webinar series 👇

Adaptation & Resilience "@ClimateBonds

zoom.us/webinar/regist…

#sustainablefinanceEU #EUTaxonomy #EUGreenBond #sustainablefinance #greenfinance #greenbonds

#EUTaxonomyExplored - as part of Talks with #TEG Experts webinar series 👇

Adaptation & Resilience "@ClimateBonds

zoom.us/webinar/regist…

#sustainablefinanceEU #EUTaxonomy #EUGreenBond #sustainablefinance #greenfinance #greenbonds

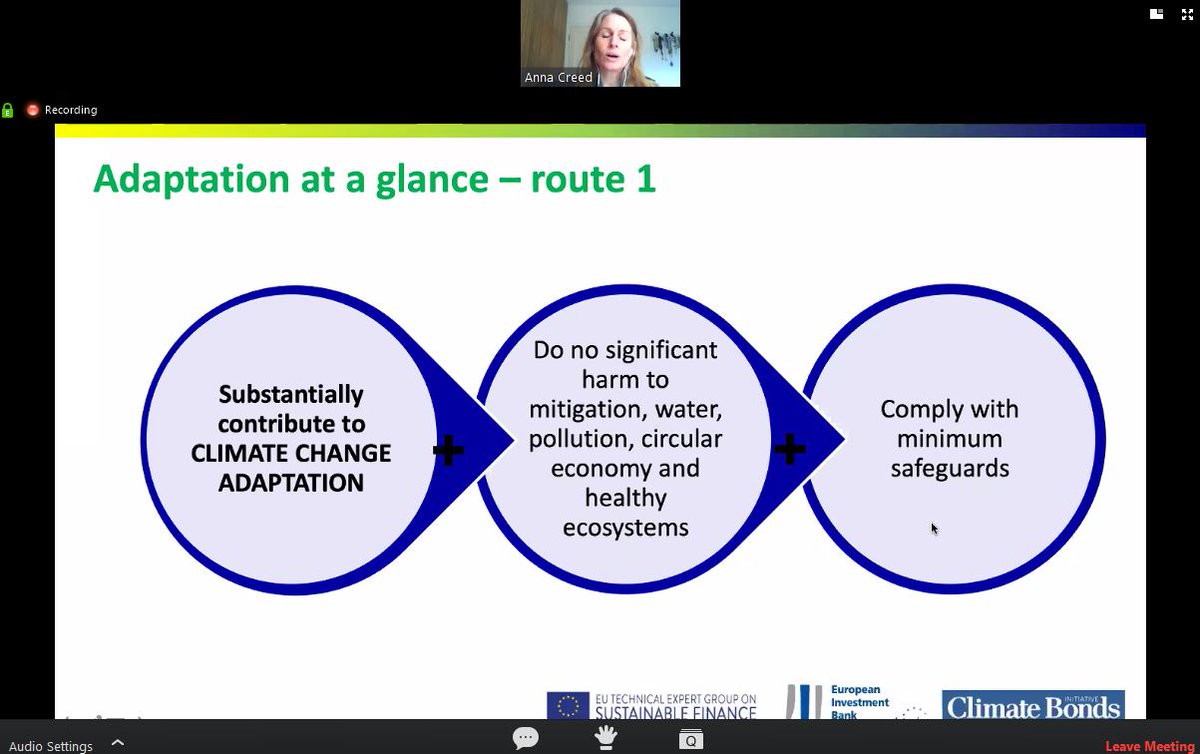

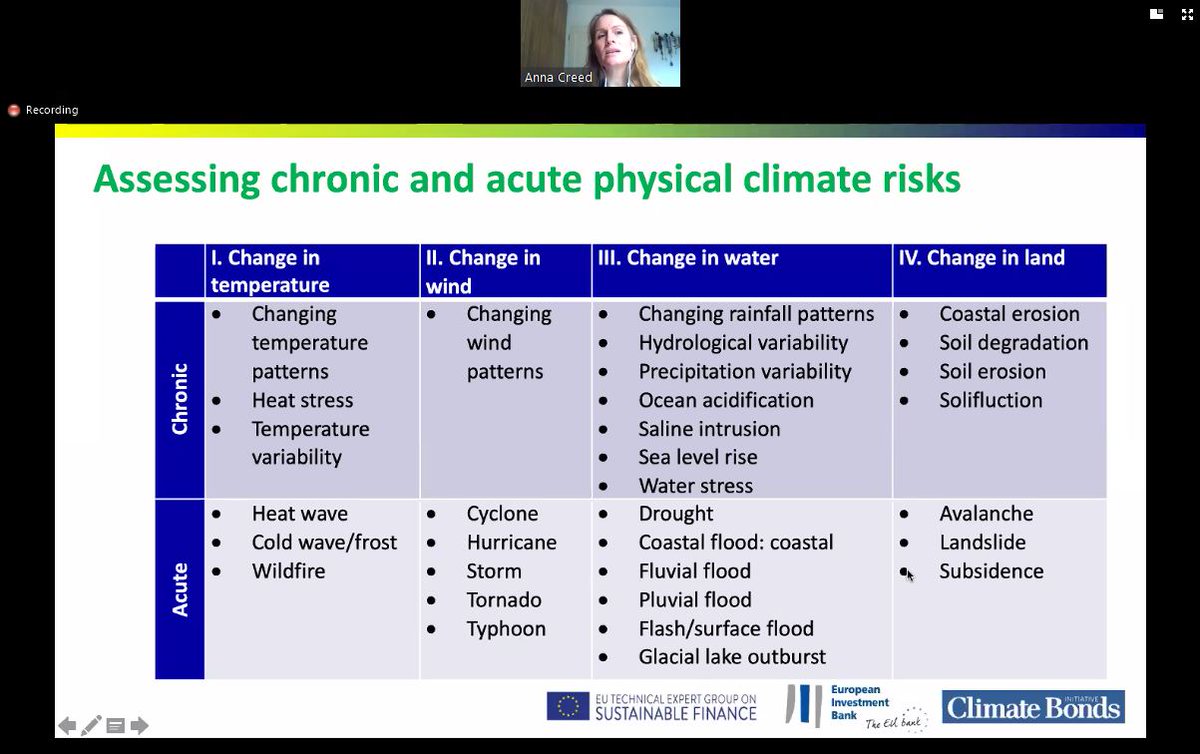

@ClimateBonds today we'll be talking abt #adaptation and #mitigation, both critical issues, says @seankidney making his opening remarks (webcasts and podcasts of previous #EUTaxonomyExplored webinars are available on @ClimateBonds' website)

#EUTaxonomyExplored

#EUTaxonomyExplored

@ClimateBonds @seankidney Anna Creed from @ClimateBonds starts making her speech by addressing the issue of physical #climaterisks

#EUTaxonomyExplored #adaptation #mitigation #sustainablefinanceEU #EUGreenBond #sustainablefinance

#EUTaxonomyExplored #adaptation #mitigation #sustainablefinanceEU #EUGreenBond #sustainablefinance

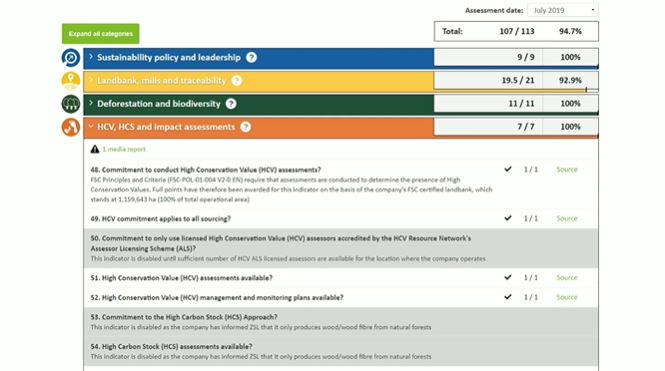

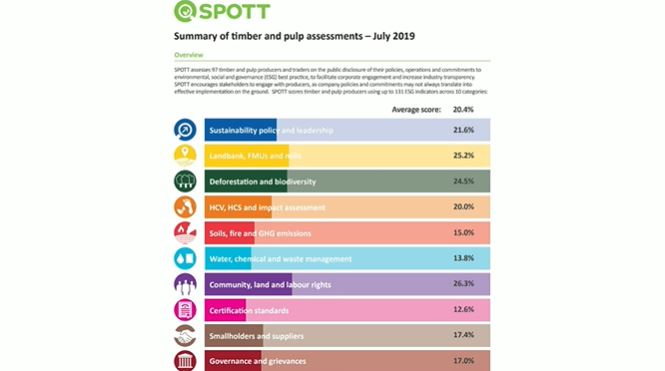

now @ClaraMelot describes what @ZSLSPOTT is and how it works

#webinar #sustainablefinance #climate #netzero #esg #sustainablefinance

#webinar #sustainablefinance #climate #netzero #esg #sustainablefinance

@ClaraMelot @ZSLSPOTT the main #esg issues analysed and assessed thru @ZSLSPOTT, now being explained by @ClaraMelot

#webinar #sustainablefinance #climate #netzero #esg #sri #sustainablefinance #responsibleinvestment

#webinar #sustainablefinance #climate #netzero #esg #sri #sustainablefinance #responsibleinvestment

@ClaraMelot @ZSLSPOTT we encourage companies to get in touch directly and engage with us, @ClaraMelot concludes

#webinar #sustainablefinance #climate #netzero #esg #sri #sustainablefinance #responsibleinvestment #engagement

#webinar #sustainablefinance #climate #netzero #esg #sri #sustainablefinance #responsibleinvestment #engagement

@McKinsey_MGI takes a deep dive into '#ClimateRisks & Response: Physical hazards & socioeconomic impacts' here: mckinsey.com/business-funct… Some takeaways...(1/12)#GlobalTrends #Risks

2/12 #ClimateRisks - the long view on changes...moving from the relatively stable to something more volatile... #GlobalTrends

3/12 #ClimateRisks - Overview of how 'climate hazards are projected to intensify' around the world...#GlobalTrends

Our Side-Event on #Youth4ClimatePeaceSecurity @ #UNGA is about to start.

We titled it "Time for Action: Climate Change & Youth, Peace and Security Nexus".

It will bring together two agendas crucial to the future of our increasingly urban🏙️ , young👦👧, and climate ravaged 🌍.

We titled it "Time for Action: Climate Change & Youth, Peace and Security Nexus".

It will bring together two agendas crucial to the future of our increasingly urban🏙️ , young👦👧, and climate ravaged 🌍.

You can follow the event live on UN WebTV 10 minutes after this tweet is posted.

We will tweet too, and add interesting information and key quotes of our panel and audience to this developing thread.

#Youth4ClimatePeaceSecurity #UNGA #ClimateChange

webtv.un.org/live-now/watch…

We will tweet too, and add interesting information and key quotes of our panel and audience to this developing thread.

#Youth4ClimatePeaceSecurity #UNGA #ClimateChange

webtv.un.org/live-now/watch…

Why should you follow?

We have an excellent set-up!

Our ED @MaimunahSharif , His Royal Highness Crown Prince Haakon of Norway @Kronprinsparet, Nobel Peace Prize Laureate @k_satyarthi .

We have @SofieNordvik , Norwegian #UNYouthDelegate to #ClimateSummit2019 , @Shan_Agrwl ...

We have an excellent set-up!

Our ED @MaimunahSharif , His Royal Highness Crown Prince Haakon of Norway @Kronprinsparet, Nobel Peace Prize Laureate @k_satyarthi .

We have @SofieNordvik , Norwegian #UNYouthDelegate to #ClimateSummit2019 , @Shan_Agrwl ...

Investor Group on Climate Change (over trillion$$): institutional investors “increasingly interested in whether industry associations were supporting or undermining climate action,” because... theguardian.com/business/2019/…

...“climate change is a core financial risk for investors and a systemic risk to the financial system and the economy.” #ClimateRisks

For the record, @USChamber (aka #ChamberofCarbon) & NAM are two industry associations “undermining” worse than anyone in America, per @InfluenceMap. I repeat: the WORST. Could you investors be a little bit more than just “interested”? #ClimateRisks

Last year, Hurricane Florence tore through NC. Hurricane Michael ripped through FL. And floods put Plains states like NE underwater. It will cost US taxpayers billions of dollars just to repair three bases because of those storms. #climatecosts defensenews.com/smr/federal-bu…

The climate crisis poses an existential threat to our country & our planet. We see #climaterisks every day: record floods. Devastating wildfires. Monster storms. It jeopardizes our air, water, homes, businesses, food, infrastructure, economy, & national security. #climatecosts

Even some giant multinational corporations are starting to disclose to their shareholders that climate change will have an enormous effect on their bottom line – & I have a bill to force them all to fess up. #climatecosts nytimes.com/2019/06/04/cli…

Even @USATODAY is starting to pay attention to #ClimateRisks. (BTW its editorial page did a great editorial some time ago.) The problem is that forces we set in motion today will have this effect in later years. It’s on us to act.

usatoday.com/story/news/nat…

usatoday.com/story/news/nat…

But the climate-denying @WSJ editorial page can’t resist publishing another crank. Unbelievable. Literally. We need good coverage of the threat sea level rise poses to property values, and our entire economy. #ClimateCosts

wsj.com/articles/exami…

wsj.com/articles/exami…

Increasing #ClimateRisks are forcing the insurance industry to recalculate. Climate change may be gradual, but its market effects are volatile. What we are doing currently — nothing—will cost us big.

wsj.com/graphics/clima…

wsj.com/graphics/clima…

Look at Texas. The annual probability of a Texas storm dropping 20 inches of rain is expected to rise from 1% to 18%. When insurance companies get scared, that’s a pretty good sign that we should be too. #ClimateCosts usatoday.com/story/weather/…

Where does this end? For some coastal areas, insurance companies stop offering protection all together. Homeowners will be left on their own to deal with the #ClimateCosts.

We know the consequences of climate inaction:

1⃣#ClimateRisk becomes uninsurable leading to crisis in insurance markets.

2⃣Sudden collapse of coastal property values when markets react to #ClimateRisks of rising sea levels.