Discover and read the best of Twitter Threads about #Contrarian

Most recents (9)

NEW EXCLUSIVE from me:

#Denounce, #deny, #deceive - 6 common tactics of media manipulators and why they work to sabotage public discourse

Read:

protagonistfuture.substack.com/p/denounce-den…

#Denounce, #deny, #deceive - 6 common tactics of media manipulators and why they work to sabotage public discourse

Read:

protagonistfuture.substack.com/p/denounce-den…

It is time to stop being naive about online discourse.

“The discourse holds so many traps for the unwary. It’s a bit like financial scams and gambling that are a tax on the financially naïve. A similar tax is being levied on the intellectually naïve.” — @ArthurCDent

1/

“The discourse holds so many traps for the unwary. It’s a bit like financial scams and gambling that are a tax on the financially naïve. A similar tax is being levied on the intellectually naïve.” — @ArthurCDent

1/

@ArthurCDent In the article, I lay out 6 common #manipulation tactics and why they work to sabotage discourse on scientific topics.

First up is "just asking questions" or "#sealioning", which uses social expectations and #framing effects to distort conversations.

2/

First up is "just asking questions" or "#sealioning", which uses social expectations and #framing effects to distort conversations.

2/

Some say recession won't come because too many see it ahead which is not normal.

Being contrarian is a skill, it requires careful calibration, let's break down some reasons why recession will likely come and dismissing it is not "black sheep" thinking at all:

1.

Being contrarian is a skill, it requires careful calibration, let's break down some reasons why recession will likely come and dismissing it is not "black sheep" thinking at all:

1.

Recessions aren't signaled ahead, but depressions can be. This is what many are missing, we won't go into recession but more likely global depression crisis. Those come slowly and creep upon unlike recessions which strike fast. Recessions are more common unlike depressions.

2.

2.

All past modern crisis events were recessions and therefore unexpected. Many use past two examples to build their whole reasoning on why we won't see crisis "because too many see it ahead". They are missing the fact that we are repeating older cycle from 30s and not 2008.

3.

3.

#reflexivity between #bubbles vs #antibubbles once again distorting markets

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

1) Embrace #volatiltiy. Don’t fight it.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

4) Seek #Emotional indifference. If your trading makes you overly happy or sad, you are trading too big.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

Hard Reit Portfolio (#REITs + #BTC)

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

PORTFOLIO STRUCTURE

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

ALLOCATION

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

Whichever way you personally lean, the most consequential narrative that will determine the framework for major investment decisions is #inflation vs #deflation.

ICYMI: @JeffSnider_AIP presented his case on MacroVoices

ICYMI: @JeffSnider_AIP presented his case on MacroVoices

Whether our future challenge is deflation vs inflation will ultimately determine the value of not only traditional assets but also new ones.

#Bitcoin & #cryptocurrencies in general have had an evolving narrative to explain away the madness - most current one is "digital gold".

#Bitcoin & #cryptocurrencies in general have had an evolving narrative to explain away the madness - most current one is "digital gold".

The overwhelming consensus is one of an inflation ravaged future economy.

It's just so obvious, isn't it?

And so effortless to make the argument that it would be asinine to suggest otherwise... and yet, recall Granville on the obvious in financial markets.

h/t @NuitSeraCalme

It's just so obvious, isn't it?

And so effortless to make the argument that it would be asinine to suggest otherwise... and yet, recall Granville on the obvious in financial markets.

h/t @NuitSeraCalme

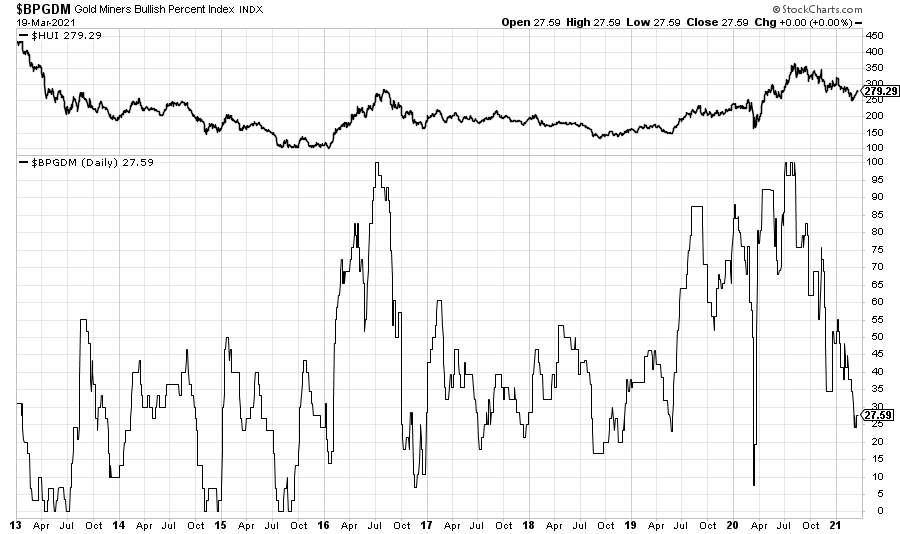

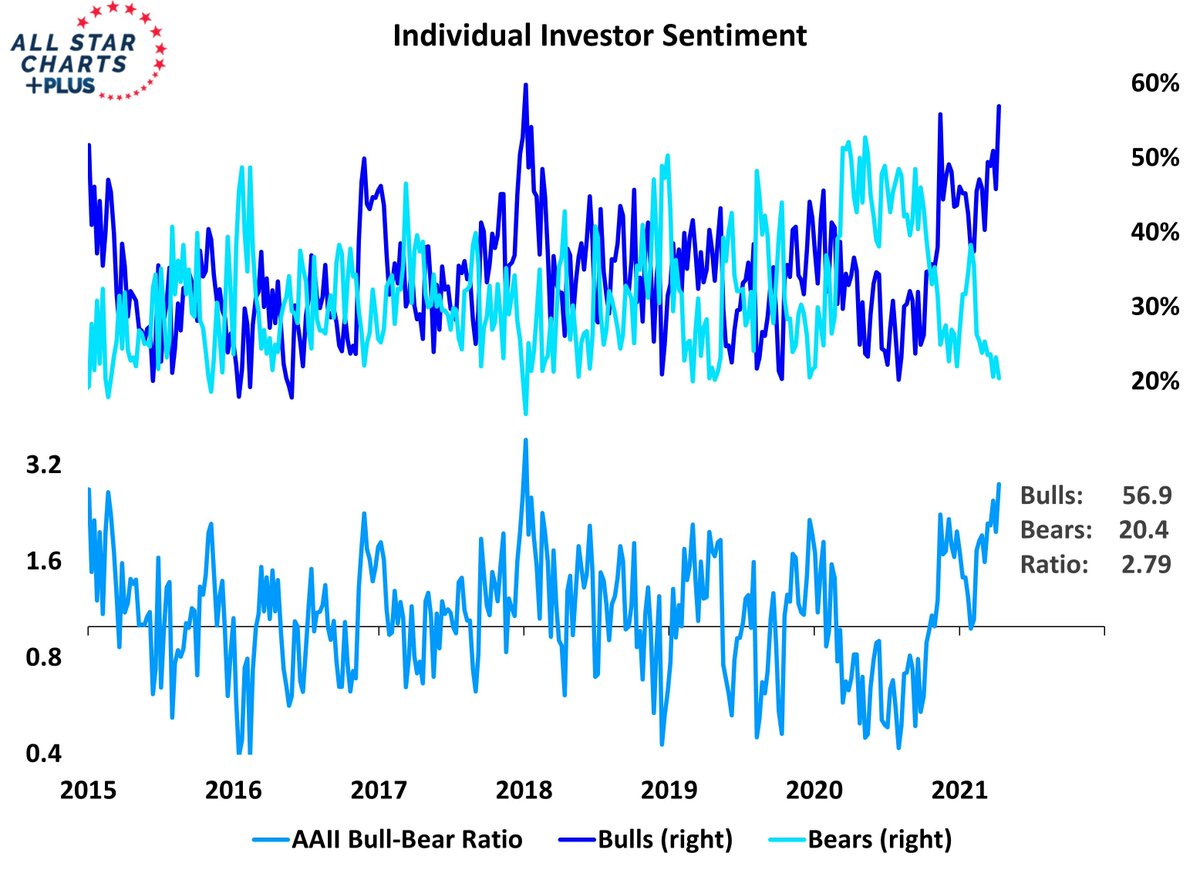

Quick look at a few #sentiment charts:

Investor Intelligence newsletter sentiment metric continues to recover with bulls 60.8% (+6.4%), bears 16.7% (-.8%) and the correction camp at 22.5% (-5.6%)

chart via @WillieDelwiche

Investor Intelligence newsletter sentiment metric continues to recover with bulls 60.8% (+6.4%), bears 16.7% (-.8%) and the correction camp at 22.5% (-5.6%)

chart via @WillieDelwiche

Retail investor #sentiment much more optimistic with those expecting the stock market to continue to rally at the highest levels since January 3rd 2018:

chart via @WillieDelwiche

chart via @WillieDelwiche

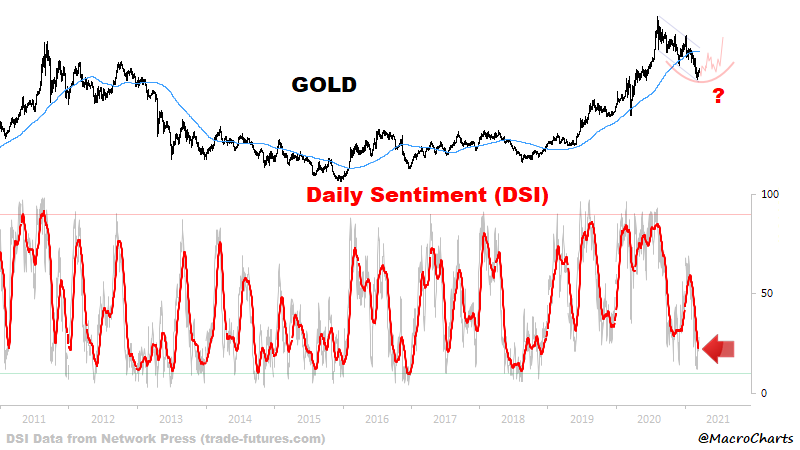

While #sentiment for gold is most definitely depressed and close to historic extremes...

chart via @MacroCharts

chart via @MacroCharts

🗓️ Hoy estrenamos una nueva línea editorial en la que repasaremos momentos destacados de algunos de los #GrandesInversores de la historia. Esta primera entrega se extenderá a lo largo de las próximas tres semanas.

Por algunos paralelismos con el mercado actual, comenzaremos con el 1999 y con el que es considerado como el mejor inversor de toda la historia: Warren Buffett, el Oráculo de Omaha.

#ValueInvesting

#ValueInvesting